Forex analysis review |

- EUR/USD left a trap for buyers

- EUR/USD. December 4. Results of the day. New US laws puts pressure on Beijing

- EUR/USD: weak ADP report allowed the pair's bulls to show character

- Prospects for the euro - EURUSD in the context of the end of 2019

- Growth to $1.39 or a crash to $1.15 - what to expect from the pound after the December 12 election?

- GBPUSD and EURUSD: British pound received a new charge of vigor. Euro continues to stagnate after mixed service sector reports

- The White House awakened gold

- EUR/USD: euro still has a chance to grow, however trade disputes may get in the way

- Dollar: the staggering throne

- December 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- December 4, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- NASDAQ_ideas for the session

- BTC 12.04.2019 - Watch for another down wave

- Gold 12.04.2019 - Watch for potential breakout of $1.484 to confirm further upside continuation

- EUR/USD for December 04,2019 - First upward objective at the price of 1.10964 reached, potential for more upside

- GBP/USD: plan for the US session on December 4. The services sector revived demand for the British pound, which went to update

- EUR/USD: plan for the US session on December 4. The euro held its position after good reports on the services sector

- Fractal analysis for major currency pairs as of December 4

- Evening review for EURUSD on 12/04/2019

- Technical analysis of AUD/USD for December 04, 2019

- EUR/USD. December 4. The euro took the lead in the confrontation with the dollar, but for how long?

- GBP/USD. December 4. "Sword of Damocles" for the pound

- Trading plan for EUR/USD for December 04, 2019

- No thrills, EUR / USD and GBP / USD review on 12/04/2019

- Volumetric oil analysis

| EUR/USD left a trap for buyers Posted: 04 Dec 2019 03:40 PM PST Good evening, dear traders! I present the trading idea for the EUR/USD pair. Today, December 4, data on employment in the non-productive sphere of the United States were released at 14:00 Universal time and at the same time, statements by the Bank of Canada were passed, which significantly strengthened the Canadian dollar. Against this background, the dollar strengthened locally, including relative to the euro. On the daily time frame, the EUR/USD pair closes with a "double bottom" at a quote of 1.10650. It is behind this minimum that buyers have been hiding for the last two days: How to earn profit and/or not to lose? Very simple. 1. If you are in short positions - I recommend taking profit at a quote of 1.10650. 2. If you are not in position - develop the target of 1.10650. 3. If you are in the "longs" - I do not recommend putting a stop below the level of 1.10650 - it will be removed by a true or false breakdown. Good luck in trading and see you tomorrow at the morning review! The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. December 4. Results of the day. New US laws puts pressure on Beijing Posted: 04 Dec 2019 02:57 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 33p - 20p - 47p - 87p - 27p. Average volatility over the past 5 days: 43p (low). On December 4, the EUR/USD currency pair made another jump, however, if we look more closely at the European currency's growth on Wednesday, it becomes clear that the entire leap is 30 points, and the volatility of the entire trading day is currently at 49 pips. Thus, from our point of view, nothing extraordinary happened except that the pair nevertheless updated the previous local high and, thus, showed its intention to form a more or less tangible upward trend. However, at the same time, we still believe that there are no good reasons for strengthening the European currency. Macroeconomic reports provide local support for the euro, but this joyful period for the EU currency can end very quickly, since in general the state of the EU economy remains much weaker than in the United States. Yes, inflation in the EU has shown positive dynamics in recent weeks, business activity indices in the services sector, but US data cannot be called a failure. Thus, the euro can still resume falling at any time. Data was published during the European trading session today, it includes indices of business activity in the services sector of Germany and the European Union. Both exceeded their values and reached 51.7 and 51.9, respectively. However, the previous values and forecasts did not differ much from the total values for November. The situation is similar with the composite business activity indexes in Germany and the EU, both showed a slight improvement. But in France and Italy, business activity in the service sector decreased. Thus, it can hardly be stated that the euro showed growth today due to these reports. It would be more correct to say that the euro was strengthening due to the failed US ADP report reflecting the change in the number of workers in the private sector. Traders saw only 67,000 jobs instead of the expected 140,000. Thus, one of the relatively important macroeconomic reports of the United States completely failed, which triggered a sell-off of the US currency in the afternoon. But even with such a weakness in the US labor market report, the US dollar lost a few positions against the euro, which once again convinces us that bulls are very cautious about buying the euro. The Markit US business activity index in November was 51.6, which is fully consistent with experts' forecasts, and the composite index is 52.0, which is 0.1 points higher than forecasts. Meanwhile, the United States clearly lacked one "Hong Kong Law" and was followed by another Law on Human Rights and Democracy, this time a bill that condemns the treatment of Muslims and ethnic minorities in China, in Xinjiang . The bill has already been passed by Congress and must now go through the Senate and the US President. It is anticipated that sanctions will be imposed against China, as well as against the country's first officials. According to correspondent John Sudworth, if the bill is approved, it will be the most significant attempt to force Beijing to stop the camp system in Xinjiang. The Chinese Foreign Ministry has already issued a statement, stressing in it that the bill intentionally distorted the goals of the Chinese authorities in Xinjiang County. In fact, the province is fighting against radical elements, terrorists and separatists. The Chinese Foreign Ministry also once again warns the US government that they will grossly intervene in the internal affairs of China and that retaliatory measures will immediately follow again if this law is signed by the president. Despite the fact that there are all visible reasons for another escalation of the trade conflict between the United States and China, some sources close to the negotiation process argue that the parties are approaching consensus on the issue of canceling tariffs, which will be canceled as part of the first phase of the agreement. Even despite the situation around Hong Kong and Xinjiang, experts believe that they will not affect trade negotiations. Moreover, experts and political scientists believe that the deal will nevertheless be concluded before December 15, although we personally do not see any reasons or grounds for this. It is much more likely that on December 15, Trump will introduce new duties on Chinese imports for another 160 billion dollars. However, the wait was short. From a technical point of view, the currency pair made a new attempt today to resume the upward trend, but after half an hour, it could be said that it failed, like the report from ADP. The euro grew by 30 points and could not hold on to new positions for itself and immediately began to fall, which again could be the beginning of a downward correction, which will eventually turn into a downward trend. Trading recommendations: The EUR/USD pair retains the prospects for an upward movement, and the volatility at today's trading is again low. Thus, it is still recommended to buy the euro very carefully, since it is growing very reluctantly and only thanks to weak macroeconomic statistics from across the ocean. Tomorrow, for example, there will definitely not be such gifts in the form of weak reports from the United States. Selling the euro, which has more fundamental grounds, will be better after overcoming the critical Kijun-sen line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

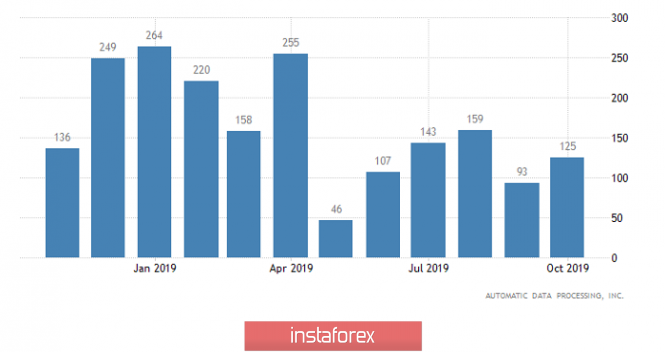

| EUR/USD: weak ADP report allowed the pair's bulls to show character Posted: 04 Dec 2019 02:57 PM PST The euro-dollar pair made another attempt to leave the price range of 1.0970-1.1090 today, in which it has been trading since the beginning of November. Last week, the bears tested the lower boundary of this band, while the bulls seized the initiative this week and sent the price to the area of the 11th figure. Today's attempt also failed - the bullish momentum faded and the pair retreated. But at the same time, it is worth recognizing that EUR/USD buyers are clearly taking advantage of the current situation: the European currency feels indirect support from the European Central Bank (which, according to rumors, is ready to adhere to a wait-and-see attitude), while the dollar is actively losing its position against the background of Donald Trump's belligerent mood and disappointing statistics. In addition, a stream of positive news regarding Brexit's prospects also provides indirect support to the EUR/USD pair. All this makes it possible for buyers to test multi-week highs based on a trend reversal. However, it is too early to talk about a trend reversal. Correctional growth of the pair is now mainly due to the dollar's weakness than the strengthening of the euro. For the US currency, the "black bar" has come - both from the side of the external fundamental background, and from the side of internal statistics. Following the release of the extremely weak ISM manufacturing index, a weak report was released today from the analytical agency ADP, after which the dollar index continued to decline. If you believe the specialists of Automatic Data Processing agency, the US private sector created only 67 thousand jobs in November. Such a low result was the worst in the last five months, since this indicator reached 41 thousand in May - while Nonfarm was at 72 thousand. Last month's results were also revised downward. The situation is even worse in the manufacturing sector - job losses have been recorded here (-18 thousand jobs). It is worth recalling that on the eve of the May reports, the ADP report likewise alerted traders, foreshadowing the weak Nonfarm. As it turned out later, the agency's specialists confirmed their reputation: official figures came out worse than forecasts, causing concern not only among experts, but also among Federal Reserve members. Today the situation is repeating, only now the rates are slightly higher: if Friday's data confirms the weakening labor market, this will be a serious argument in favor of lowering the interest rate at the beginning of next year. The ISM manufacturing index is also worth mentioning here: the industrial activity index in the US fell to 48.1 points, contrary to analysts' forecasts, who expected its growth in November. The ISM composite index for the non-manufacturing sector also came out in the red zone, not reaching forecast values: instead of rising to 54.5, it fell to 53.9 points. And although in this case the decline is low, this fact also put pressure on the greenback in the context of other events. The situation was slightly mitigated by a fairly strong employment component in the ISM report. Despite such a gloomy fundamental background for the dollar, the EUR/USD pair could not gain a foothold in the 11th figure today. After reaching the daily price peak (1.1116), the pair attracted sellers, after which the price returned to the range indicated above. On the one hand, this indicates the uncertain positions of the EUR/USD bulls. On the other hand, such a rapid rise in prices (1.0980 last week and 1.1116 today) indicates the vulnerability of the dollar, and therefore the riskiness of short positions. In general, it can now be assumed with great certainty that official data on Friday will also disappoint the market, although a consensus forecast suggests the opposite. According to most analysts, the figure will reach 189 thousand. In other words, now the EUR/USD pair is at a crossroads: either the bulls will continue to correct on Friday, or the pair will return to the bottom of the 10th figure again, followed by a test of the lower boundary of the range of 1.0970-1.0190. But it is worth noting here that if official data on the labor market come out even better than expected, the pair is unlikely to consolidate below 1.0970. Yes, the impulse response will be bearish, but the downward movement will be limited, since the US currency is now under the yoke of its own problems - primarily in view of the uncertainties regarding US-China trade negotiations. Thus, at the moment it is advisable for the pair to take a wait-and-see attitude. Buyers of EUR/USD are still not confident in their abilities, while the dollar looks too vulnerable - not only when paired with the euro, but throughout the entire market. The material has been provided by InstaForex Company - www.instaforex.com |

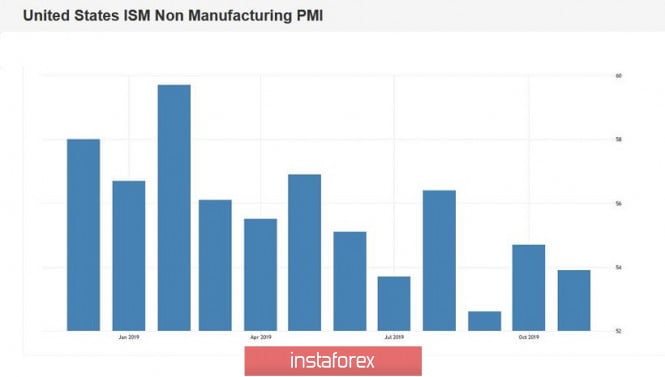

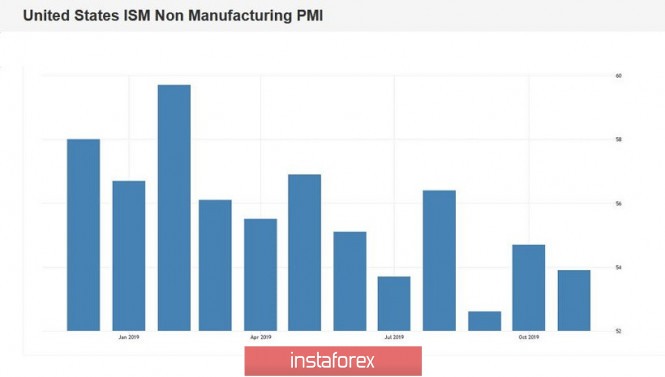

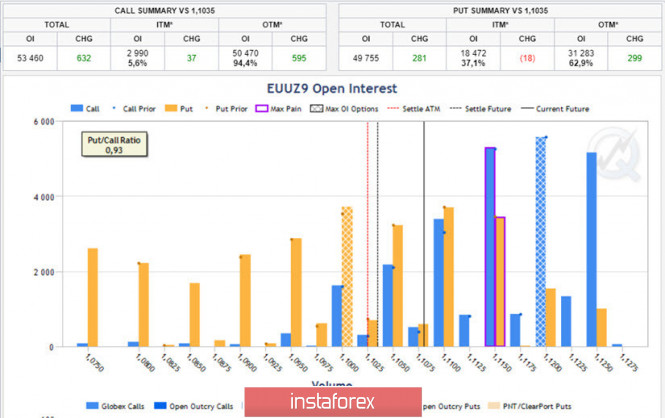

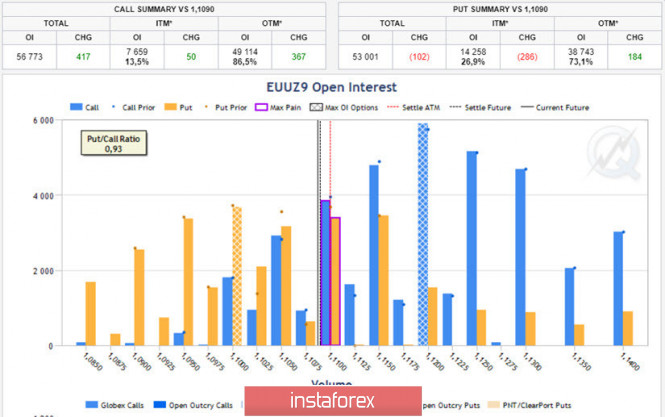

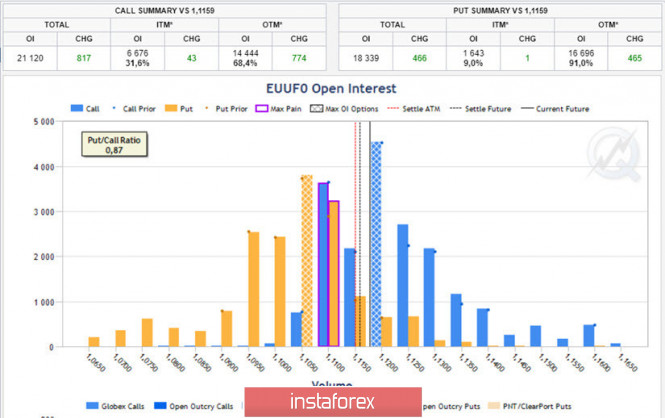

| Prospects for the euro - EURUSD in the context of the end of 2019 Posted: 04 Dec 2019 02:57 PM PST There is the concept of seasonality in any market, including foreign exchange. Some markets, such as the energy market, are more prone to this, while other markets, such as the currency market, are less susceptible, but absolutely all financial markets are subject to seasonal changes. Many of you have heard of the pre-Christmas stock market rally, usually taking place on New Year's Eve, but few have wondered how the end of the year affects exchange rates. Let's try to figure this out. First of all, we must understand that financial markets are connected with economic cycles and time periods, just as the quotes in our InstaForex terminals are subject to session changes. If you did not know this, then I inform you that the worst time to open positions is the period one and a half hours before the opening of the US session and half an hour after the opening. At the current moment, this corresponds to the period from 12 to 14 London time. It was at this time, before and immediately after the beginning of the US trading session, that the market generated a lot of false signals that mislead traders, but let's return to seasonality. The generally accepted economic periods are the quarter, the end of the half year and the end of the year. Moreover, the end of the year, coinciding with the end of the fourth quarter, is the most important period that coincides with the Christmas holidays, which are widely celebrated in the US and Western Europe. As you close the year, you get such a bonus. Close the year with a loss, you will declare a loss in the statements, close the year with a profit - you will receive a premium. That is why the closure of numerous financial contracts in December is of such great importance. In addition, the Christmas holidays do not allow traders and investors to quickly respond to possible threats, and in this regard, part of the open position is reduced. In other words, liquidity is leaving the market, and the market is becoming thin. This is fraught with significant price spikes and increased volatility, which occurs in the absence of a counterparty to transactions. This is especially dangerous in low liquid currency pairs and cross rates, as well as other assets that are not very popular, but liquid assets, such as EURUSD, are also subject to stress at this time. Significant increases in swaps and spreads are also possible during this period, which is fraught with unplanned losses for traders. In turn, the increase in liquidity begins immediately after the New Year and by the second half of January, liquidity in the markets is usually restored. This Friday, December 6, the last option contract of the current year will be closed in the futures currency markets, and, as you understood from the narration above, how it is closed will largely determine whether option sellers will profit in the current quarter. They no longer have time to correct a mistake and withdraw positions from losses. Let me remind the reader of the mathematically proven truth: 75% of options burn out without money, and rare exceptions only confirm this rule. However, we have the opportunity, falling out only once a year, to test this theory in practice. Let's see how the optional barriers were located in the course of the European currency a week ago, November 26 (Fig. 1). Fig. 1: Optional barriers (strikes) as of November 26 As you can see from the diagram below, the largest barrier of Put options was located at 1.10. At the same time, the largest option barrier of Call options was located at around 1.12. The point of maximum pain for option buyers - Max Pain was located at 1.1150. The number of Call options in the money was 5.6%. The number of Put options in the money was 37.1%. The EURUSD rate closed at 1.1020 on November 26. On Friday, November 29, using the thin market triggered by Thanksgiving in the USA, EURUSD updated its low, took off stops below 1.0985, after which on Monday, November 30, it sharply grew and ended the session at 1.1080, i.e. actually achieved goals at the end of this week. Let's see how the optional barriers have changed since November 26? (fig. 2) First of all, it should be noted that by December 3, the MP point has shifted from the level of 1.1150, to the value of 1.11. At the same time, the number of Call options in money increased to 13.5%, and the number of Put options in money decreased to 26.9%. The price of the EURUSD cash rate has almost matched the futures contract and is now actually at the point of Max Pain for option buyers, which was to be proved. An accident? I don't think so. Fig. 2: Optional barriers (strikes) as of December 3 What conclusion can we draw from these facts? First of all, it can be assumed that, with a high degree of probability, before the closing of the option contract EUUZ9, the EURUSD rate will be in the zone of 1.11. Then a period of low liquidity will come, which will intensify even more after December 16, when the December futures contract for the ECZ19 euro will be closed. It will not be superfluous to note that the European Central Bank meeting will be held on December 12, and a decision by the US Federal Reserve will be announced on December 18. These meetings will serve as additional uncertainties for the entire foreign exchange market and, in particular, for the euro. Considering the fact that unemployment data in the US will be published this Friday, December 6, the picture of the forthcoming movement of the euro exchange rate by the end of December becomes completely uncertain. However, let's see how option barriers are located in the next January option contract. Perhaps there, we will receive answers to our questions. Fig. 3: Optional barriers (strikes), January EUUFO option contract The January option contract, with the closure on January 3, 2020, although it has good liquidity, still does not have such key significance as the December contract. However, if you look at the current status of this EUUFO contract, you can see that the maximum open interest of Put options is on strike 1.1050, and the maximum open interest of Call options is on strike 1.12. In turn, the MP point of the January contract coincides with the MP point of the December contract and is at a value of 1.11. This is a very narrow range, so during December it is impossible to exclude a change in the parameters of open interest at the optional levels in this contract, and therefore the shift of the MP point. Traders, when opening positions for buying, should be guided by the level of 1.12, and when opening positions for sale as a price reference, by the end of the current year, the level of 1.1050 should be considered, at least until new data allow another informed decision . In conclusion, I would especially like to note that the main thing in trading financial instruments is not determining the direction, but following the rules of money management. The material has been provided by InstaForex Company - www.instaforex.com |

| Growth to $1.39 or a crash to $1.15 - what to expect from the pound after the December 12 election? Posted: 04 Dec 2019 02:57 PM PST The GBP/USD pair updated its seven-month highs amid reports that the Conservative Party continues to hold leading positions in the election race. Apparently, investors consider the Conservative majority following the December 12 election as the most positive result for the market. In an effort to find a way out of the impasse around Brexit, the head of the British Cabinet of Ministers, Boris Johnson, supported his proposal in the national Parliament to hold early elections in the country before Christmas. It is noteworthy that opponents of Johnson hope that these elections will put an end to his prime minister's career. Labour leader Jeremy Corbyn promises to hold a referendum on a new deal to leave the UK from the EU, and the Liberal Democrats, led by Joe Swinson, calls for the abolition of Brexit altogether. The results of the pre-election polls cause the British currency to fluctuate continuously. Market participants are sensitive to them, because they are afraid of two events: Brexit without a deal and the formation of a Labour government led by Corbyn, who promised to nationalize the main industries and raise taxes for high-income citizens. The British currency strengthens when opinion polls indicate the likelihood of a Conservative victory with a significant advantage. When they allude to the possibility of resistance from the Labour Party, the pound is reduced. According to some experts, the British currency is underestimated, and everything indicates the possibility of its rally after early elections. "Now all polls promise the Conservatives victory. But even if they are mistaken, as was the case in 2016, the outcome of the election may not be so bad. Even if the Conservatives win with a slight advantage and none of the parties gets the 326 seats needed to get a parliamentary majority, and Labour unexpectedly won the election, the pound still has a good chance of growth. Corbyn will have to form a government with the support of other parties, which will make the implementation of his policy impossible," said Anatole Kalecki, chief economist at Gavekal Research. "Of course, the prospects for the pound will be better in the event of a clear victory for the Tories. The Conservatives gaining a confident majority corresponding to the latest polls will allow the GBP/USD pair to rise to 1.33 in a couple of months," said Petr Krpata, currency strategist at ING. UBS Global Wealth Management experts continue to evaluate the pound's prospects as positive and believe that the pound could go up to $1.35 in case the Tories receive the majority. Bank of America analysts believe that the British currency should benefit from resolving the situation with Brexit and expect GBP/USD to rise to 1.39. Meanwhile, Rabobank experts warn that the pound could fall to $1.15 if Great Britain could not agree with the EU to conclude a free trade agreement after Brexit. The UK will leave the EU on January 31, 2020 if the Tories get a majority in the December 12 elections, and the country's Parliament approves a "divorce" agreement promoted by Prime Minister Boris Johnson and allowing negotiations to begin on trade deals. "In the election, it is likely that many moderate Conservative MPs will be replaced by Brexiters, which will increase the risk of inaction after the Brexit transition. This could lead speculators to hastily increase their net short positions in the pound early next year," said Jane Foley, strategist at Rabobank. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Dec 2019 02:56 PM PST The British pound continues to hit highs after news that the Conservative Party could get a majority in Parliament in the December 12 general election. Such a scenario will allow incumbent Prime Minister Boris Johnson to secede from the EU and bring into play the agreed Brexit plan. In the morning, I noticed that according to the Kantar report, the ruling Conservative Party of Great Britain increased its margin from the Labour Party to 12 points, which supports the pound, as it changes investors' attitude to risk for the better. But do not forget that the closer we get to the election date, the more attention investors will pay to the survey results. The pound buyers' optimism was also filled with enthusiasm by the UK services activity report, which was revised upward after preliminary data. Despite the fact that the index is below the mark of 50 points, it showed a slight increase in November from a preliminary estimate. According to the IHS Markit report, the index of procurement managers for the UK services sector was 49.3 points in November against a preliminary estimate of 48.6 points. However, one growth to the level of 50 points is clearly not enough, as the British economy continues to feel insecure. IHS Markit economists still expect a quarterly decline in GDP of about 0.1%. As for the technical picture of the GBPUSD pair, the breakthrough of the large resistance of 1.3010, to which I paid attention in the morning, led to a powerful upward momentum. Now the bulls are focused on a new high in the area of 1.3125, the breakout of which will provide a direct path to a resistance of 1.3170. The downward correction will be limited to the first support level of 1.3055, and there is no need to talk about the trading instrument's return to a low of 1.3010. EURUSD Buyers of the European currency were not so optimistic after the data on the service sector, which indicated the persistence of problems in the eurozone economy. However, they turned out to be enough to prevent the bears from breaking below yesterday's lows, which preserves the upward potential in the pair. According to IHS Markit, PMI for the Italian services sector in November was at 50.4 points versus 52.2 points in October. Given that economists had forecast a decline to 51.4 points, this did not add any particular problems to the market. But the PMI for the French services sector remained above 52 points and amounted to 52.2 points in November compared to 52.9 points in October. An indicator above 50 points indicates an increase in activity. In Germany, there was a surge in service activity, where the PMI reached 51.7 points in November against 51.6 points in October this year, with a forecast of decline to 51.3 points. In the eurozone as a whole, the service sector has slightly decreased, but this did not upset traders. According to the report, PMI for the eurozone services sector fell to 51.9 points in November. Economists predicted that the figure would drop to 51.5 points. But the composite index, which already includes the manufacturing sector and the services sector, still indicates a weak economic growth in the eurozone in the fourth quarter of this year. According to IHS Markit, eurozone PMI Composite was finalized at 50.6 points compared to 50.3 points in October and the preliminary value of the same 50.3 points. All this once again suggests that the economic growth of the eurozone will remain weak in early 2020, however, the actions of the European Central Bank will help maintain growth. The fears that the problems of the manufacturing sector extend to the service sector are decreasing with each report. Nothing has changed in EURUSD from a technical point of view. Bulls ran into a resistance of 1.1095 and cannot get above this range. Only its breakthrough will provide risky assets with a new impetus, which will lead to the renewal of highs in the areas of 1.1131 and 1.1180. If pressure on the euro returns, and for this, sellers of risky assets only need to push the trading instrument below the support of 1.1060, we can expect EURUSD to fall to the lows of 1.1030 and 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

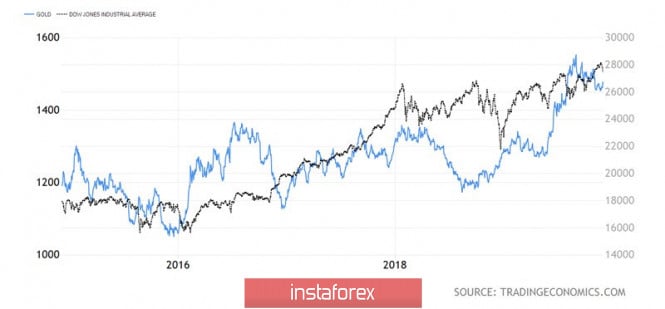

| Posted: 04 Dec 2019 02:56 PM PST Gold has grown by 15% since the beginning of the year due to a protracted trade dispute between China and the United States, an increase in the likelihood of a recession in the US economy and the associated reduction in the federal funds rate by 75 bp. Is it any wonder that after these factors were back in the game, the precious metal jumped 1.1% on December 3? US President Donald Trump claims that he is in no hurry to sign a trade agreement with China and is ready to wait until the presidential election. If uncertainty drags on, there will be a resurgence in demand for safe haven assets! According to US Secretary of Commerce Wilbur Ross, if the agreement is not signed before December 15 or by this time there will be significant progress in relations between Washington and Beijing, the White House will introduce tariffs on $156 billion-worth of Chinese imports. The markets have already set up that this will not happen, so the rhetoric of the president and his team forced speculators to curtail long positions in the S&P 500, which led to the development of a correction in the stock index and supported the bulls in XAU/USD. Gold tends to grow during periods of uncertainty, which suppresses global risk appetite. The dynamics of gold and the Dow Jones The USD index also went down at the same time as the US stock market. The outperforming S&P 500 over foreign counterparts and the associated inflow of capital to the United States in 2019 contributed to the strengthening of the US dollar, so it is not surprising that the pullback of the stock index weakened its position. Along with uncertainty surrounding the trade wars, the XAU/USD bulls have a helping hand in increasing the likelihood of federal rate cuts and disappointing US statistics. The index of purchasing managers in the US manufacturing sector is in the critical zone below 50, which indicates the problems of the sector, for the fourth consecutive month and the balance of foreign trade in services continues to deteriorate due to the strong dollar and high US prices for medicine and education. As a result, rumors of a recession are beginning to spread around the market, which faithfully served gold for most of this year. CME derivatives expect the federal funds rate to drop from 1.75% to 1.5% in July 2020, although a week ago it was about November. Thus, the main advantages of the precious metal are back in the game, and if the United States impose duties on $156 billion in Chinese imports from December 15, the S&P 500 will continue to adjust, and the probability of the Federal Reserve's monetary expansion next year will increase, its quotes will easily return above the psychologically important level of $1,500 for an ounce. Technically, the initial goal of the bulls is to consolidate within the range of the previous consolidation $1475-1515. It will turn out - you can think about going down a trading channel abroad and about activating the Expanding Wedge reversal pattern. A successful assault on resistance by $1515-1520 will increase the risks of implementing the target by 161.8% according to the Crab pattern. It is located near the mark of $1560 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: euro still has a chance to grow, however trade disputes may get in the way Posted: 04 Dec 2019 02:56 PM PST You can lose individual battles to win the war. Despite the fact that the head of the White House, Donald Trump, says that he does not follow the US stock indexes, everyone knows how much he really enjoys the success of the S&P 500. The decrease in tension in trade relations between Washington and Beijing, combined with a preventive cut in the Fed interest rate by 75 basis points made it possible for the US stock market to increase its capitalization by 25%, after which apparently, the American president then decided to retreat. The new US tariffs for Brazil and Argentina, as well as the announcement of the introduction of US duties against France, led to a two-day sell-off of the S&P 500, which accelerated after Trump's comments that he was ready to wait another year before concluding a comprehensive trade agreement with China. As you know, choose the least of the two evils. It is possible that the US president believes that at this stage, a strong greenback is a greater threat to the US economy than a decline in stock indices. U.S. stock market rallies and the related capital inflow into the country supported the dollar in 2019, so the S&P 500 correction weakened its position. According to Deutsche Bank analysts, the single European currency is increasingly used in interbank financing, international borrowing and carry trade operations. According to Bloomberg, in 2019, it was beneficial to use the euro as a borrowing currency against 20 of the 23 currencies of developing countries. This circumstance, cheap liquidity from the ECB and the euro's record low volatility contribute to the fact that it takes away the main funding currency status from the greenback. If this is true, then it becomes clear why the EUR/USD pair is growing in response to the weakening global risk appetite, including that caused by the escalation of the trade conflict between the US and China. It should be understood that without the end of the trade war, there can be no talk of restoring the eurozone economy. Therefore, the short-term success of the euro still does not mean anything. On the medium and long-term horizons, prospects for the single currency look far from bright, especially since frictions of Washington and Paris risk escalating into a new trade war involving the EU. France has already stated that the EU will retaliate if the US fulfills the threat of imposing duties on French goods worth $2.4 billion. Far from peaceful statements by Trump regarding the China reduce the chances that US tariffs worth $156 billion in Chinese imports will not be introduced on December 15. This increases the likelihood of further correction of the S&P 500 index and the growth of EUR/USD to 1.1115 and 1.1135. Another escalation of the trade conflict will negatively affect European business activity and will soon block oxygen to the bulls. In addition, the history of recent months shows that the main currency pair is quite closely correlated with the global economic growth rate. Their slowdown or even just waiting for this causes pressure on the quotes. Given the fact that Trump is directing the weapons of his tariff war to the economy of an increasing number of countries, from South America to Europe and China, hopes for a global recovery, as well as for the movement of EUR/USD above 1.12, can disappear quite quickly. In this case, the euro risks falling in price to $1.09 by the end of the year. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Dec 2019 02:56 PM PST The US currency is facing turbulence again this week. The volatility of the dollar is facilitated by the introduction of US duties on the import of steel and aluminum from Brazil, as well as active criticism of the Fed's actions by the head of the White House. Such measures undermine the greenback, taking away its chances of a dominant position. Experts do not exclude that the statements of Donald Trump are not always a guide to action, however, regular calls to the Federal Reserve on the devaluation of the national currency are not in vain for the USD. The dollar responded by sagging these attacks, and its recovery was complicated by a report on weak US production data. The current turmoil negatively affected the EUR/USD pair. At the same time, the European currency felt better, having made growth attempts, although in the future it again lost ground. The EUR/USD pair consolidated above the correctional level of 1.1057 on Tuesday, December 3, and began to move to 1.1080. Experts consider this bar a key level for the pair. Subsequently, the pair rose to the levels of 1.1081–1.1082, but could not stay there for long. Analysts assumed that the pair will be able to reach the most important level of 1.1100, but this did not happen. On the contrary, it showed a downward trend. The EUR/USD pair is trading in the range of 1.1075–1.1076 today, making desperate attempts to overcome the appeal of these numbers. After some time, this attempt was successful, and the pair rose to 1.1083–1.1084. Now the EUR/USD pair is trying to gain a foothold at these levels, pushing off from them in order to move on. According to experts, a radical reversal is possible only if the 1.1160 bar is overcome. Note that a 200-day moving average passes through this level, and there are two previous peaks of the EUR/USD pair on it. At the beginning of the week, the EUR/USD pair showed strong growth, and the greenback entered the peak, being on the verge of collapse. Specialists drew attention to the market decline at the same time as the dollar, which is a rare combination than their parallel growth. A significant driver of the greenback's fall was the rapid rise of the Australian dollar. The AUD/USD pair rose by 0.8% due to disappointing data on the index of business activity in America. Recall, after this report, the greenback sharply dipped in relation to most world currencies. According to analysts, the current situation may be extremely negative for the dollar. At the moment, its weakening is recorded, although the greenback is still not going to give up its positions. Experts believe that the stock markets will try to return to the rise amid the US currency's fall. Another scenario is also likely: markets may continue to fall due to fear of trade conflicts. In any case, the greenback will have a hard time, especially when its dominant position is under threat. The material has been provided by InstaForex Company - www.instaforex.com |

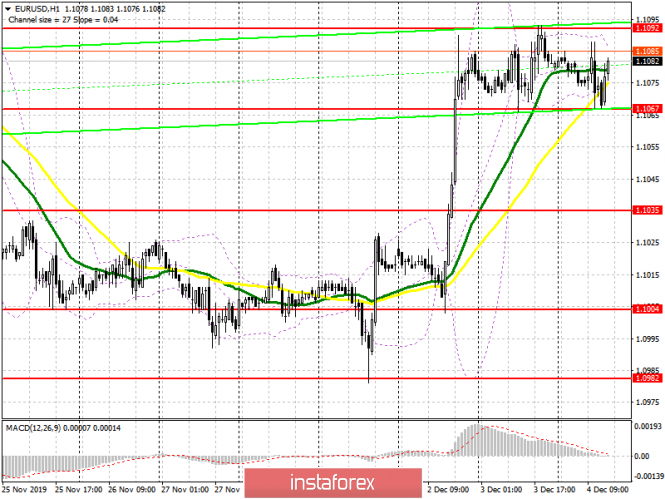

| December 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 04 Dec 2019 11:01 AM PST

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. That's why, two consecutive bearish pullbacks were executed towards 1.1025 and 1.0995 where two episodes of bullish rejection were demonstrated. Recent bullish pullback was demonstrated towards 1.1065-1.1085 where a cluster of supply levels were located (61.8% Fibo - 50% Fibo levels) that initiated a bearish movement towards 1.1000. On the other hand, recent price action suggested a high probability of bullish reversal around 1.1000 that brought the EURUSD pair again towards 1.1065-1.1085 as expected. Thus, the EUR/USD Pair has been trapped between the price levels of 1.1000 and 1.1085 until Today as a bullish spike is being demonstrated towards 1.1110. Initial bearish rejection should be anticipated around 1.1110 to bring bearish decline towards 1.1065. Moreover, a Head & Shoulders reversal pattern is being demonstrated with neckline located around 1.1065. Hence, a valid SELL entry can be offered upon bearish breakout below 1.1065. Initial bearish target would be located around 1.1010. Please also note that any bullish breakout above 1.1090 will probably bring further bullish advancement towards 1.1140 and 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

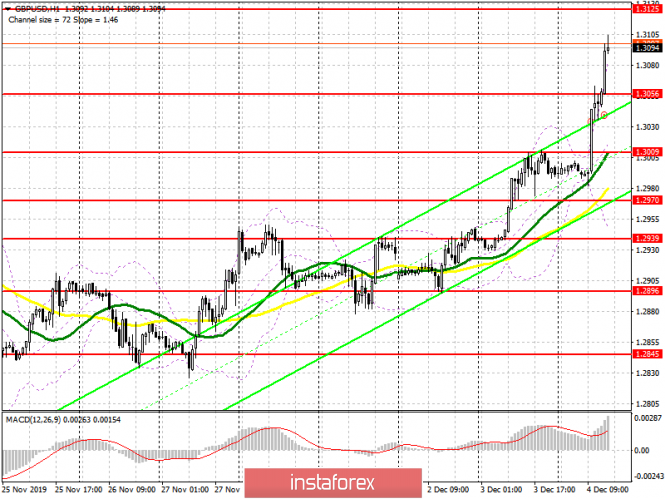

| December 4, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 04 Dec 2019 07:45 AM PST

Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where bullish recovery was recently demonstrated on two consecutive visits. Since then, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Today when bullish breakout above 1.3000 was achieved. Short-term technical outlook remains bullish as long as consolidations are maintained above 1.3000 on the H4 chart. On the other hand, the pair is currently testing the upper limit of the newly-established depicted short-term bullish channel. That's why, high probability of bearish rejection exists around the current price levels. Conservative traders may have to wait for a bearish pullback towards 1.2980-1.3000 for a valid BUY signal. Estimated bullish target to be located around 1.3120 and 1.3150. On the other hand, please note that any bearish closure below 1.2980 invalidates the bullish scenario for the short-term allowing further bearish decline towards 1.2900 then 1.2850. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Dec 2019 06:41 AM PST

Good afternoon, NASDAQ has dropped sharply in the recent 2 days from 8,400 levels. It found support in the 8,160 area, lows of early November, now is almost 150 ticks higher. While the yellow trendline, the steepest descending channel has been broken this morning, providing some technical relief, I would like to SELL close to 8,325 levels (red line) with stops around 8,345. The 1st target in the green line should be met somewhere around 8,270. Check out if it's broken. Stay safe The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 12.04.2019 - Watch for another down wave Posted: 04 Dec 2019 06:40 AM PST Crypto news: Cryptocurrency data analytics firm, CoinMetrics, recently published the 28th issue of its weekly 'State of the Network' series, reporting changes in network data over the past week. According to CoinMetrics, mining revenue for both Bitcoin and Ethereum are down significantly for the second consecutive week, mostly due to the pronounced fall in prices over the same period. The report also showed that ETH fees dropped by 14.4% this week, compared to the 20% growth seen the week before, which CoinMetrics attributed to the launch of the Gods Unchained marketplace. The data also highlighted that Bitcoin's market value to realized value (MVRV) ratio had started to increase over the past week, after dipping to a six month low of 1.23 last week. The report noted that as of 1 December, BTC MVRV was 1.32. Technical analysis:

Bitcoin has been trading higher in the past 8hours. Anyway, BTC reached and rejected of the very important resistance at the price of $7.650, which his good sign that sellers are still in control. In my opinion BTC did re-test of the broken bear flag pattern. Watch for selling opportunities and downward targets at $7.079, $6.889 and $6.561. MACD oscillator is showing neutral stance and no expansion. Resistance levels are found at the price of $7.650 and $7.750. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 12.04.2019 - Watch for potential breakout of $1.484 to confirm further upside continuation Posted: 04 Dec 2019 06:27 AM PST Gold is building pivots around Pitchfork ML and important resistance at $1.479. It is very common that after the price reach Pitchfork ML, we see multiply pivots to form around that ML. The breakout of the $1.484 will confirm further upside and potential test of $1.484,$1.500.

Stochastic oscillator is showing overbought condition but at the same time I found that new high in reading, which confirms stronger money flow on the upside. Support levels are seen at the price of $1.472 and $1.466. Resistance levels are set at the price of $1.484, $1.494 and $1.503. The material has been provided by InstaForex Company - www.instaforex.com |

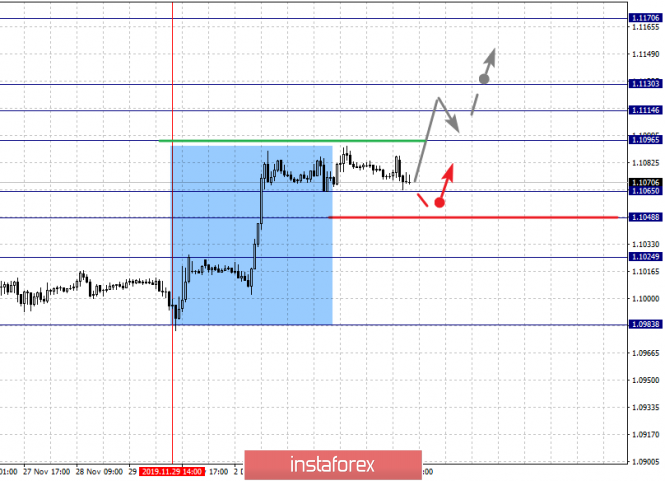

| Posted: 04 Dec 2019 06:14 AM PST EUR did break our important multi-pivot resistance at 1.1094 and reached first upward target. There is potential for further upside and potential test of 1.1176 (second upward target).

MACD oscillator is showing increase on the upside momentum, which is good sign that buyers are in control and that buying on the dips is preferable strategy for today. The cause of the upside move on the EUR may be the news from ECB this week combined with US-China potential trade deal. Support levels are seen at the price of 1.1094 (resistance became support) and 1.1066. Resistance level is set at 1.1176. The material has been provided by InstaForex Company - www.instaforex.com |

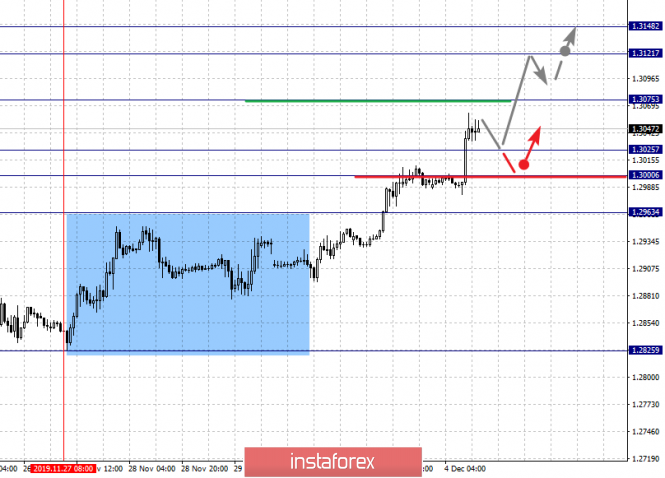

| Posted: 04 Dec 2019 05:38 AM PST To open long positions on GBPUSD, you need: The services sector has revived demand for the British pound, which went to renew highs before the important general election in the UK, which is scheduled for December 12 this year. The breakout of the large resistance of 1.3009, which I paid attention to in my morning forecast, led to the demolition of several stop orders of sellers and further supported GBP/USD. At the moment, after fixing above the next resistance of 1.3039, the bulls rushed to the maximum of 1.3074 and 1.3125, where I recommend taking the profits. With a downward correction in the second half of the day, which is unlikely to happen today, you can count on new purchases after a false breakout at a minimum of 1.3055. To open short positions on GBPUSD, you need: Sellers are in no hurry to return to the market after the demolition of several stop orders. Therefore, it is best to focus on the resistance of 1.3125, the formation of a false breakout on which will be a signal to sell the pound. Otherwise, it is best to sell GBP/USD on a rebound from the level of 1.3167. Only good data on the services sector in the United States, the release of which is scheduled for the second half of the day, will help the pound. The growth of the index will lead to small profit-taking on long positions in GBP/USD and a decline in the support area of 1.3056, where buyers will again actively act. The more important task of the bears will be to consolidate the pound under the support of 1.3056, which will push the pair to a minimum of 1.3009, where I recommend taking the profits. Indicator signals: Moving Averages Trading is above the 30 and 50 daily averages, indicating an upward trend. Bollinger Bands In the case of a decline in the pound, the average border of the indicator around 1.3009 will provide support.

Description of indicators

|

| Posted: 04 Dec 2019 05:38 AM PST To open long positions on EURUSD, you need: In the first half of the day, we could observe the release of several reports on the services sector of the eurozone countries, which, as one, showed growth, which allowed buyers of the European currency to hold their positions above yesterday's low, forming support of 1.1067. The eurozone composite PMI rose to 50.6 points in November this year. At the moment, the entire focus is shifted to data on the services sector in the United States. Weak reports will allow the bulls to re-test the resistance of 1.1092 and break above this maximum, which will strengthen the demand for EUR/USD and lead to an update of the levels of 1.1109 and 1.131, where I recommend taking the profits. With another unsuccessful attempt to grow above 1.1092, you can count on long positions after the correction from the support of 1.1067, provided that a false breakdown is formed or buy for a rebound immediately from the minimum of 1.1035. To open short positions on EURUSD, you need: Like yesterday, the bears will expect an unsuccessful consolidation above the resistance of 1.1092, which will be the first signal to open short positions in the euro, the purpose of which will be the support of 1.1067. A good report on the growth of the service sector in the United States will help sellers in this. However, a return to support level of 1.1035 will be more important, where I recommend taking the profits. It is in the area of 1.1035 that euro buyers will try to build the lower border of the new upward channel. If the report disappoints buyers of the dollar, in the scenario of EUR/USD growth above the resistance of 1.1092 in the afternoon, it is best to consider short positions after the update of the maximum of 1.1109 or sell immediately on the rebound from the resistance of 1.1131. Indicator signals: Moving Averages Trading is just above the 30 and 50 moving averages, which keeps the chance of a rise in the euro. Bollinger Bands A break of the upper border of the indicator, which coincides with the resistance of 1.1092, will also be a signal to buy the euro.

Description of indicators

|

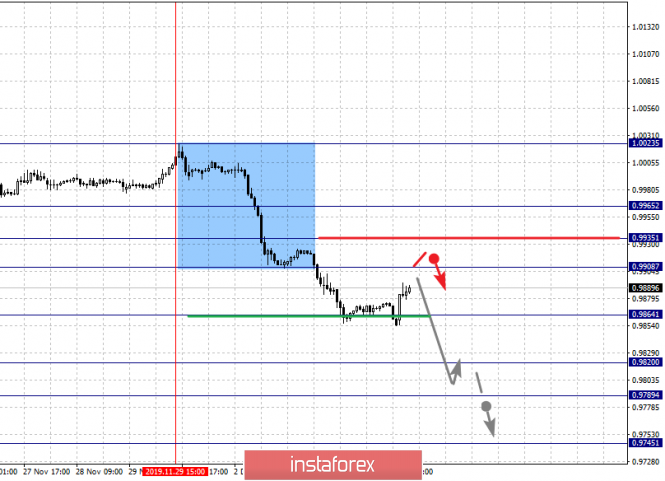

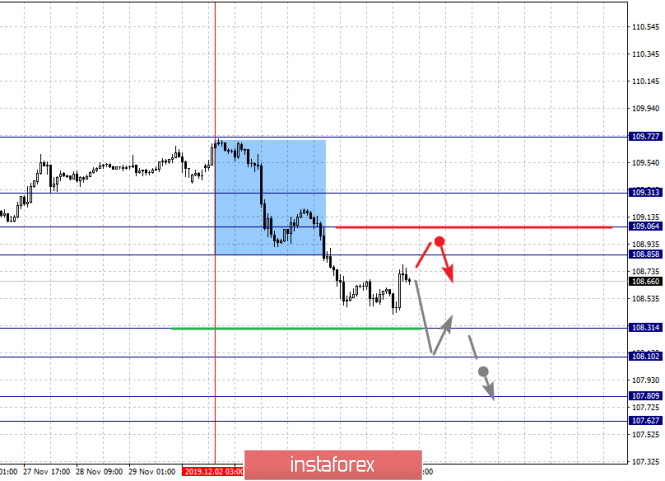

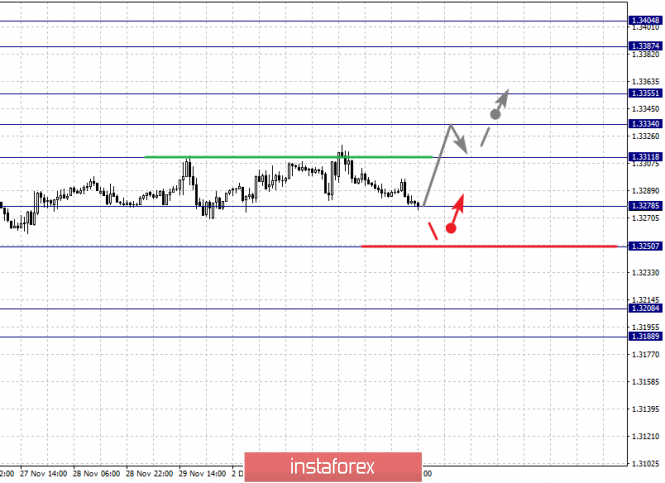

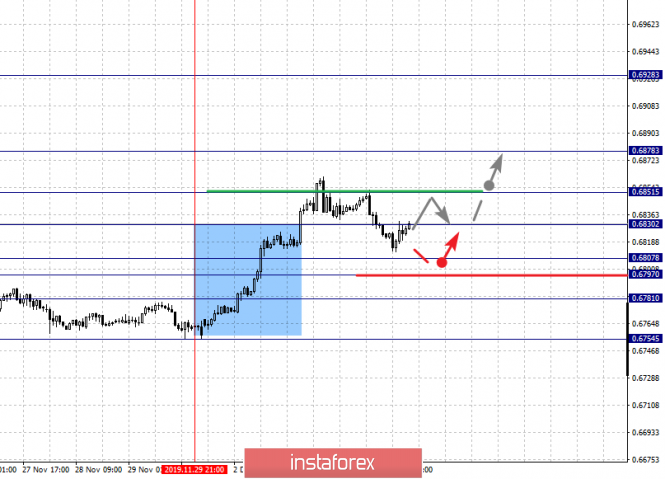

| Fractal analysis for major currency pairs as of December 4 Posted: 04 Dec 2019 05:07 AM PST Hello, dear colleagues. For the Euro/Dollar pair, the price forms the initial conditions for the top of November 29 and the level of 1.1096 is the key resistance. For the Pound/Dollar pair, we expect the continuation of the upward cycle from November 27 after the breakdown of 1.3075. For the Dollar/Franc pair, we expect the development of the upward structure from November 29 after the breakout of 0.9862. For the Dollar/Yen pair, we follow the formation of a downward structure from December 2 and the level of 108.31 is the key resistance. For the Euro/Yen pair, the price is close to the cancellation of the upward structure of November 22, which requires a breakdown of the level of 120.10. For the Pound/Yen pair, the price is still in the correction area for the upward structure of November 22 and the level of 140.24 is the key support. Forecast for December 4: Analytical review of currency pairs on the H1 scale:

For the Euro/Dollar pair, the key levels on the H1 scale are 1.1170, 1.1130, 1.1114, 1.1096, 1.1065, 1.1048, and 1.1024. We follow the formation of the expressed initial conditions for the top of November 29. We expect the upward movement to continue after the breakdown of 1.1096. In this case, the target is 1.1114 and in the area of 1.1114-1.1130 is the price consolidation. The breakdown of the level of 1.1130 will lead to the development of a pronounced movement. The potential target is 1.1170. The short-term downward movement is expected in the range of 1.1065-1.1048 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1024 and this level is the key support for the upward structure. The main trend is the formation of initial conditions for the top of November 29. Trading recommendations: Buy: 1.1096 Take profit: 1.1146 Buy: 1.1132 Take profit: 1.1170 Sell: 1.1065 Take profit: 1.1050 Sell: 1.1046 Take profit: 1.1026

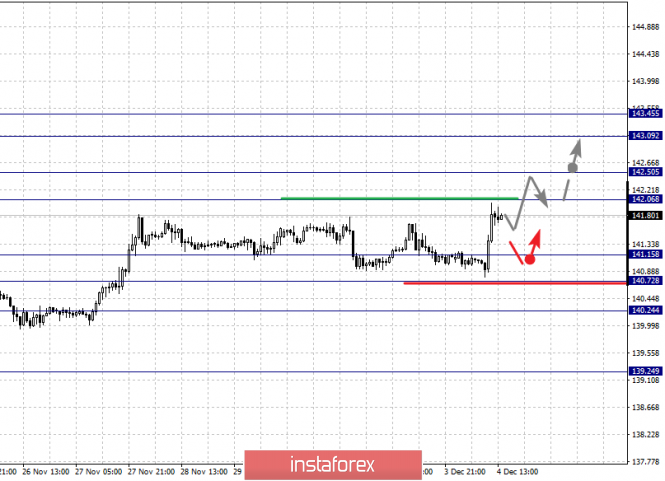

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3148, 1.3121, 1.3075, 1.3025, 1.3000, and 1.2963. We follow the development of the upward cycle of November 27. We expect the upward movement to continue after the breakout of 1.3075. In this case, the target is 1.3121 and consolidation is near this level. We consider the level of 1.3148 as a potential value for the top, after reaching this level, we expect consolidation and a pullback downwards. A short-term downward movement is possible in the area of 1.3025-1.3000 and the breakdown of the last value will lead to a deep correction. The target is 1.2963 and this level is the key support for the top. The main trend is the upward cycle from November 27. Trading recommendations: Buy: Take profit 1.3075: 1.3120 Buy: 1.3123 Take profit: 1.3148 Sell: 1.3025 Take profit: 1.3003 Sell: 1.2998 Take profit: 1.2965

For the Dollar/Franc pair, the key levels on the H1 scale are 0.9965, 0.9935, 0.9908, 0.9864, 0.9820, 0.9789, and 0.9745. We follow the development of the downward structure of November 29. We expect the downward movement to continue after the breakout of 0.9864. In this case, the target is 0.9820 and in the area of 0.9820-0.9789 is the short-term downward movement, as well as consolidation. The breakout of the level of 0.9789 should be accompanied by a pronounced upward movement. In this case, the potential target is 0.9745 and we expect a pullback to the correction from this level. The short-term upward movement is possible in the area of 0.9908-0.9935 and the breakdown of the last value will lead to an in-depth movement. The target is 0.9965 and this level is the key support for the downward structure from November 29. The main trend is the formation of initial conditions for the bottom of November 29. Trading recommendations: Buy: 0.9908 Take profit: 0.9933 Buy: 0.9937 Take profit: 0.9965 Sell: 0.9862 Take profit: 0.9825 Sell: 0.9820 Take profit: 0.9790

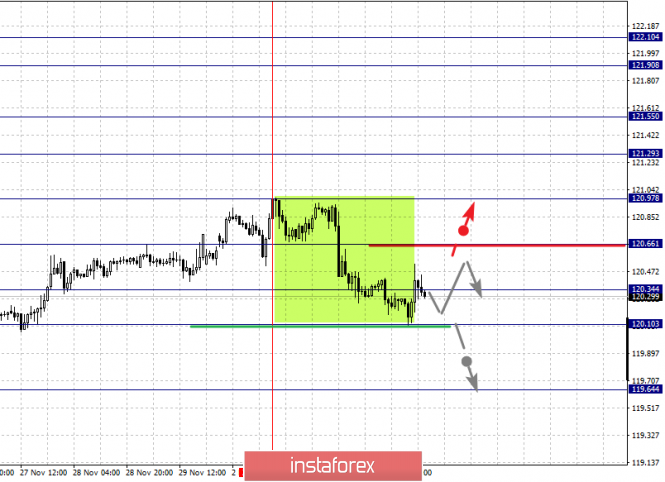

For the Dollar/Yen pair, the key levels in the scale H1 are 109.31, 109.06, 108.85, 108.31, 108.10, 107.80, and 107.62. We follow the formation of the downward structure of December 2. The short-term downward movement is expected in the range 108.31-108.10 and the breakdown of the last value will lead to a pronounced movement. The target is 107.80. The potential value for the bottom is the level of 107.62, upon reaching which we expect consolidation, as well as a pullback upwards. The short-term upward movement is expected in the range of 108.58-109.06 and the breakdown of the last value will lead to an in-depth correction. The target is 109.31 and this level is the key support for the downward structure. The main trend is the formation of initial conditions for the downward movement from December 2. Trading recommendations: Buy: 108.85 Take profit: 109.04 Buy: 109.08 Take profit: 109.30 Sell: 108.30 Take profit: 108.12 Sell: 108.08 Take profit: 107.80

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are 1.3404, 1.3387, 1.3355, 1.3334, 1.3311, 1.3298, 1.3278, and 1.3250. The price entered in the equilibrium condition. We expect the upward movement to continue after the breakout of 1.3311. In this case, the first target is 1.3334. The short-term upward movement is expected in the area of 1.3334-1.3355 and the breakdown of the last value should be accompanied by a pronounced upward movement. The target is 1.3387 and in the area of 1.3387-1.3404 is the price consolidation. The short-term downward movement, as well as consolidation, are possible in the area of 1.3298-1.3278 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3250 and this level is the key support for the upward structure. The main trend is the equilibrium state. Trading recommendations: Buy: 1.3311 Take profit: 1.3333 Buy: 1.3335 Take profit: 1.3355 Sell: 1.3276 Take profit: 1.3252 Sell: 1.3248 Take profit: 1.3220

For the Australian dollar/Dollar pair, the key levels on the H1 scale are 0.6878, 0.6851, 0.6830, 0.6807, 0.6797, and 0.6781. We follow the formation of the expressed initial conditions for the top of November 29. The short-term upward movement is expected in the range of 0.6830-0.6851. The breakout of the level of 0.6851 will lead to a pronounced upward trend. The potential target is 0.6878 and near this value is consolidation. The short-term downward movement is expected in the area of 0.6807-0.6797 and the breakdown of the last value will lead to an in-depth correction. The target is 0.6781 and this level is the key support for the upward structure. The main trend is the formation of pronounced initial conditions for the top of November 29. Trading recommendations: Buy: 0.6830 Take profit: 0.6848 Buy: 0.6853 Take profit: 0.6878 Sell: 0.6807 Take profit: 0.6797 Sell: 0.6795 Take profit: 0.6783

For the Euro/Yen pair, the key levels on the H1 scale are 122.10, 121.90, 121.55, 121.29, 120.97, 120.66, 120.34, 120.10, and 119.64. The price is close to the cancellation of the upward structure of November 22, which requires a breakdown of the level of 120.10. In this case, the first potential target for the downward structure of December 2 is 119.64. The resumption of upward movement is expected after the breakdown of 120.66. The first target is 120.97 and the breakdown of which, in turn, will lead to a movement to the level of 121.29, consolidation is near this level. In the area of 121.29-121.55, there is a short-term upward movement and the breakdown of 121.55 should be accompanied by a pronounced upward movement. The target is 121.90. The potential value for the top is the level of 122.10, upon reaching which we expect consolidation in the area of 121.90-122.10, as well as a pullback downwards. The main trend is the local upward structure of November 22, the stage of deep correction. Trading recommendations: Buy: 120.66 Take profit: 120.95 Buy: 120.98 Take profit: 121.25 Sell: 120.32 Take profit: 120.10 Sell: 120.05 Take profit: 119.70

For the Pound/Yen pair, the key levels on the H1 scale are 143.45, 143.09, 142.50. 142.06, 141.15, 140.72, and 140.24. We follow the development of the upward cycle of November 22. The short-term upward movement is expected in the area of 142.06-142.50 and the breakdown of the last value will lead to a pronounced movement. The target is 143.09. The potential value for the top is the level of 143.45, after reaching this level, we expect a correction. The short-term downward movement is possible in the area of 141.15-140.72 and the breakdown of the last value will lead to an in-depth correction. The target is 140.24 and this level is the key support for the top. The main trend is the upward structure from November 22. Trading recommendations: Buy: 142.06 Take profit: 142.50 Buy: 142.52 Take profit: 143.07 Sell: 141.15 Take profit: 140.74 Sell: 140.70 Take profit: 140.26 The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD on 12/04/2019 Posted: 04 Dec 2019 05:07 AM PST

There was some optimism in the market: The pound is starting to rise on the way out of a narrow consolidation - in new polls ahead of the December 12 election. Polls show a strong lead of the conservative. This means that Johnson will be able to carry out his version of Brexit. US: It has been reported that China and the US are successfully moving towards a trade agreement - despite disagreements and other issues such as Hong Kong. We are waiting for important data on the US: the employment report from ADP at 14:15 London time and the ISM service index report at 16:00. We keep purchases from 1.1035 and expect to break above 1.1100 and close the day above 1.1100. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for December 04, 2019 Posted: 04 Dec 2019 04:48 AM PST Overview: The AUD/USD pair will continue moving downwards from the level of 0.6826 (this level coincides with the 38.2% of Fibonacci retracement levels in H4 chart). Accordingly, the Aussie is going to show signs of strength at the lowest price of 0.6820. Thus, it will be a good deal to sell below the level of 61.8% of Fibonacci retracement levels on H1 chart with the first target at 0.6771 and further at 0.6726. Equally important, 0.6726 will be acting as a strong support so it is going to be a good place to take profit, it also should be noted that this level of taking profit will coincide with around last bearish wave. On the other hand, in case a reflection takes place and the AUD/USD pair is not able to break through the resistance at the 0.6820 level, the market will further decline to 0.6726 in order to indicate a bearish market. Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100. According to previous events, the AUD/USD pair has still been trapped between the level of 0.6826 and the 0.6726 level (those levels coincided with the fibonacci retracement levels 61.8% and last bearish wave respectively). It should be noted that the 0.6914 price (around double top at the level of 0.6914) will act as a strong resistance on November 7, 2019. Therefore, it will be too gainful to sell short below 0.6826 and look for further downside with 0.6771 and 0.6726 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 0.6914 level today. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. December 4. The euro took the lead in the confrontation with the dollar, but for how long? Posted: 04 Dec 2019 02:23 AM PST EUR/USD - 4H.

On December 4, the EUR/USD pair performed an increase to the Fibo level of 50.0% (1.1080). However, this level did not become any strong barrier for the euro-dollar pair. At least, a pronounced rebound from it did not happen, but now the quotes can perform a reversal in favor of the US currency and resume the process of falling. It is difficult to say how long it will last and how strong it will be, as the pair closed over the downward trend corridor, indicating a desire to start an upward trend. The information background can now be safely identified with only one figure on the world stage - with Donald Trump. The US president likes to be on the front pages of all periodicals, so he continues to distribute comments in which he criticizes half the world, not forgetting "his own garden" - the Fed and Jerome Powell. However, there is no shortage of Trump's actions by US trade partners. The American president imposed duties against Argentina, Brazil, Turkey, China; he is preparing to impose duties on France, as well as automotive products from the European Union. Not to mention the expansion of the trade war with China, which according to Trump, is not too zealously seeking to conclude a trade deal with America, which in the first place "is very necessary for China." Traders do not pay too much attention to this information, reasonably believing that economic reports are much more important. However, reports are not available every day. Yesterday, for example, there was none, as a consequence - weak activity of traders throughout the day. Today, the information background should be more interesting. There will be several indices of business activity in the eurozone in the services sectors of different countries. Fortunately for the euro currency, while most of these indices are kept above the level of 50.0, so it is too early to talk about the decline in the services sector. However, it is impossible to ignore the negative trend of business activity in the service sector. Not too fast, but the indices are falling, bringing the entire industry closer to a period of recession. On Monday, business activity in the manufacturing sector encouraged traders a little, but it cannot be said that much. Today, business activity in the service sector at best will not disappoint, at worst - will come close to the level of 50.0. But the US business activity indices, on the contrary, are in excellent condition. The ISM index is now 54.7 and Markit is 51.6. Even a small decline in business activity in the US services sector is unlikely to cause serious disappointment among traders. As a result of the analysis, I believe that the information background will be on the side of the US currency today. It remains only to wait for the economic reports themselves. Forecast for EUR/USD and trading recommendations: On December 4, traders will try to turn the pair down. Thus, an attempt to overcome the correction level of 50.0% (1.1080) can be considered unsuccessful or false. If so, then today again it is necessary to sell the pair with the targets of 38.2% (1.1057) and 23.6% (1.1030) and the stop-loss order above the level of 1.1080. The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

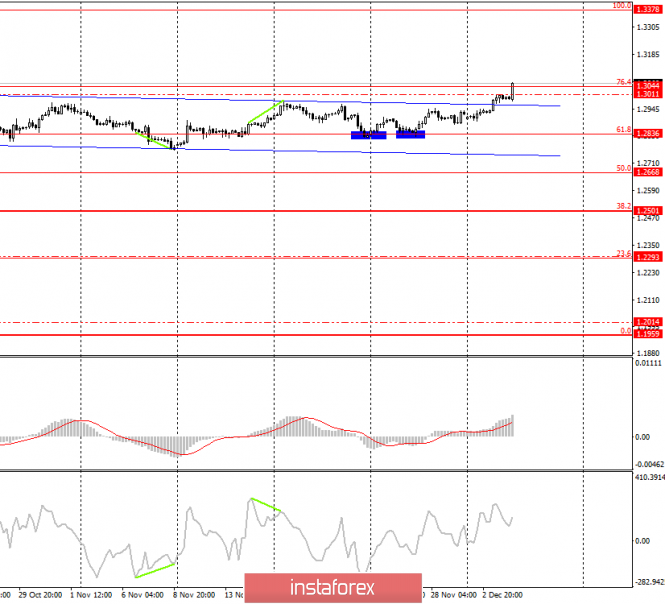

| GBP/USD. December 4. "Sword of Damocles" for the pound Posted: 04 Dec 2019 02:23 AM PST GBP/USD - 4H.

On December 4, the GBP/USD pair shows a great desire to continue the growth and fulfilled the correction level of 76.4% (1.3044). Thus, the pair's quotes have been going to this level for a long time, now the moment of truth has come. The rebound of the pound-dollar pair from this level will allow us to count on a reversal in favor of the US dollar and some fall towards the level of 61.8% (1.2836). Closing the pair above 1.3044 will significantly increase the pair's chances of further growth in the direction of the correction level of 100.0% (1.3378). Today, the divergence is not observed in any indicator. The pound rebounded after more than a month of trading in a side corridor, which was able to leave only yesterday. It may seem that now traders rush to buy the "Briton", but with the growth of optimism of traders about the upcoming elections to the US parliament, there is a growing danger that the conservatives will not gain the necessary number of votes and the whole process of Brexit will be delayed for an indefinite period. Moreover, what about the growth of the currency, which is not based on anything? After all, in the last two months, the British pound has been growing solely on expectations that Brexit will be implemented before the end of January, and Brexit "No Deal" will be avoided. What if there is no Brexit until the end of January? The pound will "return" everything back and fall down points by 500-600? At the same time, economic data from the UK are completely ignored by the markets, which causes even more fears for the future of the pound. Based on this, I believe that buying too much of the pound is dangerous now. No one knows how the election will end, how many seats in parliament will be occupied by coalition deputies who will oppose Boris Johnson and his plan to leave the EU at any cost. Forecast for GBP/USD and trading recommendations: The pound-dollar pair resumed the growth process, which is very difficult for traders to win back. The rebound of quotes from the correction level of 1.3044 may be the beginning of a new fall in the pair's rate, which is quite appropriate to win back. But I advise you to buy the pound if the consolidation above the Fibo level of 76.4% is performed with the target of 100.0% (1.3378). The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD for December 04, 2019 Posted: 04 Dec 2019 02:05 AM PST

Technical outlook: EUR/USD is seen to be drifting sideways for last 2 trading sessions after breaking out higher last week and printing highs at 1.1094 levels. It is high probable for the euro bulls to push through 1.1110 and 1.1130 levels which are seen as short-term targets. The current wave structure is pointing towards a bullish EUR/USD in the near term, while a potential bottom seems to have been formed at 1.0981 last week. Until 1.0981 remains intact, bulls are expected to print higher highs and higher lows towards 1.1180, 1,1150 and above. Besides, note that 1.0980 is well supported by fibonacci 0.618 retracement of the previous rally along with the past resistance that turned into the support zone as marked here. On the flip side, if the price drops below 1.0981 lows, it is likely to find support at 1.0940, which is close to the fibonacci 0.786 support/retracement. To sum up, please be aware that prices may drop one last time below 1.0981 before turning bullish. Trading plan: Remain long against 1.0879, the target above 1.1500 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

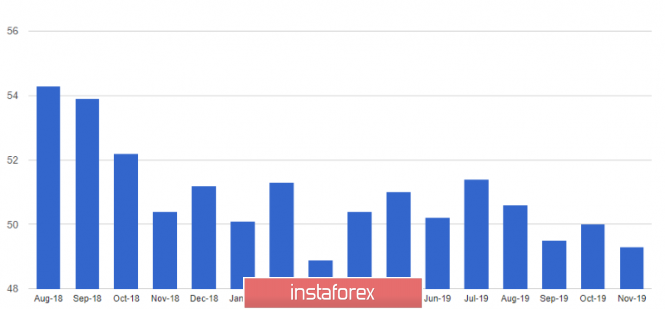

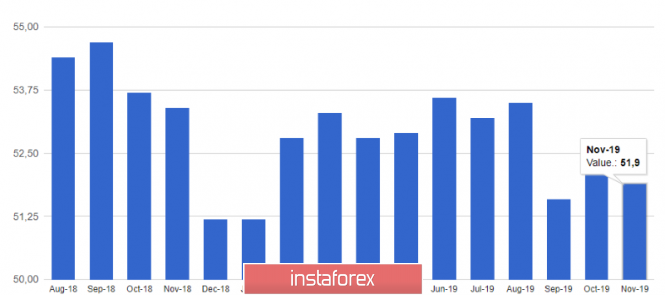

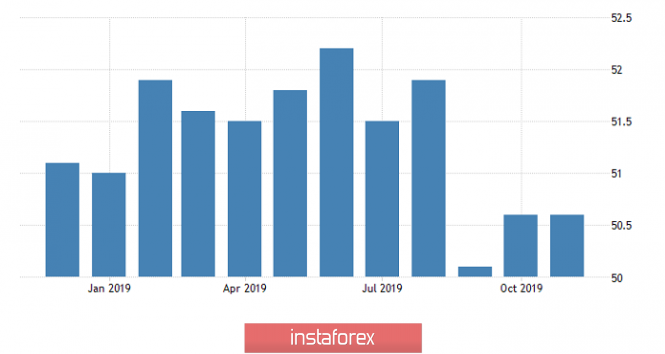

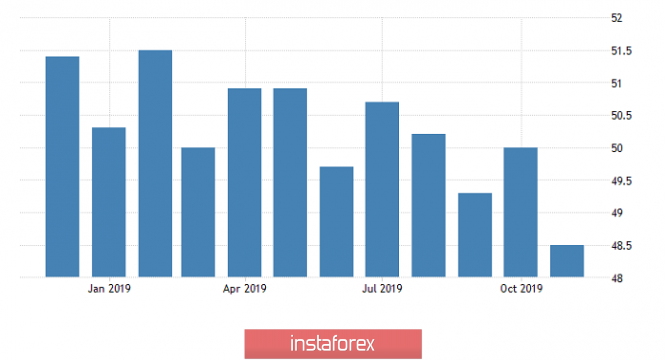

| No thrills, EUR / USD and GBP / USD review on 12/04/2019 Posted: 04 Dec 2019 01:51 AM PST The market needs a thrill, and it needs to be in the form of intrigues and scandals. Typically, with a political color, because there is no other way to explain yesterday's market behavior, which has tritely ignored European macroeconomic statistics. Indeed, the pace of decline in producer prices in Europe accelerated from 1.2% to 1.9%, this is contrary to what the forecasts have predicted with 2.2%, respectively. And this clearly indicates that the recent increase in inflation in Europe is likely to be temporary and we will soon see a resumption of its decline. So these data did not show anything good, but the single European currency stood still. And if you recall how events unfolded on Monday, it becomes clear that market participants lacked political factors for confidence yesterday.

But the pound unexpectedly reacted quite cheerfully to the index of business activity in the construction sector, which grew from 44.2 to 45.3. It should be noted that the forecast predicted a growth of 44.5. We must not forget that the real estate market and the construction industry are directly related because it is extremely important for determining the investment attractiveness of the UK. However, it must be remembered that the United Kingdom is preparing for early parliamentary elections to be held next week, and the information space is full of all kinds of messages on this subject. In particular, the results of regular polls and all kinds of forecasts regarding the voting results. So traders are on knives and their nerves are strained to the limit. So yesterday's growth is partially associated with increased nervousness. Construction sector business activity index (UK):

The pound continued to grow today, but not alone, it is in tandem with the only European currency. This is partly due to the publication of a number of macroeconomic data on the Old World. But beyond that, the market is preparing for today's publication of ADP employment data in the United States, although first things first. The final data on the index of business activity in the service sector was published in Europe, as well as the composite index of business activity. However, the data came out not quite as expected, for the index of business activity in the services sector in Europe fell from 52.2 to 51.9 although they were waiting for its decline to 51.5. Nevertheless, given the growth of the index of business activity in the manufacturing sector, the composite index remained unchanged at 50.6. Furthermore, if you look at the largest economies of the euro area, it's not so bad in terms of Germany, where the index of business activity in the service sector grew from 51.6 to 51.7, although they expected it to decline to 51.3. Due to this, the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped. the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped. the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped. Composite Business Activity Index (Europe):

The pound is holding on. However, the final data on business activity indices, as in the case of the single European currency, will lead to the fact that it might need to retreat. The fact is that, unlike the eurozone, forecasts for the UK do not spark any optimism. In particular, the index of business activity in the service sector may decrease from 50.0 to 48.6, and the composite index from 50.0 to 48.5. Not only is this decline, but also the indices should fall below 50.0 points, which indicates increasing risks of the onset of an economic downturn. Composite Business Activity Index (UK):

However, the main news of the day is the ADP data on employment, which can show its growth by 140 thousand against 125 thousand in the previous month. The increase in employment growth rates clearly indicates an improvement in the market situation, and in anticipation of the Friday publication of the report of the United States Department of Labor without any political factors, this will be a serious help in strengthening the dollar. In addition, the United States also publishes a summary of data on business activity indices, forecasts for which are rather optimistic. Thus, the index of business activity in the service sector should increase from 50.6 to 51.6. A composite index of business activity is likely to grow from 50.9 to 51.9. Employment Change from ADP (United States):

Thus, the single European currency has every chance to end the day at 1.1050.

The pound will also have to decline, and the reference point is the 1.2950 mark.

|

| Posted: 04 Dec 2019 01:49 AM PST Good afternoon, dear traders! I present to you the volumetric analysis of oil. So, let's analyze the last days by bars: Bar 1. The downward movement was without America. Moreover, the volume is very high. And the price falls into the zone of large volumes. Volume without America !!!!! Bar 2. A bar of purchases without progress in price growth in relation to the previous price increase. The "tail" of sales indicates the presence of a seller. Waiting down. Bar 3. Shopping bar. The volume is still high. The seller showed himself poorly. The price began to resume sales, but the closing of the day is even higher, from where the expectation of resumption of sales was. Then the question is - why, after such a strong Bar 1, the price has not resumed sales for 2 days already? It is worth noting that Thursday and Friday of the previous week were a weekend for America. And on Monday, America began to trade in the shopping area at 55.00 after Friday's collapse. That is, prices are clearly not favorable for the US for further sales. Today, according to the news calendar, weekly oil reserves, during which there will be increased volatility of the instrument and, possibly, at this time there will be the main movement of the day to absorb last Friday. H1: A reminder that today, at 15:30 universal time, oil reserves in the United States will be released. If the Americans pump up a lot, the long scenario is canceled. The analysis is based on the US oil futures. Good luck in trading and follow money management. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment