Forex analysis review |

- "Viral" rate cuts apply to Asia-Pacific

- Balancing the abyss: New Zealand dollar is on the verge of falling

- Storm in a glass or are investors' fears for the fate of the global and US economies justified?

- China has moved on to threats. What to expect from the yen?

- GBP/USD. August 15. Results of the day. Pound received the long-awaited news support

- EUR/USD. August 15. Results of the day. US retailers knocked out the euro

- AUDUSD trapped inside trading range

- EURUSD at important Fibonacci support

- Gold price remains in a bullish trend with $1.568 the next target

- BTC 08.15.2019 - New momentum down and possible more downside

- EUR/USD for August 15,2019 - Downward brekaout of 6-day trading range

- Gold 08.15.2019 - Gold in the buy zone

- Firm US data encourage investors, USD/JPY support on dips

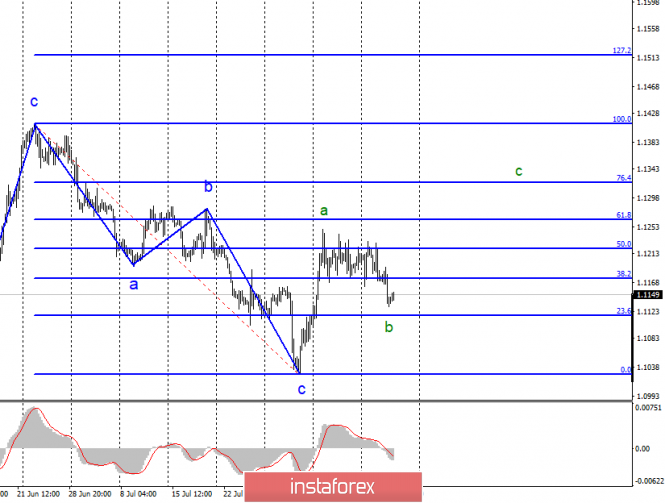

- August 15, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

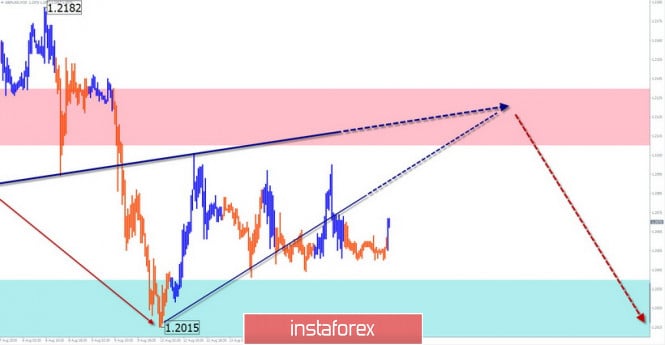

- August 15, 2019 : The GBP/USD is probably going to achieve a bullish breakout above 1.2230.

- Inversion: hope for the best but prepare for the worst

- GBP/USD. Corbyn is preparing a plot against Johnson, the pound shows restrained optimism

- Technical analysis of GBP/USD for August 15, 2019

- The dollar is in demand as a reserve currency in the conditions of impending economic chaos (We expect a resumption of the

- Panic is growing, the yen and the Canadian dollar are trying their best to stay in the range

- Simplified wave analysis and forecast for GBP/USD, USD/JPY, and USD/CHF on August 15

- Demand for protective assets is growing, focus is on the yen

- Analysis of EUR / USD and GBP / USD for August 15. Economic performances of the European Union continue to disappoint the

- Job gains boost Australian dollar, risk conditions crucial

- Forecast for Bitcoin and US dollar on August 15th. The collapse of bitcoin is caused by a massive outflow of one-day investors

| "Viral" rate cuts apply to Asia-Pacific Posted: 15 Aug 2019 04:56 PM PDT Several central banks in the Asia-Pacific region have sharply reduced their interest rates. Many regulators are ready to follow their example, since mitigation in the US and Europe provides them with a certain freedom of action. It is worth noting that the Asia-Pacific regulators not only responded to changes in the policies of the ECB and the Fed, but also try to anticipate their next steps. They expect the ECB to implement the planned measures, and possibly reduce the rate by the Federal Reserve at the September meeting. The Bank of New Zealand cut the rate from 1.5% to 1%, although the markets did not expect such a generous surprise. We can say that in this way the regulator paved the way for a similar easing of monetary policy in Australia. In this regard, the AUD/USD pair is prone to further decline from a fundamental point of view, despite the fact that its recovery is observed on Thursday. The growth was facilitated by positive data on the country's labor market. On Wednesday, data were published indicating an increase in wages in Australia. However, this is not enough to accelerate inflation. The moderate wage growth, coupled with the current unemployment rate, suggests that the RBA will lower the rate again by the end of this year. "It is reasonable to expect that a long period of low interest rates will be required for progress towards reducing unemployment and confidently moving towards the target inflation rate," said the head of the Australian central bank following a meeting in early August. The expectation of a softening of the RBA's policy makes the aussie vulnerable. Growing signs of global recession The heads of the world central banks are making efforts to stimulate the economy in connection with the growing risks of a global recession. Compounding negative expectations, the US-China trade conflict is becoming increasingly violent. However, it is far from the fact that cheap money will help to change the situation for the better, but the central bank is not backing down. High rates support exchange rates, while the United States, Europe and China are struggling to keep their national currencies in check. The central bnk of Switzerland and England, which are issuers of two reserve currencies, also came under general influence. For example, for Switzerland, which recently initiated interventions to weaken the franc, this would mean further immersion in the negative zone. The Bank of England not so long ago spoke of its intention to tighten its monetary policy. Unlike other industrialized countries, Britain is facing inflationary pressures, but the growing uncertainty about Brexit is forcing the central bank to follow the worn-out path - lowering rates to mitigate the effects of an erratic exit from the European Union. The US market fell amid another inversion of the yield curve. In the UK, the yield on 2-year government bonds increased by one basis point, and on 10-year bonds, it decreased by 2 basis points, also reversing this curve. Inversion does not always and not immediately acts as a guarantee of an immediate recession. However, given extremely pessimistic data (such as a decline in German GDP), markets may succumb to real panic. The material has been provided by InstaForex Company - www.instaforex.com |

| Balancing the abyss: New Zealand dollar is on the verge of falling Posted: 15 Aug 2019 04:43 PM PDT According to most analysts, the currency of New Zealand shows a downward trend. The current state of the market forms a "bearish" trend in relation to the "kiwi", which cannot but worry investors. The situation was largely influenced by the decision of the Reserve Bank of New Zealand (RBNZ) to reduce the rate immediately by 50 basis points (bp), to 1%. The regulator explained the sharp decrease in the rate by the aggravation of the trade conflict between the US and China, as well as the loss of momentum in the New Zealand economy. The RBNZ believes that the current wage growth remains weak. At the same time, inflationary expectations are reduced, and low levels of business confidence indicate a slowdown in wage growth and low employment. The New Zealand economy, which is predominantly export-oriented, is very vulnerable in the context of the escalation of the trade confrontation between Washington and Beijing. Many participants in international financial markets have expressed concern that a slowdown in economic growth and the threat of recession will spread throughout the world. Analysts believe that in the next few months, the global cycle of lower rates will gain momentum. In this situation, we should expect further easing of the monetary policy of the RBNZ, analysts warn. Most economists believe that before the end of this year, the regulator can lower the interest rate at least twice. According to experts, such a measure will negatively affect the rate of the New Zealand dollar. The next meeting of the Reserve Bank of New Zealand, dedicated to monetary policy issues, is scheduled for September 24, 2019. Until this time, the Kiwi and the NZD/USD pair will remain under pressure, analysts are certain. They believe that the short-term dynamics of NZD/USD will be determined by both the state of the US currency and economic events in the Asia-Pacific region, including news about the trade conflict between the United States and China. At the moment, the NZD/USD pair is trading near the mark and the local support level of 0.6430, which is the low since October 2018. The high probability of a further reduction in the RBNZ rate puts pressure on NZD/USD towards its decrease, forming a steady "bearish" trend. A breakdown of the local support level of 0.6430 could cause a further drop in the NZD/USD pair, analysts warn. They recommend that traders observe short positions in the kiwi. Further growth of the NZD/USD pair is unlikely if the Fed does not begin a cycle of aggressive reduction in interest rates due to instability in the financial markets. In the medium term, the New Zealand currency expects a bearish trend, analysts say. The material has been provided by InstaForex Company - www.instaforex.com |

| Storm in a glass or are investors' fears for the fate of the global and US economies justified? Posted: 15 Aug 2019 04:42 PM PDT The departure of German GDP to negative territory, weak statistics on China, as well as the growth of the global debt market to a new record high of $16 trillion, raised investor concerns for the fate of the global economy and sent the US stock market to a peak. As a result of Wednesday, US stock indices lost an average of 3%. The publication on German GDP for the second quarter, released on the eve, confirmed analysts' forecasts, however, the very fact of a decrease in the indicator by 0.1% in quarterly terms made a strong impression on investors. The figures indicate that the German economy is turning from the "locomotive" of the eurozone into the weakest link and needs not only monetary, but also fiscal incentives. However, while the increase in government spending and tax cuts in Germany are still in doubt, the ECB may launch another program of quantitative easing next month. This puts serious pressure on the bulls on EUR/USD. Meanwhile, the US economy is still in good shape. The fact that it does not have such phenomena as the bursting of the dot-com bubble, the mortgage crisis and financial instability, supports the greenback. The only concern is the inverse of the yield curve of US government bonds. For the first time since the global financial crisis of 2008, the yield on ten-year bonds was lower than the yield on two-year bonds. This phenomenon is usually perceived as a harbinger of recession in the US economy. It is important to understand that, although each recession was preceded by an inversion, not every inversion signals a recession. False positives sometimes occur. According to a Credit Suisse study, even in the worst case scenario, 22 months can elapse before a recession. Now, it would be easy to ignore the signal of the yield curve if the world economy grew, and bright time awaited us, but this is not so. Any of such negative factors as the escalation of the US-China trade war, Brexit, Hong Kong protests and political problems in Italy could lead to a recession. According to experts, regardless of the duration of the inversion of the yield curve, the risk of a recession in the US economy in the current cycle is higher than ever. The emergence of the inversion of the curve also indicates an increase in expectations of a rapid reduction in rates by the Fed. "The Federal Reserve can make a difference, and the market clearly says that the regulator should lower the interest rate three times, and then the yield curve will look right. I think this is what the central bank must do so that the US economy continues to develop, it will support foreign markets. At the same time, I don't see anything good in that even after the tax reform and against the backdrop of a growing economy, we are in a cycle of lowering rates - this is all the result of the White House's foreign policy," said Ross Gerber, co-founder of investment company Gerber Kawasaki. At first glance, the postponement of the entry into force of "Chinese" tariffs and the acceleration of US inflation should outweigh the concerns about the global recession. However, the Fed has lately been paying more attention to international risks, and not to trade wars and internal statistics. If the US central bank continues to operate in the same vein, the potential for lowering the EUR/USD pair will be limited to 1.1-1.11. |

| China has moved on to threats. What to expect from the yen? Posted: 15 Aug 2019 04:28 PM PDT Either officials from Beijing do not follow Donald Trump's twitter, or they decided to ignore his call and go on the escalation of the conflict. On Thursday, the Chinese Treasury said the increase in US duties on domestic goods violates the consensus reached by the parties and makes it impossible to resolve the conflict through negotiations. Therefore, China has no choice but to take the necessary countermeasures. At the same time, the official department did not say what kind of measures are in question. Analysts have already taken the news into circulation and are trying to predict the next steps of the Chinese and the consequences that the United States will face. It is believed that in the near future Beijing will nevertheless increase duties on goods from the United States, but they will not bring much damage to the US economy. China has already raised duties on $110 billion worth of goods, while a negligible $10 billion remained intact." It is possible that China will have to reduce their purchase of Treasuries, continue the devaluation of the renminbi and limit the supply of rare earths to the US. Meanwhile, the Chinese press calls Donald Trump's concession a manifestation of weakness. The media says there is plenty of irony over how the aggressive strategy of the owner of the White House failed. What does the defensive yen say? After a short break, the US currency continues to lose against the Japanese yen. An attempt to gain a foothold above 106.50 was a failure. Traders and investors have little faith that the two giants will manage to overcome trade differences and sign a bilateral agreement. Additional pressure on the dollar has a decrease in the yield of the national debt market. The yield on 10-year Treasuries dipped to 1.6%. The yield spread of the "two-year" and "ten-year" has already dropped below zero. The inversion of the yield curve is obvious. In turn, it signals an approaching recession. It is worth noting that since the beginning of August, the US market has already twice shown the most serious one-day decline in a year. Until August 14, the most negative one-day dynamics was recorded on August 5. The reason is the aggravation of the US-China trade conflict. On Thursday, markets evaluate data on retail sales, applications for unemployment benefits and the dynamics of industrial production. Another batch of weak statistics will increase concern about a slowdown in US GDP growth. Such a development of events will push Treasury yields even further and force the Federal Reserve to ease the monetary policy. The continuing tension in trade relations, together with the prospect of a more active reduction in rates, make the USD/JPY pair an excellent candidate for a bear rally. You can look at around 104.50. |

| GBP/USD. August 15. Results of the day. Pound received the long-awaited news support Posted: 15 Aug 2019 04:12 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 88p - 126p - 92p - 56p - 56p. Average amplitude over the last 5 days: 84p (86p). The GBP/USD pair's growth for today is a breath of fresh air for the pound. In fact, there is only one reason for the strengthening of the British currency - this is a strong UK retail sales report for July. In annual terms, the indicator grew by 3.3% with a forecast of +2.6%, in monthly terms it added 0.2% with market expectations of -0.2%. True, the effect of a strong report was slightly offset by a similar report from the US, where real values also exceeded forecasts, but nonetheless. For the pound, now and such a growth - for happiness. There is a second factor that partially offset the strength of the retail sales report. Most Britons have been actively preparing for the "hard" Brexit over the past two months, buying up food, medicine, and essentials. This explains the growth in sales, which turns out to be partly artificial. Well, the pound's current growth only looks like a small timeout. The most interesting thing in the UK will begin in two weeks, when MPs will return from the summer holidays and Parliament will resume work. The Brexit procedure will again enter the active phase and a confrontation between Jeremy Corbyn and Boris Johnson will begin in the government. We already wrote earlier that the Labour leader openly expresses resistance to the hard Brexit and, accordingly, to Prime Minister Johnson. Corbyn openly declares his desire to declare a vote of no confidence in Johnson, but he should be supported by Parliament. All these political wars will begin in September, exactly 2 months before the official date for the United Kingdom to leave the EU. Actually, the main question now is whether the Parliament will be able to resist the initiatives of Boris Johnson and save the country from a disordered Brexit? Would it like to? Brexit cannot last forever, the government has shown a surprising inability to work together and produce results in the last year. Meanwhile, every additional month of delay brings Britain closer to a crisis, from which the country will recover more than a year. Well, the number of possible options for what will happen in the next two months is huge: starting from the Parliamentary elections, the resignation of Boris Johnson, ending with a new postponement of Brexit. On the technical side, it's too early for bulls to celebrate the victory. The pound has grown by only 75 points, but these points can be the beginning of an upward correction, which can be saving and give a respite for a couple of weeks. In general, the pound continues to remain near record lows. Trading recommendations: The GBP/USD currency pair has started an upward correction. Thus, long positions are formally relevant now with targets at resistance levels of 1.2147 and 1.2192, however, transaction volumes should be minimal. It's best not to take any chances and generally refuse to buy the British pound, no matter how attractive the current levels may seem. It is not known how Brexit will end. It is possible that in two and a half months we will catch the pound at parity with the US dollar. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

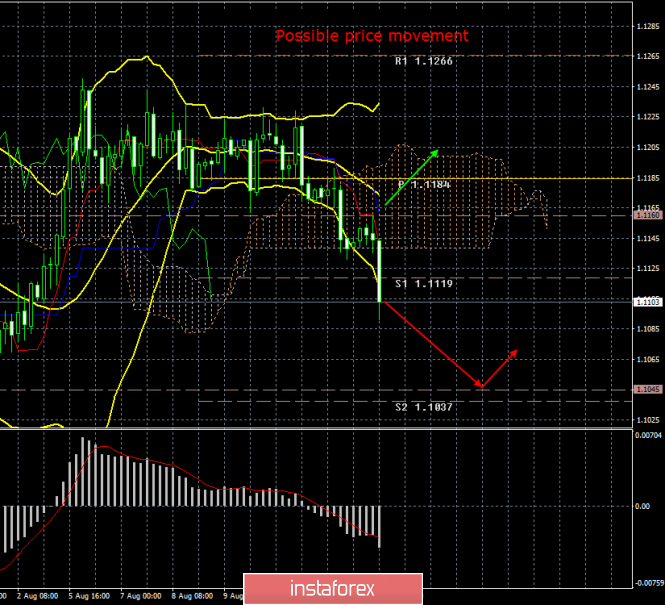

| EUR/USD. August 15. Results of the day. US retailers knocked out the euro Posted: 15 Aug 2019 03:52 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 59p - 44p - 69p - 59p - 60p. Average amplitude over the last 5 days: 58p (59p). The EUR/USD pair ended Thursday, August 15, with another fall. This time, sales of the euro currency were triggered by a strong macroeconomic report on US retail sales in July, which grew by 0.7% in monthly terms, and excluding car sales - by 1.0%, although traders expected growth of 0.3% and 0.4%, respectively. Sales in the "control group" subset grew 1.0% in July, although analysts forecasts were also lower. Thus, in recent weeks, statistics from the US openly pleases the markets. The only thing that does not please the markets is Donald Trump's actions in the international arena, the escalation of the trade conflict with China, which makes the stock market in the "red zone". But fortunately for traders in the foreign exchange market, the skirmishes between Beijing and Washington are not noticeable. But Donald Trump must be furious, since the US dollar is growing again, the ECB does not support the euro in any way, and he does not need it, and the US president can do nothing with high demand for the greenback. There have already been rumors that, under the patronage of Trump, currency interventions can be launched to pull down the dollar, but so far this has not come to this. Thus, Trump's hope remains only on the Fed, which, in his opinion, should lower the rate at least three more times. Meanwhile, more and more traders and analysts are discussing a possible recession into which the United States and the entire world economy could fall. Too many in recent months and years have happened geopolitical, trade conflicts and disagreements in the world. Inflation is not high enough in both the European Union and the US, and China's GDP is slowing down, which is already a reason for panic. However, we are interested in all these factors only in the context of the euro/dollar pair. And here everything is much simpler, since the Fed and the ECB are ready to soften the monetary policy, and collapses in the US stock market, as we see, do not particularly affect the dollar in the foreign exchange market. However, due to good statistics, the Fed may not reduce the rate quickly and sharply. Powell already noted that the regulator will respond to economic indicators, and not just lower the rate, following the requests of Trump. Therefore, macroeconomic statistics and the technical picture remain as the main factors. From a technical point of view, the Ichimoku indicator generated a new "dead cross" sell signal, and the price crossed the Ichimoku cloud, so the way down is open. Trading recommendations: The EUR/USD pair resumed the downward movement. The support level of 1.1119 can be overcome at the current bar. Thus, it is now recommended to sell the euro with a target level of 1.1045, which is located in close proximity to the pair's 2-year low. Buying euros is now impractical. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

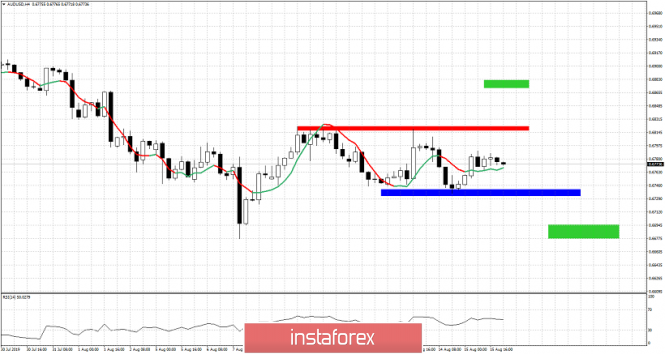

| AUDUSD trapped inside trading range Posted: 15 Aug 2019 03:18 PM PDT AUDUSD is trading inside a trading range between 0.6820-0.6735. Soon a break out above this range will most probably give a 150 pip move towards the breakout direction.

Blue rectangle - support Red rectangle - resistance AUDUSD is mainly moving sideways. As long as this situation remains the same, we remain neutral waiting for a signal. Short-term resistance levels are found at 0.6790 and at 0.6820. Support is found at 0.6735. Buying near support and selling near resistance levels could prove to be profitable if price continues to swing like that. The material has been provided by InstaForex Company - www.instaforex.com |

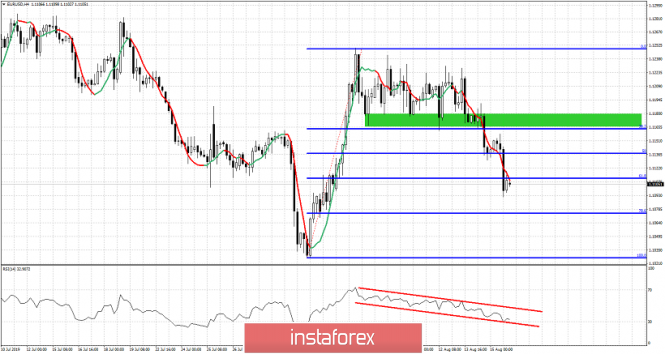

| EURUSD at important Fibonacci support Posted: 15 Aug 2019 03:12 PM PDT EURUSD has broken below the 1.1165 support while short-term trend remains bearish. Price is now challenging important Fibonacci support level. A bounce off this area is very probable. Bulls need to hold above 1.1073.

Green rectangle - resistance (previous support) EURUSD is trading just above 1.11. Price is marginally below the key support of the 61.8% Fibonacci retracement. Moving lower and further away from the 61.8% level, will increase chances of breaking below 1.1050-1.10. Trend is bearish. Bulls need to recapture the 1.1165-1.1185 area in order to get a small win. In order for short-term trend to change to bullish we need to see at least a move above 1.1225-1.1235. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price remains in a bullish trend with $1.568 the next target Posted: 15 Aug 2019 03:07 PM PDT Gold bulls have managed to recapture the key resistance level of $1,510 and as expected price continues to new higher highs. Price is inside bullish short-term channel and we should expect to see $1,550-70 area soon. Bulls however need not be very overconfident.

Green line - major long-term support Blue line - medium-term important support With a weekly RSI at 84.10 and Gold making higher highs and higher lows, we remain long-term optimistic but cautious in the short-term Gold price is targeting $1,568 where the recent rise from $1,266 will be equal to the rise from $1.160 to $1,346. There is no reversal sign yet but the overbought RSI and some short-term bearish divergence signs make me want to be prepared for a deeper than usual pull back. First important short-term support is found at $1,500-$1,510. Breaking below this level will be the first weakness sign. As long as price holds above it then we should expect to see $1,568 or even higher. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.15.2019 - New momentum down and possible more downside Posted: 15 Aug 2019 10:22 AM PDT Industry news: The cryptocurrency market sentiment is hitting rock-bottom as of late with the Cryptocurrency Fear & Greed Index hitting a 244-day low. This level has not been seen since December 13, 2018, when Bitcoin (BTC) collapsed to $3,000. Technical view:

My second downward target at the price of $9,170 has been reached and there is a chance for more downward movement. Yellow rectangle – Support ($9,170) Magneta rectangle –Support 2 and downward target ($8,070) Green lines – Bollinger band MACD is showing the new momentum down on the oscillator, which is good indication for further downside continuation move. Watch for any decent rally on lower frames to establish new selling positions. Main target is set at the price of $8,080/ The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for August 15,2019 - Downward brekaout of 6-day trading range Posted: 15 Aug 2019 09:23 AM PDT EUR/USD did break the 6-day balance to the downside and it is down breakout mode. There is still more downside yet to come in my opinion and potential test of 1.1035.

Green rectangles – Balance boundaries Blue rectangle – Resistance (1.1130) Magenta rectangle – Swing low support (1.1035) EUR did establish lower highs and lower lows, which is clear sign for me that trend is downward and that supply is in the control. Usually, when we are in the breakout mode, I would wait for 3-5 days before any short-term long entry. I would watch mostly for selling positions on the rallies. Key swing low is set at 1.1035. Stochastic oscillator is holding into extreme low reading but that is normal due to the breakout of bracket. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 08.15.2019 - Gold in the buy zone Posted: 15 Aug 2019 08:41 AM PDT Gold price continues to trade sideways inside the flag pattern. I expect more upside to come on the Gold due to strong underlying bullish trend.

Red line – expected path Blue rectangle – Resistance 1 ($1,533) Blue rectangle – Resistance 2 ($1,550) Yellow rectangle – Support ($1,505) Gold price continues to trade inside the range of the flag pattern. Support is at $1,505 and resistance at $1,533. The break above $1,523 could give us a target of around $1,533-$1,550. Bulls are in control I so far I don't see any reversal signal. As long as the Gold is trading above the $1,505 level, you should watch for long positions. MACD is holding into positive territory, which is good confirmation for my long bias... The material has been provided by InstaForex Company - www.instaforex.com |

| Firm US data encourage investors, USD/JPY support on dips Posted: 15 Aug 2019 06:27 AM PDT Headline US retail sales increased 0.7% in July, above consensus forecasts of 0.3%, although there was a marginal downward revision of June's data. Underlying sales increased 1.0%, above expectations of 0.4% and the control group also posted strong growth of 1.0%. The Philadelphia Fed manufacturing survey declined to 16.8 for August from 21.8 previously, although this was above consensus forecasts. There was strength in new orders, although employment growth slowed sharply. The New York Fed manufacturing index rose marginally to 4.8 from 4.3 previously as new orders moved into positive territory. Employment indices remained subdued and pricing pressures eased. Initial jobless claims increased to 220,000 from 211,000 previously. The data improved overall market sentiment and Treasuries retreated following the releases. Although the 10-year yield was still below 1.60%, the yield curve nudged back into positive territory. There was a rebound in US equity futures after heavy losses recorded on Wednesday. Following the data, the chances of a 0.50% rate cut at September's meeting declined to around 31% from 36% ahead of the data. The dollar secured limited gains with USD/JPY trading around 106.20 after again finding support near 105.80 while EUR/USD retreated to 1.1140. Volatile trading will remain inevitable with further fluctuations on trade and currency rhetoric. Risk conditions will remain brittle at best. However, USD/JPY held up better than expected during Wednesday's downturn on Wall Street, increasing speculation that Japan's Finance Ministry may have been orchestrating some dollar buying by major domestic institutions. On a very short-term view, USD/JPY has scope for support in the 105.80-106.00 band with selling pressure at 106.75.

|

| August 15, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 15 Aug 2019 05:54 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where temporary bullish rejection was demonstrated before bearish breakdown could take place on July 31. On July 31, Temporary Bearish breakdown below 1.1115 allowed further bearish decline towards 1.1025 (lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with bullish target projected towards 1.1115, 1.1175 and 1.1235. During the past week, the depicted Key-Zone around 1.1235 has been standing as a prominent Supply Area where TWO Bearish Engulfing H4 candlesticks were demonstrated. Earlier this week, another bullish visit was demonstrated towards 1.1235 where another episode of bearish rejection was anticipated. Thus, the EUR/USD was trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred Yesterday. Bearish persistence below 1.1175 is promoting further bearish decline towards 1.1125-1.1115 where another intermediate-term bullish position can be offered (The right shoulder of the expected reversal pattern). Trade recommendations : Conservative traders should wait for a deeper bearish pullback towards 1.1125-1.1115 for a valid BUY entry (where the right shoulder of the reversal pattern is expected to be located). S/L should be placed just below 1.1080 while initial T/P levels should be located around 1.1160 and 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

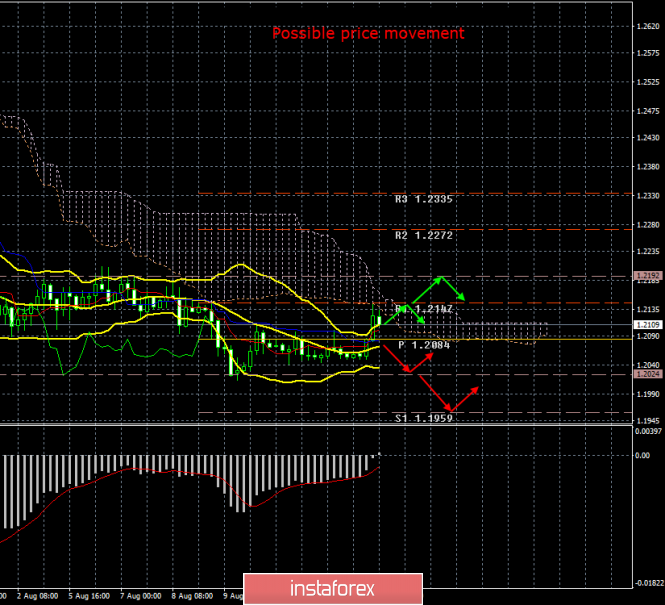

| August 15, 2019 : The GBP/USD is probably going to achieve a bullish breakout above 1.2230. Posted: 15 Aug 2019 05:46 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (the lower limit of the movement channel) which failed to provide consistent bullish demand for the GBP/USD. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2100 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Last week, temporary signs of bullish recovery were being demonstrated around 1.2100 before Friday when another bearish movement could be demonstrated towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025) bringing the GBP/USD pair back towards 1.2100 (recently-established SUPPLY Level). This is supposed to enhance further bullish advancement towards 1.2230 then 1.2320 if sufficient bullish momentum is demonstrated above 1.2100. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2100 then above 1.2230 for Intradaycounter-trend BUY entries. Conservative traders should wait for bullish pullback to pursue towards 1.2320 - 1.2350 for new valid SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

| Inversion: hope for the best but prepare for the worst Posted: 15 Aug 2019 04:55 AM PDT Market sentiment worsened after data from China and Germany showed the extent of damage caused by trade wars. Risk-appetite fell, throwing the gold to new heights. There is also the inversion of the yield curves of 2-year and 10-year US government bonds. Traders and investors perceive this news as a signal of an almost imminent recession in the coming months. It is worth noting that the inversion of the yield curve affected the UK government, which also increased pressure on the stock markets. The worst thing about this situation is that market concerns about the recession may eventually fuel further demand for safe havens, further exacerbating the anxiety of stock markets. However, as we can see, financial market participants avoid sharp dynamics. The EUR/USD pair fell from 1.12 to 1.1150 in the previous two days, while the stock markets walked on a rather bumpy road with big shocks. The GBP/USD exchange rate is almost in place for the fifth session in a row. The growth of the Japanese yen was less impressive than its previous decline, although the pair is closely correlated with the dynamics of the stock markets. An ounce of gold rose to $1.520, but the precious metal failed to cover the highs of the environment. Oil went below $59 but continues to record a series of higher intraday lows. It seems that outside the stock and debt markets, the sentiment is far from panic. Investors have hopes that the World Central Bank, and especially the Fed, will take the necessary measures to mitigate monetary policy. Stock indices in Hong Kong and Shanghai moved away from local lows, gaining about 1.4% intraday. Futures on the S&P 500 also come to life, showing an increase of 0.7%. Market participants take themselves together and in the absence of new disturbing news, may well return to cautious purchases, "digesting" the news about the inversion of the yield curve. Euro The main currency pair does not show a trend. The forces of the "bulls" and "bears" are constantly balanced, which leads to already rather fed up "laterals". But it is worth noting that the euro is the only currency that gives signals to the exit. On Wednesday, EUR/USD quotes left the range in which they were from August 5. Since the output was very calm, without strong impulses, the risk of returning to this range remains, unless, of course, the minimum of the last session is rewritten. If the main pair is returned to the range, you can look at the sales. Pound In the forex market, the GBP/USD pair is dominated by balance. On the one hand, there is a strong resistance for GBP at 1.2096, on the other hand, there is good support at 1.2050. The risks of disorderly Brexit may again outweigh all available factors and the British pound will go out of range. The probability of a "hard scenario" has increased to 60%. This should add pessimism to the market. Despite the fact that there is a mark of 1.10 for the GBP/USD pair in many forecasts of the world's leading banks, the quotes have a chance of recovery, although not this year. |

| GBP/USD. Corbyn is preparing a plot against Johnson, the pound shows restrained optimism Posted: 15 Aug 2019 04:55 AM PDT The pound is paired with the dollar within the 20th figure, although the GBP/USD bears made cautious attempts this week to reduce the price to the base of this level. To continue the development of the southern trend, sellers of the pair need to overcome the support of 1.2000 and, accordingly, gain a foothold in the 19th figure. In this case, the GBP/USD pair will change the price corridor, opening up new horizons – up to the 15th figure. But this is not such an easy task: the last time the pair fell to a multi-year low (1.1986) in January 2017, when the British Supreme Court ruled that the government needed the consent of parliament to start the country's exit from the European Union. More than two years later, the pound returned to the region of record low price levels, and thanks to Brexit again. The only difference is that this time, the British Parliament acts as the "savior" of the pound – according to the vast majority of experts, only members of the House of Commons can prevent the implementation of the "hard" scenario. The new political season in Britain will begin very soon – in just two weeks when parliamentarians will return from summer vacation. However, the key political players of Albion have already announced a "hot autumn" in the House of Commons.

For example, the leader of the Labor Party Jeremy Corbyn, announced today his readiness to initiate in Parliament the issue of announcing a vote of no confidence to the Prime Minister. He said this in an open letter to the leaders of political parties oppositional to the conservative centrists. Corbyn noted that this issue will be submitted to the Parliament "at the first opportunity", adding that he needs to make sure that this scenario will be doomed to success. The House of Commons will return from vacation in early September, and it is obvious that by this time, the Labor Party will understand the general political alignment in Parliament. Although most of the deputies rejected the option of "hard" Brexit, they are unlikely to "automatically" support the idea of Corbyn. After all, in addition to declaring a vote of no confidence in Johnson, he also proposes to form a government – under the leadership of Labor. As stressed by Corbyn, the term of office of the Cabinet will be "strictly limited in time." The interim government will be called upon to carry out only two tasks. Firstly, it is the prevention of "hard" Brexit, and secondly – the preparation for early national elections. Also, the Laborites will try to lobby for the idea of holding a second referendum, which will raise the question of not only about the expediency of the country's exit from the EU but also about the conditions under which this process should take place. However, according to representatives of Labor, the issue of holding a second referendum in this context looks optional. The main task of the opposition is to remove Johnson from the post of Prime Minister, form a provisional government and prevent chaotic Brexit by another extension of the postponement of the "X-hour" (that is, the extension of article 50 of the Lisbon Treaty). And after that, Corbyn is ready to go to early national elections. The pound reacted quite positively to the proposal of the opposition leader – the pair GBP/USD rose to the area of the 21st figure. But the growth of the pair is limited. On the one hand, members of the House of Commons can step over their political claims to each other, taking a general decision to declare a vote of no confidence in Johnson. On the other hand, Conservatives are unlikely to agree to entrust Corbyn with a temporary mandate to organize general elections. In other words, the situation around Brexit prospects remains tense – and apparently, the pound will continue to be under the background pressure of this issue until the deputies agree on a common algorithm of action. It is also worth noting that the British currency this week received support from macroeconomic statistics. Almost all of the key indicators came out either at the level of forecasts or better than expectations. For example, data on the labor market in Britain surprised the dynamics of the growth of the wage component. This indicator (excluding bonuses) jumped to an 11-year high (3.9%), confirming the positive trend of recent months. Taking into account the premiums, this indicator also pleased investors with the growth of up to 3.7% (three-year maximum). Similarly, inflation rates have shown very good results. The overall consumer price index rose in annual terms to 2.1% (the highest since April), and the core index, excluding volatile energy and food prices, rose to 1.8% (the growth rate is recorded for the second month in a row). All inflation indicators came out above the forecast values. The data published today on retail sales in Britain also came out in the "green zone". Although almost all components of this indicator slowed down, experts expected a more deplorable result.

Thus, the current fundamental picture does not allow the GBP/USD bears to organize a large-scale offensive to the South. If Corbyn still implements his ideas (at least partially, in terms of blocking the "hard" Brexit), the pound will receive significant support. So bears are limited in their ambitions – at least the 19th figure is not yet available to them. The bulls GBP/USD, in turn, can settle for a modest weekly rise, the "ceiling" of which is the mark of 1.2205 (middle line of Bollinger Band daily chart). Most likely, the pair will be traded in the middle of the price range of 1.2005-1.2205 until September, in anticipation of powerful information drivers, which, of course, will be associated with the prospects of Brexit. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for August 15, 2019 Posted: 15 Aug 2019 04:24 AM PDT The GBP/USD pair wasn't make any significant movements seven days ago. There are no changes in our technical outlook. The bias remains sideways in the nearest term testing the levels of 1.1999 and 1.2248. The trend of GBP/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.2248 and 1.2080. So, the daily resistance and support are seen at the levels of 1.2248 and 1.2080 respectively. Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. On the H1 chart, the market seemed sideways for that the trend had hit only the resistance 1 last week and the range was tiny around 168 pips (1.2248 - 1.2080). Moreover, it should be noted that if moving averages cross over one another, then we expect sideways trend. But if moving averages cross over one another, the trend is probably changing soon. Finaly, if the pair fails to pass through the level of 1.2248, the market will indicate a bearish opportunity below the strong resistance level of 1.2248. Sell deals are recommended below the level of 1.2248 with the first target at 0.6600. If the trend breaks the support level of 1.2080 in rder to test the double bottom. The market is still ranging, hence we still prefer the sideways trend scenario. It is of the wisdom to trade only between these levels of 1.2248 and 1.2080 this week. The material has been provided by InstaForex Company - www.instaforex.com |

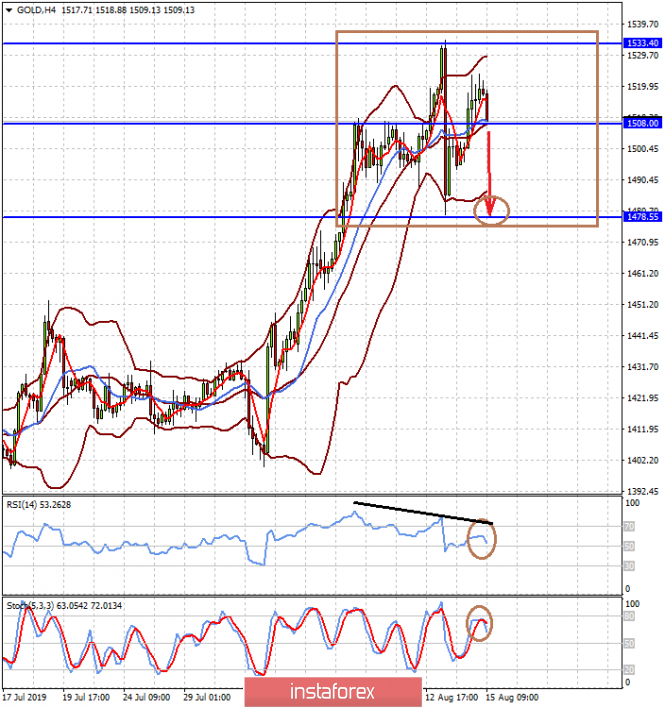

| Posted: 15 Aug 2019 04:08 AM PDT In the markets, investor sentiment is subject to a sharp change again like the direction of the weather vane and sharp gusts of "wind" that are really sharp and unpredictable at the moment. In general, it seems that its participants do not want to notice anything and continue to believe that everything will somehow change for the better. All of these resemble the situation in the markets in 2007 before the last and most devastating financial crisis in world history after the Second World War. The data on industrial production and retail sales in China released on Wednesday plunged global markets into shock. On an annualized basis, industrial production in growth sharply decreased to 4.8% from 6.3%, while retail sales fell on an annualized basis to 7.6% from 9.8%. The latest fresh intermediate values of Germany's GDP for the second quarter, which were presented later, were finally broken down with the markets. They showed a year-on-year trend of zero growth from 0.6% last July. Moreover, the quarterly figures themselves showed a negative dynamic by 0.1% decline this year, returning to negative territory after the failure last November. This news impressed investors so much that major stock indices in Europe and the US closed in deep red, reflecting a high degree of investor concern over the already clear signals of an impending recession. What is very important is that while the financial authorities and Donald Trump personally declare that they do not see the risk of America slipping into a recession. Ex-Fed Chairman Janet Yellen, who said on Wednesday that there are really negative moments in the economy, has the same opinion. She sees external risks have grown but the economy is still strong. These statements, as well as previously ignored consumer inflation data, which showed their growth, lowered expectations of markets to lower their key interest rate by 0.25% at the next September meeting to 69.6% from 95.5% a day earlier. We believe that the overall emerging picture around expectations of new Fed rate cuts will only increase uncertainty. We previously pointed out that the mixed US economic statistics will force the Fed to do nothing, taking a wait and see attitude. In this case, the local stock market will continue to show negative dynamics. On the contrary, the dollar will receive support as the world's reserve currency, which is in demand in the context of a full-blown economic crisis. Forecast of the day: The EUR/USD pair is trading below the level of 1.1160 and it can recover to this mark. However, if it holds below it, we should expect a price reversal and resumption of the fall to 1.1100-10. The price of gold is likely to consolidate in the near future in the range of 1478.55-1533.40 in anticipation of the Fed decision on rates in September. But today, the price may continue to decline to the lower boundary of this range if it overcomes the mark of 1508.00. |

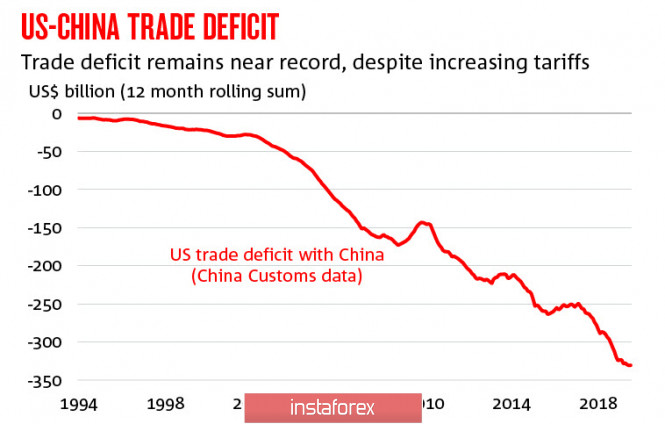

| Panic is growing, the yen and the Canadian dollar are trying their best to stay in the range Posted: 15 Aug 2019 03:03 AM PDT The US stock markets ended trading Wednesday with a sharp decline amid reports that the 10- and 2-year-old bond yields curve had entered negative territory for the first time since 2007. This could be considered an official inclusion of a counter, counting the days prior to the recession. Markets instantly forget that July inflation soared more than forecasts, indicating that consumer demand is still growing steadily. Meanwhile, import and export prices rose by 0.2% in July with zero growth forecasts, which also indicates positive developments. The inversion of the yield curve is only one of the drivers of market decline, but the second came from China. The growth of industrial production in July by 4.8% is the worst result for 17 years. Also, the growth of retail sales was weaker than forecasts by 7.6% against 9.8% a month earlier. First of all, if the data from the US provoke the reaction of financial instruments as investors are guided by certain trends in asset yields and risk levels, China in recent years has acquired the status of a driver for Asian and commodity markets. The stability of the Chinese economy indicates the stability of the raw materials market and global production, as well as the slowdown that signals the beginning of a period of business recession. A characteristic feature in the recent months is a slowdown of iron ore imports to 1.2% y/y and a decrease in copper imports by 7.1% y/y, which indicates a slowdown in the production of technological goods. The growing trade deficit in the United States and China is breaking records. The trend has no signs of change, despite Trump's desperate attempts. This means that escalation is inevitable, and the US withdrawal from the WTO may not be the last step in the battle for world leadership. Under the current conditions, hoping to wait for the resumption of economic activity are becoming more and more illusory. The growth trend in the demand for protective assets is developing. Therefore, the growth of gold and demand for bonds looks natural and logical. Only dollar strengthening can prevent the growth of gold due to the withdrawal of the liquidity part of the US Treasury to restore a single treasury account (GCA). In the coming days, we should expect the development of negative processes in the global economy. The demand for gold and bonds will be steady and safe-haven currencies such as the yen and franc will be in high demand. Oil and commodity currencies are under pressure. USD/CAD pair Against the background of the lack of macroeconomic news, the Canadian dollar managed to stay below the maximum of the month trade at 1.3345. Despite the growth of panic, it is mainly in the lateral range. Part of the reason is a partial recovery of oil prices from the lows of August 8 but the main reason is still the low probability of a rate cut by the Bank of Canada since inflation exceeds the target level of 2%. The average wage growth in July was 4.5% YoY, which allows counting on steady consumer demand. The Loonie has no direction and trading in the range is the most likely scenario. If a new wave of panic covers the markets, then a breakdown of resistance of 1.3345 and growth to 1.3420/35 are likely. Otherwise, slow drift to the channel boundary of 1.3230/35 is likely. USD/JPY pair The yen maintains an advantage against the dollar. Primarily, it is due to demand as a protective currency, and secondly due to unexpectedly strong data on industrial production in June, which will support exporters. Orders for engineering products increased by 13.9% YoY, which is the maximum for 4 years. The preliminary data on GDP growth rates of in Q2 were significantly better than forecasts with a growth of +1.8% and expectations of +0.4%, which signals no threat of a recession. The yen is trading in a wide range of 105 and 107, and the Bank of Japan will defend support 105, possibly even through interventions. However, if the external environment worsens and markets become more convinced of an imminent recession, the yen will continue to strengthen. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis and forecast for GBP/USD, USD/JPY, and USD/CHF on August 15 Posted: 15 Aug 2019 02:06 AM PDT GBP/USD Fluctuations in the price of the British pound in recent weeks occur within the emerging bullish wave of July 30. The wave is correctional that develops in a lateral plane. In the last 3 days, quotes are clamped in a narrow corridor between the opposite zones. Forecast: Today, the flat mood of the pair will continue. At the next session, an upward movement mood is likely. Short-term puncture of the upper boundary of the resistance zone is not excluded. By the end of the day, the chance of a reversal and price decline will increase. Volatility can increase dramatically. Recommendations: When buying the pound today, you should lower the lot and be ready to close the deal at the first signs of a reversal. In the area of the resistance zone, it is recommended to monitor the signals of the instrument sale. Resistance zone: - 1.2110/1.2140 Support zone: - 1.2040/1.2010

USD/JPY Since April, the current trend in the Japanese yen market has been dominated by its strengthening against the US currency. In the last 3 months, the bullish correction has been developing. On August 13, a new wave began to form in the direction of the main course. Since yesterday, the price is rolling back up. Forecast: During the current day, it is expected that the current price growth, the formation of a reversal and the pair moves down. The last phase can begin against the background of increased volatility and move forward in time the next day. Recommendations: Today, yen purchases are possible only within the framework of intra-session trade. It is safer to wait for the completion of the entire rollback up and to look for signals to sell the pair at its end. Resistance zone: - 106.60/106.90 Support zone: - 105.90/105.60

USD/CHF On the chart of the Swiss franc, the current wave design is a bullish wave from June 25. It formed the first 2 parts (A+B). From August 6, conditions are being created for the beginnings of the final part (C). The preparatory wave has the wrong kind of structure. The price is within a strong support area of a large TF. Forecast: Today, a common flat mood of the pair is expected. In the morning, a downward vector is more likely. By the end of the day, a change of priorities in movement and a price increase to the borders of the resistance zone are expected. Recommendations: Trading in the flat today can carry an increased degree of risk, so you should only trade within the sessions with a reduced lot. Purchases look more preferable. Resistance zone: - 0.9780/0.9810 Support zone: - 0.9710/0.9680

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Attention: The wave algorithm does not take into account the length of time the instrument moves. The material has been provided by InstaForex Company - www.instaforex.com |

| Demand for protective assets is growing, focus is on the yen Posted: 15 Aug 2019 01:54 AM PDT The tense economic and political situation dictates the demand for the assets of the "safe haven", among which the leaders are gold, silver and the Japanese currency. The increasing fear of recession that has swept the markets is pushing investors toward protective assets, experts say. Assets of the "safe haven" are in high demand, despite the low implied volatility in major world currencies. Analysts draw attention to a slight depreciation of the Scandinavian currencies, as well as to massive sales in the bond markets of Argentina and South Africa. Demand for "safe haven" currencies, primarily the yen, is recovering after new data on retail sales and industrial output in China, which turned out to be worse than forecasts. Concerns over continued German economic growth and global trade tensions keep investors in tone. The current situation negatively affected the EUR / USD pair: it fell 0.1% after the publication of weak data on the German economy. According to the report, the German economy experienced a recession in the second quarter of 2019. The dynamics of the yellow metal is showing growth again. On Wednesday evening, August 14, the price of gold reached $ 1,511 per 1 troy ounce, and today, the precious metal is trading in the range from $ 1,524 to $ 1,525 per ounce. The yen is at the peak of demand, as traders overestimated the likelihood of progress in trade negotiations between the United States and China. Although, experts do not expect a positive resolution of the protracted trade conflict in the near future. At the same time, the USD / JPY pair fell 0.8% to 105.88, after increasing by 1.4% last Tuesday. According to analysts, the current rise was the largest since March 2018. Therefore, most experts expect further appreciation of the Japanese currency. Currently, the yen is holding near the level of 106.24 for 1 US dollar and is not going to give up positions. |

| Posted: 15 Aug 2019 01:36 AM PDT EUR / USD Wednesday, August 14, ended for the EUR / USD pair with a decrease of 30 bp. Thus, the estimated wave b of the upward trend section takes on a more complex form, but the current wave marking does not change. Based on the wave pattern, the euro-dollar instrument is still expected to increase with targets located above the 13th figure. However, as mentioned earlier against the euro and the pound, the news background is now working. For example, yesterday, industrial production in the European Union collapsed by 2.6% y / y. Today, markets will wait for the publication of a report on retail sales in America and if the forecast of + 0.3% m / m is exceeded, then we can expect an even greater decline in the pair and the complication of wave b. The most interesting thing is that the constant feeding of a pair with a negative news background can calmly lead to a drop in quotations to a minimum of wave c, which will complicate the entire wave pattern and continue the construction of the downward trend section. It is the news that is now of paramount importance for EUR / USD. Purchase goals: 1.1264 - 61.8% Fibonacci 1.1322 - 76.4% Fibonacci Sales goals: 1.1027 - 0.0% Fibonacci General conclusions and trading recommendations: The euro-dollar pair continues to build the upward trend section. Thus, I recommend buying a pair with targets near the calculated levels of 1.1264 and 1.1322, which is equal to 61.8% and 76.4% according to Fibonacci signal, and according to the MACD signal upwards, counting on the construction of the ascending wave s. GBP / USD On August 14, the GBP / USD pair is trading near multi-year lows, while maintaining high chances of further complicating the downward trend section. The inflation report published in the UK yesterday did not trigger demand for the pound sterling, although it turned out to be higher than the forex market expected. Today, the foreign exchange market is waiting for data on retail sales in the United States and Britain, and expectations of a slowdown in the Foggy Albion. However, the main theme for the pair pound-dollar remains to be the Brexit. And although there are no recent and interesting messages on this topic, the market is waiting for them. But it is unlikely that anything positive will be expected, since there are no prerequisites for improving the situation. The country is rapidly moving towards Brexit without a deal, which will have a detrimental effect on the economy of the United Kingdom. Nevertheless, Boris Johnson refuses to consider options other than hard. Sales goals: 1.2056 - 323.6% Fibonacci 1.1830 - 423.6% Fibonacci Purchase goals: 1.2783 - 0.0% Fibonacci General conclusions and trading recommendations: The downward section of the trend became more complicated, and the pound-dollar pair made a successful attempt to break through the 323.6% Fibonacci level. Despite the fact that the wave e looks complete, it can take an even more complex form. Thus, with the new MACD signal down, I recommend selling a pair with targets near the level of 1.1830, which corresponds to 423.6% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| Job gains boost Australian dollar, risk conditions crucial Posted: 15 Aug 2019 01:21 AM PDT Risk appetite deteriorated sharply during Wednesday as fears over a global recession intensified. The immediate panic was triggered by an inversion of the US yield curve for the 10-year Treasuries dipping below 1.60% and trading below 2-year rates for the first time in over 10 years. There was a rapid slide in equity markets during the day as fears increased. Given a lack of confidence in the global economy, AUD/USD came under renewed selling pressure with a dip below 0.6750. There was an element of resilience with AUD/USD holding above August's 10-year lows despite carnage in equity markets. Australian dollar sentiment was boosted by the latest labour-market data with July employment increasing 41,100 compared with consensus forecasts of around 14,000. Unemployment remained at 5.2% as an increase in the work force and strong demand for jobs prevented a decline. The Reserve Bank of Australia stated that it is carefully monitoring the labour-market data to determine potential changes to interest rates. The stronger-than-expected employment gains should provide an element of relief, although the unemployment rate is still too high to generate stronger wages growth. The US Administration will continue to force the Federal Reserve to cut interest rates. According to media sources, President Trump's attack on the Fed will intensify. The prospect of further rate cuts by the US Fed is bullish for the Australian dollar. Donald Trump is also monitoring Wall Street very closely with a strong equity market seen as a key indicator of success and crucial for his re-election prospects. Amid his struggle for lower interest rates, the market expects further support measures such as further concessions on China over trade. The Shanghai bourse also edged into positive territory as the PBOC added liquidity and government funds are liable to be deployed to support domestic financial markets.

|

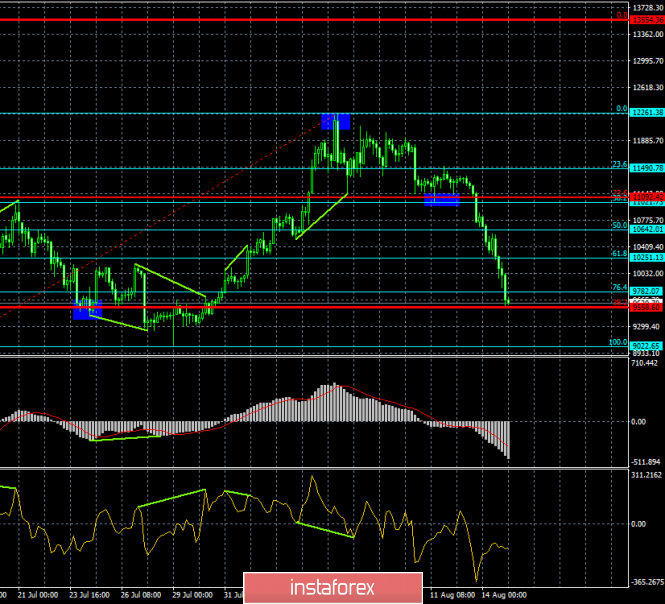

| Posted: 15 Aug 2019 12:13 AM PDT Bitcoin – 4H.

Just yesterday, I wrote in my article about bitcoin that 80% of the price of the coin depends on the inflow or outflow of one-day investors, and not on fundamental factors, the actions of Donald Trump, the Fed, and the introduction of legislation relating to the cryptocurrency sphere. Today, we can state the fact: for about a week, bitcoin lost about $2,600 in value. This fact once again raises the question: how can bitcoin be used for the function of preserving value if it can lose about 20% of this value in a week? Therefore, I continue to hold the opinion that bitcoin is too overrated. Further, if you look at a large chart (for example, monthly), you can see that the first top of the "cue ball" was around $19500, the second – about $13500. I believe that there is a process of consolidation of the coin value of the most famous cryptocurrency. That is, there is a process of averaging the value, its reduction to market and fair. It is obvious that more or less of the average value of one coin is in the area of $7000 and $8000. However, "swings" can send BTC well below these levels. At the same time, I want to note once again that most of the "fantastic" forecasts (about the growth of bitcoin to $ 50,000 or even up to $ 250,000) have no basis, but are only the opinion of the author of the forecast, who is often a large investor and is interested in such forecasts, against which small investors want to earn, buy bitcoin and it shows growth. Thus, I believe that the current fall of the "cue ball" is not worth Trump's decision to postpone the introduction of duties on imports from China in the amount of 300 billion, there is no policy of easing the monetary policy of the Fed, the fall of the yuan and other fundamental factors. It's just that bitcoin is starting to lose popularity and fewer traders are considering it as a tool for quick and large earnings. The Fibo grid is built on the extremes of July 17, 2019, and August 6, 2019. Forecast for Bitcoin and trading recommendations: Bitcoin has completed the consolidation under the level of 76.4% ($9782). Thus, I recommend selling the cryptocurrency with the target of $9022, with the stop-loss order above the level of 76.4%. I recommend buying bitcoin with a target of $9782, and with a stop-loss order at the level of $9022, if a rebound from the correction level of 100.0% is performed. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment