Forex analysis review |

- Fractal analysis of the main currency pairs on January 27

- EUR/USD. Preview of the new week. Fed passage meeting. EU, US GDP data

- GBP/USD. UK after Brexit: waiting for collapse?

- EUR/USD. Trump impeachment: fair trial or political process?

- EUR/USD. Equal - Coronavirus 2019-nCoV: panic still dominates the market

| Fractal analysis of the main currency pairs on January 27 Posted: 26 Jan 2020 06:02 PM PST Forecast for January 27: Analytical review of currency pairs on the scale of H1:

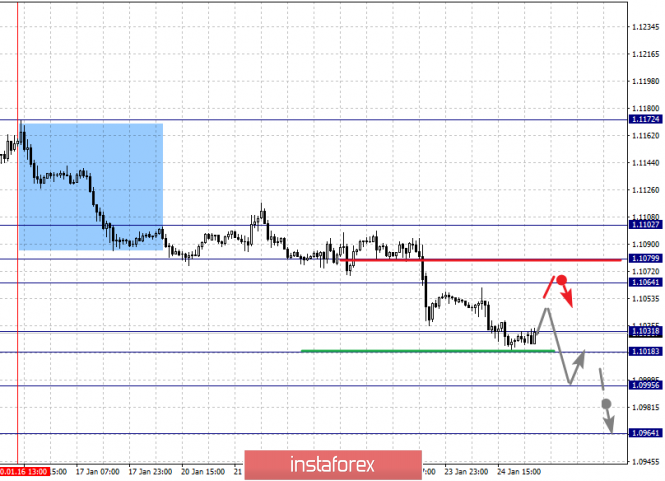

For the euro / dollar pair, the key levels on the H1 scale are: 1.1102, 1.1079, 1.1064, 1.1031, 1.1018, 1.0995 and 1.0964. Here, we are following the descending structure of January 16. Short-term downward movement is expected in the range of 1.1031 - 1.1018. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.0995. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.0964. Upon reaching which, we expect a rollback to the top. Short-term upward movement is possibly in the range of 1.1064 - 1.1079. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 1.1102. This level is a key support for the downward structure. The main trend is the descending structure of January 16 Trading recommendations: Buy: 1.1065 Take profit: 1.1077 Buy: 1.1082 Take profit: 1.1100 Sell: 1.1031 Take profit: 1.1018 Sell: 1.1016 Take profit: 1.0996

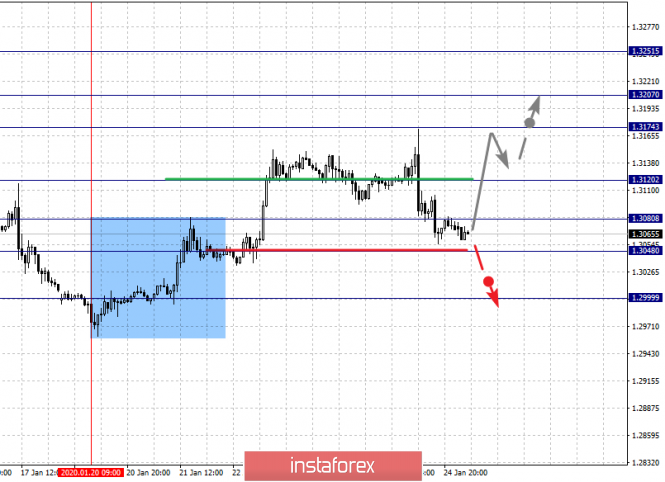

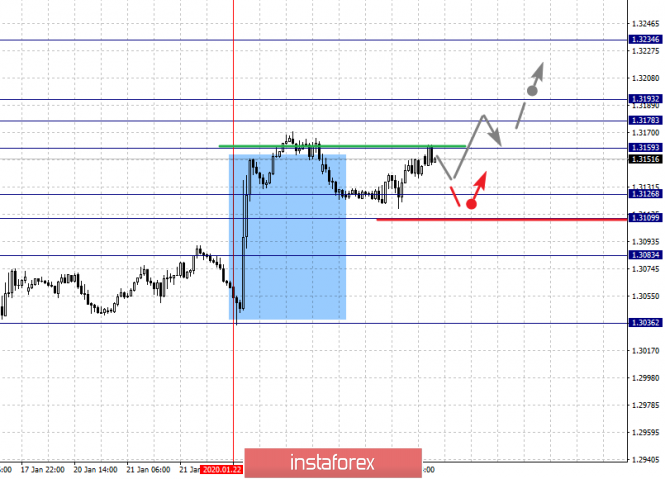

For the pound / dollar pair, the key levels on the H1 scale are: 1.3251, 1.3207, 1.3174, 1.3120, 1.3080, 1.3048 and 1.2999. Here, we continue to follow the upward cycle of January 20. The continuation of the movement to the top is expected after the breakdown of the level of 1.3120. In this case, the first target is 1.3174. Short-term upward movement is expected in the range 1.3174 - 1.3207. The breakdown of the latter value will lead to movement to a potential target - 1.3251. We expect a pullback to the bottom from this level. Short-term downward movement is possibly in the range of 1.3080 - 1.3048. The breakdown of the latter value will lead to the formation of a downward structure. In this case, the potential target is 1.2999. The main trend is the upward structure of January 20, the correction stage Trading recommendations: Buy: 1.3120 Take profit: 1.3172 Buy: 1.3176 Take profit: 1.3207 Sell: 1.3046 Take profit: 1.3000 Sell: Take profit:

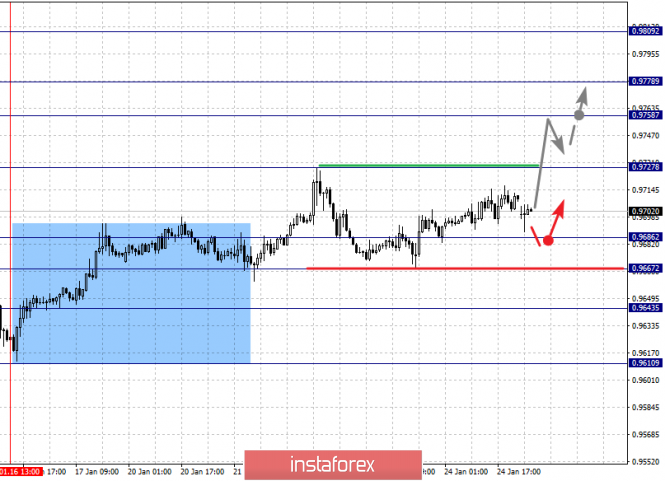

For the dollar / franc pair, the key levels on the H1 scale are: 0.9809, 0.9778, 0.9758, 0.9727, 0.9686, 0.9667 and 0.9643. Here, we are following the development of the ascending structure of January 16. The continuation of the movement to the top is expected after the breakdown of the level of 0.9727. In this case, the target is 0.9758. Short-term upward movement, as well as consolidation is in range of 0.9758 - 0.9778. We consider the level of 0.9809 to be a potential value for the upward movement; We expect a pullback to the bottom upon reaching this level. Short-term downward movement is possibly in the range of 0.9686 - 0.9667. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9643. This level is a key support for the top. The main trend is the upward cycle of January 16 Trading recommendations: Buy : 0.9727 Take profit: 0.9756 Buy : 0.9758 Take profit: 0.9776 Sell: 0.9665 Take profit: 0.9645 Sell: 0.9640 Take profit: 0.9616

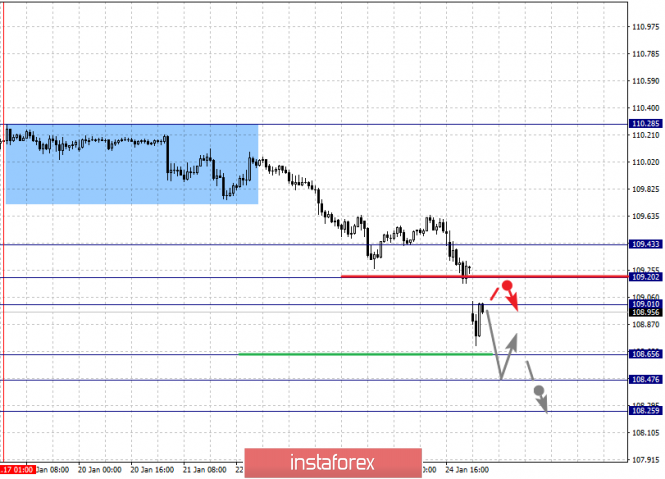

For the dollar / yen pair, the key levels on the scale are : 109.43, 109.20, 109.01, 108.65, 108.47 and 108.25. Here, we are following the downward cycle of January 17. Short-term downward movement is possible in the range of 108.56 - 108.47. The breakdown of the last value will lead to a movement to a potential target - 108.25, and upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 109.01 - 109.20. The breakdown of the last value will lead to an in-depth correction. Here, the target is 109.43. This level is a key support for the downward structure. Main trend: potential downward structure of January 17 Trading recommendations: Buy: 109.01 Take profit: 109.20 Buy : 109.23 Take profit: 109.40 Sell: 108.65 Take profit: 108.48 Sell: 108.45 Take profit: 108.25

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3234, 1.3193, 1.3178, 1.3159, 1.3126, 1.3109 and 1.3083. Here, the price registered the local upward structure of January 22. The continuation of the movement to the top is expected after the breakdown of the level of 1.3160. In this case, the target is 1.3178. Price consolidation is near this level. Passing at the price of the noise range 1.3178 - 1.3193 will lead to a movement to a potential target - 1.3234. We expect a pullback to the bottom from this level. Short-term downward movement is possibly in the range of 1.3126 - 1.3109. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3083. The main trend is the local ascending structure of January 22. Trading recommendations: Buy: 1.3160 Take profit: 1.3178 Buy : 1.3194 Take profit: 1.3234 Sell: 1.3126 Take profit: 1.3110 Sell: 1.3107 Take profit: 1.3085

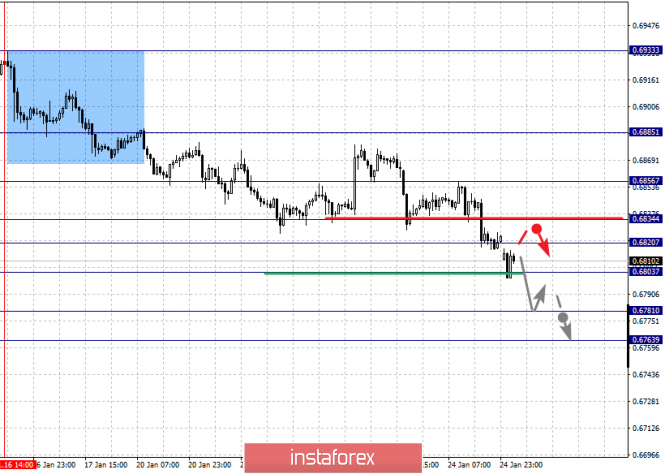

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6885, 0.6856, 0.6834, 0.6820, 0.6803, 0.6781 and 0.6763. Here, we are following the development of the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 0.6803. In this case, the target is 0.6781. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 0.6763. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is expected in the range of 0.6820 - 0.6834. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6856. This level is a key support for the bottom, its passage in price will lead to the formation of initial conditions for the upward cycle. Here, the potential target is 0.6885 . The main trend is the descending structure of January 16 Trading recommendations: Buy: 0.6801 Take profit: 0.6781 Buy: 0.6779 Take profit: 0.6765 Sell : 0.6820 Take profit : 0.6833 Sell: 0.6835 Take profit: 0.6855

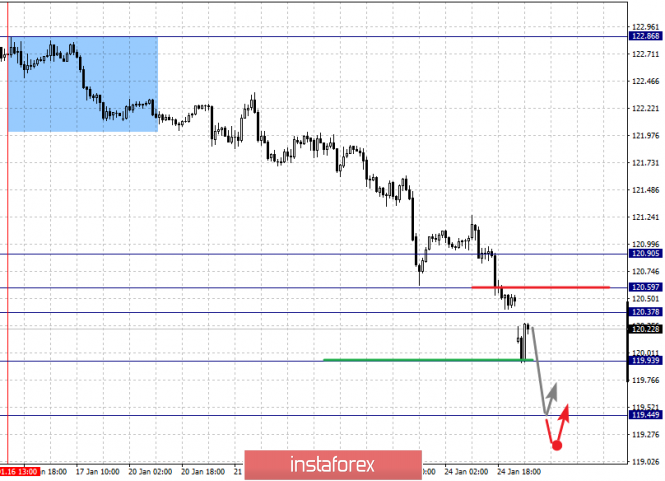

For the euro / yen pair, the key levels on the H1 scale are: 120.90, 120.59, 120.37, 119.93 and 119.44. Here, we are following the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 119.90. In this case, the potential target is 119.44. We expect a pullback in correction upon reaching this level. Short-term upward movement is possibly in the range of 120.37 - 120.59. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.90. This level is a key support for the downward structure. The main trend is the descending structure of January 16 Trading recommendations: Buy: 120.37 Take profit: 120.57 Buy: 120.61 Take profit: 120.90 Sell: 119.90 Take profit: 119.48 Sell: Take profit:

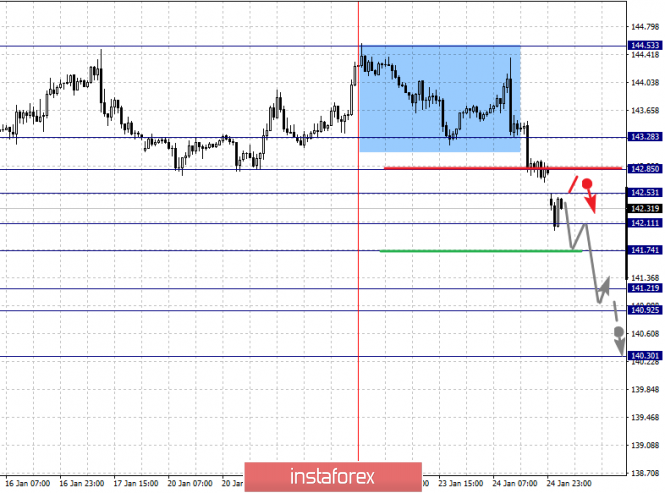

For the pound / yen pair, the key levels on the H1 scale are : 143.28, 142.85, 142.53, 142.11, 141.74, 141.21, 140.92 and 140.30. Here, we are following the development of the downward cycle of January 22. Short-term downward movement is expected in the range of 142.11 - 141.74. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 141.21. Price consolidation is in the range of 141.21 - 140.92. For the potential value for the bottom, we consider the level of 140.30. We expect a pullback to the top upon reaching this level. Short-term upward movement is expected in the range of 142.53 - 142.85. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 143.28. This level is a key support for the downward movement. The main trend is the descending structure of January 22 Trading recommendations: Buy: 142.53 Take profit: 142.85 Buy: 142.87 Take profit: 143.28 Sell: 142.10 Take profit: 141.76 Sell: 141.72 Take profit: 141.25 The material has been provided by InstaForex Company - www.instaforex.com |

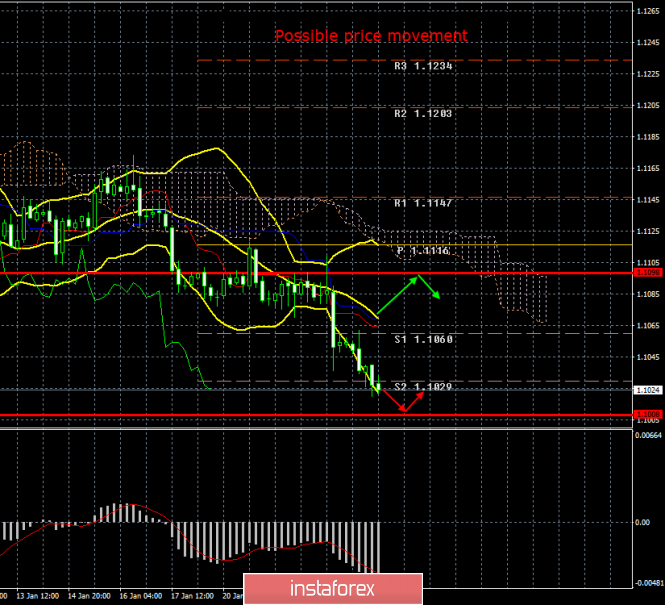

| EUR/USD. Preview of the new week. Fed passage meeting. EU, US GDP data Posted: 26 Jan 2020 02:52 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 25p - 38p - 28p - 73p - 42p. Average volatility over the past 5 days: 41p (average). The last trading week for the EUR/USD pair ended with the resumption of the downward movement. From our point of view, what happened was inevitable in almost any case. The euro/dollar has consolidated below the Ichimoku cloud, and now nothing prevents it from continuing to move down. As we have repeatedly said, the fundamental background and the macroeconomic background are the main drivers of the pair's fall. Due to technical factors, the euro-currency manages to adjust from time to time, and since trends are not only short-term, but also long-term, then corrections happen for several days, and for several months. However, the essence remains the same. The EU economy still looks much weaker than the US. The monetary policy parameters of the Federal Reserve look much stronger than the ECB. On the eve of the new trading week, we propose to look at such images with what macroeconomic events and publications await us. Monday, as often happens, will be completely empty in terms of macroeconomic events. However, on Tuesday we are waiting for the publication of orders for durable goods in the United States. This is a rather important report, since the goods of this category are quite expensive, respectively, their growth or vice versa, a fall can reflect current trends in the economy. Recall that the main concerns associated with the US economy are currently in the falling business activity index in the manufacturing sector of Markit, in the PMI ISM index, which has fallen into the "recession zone", as well as in the continued decline in industrial production. Other macroeconomic indicators are still at a decent level, but the industrial sector may begin to pull other indicators down as well. According to expert forecasts, the main indicator of orders will show an increase of 0.4% in December. A month earlier, the growth was negative -2.0%. That is, the number of orders decreased by 2%. If we take into account orders excluding defense, then an increase of 0.5% is expected, excluding transport - an increase of 0.1%, and excluding defense and aviation - an increase of 0.2%. Thus, experts expect an improvement in the situation compared to November, which, in principle, is not difficult. This data may support the US dollar. On Wednesday, the United States will hold an absolutely passing Fed meeting. Passing - because the probability of changing the key rate is 0%. The Fed took a firm wait-and-see position, which has already informed the markets several times. Thus, traders will be able to gather important and interesting information from the Fed's accompanying statement or from a press conference. It hardly makes sense to predict anything here, however, since there have not been any major changes in macroeconomic statistics in the United States recently, there is nothing to worry about for the members of the monetary committee. Moreover, the signing of the "first phase" trade deal between China and the United States 11 days ago, should inspire optimism in the Fed. Insignificant reports on unemployment and changes in the number of unemployed will be published in the European Union on Thursday. Traders rarely respond to this data with purchases or selling the pair. In Germany, the preliminary value of the consumer price index for January will be published on this day, and, as before, this indicator is interesting from the perspective of forecasting the future value of inflation in the EU, which remains at an extremely low value. Furthermore, data on GDP for the fourth quarter (also a preliminary value) will be published on this day, with a forecast of +2.1% and an index of expenditures on personal consumption with a forecast of 2.1%. On this day, of course, much will depend on the real value of GDP, although it will not be final. Well, on Friday, the eurozone GDP for the fourth quarter will be published, as well as a change in the levels of income and expenses of the US population in December 2019. GDP in the European Union remains much lower than in the United States. Forecasts predict an increase of the indicator compared to the fourth quarter of 2019 by only 1.2%. In general, the following can be said. Most macroeconomic statistics remain stronger in the US. You should not expect any action from the Fed and the ECB in the near future. More attention now needs to be paid to a possible trade war between the EU and the US, however, it is unlikely to start right tomorrow. Since, from a technical point of view, we already have a downward trend, it will be difficult for the bulls to show something more than just a correction, even if macroeconomic statistics are strong in the EU and weak in America. Trading recommendations: EUR/USD continues to move down. Thus, it is recommended that you either hold open shorts with targets of 1,1008 and 1,0973, until the start of the corrective movement (rebound from any target or turn the MACD indicator up). It will be possible to consider purchases of the euro/dollar pair no earlier than the traders of the Senkou Span B line overcome with the first goal the resistance level of 1.1203. All goals will be specified at the beginning of a new trading week. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. UK after Brexit: waiting for collapse? Posted: 26 Jan 2020 02:52 PM PST The UK will officially leave the European Union in five days. More precisely, the so-called "transition period" will begin, with which many identify the beginning of the real Brexit. Over the next 11 months, little will change for Great Britain. The country will cease to take part in the decision-making of the European Union, the British deputies will leave the European Parliament, however, the established trade relations and other rules and regulations by which the UK has lived in recent years will remain in force. Now, a month and a half after Boris Johnson's victory in the election, when passions and euphoria subsided, many experts conclude that the victory of the Conservatives is a result of the fragmentation of the political views of the opponents of Brexit, and not the excessive popularity of Conservatives among the people. In other words, there was only one option with the end of Brexit - vote for the Conservatives, and there were much more options against Brexit. At the same time, both the Scots, the Northern Irish, and the Welsh, supporting Brexit, had to vote not for "their" parties, but all for those Conservatives. For those who reject Brexit, they voted for the Scottish National Party, for the Labour Party, and for other political forces. As a result, all the voices of the opponents of Brexit were divided into 3-4 parties, all the voices of the supporters of Brexit left the party of Boris Johnson. However, now all this is not important. It's important - what the odious prime minister and his ruling party will lead the country to. In fact, in the coming year, all questions to Johnson's team come down to whether he will be able to agree with the U on a new trade deal that will operate after the end of the transition period? According to many experts, the main thing that is required of Johnson is to sign such a deal that does not harm the UK economy as much as possible, which has been losing huge amounts over the past three years due to Brexit and, in any case, will continue to lose them in 2020. Nobody believes that the deal will be the way Johnson himself sees it. Johnson is not Trump, but the European Union is not China. The biggest question that causes skepticism among all market participants is the timing of negotiations on trade relations with the EU. Eleven months is very little to conclude such a comprehensive deal. Thus, either Johnson will be able to conclude a "surface" agreement in a short time, or he will have to extend the transition period for two years (which Johnson does not want) and conduct more meaningful negotiations, without forcing events and slowly. Well, the biggest danger for London now comes from Edinburgh. Nicola Sturgeon, the first Minister of Scotland, has repeatedly stated that "London will not be able to lock us up and hope that everything will work out." Scotland opposes an exit from the EU, but advocates an exit from the UK if its interests are not taken into account by the government of Johnson. "If the UK continues to exist, it is only on the basis of universal consent," said Sturgeon. A formal request for a second independence referendum has already been sent to Johnson and has been rejected. However, it is unlikely that Edinburgh will so simply dwell on the refusal of permission to referendum. In the best case for Britain, the Scots will regularly put this issue on the agenda. At worst, separatism, refusal to subordinate to London, and unauthorized referendum are possible. I don't even want to think about what awaits Britain in the second case. Riots, a military conflict and a host of other "unpleasant things" are possible. Thus, all those who, following Johnson's victory in the elections, exhaled and considered that all the troubles are now behind, all that can be said is that all the troubles are still ahead, and Brexit now looks like the smallest of the problems of Great Britain. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Trump impeachment: fair trial or political process? Posted: 26 Jan 2020 02:52 PM PST While the new Coronavirus virus broke out in the world, from which several dozen people have already died in China, processes that are of much greater importance to the foreign exchange market, the global economy and politics are also continuing. Today we will talk about the impeachment of Donald Trump, the hearing of which began on January 24 in the Senate. The indictment voiced its arguments in favor of the fact that the US president should be removed from his post. In principle, all of them have already been voiced several times, even before the Senate meeting. Abuse of power, obstruction of the Congress, blackmail of Ukraine in order to influence the results of future presidential elections in November 2020. According to one of the prosecutors, chairman of the intelligence committee of the House of Representatives Adam Schiff, "the country cannot trust a leader who acts in his personal interests, and not in the interests of the country." "Such a person simply does not fit his position," summed Schiff. At the same time, Trump's lawyers did not sit idle and already presented their evidence of the lack of guilt of the US president. On Saturday, deputy attorney team Mike Purpura presented his list of evidence: 1) The Trump team has provided assistance to Ukraine more than the team of Barack Obama, has strengthened sanctions against Russia. 2) The Government of Ukraine has repeatedly stated that there is no pressure on it. 3) A telephone conversation between Trump and Vladimir Zelensky does not indicate that the US leader used military assistance as a means of pressure. 4) during a conversation between the two presidents, Zelensky did not know at all that military assistance would be delayed. 5) No investigations were launched against Joe Biden in Ukraine, although this is exactly what Trump "demanded" from Zelensky. 6) Ukraine received military assistance. Such arguments were made by Trump's lawyers, and most of these arguments look, to put it mildly, "far-fetched". The most interesting thing in this whole process is not what arguments will be voiced by the parties, but whether the Senate will go to the first in US history to directly dismiss the president? President odious and uniquely memorable. Recall that in the Senate most of the seats are occupied by the same party members of Trump - the Republicans. As for the defense arguments, at least three of them are broken up into commonplace logic. 1) what is the difference how much military assistance was provided to Ukraine by the Obama administration? 2) If Ukraine had announced pressure on it, it could have ruined relations with Trump. Is it worth recalling how Trump likes to respond most to those whose actions do not meet his expectations? 3) A telephone conversation can be interpreted in completely different ways. 4) What difference did Zelensky know about whether they would delay military aid or not? 5) If investigations against Biden began in Ukraine, this would mean that the scheme of political blackmail worked. In addition to all Trump's earlier accusations, many experts and political analysts believe that Trump, in other words, decided to use Ukraine for his personal purposes, neglecting America's foreign policy interests. Experts believe that, given the situation in the east of Ukraine, Ukraine in no case could be considered as a source of assistance in the elections. Ukraine remains an ally of the United States and needs help, not political pressure and blackmail. Most of the experts who have spoken out believe that Trump deserves impeachment. Also, most experts believe that the impeachment procedure will not have a special effect on the 2020 elections. Americans will elect a president based on a wide variety of opinions and opinions. Roughly speaking, the American people are more interested in the quality and standard of living under this or that president, and the violation of the principles of democracy because of personal interests interests him much less. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Equal - Coronavirus 2019-nCoV: panic still dominates the market Posted: 26 Jan 2020 02:52 PM PST The euro-dollar pair ended the trading week on a minor note, updating almost two-month lows. The cautious stance of Christine Lagarde and the significant increase in panic about the spread of coronavirus put pressure on the pair. Conflicting data on the growth of PMI indices in the eurozone countries could not save the situation - the price slumped, up to the last minute of the trading week. Unfortunately, panic is still prevailing in the foreign exchange market: macroeconomic reports and comments by central bank representatives have faded into the background, while traders are focusing on the news flow about the spread of the deadly coronavirus. The prevailing fundamental picture does not make it possible to make any long-term (however, as well as medium-term) forecasts. The situation is changing every day, and so far for the worse, determining the growth of anti-risk sentiment. If we draw an analogy with the spread of SARS in 2003, then sooner or later the situation will reach its climax, after which a downward trend will manifest itself. When exactly this will happen this time is unknown. At the moment there is no consensus on the prospects for the development of the situation. For example, according to the director of the State Laboratory for New Infectious Diseases at the University of Hong Kong, the magnitude of the 2019-nCoV pneumonia epidemic could be ten times greater than SARS. Here it is worth noting that this opinion is not of an ordinary specialist, but of a very authoritative one - in particular, in 2005, Time magazine included him in the list of 18 best specialists in the fight against viruses in the world. Some other experts adhere to more optimistic scenarios, pointing to the first case of a cured patient. In turn, currency strategists agree on one thing: the further spread of panic will hit not only the Chinese economy, but also global economic growth as a whole. Speaking directly about the Asian region, tourism, retail and civil aviation will be affected first (for example, during the SARS epidemic, most Hong Kong hotels are only 15% full). This will be followed by the "domino effect" - a decrease in air transportation will reduce the demand for jet fuel, which will affect the dynamics of the oil market. This fact, in turn, will affect the dynamics of commodity currencies. The general slowdown in the global economy and the growth of anti-risk sentiment will strengthen the dovish intentions of the central banks of the leading countries of the world, influencing the position of their currencies. Such prospects are pushing up defensive assets. The US currency, which is in demand during periods of general nervousness and uncertainty, also joined them. The dollar index jumped to a month and a half highs on Friday, while the debt and stock markets plunged. After the first case of coronavirus infection 2019-nCoV was recorded in the United States, the profitability of 10-year-old Treasuries fell to 1,686. There was no such downward trend even during the recent escalation of the US-Iran conflict. The bulls of the EUR/USD pair have been defending for a relatively long time around the support level of 1.1050, but still could not restrain the bearish onslaught - the trading week ended at around 1.1024. Most likely, on Monday the downward impulse will not fade, judging by the latest news. Today it became known that the number of people infected with the 2019-nCoV virus exceeded the thousandth mark, and the death toll reached the 41st. With a high degree of probability, we can assume that by Monday these deadly indicators will only increase. This fact will put additional pressure on EUR/USD, as a result of which the pair can gain a foothold in the region of the 9th figure. It is also worth recalling that the European Central Bank last week was not able to provide support for the single currency. Summarizing the January meeting, Lagarde said that monetary policy will remain stimulating "for a long period of time", despite some signs of stabilization of the situation in the eurozone. At the same time, Lagarde rather modestly commented on the growth of European inflation. But her colleague, a member of the Board of Governors of the ECB, Olli Rehn, said that inflationary expectations in the eurozone were "stuck at a low level." PMI figures released on Friday left a controversial impression. German indicators (both in the manufacturing sector and in the services sector) showed positive dynamics, exceeding forecast values. But the French indices disappointed. The pan-European composite index PMI, which ended up in the red zone, was also disappointing. In other words, the Friday release balanced optimism, which was maintained by data from the ZEW research institute. This factor put additional pressure on the pair. From a technical point of view, the EUR/USD pair shows signs of further decline on all the higher timeframes. In particular, the daily chart tells us that the Ichimoku Kinko Hyo indicator has formed a strong bearish "Parade of Lines" signal, while the price is testing the lower line of the Bollinger Bands indicator. In order to determine the goals of the downward movement, let's move on to the weekly schedule. So, the nearest resistance level is 1.0940 - this is the bottom line of the Bollinger Bands trend indicator. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment