Forex analysis review |

- EUR/USD. Preview of the week. Important data can be ignored by traders. Technical factors are stronger

- GBP/USD. February 29. Results of the week. Friday's US macroeconomic data turned out to be good, but they are not the reason

- GBP/USD. Mandate war, dollar issues and coronavirus

- EUR/USD. February 29. Results of the week. Prolonged decline in the euro was replaced by strong growth

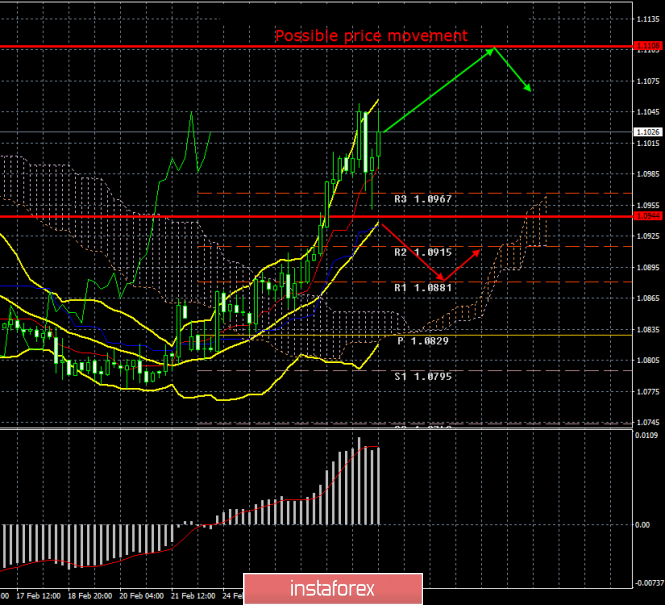

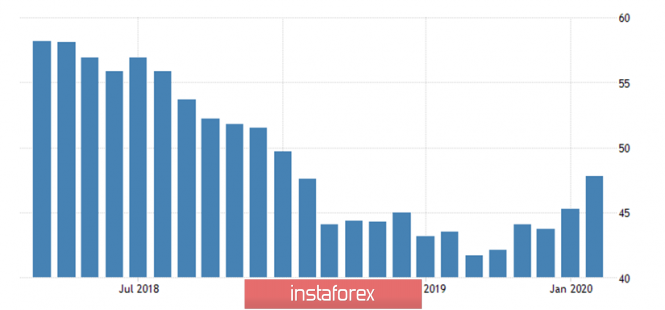

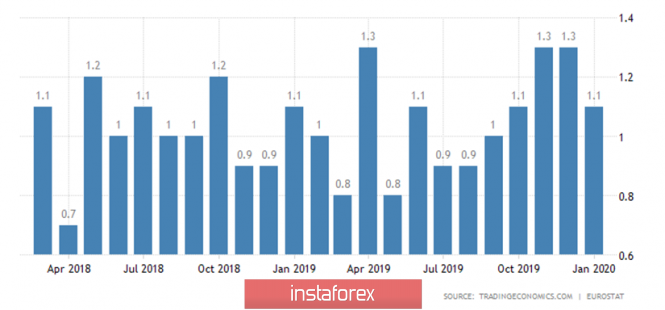

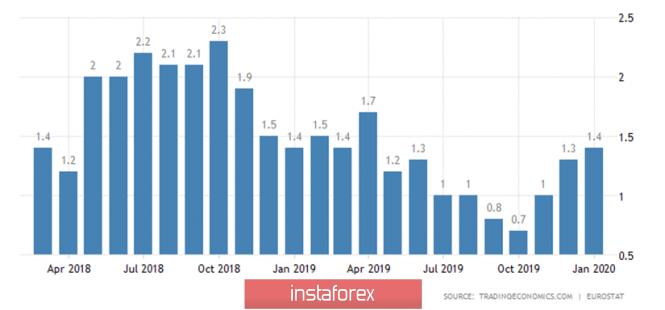

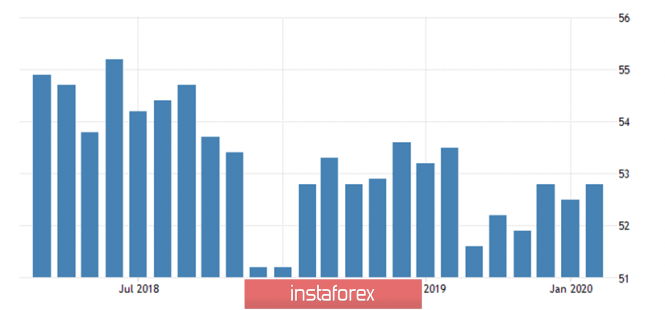

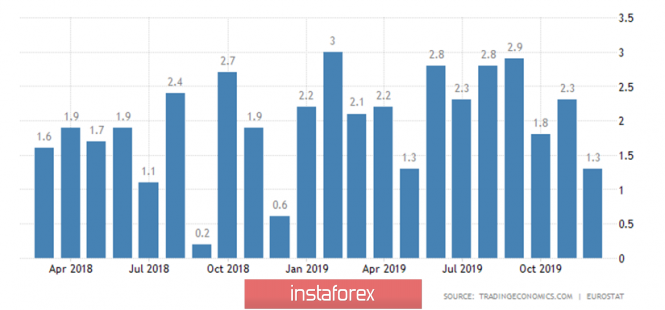

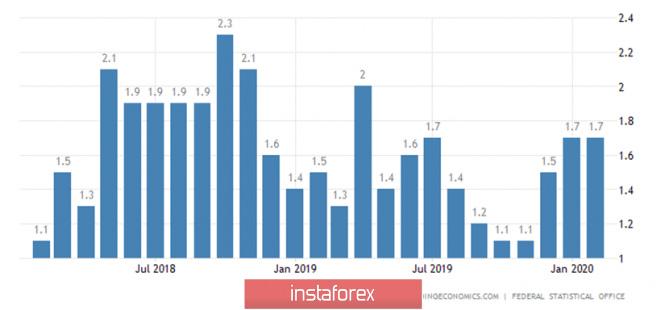

| Posted: 01 Mar 2020 07:38 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 67p - 60p - 54p - 127p - 102p. Average volatility over the past 5 days: 82p (average). After completing a completely crazy week for the EUR/USD pair, a number of reasonable questions arise that need answers. Firstly, initially the last week of February was considered corrective, following a three-week fall in the euro. Thus, the upward movement was expected, but at the end of the week it intensified too much and turned into a rather strong upward trend. Question: what next? Did the bulls reverse the trend in their favor or was the correction just too strong? Secondly, macroeconomic data last week (even though there were few of them), in fact, were ignored. It is also impossible to say that traders reacted to the fundamental background when they either got rid of the dollar, or invested in euros. Question: Are the markets ready to calm down and react logically to macroeconomic publications again? In fact, nothing has changed fundamentally for the euro/dollar currency pair. The euro is still weak, the dollar is still strong. Nothing has changed in the economies of the United States and the European Union, and the notorious coronavirus, which causes panic in the foreign exchange market, in the stock markets, has to do with both the United States and the EU. Thus, it cannot be concluded that the coronavirus has a greater negative impact on someone else's economy. Thus, we believe that nevertheless last week there was a correction. Since the euro continued to grow for six days, now we need a correction against the correction. Accordingly, in almost any case, in the new week we expect the euro's price to fall. This is evidenced by banal technical analysis. As before, we recommend that you do not try to guess the trend reversal points, but simply be prepared for a downward reversal in response to technical indicators. However, technical techniques, but also the macroeconomic background should not be pushed aside. Last week traders paid almost no attention to reports and publications. However, firstly, there were very few of them, and secondly, they were insignificant (except for the report on orders for durable goods in the US). There will be plenty of important publications this week in both the United States and the European Union. Thus, it is unlikely that traders will be able to continue to ignore macroeconomic statistics. We will begin to consider events in chronological order. Germany will release the index of business activity in the manufacturing sector for February. A value of 45.3 was recorded in January, and preliminary data for February indicated an increase to 47.8. It is such forecasts that economists give as the final value of the second month of 2020. Most likely, the forecasts will come true, so the industrial sector may begin to show signs of recovery. A similar index will be published in the European Union. According to preliminary values for February, the index rose to 49.1 and the same forecasts for the final value. Thus, the industrial sector may begin to show recovery in the eurozone. Accordingly, European data on Monday may please traders. However, both indicators are likely to remain below the level of 50.0, that is, a decline in the region will be recorded this time. Significant data will be published in the European Union on Tuesday. First, the unemployment rate and producer price index, and then the basic consumer price index and the main CPI. Core inflation, according to various forecasts, will be in February from 1.1% to 1.2% yoy. That is, acceleration, if expected, is negligible. Recall that the base indicator does not take into account changes in food and energy prices. If you look at the chart above, over the past two years, core inflation has been constantly around 1%. The main inflation indicator takes into account price changes in all categories of goods. In recent months, it began to accelerate, but forecasts for the month of February indicate a new slowdown to 1.2% - 1.3% y/y. Thus, this indicator will most likely remain at rather low values and is unlikely to support the European currency. On Wednesday, March 4, Germany will publish a retail sales figure for January, which may accelerate slightly according to experts' forecasts to 1.2%-1.4% y/y. As well as the index of business activity in the services sector, which does not cause any concern among economists and traders, although it is projected with a slight decrease to 53.3. Over the past two years, the indicator has never dropped below the key level of 50.0, so the service sector is considered a stable sector of the economy. In the eurozone, PMI will also be published for the service sector, which also does not cause any concern among traders, and is projected with a slight increase to 52.8. Retail sales in the European Union may add from 1.1% to 1.4% in January, but overall will remain at the level of the previous month, December. No important publications are planned in the European Union on Thursday and Friday. What can be said about this news package as a whole? The data is quite important, but after a strong six-day growth in the euro, traders will need very strong reports from the eurozone to continue to buy the euro. Thus, we believe that if the data on business activity in industry, inflation, as well as retail sales in the EU do not turn out to be significantly higher than forecast values, then market participants will not pay due attention to all European reports. Moreover, forecasts for some indicators predict growth, and for some - decrease. A technical correction is necessary for the pair and only very strong statistics from the EU or very weak from the USA will block the technical factors. Thus, we believe that the fall of the euro is more likely next week. Trading recommendations: The EUR/USD pair is still in an upward movement. Thus, now you can stay in long positions with the target level of volatility of 1.1108, however, the MACD indicator has already turned down, and the likelihood of the start of correction is very high. It will be possible to sell the pair with targets at 1.0881 and Senkou Span B line, when traders will be able to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

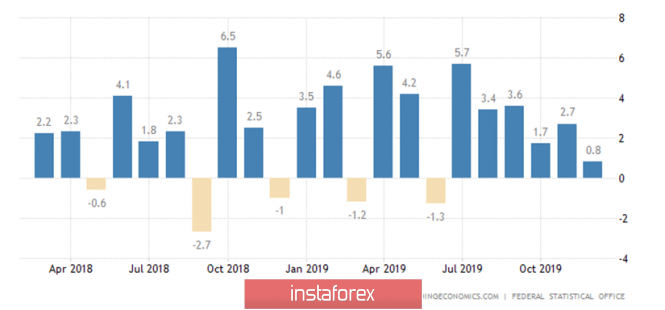

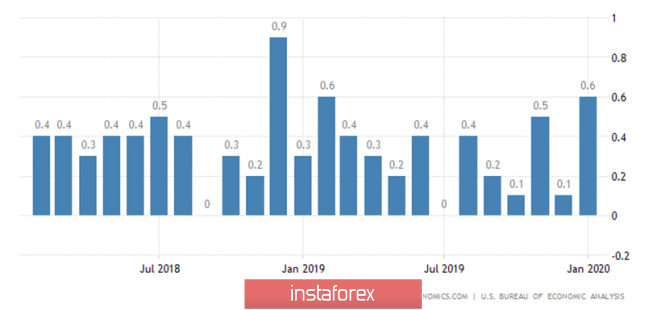

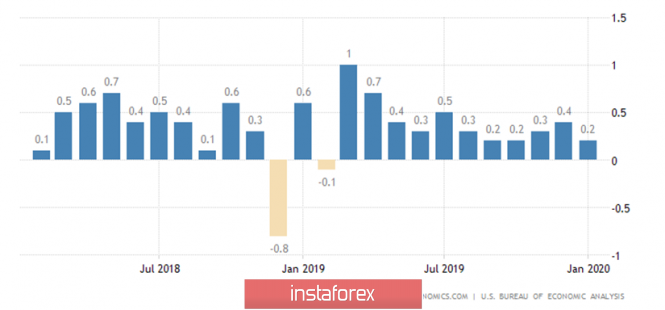

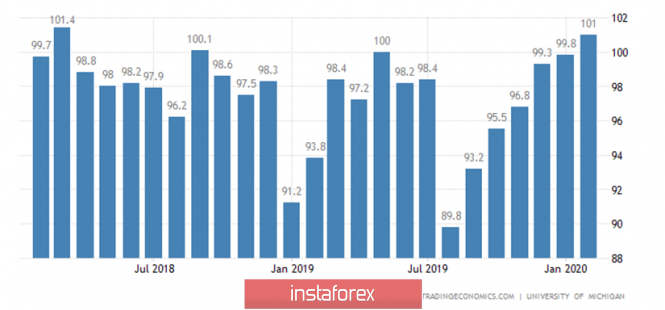

| Posted: 01 Mar 2020 03:20 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 68p - 104p - 108p - 87p - 194p. Average volatility over the past 5 days: 113p (high). The GBP/USD currency pair continued to conduct indistinct multidirectional trading for most of last week. In general, the entire period of indistinct movements was several months. However, as we have repeatedly warned traders, sooner or later, the luck of the British currency in any case would end. If the situation for the GBP/USD pair was neutral, then we could equally expect an upward trend and a downward trend. However, we have repeatedly warned: there are no grounds for strengthening the pound. From time to time, the market openly finds a reason for restrained purchases of the pound, but this is not often the case. Moreover, the situation for the pound is getting worse and worse every quarter. Previously, only Brexit and any uncertainty associated with it scared traders. Now, traders are afraid of Brexit without a deal with the EU. The most interesting thing is that if the government of Boris Johnson does not agree with Brussels, and it clearly does not burn with the desire to do this, then, in fact, Britain will be faced with the "hard" Brexit. That is, the two-year war of the Parliament with the prime ministers will be in vain. As we have said more than once, the UK economy is already losing 70 billion a year, experiencing serious problems, and slowing down. And factors such as, for example, the coronavirus, are also relevant to the British economy. In general, the situation remains, if not hopeless, then very difficult. On the last trading day of the week, pound quotes fell, although formally there were no reasons for this. Most other currencies went up against the dollar, however, the pound found the most inopportune moment to collapse. As for macroeconomic statistics this week, everything is very, very simple here. Not a single more or less significant report has been received from the UK. The first three days the calendar of events was completely empty in the United States. Several reports were published only on Thursday and Friday, but the most important (orders for durable goods, GDP) were simply ignored by traders. But on Friday, when much less significant data were published, the pound collapsed like a cut. The most significant reports published on Friday - the change in the average level of income and expenses of the US population. Personal incomes of Americans grew by 0.6% in January, which is much higher than all experts' forecasts. But personal expenses increased by only 0.2% in January compared with December, which is lower than forecasted values. Thus, in general, we can say that both indicators remained at their stable levels (as can be seen from the two-year data on income and expenses) and, in general, they can be considered neutral. Another more or less significant index is consumer confidence from the University of Michigan. This indicator increased from 100.9 to 101.0. Purely formal growth. The fundamental background from the UK over the past week was limited only to secondary messages, such as preparing both sides for the upcoming talks. The first reports of infection of British citizens with the coronavirus were also received. Mark Carney said the Chinese virus has already begun to negatively impact the British economy. Carney complained that the problems for the British economy could be the supply of goods, parts, or equipment from China, where quarantine has been declared in some provinces, many businesses are not functioning, or are operating on a limited basis. For example, the largest British automaker Jaguar Land Rover said that it has enough spare parts from China to maintain its British production for two weeks, no more. Thus, problems with deliveries from China can slow down the British economy even more, which already showed zero growth in the last quarter. Accordingly, the pound also has nothing to expect except a miracle. Perhaps traders will decide to wait for the receipt of important information from the negotiations on the deal, and before that they will decide not to build up their positions. It may take several weeks before this, as the negotiations should last at least for some time so that it can be concluded that the negotiations are progressing. However, even this hope does not save the pound from long-term downward prospects. From a technical point of view, the pound/dollar pair worked out the second support level of 1.2747 and rebounded from it. Therefore, correction may begin in the near future. We also believe that markets should calm down because Friday's trading was too volatile. Trading recommendations: GBP/USD starts upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2747 and 1.2700, after the correction is completed. We recommend considering the pair's purchases with a view to the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. In any case, the fundamental background remains not on the side of the pound. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Mandate war, dollar issues and coronavirus Posted: 01 Mar 2020 03:20 PM PST The British currency paired with the dollar showed increased volatility last week. After unsuccessful attempts to conquer the 30th figure, the GBP/USD pair collapsed to many-month lows, testing the 27th figure. The last time the price was at such lows in October last year, when British and European politicians once again frightened the financial world with a "hard" Brexit. To date, the Brexit theme is still in trend, but now traders are prone to other "horror stories." The magnitude of the possible consequences of the coronavirus epidemic made nervous not only the participants in the foreign exchange market: for example, the MSCI World index (a stock index reflecting the situation on the global stock market) showed a weekly decline of 9.4%, a similar trend was observed except in the fall of 2008. Japan's Topix index fell by 3.7%, the Australian S&P/ASX 200 and South Korean Kospi - by 3.3%. US markets finished trading on Friday with the worst result in ten years. In particular, the S&P 500 lost about 9% for four days of the week, and fell another 4.42% on Friday. The Dow Jones Industrial Average and Nasdaq Composite Index experienced a similar downward turn. The dollar index slipped to 97 points against this background, thereby reflecting sales of the US currency throughout the market (for comparison: at the end of last week, this figure was near the hundredth level). Therefore, the greenback played the role of a "whipping ball" in most currency pairs: the yen strengthened against the dollar by more than 200 points per day, and the European currency still completed the week within the 10th figure. But the pound paired with the dollar behaved somewhat differently. The British currency looked a weaker greenback, while the coronavirus factor only aggravated the position of the GBP/USD bulls. In particular, the current head of the Bank of England Mark Carney (he will leave his post in March) said on Friday that the country is already seeing an economic effect from the epidemic. According to him, the tourism industry, as well as the production sector, will suffer the most. And here it is worth recalling that the UK economy showed zero growth in the fourth quarter of last year compared to the previous three months. Manufacturing output fell 1.1% on a quarterly basis. Obviously, the epidemic will only exacerbate the situation in the first quarter of this year. It is noteworthy that the comments of Mark Carney came at a time when around 20 confirmed cases of infection in the UK were announced. Moreover, the Ministry of Health has reported the first human-to-human transmission of coronavirus in the country. The market again started talking about the fact that the English regulator could soften monetary policy at the next meeting, although until recently the likelihood of this scenario was quite low - good data on rising inflation, the labor market and the volume of retail sales eliminated the corresponding concerns. Now the issue of rate cuts is again on the agenda. This combination of news flows put pressure on the British currency. But the main catalyst for pulling down GBP/USD was Brexit. Let me remind you that last week the EU Council approved the mandate of the European Commission in negotiations on future relations with Britain. The 46-page document will become the basis for the upcoming negotiations within the transition period - the first consultations between the parties will begin on March 2, that is, on Monday. The European mandate reflected Brussels' rather tough stance in the upcoming talks. A common thread is the idea that EU standards should serve as an "unconditional reference point" in any version of a future trade agreement. According to the European Commission, these standards should be applied in the areas of state aid, competition, state, social and labor standards, environmental standards, climate change, relevant tax issues "and other regulatory measures and practices in these areas". In other words, Europeans initially rejected both the "Canadian" and the "Australian version of the deal." A few days later, London announced its mandate for trade negotiations with the European Union. It turned out to be no less rigid and quite ultimatum. First, the British continue to insist that the trade deal with the EU should be similar to the agreement with Canada. Secondly, the Johnson team ruled out the possibility of prolonging the transition period - although almost all experts unanimously say that the parties will not have time to agree on all the nuances of future relationships in such a short period. For example, the negotiations of Brussels with Ottawa lasted no less than seven years. But London stands its ground. Moreover, an intermediate "deadline" was determined on Downing Street. If by June it becomes clear that the parties will not be able to conclude a trade agreement until December, then Britain will enter the regime of preparation for exit without a deal. According to Johnson, by the beginning of the summer, negotiators should agree at least on the general features of future relations. The British also once again emphasized that they would not follow the rules and regulations of the European Union. Thus, the dispositions of the parties indicate that in the coming months we will have a "big battle" between the negotiators. The British mandate runs counter to almost everyone with the requirements of Brussels, and in categorical form. It is likely that during the many months of negotiations, the parties will nevertheless make certain compromises - as was the case during last year's dialogue. But initially, negotiators will almost certainly show an extremely tough and peremptory line of behavior, thereby raising rates and expressing readiness for any outcome of the negotiations. Therefore, the results of the first meetings of the negotiating groups can exert strong pressure on the British currency. Despite the price retreat to the close of the trading week, the GBP/USD pair may continue the downward movement next week, especially if the first dialogue between the negotiators ends on a minor note. The immediate goal of the downward movement is the support level 1.2670 - this is the lower line of the Bollinger Bands indicator, which coincides with the upper boundary of the Kumo cloud on the weekly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Mar 2020 03:20 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 67p - 60p - 54p - 127p - 102p. Average volatility over the past 5 days: 82p (average). The EUR/USD currency pair broke all records in the last week of February, both growth and volatility. The euro continued to not sharply fall for most of the second month of 2020, but surely, but it spread its wings at the end of the month. If we compare the current rate with the course of the previous month, then the euro has fallen in price anyway. Thus, despite a more than positive week, the euro continues to lose ground against the US dollar. And this despite the fact that the United States, the dollar and the whole situation that has developed now in the world, are doing their best to "try" to help the euro currency. For example, the US stock market, which fell 15% this week, could trigger a weakening dollar on all fronts. Paired with the euro, this factor may have provided some help. And paired with the pound - no. One way or another, if you look at longer-term timeframes, it becomes clear that the downward trend for the euro/dollar pair continues. Moreover, no one can say for sure why the euro has shown a record growth this week. We have already said that if we consider the entire fundamental background of recent days, it becomes obvious: the pressure on the dollar is exactly the same as the pressure on the euro. Coronavirus is not a purely American phenomenon. Moreover, in Europe, in particular in Italy, there are much more infected than in the United States, at least according to official information. Thus, the impact on the European economy will also be present and negative. The ECB and the Fed can equally resort to easing monetary policy due to the outbreak of the coronavirus. In this article, we will examine all the macroeconomic statistics of the week to understand how macroeconomic statistics have changed in the EU and the US. It should be noted right away that macroeconomic factors ruled the market this week. If at the beginning of the trading week, in the complete absence of any important publications, a purely technical strengthening of the euro currency was observed, then at the end of the week a whole bunch of various fundamental information sowed panic among traders and there was no talk of any logical and reasonable trading. No important macroeconomic statistics were published either in the United States or in the European Union on Monday, Tuesday and Wednesday. These days we can only note absolutely neutral GDP in Germany for the fourth quarter, which amounted to +0.4% y/y, and, accordingly, remains at almost zero levels of growth rates. Traders witnessed important reports on Thursday, which, however, did not have a special effect on the movement of the pair. US GDP for the fourth quarter, according to preliminary estimates, was +2.1% y/y. That was the forecast, that was the value of the previous quarter. Traders did not respond to this report. Then a more important indicator of orders for durable goods in the United States was published. All four derivatives of the indicator exceeded forecast values, but did not cause the slightest appreciation of the US currency. It can be said that for most of the week, the euro/dollar was generally traded solely under the influence of technical factors that required serious correction after a three-week fall. Friday's news didn't matter at all to market participants, as it was completely blocked by other events. Nevertheless, we cannot bypass this data. German inflation in February remained unchanged at 1.7% y/y. It cannot be said that this is frankly weak inflation, however, it remains insufficient. Thus, there is no particular reason to expect an acceleration of the pan-European inflation rate, which currently stands at 1.4% y/y. Accordingly, there is no reason to expect an improvement in the general economic condition of the European Union. Once again, we are forced to state that statistics from the EU are either failed or neutral at best. From across the ocean on Friday, information was received about changes in the level of income and expenses of the US population, which is not the most significant, as well as a consumer sentiment index from the University of Michigan, which is secondary. Such data will be discussed in more detail in the article on GBP/USD. Thus, in general, we can say that the euro was just adjusted all week, and next week the "correction against correction" will be very logical. Since the last upward movement was also completely recoilless. The first goal of the correction will be the Kijun-sen critical line. Trading recommendations: The EUR/USD pair is still continuing its upward movement. Thus, now you can stay in long positions, but the MACD indicator has already turned down, and the likelihood of a correction beginning is very high. It will be possible to return to sales of the euro/dollar pair with the goal of the support level of 1.0881, when traders will be able to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment