Forex analysis review |

- Fractal analysis of the main currency pairs on August 15

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options from August 15, 2019 APLs &

- Washington and Beijing loosened the nuts. A thin world or calm before a storm?

- GBP/USD. August 14th. Results of the day. Former Finance Minister Philip Hammond joins opponents of "hard" Brexit

- EUR/USD. August 14th. Results of the day. Eurozone industrial production falls in June

- The Dollar index remains in bullish trend but still unable to recapture the 98 level.

- EURUSD bullish pennant pattern canceled.

- Gold recaptures important price levels for continuation of up trend

- August 14, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

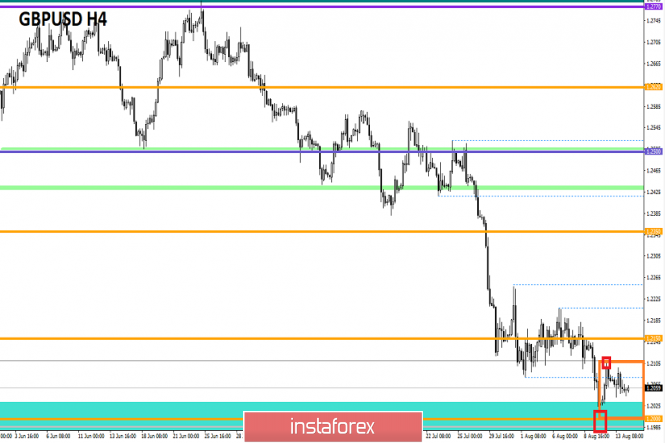

- August 14, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- The rise in oil prices by 5% – a consequence of easing the "tariff impact" of the United States

- USD/JPY. The yen is back on the horse: the situation in the debt market provoked panic

- BTC 08.14.2019 - New momentum down and possible more downside

- Gold 08.14.2019 - Shakeout in the background, more uspide yet to come

- GBP/USD 08.14.2019 -Thrid rejection of the key restiance at 1.2100

- Technical analysis of USD/CHF for August 14, 2019

- Through thorns to the stars: gold has crossed the bar at $1,500

- Silver recovers from position squeeze, buy on dips

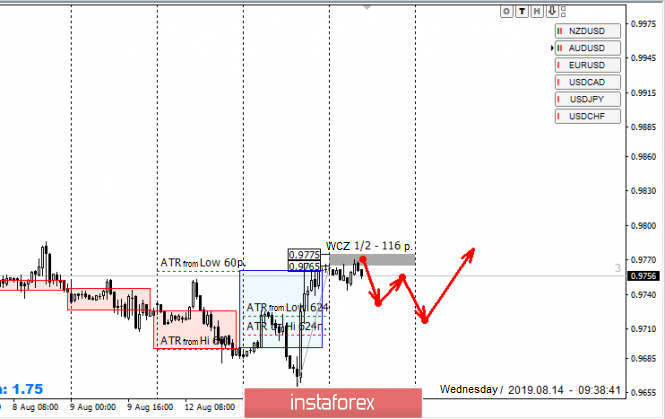

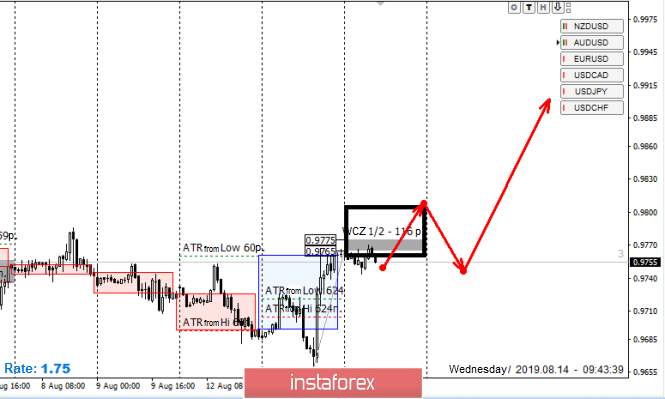

- Control zones for USD/CHF pair on 08/14/19

- UK inflation data underpins sterling, sell EUR/GBP on rallies

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 14)

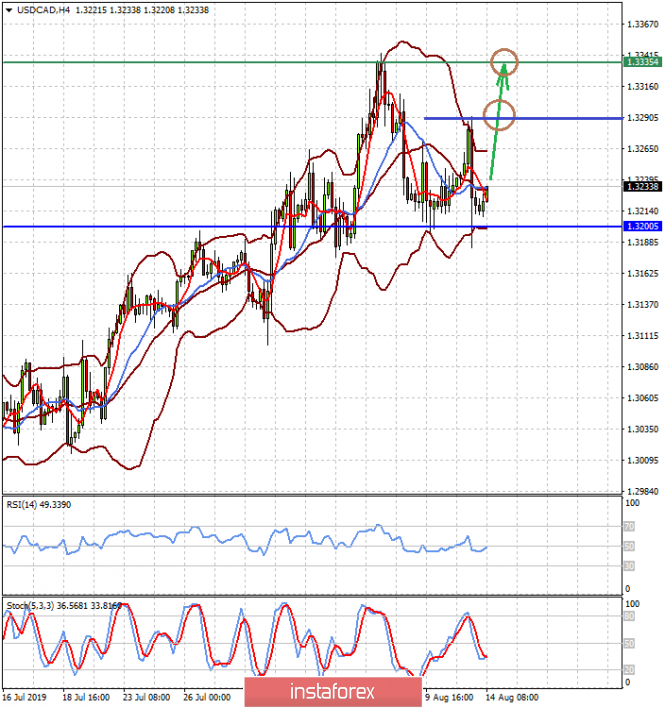

- Investors believe that the Fed will continue to lower rates anyway (We expect local growth of the USD/CAD pair and a decrease

- Analysis of EUR / USD and GBP / USD for August 14. A new round of escalation of the trade war between China and the United

- EUR / USD: Rising American inflation, Trump's "kindness" and the phlegm of the dollar

- Simplified wave analysis and forecast for EUR/USD, AUD/USD, and GBP/JPY on August 14

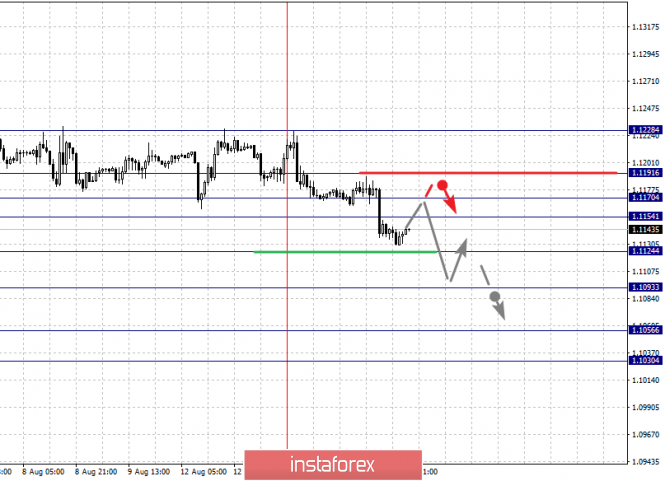

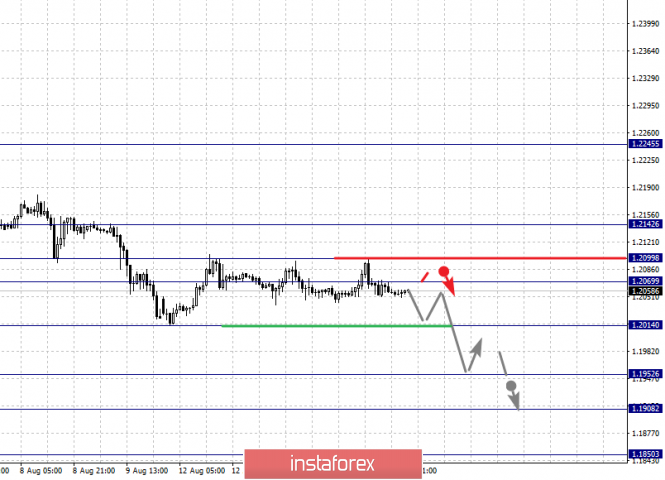

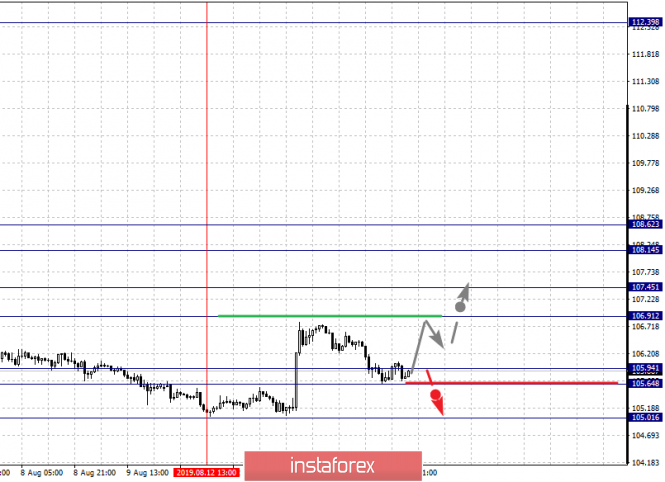

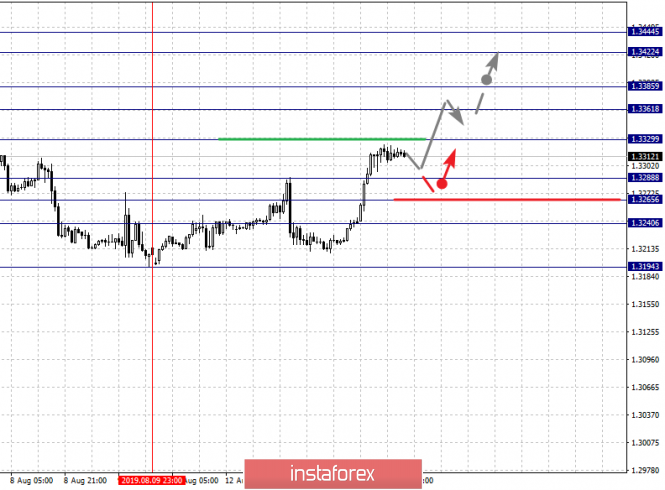

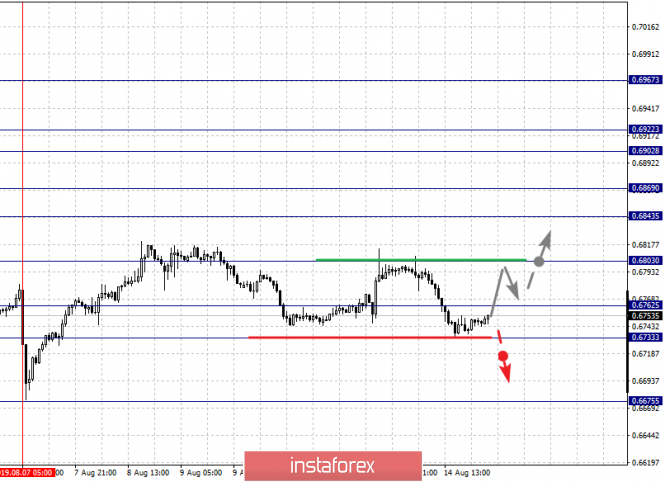

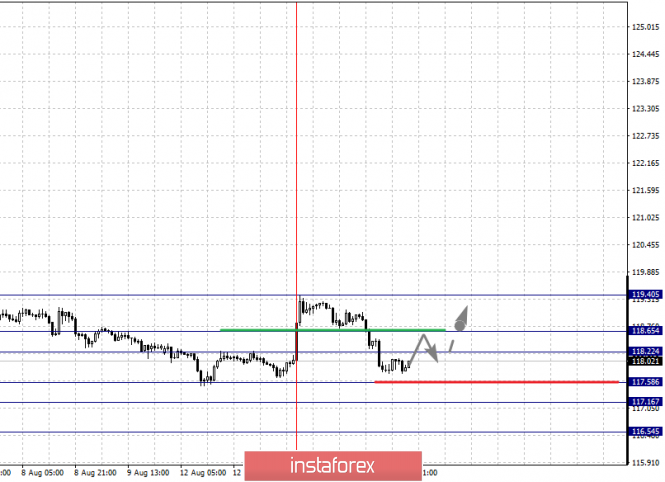

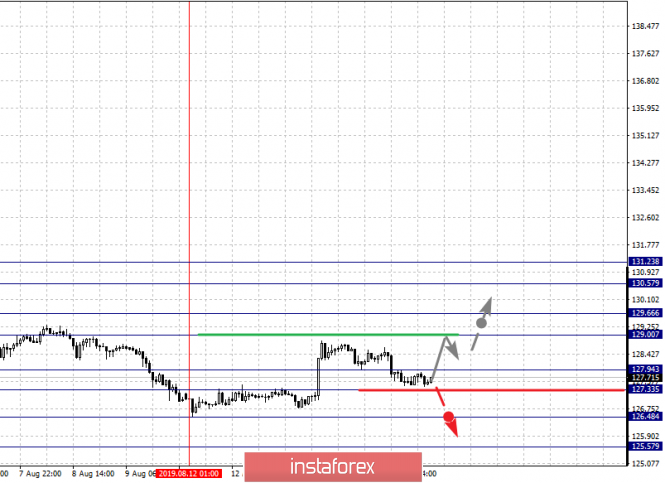

| Fractal analysis of the main currency pairs on August 15 Posted: 14 Aug 2019 05:35 PM PDT Forecast for August 15: Analytical review of currency pairs in scale H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1228, 1.1191, 1.1170, 1.1154, 1.1124, 1.1093, 1.1056 and 1.1030. Here, the price forms the potential for the downward movement of August 13. The continuation of the development of the downward structure is expected after the breakdown of the level of 1.1124. In this case, the target is 1.1093. Consolidation is near this level. The breakdown of the level of 1.1090 should be accompanied by a pronounced downward movement to the level of 1.1056. For the potential value for the bottom, we consider the level of 1.1030. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.1154 - 1.1170. The breakdown of the last value will lead to a long correction. Here, the target is 1.1190. This level is a key support for the downward structure. Its breakdown will lead to the formation of an upward structure. Here, the potential target is 1.1228. The main trend is the formation of the downward potential of August 13. Trading recommendations: Buy 1.1154 Take profit: 1.1170 Buy 1.1172 Take profit: 1.1190 Sell: 1.1122 Take profit: 1.1095 Sell: 1.1091 Take profit: 1.1058 For the pound / dollar pair, the key levels on the H1 scale are: 1.2142, 1.2099, 1.2069, 1.2014, 1.1952, 1.1908 and 1.1850. Here, we follow the downward cycle of July 31. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2014. In this case, the target is 1.1952. Short-term downward movement, as well as consolidation are in the range of 1.1952 - 1.1908. For the potential value for the bottom, we consider the level of 1.1850. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.2069 - 1.2099. The breakdown of the last value will lead to a long correction. Here, the target is 1.2142. This level is a key support for the downward structure. The main trend is the downward cycle of July 31. Trading recommendations: Buy: 1.2069 Take profit: 1.2097 Buy: 1.2100 Take profit: 1.2140 Sell: 1.2012 Take profit: 1.1954 Sell: 1.1950 Take profit: 1.1910 For the dollar / franc pair, the key levels on the H1 scale are: 0.9854, 0.9816, 0.9797, 0.9768, 0.9706, 0.9682, 0.9641, 0.9604 and 0.9536. Here, we follow the medium-term downward structure from August 1. At the moment, the price is in the correction zone and forms the potential for the top from August 13. The continuation of movement to the bottom is expected after the price passes the noise range of 0.9706 - 0.9682. In this case, the target is 0.9641. Short-term downward movement, as well as consolidation are in the range of 0.9641 - 0.9604. The breakdown of the level of 0.9604 should be accompanied by a pronounced downward movement. Here, the potential target is 0.9536. Departure for correction is expected after the breakdown of the level of 0.9768. Here, the first goal is 0.9797. Short-term upward movement is possibly in the range of 0.9797 - 0.9816. The breakdown of the latter value will lead to the formation of initial conditions for the upward cycle. Here, the target is 0.9854. The main trend is the descending structure of August 1, the correction stage. Trading recommendations: Buy : 0.9768 Take profit: 0.9797 Buy : 0.9818 Take profit: 0.9852 Sell: 0.9680 Take profit: 0.9641 Sell: 0.9638 Take profit: 0.9605 For the dollar / yen pair, the key levels on the scale are : 108.62, 108.14, 107.45, 106.91, 106.35, 105.94, 105.64 and 105.01. Here, the price is close to the cancellation of the ascending structure of August 12, which requires the breakdown of the level of 105.64. In this case, the first potential target is 105.01. The continuation of the movement to the top is expected after the breakdown of the level of 106.91. In this case, the target is 107.45. Consolidation is near this level. The breakdown of the level of 107.45 should be accompanied by a pronounced upward movement. Here, the goal is 108.14. For the potential value for the top, we consider the level of 108.62. Upon reaching which, we expect a pullback to the bottom. The main trend: the formation of potential for the top of August 12, the stage of deep correction. Trading recommendations: Buy: 106.91 Take profit: 107.43 Buy : 107.47 Take profit: 108.14 Sell: Take profit: Sell: 105.62 Take profit: 105.04 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3445, 1.3422, 1.3385, 1.3361, 1.3329, 1.3288, 1.3265, 1.3240 and 1.3194. Here, we are following the development of the local ascendant structure of August 9. The continuation of the movement to the top is expected after the breakdown of the level of 1.3330. In this case, the target is 1.3361. Consolidation is in the range of 1.3361 - 1.3385. The breakdown of the level of 1.3385 will allow us to count on movement towards a potential target - 1.3422. Upon reaching this level, we expect consolidation in the range of 1.3422 - 1.3444, as well as a pullback to the bottom. A short-term downward movement is possibly in the range of 1.3288 - 1.3265. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3240. This level is a key support for the top. The main trend is the local ascending structure of August 9. Trading recommendations: Buy: 1.3330 Take profit: 1.3360 Buy : 1.3387 Take profit: 1.3422 Sell: 1.3288 Take profit: 1.3266 Sell: 1.3264 Take profit: 1.3240 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6967, 0.6922, 0.6902, 0.6869, 0.6843, 0.6803, 0.6762, 0.6733 and 0.6675. Here, we follow the development of the ascending structure of August 7. The continuation of the upward movement is expected after the breakdown of the level of 0.6803. In this case, the first target is 0.6843. Short-term upward movement, as well as consolidation is in the range of 0.6843 - 0.6869. The breakdown of the level of 0.6870 should be accompanied by a pronounced upward movement. Here, the target is 0.6902. Consolidation is in the range of 0.6902 - 0.6922. For the potential value for the top, we consider the level of 0.6967. Upon reaching which, we expect a pullback to the bottom. We expect a consolidated movement in the range of 0.6762 - 0.6733. The breakdown of the level of 0.6733 will lead to the development of a downward structure. In this case, the potential target is 0.6675. The main trend is the ascending structure of August 7, the correction stage. Trading recommendations: Buy: 0.6805 Take profit: 0.6840 Buy: 0.6844 Take profit: 0.6867 Sell : Take profit : Sell: 0.6730 Take profit: 0.6680 For the euro / yen pair, the key levels on the H1 scale are: 119.40, 118.65, 118.22, 117.58, 117.16 and 116.54. Here, the price has canceled the formation of the ascending structure and at the moment, we are following the development of the local potential for the bottom of August 13. Short-term downward movement is expected in the range of 117.58 - 117.16. A breakdown of the latter value will allow us to expect movement to a potential target - 116.54. Consolidation is near this level. Short-term upward movement is expected in the range of 118.22 - 118.65. The breakdown of the last value will have the formation of an ascending structure for the top. Here, the first goal is 119.40. The main trend is the formation of a local descending structure of August 13. Trading recommendations: Buy: 118.22 Take profit: 118.62 Buy: 118.70 Take profit: 119.40 Sell: 117.56 Take profit: 117.18 Sell: 117.14 Take profit: 116.55 For the pound / yen pair, the key levels on the H1 scale are : 131.23, 130.57, 129.66, 127.94, 127.33, 126.48 and 125.57. Here, the price forms a pronounced potential for the development of the upward cycle of August 12. At the moment, the price is close to the cancellation of this structure. Short-term upward movement is expected in the range of 129.00 - 129.66. The breakdown of the latter value will lead to a pronounced upward movement. Here, the target is 130.57. For the potential value for the top, we consider the level of 131.23. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 127.94 - 127.33. The breakdown of the latter value will favor the development of a downward structure. Here, the first goal is 126.48. As for the potential value, we consider the level of 125.57. The main trend is building potential for the top of August 12th. Trading recommendations: Buy: 129.00 Take profit: 129.64 Buy: 129.67 Take profit: 130.55 Sell: 127.30 Take profit: 126.50 Sell: 126.44 Take profit: 125.60 The material has been provided by InstaForex Company - www.instaforex.com |

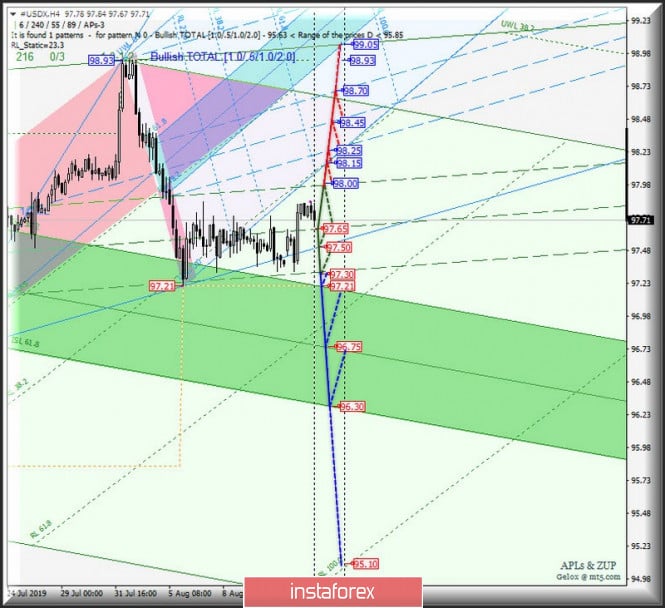

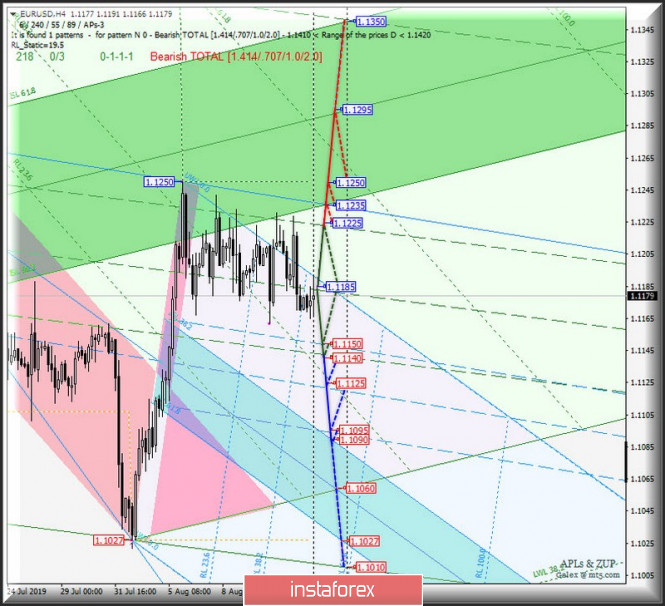

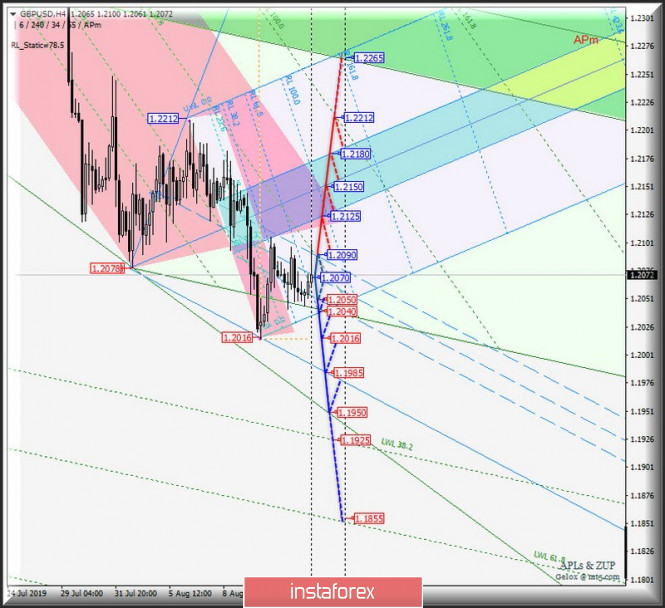

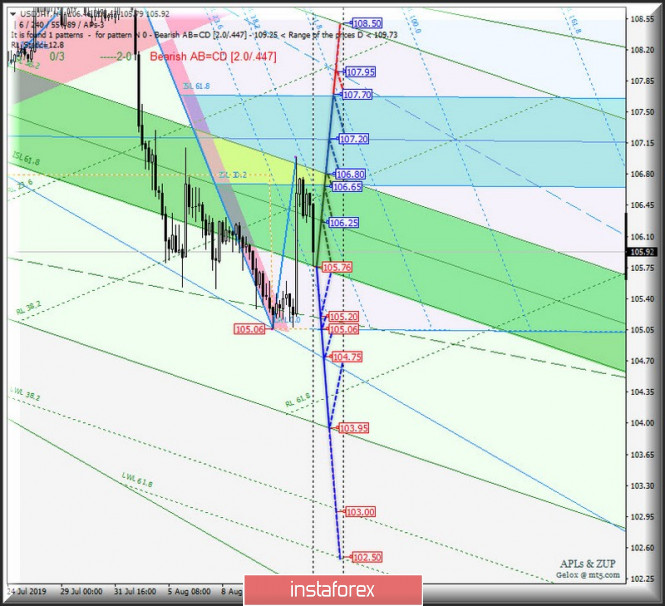

| Posted: 14 Aug 2019 05:07 PM PDT Let's see what the movement of the trading instruments EUR / USD, GBP / USD and USD / JPY , which have a specific gravity in calculating the dollar index #USDX 83.1%, will start from August 15, 2019. Minuette operational scale (H4 time frame) ____________________ US dollar index The development and direction of the breakdown of the boundaries of 1/2 Median Line channel (98.00 - 97.65 - 97.30) of the Minuette operational scale fork will determine the development of the movement of the dollar index #USDX from August 15, 2019. We look at the animated chart for the details of the movement inside this channel. A combined breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 97.30) and ISL38.2 Minuette (support level of 97.21) will determine the development of the movement of the dollar index in the equilibrium zone (97.21 - 96.75 - 96.30) of the Minuette operational scale fork. In the event of a breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 98.00), the Minuette operational scle pitchfork will make the development of the upward movement #USDX to the SSL start line (98.15) of the Minuette operational scale fork and the 1/2 Median Line Minuette channel boundaries (98.25 - 98.45 - 98.70). The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The development of the single European currency EUR / USD from August 15, 2019 will also be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.1150 - 1.1185 - 1.1225) of the Minuette operational scale fork. The details of the movement inside the 1/2 Median Line Minuette channel are shown in the animated graphics. The breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 1.1225) will determine the development of the movement of the single European currency to the boundaries of the equilibrium zone (1.1235 - 1.1295 - 1.1350) of the Minuette operational scale fork. The breakdown of the support level of 1.1140 (the lower boundary of the 1/2 Median Line Minuette channel) will direct the development of the EUR / USD movement to the goals - 1/2 Median Line Minuette (1.1125) - the lower boundary of the 1/2 Median Line Minuette channel (1.1095) - the equilibrium zone (1.1090 - 1.1060 - 1.1027) of the Minuette operational scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar The development of Her Majesty's GBP / USD currency movement from August 15, 2019 will be due to the development and direction of the breakdown of the 1/2 Median Line channel boundaries (1.2050 - 1.2070 - 1.2090) of the Minuette operational scale fork. We look at the animated chart for movement options within the specified channel. In case of breakdown of the resistance level of 1.2090, the development of Her Majesty's Currency movement will continue to the equilibrium zone (1.2125 - 1.2150 - 1.2180) of the Minuette operational scale fork with the prospect, after the breakdown of ISL61.8 Minuette (1.2180), to reach the local maximum 1.1221. In the case of a combined breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.2050) and the initial SSL line (1.2040) of the Minuette operational scale fork, the downward movement of GBP / USD can be continued to the targets - minimum 1.2016 - LTL Minuette control line (1.1985) - control line LTL Minuette (1.1950). The details of the GBP / USD movement can be seen on the animated chart. ____________________ US dollar vs Japanese yen Further development of the USD / JPY currency movement of the "country of the rising sun" from August 15, 2019 will depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (106.80 - 106.25 - 105.76) of the Minuette operational scale fork. The movement inside the equilibrium zone is marked on the animation chart. The breakdown of the support level of 105.79 at the lower boundary of the ISL61.8 equilibrium zone of the Minuette operational scale fork will make it relevant to continue the development of the downward movement of USD / JPY to the targets - the final Schiff Line Minuette (105.20) - minimum 105.06 - the control line LTL (104.75) of the Minuette operational scale fork - end line FSL Minuette (103.95). In case of breakdown of the upper boundary of ISL38.2 (resistance level of 106.80) of the equilibrium zone of the Minuette operational scale fork, the development of the USD / JPY movement will continue in the equilibrium zone (106.65 - 107.20 - 107.70) of the Minuette operational scale fork. We look at the details of the USD / JPY movement on the animated chart. ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

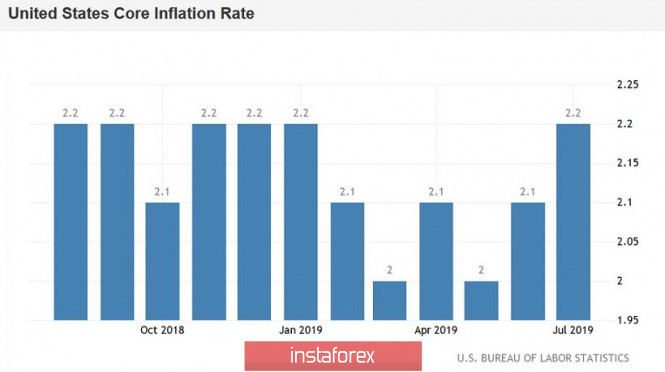

| Washington and Beijing loosened the nuts. A thin world or calm before a storm? Posted: 14 Aug 2019 04:45 PM PDT The unexpected decision of the US administration to delay the introduction of 10% tariffs on a number of goods imported into the United States from China revived the markets. Investors began to buy cheaper assets. Why did the White House retreat? Maybe the United States really wants to make concessions, or did they just see that Beijing was not afraid of their tariffs? It is enough to recall how China devalued the yuan quite simply in order to smooth out the negative effect of the duties introduced by the US. It is noteworthy that today the People's Bank of China raised the yuan to the dollar for the first time in two weeks - up to 7.0312. Previously, the regulator continuously depreciated the national currency, as a result of which it updated lows since the spring of 2008. Judging by the comments of Donald Trump, the US president's decision to postpone the introduction of new Chinese tariffs for a number of positions until December 15 is not a sign of progress in the Washington-Beijing trade negotiations, but rather a result of pressure from US companies. "We are doing this taking into account the upcoming Christmas holidays so that some of the duties do not hit consumers in the United States," he said. Thus, the head of the White House for the first time admitted that tariffs could harm the US economy. Goldman Sachs believes that Washington's departure from its original plan to levy duties on all Chinese exports to the United States is a reaction to the fall of US stock indices. According to Moody's, the recent events should not be seen as a de-escalation of the conflict between the United States and China: this is just a temporary delay. "D. Trump is afraid to look weak and unable to achieve the goal. In addition, he fears that his chosen strategy of a trade war with China will be ineffective both in the eyes of his own voters and China itself," reports the Chinese publication Global Times. "The US is making concessions as soon as negotiations between the two countries are on the verge of a complete break. Washington's latest softening said it recognizes that pressure tactics on Beijing aren't working," said Bai Ming, an analyst at the Chinese Academy of International Trade and Economic Cooperation. However, regardless of the White House's motives, the latest news from the trade front caused a stormy positive reaction from the markets, allowing US indices to win back the decline of the beginning of the week, and the greenback appreciably strengthened against major currencies, especially against the yen. The USD/JPY pair has broken the 106 mark. Data that was published yesterday also provided some support for the US currency, since the release showed the best (since 2006) two-month increase in core inflation in the United States. In July, the indicator increased by 0.3% in monthly terms and by 2.2% in annual terms. The fact that inflation accelerates after a sluggish start reduces the risks of aggressive easing of the monetary reserve monetary policy. The chances of a September cut in the federal funds rate by 50 basis points at once fell from 25% to less than 10%. The Fed leadership is becoming less likely to further lower interest rates. Today, the yen against the dollar has returned to growth amid continued geopolitical risks. Despite recent U.S. moves, markets are not waiting for a quick resolution to Washington and Beijing trade disputes, which put pressure on the entire global economy. Analysts also note the presence of geopolitical tensions in different regions of the world, which supports the demand for the yen. "Recent news provides more opportunities to strengthen the dollar and weaken the yen, but this does not mean that trade differences are resolved. In addition, there are many geopolitical risks, such as the situation in Hong Kong, the upcoming Brexit and the situation around Iran. Therefore, I do not expect significant demand for risky assets," said Tohru Sasaki, an analyst at JPMorgan Chase Bank. It is assumed that if China feels D. Trump's weakness and begins to dictate its conditions, then we will again see the corresponding market reaction, the opposite of the one observed yesterday. As for the main currency pair, it still remains within the wide lateral range. The gloomy results of recent studies of business sentiment in Germany today have been confirmed by actual economic indicators. According to Destatis, German GDP declined 0.1% in the second quarter compared to the first quarter. According to analysts, two negative quarterly indicators in a row will indicate a technical recession in the country, which is the locomotive of the entire European economy. However, the eurozone as a whole remains in relative safety: its GDP continued to grow in the second quarter, although only by 0.2% in quarterly terms. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Aug 2019 04:22 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 70p - 88p - 126p - 92p - 56p. Average amplitude over the last 5 days: 86p (90p). Over the past few days, we have repeatedly drawn the attention of traders to the fact that there are very few supporters of the hard Brexit in the UK. There are enough supporters of Brexit, but only few of hard Brexit. Simple numbers speak of this. If 52% voted for leaving the EU in a referendum in 2016, it is logical to assume that not all of them support Brexit without agreement. Accordingly, they agree to a "divorce" with the EU without a "deal" much less than 50%. Moreover, opponents of the hard Brexit are almost all the ministers of the former Cabinet before the arrival of Boris Johnson. Someone who opposes is the head of the Bank of England, Mark Carney, who has repeatedly warned that such a scenario of withdrawal from the jurisdiction of Brussels could be disastrous for Great Britain's economy. Also, if you look a little into the future, then not only economic problems await the UK, but also the possible losses of Scotland and Northern Ireland. Now ex-Minister of Finance Philip Hammond spoke about this issue. He said that leaving without an agreement is not what the citizens of Great Britain voted for in 2016. "Most citizens want to maintain their current standard of living and avoid losing jobs, and the lack of a deal now looks like a betrayal of the 2016 referendum," said Hammond. In addition, a report on inflation was published in the UK today, according to which the indicator accelerated to 2.1% in July instead of the forecast 1.9%. Good news, but not for the UK, in which inflation is now accelerating due to the pound's fall. If there had been no rapid depreciation of the British currency, then inflation would have been at the average European level, about 1.0% - 1.3%. Trading recommendations: The GBP/USD currency pair corrected once again to the Kijun-sen line and also went into the side channel. Thus, short positions that are aiming for 1.1986 remain relevant, and the bearish mood remains below the critical line. Pound sterling purchases are risky anyway. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. August 14th. Results of the day. Eurozone industrial production falls in June Posted: 14 Aug 2019 04:06 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 63p - 59p - 44p - 69p - 59p. Average amplitude over the last 5 days: 59p (63p). The third trading day of the week was held in exactly the same as the first two. The euro/dollar pair can not get out of the side band, although the Bollinger bands began to expand. However, it is difficult to say in which direction they started to expand; probably sideways. Thus, the bands' expansion indicates an increase in volatility and expansion of the side channel, but not about the beginning of any trend. Change in industrial production for June was published in the eurozone today. It turns out that the most optimistic forecasts, predicting a reduction of 1.2%, were not destined to come true. Industrial production in Europe fell by 2.6% yoy and 1.6% mom. The preliminary value of GDP for the second quarter was fully consistent with analysts' forecasts, + 1.1% yoy, however, given the decline in industrial production, a drop in GDP can also be predicted, as the value for the second quarter is not final. Such statistics could well bring down the euro currency, however, it was not enough for traders to return to the foreign exchange market. Nonetheless, the pair was in a flat for 5 days. Therefore, we can say that the euro was lucky today. However, growth prospects for this currency remain very deplorable. It is still not clear why the EU currency can show growth against the US dollar only if America and Trump begin to help the euro in this. Donald Trump can or at least really wants to help, because he does not need an expensive dollar, and through the Federal Reserve he cannot lower the dollar as much as he wants. However, through the incitement of trade wars, which negatively affect the economic performance of the United States, and through the eternal pressure on the Fed, Trump can still slightly lower the dollar. But for now, participants in the forex currency market are still leaning toward new euro-currency sales and dollar purchases. Trading recommendations: EUR/USD continues to trade inside the side channel. Thus, it is recommended to wait for the completion of the flat, the expansion of the Bollinger bands in one direction. Only after that will it be possible to return to trading on the euro/dollar pair. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

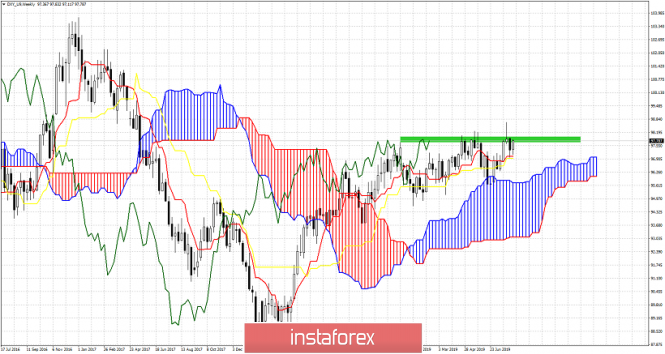

| The Dollar index remains in bullish trend but still unable to recapture the 98 level. Posted: 14 Aug 2019 10:13 AM PDT The Dollar index is making higher highs and higher lows on a monthly basis. Price has retraced 61.8% of the 103.77 to 88.22 decline. Bulls have made several attempts to break and capture the 98 level but each time price has reversed.

Green rectangle - resistance area The weekly chart above with the Ichimoku indicator tells us that same thing. Although price has managed to move briefly above 98, the weekly result was to get rejected. In Ichimoku cloud terms price is in a bullish trend as price is above the Kumo. Price is also above both the tenkan and the kijun -sen indicators. These indicators are now at 97 which is key support. Breaking below 97 could lead to a test of the upper cloud boundary at 95.70-96. For now trend remains bullish with no sign of reversal. Another rejection and reversal from the 97.70-98 area would be a bearish sign. The material has been provided by InstaForex Company - www.instaforex.com |

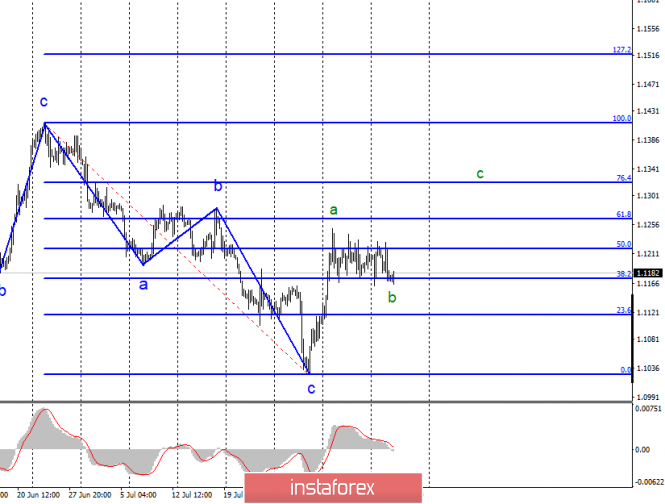

| EURUSD bullish pennant pattern canceled. Posted: 14 Aug 2019 10:08 AM PDT EURUSD has broken below 1.1165 and has canceled our bullish pattern. This means now that we are looking either at a reversal from the 61.8% Fibonacci retracement level or the continuation of the down trend targeting 1.10 and lower.

Red lines - bearish channel EURUSD is at the 50% Fibonacci retracement of the last upward leg. Short-term trend is bearish again and as long as price is below 1.12-1.1230 we do not turn bullish. Support by Fibonacci is at 1.1111 and if bulls fail to hold above it, then we the chances for a move towards 1.10 and lower increase dramatically. If support holds and prices bounce, then we could see the second leg higher we expect towards 1.13-1.1350. For now bears are in control of the short and medium-term trend. The RSI is trading inside a bearish channel and as long as we do not see an upward break out we remain pessimistic. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold recaptures important price levels for continuation of up trend Posted: 14 Aug 2019 09:54 AM PDT Gold price is above $1,510 again after shaking both bulls and bears yesterday with a volatile trading day first reaching $1,535, then plummeting to $1,480 and closing at $1,501. As we said in our last post it is key for bulls to recapture $1,510 if they want to see price heading towards $1,550.

Green rectangle - key support Gold price has broken above the $1,510 level we pointed out as key yesterday after the fake break out. Gold bulls are in control as risk off in equity markets supports Gold despite strengthening Dollar. Trend remains bullish. Holding above $1,510 is key for the short-term trend. Key support for the bigger trend is at $1,494-90. Breaking below this level will open the way for a move lower towards $1,450 at least. The material has been provided by InstaForex Company - www.instaforex.com |

| August 14, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 14 Aug 2019 08:41 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where temporary bullish rejection was demonstrated before bearish breakdown could take place on July 31. On July 31, Temporary Bearish breakdown below 1.1115 allowed further bearish decline towards 1.1025 (lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with bullish target projected towards 1.1115, 1.1175 and 1.1235. During the past week, the depicted Key-Zone around 1.1235 has been standing as a prominent Supply Area where TWO Bearish Engulfing H4 candlesticks were demonstrated. Earlier this week, another bullish visit was demonstrated towards 1.1235 where another episode of bearish rejection was anticipated. Thus, the EUR/USD was trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout occurred earlier Today. Bearish breakdown below 1.1175 is mandatory to allow further bearish decline towards 1.1125-1.1115 where another intermediate-term bullish position can be offered (The right shoulder of the expected reversal pattern). Trade recommendations : Conservative traders should wait for a deeper bearish pullback towards 1.1125-1.1115 for a valid BUY entry (where the right shoulder of the reversal pattern is expected to be located). S/L should be placed just below 1.1080 while initial T/P levels should be located around 1.1160 and 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| August 14, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 14 Aug 2019 08:20 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (the lower limit of the movement channel) which failed to provide consistent bullish demand for the GBP/USD. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2100 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Last week, temporary signs of bullish recovery were being demonstrated around 1.2100 before Friday when another bearish movement could be demonstrated towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025) bringing the GBP/USD pair back towards 1.2100 (recently-established SUPPLY Level). This is supposed to enhance further bullish advancement towards 1.2230 then 1.2320 if sufficient bullish momentum is demonstrated above 1.2100. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2100 then above 1.2230 for counter-trend BUY entries. Conservative traders should wait for bullish pullback to pursue towards 1.2320 - 1.2350 for new valid SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

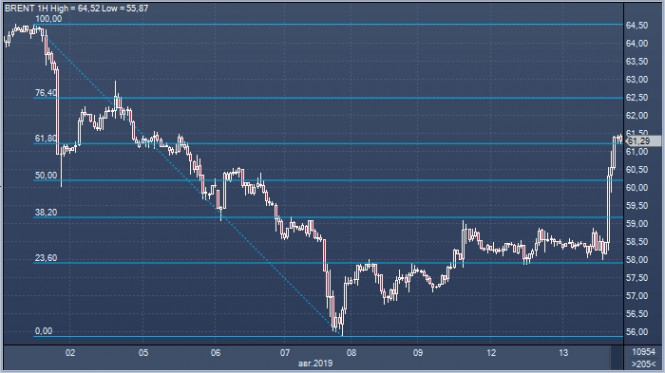

| The rise in oil prices by 5% – a consequence of easing the "tariff impact" of the United States Posted: 14 Aug 2019 07:51 AM PDT

The market for black gold was under the influence of conflicting factors. Among them, experts include the increase in the volume of shale oil production in September this year in the United States, as well as the postponement of the introduction of tariffs for Chinese goods by the US authorities. On Tuesday evening, August 13, the price of oil soared: the price of Brent rose by 5%, to a maximum from August 5 this year. For the reference-grade they gave was $61.50 per barrel. The cost of WTI light crude oil increased by 4.11% to $57.20 per barrel. According to the US Department of Energy, next month, the production of shale oil in the country's largest fields will increase by 85 thousand barrels to 8.768 million barrels or 1.1%. According to experts, the current situation puts pressure on the price of black gold. The largest increase in production is expected at the American Permian field – by 75 thousand barrels, up to 4.423 million barrels per day. The reason for the positive market sentiment was the news that the US authorities postponed the deadline for introducing a 10% duty on some Chinese goods for $ 300 billion. Earlier, it was reported that the tariffs will begin to operate from September 1, 2019. However, on Tuesday, it became known that several Chinese goods, including laptops and phones, will be exempted from duties until December 15 this year. Some products will not be affected by tariffs. Saudi Arabia is also concerned about the struggle for the global black gold market. According to Khalid al-Dabbagh, financial director of the largest oil company Saudi Aramco, oil exports in August and September this year will be about 7 million barrels per day. To implement this project, the company will need to increase the capacity of the East-West oil pipeline by 2 million barrels per day. This decision was made to ensure the reliability of supplies and increase the export of oil from the ports of the red sea, reducing them at the terminals of the Persian Gulf. Saudi Aramco plans to hold an IPO soon. Initial public offering (IPO) is an additional incentive for Saudis to raise oil prices, analysts believe. Experts' concerns are caused by the possibility of American shale oil producers. Economists find it difficult to predict how effectively American oil shale companies will be able to continue to increase production at current commodity prices. Note that prices have become much lower than in April 2019. Nevertheless, many analysts believe that the increase in shale oil production will have a positive impact on the market.

|

| USD/JPY. The yen is back on the horse: the situation in the debt market provoked panic Posted: 14 Aug 2019 07:50 AM PDT The anti-risk sentiment "rule the ball" in the financial markets again. Although Donald Trump postponed the introduction of additional duties on Chinese imports until December 15, traders' concerns about the impending global economic crisis are only growing. On the wave of general nervousness, the demand for protective assets, including the Japanese currency, is growing. After all, following the slowdown in key indicators in Europe and China, another alarming signal was received. Thus, the yield of two-year US Treasury securities fell below 10-year today – for the first time in the last 12 years. Also, in early August, the yield of 10-year Treasuries fell below the yield of three-month bonds. This fact seriously alarmed the market participants, as similar trends were observed in anticipation of the 2008 crisis. Not only then: over the past 70 years, the inversion of the curve preceded almost all recessions in the States – the signal was false only in the mid-sixties (but even then the American economy slowed significantly).

Against the background of panic, the market became interested in the yen again. After the release of data on the growth of US inflation, the pair USD/JPY showed a significant correction to the border of the 107th figure (the pair passed more than 200 points to the North). But today, the southern trend reminded itself – the yen is again a favorite of the foreign exchange market. Even such possible prospects as a rate cut by the Bank of Japan do not deter investors. The situation in the US debt market has a wider impact not only on the dynamics of the foreign exchange market but also on the stock and raw materials. According to some experts, the inversion of the yield curve is an early warning signal: the time gap between lightning and thunder is from 6 to 10 months. But here, it is worth recalling that the talk of the impending recession over the past year and a half arise on the market regularly. For example, in March last year, the yield curve was in the process of flattening (the difference in rates narrowed): the differential of ten-year and two-year Treasuries decreased to 0.54%. Reacting to this fact, the pair USD/JPY similarly fell by more than 200 points, from the 106th to the 104th figure (to be more precise, to 104.60). Then the impending economic recession began in December 2018 – the yield of 10-year bonds fell to multi-month lows, and the yield spread of 10-year and 2-year Treasuries fell to a minimum of more than 10 years. The narrowing of the spread between short and long-term US government bonds was discussed earlier – both in 2016 and in 2017, expressing corresponding concern. But then the spring expanded again, and the market switched to other fundamental factors. On the one hand, such an excursion into the recent history allows us not to panic today, on the other hand, it is still alarming that such signals are being given by the American debt market more often. The last time the yield curve of Treasuries with terms of 3 months and 10 years was inverted in March this year: first, the yield of 3-month bonds coincided with the indicator of 10-year government bonds (at 2.455%) and then exceeded this value. The situation in the stock markets of other countries also indicates a certain trend – government bonds with long maturity are becoming more expensive, while their yields are declining. In particular, for the first time in history, the yield of 30-year German government securities decreased by 10 basis points to -0.002%. Similar trends are observed in other countries, particularly in the UK. Thus, there is a general nervousness in the foreign exchange market, which is associated with fears of a slowdown in the global economy and the risk of a repeat of the crisis of 11 years ago. Against this background, the Japanese currency is in demand again, despite the announced "thaw" in relations between the US and China. According to some experts, the "point of no return" has already been passed, and the temporary postponement of new duties will not change the situation as a whole. The barriers have been on the rise for more than a year, and this fact provoked a domino effect, which in the end can lead to a recession of the American economy (and not only the American one).

Given these prospects, many fundamental factors are relegated to the background. In particular, the growth of US inflation was drowned out by panic about the inversion of the yield curve. The postponement of the introduction of new duties also did not have a proper impact on the market – the anti-risk sentiment in the markets continues to grow. Thus, the current fundamental background contributes to the strengthening of protective instruments, where the yen is the undisputed favorite. If traders' nervousness about the "return of 2008" will increase, the pair USD/JPY will not only update the low of this week but also test the main support level of 104.90 (the lower line of the Bollinger Bands indicator on the daily chart). The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.14.2019 - New momentum down and possible more downside Posted: 14 Aug 2019 06:25 AM PDT Industry news: Over the past years, many bodies have published data on massive wealth concentration in an otherwise decentralized Bitcoin network. Some of these reports have identified that less than five percent of all bitcoins addresses hold about 95 percent of all bitcoins. Research published in 2017 by How Much showed that 1 percent of those addresses had control over half of the bitcoin market. Joining the ranks of those studies is TruStory, a platform for users to research and validate people's claims online. The startup's Founder and CEO Preethi Kasireddy on Tuesday shared new statistics about bitcoin's so-called wealth disparity problems. She noted that now 2 percent of addresses control 80 percent of the cryptocurrency's supply. Daily analysis:

My first yesterday's target at the price of $10.620 has been reached. Anyway, there is a still chance for mode downside and potential test of my secondtarget at the price of $9.400. The downward started after the breakout of the 5-day balance in the background and the breakout is still active for at least few days. Important levels to watch: Yellow rectangle – Support $10.600 Yellow rectangle – Support 2 ($9.410) Green middle of the Bollinger --Sell zone on the rally ($11.000-$11.150) 4H time-frame analysis:

Based on the 4H time-frame, I found new momentum down on the MACD oscillator, which is sign of the new money selling. Anyway, the stochastic oscillator is showing temporal oversold condition and that is why the best idea in my opinion is to wait for rally and sell after the potential bullish correction. Level around $11.000 seems like a good zone to sell. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 08.14.2019 - Shakeout in the background, more uspide yet to come Posted: 14 Aug 2019 06:05 AM PDT Gold did drop strongly yesterday and the price tested the level of $1.480 but it got fast rejection, which is sign that .buyers are still present and that the used the drop to load even more long positions. The breakout of the level of $1.507, did confirm more potential upside on the Gold and potential re-test of $1.530.

Important levels to watch: Yellow rectangle – Important support ($1.507) Orange horizontal line – Swing high ($1.531) Based on the 1H time-frame, I found the up breakout of key short-term resistance at the price of $1.506, which is good sign for further upward movement. MACD oscillator turned to be into positive territory, which is another good confirmation for the further upside. Short-Mid and long term trends are bullish and my advice is to go with the direction of the overall trend. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 08.14.2019 -Thrid rejection of the key restiance at 1.2100 Posted: 14 Aug 2019 05:46 AM PDT GBP/USD reached our yesterday's targets at 1.2070 and 1.2040 and after that it went to re-test again important resistance at 1.2100. Since I found the strong rejection of the resistance cluster at 1.2100, I still expect more downside.

Important levels to watch: Green rectangle – Major resistance cluster (1.2100) Yellow rectangle – Support 1 (1.2040) Blue horizontal line – Support 2 (1.2015) Based on the 1H time-frame, I found overbought condition and down flip on the stochastic oscillator, which is good confirmation for my downward bias. As long as the resistance at the price of 1.2100 is holding, you should watch for selling opportunities on the rallies with the targets at 1.2040 and 1.2016. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of USD/CHF for August 14, 2019 Posted: 14 Aug 2019 04:30 AM PDT Pivot point: 0.9733 Trend: downtrend The USD/CHF pair has broken support at the level of 0.9780 which acts as a resistance now. The USD/CHF pair continues to move downwards from the areas of 0.9780 and 0.9733. The RSI is still signaling that the trend is downward, while the moving average (100) is headed to the downside. Accordingly, the bearish outlook remains the same as long as the EMA 100 is pointing to the downtrend. The bias remains bearish in the nearest term testing 0.9660 or lower, since the market is still in an uptrend. We still prefer the bullish scenario. Today, the USD/CHF pair is continuing to move in a bearish trend from the new support level of 0.9660, to form a bearish channel. Amid the previous events, we expect the pair to move between 0.9733 and 0.9660. Therefore, sell below the daily pivot point the level of 0.9878 0.9733 the first target at 0.9660 in order to test the daily support 1. The market will decline further to 0.9660 in order to return to the double top. Additionally, a breakout of that target will move the pair further downwards to 0.9583. However, if a breakout happens at 0.9780, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Through thorns to the stars: gold has crossed the bar at $1,500 Posted: 14 Aug 2019 04:00 AM PDT The rapid growth in the cost of yellow metal causes market players to be surprised, bordering on delight. Experts predict a further rise in "gold" quotes. They do not exclude that the immediate goal of the growth of the precious metal will be the mark of $1920 for 1 ounce. On Tuesday, August 13, yellow metal quotes crossed the upper boundary of the key channel of the daily trend in the range from $1477.04 to $1510.11. A technical mid-term target of $1,514.40 was broken later. At the moment, gold continues its upward movement with the main target at $1920.75, which was 2011 high. In the long term, quotes are expected to grow to the level of the main trend target of $2205, calculated on the basis of current market volatility. Many analysts attribute the growth of "gold" quotes to the protracted trade conflict between the United States and China. They are confident that gold will go up until a ceasefire in US-China trade relations sets in. In the current situation, experts in the market of precious metals recommend choosing a certain position for gold and stay in it for some time, watching the dynamics of the market. They are confident that the cost of the yellow metal will continue to grow. The reason for this is a total distrust of state institutions and the financial system. This is a global trend, experts say. They emphasize that the unstable geopolitical situation creates an increased demand for protective assets, primarily gold. Considering the further dynamics of the price of precious metals, experts believe that a local fracture in a growing trend may occur in September 2019. At the moment, the gold market is very overheated and it will need a correction in the near future. However, analysts do not expect a long fall. Most likely, gold will gain a foothold in the new range, consolidating before continued growth. The precious metal is currently trading at $1,512 per ounce with a long-term goal of $1,920 per ounce, experts concluded. |

| Silver recovers from position squeeze, buy on dips Posted: 14 Aug 2019 02:40 AM PDT Silver volatility increased sharply on Tuesday following the announcement from US Trade Representative Lighthizer that tariffs on some important categories of Chinese imports, including electronics, would be delayed until mid-December from the beginning of September. As risk appetite strengthened sharply, investors showed lower demand for safe haven assets including precious metals. There was an immediate position squeeze as traders rushed to close long positions, thus pushing the silver price down. From 12-month highs at $17.50 per ounce, silver declined sharply to lows near $16.50. There was still solid support on dips and silver edged back above $17.00 per ounce in Europe on Wednesday. Markets have taken a less euphoric attitude towards the US trade announcement amid fears over an underlying slowdown in the global economy. US equity futures have dipped again with S&P 500 futures shedding almost 0.50%. There has also been fresh demand for US benchmark 10-year Treasuries whose yields retreated to 1.65%. So, demand for safe haven assets is likely to remain strong amid fears over the global outlook, especially after a run of disappointing data. China's industrial production slumped to a 17-year low. Global bond yields have also continued to decline with German 10-year yields at a fresh record low after the German economy contracted 0.1% in the second quarter. Silver will be vulnerable to some extent due to fears that weak industrial production and disruption to supply chains will undermine commercial demand. This is more likely to curb gains rather than lead to net losses. In historic terms, the gold/silver ratio remains close to 10-year highs which will provide important protection. Technically, demand for silver is likely to remain buoyant on any fresh retreat to $16.80 per ounce.

|

| Control zones for USD/CHF pair on 08/14/19 Posted: 14 Aug 2019 02:35 AM PDT Today, the pair is testing the 1/2 control zone and defines the resistance of 0.9775-0.9765. In the case of the formation of a "false breakdown" pattern, the downward movement will again become a priority. It is better to refrain from sales since the instrument is located within the lower monthly control zone. The probability of earning beyond the average move is below 70%, which makes short positions unprofitable. In the event of a decrease and retention of the price below 1/2 WCZ, it is better to find more favorable prices for the purchase of the instrument if a decrease occurs. An alternative model for changing the downward priority to the upward one will be formed if the closing of today's US session occurs above the level of 0.9775. This will allow you to search for purchases with any decrease with the probability of updating the week's high above 70%. It is important to understand that the breakdown of the 1/2 WCZ will lead to testing the zone of the average weekly move and in most cases, it will cause the growth to stop until the end of the current week. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| UK inflation data underpins sterling, sell EUR/GBP on rallies Posted: 14 Aug 2019 01:58 AM PDT Tuesday's labour market data was mixed with unemployment increasing to 3.9% from 3.8% while there was a larger-than-expected increase in employment to fresh record highs. Average earnings data beat market expectations with a headline increase of 3.7% in the year to July while the core rate strengthened to an 11-year high of 3.9% from 3.6%. The CPI inflation rate increased to 2.1% for July from 2.0% previously and above expectations of 1.9%. The core inflation rate also increased to 1.9% from 1.8% the previous month. The combination of strong wages growth and a higher-than-expected inflation rate will make it more difficult for the Bank of England to justify any cut in interest rates, especially as the impact of recent sterling's weakness has not shown up yet in the inflation data. The sterling ticked higher after the inflation data, but EUR/GBP remains above 0.9250 with GBP/USD near 1.2070. Political factors still dent market sentiment on the sterling as markets are still fretting over the risk of a 'no-deal' Brexit at the end of October. The government is pushing ahead with an aggressive stance towards the EU and demanding major concessions on the Northern Ireland backstop. Prime Minister Johnson insists that the UK will leave on October 31st with or without a deal. There are major divisions within the Conservative Party and there is the likelihood of a major battle within the House of Commons when parliament returns from recess at the beginning of September. The underlying sentiment on the pound sterling will remain very fragile while these political fears continue. The euro zone, however, also faces serious risks from Brexit as well as a political crisis in Italy. Second-quarter data also confirmed that the German economy contracted in the second quarter. However, there will be an important lack of liquidity over the next two weeks during the peak holiday season. Therefore, there will be an increased threat of position squeezes and very choppy trading.

|

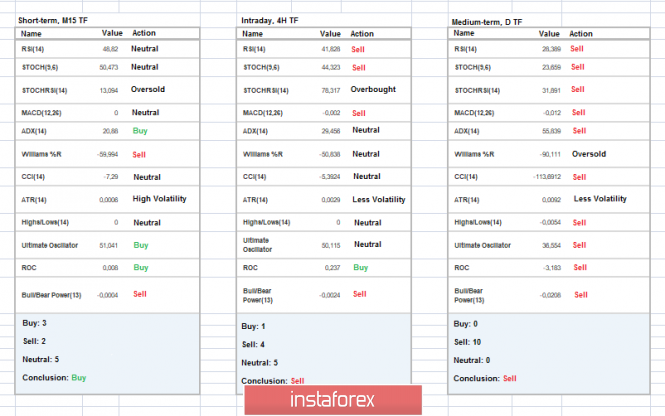

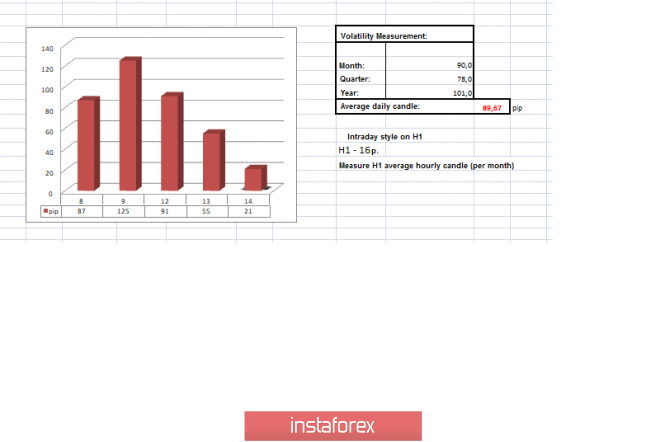

| Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 14) Posted: 14 Aug 2019 01:40 AM PDT Over the past trading day, the pound / dollar currency pair showed a low volatility of 55 points, resulting in a small amplitude in the rollback phase. From the point of view of technical analysis, we see that the quote has formed a pullback from the psychological level of 1.2000 towards the lower boundary of 1.2100 / 1.2200 of the previously completed cluster. The slowdown, which has already occurred in the form of an after-fact, was reflected in the periodic ceiling of 1.2100, which in this case, plays the role of resistance in the market. As discussed in the previous review, traders took profits from short positions at the time of the decline to the psychological level of 1.2000, after which they switched on the "wait" mode, which was justified by the risk of a rollback correction. Considering the trading chart in general terms (daily timeframe), we see the "Impulse" clock basis with a stop within the level of 1.2000. The global downward trend remains unchanged, where the quote, in principle, still has a place to fall, but the fact that the Impulse phase has dragged on for so long scares the market participants. However, there are no signs of recovery of the pound. The news background of the past day had a considerable package of statistics. Let's start with the UK, where labor market statistics were published. The UK unemployment rate accelerated from 3.8% to 3.9%, the first increase in three reporting periods since the beginning of the year. On the other hand, the number of applications for unemployment benefits decreased from 31.4K to 28.0K, and the average level of wages, taking into account and excluding premiums, grew to 3.7% and 3.9% inclusive. As the pound reacted to the statistics package, short-term growth should be expected. In the afternoon, the key indicator for the market came out. The inflation rate in the United States, and so, we have here an acceleration from 1.6% to 1.8%, which, of course, pleased speculators. As a result, sellers returned to the market. The information background, in turn, continued to procrastinate the UK & EU divorce proceedings, where this time, the "empty" pill of hope was thrown by the US national security adviser, John Bolton, who is on an official visit to London. The administration officials said that John Bolton and UK Treasury Secretary Sajid Javid are discussing the possibility of concluding a temporary deal for 6 months between Washington and London, which would affect the entire economy. Only it is necessary considering such a moment that this agreement will come into force after Brexit, the next day. Now, we recall the earlier statements of Washington under Theresa May, where they stated that the agreement already allegedly exists, and as soon as Brexit occurs, it will immediately enter into force, and now we are talking about a temporary period of 6 months, where during this time, the parties will agree on a full-fledged free trade agreement. What to say, such steps give us to think about many things. In particular, the further decline of the British currency. Today, in terms of the economic calendar, we have data on the level of inflation in the United Kingdom, where, according to preliminary forecasts, a slowdown is expected from 2.0% to 1.9%. There is silence in the United States today. Thus, we are engaged in analyzing the information background. Further development Analyzing the current trading chart, we see that after the recovery process, the quotation stopped within 1.2040 / 1.2065 (H1 timeframe), which signals a certain willingness in terms of movement. The very psychological level of 1.2000 both stood and stands, that one can judge the delay in the process of stagnation and chatter within 1.2000 / 1.2100. Traders, in turn, do not make sudden movements and do not try to speculate on minor fluctuations. A wait position is the most optimal strategy in the current time span. It is likely to assume that the amplitude fluctuation within 1.2000 / 1.2100 will still remain for some time, which will make it possible to prepare for the main course of the market. Regarding current thoughts, the situation is as follows: if the accumulation process is delayed, I do not exclude a return to the recent accumulation of 1.2100 / 1.2200, which, in principle, will not be something critical and will not change the general mood of the market. The main idea and the goal is to clearly fix the price below the psychological level of 1.2000, which will make it possible to further reduce. Summarization of the available information in the trading recommendations: - We consider buying positions in terms of a deeper stop, where in case of fixing prices higher than 1.2100, we will be pulled towards 1.2150-1.2200. - We consider selling positions in terms of the continuation of a downward trend, where a clear price fixing is necessary below the psychological level of 1.2000, with an inertial move to 1.1980-1.1950, after we consider entering the direction 1.1850-1.1700. Indicator analysis Analyzing a different sector of timeframes (TF), we see that the indicators in the short term signal an upward interest, but it looks like it is to pull the indicator by the ears. Meanwhile, the intraday and medium-term outlook remains downward against the general market background. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (August 14 was built taking into account the time of publication of the article) The volatility of the current time is 21 points, which is a low value for this time section. It is likely to assume that a waiting position is taking place at this time, possibly due to the proximity of the positioning news background. The volatility of the day will obviously increase, but whether it can overcome the daily average, everything will depend on what position the market will take: expectant or breakdown of the level. Key levels Resistance zones: 1.2150 **; 1.2150 **; 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1.3300 Support Areas: 1,2000; 1.1700; 1.1475 ** * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Aug 2019 01:37 AM PDT The American president again showed himself in all its glory, softening the backdrop of the US trade war with China. Unexpected news from the US Department of Commerce that new import duties on Chinese imports will not be introduced, primarily electronics products, mobile phones until December 15 of this year. Also, negotiations with the Chinese side have resumed that inspired financial markets, which caused rapid growth in stock markets in the United States, positive dynamics in Europe and even today the rise of Asian stock indices. The propensity to buy risky assets was not even stopped by data on the growth of consumer inflation in America. According to the data presented, the consumer price index in annual terms rose above expectations by 1.8% compared with the previous value of 1.6% and a forecast of an increase of 1.7%. On a monthly basis, the indicator grew in July in line with expectations by 0.3% against the June value of 0.1%. Also, the numbers and the basic consumer price index did not lag behind, which reflect changes in prices for goods and services, except for food and energy. This indicator shows the changes from the point of view of the consumer. In July, the value of this indicator increased by 0.3% against the forecast of a decrease in growth to 0.2%, which turned out to be in line with expectations. But its annual value showed an increase of 2.2% from 2.1% for the previous reporting period. The published values of consumer inflation were completely ignored by markets on Tuesday since all investors focused on the news on US-Chinese trade relations. However, bidders are unlikely to be able to completely abandon these important values, which in fact can bury investors' hopes that the Fed will continue to lower interest rates. But this is when we look at the overall situation without the impact of the trade conflict between Washington and Beijing. While markets are wholly at the mercy of this factor, they believe that the regulator will be forced to accept further rate cuts and the positive may remain. Incidentally, futures rates on the Fed show this probability of 95.0%. In general, observing everything that is happening in the markets, it can be said that the uncertainty factor for the prospects of resolving the trade crisis will continue. In this case, according to investors, the Federal Reserve will still be forced to lower interest rates at the September meeting, which will halt the growth of the dollar and may even become the basis for its local decline. Forecast of the day: The USD/CAD pair found support at 1.3200. We do not expect continued growth in oil prices. In addition, inflation data in the United States support the dollar. Given this, we believe that the pair will turn up and continue to grow first to 1.3290, and then to 1.3335 if it holds above 1.3200. The AUD/USD pair is turning down amid local strengthening of the US dollar due to strong data on consumer inflation in the United States. Price reduction below the level of 0.6755 may lead to the resumption of the fall in prices to 0.6680. |

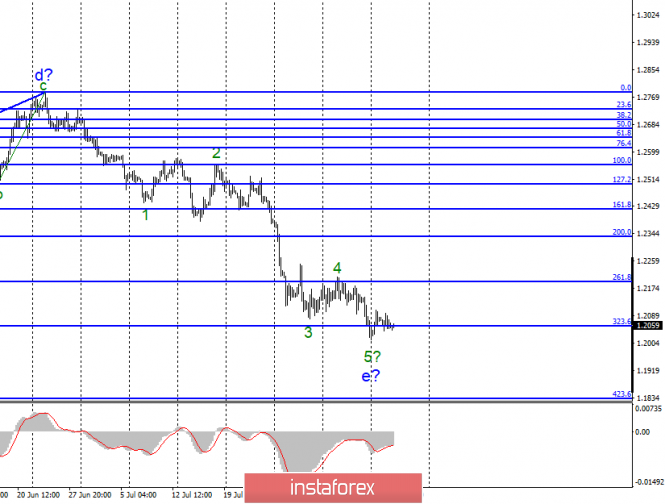

| Posted: 14 Aug 2019 12:52 AM PDT EUR / USD Tuesday, August 13, ended for the EUR / USD pair with a decrease of 40 bp, which does not specify the current wave counting. As before, the euro-dollar pair remains within the framework of constructing the proposed wave b as part of at least a 3-wave upward trend section. An obstacle to the construction of a wave c can only be a news background that supports the US currency with enviable regularity. For example, yesterday in America, the inflation report for July was higher, which turned out to be higher than the expectations of the foreign exchange market. And today, it became known that Donald Trump "relented" on China and postponed the introduction of duties for $ 300 billion from September 1 to December 15. It should be understood that Trump now needs to think not only about the trade war with China, but also about the voters, because new presidential elections are coming already in 2020, and Trump really wants to be re-elected for a second term. However, preliminary polls and studies show that Trump is unlikely to win the presidential race. Accordingly, the current president of America should think about how to increase his political rating. The rise in the price of goods from China that are in demand in America will be negatively perceived by the electorate. Therefore, under the auspices of caring for the population on the eve of the Christmas holidays (which are still a few months away), Trump has postponed the introduction of regular duties. Purchase goals: 1.1264 - 61.8% Fibonacci 1.1322 - 76.4% Fibonacci Sales goals: 1.1027 - 0.0% Fibonacci General conclusions and trading recommendations: The euro-dollar pair continues to build the upward trend section. Thus, I recommend buying a pair with targets near the calculated levels of 1.1264 and 1.1322, which is equal to 61.8% and 76.4% according to Fibonacci signal, and based on the MACD signal upwards, counting on the construction of the ascending wave s. GBP / USD On August 13, GBP / USD pair lost several base points. A rather sluggish departure of the pound-dollar quotes from the reached minimums indicates the willingness of the foreign exchange market to continue to get rid of the pound further. If this is true, then the decline in the instrument will continue with targets located near the Fibonacci level of 423.6%. The wave e, in this case, will take an even more complex form. The news background continues to support precisely the American currency, creating strong pressure on the British currency. Thus, wave marking for a long time already implies the completion of the bearish trend. However, markets continue to get rid of the pound, which leads to a regular complication of the downward set of waves. Sales goals: 1.2056 - 323.6% Fibonacci 1.1830 - 423.6% Fibonacci Purchase goals: 1.2783 - 0.0% Fibonacci General conclusions and trading recommendations: The downward section of the trend became more complicated, and the pound-dollar pair made a successful attempt to break through the 323.6% Fibonacci level. Despite the fact that the wave e again looks complete, it can take an even more complex form. Thus, with the new MACD signal down, I recommend selling a pair with targets near the 1.1830 mark, which corresponds to 423.6% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Rising American inflation, Trump's "kindness" and the phlegm of the dollar Posted: 14 Aug 2019 12:15 AM PDT Yesterday, the euro-dollar pair was under pressure from many "bearish" factors, but the price could not fall below the support level of 1.1170 (the middle line of the Bollinger Bands indicator on the daily chart) - the downward impulse faded in this price area. By and large, the EUR/USD pair did not leave the wide-range flat despite the abundance of information drivers in favor of the dollar. It is noteworthy that the American currency now enjoys support from both the external and internal fundamental backgrounds. The main news yesterday was the White House announcement saying that Washington is postponing the introduction of 10 percent duties on some Chinese goods, including computers, game consoles, children's toys, computer monitors, items of shoes and clothes, until December 15. Additional duties were supposed to take effect on September 1, but Trump "deigned" to postpone this fact until Catholic Christmas. The president argued that the White House "does not want to hurt buyers from the United States on the eve of Christmas holidays." It is worth noting here that Donald Trump is an experienced businessman and quite often applies the experience of entrepreneurship in political relations. For example, at the end of last year, just a week before the start of the next negotiations with China, he prudently "raised the rates", threatening to introduce new duties by $ 237 billion - from January 1. Thus, he expanded the range of upcoming negotiations, while duties not yet introduced became an element of "bargaining" with Xi Jinping. In this case, Trump resorted to a similar maneuver, delaying the introduction of additional tariffs until the completion of the next stage of negotiations. Now, a peculiar Damocles sword will be hanging over the Chinese side in the form of 300 billion duties. The American president has repeatedly implemented a similar scheme and not only with the Chinese, but also with the Mexicans. And if Mexico almost backtracked, China turned out to be a "tough nut": Beijing responded to verbal threats with concrete actions, such as the release of yuan for the key mark of 7.00 and froze the purchase of American agricultural products. Therefore, two weeks before the "X-hour," the White House suddenly remembered the Americans and the Christmas decade. Be that as it may, the fact remains that additional trading duties will not be introduced on September 1, and most likely this year. This fact returned the risk appetite to the market, supporting the US currency. It is also worth noting that the USD/CNY pair fell quite sharply from 7.064 to 7.014. This fact also indicates that the next period of the so-called "thaw" is beginning in relations between the US and China. Support for the US currency was also provided by macroeconomic reports. The general consumer price index showed good dynamics, rising to 1.8% in annual terms (with a growth forecast of up to 1.7%) and to the level of 0.3% on a monthly basis. However, core inflation, excluding food and energy prices, showed more significant growth. In monthly terms, the indicator grew to 0.3%, and in annual terms, it jumped to 2.2%. This has been the strongest growth rate in the last 6 months. The increase in core inflation was primarily due to higher prices for clothes, rising prices for airline tickets, household goods, and health services. However, it was not without a fly in the ointment. The positive impression of this release was spoiled by a rather weak increase in earnings. Thus, the real average hourly wage grew by only 1.3% (the previous value was 1.5%), and the average weekly wage rose to 0.8% after the previous increase of 1.2%. Let me remind you that it was Jerome Powell who focused on the growth rate of salaries following the results of the last Fed meeting. According to regulator members, the July easing of monetary policy will allow to "disperse" this indicator. It is worth noting that the dollar reacted very modestly to yesterday's events. Despite a slight strengthening throughout the market, along with the euro, the greenback remained in the price range of 1.1160-1.1240, in the region of its lower border. There are several reasons for this. Firstly, the growth of July inflation is unlikely to stop the Fed members from lowering the interest rate by 25 bp. in the fall, especially against the background of weak growth in wage levels. After yesterday's release, traders have not actually changed their minds regarding the prospects for easing of monetary policy parameters in Autumn. Hence, the dollar remains under background pressure. As for Trump's actions, his decision was predictable. As I said above, this is not the first time he has resorted to such methods, therefore, yesterday's announcement did not cause a stir in the market. Besides, the fact that the introduction of duties has been delayed does not solve the problem as a whole since both China and the United States continue to defend their positions. In the context of the upcoming presidential election, we can assume that the Chinese will "keep the defense" further. Thus, if the EUR/USD bears do not consolidate below the 1.1160 mark in the near future, then the price will most likely return to the borders of the 12th figure. In general, the pair continues to trade within the price range of 1.1140-1.1260. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis and forecast for EUR/USD, AUD/USD, and GBP/JPY on August 14 Posted: 14 Aug 2019 12:09 AM PDT EUR/USD After the completed downward wave, the upward wave structure from August 1 looks promising. Its potential allows us to wait for the continuation of the rise on a larger scale of movement. A flat correction has been formed in the wave structure since August 6. The price is at the upper limit of strong support. Forecast: In the next session, a flat mood of price movement is possible today. Possible pressure on the support area. In the afternoon, a reversal and the beginning of the price rise are expected. Recommendations: In the next session, selling the euro makes sense only with "pipsing" transactions today. In the support area, it is recommended to track the reversal signals of your vehicle to find entry points in long positions. Resistance zone: - 1.1230/1.1260 Support zone: - 1.1160/1.1130

AUD/USD The direction of the short-term "Aussie" trend is indicated by the last, unfinished wave of July 19. In its structure, a counter upward section is formed, the current wave level of which at the time of analysis does not go beyond the correction. In the structure of the wave from yesterday, within the framework of the last part (C,) a pullback develops. Forecast: In the next trading session, the price of the pair expects a flat mood of movement with a downward vector. The breakthrough of the lower boundary of the zone is unlikely. The change of the movement vector can be expected in the afternoon. Recommendations: The pair's sales may be risky due to the expected slow down. In the area of the support zone, it is recommended to focus on the signals of buying the instrument. Resistance zone: - 0.6840/0.6870 Support zone: - 0.6780/0.6750

GBP/JPY The bearish trend that started in March continues on the cross chart. Since August 5, in the framework of its last section, a counter correction of the wrong kind is formed. Its structure currently looks fully formed. The downward section, which began yesterday, has a reversal potential. Forecast: Today, the most likely flat mood of the price movements of the pair between the nearest opposite zones. After a possible attempt to put pressure on the support zone, a general upward movement vector is expected. We can expect a return to the bearish rate by tomorrow. Recommendations: When buying a pair today, it is necessary to take into account the probability of counter-rollbacks. It is more reasonable to lower the lot. It is safer to refrain from trading transactions and look for the sell signals at the end of the price rise. Resistance zone: - 129.20/129.50 Support zone: - 128.30/128.00

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Attention: The wave algorithm does not take into account the length of time the instrument moves. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment