Forex analysis review |

- Forecast for EUR/USD on March 6, 2020

- Forecast for GBP/USD on on March 6, 2020

- Forecast for USD/JPY on March 6, 2020

- Comprehensive analysis of movement options of #USDX vs Gold & Silver (H4) from March 06, 2020

- EUR/USD. March 5 results. ECB next central bank in line to lower the key rate

- March 5, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- March 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC analysis for 03.05.2020 - Bigger drop is expected towards the levle of $7.650, potential completion of the ABC correction

- EUR/USD analysis for 03.05.2020 - Massive buying climax in the background, watch for selling opportunities with the first

- Analysis for Gold 03.05.2020 - Major multi-pivot resistance at the price of $1.655-$1.660 on the test, watch for potential

- Technical analysis of EUR/USD for March 05, 2020

- Overview and forecast for USD/CAD on March 5, 2020

- GBP/USD: plan for the US session on March 5. The pound continues to strengthen even after yesterday's statements by the future

- EUR/USD: plan for the US session on March 5. Buyers of the euro returned resistance to 1.1145, however, further growth may

- Outlook for EUR/USD for March 3rd. Virus still posing real risk to markets

- Trading recommendations for EURUSD pair on March 5

- Instaforex Daily Analysis - 5th Mar 2020

- Instaforex Daily Analysis - 5th Mar 2020

- Trading recommendations for GBP/USD pair on March 5

- EUR / USD: The ECB is at a crossroads

- Analysis and forecast for EUR/USD on March 5, 2020

- AUD/USD approaching key resistance, potential drop!

- NZD/CAD approaching resistance, potential drop!

- GBP/USD approaching support, potential bounce!

- EUR/USD Bullish Momentum Expected Soon!

| Forecast for EUR/USD on March 6, 2020 Posted: 05 Mar 2020 07:57 PM PST EUR/USD The expected euro reversal is delayed. Markets are laying the probability of a threefold Fed rate cut by April, that is, from the current of 1.25% to 0.50%. Investors clearly suffered, because on Wednesday the head of the St. Petersburg Federal Reserve Bank of St. James James Bullard spoke and said bluntly that the markets were mistaken, laying even a quarter point rate hike on March 18, since an emergency rate cut on Tuesday was a preventive measure, you need to get at least some information on the impact of coronavirus on the US economy. Trading volumes sharply fell, but still exceeded the top five-month volumes. This is excessive volumes for yesterday's growth of the euro by 100 points, which means that strategic investors still continued to close positions on the purchase of middle-hand players. The price stopped at the Fibonacci level of 100.0% - at the top of December 31. The Marlin oscillator began to turn around from overbought zone. Today, US employment data for February will be released. The consensus forecast for unemployment is the previous 3.6%, but there are estimates even lower at 3.5%. Outside the agricultural sector, an increase of 175 thousand new jobs is expected. This news is likely to become a turning point for the entire market. On the four-hour chart according to Marlin, divergence is forming. The purpose of the euro decline is the Fibonacci level of 61.8% (in fact 38.2% of the growth since February 20), the MACD line is striving for this level both on the daily chart and on the four-hour chart. The material has been provided by InstaForex Company - www.instaforex.com |

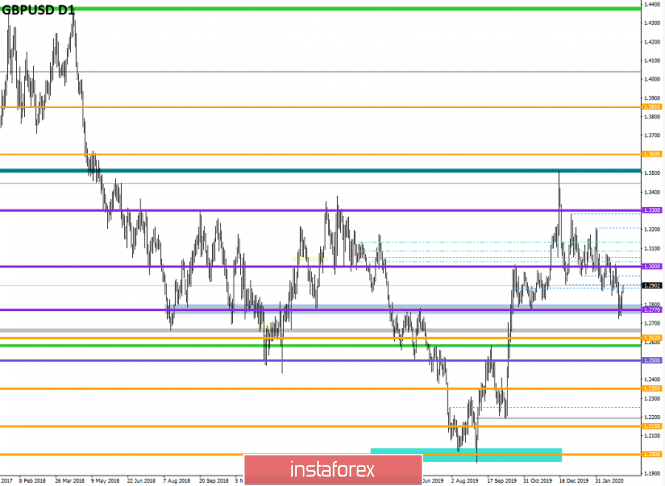

| Forecast for GBP/USD on on March 6, 2020 Posted: 05 Mar 2020 07:55 PM PST GBP/USD The pound rose 83 points on Thursday and entered the uncertainty zone, limited by Fibonacci levels of 100.0-76.4% on the daily chart. This range is indicated by a gray rectangle. The graph shows that the price in it has unpredictably moved since December 23. Purely technical, the price shows an intention to work out the upper limit of the range or to even slightly move above it, having worked out the resistance of the MACD line in the price area of 1.3080. The signal line of the Marlin oscillator looks stable in the positive trend zone. The growth of the pair looks predominant. The indicators have not created reversal patterns on the H4 chart by the current moment, the only sign of a correction or reversal that can develop and work out is the appearance of a reversal of the signal line of the Marlin oscillator in the overbought zone. The impetus for such a reversal might come from today's data on labor in the United States. Non-Farm Employment Change is projected at 175 thousand and wage growth of 0.3%, which is in force to send the pound in a downward correction. The purpose of the decline: 1.2880 - support for the MACD line on H4, 1.2843 - Fibonacci level of 110.0%, 1.2760 - Fibonacci level of 123.6%, but this is the intention to continue to fall in the medium term. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on March 6, 2020 Posted: 05 Mar 2020 07:54 PM PST USD/JPY The Japanese yen worked out precisely the target range of 105.92-106.13, determined by the Fibonacci levels of 271.0% and 261.8%. The Marlin oscillator on a daily scale has penetrated into the oversold zone. Pessimism reigns in the stock market. The US S&P 500 lost 3.39% yesterday (remaining in the range of Monday), the Japanese Nikkei 225 is losing 3.08% today, updating the September low, the Chinese China A50 is down 1.62%. Data on labor in the United States can relieve pressure on the stock market today. The forecast for new jobs outside the agricultural sector is 175 thousand. The growth of the dollar against the yen is possible to the Fibonacci level of 238.2% (106.70). The development of local optimism may extend the growth to the embedded line of the price channel near the Fibonacci level of 223.6% at the price of 107.10. The growth of the pair, of course, will not be a reversal, but corrective, since even the initial signs are not formed for a reversal. |

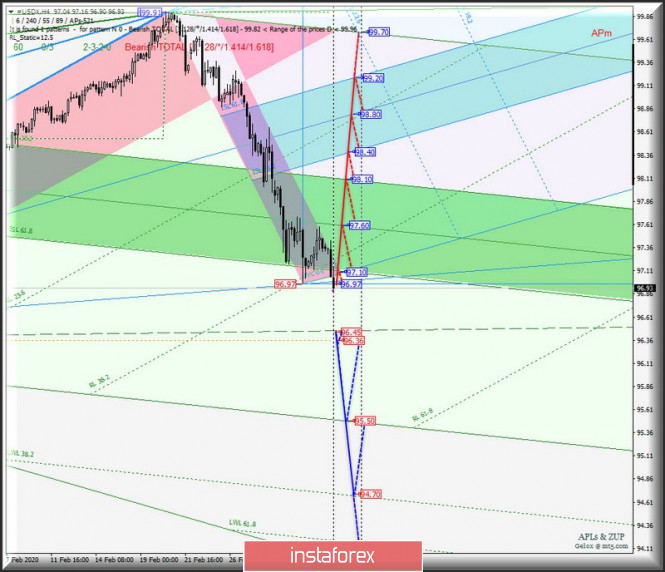

| Comprehensive analysis of movement options of #USDX vs Gold & Silver (H4) from March 06, 2020 Posted: 05 Mar 2020 05:51 PM PST Do people long for metal along with the US dollar? Here's a comprehensive analysis of the development movement options for the #USDX vs Gold & Silver for March 06, 2020 Minuette operational scale forks (H4) ____________________ US dollar index The movement of the dollar index #USDX from March 06, 2020 will depend on the direction of the breakdown of the range :

The return of the dollar index above the resistance level of 96.97 (local minimum) followed by the breakdown of ISL61.8 Minuette (97.10) will determine the development of the #USDX movement in the equilibrium zones (97.10 - 97.80 - 98.10) of the Minuette operational scale forks with the prospect of reaching the boundaries of the equilibrium zones (98.40 - 98.80 - 99.20) of the Minuette operational scale forks. On the other hand, the breakdown of support level of 96.45 on the final Schiff Line Minuette with the subsequent update of minimum 96.36 will lead to an option to continue the downward movement #USDX to the final line FSL (95.50) of the Minuette operational scale forks and the warning line LWL38.2 Minuette (94.70). The markup of #USDX movement options from March 06, 2020 is shown in the animated chart.

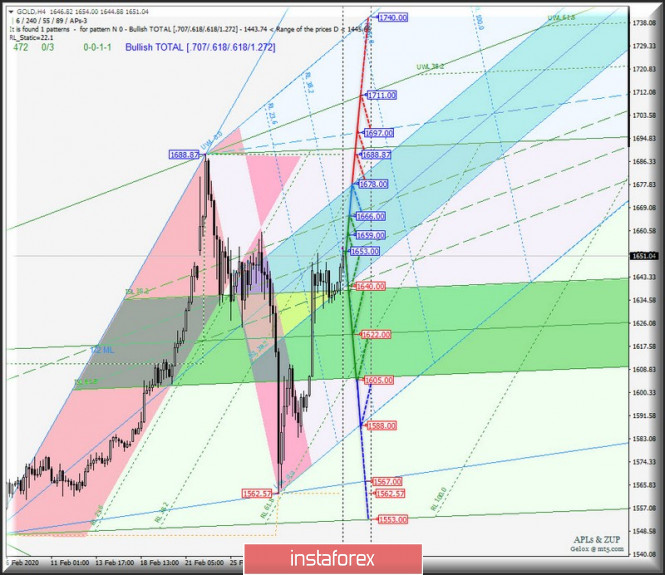

____________________ Spot Gold The development of the Spot Gold movement from March 6, 2020 will be determined by the development of the boundaries of the 1/2 Median Line channel (1640.00 - 1653.00 - 1666.00) of the Minuette operational scale forks and the equilibrium zone (1640.00 - 1659.00 - 1678.00) of the Minuette operational scale forks. The details are presented on the animated chart. The breakdown of the support level of 1640.00 on the lower boundary of the 1/2 Median Line Minuette channel will lead to an option for the development of Spot Gold movement within the equilibrium zone (1640.00 - 1622.00 - 1605.00) of the Minuette operational scale forks with the prospect of reaching the initial SSL line (1588.00) of the Minuette operational scale forks. Alternatively, in case of breakdown of the resistance level of 1678.00 on the upper boundary of ISL61.8 equilibrium zone of the Minuette operational scale forks, then the upward movement of Spot Gold can be continued to the goals: - maximum 1688.87; - the final Schiff Line Minuette 1697.00; - control line UTL (1711.00) of the Minuette operational scale forks. The details of the Spot Gold movement options from March 06, 2020 is shown in the animated chart.

____________________ Spot Silver The development and direction of the breakdown of the boundaries of 1/2 Median Line channel (17.070 - 17.400 - 18.030) of the Minuette operational scale forks will begin to determine the development of the Spot Silver movement from March 6, 2020. Look at the chart for the details of the development of the indicated levels. The breakdown of the support level of 17.070 on the lower boundary of the 1/2 Median Line channel of the Minuette operational scale forks, will lead to the development of Spot Silver movement which can be continued to the UTL control line (16.800) of the Minuette operational scale forks and the SSL start line (16.420) of the Minuette operational scale forks. In contrast, a sequential breakdown of the resistance level of 17.640 on the upper boundary of the 1/2 Median Line Minuette channel as well as the 1/2 Median Line Minuette (17.720) will direct the development of Spot Silver movement to the upper boundary of the ISL61.8 (18.030) equilibrium zone of the Minuette operational scale forks and the final Shiff Line Minuette (18.500). The details of the Spot Silver movement from March 06, 2020 can be seen in the animated chart.

___________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

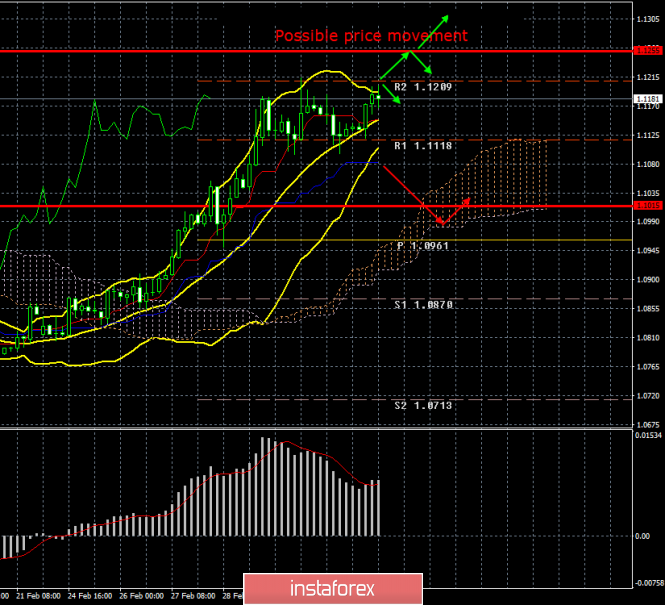

| EUR/USD. March 5 results. ECB next central bank in line to lower the key rate Posted: 05 Mar 2020 02:47 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 127p - 102p - 157p - 119p - 92p. Average volatility over the past 5 days: 120p (high). The EUR/USD currency pair unexpectedly resumed the upward movement on Thursday, March 5. Thus, the correction was of the weakest nature; quotes of the pair were not even able to reach the critical Kijun-sen line. Based on this, we make an unambiguous conclusion: bulls continue to own the initiative in the market, do not want to let the euro go, believe in a further weakening of the US dollar. In general, all the reasons that provoked a strong strengthening of the euro in the last two weeks continue to be in effect. And it does not matter that most of these reasons are completely contrived by traders. Indeed, in fact, only one thing is important - whether market participants will buy (or sell) this or that currency. And why they do this is a secondary issue. Typically, markets are driven by speculators, that is, players who wish to capitalize on exchange rate differences. However, in addition to speculators and traders, there are also other participants on the market who buy this or that currency to conduct their own business, business, conduct international trade operations and settlements. It does not matter to them whether it is advisable at this time to buy the euro in terms of fundamental analysis. If they need the euro then they will buy it. If they need to hedge risks then they are buying the euro for the future. Thus, now the euro/dollar is in such a turbulent trading period, when the foundation has minimal impact on the movement of the pair. And the movement itself is illogical and unreasonable. In this case, more attention should be paid to technical analysis, which just shows the current trend in the market and does not try to predict when the current upward trend will complete. This is exactly what we do not recommend to traders: try to guess when the euro will strengthen and sell the pair in an upward movement. You should trade "in the trend", even if the "foundation" is against. Meanwhile, markets continue to be in a state of panic. Or if not panic, then in an excited state. After the Fed decided to soften monetary policy immediately by 0.5%, the US stock market began to recover. As of March 4, stock indices rose significantly. The S&P 500 and Dow Jones added more than 4% each. However, as we see, this did not affect the position of the US currency. It did not manage to correct normally after a strong fall, and news about the growth of the US stock market did not lead to an increase in the dollar. Thus, our hypothesis that the stock market did not fall caused the depreciation of the US dollar. In the same way, other "popular" theories of the fall of the US currency do not work in this case. The euro and the dollar are simply not being traded now in accordance with macroeconomic data, which is why there is no point in looking for logic in the behavior of the market. At the same time, many experts and analysts are almost completely sure that the ECB will be the next central bank to cut the key rate. First, the situation with coronavirus requires the intervention of a European regulator. Secondly, this week it became known that inflation in the European Union began to slow down again and reached only 1.2% y/y. Thus, the recent statements by the EU and Christine Lagarde that "inflation is the key indicator and the ECB will strive to achieve the target level using any monetary instruments" are of particular importance now. Since inflation is falling again, many central banks of the world have already lowered the rate, the ECB will also take this step with a 95% probability. Experts believe that the ECB will again lower the current deposit rate by 0.1% and bring it, thus, to a value of -0.6%. In fact, with negative rates, the ECB wants financial institutions to take out loans rather than place money on deposits. The exact same decision is expected from the Bank of England. It remains for us to understand how the market can react to these events. For example, today no macroeconomic statistics have been published either in the United States or in the European Union. Nevertheless, the currency of the European Union began to rise again. Will it continue to grow if the ECB softens monetary policy even more? In the long run, from our point of view, such a decision by the ECB will negatively affect the position of the euro. However, who is now worried about the future course of the euro or the dollar? In general, the balance of power between the dollar and the euro will not change in this case. Monetary policy in the United States will remain stronger than in Europe. Thus, we do not believe that the euro can continue to grow for a long time. That is, from a technical point of view, growth can continue as long as you like. The only condition for the technique is the presence of corrections (which are also missing now). But the period of illogical movement from the point of view of the foundation will end sooner or later, and then everything will fall into place. The technical picture now indicates the resumption of an upward trend. The pair once again worked out the resistance level of 1.1209 and can bounce off of it, starting a new round of correction. Overcoming this level will open the way for the pair to move upwards. Trading recommendations: The EUR/USD pair retains the same chances for the beginning of the correction, and for the continuation of the upward movement. Thus, new long positions can now be considered with the objectives of 1.1209 and 1.1255, as the MACD has turned up. It will be possible to sell the pair with the first goal of the Senkou Span B line, when traders will be able to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

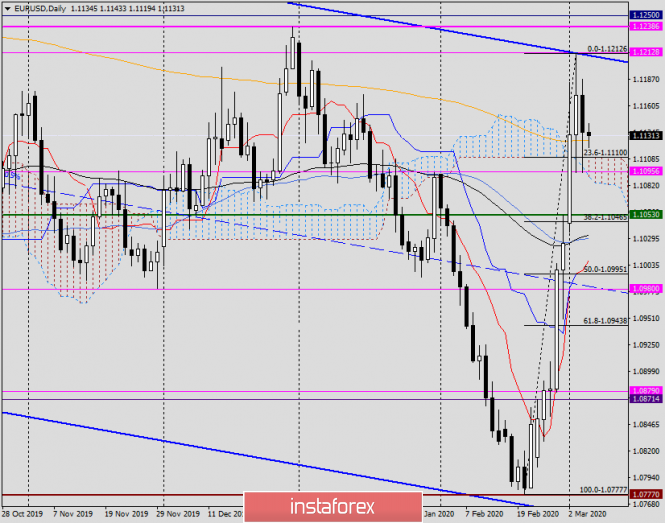

| March 5, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 05 Mar 2020 08:44 AM PST

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 (Previous Key-zone) just before another bearish movement could take place towards 1.1100 (In the meanwhile, the EURUSD pair was losing much of its bearish momentum). One more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Since then, the pair has been down-trending within the depicted bearish channel until two weeks ago, when extensive bearish decline established a new low around 1.0790. This was where the EUR/USD pair looked oversold after such a long bearish decline. Hence, Intraday traders were advised to look for signs of bullish recovery around the price levels of (1.0790). By the end of Last week, recent signs of bullish recovery were manifested around 1.0790 leading to the current bullish movement towards 1.0910, 1.0950 and 1.1000. The price level of (1.1000) constituted a temporary SUPPLY level in confluence with the upper limit of the current movement channel. That's why, transient bearish pullback was executed towards 1.0950 (Backside of the broken channel) where another bullish swing was initiated. On Monday, a quick bullish spike was expressed above 1.1100 (Previous Key-Level). Further bullish advancement was anticipated towards 1.1175 where the current triple-top pattern is being demonstrated. Currently, the EURUSD pair is trapped between the price levels of 1.1100 and 1.1175. Bearish rejection is anticipated around the current price levels of 1.1175-1.1190 with bearish targets around 1.1040 and possibly 1.1000. Otherwise, bullish persistence above 1.1190 enables further upward movement towards 1.1235 where a more prominent Supply-Zone is located. The material has been provided by InstaForex Company - www.instaforex.com |

| March 5, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 05 Mar 2020 08:21 AM PST

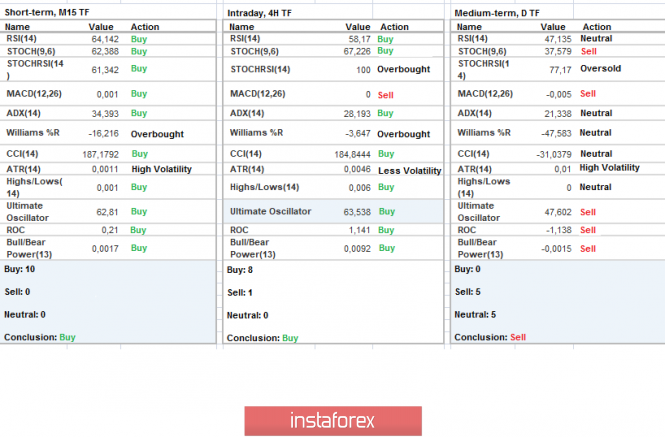

In the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by quick bearish decline below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where the current wide-ranged movement channel was established between (1.3200-1.2980). Since January 13, progressive bearish pressure has been built over the price zone of 1.2980-1.3000 until February 5. On February 6, recent bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 (the lower limit of the movement channel) where two episodes of bullish rejection were manifested on February 10th and 20th. This was followed by the recent bullish pullback towards the price zone of 1.2980-1.3000 which has offered considerable bearish rejection. On the other hand, the lower limit of the channel around 1.2850 has failed to provide enough bullish Support for the pair. That's why, a quick bearish decline was expressed towards the nearest DEMAND level around 1.2780 where significant bullish rejection and an atypical double-bottom pattern was recently demonstrated. The current Bullish recovery is expected to pursue towards 1.2980 provided that the ongoing bullish breakout above 1.2850 is maintained on daily basis Bearish rejection and bearish pullback is expected to exist around 1.2980 unless bullish breakout above 1.3000 is achieved soon enough. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2020 06:24 AM PST Industry news:

According to reports, a full session of the National Assembly of the South Korean parliament has passed an amendment to the Act on Reporting and Use of Specific Financial Information. Owing to this amendment, cryptocurrency trading is now 'legitimized' and has made its way into the legal system for the South Korean government.This is a huge win for the digital asset industry, especially for the many exchanges and platforms based in South Korea, as the report claimed that this amendment will usher in a complete restructuring of the blockchain industry. Technical analysis: BTC been trading upwards.The price reached the resistance at the $9.100. I found potential end of the upward correction and completed ABC pattern. I would watch for selling opportunities and downward tarrgets at the prrice of $8.210 and $7.678. Stochastic is in overbought zone and it is good confirmation that buying looks risky and selling preferable. Resistance level is set at the prie of $9.280 Support levels and downward targets are set at the price of $8.210 and $7.678 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2020 06:12 AM PST Technical analysis:

EUR/USD has been trading upwards.The price reacehd main multi-pivot resistance at the price of 1.1200.Due to test of major resistance, I expect downside movement towards the levels at 1.195, 1.1056 and 1.0955. Additionally, I found massive buying climax few days ago, which is indication that buyers might be in the trouble. Watch for selling opportuniteis using the intraday frames like 15/30 minutes... Major resistance level is set at the price of 1.1210 Support levels and downward targets are set at the price of 1.1095 and 1.1056 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Mar 2020 06:00 AM PST Technical analysis:

Gold has been trading upwards.The price reacehd main multi-pivot resistance at the price of $1.655. I expect downside movement and potential test of $1.626 and $1.611.Watch for selling opportunities due to test of major resistance and lack of demand around pivot. Any bearish pattern on low frames like 15/30 minutes can be the trigger for the sell. Stochastic oscillator is showing overbought condiiton and bearish divergence, which is indication that buying looks risky and selling very attractive. Resistance levels are set at the price of $1.655-$1.660 Support levels and downward targets are set at the price of $1.626 and $1.611. The material has been provided by InstaForex Company - www.instaforex.com |

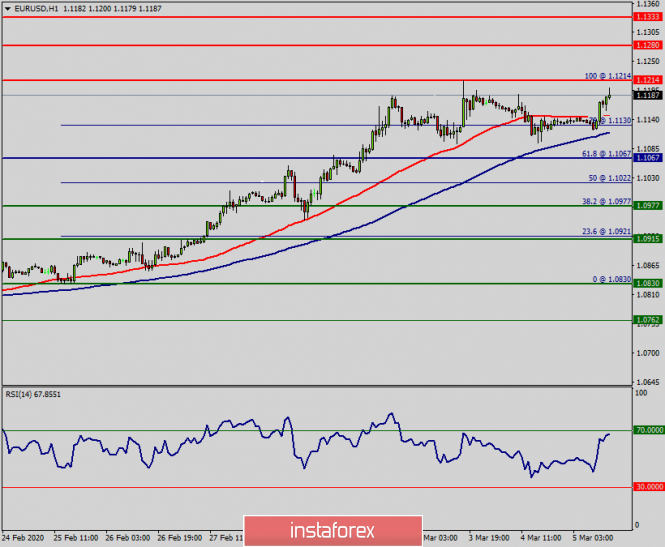

| Technical analysis of EUR/USD for March 05, 2020 Posted: 05 Mar 2020 04:38 AM PST Overview: Pivot: 1.1067. Trend: uptrend. The EUR/USD pair continues to move upwards from the level of 1.1067. Yesterday, the pair rose from the level of 1.1067 to a top around 1.1214. Today, the first resistance level is seen at 1.1214 followed by 1.1280, while daily support 1 is seen at 1.1067 (61.8% Fibonacci retracement). According to the previous events, the EUR/USD pair is still moving between the levels of 1.1130 and 1.1280 ; so we expect a range of 150 pips. Furthermore, if the trend is able to break out through the first resistance level at 1.1214, we should see the pair climbing towards the double top (1.1280) to test it. Therefore, buy above the level of 1.1214 with the first target at 1.1280 in order to test the daily resistance 1 and further to 1.1280. Also, it might be noted that the level of 1.1333 is a good place to take profit because it will form a new double top. On the other hand, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.1067, a further decline to 1.0915 can occur which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

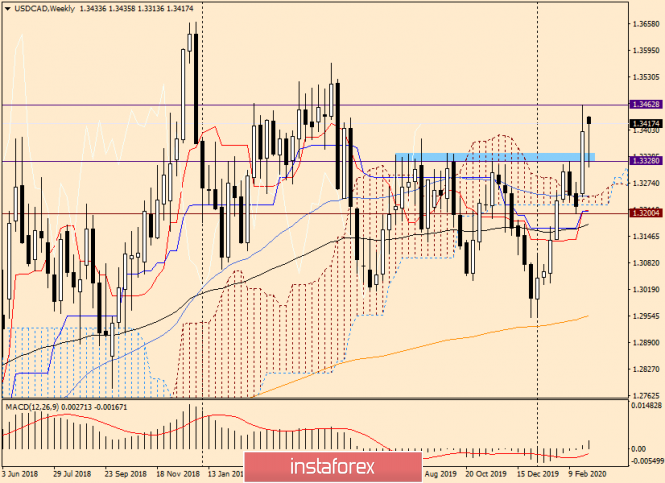

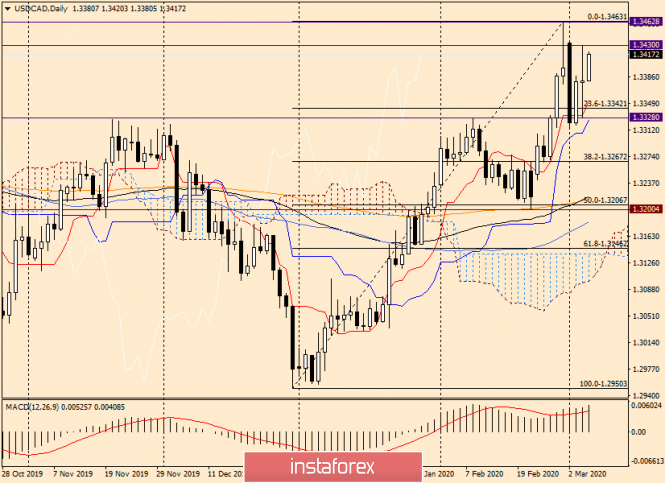

| Overview and forecast for USD/CAD on March 5, 2020 Posted: 05 Mar 2020 04:35 AM PST The Bank of Canada followed in the footsteps of the Fed. Good day! At yesterday's meeting, the Bank of Canada made changes to its monetary policy and decided to reduce the main interest rate from 1.75% to 1.25%. Thus, the Canadian regulator followed in the footsteps of the Fed and lowered the main rate by 50 basis points at once. If we recall that the Reserve Bank of Australia (RBA) also lowered the rate, however, by 25 bps, we can conclude that the world's leading central banks have moved to the trend of ultra-soft monetary policy and lower interest rates. The main reason for the decline in borrowing costs is the spread of the coronavirus epidemic almost all over the world. Fears of the beginning of another financial and economic crisis and the maintenance of their own economy were the reason for taking appropriate measures. At the same time, the Canadian central bank said that if necessary, it is ready to go for further easing of monetary policy. Just like the Federal Reserve, the Bank of Canada lowered its main interest rate by 50 basis points for the first time since the last global crisis of 2008-2009. Now let's look at the reaction of the USD/CAD currency pair after the central banks of both neighboring countries made decisions to reduce the rate by 0.50% at once. Weekly

Last week, the USD/CAD currency pair strengthened significantly and broke through the difficult resistance zone of 1.3328-1.3381. The maximum trading values of the last five days were shown at 1.3463, and the closing price was 1.3398. In the course of trading this week, the pair managed to pull back to 1.3313, after which it began to strengthen, and at the moment of writing the review, it rises to the opening price of 1.3433. If the upward movement continues, USD/CAD will re-test the seller's resistance of 1.3463 for a breakdown. If this level is broken, the quote will rise to a significant psychological level of 1.3500, which will determine the pair's future prospects. Let's see what the situation is on lower timeframes and whether there are interesting points for opening positions. Daily

Yesterday's candle on the daily chart shows the market participants' moods as well as possible after both central banks lowered the main interest rate by 0.50%. At the end of this article, the pair is strengthening. If growth continues, the nearest target will be yesterday's highs at 1.3430. If this level is broken, the USD/CAD will head to the maximum trading values on February 28 - at 1.3463. Judging by the intensity of the upward trend, the US dollar is in high demand, which is probably due to players' concerns about the continuing growth of the coronavirus epidemic. H4

On this timeframe, the pair is trading in an ascending channel, in case of a decrease to the middle line of which you can count on the support and plan purchases. You should look for more favorable prices for opening long positions when the price drops to the area of 1.3345-1.3320. First, this is a strong technical area. Second, there are 50 MA and 89 EMA, which can support the price to return the pair to growth. At the moment, it is recommended to plan purchases after rollbacks to the indicated prices. Since the pair is trading near the resistance of 1.3430, I consider it risky to buy here and now, despite the bullish market mood. Do not forget that tomorrow at 14:30 (London time), data on the US labor market and labor statistics from Canada will be published. Volatility will be high, and price movements will be sharp and strong, possibly in each direction. Be careful and attentive! Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

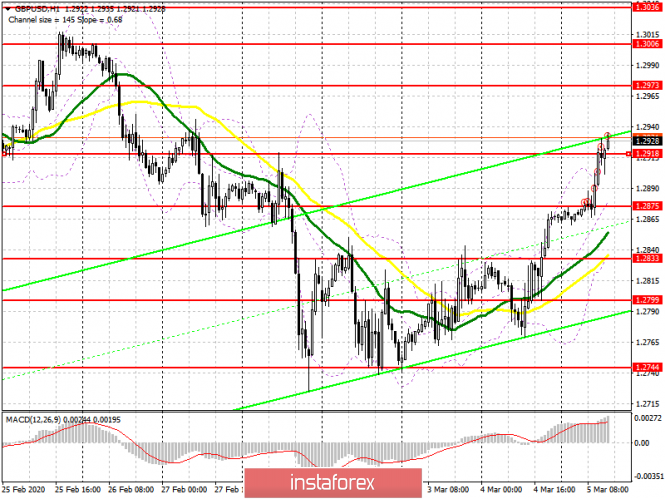

| Posted: 05 Mar 2020 04:13 AM PST To open long positions on GBPUSD, you need: Buyers of the pound climbed above the resistance of 1.2875 today, ignoring the statements of the future Governor of the Bank of England, Andrew Bailey, who will take office on March 16 and replace Mark Carney. Bailey mostly talked about the high probability of interest rate cuts in the near future. At the moment, the pair has hit the resistance of 1.2918 and is still experiencing some problems with continuing growth above this level. Only bad data on the US and today's speech by Mark Carney will allow GBP/USD to strengthen to new highs in the area of 1.2973 and 1.3006, where I recommend taking the profits. In the scenario of the pair's decline in the second half of the day, the area of 1.2875 will be a good level for purchases, but it is best to open long positions from it only after a false breakdown is formed. I recommend making purchases for the rebound only from the minimum of 1.2833. To open short positions on GBPUSD, you need: Sellers are still standing on the sidelines and are counting on a reduction in interest rates by the Bank of England or at least on direct statements on this topic by the current Governor, Mark Carney. His presentation today will take place in the second half of the day. It is best to consider short positions after updating the maximum of 1.2973 or sell the pound on a rebound from the resistance of 1.3006. The formation of a false breakdown and consolidation below the area of 1.2918 will quickly push GBP/USD to the support of 1.2875, and in the case of lower interest rates, the pound may return to the lows of 1.2833 and 1.2799, where I recommend fixing the profits. A larger fall in the pair will not occur, since the scenario with monetary policy easing has already been partially taken into account by the market. Signals of indicators: Moving averages Trading is conducted around the 30 and 50 daily averages, which indicates a possible continuation of the pound's growth. Bollinger Bands If the pair declines in the second half of the day, the lower border of the indicator around 1.2875 will provide support.

Description of indicators

|

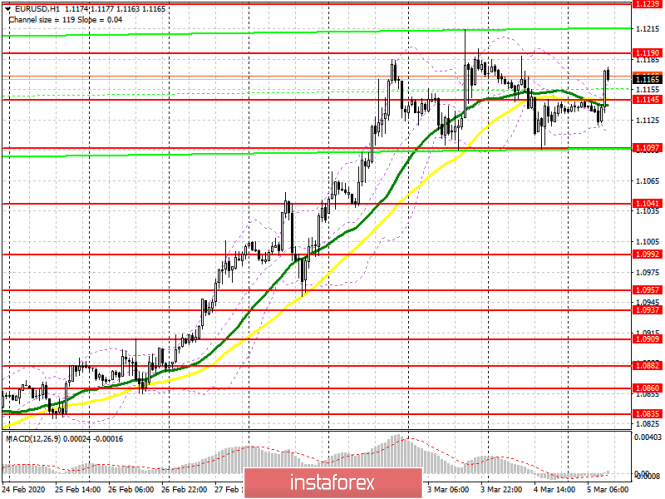

| Posted: 05 Mar 2020 04:02 AM PST To open long positions on EURUSD, you need: In my morning review, I drew attention to the lack of important fundamental statistics, which allowed buyers of the euro to regain the resistance of 1.1145. However, a more important task for the North American session will be to break through and consolidate above the resistance of 1.1190, which will open a direct road to the highs of 1.1239 and 1.1263, where I recommend fixing the profits. This will also indicate in favor of continuing the upward trend. Data on the US labor market may support the dollar, which will again return EUR/USD to the level of 1.1145. In this scenario, it is best to postpone new long positions until a false breakdown of the level of 1.1097 or buy for a rebound immediately from the lows of 1.1041 and 1.0992. To open short positions on EURUSD, you need: Sellers of the euro did not fight for the middle of the channel of 1.1145 and retreated from it at the first attempt to breakthrough. At the moment, the focus has shifted to reports on the number of initial applications for unemployment benefits in the United States and data on the volume of production orders. Good indicators will return EUR/USD to the support of 1.1145, which will increase the pressure on the pair and lead to an update of the lower border of the side channel of 1.1097, where I recommend fixing the profits. An equally important task for sellers will be to hold the resistance at 1.1190 and only the formation of a false breakdown there will be a signal to open short positions. Otherwise, it is best to sell EUR/USD on a rebound from the new highs of 1.1239 and 1.1263, but only with the aim of correcting no more than 20-30 points inside the day, since the breakout of 1.1190 forms a new upward channel. Signals of indicators: Moving averages Trading is just above the 30 and 50 moving averages, which indicates a possible return of the bullish market. Bollinger Bands A break in the upper limit of the indicator at 1.1180 may lead to an increase in the euro.

Description of indicators

|

| Outlook for EUR/USD for March 3rd. Virus still posing real risk to markets Posted: 05 Mar 2020 04:00 AM PST After two days of silence, the issue of the coronavirus is again on the agenda. On Tuesday, the US Fed cut the key interest rate by 0.5% thus encouraging market participants. However, on Thursday, futures on the US indices showed a decline. Besides, the US dollar lost ground against the yen and the franc. A rapid spread of the coronavirus disease is the main threat to the global economy. At the moment, cases of the virus have been confirmed in 66 countries. There are over 12 000 infected people outside China. A number of infected people is increasing by 20% a day. The virus outbreak was mainly registered in South Korea, Italy, and Iran. Moreover, Iran does not have enough resources to combat against the disease. EUR/USD: the pair is likely to resume the upward movement and hit 1.1246. Buy positions can be opened from the 1.1100 level. The material has been provided by InstaForex Company - www.instaforex.com |

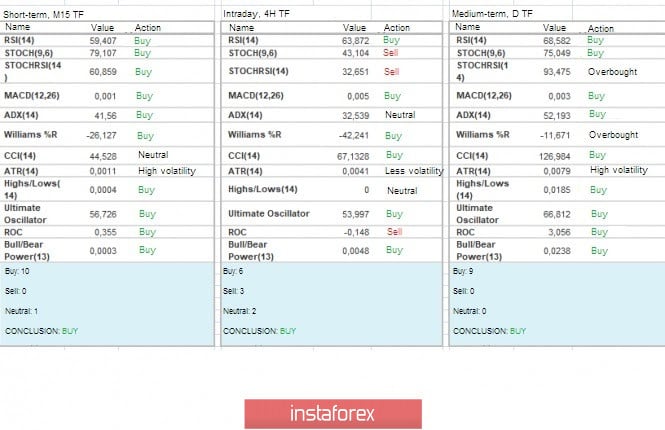

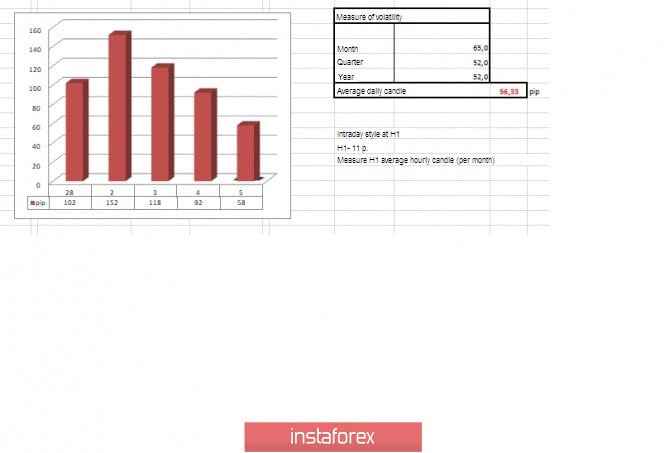

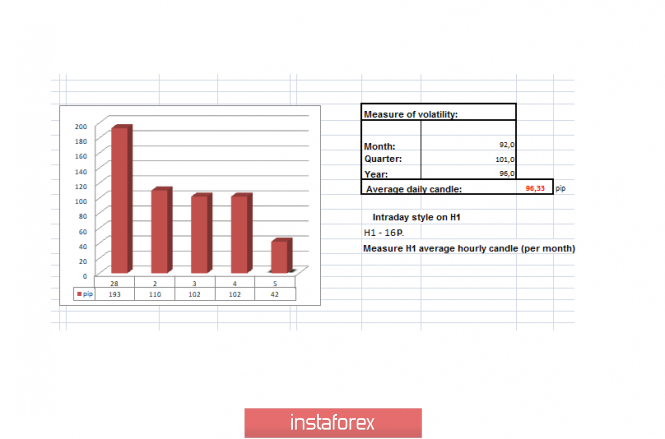

| Trading recommendations for EURUSD pair on March 5 Posted: 05 Mar 2020 03:49 AM PST From a comprehensive analysis, we see a characteristic slowdown relative to the early inertial course. Now about the details. 435 points – this is how much the quote managed to fly to the first impressive stagnation, where the values of 1.1100 and 1.1180 became the time frames. In fact, overbought has not gone away, however, this mess has added a large-scale uncertainty caused by the information background – in particular, the actions of the Federal Reserve System. It turns out that the market fell into a trap of emotions, where the FOMO syndrome was already raging. Altogether, it leads the market to instability, where the existing stagnation is a conditional "bomb" that can lead to local jumps. As mentioned in previous reviews, it is not necessary to focus on the main trends now, since the noise is so great that market fluctuations work exclusively on it and even sometimes across the entire logic. Naturally, this will not last forever, however, it is worth taking measures with the existing circumstances and working together with the accumulated data. In terms of volatility, we see a slight slowdown on the scale of recent days, since even the last daily candle exceeds the daily average by 64%. Volatility details: Thursday-127 points; Friday-102 points; Monday-152 points; Tuesday-118 points; Wednesday-92 points. The average daily indicator, relative to the dynamics of volatility – 55 points (see the volatility table at the end of the article). Analyzing the past day by the minute, we see a full cycle of movement from the level of 1.1180 to the variable value of 1.1100. After that, 1.1100 is worked out, followed by a slowdown. As discussed in the previous review, traders were waiting for more activity and going beyond the established limits. However, the market still could not move further than 1.1100, thus short positions received income in the area of 40 points. Looking at the trading chart in general terms (the daily period), we see that there are no significant changes relative to global trends at this time, and the existing inertial course is an unstable structure. News background of the past day had the ADP report on employment in the United States, where the data was better than expected. However, in comparison with the previous period, we still observe a decrease from 209,000 to 183,000. The market reaction was already in the background, as the foreground noise is the general background. In terms of the general information background, we have a wave of panic caused by the actions of the Fed, where the ECB and the Bank of England can take similar measures. So, according to rumors, the Bank of England is already planning to organize an unscheduled meeting, and the ECB is considering a rate cut of 10 basis points, which will lead to negative values. The fact that such rapid changes in monetary policy in several central banks at once leads to noise, fear and uncertainty among investors and traders. Today, in terms of the economic calendar, we have data on applications for unemployment benefits in the United States, where a slight increase of 5,000 is expected: Primary +1thousand; Repeated +4 thousand. At the same time, the first round of negotiations between Britain and Brussels on post-Brexit trade interactions is coming to an end today, where interesting comments may appear. Further development Analyzing the current trading chart, we see that the quote once again approached the level of 1.1180, where it felt a kind of pressure and, as a fact, slowed down the movement, forming a rebound. In fact, the movement in the conditional range of 1.1100/1.1180 remains on the market for as long as 60 hours, which once again confirms the characteristic uncertainty among market participants, where it is necessary to prepare for new jumps. In terms of emotional mood, we see that the FOMO syndrome has reduced the appetite, but at the same time, the coefficient of speculative operations is breaking new records, and this is confirmed by the existing activity. Detailing the available period every minute, we see that the round of long positions occurred during the period of 10:30-11:45, during which the convergence with the level of 1.1180 occurred. In turn, traders temporarily work within the range of 1.1100/1.1180, but the main tactic is to break it, where they expect the greatest return. It is likely to assume that the movement within 1.1100/1.1180 will still remain in the market, where a return of the quote in the direction of 1.1145–1.1100 is not excluded. If you refer to the noise and the risk of a possible ECB rate cut, paired with a huge overbought, then short positions automatically become a priority. Based on the above information, we will output trading recommendations: - Buy positions are considered if they are fixed higher than 1.1230 and exit above the peak on December 31 (1.1240). The outlook is towards 1.1280-1.1300. - Sell positions are considered towards the lower limit of the range of 1.1100 in case of fixing lower than 1.1145. The main deals will come after breaking the mark of 1.1100 and fixing the price below 1.1080. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are focused on the upward course, where the daily periods make reference to the inertial course, but the minute and hour periods work exclusively on the range of 1.1100/1.1180. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (March 5 was based on the time of publication of the article) The current time volatility is 58 points, which is already 3% higher than the daily average. It is likely to assume that the acceleration will still persist in the market due to the massive noise and fear of investors. Key levels Resistance zones: 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1080**; 1.1000***; 1.0950**; 1.0850**; 1.0775*; 1.0700; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Instaforex Daily Analysis - 5th Mar 2020 Posted: 05 Mar 2020 01:55 AM PST Today we take a look at AUDUSD and how we can use Fibonacci retracements, Fibonacci extensions, market momentum, trend lines and support/resistance to play this move. The material has been provided by InstaForex Company - www.instaforex.com |

| Instaforex Daily Analysis - 5th Mar 2020 Posted: 05 Mar 2020 01:55 AM PST Today we take a look at AUDUSD and how we can use Fibonacci retracements, Fibonacci extensions, market momentum, trend lines and support/resistance to play this move. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for GBP/USD pair on March 5 Posted: 05 Mar 2020 01:55 AM PST From the point of view of complex analysis, we see a local surge in prices beyond the established flat, and now let's talk about the details. So, a three-day flat with variable boundaries of 1.2740 / 1.2850 was still broken through towards the upper frame. The level of 1.2770, with which it all began, has survived, but this step, as a rebound from the key coordinate, may well play into the hands of further downward development. In this judgment, I am referring to a kind of regrouping of trading forces, where there will no longer be so much pressure with subsequent rapprochement with the area of 1.2770 and the price will still be able to pass it. A similar development was already with an average level of the range 1.2770 // 1.2885 // 1.3000, where we had a systematic interaction at first, but with a sequential puncture, the pressure came to naught and the price calmly passes the coordinates. Regarding the theory of downward development, the tactics of conducting medium-term transactions remain unchanged, where the external background plays into the benefit of the theory, and we can only wait for further development. Let me remind you that we are now considering a possible course recovery relative to the medium-term upward trend, and for this, we need to go through more than half of this trend, where just the conditional middle is located in the region of the level of 1.2770. In terms of volatility, we continue to record acceleration, where the dynamics of Tuesday coincided with the dynamics of the environment, having an increase relative to the average daily indicator of 6%. Details of volatility: Tuesday - 103 points; Wednesday - 115 points; Thursday - 86 points; Friday - 193 points; Monday - 110 points; Tuesday - 102 points; Wednesday - 102 points. The average daily indicator, relative to the dynamics of volatility, is 96 points [see the table of volatility at the end of the article]. Detailing the minute by minute, we see that the round of growth that led to the breakdown of the conditional flat occurred at the moment of the next touch of the level of 1.2770, where the quote consistently reached the height of 1.2871 [10:00-18:15 UTC+00 time on the trading terminal] . The successive fluctuation was in the form of consolidation. As discussed in the previous review, intraday traders were waiting, and they were waiting for the breakdown of the February 28 low [1.2725] as a starting point in descending positions, which did not happen. At the same time, local buy positions were considered in case of breakdown of the upper border of the 1.2850 flat, where a small profit was received. Considering the trading chart in general terms [the daily period], we see the first significant correction since touching the level of 1.2770 relative to the period earlier. In fact, this step can lead to the subsequent acceleration of short positions and the breakdown of the control level. The news background of the past day contained data on the index of business activity in the UK services sector, where they recorded a decrease from 53.9 to 53.2. In the afternoon, they published an ADP report on the level of employment in the United States, where the data came out better than forecast, but in comparison with the previous period, we still record a decrease from 209 thousand to 183 thousand. The reaction of the market is more like technical fluctuations than the reflection of statistical data on the quote. In terms of the general information background, we have the pressure that occurred after the actions of the Federal Reserve System. A round of ambiguity and possible actions by other central banks swept the market, and thus, there were rumors that the Bank of England could soon hold an unscheduled meeting, during which the interest rate would be reduced by 0.25%. Naturally, there is no confirmation of this, but the background speaks for itself. In a previous review, we looked at the comments of outgoing Mark Carney, who spoke about the interaction of central banks. Now, we have a statement from his successor, Andrew Bailey, who intends to support British companies amid a raging coronavirus, but at the same time, has managed to interest investors with plans for monetary policy. Andrew Bailey said that he is in no way to reduce the importance of monetary policy, but all attention is focused on it. I think it is reasonable to expect that we are going to provide some form of supply chain financing in the near future to ensure that the effects of this shock from the virus will not harm many forms of activity. The new head of the Bank of England added that the interest rate will be reduced, but not lower than 0.1%, which eliminated a lot of doubts and fear among investors. In fact, such openness of the regulator in some sense locally supported the British currency, but this is all temporary. Today, in terms of the economic calendar, we have data on applications for unemployment benefits in the United States, where a slight increase of 5 thousand is expected: Primary +1 thousand; Repeated +4 thousand At the same time, today ends the first round of negotiations between England and Brussels regarding trade interactions after Brexit, where interesting comments may appear. Further development Analyzing the current trading chart, we see that the corrective move is still preserved in the market, where the quote has reached an average level of 1.2885 and has gone slightly above it. In fact, we have fluctuations in the stagnations of the past week, where there is a slight pressure. Regarding the theory of development, top-down tactics are a priority position, but their full implementation requires time. From the point of view of the emotional mood, we see that the information background, paired with a high speculative mood, gives the market an acceleration, which was written about at the beginning of the article. By detailing the time segment that we have every minute, we see that night stagnation has been replaced by local leaps, just as Europeans entered the market. In turn, intraday traders continue to work in local long positions that were open at the time of the breakdown of the 1.2740 / 1.2850 flat. In fact, there is already the most optimal point for profit taking. Having a general picture of actions, we see that the current move is not constant, and the levels are 1.2910; 1.2945 can play the role of resistance. Based on the above information, we derive trading recommendations: - Local buy positions are already from the value of 1.2850, the point of possible fixation is 1.2910; 1.2945. - Sales positions are considered lower than 1.2850, towards 1.2770. The main positions will come after fixing the price lower than 1.2725. Indicator analysis Analyzing a different sector of timeframes (TF), we see that the indicators of technical instruments have changed to the upside relative to minute and hour periods due to the development of correction. At the same time, daily periods remain downward interest. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for Month / Quarter / Year. (March 5 was built taking into account the time of publication of the article) The current time volatility is 42 points, which is still a low value. It is likely to assume that there is still room for further acceleration, and an urgent information background will help us in this. Key levels Resistance Zones: 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **. * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: The ECB is at a crossroads Posted: 05 Mar 2020 01:39 AM PST

The ECB was caught in the middle, after the Fed, the Reserve Bank of Australia and the Bank of Canada lowered their interest rates. On the one hand, easing the monetary policy will have no impact on the Eurozone economy, and may even be counterproductive to some extent. However, on the other hand, investors expect this monetary expansion from the European Central Bank, so the probability of reducing the deposit rate at the meeting of the ECB's Governing Council in March has increased from 80% to 100%. Money markets expect to see another rate cut before the end of 2020. Meanwhile, strong data on the business activity in the non-manufacturing sector of the United States from ISM, as well as the report on employment in the private sector of the country from ADP allowed EUR/USD's bulls to take a breath. Due to the faster reduction of rates in the US government bonds, the main currency pair registered a 3.5% increase, as compared to their German counterparts. Eurozone's slowing inflation to a three-month low, as well as the risks of recession in Italy and France, are forcing the ECB to act aggressively. Although the regulator's deposit rate is already too low, it is still possible to lower the refinancing rate into the red zone, expand the scope of quantitative easing (QE), or launch a new round of long-term bank refinancing (LTRO) to ease the situation. Anyhow, EU's social protection system, which provides support for the sick and unemployed in the region, as well as allows subsidies for companies whose employees work part-time, makes the Eurozone more resistant to the effects of the coronavirus than the United States.

Although the head of the Federal Reserve Bank of St. Louis, James Bullard, argues that the market should not rely heavily on the reduction of Federal funds rate at the upcoming FOMC meeting on March 17-18, history suggests otherwise. Since 1998, the US central bank has eased its monetary policy at unscheduled meetings six times. Now, rumors about the Fed rate cut from its current 1.25% to 0% are circulating on the market. Experts at JP Morgan see a 50% probability of such an outcome happening in 2020, while analysts at Rabobank believe that it could happen as early as June. "Euro's prospects have improved significantly, after the Federal Reserve lowered its interest rate by 50 basis points on Tuesday and left the door open for further rate cuts. Although the ECB said that it is ready to take measures to neutralize the economic impact of the coronavirus, it has less room to cut rates than the Fed. Reducing the ECB's deposit rate by 10 basis points is possible, but it looks irrelevant in economic terms," analysts at Commerzbank believe. The prospect of easing the ECB's monetary policy is putting pressure on the euro. However, if the European regulator insists on a fiscal response to the coronavirus challenge, rather than a monetary one, while its American counterpart continues to weaken its monetary policy, the spread of the US and German government bond yields will narrow, and the European currency will grow. As a result, if the Fed's aggressive move on rates is not repeated and surpassed by the ECB in the near future, the US currency may come under pressure. The first signal on this path is the consolidation of EUR/USD above 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and forecast for EUR/USD on March 5, 2020 Posted: 05 Mar 2020 01:34 AM PST Hello, colleagues! At yesterday's trading, the main currency pair of the Forex market showed a moderate decline and performed a pullback to the previously indicated price zone near the important level of 1.1100. We will turn to the technical picture for EUR/USD a little later, but for now, we will talk about yesterday's macroeconomic data and what is expected today. Yesterday, the eurozone presented reports on retail sales, which were generally quite good. In annual terms, retail sales in the euro area increased by 1.7%, although an increase of only 1.1% was expected. On a monthly basis, the indicator coincided with expectations and amounted to 0.6%. Now about the American statistics, where first of all you need to pay attention to the change in the number of employees from ADP. Employment in the private sector of the American economy (with the exception of the agricultural sector) grew stronger than expectations, which were reduced to 170,000 and in fact, the figure was at the level of 183,000. This is a good signal before Friday's official data on the US labor market, as the change in the number of employees from ADP is often a leading indicator of Nonfarm Payrolls. Well, let's see. We don't have to wait long. Let me remind you that tomorrow at 14:30 (London time), the data on the US labor market will be released, which will affect the closing of weekly trading. If we talk about the publication of the Fed's Beige Book, the main message in it is the thesis about moderate economic growth in the United States of America. That is, the stability of the American economy was confirmed, and moderation is explained by the spread of the coronavirus and the upcoming US presidential election. These factors were identified as risks that will constrain the economic activity of corporations and companies. No statistics are expected from Europe today. Several reports will be received from the United States, which should pay attention to initial applications for unemployment benefits and production orders. I do not think that these data will have a strong impact on the price dynamics of the euro/dollar and radically change the technical picture. After all, the main events will be published tomorrow. Daily

As expected, the pair retreated to the price zone, where the following are located: 200 exponential moving average, the upper limit of the Ichimoku indicator cloud, and the support level of 1.1095. By the way, this level turned out to be quite strong, since it held back the further decline of the quote for two days in a row. Thus, for those who wanted to buy euro/dollar, this opportunity was provided yesterday. Yesterday's trading closed at 1.1334. This is above 200 EMA, which is extremely important. Since yesterday's daily candle was the third in a row to close above the 200 exponential, we can assume that the pair has fixed above this moving average. At the time of writing the review, the euro/dollar is moderately strengthening. If the rise continues, you should wait for the pair in the area of 1.1187-1.1210, where the maximum values of yesterday's trading are shown, as well as the blue resistance line drawn at 1.1411-1.1212 points. The breakdown of this resistance line and the mark of 1.1212 will signal further growth of the pair and testing for the breakdown of the key resistance level of 1.1238 at the moment. If the euro bulls manage to complete this task, the road will open to higher targets, which will be indicated later, after the true breakdown of 1.1238. Do not forget that Nonfarm Payrolls can significantly affect the technical picture of the main currency pair and the results of the closing of trading on March 2-6. If we consider an alternative downward scenario, it will begin to be implemented after the breakdown of the support level of 1.1095. In the event of such a development, we should expect a deeper corrective pullback towards the level of 1.1050. Taking into account yesterday's correction candle with a long lower shadow, as well as the closing of trading on March 4 above 200 EMA, today's strengthening of the pair looks reasonable from the point of view of technical analysis. However, it is not necessary to forget about the factor of coronavirus, which had previously supported the US currency. Nevertheless, I consider the main trading idea today is purchases that are better planned after a short-term decline in the price zone of 1.1110-1.1055. The confirmation signal for opening long positions on EUR/USD will be the appearance of candlestick patterns that are typical for the resumption of growth on the 4-hour and (or) hourly charts. Successful and profitable trades! The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD approaching key resistance, potential drop! Posted: 05 Mar 2020 01:30 AM PST

Trading Recommendation Entry: 0.66623 Reason for Entry: 61.8% Fibonacci retracement, 100% Fibonacci extension Take Profit: 0.65653 Reason for Take Profit: 38.2% Fibo retracement Stop Loss: 0.7443 Reason for Stop loss: Horizontal swing high The material has been provided by InstaForex Company - www.instaforex.com |

| NZD/CAD approaching resistance, potential drop! Posted: 05 Mar 2020 01:28 AM PST

Trading Recommendation Entry: 0.84892 Reason for Entry: Horizontal swing high,38.2% Fibonacci retracement Take Profit: 0.83759 Reason for Take Profit: Horizontal pullback support Stop Loss: 0.85495 Reason for Stop loss: Horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD approaching support, potential bounce! Posted: 05 Mar 2020 01:26 AM PST

Trading Recommendation Entry: 1.2553 Reason for Entry: 61.8% fibonacci retracement, 61.8% fibonacci extension, horizontal pullback support Take Profit : 1.3282 Reason for Take Profit: Horizontal swing high resistance, 76.4% fibonacci retracement Stop Loss: 1.2232 Reason for Stop loss: Horizontal swing low support The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD Bullish Momentum Expected Soon! Posted: 05 Mar 2020 01:07 AM PST EUR/USD is consolidating right above the broken 1.1111 static resistance. The pair should climb higher if the price stabilizes above this obstacle. The price has decreased a little after the rejection from the 1.1215 -1.1200 resistance area and after the USDX's minor rebound. It remains to see what will happen on the USDX which is trading at 97.36. A further drop will force EUR/USD to jump above the 1.1200 - 1.1215 area and to reach fresh new highs. The dollar could depreciate if the US data could disappoint tomorrow. The pair could change little ahead of the NFP release as employment growth is expected around 175K. Today, you should focus on the Factory Orders and on the Unemployment Claims release.

Technically, EUR/USD maintains a bullish outlook as long as it is traded above the 1.1111 level. The price tries to recapture the bullish energy ahead of another upside momentum, we may have a sideways movement on the short term. EUR/USD has registered only a false breakout above the 1.1200 level and above the second warning line (wl2), it has come back down to retest the first warning line (wl1) and now is fighting hard to advance. The pair could develop a triangle on the short term. That's why it would be better to wait for a confirmation that the price will resume the upside movement because we cannot exclude a potential correction on the short term.

A valid breakout above the 1.1200 - 1.1215 will confirm a larger increase on the medium to the long term, this will represent a reversal on the EUR/USD. Personally, I believe that the price will take out the static resistance area if it makes a valid breakout above the second warning line (wl2). I would like to see a consolidation before the price tries to resume the upside movement, a potential range could attract more buyers. You should be aware that another false breakout above the warning line (wl2) could announce a corrective phase. A deeper correction will be confirmed if the price closes below the 1.1094 level. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment