Forex analysis review |

- Forecast for EUR/USD on January 30, 2020

- Forecast for GBP/USD on January 30, 2020

- Forecast for USD/JPY on January 30, 2020

- Fractal analysis of the main currency pairs for January 30

- GBP/USD. January 29. Results of the day. Great Britain leaves the EU and 73 British deputies leave the European Parliament

- EUR/USD. January 29. Results of the day. US economy is slowing again. Will Fed and Jerome Powell confirm this?

- USD/JPY. Yen takes a break in anticipation of a new wave of panic

- EURUSD and AUDUSD: Fed meeting to be held quietly for the market. When to buy the aussie?

- EUR/USD: will the Fed lend a helping hand to the euro?

- Ichimoku cloud indicator short-term analysis of Bitcoin for January 30, 2020

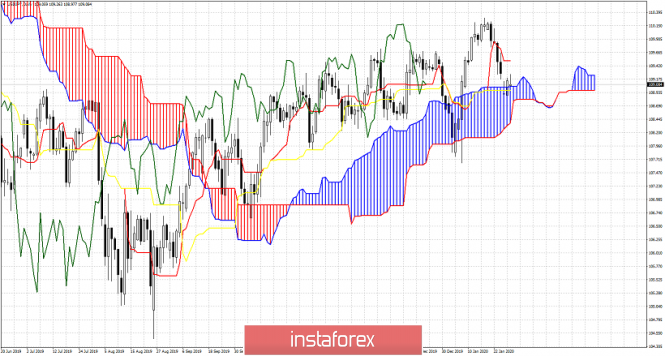

- Ichimoku cloud indicator Daily analysis of USDJPY

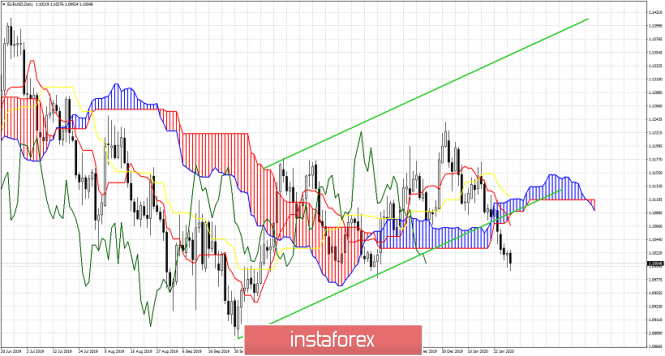

- Ichimoku cloud indicator Daily analysis of EURUSD

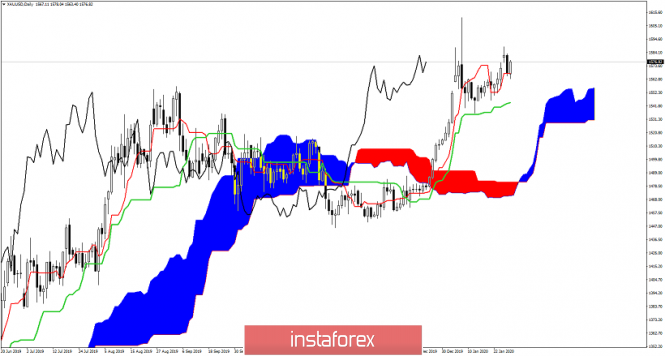

- Ichimoku cloud indicator short-term analysis of Gold for January 30, 2019

- Analysis of EUR/USD and GBP/USD for January 29. Ahead of the Fed meeting, both European currencies continue to decline

- EUR/USD for January 29,2020 - Strong selling pressure and potential for bigger drop, main downward target set at 1.0940

- GBP/USD: plan for the US session on January 29. The pound froze amid a lack of further guidance ahead of Central Bank meetings

- EUR/USD: plan for the US session on January 29. The bears again focused on the level of 1.1000. Buyers of the euro have one

- Evening review for EURUSD on 01/29/2020

- Gold 01.29.2020 - Downside break of the Pitchfork warning line 1, more downside yet to come

- BTC analysis for 01.29.2020 - Watch for potential downside opportuntiies and few swing pivots to form around median line

- Technical analysis of GBP/USD for January 29, 2020

- Trading recommendations for EURUSD on January 29

- January 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- January 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- GBP / USD: Saved sell priority, 50 points floating profits and CME Options Analysis Levels

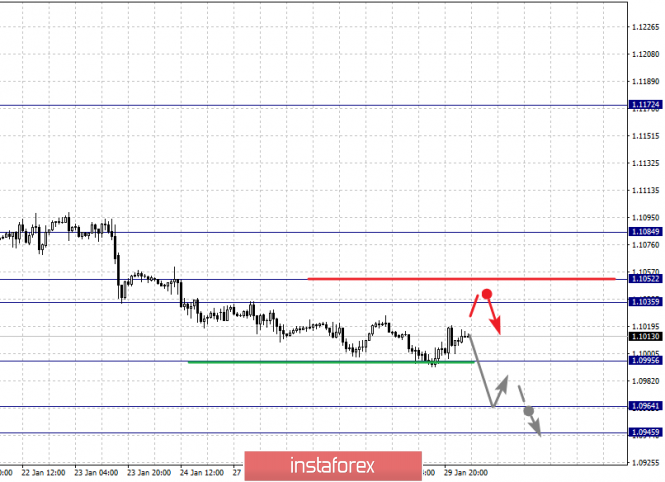

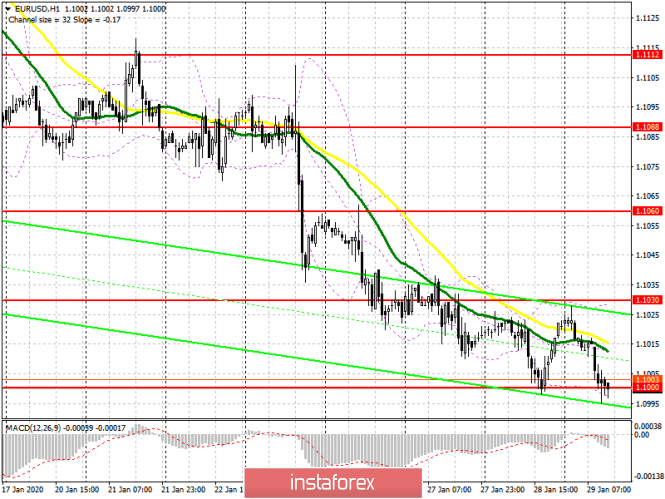

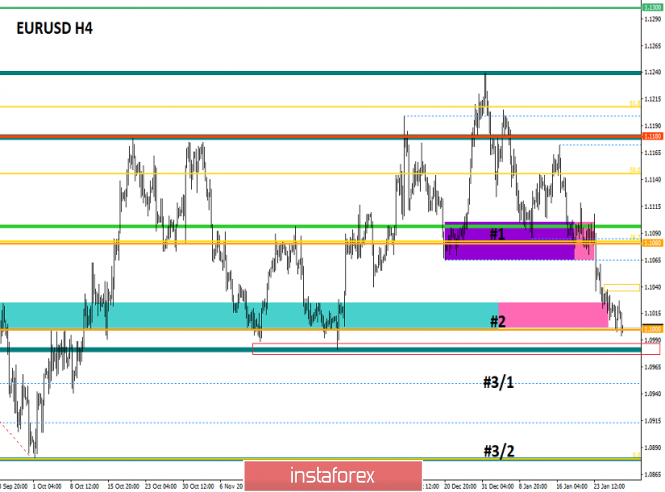

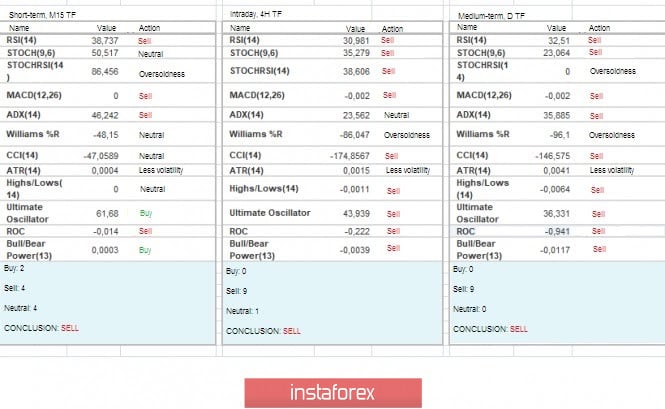

| Forecast for EUR/USD on January 30, 2020 Posted: 29 Jan 2020 08:04 PM PST EUR/USD The results of yesterday's Fed meeting were completely neutral. The US central bank has identified the current economic situation as stable by including coronavirus in the risk factor. Current repo operations will continue until May without substitution for long-term repurchase of securities. Exchange rates did not respond to this information. The euro nearly touched the target level at the Fibonacci level of 1.0986 yesterday, at the moment the price is below the line of the price channel and the probability of further decline remains, but correctional growth has been outlined on a smaller chart. The main sign of correction for H4 is the convergence of the Marlin oscillator, its signal line has already penetrated into the growth zone. There are two resistances on the path of price correction: 1.1046 - the MACD line on H4 and 1.1080/90 - the area of the Fibonacci level of 123.6% and the MACD line on the daily chart. We look forward to the completion of the correction and further weakening the euro. The material has been provided by InstaForex Company - www.instaforex.com |

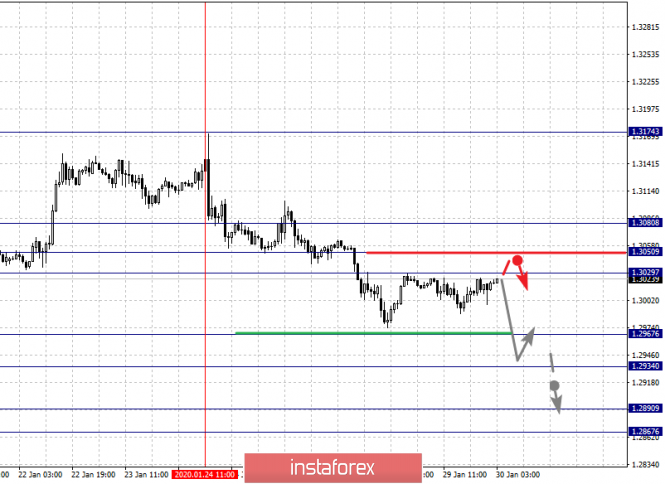

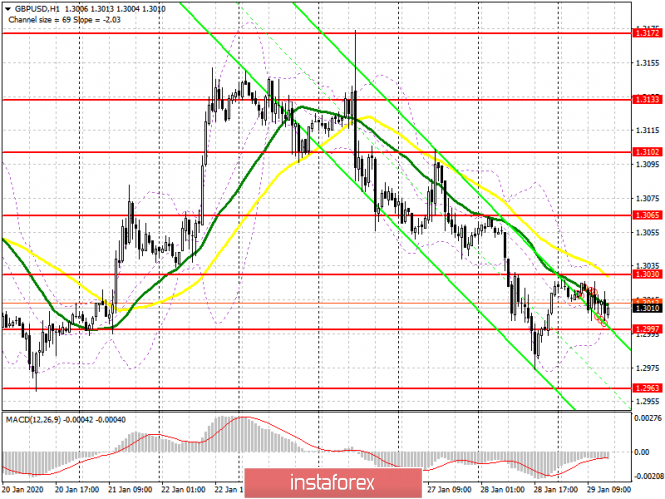

| Forecast for GBP/USD on January 30, 2020 Posted: 29 Jan 2020 08:02 PM PST GBP/USD Yesterday, the British pound, in anticipation of today's decision by the Bank of England on monetary policy, traded in a small range, which only strengthened the technical signs of an upward price movement. On the daily chart, the signal line of the Marlin oscillator outlined a reversal up and thereby formed a wedge with the same probability of exiting from it in any direction. To break this triangle down, the price needs to gain a foothold at the Fibonacci level of 161.8% (1.2968), the target of the movement will be the Fibonacci level of 138.2% at the price of 1.2820. If the triangle breaks up, prices will go above 1.3070. In this case, the MACD line will be the target level, located near the Fibonacci level of 200.0%, near the price level of 1.3220. Moreover, growth may not stop there. On the four-hour chart, the signal level 1.3070 corresponds to the MACD line. This strengthens the significance of the level. The driver of the movement, obviously, will be the outcome of the Bank of England meeting. Changes in monetary policy are unlikely to be, as the economic situation in the UK remains neutral, and today's meeting will be Mark Carney's final for the central bank, his term of office will expire. The main intrigue in the distribution of votes for maintaining the rate. The consensus forecast is 3-6 versus 2-7 at the last meeting, but the forecast range itself is wider, up to 4-5, and it is precisely such a voting result that can send the pound to growth much higher than the first target 1.3220. The material has been provided by InstaForex Company - www.instaforex.com |

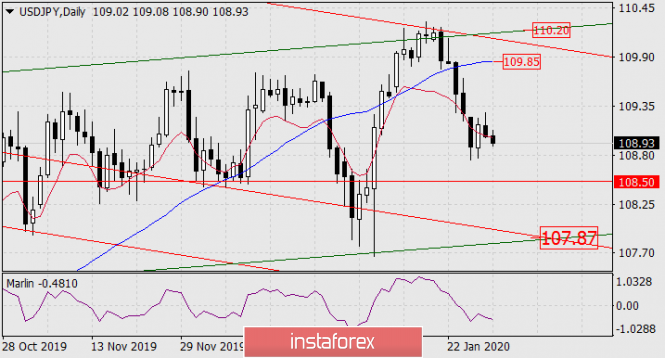

| Forecast for USD/JPY on January 30, 2020 Posted: 29 Jan 2020 08:01 PM PST USD/JPY Yesterday's Fed meeting had a neutral effect on stock indices: Dow Jones added 0.04% while the S&P 500 fell 0.09%. Today in the Asian session, the Japanese Nikkei 225 lost 1.02%, the Australian S&P/ASX200 shed 0.19%, and the South Korean Kospi SEU index was down 0.45%. The yen is trading in the range of January 27-28 with a falling mood: on the daily chart, the price returned below the balance line, the signal line of the oscillator turned down in the bearish trend zone. The purpose of the movement is the level of 108.50 - the peak of September 18, 2019. Consolidation under the level opens the more significant goal of 107.87 - the point of intersection of two trend lines of price channels: declining red and rising green. On the H4 chart, the price reversed yesterday from the red indicator line of the balance, the price returned to the range of January 27-28. The Marlin oscillator is also returning to the bears zone. We are waiting for the price to fall to the magnetic point of 107.87. In an alternative scenario, after the price goes above yesterday's peak, growth may continue to the MACD line in the 109.70/85 range - here the resistance of this line is close on the charts of both scales. The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of the main currency pairs for January 30 Posted: 29 Jan 2020 06:24 PM PST Forecast for January 30: Analytical review of currency pairs on the scale of H1:

For the euro / dollar pair, the key levels on the H1 scale are: 1.1084, 1.1052, 1.1035, 1.0995, 1.0964 and 1.0945. Here, we are following the descending structure of January 16. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.0995. In this case, the target is 1.0964. For the potential value for the bottom, we consider the level of 1.0945. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.1035 - 1.1052. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1084. This level is a key support for the downward structure. We expect the initial conditions for the upward cycle to be formed before it. The main trend is the descending structure of January 16 Trading recommendations: Buy: 1.1035 Take profit: 1.1051 Buy: 1.1054 Take profit: 1.1082 Sell: 1.0995 Take profit: 1.0970 Sell: 1.0964 Take profit: 1.0947

For the pound / dollar pair, the key levels on the H1 scale are: 1.3080, 1.3050, 1.3029, 1.2967, 1.2934, 1.2890 and 1.2867. Here, we are following the development of the downward cycle of January 24. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2967. In this case, the target is 1.2934. Price consolidation is near this level. Its price passage should be accompanied by a pronounced downward movement to the level of 1.2890. For the potential value for the bottom, we consider the level of 1.2867. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.3029 - 1.3050. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3080. This level is a key support for the bottom. The main trend is the descending structure of January 24 Trading recommendations: Buy: 1.3029 Take profit: 1.3050 Buy: 1.3052 Take profit: 1.3080 Sell: 1.2965 Take profit: 1.2936 Sell: 1.2932 Take profit: 1.2890

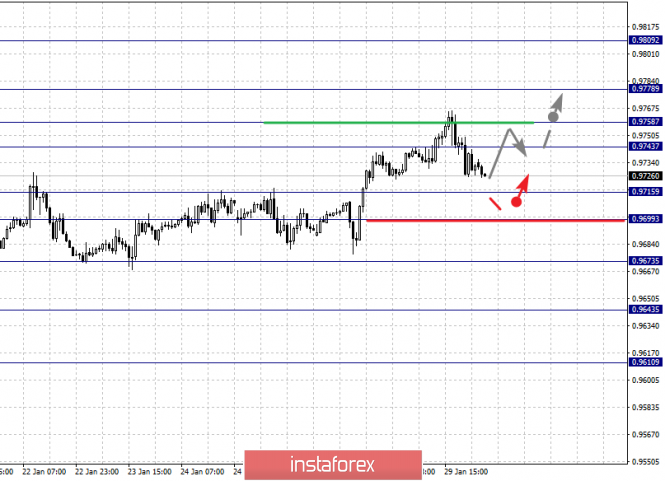

For the dollar / franc pair, the key levels on the H1 scale are: 0.9809, 0.9778, 0.9758, 0.9743, 0.9715, 0.9699 and 0.9673. Here, we are following the development of the ascending structure of January 16. Short-term upward movement is expected in the range of 0.9743 - 0.9758. The breakdown of the latter value will lead to a movement to the level of 0.9778. Price consolidation is near this level. We consider the level of 0.9809 to be a potential value for the upward movement; upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9715 - 0.9699. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9673. This level is a key support for the top. The main trend is the upward cycle of January 16 Trading recommendations: Buy : 0.9743 Take profit: 0.9756 Buy : 0.9758 Take profit: 0.9776 Sell: 0.9715 Take profit: 0.9700 Sell: 0.9697 Take profit: 0.9675

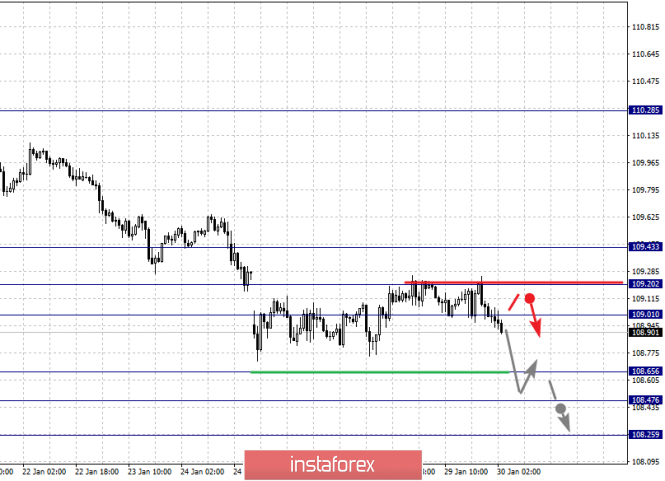

For the dollar / yen pair, the key levels on the scale are : 109.43, 109.20, 109.01, 108.65, 108.47 and 108.25. Here, we are following the downward cycle of January 17. Short-term downward movement is possible in the range of 108.56 - 108.47. The breakdown of the last value will lead to a movement to a potential target - 108.25, and upon reaching this level, we expect a pullback to the top. Consolidated movement is possibly in the range of 109.01 - 109.20. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.43. This level is a key support for the downward structure. Main trend: potential downward structure of January 17, correction stage Trading recommendations: Buy: Take profit: Buy : 109.23 Take profit: 109.40 Sell: 108.65 Take profit: 108.48 Sell: 108.45 Take profit: 108.25

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3312, 1.3271, 1.3238, 1.3198, 1.3178, 1.3157 and 1.3126. Here, we are following the development of the upward cycle of January 22. The continuation of the movement to the top is expected after the breakdown of the level of 1.3198. In this case, the target is 1.3238. Price consolidation is near this level. There is a short-term upward movement in the range of 1.3238 - 1.3271. Hence, a reversal to a correction is also possible. The potential value for the top is considered to be the level of 1.3312. Consolidated movement is possibly in the range of 1.3178 - 1.3157. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3126. This level is a key support for the top. The main trend is the local ascending structure of January 22, the correction stage Trading recommendations: Buy: 1.3198 Take profit: 1.3236 Buy : 1.3240 Take profit: 1.3270 Sell: Take profit: Sell: 1.3155 Take profit: 1.3130

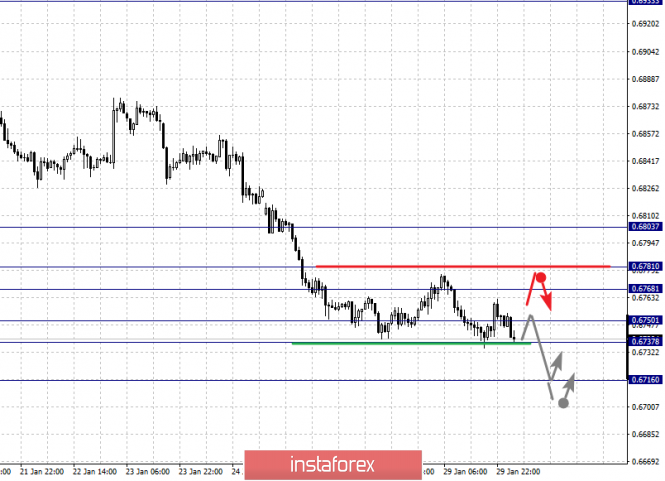

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6803, 0.6781, 0.6768, 0.6750, 0.6737 and 0.6716. Here, we are following the development of the descending structure of January 16. Short-term downward movement is expected in the range 0.6750 - 0.6737. The breakdown of the latter value will lead to movement to a potential target - 0.6716. We expect a pullback to the top from this level. Short-term upward movement is expected in the range of 0.6768 - 0.6781. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6803. This level is a key support for the bottom and before it, we expect the initial conditions for the upward cycle to be formed. The main trend is the descending structure of January 16 Trading recommendations: Buy: 0.6768 Take profit: 0.6780 Buy: 0.6783 Take profit: 0.6800 Sell : 0.6750 Take profit : 0.6737 Sell: 0.6736 Take profit: 0.6716

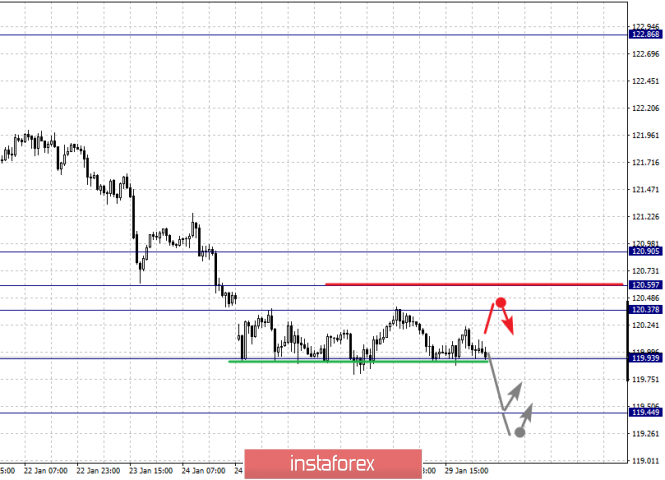

For the euro / yen pair, the key levels on the H1 scale are: 120.90, 120.59, 120.37, 119.93 and 119.44. Here, we are following the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 119.90. In this case, the potential target is 119.44. We expect a pullback in correction upon reaching this level. Short-term upward movement is possibly in the range of 120.37 - 120.59. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.90. This level is a key support for the downward structure. The main trend is the descending structure of January 16 Trading recommendations: Buy: 120.37 Take profit: 120.57 Buy: 120.61 Take profit: 120.90 Sell: 119.90 Take profit: 119.48 Sell: Take profit:

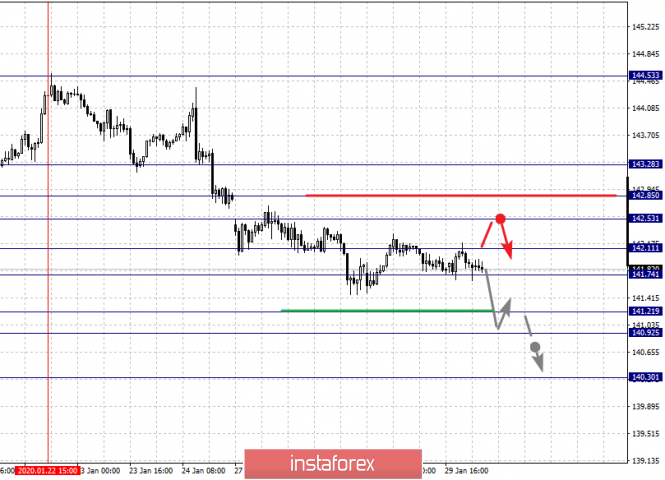

For the pound / yen pair, the key levels on the H1 scale are : 143.28, 142.85, 142.53, 142.11, 141.74, 141.21, 140.92 and 140.30. Here, we are following the development of the downward cycle of January 22. Short-term downward movement is expected in the range of 142.11 - 141.74. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 141.21. Price consolidation is in the range of 141.21 - 140.92. For the potential value for the bottom, we consider the level of 140.30. We expect a pullback to the top upon reaching this level. Short-term upward movement is expected in the range of 142.53 - 142.85. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 143.28. This level is a key support for the downward movement. The main trend is the descending structure of January 22 Trading recommendations: Buy: 142.53 Take profit: 142.85 Buy: 142.87 Take profit: 143.28 Sell: 142.10 Take profit: 141.76 Sell: 141.72 Take profit: 141.25 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jan 2020 02:52 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 52p - 89p - 118p - 54p - 118p. Average volatility over the past 5 days: 87p (average). After a slight upward correction, the British pound resumed the downward movement on Wednesday, January 29. No important macroeconomic reports have been made today in either the United States or the United Kingdom. Britain is on the verge of leaving the European Union; the process began 3.5 years ago. The last vote on Brexit (pure formality) will take place in the European Parliament today, and in the European Council (the same formality) tomorrow. Thus, we can assume that all the formalities have already been settled and the UK can only wait until January 31 and officially set foot in the "transition period". Another extremely important event will take place until January 31 - a meeting of the Bank of England, within which the key rate can be lowered. This is a really important event, as the meeting will be the last for the head of the bank, Mark Carney. Is it worth mentioning once again that the BoE's decisions can have a strong impact on the British currency, on its rate paired with the US dollar? Also, the movement of the currency pair can be seriously affected by the Fed's meeting today, from which, however, traders expect much less than from the BoE meeting. Nevertheless, both of these events could potentially turn things upside down. We have long been waiting for the British currency to resume the downward trend, as we continue to believe that the UK economy is now experiencing serious problems. And most importantly, it will continue to experience them throughout 2020. What will happen after 2020, for example, if a trade agreement cannot be signed with the European Union, I don't even want to think now. In any case, even if the US economy begins to experience problems (again), we believe that almost any currency will look stronger together with the British pound at this time. We have already said that the transition period essentially does not change anything for the UK and its economy. All conditions of coexistence with the European Union will remain the same. The only thing is that Britain will lose the opportunity to take part in the EU's administration. Simply put, the British deputies of the European Parliament will leave their seats. At the moment, the UK office in the European Parliament is one of the largest and has 73 seats. Accordingly, 73 seats will be empty in the Parliament on February 1. It has already been decided that 27 deputy mandates will be divided between EU member states, and another 46 will remain unoccupied and will be available for new members of the EU. Of the 27 seats that will be distributed among the participants of the bloc, it is expected that five will get France and Spain, three each - Italy and the Netherlands, one each - Croatia, Finland, Slovakia, Romania, Poland, Denmark, Austria, Sweden, Estonia. Meanwhile, the question of further negotiations between London and Brussels regarding trade relations after the completion of Brexit is becoming increasingly acute. Michel Barnier just recently gave an extensive interview, which highlighted the most important issues and contradictions in the negotiation process between the countries. The main problems, according to the EU's main negotiator, are Britain's wrong expectations ("the British will not be able to use the privileges of EU membership while outside the EU"), as well as tight deadlines (Boris Johnson does not want to extend the transition period and, accordingly, you need to reach a deal in 11 months). Barnier also said that the EU will closely monitor the implementation of the minutes of the exit agreement. The main difficulty of this deal is that Northern Ireland will have access to European markets over the next four years without tariffs, quotas, inspections and controls. At the same time, Northern Ireland will leave the EU together with Great Britain and, accordingly, a border should appear between the EU and the UK. According to the plan developed by European and British politicians, there will be no tight border between Ireland and Northern Ireland, so as not to provoke riots and popular uprisings among the inhabitants of the island, which barely managed to be repaid in 1998. Thus, a semblance of a border will pass along the Irish Sea, that is, between the island of Ireland and the rest of Great Britain. This is a very subtle mechanism that has a whole host of inconsistencies, various loopholes and places where it can frankly break. The British need peace of mind on the island of Ireland, respectively, London can turn a blind eye to some points, just to prevent unrest on the island. Of course, the EU does not like this position and Barnier warns the British that all agreements must be implemented exactly. From a technical point of view, the downward movement has now resumed. Therefore, the downward trend persists. The Ichimoku indicator continues to indicate a movement up and down and allows you to trade lower. A strong support area is near the support level of 1.2963. The pound/dollar pair has rebounded from it at least three times. Trading recommendations: GBP/USD is trying to resume a downward trend. Thus, traders are advised to resume selling the euro/dollar pair while aiming for 1.2963 and 1.2935. Purchasing the pair can be considered if the price returns to the area above the Kijun-sen line with targets at 1.3113 and 1.3176. Tonight, it is recommended to be extremely careful with any positions, since the reaction of traders to the Fed meeting can be unpredictable. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jan 2020 02:52 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 28p - 73p - 42p - 28p - 28p. Average volatility over the past 5 days: 40p (average). The third trading day of the week ends the same as the previous two - a sluggish, calm, low-volatility downward movement. There were certain hopes for increased volatility or for the beginning of an upward correction yesterday, when sufficiently important data on orders for durable goods were published in the United States. However, by the end of the day, we can say that the volatility remained low (28 points), and instead of the correction there was only one name. Today, the euro/dollar pair has reached the level of 1.0990, which it has not yet managed to overcome. As we said earlier, such a weak movement can be very long and recoilless. Thus, it is possible that it will continue today without any gain. Although we are waiting for an extremely important event in its name in the evening, which, most likely, will become completely passing. This is the Fed meeting, and it is on it that we will dwell in more detail, since no other macroeconomic events have been planned to date. With a probability of 99%, the Fed meeting will end with rates remaining unchanged. Thus, the monetary policy parameters will remain unchanged. In these parameters, one should take into account not only the Fed's key rate, but also the volume of monthly asset buybacks from the open market, which the Fed itself prefers not to mention, not to call them a "quantitative easing program", and when questions are asked, answer repurchase of short-term bills in order to ensure stable liquidity of the financial sector. A very convenient interpretation, which can be used in almost any action of the Fed. In fact, this means that the Fed stimulates the US economy every month in the amount of $60 billion. This program began in the fall of 2019, and in the first months it really seemed that this was a short-term measure. However, January is already ending, and no statements have been received on the completion of this program on the markets. Thus, in fact, we are dealing specifically with the QE program. Furthermore, in light of the fact that the Fed has been stimulating the US economy with money for at least four months, this means that this very economy needs such stimulation. We mentioned earlier that the main indicators that cause the most concern are industrial production, GDP, and business activity in the manufacturing sector. It seems that the Fed also shares these concerns of traders and investors, but does not want to sow panic and to announce a resumption of the quantitative stimulus program. As you can see, this is very good for the US dollar. Because if Jerome Powell announced the restart of the quantitative easing program, then a wave of disappointment would certainly have swept the dollar bulls. However, in the light of this information, it is worth asking a question whether the US economy will slide into the same recession in the coming months of the second half of 2019 and because of which the asset repurchase program was resumed and the key rate was reduced three times. If so, then the prospects for the US currency are becoming more vague than just a few months ago. Recently, we regularly said that the US economy looks much stronger than the European one in the eyes of investors. This fact remains so. However, if the US economy shrinks at a faster pace than the European, which is now more in stagnation, then sooner or later it will catch up with it. Sooner or later, the Fed will start lowering the rate again, and everyone will understand that "monthly repayment of short-term bills" is not just a solution to short-term liquidity tasks, but a full-scale support for the economy, which, accordingly, is experiencing problems. In general, it will be of great importance what exactly Powell will say today and what the Fed's accompanying statement will be. I also recommend paying attention to the conformity of what Powell said with the real picture of things, because if the Fed chairman says that the industrial sector is doing well, then there will be much less reason to trust his words. In fact, changes in the rhetoric towards the dovish may mean that the US economy may require more serious incentives in the near future. And also the fact that the loud signing of the first phase of the trade deal with China so far has not had any positive impact on the US economy. Have you noticed how sharply the criticism of Trump towards the Fed and Jerome Powell ended? Trading recommendations: EUR/USD continues to move down. Thus, it is recommended to hold open short positions with the targets of 1.0990, 1.0982 and 1.0956, until the start of the correctional movement (rebound from any target or MACD indicator upward with a parallel increase in price). It will be possible to consider purchases of the euro/dollar pair no earlier than traders of the Kijun-sen line are traded in small lots with the goals of resistance level 1.1088 and Senkou Span B. line Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY. Yen takes a break in anticipation of a new wave of panic Posted: 29 Jan 2020 02:52 PM PST The Japanese currency traditionally reflects the general mood of the foreign exchange market. As a defensive asset, the yen is keenly responsive to the external fundamental background, reflecting an increase or decrease in demand for safe haven instruments. In mid-January, the currency significantly fell - including paired with the dollar. As soon as the US-Iran conflict moved to the economic plane (and the threat of the third world, respectively, passed), the price of USD/JPY grew sharply, reaching 110.30. The pessimistic results of the January meeting of the Bank of Japan only fueled interest in long positions in the pair, and it is likely that the price would have settled in the 111th figure at the end of this month, if not for one "but". An unexpected outbreak of pneumonia in China returned interest in defensive assets, after which the yen returned to service, rapidly increasing momentum. In other words, the Japanese currency now (however, as always) acts as a weather vane of anti-risk sentiment in the foreign exchange market: if the Japanese rises in price, then there is still panic among traders. That is why yesterday's dynamics of the USD/JPY pair aroused some interest. The price has been falling nearly without pulling back for almost a week and a half (to be more precise, since January 21), losing more than 150 points. But yesterday, the downward momentum faded, and buyers were able to develop a slight correction. Comparing this price dynamics with the news flow regarding the spread of coronavirus, we can conclude that the bearish prospects of USD/JPY are based only on the nervousness of market participants. And as soon as traders hear a more or less encouraging informational occasion, the bears' grip instantly wanes. All this suggests that the downward trend is uncertain and unsteady - as soon as the situation with the incidence is stabilized, the pair will sharply turn up. Anti-risk sentiment is the main driving force of USD/JPY - there are no other arguments for revaluing the yen. The Bank of Japan continues to take an extremely cautious and pessimistic position, and key macroeconomic reports of Japan have a weak effect on the dynamics of the pair. But back to the "chronicle of the coronavirus." Yesterday's correction was due to two factors that have similar roots. First, Hong Kong developed a vaccine against the ill-fated coronavirus. True, the details of this fact are no longer so optimistic - according to scientists, they will test the created drug in animals for several months and only after that they will conduct clinical trials in humans. In total, this process will require at least a year. Nevertheless, amid all sorts of apocalyptic scenarios, this informational occasion carried positive features, so the market reacted accordingly. In addition, similar news came from Australia yesterday. There they managed to create a laboratory copy of the Wuhan Coronavirus. According to experts, this will help to quickly create the necessary vaccine. In addition, a laboratory copy of the virus can help diagnose coronavirus in infected people in the early stages - even before symptoms appear. These news drivers helped reduce the degree of heat in the financial markets. The yen also reacted accordingly, slowing its growth paired with the US currency. However, the subsequent flow of information offset the "germs of optimism" - the number of infected people exceeded the 6,000th mark, and the death toll reached 132 people. More than 400 patients are in critical condition. Obviously, in the coming days, these indicators, alas, will only increase, thereby supporting interest in defensivee tools. Since the new coronavirus has an incubation period (within 10-12 days), all the observed statistics today are an epidemiological picture within the previous 10-day period, that is, when quarantine has not yet been entered. In other words, the active spread of the virus through human contacts has already taken place, and the symptoms are only now appearing. Therefore, over the next one and a half weeks, experts predict a peak in incidence, after which the increase will go to a gradual decline. At least, many experts adhere to this scenario. Such prospects allow the bears of the USD/JPY pair to regain a few dozen points. For example, when the number of infected people exceeds the 10,000th mark (this will happen in the coming days), the yen will again be in demand in the wake of anti-risk sentiment. But if the situation develops within the framework of the scenario stated above, then the pair is unlikely to overcome the support level of 108.10 (the lower line of the Bollinger Bands, which coincides with the lower boundary of the Kumo cloud on the daily chart). If the panic disappears ahead of schedule, then the pair will return to the area of the 110th figure in a matter of days, especially if today's Fed meeting will be held at least in a neutral manner. The material has been provided by InstaForex Company - www.instaforex.com |

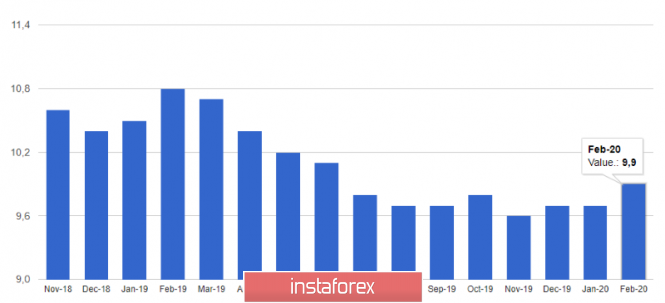

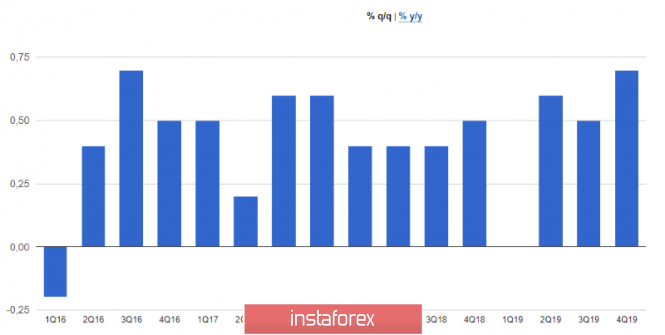

| EURUSD and AUDUSD: Fed meeting to be held quietly for the market. When to buy the aussie? Posted: 29 Jan 2020 02:52 PM PST There is still no risk appetite for investors, since the problem with China's coronavirus remains at a fairly high level, and meetings of world central banks are forced to take a wait-and-see position. Safe-haven assets are now of greater interest. Data on improving consumer sentiment in Germany at the beginning of the year will not greatly affect the improvement of the situation in the economy. According to a GfK research group report, the leading consumer confidence index in Germany will rise to 9.9 points in February from 9.7 points in January. The indicator for January was revised upwards. Despite this, no one was willing to buy the euro, which led the EURUSD trading instrument to return to the area of weekly lows. Economists predicted that the figure would remain unchanged in February. The agency noted that revenue growth contributed to improving consumer sentiment. The index of economic expectations rose to -3.7 points from -4.4 points in December, while the indicator of expectations regarding income rose to 44.6 points against 35.0 points in December 2019. Most likely, it is private consumption that will remain one of the most important components for the German economy in 2020. Private spending is projected to rise in the region of 1%. French consumer confidence index data did not have a positive effect on the euro, even with growth. According to the report, confidence rose to 104 points in January against 102 points in December, with the forecast of economists who expected the index to remain unchanged. As I noted above, all attention this afternoon will be focused on the decision of the Federal Reserve on interest rates. The interest rate is expected to remain unchanged, which will have a limited impact on the US dollar. It is another matter what statements Fed Chairman Jerry Powell will make. Many experts expect that his rhetoric will not change and also restrained in relation to further changes in credit policy. In my morning review, I focused on overnight rates and the prospects for the Fed's balance sheet, which the markets are now interested in no less than interest rates. Currently, the repurchase asset purchase program has already inflated the central bank's balance sheet to $4.1 trillion from $3.8 trillion last September, when the program started. Whether such operations will be preserved is also a very important point, since their curtailment can seriously affect the course of the US dollar towards its growth. However, skeptics have a number of doubts about the fact that the Fed will present a complete and detailed plan for balance. Therefore, all emphasis will be reduced to statements by the head of the Fed on this subject. As for the technical picture of the EURUSD pair, it remained unchanged with the exception that the bears managed to return to the support of 1.1000, and whether the pair will be able to break through and the future direction of the pair will depend on it. The nearest support levels are visible in the area of 1.0960 and 1.0910. Softer statements by the Fed chief may lead to increased demand for the euro, but it will be all limited. The nearest resistance levels are visible in the area of 1.1030 and 1.1060. AUDUSD The Australian dollar completely lost its position against the US dollar after rising amid good data on rising consumer prices in Australia in the fourth quarter of last year, which slightly reduces tension from the Reserve Bank of Australia and puts off the likelihood of further lower interest rates. According to the Australian Bureau of Statistics, the consumer price index increased by 0.7% in the fourth quarter of 2019 compared to the third quarter and by 1.8% compared to the fourth quarter of 2018. Economists had expected prices to rise 0.6% from the previous quarter and 1.7% from the same period of the previous year. However, it must be understood that core inflation continues to remain below the RBA target range of 2-3%, which sooner or later, especially if this growth is only temporary, will force the bank to return to the path of further reduction in rates. A sharp increase in retail sales and the December unemployment rate, which declined, advocate maintaining the current policy unchanged. As for the technical picture of the AUDUSD pair, it is still too early to talk about the reversal of the current trend. The first major support is seen at the low of October 16 last year in the region of 0.6723 and the low of October 10 - 0.6709. An upward correction in the pair will be possible only after a break and consolidation above the resistance of 0.6780. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: will the Fed lend a helping hand to the euro? Posted: 29 Jan 2020 02:52 PM PST The start of the year, which was not optimistic for the global economy, made investors forget about the Federal Reserve for some time. Today, the regulator will announce the results of the first meeting this year. Should we expect any surprises from the central bank, whose representatives almost say that the US economy is still on its feet, and monetary policy is in the right place? The Treasury yield curve for some time went into the red zone for the first time since October last year. The chances of monetary expansion by the Fed until the end of the year are growing by leaps and bounds. It gives market participants food for thought. Short-term consolidation of the EUR/USD pair near the psychological mark of 1.1000 resembles the calm before the storm. Apparently, the US central bank managed to return attention to its person. The fact that the Fed will keep the interest rate at 1.75% at the end of the January meeting is practically beyond doubt among investors. However, the issue of reducing the balance of the regulator seriously worries them. In order to stabilize the situation in the US money market, the Fed began buying short-term promissory notes worth $60 billion every month, as a result of which the portfolio of assets of the central bank increased from $3.8 trillion to $4.1 trillion. Fed Chairman Jerome Powell prefers not to call buying assets QE, and it is understandable: at one time, hints of curtailing asset purchases provoked negative sentiment in the financial markets. Obviously, the US central bank does not want to get on the same rake. Therefore, the regulator is unlikely to change anything in January. Reducing the balance of the Fed would increase the cost of borrowing. This is not good news for a country whose budget deficit is expected to grow by $1 trillion annually over the next few years. In addition, according to estimates of the Congressional Budget Office, the volume of public debt to national GDP will expand from 81% (in 2020) to 98% (in 2030). Do not forget about the correction of the S&P 500 index associated with the outbreak of coronavirus in China. There is an opinion on the market that stock indices are growing primarily due to the support of the Fed. If the central bank begins to tighten monetary policy, then US stocks will lose an important growth driver. The inversion of the Treasury yield curve, which in the recent past forced the Fed to take on preventive monetary expansion, the pullback of the S&P 500 index, as well as increased international risks, makes it possible to count on the dovish tone of statements by Powell following the results of the next FOMC meeting. If this happens, then the EUR/USD pair will be able to cling to an important level of 1.1000. The main currency pair's downwards path is largely due to the epidemic of coronavirus in China. The point is not only its negative impact on the global economy, but also the decline in oil prices and the associated peak in European five-year inflation expectations from 1.33% noted at the beginning of the year to 1.26%. As a result, the chances of easing the ECB's monetary policy in 2020 began to grow. Thus, only the Fed can stop the fall of EUR/USD. As for the medium-term prospects of the main currency pair, they will depend on how quickly the Chinese authorities manage to deal with the coronavirus and whether a new trade war breaks out - between the United States and the European Union. Getting answers to these questions will clarify the fate of not only the global economy, but also the euro. The material has been provided by InstaForex Company - www.instaforex.com |

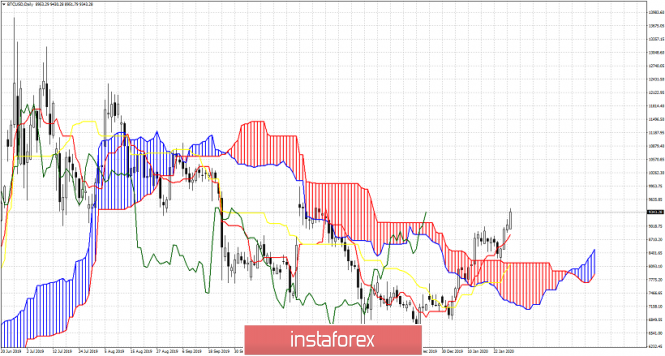

| Ichimoku cloud indicator short-term analysis of Bitcoin for January 30, 2020 Posted: 29 Jan 2020 01:55 PM PST BTCUSD has now managed to reach the 38% Fibonacci retracement of the decline from $13,856. This is important technical resistance. Now we expect prices to continue to move higher as there is no bearish divergence and as price is trading above the Ichimoku cloud for the first time since 12/08/2019.

BTCUSD has broken out of the wedge pattern and is making higher highs and higher lows. The RSI is far from overbought and with no bearish divergence. Price has reached the first important Fibonacci resistance level and I expect to see more upside towards the 61.8%.

|

| Ichimoku cloud indicator Daily analysis of USDJPY Posted: 29 Jan 2020 01:44 PM PST The USDJPY has stopped its decline from 110.30 to 108.90. Price the last three days is moving around 109. There is no progress to the downside. Why?Important cloud support is found in this price level.

|

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 29 Jan 2020 01:39 PM PST EURUSD has provided us in previous posts with two sell signals according the Ichimoku indicator. The first was a weak sell signal when the tenkan-sen crossed below the kijun-sen. This happened when price was trading at 1.1130. The second sell signal came when price broke below the Kumo (cloud).

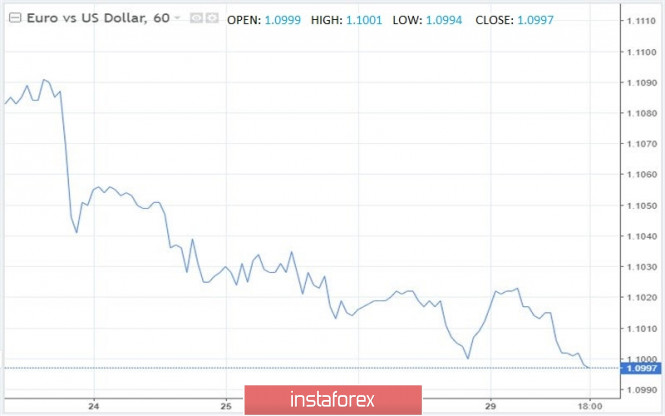

The second sell signal came when price broke below the cloud at 1.1035 and at the same time exited the bullish channel. Price is now at 1.10 with next support at 1.0970. Resistance is at 1.1075 and as long as price is below that level trend remains bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator short-term analysis of Gold for January 30, 2019 Posted: 29 Jan 2020 01:35 PM PST Gold price remains supported despite the pull back from $1,588 to $1,563. Price continues to make higher highs and higher lows after bottoming back on January 14th and is trading inside a bullish channel.

Green lines - bullish channel Red lines - Fibonacci extensions Gold price has so far managed to reach our first target which was at $1,578. Price since then pulled back towards $1,560 and is now bouncing off the lower channel boundary. We might next see the second Fibonacci extension target at $1,599. The oscillators are not in overbought territory and both an positive slope. This shows that there is potential to the upside.

|

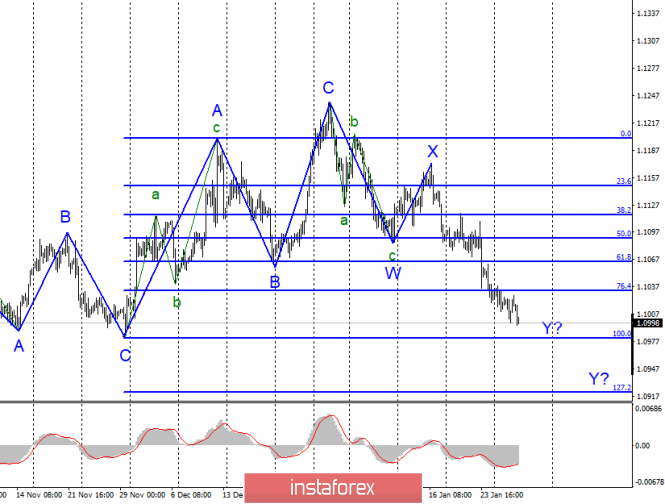

| Posted: 29 Jan 2020 06:06 AM PST EUR/USD On January 28, the EUR/USD pair gained several base points and thus continues to build the expected wave y. Markets continue to get rid of the European currency. An unsuccessful attempt to break through the Fibonacci level of 76.4% may lead to quotes moving away from the reached lows and completing the construction of a downward wave and the entire downward trend section. A successful attempt will indicate the readiness of the Forex market to continue selling the euro currency and complicate the wave y. Fundamental component: The news background on Tuesday was interesting. Markets were waiting for the release of the report on orders for durable goods in America. And the results of this report surprised me enough. The total number of orders increased in December by 2.0% compared to November 2019. Markets expected to see a much more modest value. But other indicators were much worse than the expectations of the currency market. Orders for goods excluding defense decreased by 2.5%, excluding transport - decreased by 0.1%, and excluding defense orders and aviation - decreased by 0.9%. Thus, the data could be interpreted in different ways. This is exactly what the markets did, which at first continued to sell the euro, and then slightly weakened their selling positions, which led to the departure of quotes from the reached lows. In general, the decline of the European currency continues. Today, all the market's attention is focused on the evening meeting of the Fed, as well as on the speech of Jerome Powell. Economists, analysts, and currency market participants have little doubt that the US Central Bank will leave the key rate unchanged. Thus, the main attention will be focused on the accompanying statement of the Fed, as well as on the speech of the Fed Chairman Jerome Powell and his rhetoric. The latest not-so-good reports from America make us consider an option in which the rhetoric of the head of the Fed will become more "dovish". Earlier, Powell said that during 2020, it is unlikely that the key rate will be revised downwards. However, if economic reports continue to deteriorate, the Fed may lower the rate again. In general, today, we just have to find out what has changed in the mood of the Fed. General conclusions and recommendations: The euro-dollar pair is presumably continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located around the mark of 1.0982, which corresponds to 100.0% of Fibonacci. An unsuccessful attempt to break this mark will lead to a departure of quotes from the reached lows and, possibly, the completion of the wave y. Otherwise, I recommend staying in sales. GBP/USD The GBP/USD pair lost about 40 basis points on January 28 and continues to decline within the expected wave 3 or C. The expected wave 3 or C, if it is currently being built, takes a very complex and extended form. The entire wave structure after December 23 may require adjustments and additions. Only a successful attempt to break through the Fibonacci level of 38.2% (the blue grid) can give confidence that the construction of the downward trend section will continue. Fundamental component: The news background for the GBP/USD instrument on Tuesday was the same as for the EUR/USD. And the market reaction was similar. There are no interesting news and economic reports from the UK at the moment, so only European and American news has to be examined. Today – it's the same meeting of the Fed, but tomorrow will be a meeting of the Bank of England and the markets are hoping to get information about the plans of the British Central Bank in the coming months, as rumors about the willingness to lower the key rate have been going for a long time. It may be lowered tomorrow. In any case, the instrument needs to make a successful attempt to break the mark of 1.2941 to execute the main option. This requires strong comments today from Jerome Powell or weak comments tomorrow from Mark Carney (or a reduction in the key rate, or an increase in the number of votes cast for a rate cut). General conclusions and recommendations: The pound-dollar tool continues to build a new downward trend. I recommend selling the instrument with targets located around 1.2941 and 1.2764, which corresponds to 38.2% and 50.0% for Fibonacci. The tool can complicate the entire wave markup, so the increase can resume at 1.3329 (in the case of a successful attempt to break the 23.6% Fibonacci level) and then I recommend considering new sales of the tool around the mark of 1.3329. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jan 2020 06:00 AM PST Technical analysis:

EUR/USD has been trading downwards with strong momentum. The price tested the level of 1.0993. Due to strong bearish condition and short-term bear trend, my advice is to watch only for selling opportunities on the rallies. EUR is on the extended run to the downside with many closes below 5SMA on the daily, which is strong confirmation of the downside trend. MACD is showing increased momentum to the downside, which is good confirmation for the downside. Resistance levels are seen at the price of 1.1023 and 1.1037. Support levels and downward targets are set at the price 1.0980 and 1.0940. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jan 2020 05:34 AM PST To open long positions on GBPUSD, you need: The technical situation in the GBP/USD pair has not changed in any way compared to the morning forecast, as traders do not have fresh guidelines regarding Brexit and the Bank of England's decision on interest rates, which will be announced tomorrow. The task of buyers today remains to hold the support range of 1.2997-90, where the formation of a false breakout will be the first signal to open long positions. The lower boundary of the upward channel can also be built in this area. An equally important point will be the breakout and consolidation above the resistance of 1.3030, which will lead to the demolition of sellers' stop orders and a larger upward correction to the area of the highs of 1.3065 and 1.3102, where I recommend fixing the profits. If the bulls do not have the strength to cope with the pressure of sellers in the area of 1.2997, then in this scenario, it is best to postpone purchases until the update of the lows of 1.2963 and 1.2939, which will mean the continuation of the bearish trend. To open short positions on GBPUSD, you need: While the bears do not let the pair go to the resistance area of 1.3030, where the formation of a false breakout will be a signal to sell GBP/USD, which will return the pound to the support area of 1.2997-90, near which the main struggle for further direction will unfold. Low volatility remains, and further movement will depend on the news on the US economy, as well as on the Federal Reserve's decision on interest rates. Fixing below the area of 1.2997 will quickly push the pair to the lows of 1.2963 and 1.2939, where I recommend fixing the profits. If there is no pressure from sellers in the resistance area of 1.3030 in the second half of the day, then it is best to postpone short positions until the test of the highs of 1.3065 and 1.3102. Indicator signals: Moving averages Trading is conducted around 30 and 50 daily averages, which indicates market uncertainty. Bollinger Bands In the scenario of an upward correction, the upper limit of the indicator around 1.3030 will act as a resistance. Breaking the lower border in the area of 1.2995 will increase the pressure on the pair.

Description of indicators

|

| Posted: 29 Jan 2020 05:34 AM PST To open long positions on EURUSD, you need: From a technical point of view, the market has not changed much, however, the bulls again have to actively defend the support level of 1.1000, which was formed yesterday. The lack of volume at each false breakout of this level does not inspire confidence in euro buyers. Therefore, do not forget about stop orders, since a breakout of 1.1000 will quickly push the pair lower to the lows of 1.0982 and 1.0964, from where I recommend opening long positions immediately for a rebound. The bulls will also rely on the current decision of the Federal Reserve System on interest rates, as well as on maintaining a softer approach of the Central Bank to the issue of monetary policy in the future, which may partially weaken the position of the US dollar and lead to the return of EUR/USD to the resistance area of 1.1030 where I recommend taking the profits. However, it will be possible to talk about further upward correction only after a breakthrough and consolidation above this range, which will open a direct path to the highs of 1.1060 and 1.1088. To open short positions on EURUSD, you need: Demand for the dollar as a safe-haven asset persists in the face of a difficult situation related to coronavirus infection in China, which may affect the global economy. In the short term, the bears today again coped with the morning task of updating the support of 1.1000, however, they still have not managed to break below this range, which indicates the wait-and-see position of the major players before today's decision of the Federal Reserve on interest rates. The bears' task, if the pair grows in the second half of the day, is to form a false breakout in the area of resistance 1.1030, which will be the first signal to open short positions. Fixing below the level of 1.1000 will push the pair to the lows of 1.0982 and 1.0964, where I recommend fixing the profit. In the scenario of EUR/USD growth above the resistance of 1.1030, it is best to postpone short positions until the highs of 1.1060 are updated or sell immediately for a rebound in the resistance area of 1.1088. Indicator signals: Moving Averages Trading is conducted below the 30 and 50 moving averages, which keeps the chance of a decline in the euro. Bollinger Bands Breaking the lower border of the indicator around 1.0995 will lead to a decrease in the euro. Growth will be limited to the upper level of the indicator in the area of 1.1030.

Description of indicators

|

| Evening review for EURUSD on 01/29/2020 Posted: 29 Jan 2020 05:34 AM PST

Markets continue to be under pressure from the virus situation in China. Still, the markets have slowed down a bit. They are waiting for new data on the epidemic. So, the US market closed the day in positive territory. Now, the main event of the evening will be the decision of the Fed at 20:00 London time. There is no doubt that the Fed will leave the rate unchanged at 1.625%. However, it is possible. Given the danger of an epidemic in China, the Fed may announce its readiness to cut rates at the next meeting. This can cause a strong rebound of the euro up. EURUSD: We keep sales from 1.1084. Sales are possible from 1.1050. Canceling the signal down at 1.1110. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 01.29.2020 - Downside break of the Pitchfork warning line 1, more downside yet to come Posted: 29 Jan 2020 05:33 AM PST Technical analysis:

Gold has been trading to the downside. Price tested our downward target at the price of $1.568. I see further downside continuation and potential test of $1.563 and $1.557. My advice is to watch for selling opportunities on the rallies with the first downward target at $1.563. Stochastic oscillator is showing overbought condition, which is sign that selling might come from here. There is also breakout of the Pitchfork warning line 1 and potential test of the second. Resistance levels are set at the price of $1.572 and $1.578 Support levels and downward targets are set at the price of $1.563, $1.557 and $1.546. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jan 2020 05:23 AM PST Industry news: The trading volume of the Bitcoin options being traded on the Intercontinental Exchange (ICE)-owned trading platform Bakkt has dropped to zero over the past week, one month after the product was launched. According to data from the ICE's website, the last day where its Bitcoin options were traded was January 17, when 20 contracts were traded. Since then, no trades have been taking place. Bakkt's bitcoin options contracts were launched last month, and are regulated by the Commodity Futures Trading Commission (CFTC). Technical analysis:

As I alerted you yesterday, BTC did rotate around Pitchfork median line at $9.300. I do expect few pivot swings to form around median line. Stochastic oscillator is showing overbought condition and bearish divergence, which is sign that buying looks risky and that sellers may use that fast to establish sell positions. MACD oscillator is showing decrease on the upside momentum, which is sign of the weak buying. Resistance levels are set at the price of $9.430 and $9.550 Support levels and downward targets are set at the price of $9.111, $8.970 and $9.790. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for January 29, 2020 Posted: 29 Jan 2020 04:39 AM PST Overview: Pivot point: 1.3042. The GBP/USD pair traded above strong support at the level of 1.3011, which coincides with the 23.6.2% Fibonacci retracement level and 1.2961. This support has been rejected for four times confirming uptrend veracity. Major support is seen at the level of 1.3011 because the trend is still showing strength above it. The pair is still in the uptrend from the spot of 1.3011 and 1.3174. The GBP/USD pair is trading in a bullish trend from the last support line of 1.3011 towards the first resistance level at 1.3127 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.3127 and further to the level of 1.3174. The level of 1.3174 will act as second resistance and the double top is already set at the point of 1.3174. At the same time, if a breakout happens at the support levels of 1.3011 and 1.2961, then this scenario may be invalidated. But in overall, we still prefer the bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

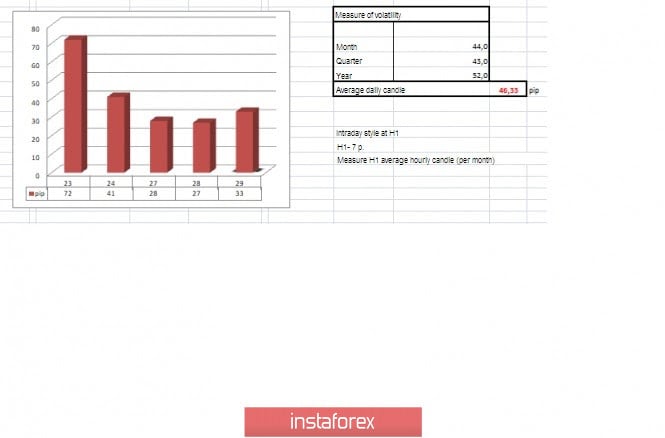

| Trading recommendations for EURUSD on January 29 Posted: 29 Jan 2020 04:22 AM PST From a complex analysis, we see the long-awaited touch of the psychological level of 1.1000, where the quote almost immediately reacted with a rebound, signaling indecision. The entire day yesterday was marked by extreme caution by market participants, conditionally having a sideways movement with a low amplitude, where the touch of the level of 1.1000 was in the testing plan, no more than that. The pattern associated with the psychological level of 1.1000 has been haunting the market for a very long time, where there has not been a case in history when the level has not led to interaction with it of market segments. In terms of the theory of the recovery process relative to the oblong correction, we see the concentration of trading forces at the second stage, which signals the stability of the tact set by the market at the beginning of January. This is the second attempt on the history of the oblong correction when the quote tries to form a recovery process. The first attempt was at the end of autumn 2019, but unlike the current one, we did not have such a detailed inertial course at that time. In terms of volatility, there was a sharp slowdown that lasted for the second day in a row (28 points - Monday; 27 points - Tuesday). This kind of slowdown confirms the indecision theory, where traders are waiting. At the same time, the compression of the quote, as well as the absence of any reaction, signals an accumulation that will result in acceleration. Analyzing the past day by the minute, we see an amplitude of 1.1000/1.1025, where the whole day can be described as a V-shaped formation. As discussed in the previous review, traders fixed their short positions as soon as the quote got close to the psychological level of 1.1000. The next steps were in the waiting plan, where the focus was on the index of 1.0980, which was considered for further downward positions. Looking at the trading chart in general terms (the daily period), we see that the recovery process is maintained on the market as early as 19 trading days in comparison with the previous attempt, where the recovery process ended on day 8. The news background of the previous day included data on orders for durable goods in the United States, the volume of which increased by 2.4%. Relative to the previous data, we have a significant improvement, if we take into account the fact that the data for November was revised even worse -2.0% -> -3.1%. Also in the US, we published data on house prices (S&P/Case-Shiller), where expectations coincided and we saw an acceleration from 2.2% to 2.6%. There was no market reaction to good statistics, which once again suggests a waiting process. In terms of the general information background, we have nothing new. The whole world is actively discussing the coronavirus, trying to write off problems that arise in completely different areas of activity on its basis. The reaction to the market may happen in the future, but the credit for this will be from the media, which managed to inflate the noise to immense heights. The most interesting areas in the form of market reaction will be pharmaceutical corporations, which against this background will receive new injections and, as a fact, the growth of shares, but this is another story. Today, in terms of the economic calendar, we have the most important event of the week - the meeting of the Federal Reserve System (FRS). This is the first meeting this year, and if we refer to the results of the December meeting, we will see that the regulator refrains from acting, which will continue for a long time. At the same time, many surveys confirm the opinion that the rate will remain unchanged. The most interesting moment for investors will be the comments of the regulator at the subsequent press conference after the announcement of the bid. The Fed wants to hear plans for further actions and whether the existing interest rate level will be maintained. 20:30 London time - press conference of the Federal Open Market Committee of the Federal Reserve. Further development Analyzing the current trading chart, we see the price fluctuation within the psychological level of 1.1000, where the desire to continue the recovery process persists as never before. This is a rare moment when the market continues to maintain volumes. Perhaps the past two days, which were expressed in accumulation, helped the market to develop a platform. In terms of the emotional component of the market, we see the high activity of speculative positions that are eager to ride the local jump caused by the upcoming Fed meeting, as well as two-day accumulation. Detailing the minute-by-minute trading day, we see that the downward interest at a small amplitude was set at the time of the Pacific trading session and is held to the current moment. In turn, traders are on a low start, as acceleration can happen very soon, where the main positions are downwards, and long operations are considered as local speculative positions. It is likely to assume that the quote will continue to wander uncertainly along with the psychological level, where it is not necessary to make hasty actions. Our task is to catch the momentum that will lead to a full move. If you follow the recovery theory, then the quote should be fixed below 1.0980. In this case, the probability of a move to the steps #3/1-1.0950 and #3/2-1.0879 will be much higher. Alternative positions are considered in case of wordplay at the time of the Fed's press conference, where if the price is fixed higher than 1.1040, local purchase operations will take place. Based on the above information, we will output trading recommendations: - Buy positions will be considered in case of a rebound from the psychological level of 1.1000 and a price fix higher than 1.1040. - Sell positions are considered if the downward interest is held and the price is fixed below 1.0980, without the shadow piercing the candle. The perspective of the move is located in the following stages: #3/1-1.0950 and #3/2-1.0879. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are directed in a downward direction relative to all the main time intervals, which corresponds to the general market interest. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year. (January 29 was based on the time of publication of the article) The volatility of the current time is 33 points, which is already higher relative to the past days. It is likely to assume that against the background of technical and fundamental factors, the quote has a chance of accelerating during the current day. Key levels Resistance zones: 1.1000***; 1.1080**; 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1000***; 1.0900/1.0950**;1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| January 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 29 Jan 2020 03:42 AM PST

In December, the depicted bullish channel was initiated around 1.1000 allowing another bullish breakout above 1.1110 to pursue towards 1.1175. Initial Intraday bearish rejection was expected around the price levels of (1.1175). On December 20, bearish invalidation of the depicted short-term channel was demonstrated. Thus, further bearish decline was expressed towards 1.1065 where significant bullish recovery has originated. Shortly-after, a quick bullish spike towards 1.1235 (Previous Key-zone) was suggested to be watched for bearish rejection and another valid SELL entry. Suggested bearish position has achieved its targets while approaching the price levels around 1.1110. However, the Key-Level around 1.1110 has provided some bullish demand. This was followed by a bullish pullback towards 1.1140 and 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Recently, evident signs of bearish rejection were demonstrated around 1.1175. That's why, quick bearish decline was executed towards 1.1110. As expected in a previous article, bearish persistence below 1.1110 enabled further bearish decline towards 1.1060 then 1.1035 which failed to provide any bullish SUPPORT for the EURUSD pair. Instead, further bearish decline is currently being demonstrated towards 1.1000 where the pair looks quite versold while approaching the depicted demand level (1.1000). On the other hand, the EURUSD pair has a recently-established Key Level around 1.1035 to be watched for price action if any bullish pullback is expressed. Short-term technical outlook remains bearish as long as the EURUSD maintains its movement below 1.1035. Otherwise, bullish breakout above 1.1035 is needed to bring further bullish advancement towards 1.1085 where a more consistent supply level is located. The material has been provided by InstaForex Company - www.instaforex.com |

| January 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 29 Jan 2020 03:39 AM PST

On December 13, the GBPUSD pair looked overpriced around the price levels of 1.3500 while exceeding the upper limit of the newly-established bullish channel. On the period between December 18 - 23, bearish breakout below the depicted channel followed by initial bearish closure below 1.3000 were demonstrated on the H4 chart. However, earlier signs of bullish recovery were manifested around 1.2900 denoting high probability of bullish pullback to be expected. Thus, Intraday technical outlook turned into bullish after the GBP/USD has failed to maintain bearish persistence below the newly-established downtrend line. That's why, bullish breakout above 1.3000 allowed the recent Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where bearish rejection and another bearish swing were suggested for conservative traders in previous articles. Moreover, new descending highs were recently demonstrated around 1.3120 and 1.3085. That's why, Intraday technical outlook is supposed to remain bearish as long as the pair maintains its movement below 1.3120 (recently established descending high). Conservative traders can wait for bearish breakdown below 1.2980. This would be needed first to enhance further bearish decline towards 1.2900, 1.2800 and 1.2780 where the backside of the previously-broken downtrend is located. In the Meanwhile, Intraday traders can watch for bullish rejection around 1.3000-1.2980 as a bullish signal for another bullish pullback towards the depicted price zone (1.3180 - 1.3200). The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD: Saved sell priority, 50 points floating profits and CME Options Analysis Levels Posted: 29 Jan 2020 02:58 AM PST At the beginning of the trading week, the GBP / USD pair is under pressure from the "bears", which is reflected in a gradual movement to our target levels, formed by strategic goals. However, at the moment, support to the "bulls" is provided by the level of the 30th figure (1.3000), the confident passage of which on an impulse and subsequent testing on a declining volume will open the way to goals 1.2925 and 1.2680. "Everyone chooses his own path. And the more obvious the goal, the easier the path." Good morning, dear colleagues. With you, as always, Sergey Denisov and the forecast for the possible movement of the GBP / USD currency instrument. I remind you that this forecast is a derivative of the main long-term forecast for GBP / USD "Sell with us - sell better than us!" The trading plan is based on technical analysis and the levels of open interest of the SME exchange and serves to ensure that we each day move step by step towards our cherished goal which is profit. During the trading session on Tuesday, January 28, 2020, the GBP / USD trading instrument showed itself as if in a fairy tale and we all see this very well. The "bears" calmly and permanently put pressure on the pair henced forced for it to decline. A pleasant decrease in all the sense for us as a little more than 85p was interrupted by a correction to the area of 50% -61.8% Fibo, where the price is currently located. The GBP / USD trading plan has not changed the basic forecast, where we continue to sell in the area of large concentrations of open interest and the volume of 1.2925, where the "smart guys" put up a large number of PUT options, which may indicate a probable hedging of risk when buying futures contracts on BUY, as well as to strategic goal 1.2680.

IMPORTANT: Fear is particularly impulsive "bullish" movements with the update of local maximums. This is the biggest danger for us at the moment! Seems hard? And no! Every day we will touch on the topic of options and strategic levels, on the future articles and subsequently, if you, dear colleagues, have a desire to receive answers to your questions according to my forecasts, I will conduct a webinar with great pleasure for you! Dear colleagues, please follow the publication of the "derivative" forecasts for GBP / USD during the whole time the relevance of the main long-term forecast, for you to not miss anything important and eventually get a profit. IMPORTANT: Remember that you should enter the market exclusively by graphic patterns that are often repeated on the market, this results in a certain pattern of price behavior in the future. In my trading, I use patterns consisting of candlestick analysis and volume analysis. One of my favorite patterns is updating local extremes on a sharply increasing volume, followed by testing up to 50% -61.8% Fibo. Thank you for your attention, dear friends. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment