Forex analysis review |

- Evening review of EUR/USD on April 10, 2020. EUR gains ground ahead of weekend

- April 10, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- April 10, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- The dollar is losing its gloss

- Weekly Ichimoku cloud analysis of Gold

- EUR/USD analysis for 04.10.2020 - EUR/USD found resistance at the price of 1.0950, potential forr downside rotation towards

- Weekly analysis on EURUSD

- Analysis for Gold 04.10.2020 - Major resistance zone ($1690-$1.700) is on the test, watch carefully for the price action

- BTC analysis for 04.10.2020 - The drop started (broken support trendline), watch for downside movements towards the level

- Trading recommendations for EURUSD pair on April 10

- Technical analysis of EUR/USD for April 10, 2020

- EUR / USD: finest hour of euro or temporary weakness of dollar?

- Analysis and trading recommendations for EUR/GBP on April 10, 2020

- Technical analysis recommendations for EUR/USD and GBP/USD on April 10

- Analysis of EUR/USD and GBP/USD for April 10. US unemployment rate is massively increasing, next up is the inflation report

- Overview of the EUR/USD pair for April 10, 2020

- Bitcoin Halving: will it increase the price of the cryptocurrency?

- Let's work out trading idea on GBP/USD: how to lock in profits of +1,700 pips

- Trading recommendations for GBP/USD pair on April 10

- USD/CAD unaffected by oil drop

- Simplified wave analysis of GBP/USD and USD/JPY for April 10

- Passionate projection (review of EUR/USD and GBP/USD on 04/10/2020)

- EUR/USD. April 10. The bulls developed their success. Now they need to capture the level of 1.0964, otherwise, the bears

- GBP/USD. April 10. Bulls are losing strength around the level of 1.2486. To continue growth, a close above 1.2516 is required.

- Instaforex Daily Analysis - 10th April 2020

| Evening review of EUR/USD on April 10, 2020. EUR gains ground ahead of weekend Posted: 10 Apr 2020 07:56 AM PDT

The euro has been growing slightly for the second day in a row after on Thursday the Fed announced a new record $ 2.3 trillion round of loans to support the labour market, as well as after dismal data on unemployment in the United States where the number of new weekly jobless claims jumped by 6.6 million. Today, the market has closed earlier due to Easter. Investors are awaiting some new data on the coronavirus epidemic after the weekend in order to adjust their outlook. For now, it can be seen that in Italy and Spain, the epidemic has passed its peak. There is a slower pace of new cases - about 3-4 per cent per day, while an increase below 7 per cent per day reflects a decline in the epidemic spread. The number of deaths in Italy and Spain fell to the level of 500-600 per day. Nevertheless, France, Britain, and Belgium reported surges in coronavirus death tolls per day. In the United States, there are also signs of stabilization. The growth of new cases has slowed to 7 per cent per day; while the daily death toll is still high - about 2,000. New data on the epidemic for April 10 has not been released yet, perhaps again due to Easter. EUR/USD: Open buy deals from 1.0930 with a stop loss order at 1.0840. Take care and stay healthy. The material has been provided by InstaForex Company - www.instaforex.com |

| April 10, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 10 Apr 2020 07:42 AM PDT

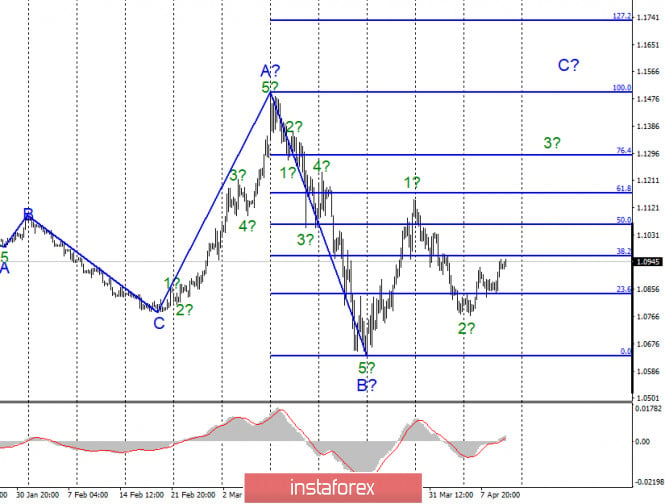

Since December 30, the EURUSD pair has trended-down within the depicted bearish channel until the depicted two successive Bottoms were established around 1.0790 then 1.0650 where the EUR/USD pair looked OVERSOLD after such extensive bearish decline. Few weeks ago, the pair has expressed significant bullish recovery around the newly-established bottom around 1.0650. The following bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibonacci Level 50%). Key Supply-Levels in confluence with significant Fibonacci levels are located around 1.1075 (50% Fibonacci) and 1.1175 (61.8% Fibonacci) where bearish rejection was highly-expected. Moreover, a Head & Shoulders continuation pattern was demonstrated around the price levels of (1.1000 - 1.1075). Shortly after, further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Early signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the current bullish spike up to 1.0950. The short-term technical outlook remains valid as long as bullish persistence is maintained above the recently-established ascending Bottom around 1.0830. Further bullish advancement is expected to pursue towards 1.1000, 1.1075 then 1.1175 where 61.8% Fibonacci Level is located. On the other hand, any bearish breakout below 1.0830 or 1.0770 (the recently established bottoms) invalidates the previously-mentioned bullish outlook. Trade recommendations : For those who caught the initial bullish trade just above 1.0800, Stop Loss should be elevated to 1.0800 to offset the associated risk of the trade. Intraday traders can wait for bullish breakout above 1.1000 for another short-term BUY signal. S/L to be placed below 1.0870 while Initial T/P levels to be located around 1.1075 and 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

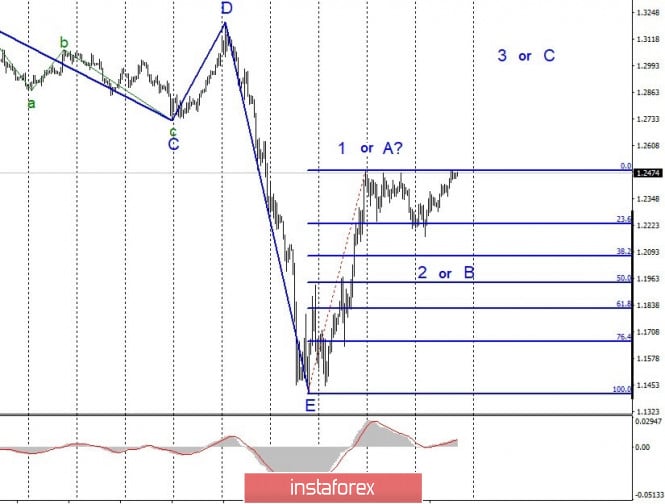

| April 10, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 10 Apr 2020 07:17 AM PDT

Recently, the GBPUSD has reached new LOW price levels around 1.1450, slightly below the historical low (1.1650) achieved in September 2016. That's when the pair looked very OVERSOLD around the price levels of 1.1450 where a double-bottom reversal pattern was recently demonstrated as depicted on the chart. Technical outlook will probably remain bullish if bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts. Bullish breakout above 1.1900 (Latest Descending High) invalidated the bearish scenario temporarily & enabled a quick bullish movement to occur towards 1.2260. Next bullish targets around 1.2520 and 1.2680 were expected to be addressed if sufficient bullish momentum was maintained. However, early bearish pressure signs have originated around 1.2470 leading to the previous bearish decline towards 1.2265. That's why, H4 Candlestick re-closure below 1.2265 was needed to hinder further bullish advancement and enhance the bearish momentum on the short term. If so, Initial Bearish target would be located around 1.1900 provided that quick H4 bearish closure below 1.2265 is achieved. On the other hand, the current bullish persistence above 1.2265 is enhancing another bullish pullback movement up to the price levels of 1.2500-1.2550 where bearish rejection should be expected. Trade recommendations : Conservative traders should be waiting for the current bullish pullback towards 1.2500 as a valid SELL signal. T/P level to be located around 1.2100 and 1.2000 while S/L should remain above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is losing its gloss Posted: 10 Apr 2020 06:19 AM PDT The financial markets are again obeyed by the Fed, and any good news is overshadowed by a huge negative. Against this backdrop, the best weekly S&P 500 rally since 1974 should not surprise anyone. The stock index is rapidly reducing losses, ignoring the growth in the number of infected and died from coronavirus in the United States and in the world, the increase in the number of applications for unemployment benefits by 17 million in three weeks, the pessimistic forecasts of Wall Street Journal experts, who expect to see a 25% decline in US GDP in the second quarter, a rise in unemployment to 13% and a reduction in corporate profits by 36%. American stocks do not care, because if you do not have time to buy them now, you can be late. History shows that stock indices usually recover faster than national economies, which is not surprising: GDP is a lagging indicator, and the S&P 500 is growing on expectations of a positive. According to the chief economic adviser to the US President Larry Kudlow, the US economy will need 4-8 weeks to return to normal operation at full capacity. Donald Trump would like to see its explosive growth. Together with moderate optimism from the New York city administration about the gradual release of coronavirus to the plateau, this creates a stir among buyers of equity securities. The growth of global risk appetite puts pressure on safe-haven assets, so we should not be surprised by the strengthening of EUR/USD. Dynamics of the S&P 500 and EUR/USD

The euro was supported by the decision of Eurozone Finance Ministers to collectively help the countries of the currency bloc affected by the epidemic in the amount of €500 billion, as well as a split in the ranks of the ECB. According to the minutes of the March meetings of the Governing Council, a number of officials opposed the lifting of restrictions on bond purchases under QE. They suggest launching a new direct funding program for OMT for individual states. The idea of selling the US dollar in the long run looks interesting. The growth of the Fed's balance sheet to $9-12 trillion by the end of 2020 and the expansion of the US budget deficit to $3.6 trillion in the current fiscal year, which will end on September 30, are "bearish" factors for the USD index. On the short-term time horizon, against the background of good news from the Old World and the rally of US stock indices, the overall picture for the main currency pair is moderately optimistic. However, at any moment, the scales can swing in the direction of the "bears". It is enough to know that the G7 countries did not support the efforts of OPEC+ to reduce oil production. The growth of Brent and WTI on expectations of a 15 million b/d decline supported the shares of US oil companies and the S&P 500. If it stops, the stock index will go down and pull EUR/USD. Technically, the pair plays a combination of "Expanding Wedge" and "Rhombus" patterns. A break in the diagonal resistance near 1.0965 will be a signal to open long positions in the target by 127.2% using the AB=CD pattern. It is located in close proximity to the mark of 1.121. On the contrary, a successful storm of support at 1.0765 will cause the euro to sell against the US dollar in the direction of 1.05. EUR/USD, the daily chart

|

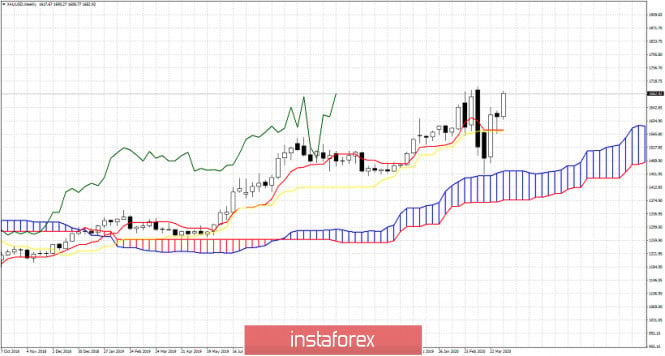

| Weekly Ichimoku cloud analysis of Gold Posted: 10 Apr 2020 05:19 AM PDT Gold price remains in a weekly bullish trend according to the Ichimoku cloud. Gold price tested the weekly Kumo (cloud) and bounced strongly off of it providing us with a move that has reached 2020 highs. There are a lot of chances of breaking to new highs but bulls need to be cautious.

|

| Posted: 10 Apr 2020 05:11 AM PDT Corona virus news:

A messy compromise to unlock €500bn (£438bn) of EU support for countries hit hardest by the coronavirus pandemic has been struck after Italy's prime minister, Giuseppe Conte, warned that the existence of the bloc was at stake. EU finance ministers on a video conference call struck a deal late on Thursday after the Netherlands shifted on a demand for "economic surveillance" of countries benefiting from €240bn of credit lines via the European stability mechanism, a bailout fund for struggling member states. Technical analysis: EUR/USD has been trading upwards. The EUR/USD found resistance at the price of 1.0950. I see chance for the downside rotation towards the levels at 1.0920 and 1.0890. Trading recommendation: Watch for selling opportunities on the EUR/USD with the stop above 1.0950 and potential downside targets at 1.0920 and 1.0890. MACD oscillator is showing still rising curve and rising slow line. Major resistance zone is set at $1.690-$1.700. Support levels and downward targets are set at the price of 1.0890. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Apr 2020 05:09 AM PDT EURUSD remains in a bearish weekly trend. Despite the try to break above 1.1150-1.12, bulls failed to maintain control of the break out and price got rejected. This failed break out continues to point to us the major resistance ahead.

EURUSD 5 weeks ago tried to break out of the weekly trend and above the resistance trend line. This failed attempt was another bearish sign. Price not only pulled back below the resistance trend line again, but at the attempt to back test it at 1.1150 two weeks ago, it got rejected. This week price bounced off last weeks low but still there is no important bullish or reversal sign in the chart. Key support is 1.1075. Breaking below this low we expect price to move towards 1.07 again. Resistance is at 1.1130. So far any bounce is considered a selling opportunity as long as price is below 1.1130-1.1150. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Apr 2020 04:59 AM PDT Corona virus news:

Confirmed coronavirus deaths around the world have exceeded 95,000 and there are at least 1.6m cases. Countries including Spain and Italy report their rates of infection are beginning to plateau while others, such as Russia, announce record 24-hour rises. Many countries now enter the Easter and Passover holidays, or look towards the Ramadan month of fasting, as citizens are told to continue to abide by physical distancing measures. Warnings. Despite Trump's claims, the World Health Organization warned of the human-to-human transmission risk as early as 10 January and urged precautions, though it did tweet days later appearing to contradict itself. Technical analysis: Gold has been trading upwards. The gold has reached the main resistance zone at the price of $1.690. The zone from $1.690-$1.700 is very important pivot zone for the further development on the Gold. Trading recommendation: The eventual rejection of the resistance zone would lead for potential downside rotation towards the level at $1.641 The eventual breakout with the high volume will lead the Gold towards the level at $1.750 (Weekly chart swing high. Stochastic oscillator is showing potential overbought condition bust still with no new fresh bear cross. Major resistance zone is set at $1.690-$1.700. Support levels are set at the price of $1.6372 and $1.641/ The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Apr 2020 04:44 AM PDT Corona virus news:

The World Trade Organisation, in its latest report, revealed that global trade is expected to fall between 13% to 32% for the year 2020 because of the ongoing global pandemic. The World Trade Organisation reported that global trade is expected to fall by between 13% and 32% in 2020 as the COVID 19 pandemic disrupted normal economic activity and life all around the world. The report emphasizes that the immediate goal is to bring the pandemic under control. WTO also mentioned that forecasting how the world economy will look like in 2021 or 2022 remains difficult.Technical analysis: BTC has been trading downwards as I expected. The price started the drop as I forecasted yesterday and now is heading for the test of our downside targets You can still watch for selling opportunities on the rallies using the intraday time-frames. The downward targets are set at the price of $6.595, $5.813, $4.410 and $3.810. MACD oscillator is showing that the slow line is in decline, which is good indication for further downside. Major resistance level is set at the price of $7.500. Support levels and downward targets are set at the price of 6.59 5, $5.813, $4.410 and $3.810. The material has been provided by InstaForex Company - www.instaforex.com |

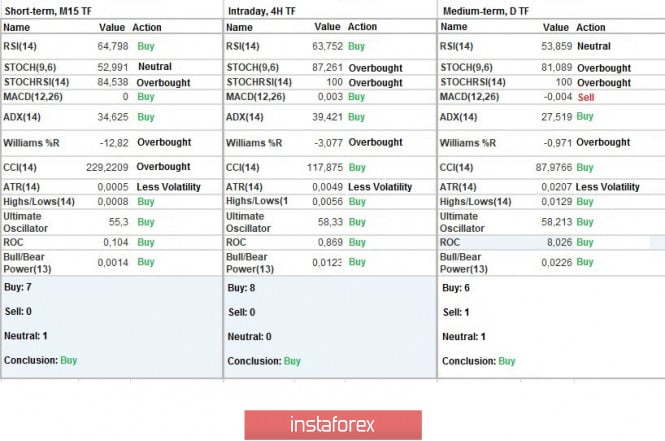

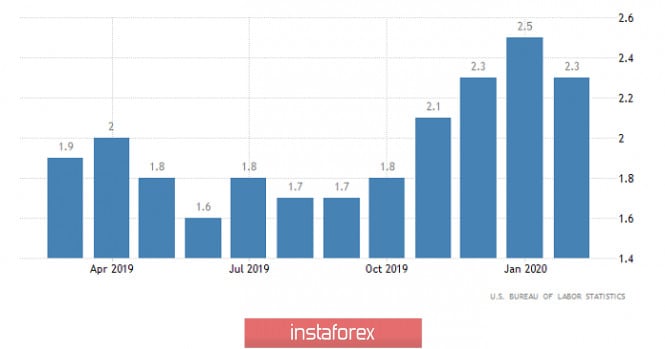

| Trading recommendations for EURUSD pair on April 10 Posted: 10 Apr 2020 03:23 AM PDT From a comprehensive analysis, we see something more than just a correction. And now about the details. The current week's correction had an upward mood, which arose after the quote approached the support area of 1.0775 during inertia. After that, the first upward turn appeared, which led the quote to the variable level of 1.0920 and everyone was already inspired by the possible recovery and return of the price back to the support point of 1.0775. However, the movement slowed down, during which a variable range of 1.0850/1.0885 was formed. The wobbly design from the range focused a considerable number of speculators, where there was just enough noise for market interest to form a local jump, overcoming the limits of the variable range. The noise was like the flow of the external background, during which speculators literally got what they were waiting for in half an hour, that is, a local surge in the activity. I don't think that the downward mood has fallen into being and everyone is already working on a purchase, since analyzing the fluctuations from the beginning of March, it is clearly visible in which direction the main positions are focused. The only thing that can be considered for sure is the slowdown, I do not mean variable ranges during a particular stroke, but in general in the market. Successive intentions have already signaled that activity decreases with each successive turn, and now a distinct zigzag-shaped model is visible. That is, theoretically, in the case of a decline in the downward mood, a wide flat may occur, approximately in the range of 1.0775/1.1000 (+/-50 p), but this conversation will come a little later in the case of the first signals of confirmation of the theory. Analyzing the last trading day, we see that the main round of long positions appeared at the start of the American session, but it lasted a modest 1.5 hours, where the quote eventually moved to a new variable range of 1.0920/1.0950. In terms of volatility, we see a characteristic acceleration relative to April 8, but on the general scale of the last two months, activity is within the norm. Details of volatility: Monday-155 points; Tuesday-183 points; Wednesday-115 points; Thursday-278 points; Friday-166 points; Monday-151 points; Tuesday-234 points; Wednesday-243 points; Thursday-326 points; Friday-194 points; Monday-191 points; Tuesday-160 points; Wednesday-133 points; Thursday-188 points; Friday-194 points; Monday-134 points; Tuesday-127 points; Wednesday-136 points; Thursday-147 points; Friday-91 points; Monday-67 points; Tuesday-142 points; Wednesday-72 points; Thursday-110 points. The average daily indicator, relative to the dynamics of volatility is 107 points (see the table of volatility at the end of the article). As discussed in the previous review, traders worked on the breakdown of one or another boundary of the variable range of 1.0850/1.0885, which resulted in a profit to the trading deposit. Looking at the trading chart in general terms (the daily period), we see just the same sequential inertial fluctuations that are in the structure of the zigzag-shaped model, as we wrote at the beginning of the article. The news background of the last day did not include data on the labor market in the United States, where once again everyone saw the real picture of the consequences of the COVID-19 virus. So, every week we record huge figures for the number of applications for unemployment benefits in the United States that have already recalled the crisis of 2008-2009, and the great depression. This time, repeated applications for benefits set an absolute record in the history of 7,455,000, but the primary surprisingly fell by 261,000, but in the past week their figure was 6,606,000. The market reaction to the statistics this time was positive in terms of logic, the dollar locally began to lose its positions, forming impulses and breaking through just the same variable range. At this point, the noise and pressure on the dollar did not stop, as the news that the Federal Reserve (FRS) announced $ 2.3 trillion in measures to support the economy in the midst of a raging coronavirus. "The role of the Fed is to provide as much assistance and stability as possible during a period of limited economic activity. Our actions today will help ensure that the recovery that will ultimately happen is as energetic as possible," Fed Chairman Jerome Powell said in a release. In turn, the head of the European Central Bank, Christine Lagarde, calls on EU countries to support each other during this difficult period of time in order to develop the best policy to counter the shock of the coronavirus emergency. Lagarde also reminded that there is no discussion of the widespread cancellation of debts incurred in connection with the coronavirus crisis. Now is not the time to ask about the cancellation, now we are focused on maintaining the economy, later we will consider how to pay off debts and how to manage public finances most effectively, the head of the ECB said. Today, in terms of the economic calendar, we have data on inflation in the United States, where they record a slowdown from 2.3% to 1.5%, which may directly affect the Fed's future decisions on actions on the refinancing rate, and more specifically, on its further reduction. At the same time, do not forget that today is a day off in many countries, including in Europe, the United States, and Britain, where good Friday is celebrated. Thus, trading volumes may be reduced. The upcoming trading week in terms of the economic calendar begins with a weekend in Europe, where trading volumes may be reduced. The main data stream starts on Wednesday, and the most relevant indicator will be released only on Friday – EU inflation. The most interesting events are displayed below: On Monday, April 13 Great Britain/EU - Bright Monday On Wednesday, April 15 US 13:30 London time - retail sales volume US 14:15 London time - industrial production On Thursday, April 16 EU 10:00 London time - industrial production US 13:30 London time - applications for unemployment benefits US 13:30 London time - number of construction permits issued US 13:30 London time - volume of construction of new homes On Friday, April 17 EU 10:00 London time - Inflation Further development Analyzing the current trading chart, we see that the variable range (1.0920/1.0950) has been held on the market for more than 15 hours, which means that it was again noticed by speculators, during which a new local surge may occur. In fact, this is another position with a limited life span, but under the current circumstances, a small profit is also a profit. It is too early to talk about the main directions now since there is no complete picture, but I think that next week we will get enough data to set the direction. In terms of emotional mood, a high coefficient of speculative positions is recorded, which can play into the hands of volatility. In turn, traders closely monitor the variable range, in particular, its borders. We can assume that the fluctuation within the values of 1.0920/1.0950 will not last very long, and our main task is to make money on the local surge, and here the direction does not matter. The trading strategy is selected using the method of breaking through a certain accumulation limit. Based on the above information, we will output trading recommendations: - Buy positions are considered higher than 1.0960, with the prospect of a move to 1.0980-1.1000 - Positions for sale are considered lower than 1.0910, with the prospect of a move to 1.0890-1.0850. Indicator analysis Analyzing different sectors of timeframes (TF), we see that by maintaining the upward movement and updating the maximum correction, the indicators of technical instruments relative to all periods signal a purchase. It is worth noting that the minute and hour periods are affected by deceleration, and the signal may be variable. Weekly volatility / Measurement of volatility: Month; Quarter; Year. Volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (April 10 was based on the time of publication of the article) The current time volatility is 32 points, which is 70% lower than the daily average. We can assume that as soon as the variable range closes, the activity will grow 2-2.5 times. Key levels Resistance zones: 1.1000***; 1.1080**; 1.1180; 1.1300; 1.1440; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.0850**; 1.0775*; 1.0650 (1.0636); 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for April 10, 2020 Posted: 10 Apr 2020 03:05 AM PDT The EUR/USD pair continues to move downwards from the level of 1.1035. Yesterday, the pair dropped from the level of 1.0900 to the bottom around 1.0833. But the pair has rebounded from the bottom of 1.0833 to close at 1.0945. Today, the first support level is seen at 1.0900, the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.1035, which coincides with the 100% Fibonacci retracement level. This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.0900, the market will decline further to 1.0769 in order to test the weekly support 2. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.1035 with the first target at 1.0900 and further to 1.0769. However, stop loss is to be placed above the level of 1.1143. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: finest hour of euro or temporary weakness of dollar? Posted: 10 Apr 2020 02:58 AM PDT

The EUR / USD pair rose to 1.0950 due to the fact that EU finance ministers have finally agreed on a new package of financial assistance to the economy. They approved a package of anti-crisis measures worth € 540 billion to help the EU economy recover from the coronavirus pandemic. According to Mario Centeno, chairman of the Eurogroup, € 100 billion will be allocated to the SURE program approved last week (which aims to support employment in EU), € 200 billion for the European Investment Bank (EIB) business lending program, and the remaining € 240 billion for the back up funds of the Eurozone. Meanwhile, the minutes of the ECB's meeting last March showed that some of its members expressed doubts about the launch of new bond purchases. Instead of expanding QE, they proposed launching OMT, a program developed in 2012 for direct financing of stressed eurozone countries with a credit line with ESM. This split decision of the ECB members helped in pushing the euro upwards. However, the main reason why EUR / USD rose was the statement of Fed Chairman Jerome Powell. According to him, the regulator decided to allocate $ 2.3 trillion to support local governments and small and medium-sized businesses.

"The Fed will continue to use all the tools at its disposal until the US economy begins to fully recover from the damage caused by the coronavirus outbreak," said J. Powell. Against this background, the USD index, which measures the strength of the US dollar against other major currencies, dropped to the weekly low of 99.50 points. In March, the central banks of G7, led by the Fed, bought bonds worth $ 1.4 trillion. It is assumed that such enormous flows of dollar liquidity will affect the USD exchange rate negatively in the future, and increase the Fed's balance sheet to $ 9-12 trillion by the end of the year. It is also expected to expand the US state budget deficit to $ 3.6 trillion this year, and expand it to up to $ 2.4 trillion in the next. In addition, according to JP Morgan, the US economy may be hit harder by the coronavirus pandemic than other countries. Thus, the dollar may be vulnerable in 2021. At the moment, the dollar remains stable, even though the Fed has lowered interest rates to almost zero, resumed quantitative easing, and increased dollar liquidity to combat the deficit in the markets. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and trading recommendations for EUR/GBP on April 10, 2020 Posted: 10 Apr 2020 02:51 AM PDT Eurogroup adopted a plan to save the economy. Good day, dear traders! In recent days, the COVID-19 epidemic has been rampant in the UK, where 881 people died from the coronavirus within a day. Let me remind you that 938 deaths were registered a day earlier. Thus, the predictions of the British Prime Minister Boris Johnson, who himself was among those infected with a new type of coronavirus infection, come true. By the way, the head of the Cabinet of Ministers has already been discharged from the intensive care unit and his condition is improving. As a result of the pandemic, economic growth in the United Kingdom may decline by 25%. Let me remind you that in the first quarter, the British GDP fell by 5%. That is, the decline in the UK economy began even before the introduction of strict restrictive measures that were supposed to limit the spread of the epidemic. But the European Union still adopted a plan to save the economy from the consequences of COVID-19. The total amount of the package of measures approved by the Eurogroup is about 500 billion euros. In light of the current events, it is interesting to observe the reaction of the euro/pound cross rate to them. What would you think? The British pound is strengthening against the single European currency. Weekly

Since this cross is considered once a week, I will start with the appropriate timeframe in order to determine the options for closing trades on April 6-10 and the future prospects of this interesting currency pair. As you can see, as a result of the downward dynamics, the cross fell to 89 exponential and 50 simple moving averages, where it found support, and at the moment of writing this article, it is trying to reduce losses. I believe that the closing price of weekly trading relative to 89 EMA and 50 MA will be very important here. If the EUR/GBP bears manage to resume pressure and the week ends at 89 EMA and below 0.8720, the further downward prospects of the instrument will become clearer. If the current rebound continues and a candle with a long lower shadow appears, I do not exclude the rise of the euro/pound to the price area of 0.8890, where the Tenkan and Kijun lines, as well as the lower border of the Ichimoku indicator cloud, are located. It is likely that from here it will be possible to consider opening short positions if the corresponding signals appear on smaller timeframes. At the moment, judging by the weekly chart, the nearest landmarks are marked. Daily

At this time interval, we can see that yesterday, there was a small candle Doji. However, it is not the size of the candle that matters here, but where exactly it originated. The candle formed near the support level of 0.8735, 61.8 Fibo from the growth of 0.8281-0.9498 and above the used moving averages: 50 MA, 89 EMA, and 200 EMA. Thus, the price zone of 0.8746-0.8711 can be considered strong support and considered when reducing to these prices, opening long positions at the euro/pound cross rate. However, the nearest sales are not far away. This is the price area of 0.8847-0.8862, where the Tenkan line is located and the maximum trading values were shown on April 7. It will become more clear in which direction to open positions on EUR/GBP after the closing of today and weekly trading. I do not recommend opening cross-currency trades today. It is highly likely that the next week's trading will open with a price gap, the direction of which will depend on the situation with COVID-19 in Europe and the UK. Have a good weekend and don't get sick! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on April 10 Posted: 10 Apr 2020 02:24 AM PDT Economic calendar (Universal time) The data on the US consumer price index (12:30) can be noted among the most important events of today's economic calendar. EUR / USD Players on the rise managed to hold the situation and continued to rise yesterday. Today, the nearest resistances in the area of 1.0965 are divided, thus making the possibility of a breakdown level. Today. further upward directions remain the same 1.0965 (weekly Fibo Kijun) - 1.1012 (daily cloud) - 1.1067-1.1100 (accumulation of important levels of the monthly and weekly half). Friday is the closing of the week, so today can bring surprises.The attraction and nearest support in the current situation is provided by the zone of 1.0911-1.08879 (daily Tenkan + historical level), then the most significant support of this section 1.0778 is located. The key support for the lower halves (the central Pivot level and the weekly long-term trend) completed their mission yesterday. They retained the advantage of players to increase and helped to continue the rise. Today, the levels have diverged and are forming important support lines again in case of a downward correction - 1.0907 (central Pivot level) - 1.0858 (weekly long-term trend). Now, the upward reference points within the day are R1 (1.0973) - R2 (1.1018) - R3 (1.1084). GBP / USD Yesterday, it was not possible to break through the significant resistance of the current section 1.2450 - 1.2540 (monthly Tenkan + weekly Kijun and Senkou Span A + final line of the daily cross + monthly Fibo Kijun), therefore, we are testing this zone again. Consolidation above opens the direction to 1.2670 - 1.2711 (weekly Senkou Span B + Fibo Kijun) and 1.2893 (monthly Kijun and daily cloud). The strength and significance of the support zone 1.2305 - 1.2214 (daily Kijun and Tenkan + weekly Tenkan and Fibo Kijun) remains relevant today. The advantages of the lower halves are now on the side of the players to increase, but the bulls are currently facing the resistance of the higher halves (1.2450 - 1.2540). That is what is holding back the development of the situation. The daily resistance R1 (1.2505) - R2 (1.2556) - R3 (1.2628) can be added to the upward reference points. Among the most significant support in the case of a downward correction, we can certainly distinguish the key levels at H1 - 1.2433 (central Pivot level) and 1.2340 (weekly long-term trend). Consolidation below will change the existing balance of forces and will be the beginning of a new rebound from the met resistance of the higher halves. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Apr 2020 01:56 AM PDT EUR / USD On April 9, the EUR/USD pair gained about 70 baise points, and thus continued to build the alleged wave 3 in C of a new upward trend section, starting on March 20. If the current wave marking is correct, then the increase in quotes of the instrument will continue with targets above the 11th figure. Wave 3 in C, like all C, can turn out to be very long. Fundamental component: On Thursday, the news background for the EUR / USD instrument was noticeable again. Perhaps the most important messages were from the Fed and the Eurogroup. Each of the organizations decided on additional measures to support the economy. Firstly, by 2.3 trillion dollars and secondly by 0.5 trillion euros. The US dollar will be directed to cheap lending to small and medium-sized businesses, as well as to help households. Fed's President, Jerome Powell, said his organization will continue to act aggressively in response to the COVID-2019 virus epidemic and is ready to continue to provide financial assistance until the situation improves. It is also understood that multi-trillion measures should allow Americans to keep their jobs to support the economy. However, according to reports on applications for unemployment benefits, these measures of the Fed and Congress are not very effective. In total, about 17 million Americans have become unemployed over the past three weeks. In Europe, they also agreed on a package of assistance to business, citizens and the most affected countries from the epidemic. The money will also be directed to cheap lending. Today, markets will have to find out how much inflation has changed in March, when the pandemic reached America. If the report is weak, the demand for US currency may decrease even more. In any case, the current wave marking implies a continued increase in quotes. General conclusions and recommendations: The euro/dollar pair supposedly continues to build the rising wave C and began its internal wave 3. Thus, I now recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% for Fibonacci, since the MACD signal "up" has already announced the completion of the construction of the alleged wave 2. I recommend placing a protective Stop Loss order below the low of wave 2. GBP / USD On April 9, the GBP/USD pair gained about 80 basis points, so wave 2 or B can either be completed or take on a very complex horizontal look. In any case, before a successful attempt to break through the maximum of wave 1 or A, you should not expect a further increase in the quotes of the pair. The wave pattern of the instrument is now completely ambiguous and may require adjustments and additions. Fundamental component: There was almost no news background for the GBP / USD pair on April 9. Now, there are no new interesting events in the UK. The whole life seems to be put on pause. Today, Good Friday is celebrated throughout Europe, so there are no events at all. The British pound is in demand from the markets, but it is unlikely that this will continue for long, although the wave marking suggests the continuation of formation of a new upward part of the trend. On the other hand, Prime Minister Boris Johnson, who was infected with a coronavirus, was transferred to a regular ward, however, according to doctors, he will not be able to start performing his duties until a month later. General conclusions and recommendations: The pound/dollar instrument supposedly completed the construction of the first rising wave. Thus, I now recommend selling the pound in the calculation of building wave 2 or B with targets located near the calculated levels of 1.2072 and 1.1944, which corresponds to 38.2% and 50.0% Fibonacci, but this requires a successful attempt to break through the 23.6% Fibonacci level. An alternative is to wait for the completion of the construction of wave 2 or B and enter the market with purchases at the beginning of the construction of wave 3 or C. The material has been provided by InstaForex Company - www.instaforex.com |

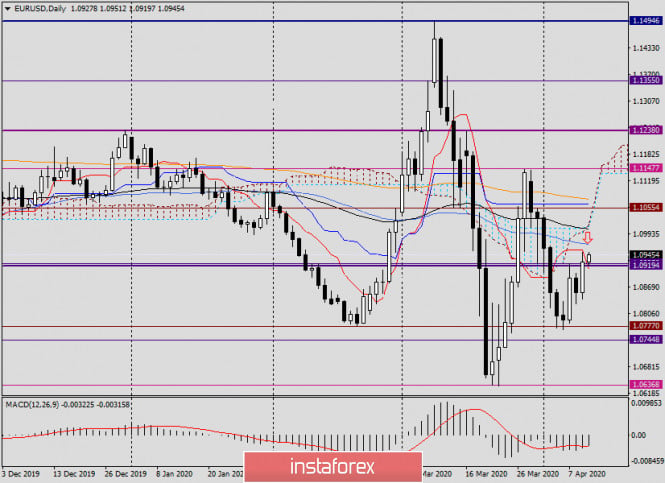

| Overview of the EUR/USD pair for April 10, 2020 Posted: 10 Apr 2020 01:53 AM PDT The Fed announced the launch of a grand-scale program. Hello, traders! Today's review of the main currency pair of the Forex market will start with the macroeconomic statistics that were published yesterday, and the releases expected on the last day of weekly trading. Yesterday's data from the US came out mixed. While the producer price index was better than economists' expectations, initial jobless claims rose more than expected. The University of Michigan consumer sentiment index also turned out to be significantly worse than forecast and showed the strongest drop since 2011. All figures and details can be seen in the economic calendar. There were a lot of reports, and I don't think it's appropriate to give all the values. Today at 13:30 (London time), data on consumer prices will come from the United States. In normal circumstances, this is a very important indicator that determines the degree of inflationary pressure in the country, which, in turn, affects the monetary policy of the Federal Reserve System (FRS). However, as you can see, market participants are simply ignoring important reports from the United States. The main topic continues to be the spread of the COVID-19 epidemic around the world, and in particular in the United States. Against this background, the Fed decided to launch a grand program in scope. As stated by the Fed Chairman Jerome Powell, the US Central Bank will allocate 2.3 trillion US dollars to support small and medium-sized businesses that are suffering significant losses during the current pandemic. Powell said that the agency headed by him went on such large-scale lending in order to support economic stability in the country, and the Federal Reserve intends to do everything possible to do this. Of that $ 2.3 trillion, loans will be made to American households, local governments, and businesses to deal with the effects of COVID-19. The European Central Bank does not sit idly by, although officials at different levels have enough disagreements. However, the ECB has already started buying up the debt of the countries most affected by the coronavirus, primarily Italy. The total amount of debt purchases will be approximately 1.1 trillion euros. It's an impressive amount, isn't it? However, the actions of the European regulator alone may not be enough to overcome the terrible consequences of the pandemic. Other aid mechanisms must also be involved, and for this to happen, a consensus must be reached between the wealthiest and the poorest countries in the European Union. At the moment, it seems that the Fed is taking more significant and coordinated measures than their ECB counterparts. Let's see how the euro/dollar currency pair reacted to all this. Daily

Despite the decisive and unprecedented actions of the Federal Reserve, the single European currency strengthened against the US dollar following yesterday's trading. The euro/dollar pair closed yesterday's session slightly above the resistance level of 1.0925, thus making its breakout. However, we can make a more convincing assessment of this after the end of today and weekly trading. At the moment, the situation is such that with a high probability, we can assume a further rise in the rate to the area of 1.0970-1.1005. I fully assume that here the quote will meet strong resistance and turn down. At the same time, it is difficult to assume whether this will be a corrective pullback or a reversal to continue the main downward trend. H1

You can see for yourself what the picture is on the hourly chart. With great difficulty and no less persistence of the bulls in the euro, the pair passed up the red resistance line of 1.1484-1.1443, as well as the mark of 1.0925. For those who want to open new positions today, I will give priority to purchases that are better to open after rollbacks to the price zone of 1.0930-1.0890. It is more aggressive and risky to try buying near the current price of 1.0942. Sales, as already noted, should be considered after the rise to the area of 1.0970-1.1005. However, it is better to think about opening short positions on Monday. At least it's safer that way. It is unknown what may happen in the coming weekend and how the auction will open on the night from Sunday to Monday. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin Halving: will it increase the price of the cryptocurrency? Posted: 10 Apr 2020 01:52 AM PDT

The problems brought by the coronavirus pandemic has put cryptocurrency issues at the back of traders' minds. Now, because of the upcoming Bitcoin Halving in May, they have gained relevance, putting out the question: will bitcoin rise? Earlier, in 2012 and 2016, Bitcoin Halving has become the catalyst of growth of BTC prices. It cuts down the supply of BTC, making the asset more scarce, so, if the demand is high, the price is likely to increase. However, experts draw attention to the fact that for a number of cryptocurrencies, halving did not work, and digital assets did not rise in price. Currently, experts are not sure about the effect of halving on the dynamics of bitcoin. They made cautious predictions in connection with this procedure. According to analysts from Coincident Capital, in anticipation of halving, bitcoin will reach $ 8,000, and will grow a little more in the future. They focused on strengthening the correlation between the cryptocurrency and the stock market, so they believe that the upward trend recorded in the US and EU exchange markets will positively affect BTC. Other strategists, on the other hand, although confident in the prospects of bitcoin and gold, are skeptical of the further growth of the global stock market. These include Mike Novogratz, CEO of Galaxy Digital, who spoke disapprovingly of the current monetary policy of the US Federal Reserve, believing that the regulator is pouring trillions of dollars into the economy in vain. Novogratz believes that these measures will not help restore the US economy much. Meanwhile, according to crypto enthusiast Tim Draper, the coronavirus pandemic could be a turning point for BTC. If these measures implemented by the governments were not able to help mitigate the consequences of the pandemic, traditional protective assets (gold) and digital assets (bitcoin) will come to the rescue. According to Draper, in the near future, the advantages of BTC will become obvious, and the market will begin to turn to it again. Some analysts also believe that incentive measures by the US authorities aimed at supporting the national economy will help boost the cryptocurrency industry. However, its effects will only become noticeable much later. At the moment, many are betting on a surge in interest in bitcoin after the halving. If this happens, the demand for BTC will increase, and the price of other digital assets will also increase. Thus, some crypto enthusiasts put forward bold hypotheses regarding the prospects of bitcoin. One of them, Tommy Lee, ex-director of BTCC, is sure that halving will first push bitcoin to up to $ 10,000. Then, by the end of this year, it will skyrocket to $ 25,000. Such forecasts look overly self-confident, as the cryptocurrency has not left the range of $ 7,200– $ 7,300. On Friday, April 10, the digital asset fell a little and is now trading between $ 6,940– $ 6,950. Many economists are confident that bitcoin will not turn into a full-fledged defensive asset and stand on a par with gold and dollar. They consider the cryptocurrency as a crisis decentralized asset created to make payments without the participation of banks and regulatory authorities. In the event of a global economic crisis, it will lose its original functions, retaining only the speculative component. The material has been provided by InstaForex Company - www.instaforex.com |

| Let's work out trading idea on GBP/USD: how to lock in profits of +1,700 pips Posted: 10 Apr 2020 01:46 AM PDT

Hi dear traders! My congratulations to those, who followed my trading idea from April 8 about long deals on GBP/USD. Let me remind you that the idea was based on the methods of hunting stop orders and Price Action. In a nutshell, we had to work out or "digest" the trend. Trading plan:

How it worked:

If you were careful about my analysis and forecast, I recommended placing take profit at 1.25. However, European trading floors are working a shorter week and closing on Good Friday. So, amid lower volatility my trading decision is to lock in profit at the current price level. I reckon I can reap a profit of nearly 1,700 pips. Good luck in trading! Have a nice weekend! The material has been provided by InstaForex Company - www.instaforex.com |

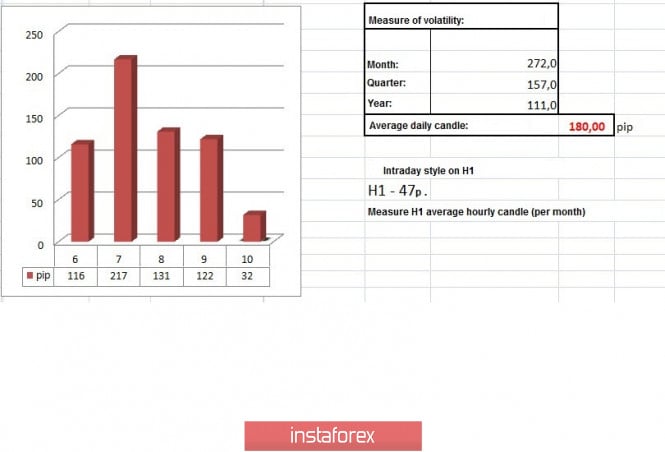

| Trading recommendations for GBP/USD pair on April 10 Posted: 10 Apr 2020 01:43 AM PDT From the point of view of complex analysis, we see a round of long operations that led the quote to where it all began, and now let's talk about the details. A full tact for four trading days suggests that activity is still high, and the wide flat 1.2150 / 1.2480 (1.2500) focuses on itself the special attention of market participants. A detailed examination of tact 1.2150 (1.2166) -> 1.2482 shows that the move was stepwise, that is, the very variable ranges appeared on the path, which was written in the previous review. These steps were a kind of framework for the accumulation of trade forces, due to which it was possible to move within such a wide framework of the flat. Regarding the structure of the flat and the scale, one can single out the fact that price retention is already in its second week, and this is already a violation of the structure of upward inertia of March 20. That is, the movement following the flat will not be connected with the past inertial move, which means that the scale restriction, and most importantly the direction, does not matter, since a completely new movement in the market awaits us. Example Let's imagine that we are considering a breakdown of the upper boundary of the flat, where there is already a significant height from the historical lows, but we have a new turn, and it can literally develop the scale of inertia 09.03.20 - 20.03.20. Naturally, this is just an example that shows that the subsequent movement can be full-scale, not local. Regarding the theories of further development, we have already mentioned that the pound can be under further pressure in the medium and long term, where the global downward trend will continue, but external factors [background] will aggravate the already shaky structure. Analyzing the past trading day, we see that the round of ascending positions appeared during the start of the European session and was held until the beginning of the American session. The subsequent oscillation had a lateral character with variable boundaries of 1.2440/1.2480 (1.2500) In terms of volatility, we see activity similar in dynamics to last day [April 8], where the slowdown relative to the average daily indicator is 32%. Working with volatility, it can be seen that the dynamics has been declining over the past two weeks, but not so much. Having indicators of 116 - 130 points is considered a considerable level, and this is still an acceleration, on which speculators are actively working. Details of volatility: Monday - 165 points; Tuesday - 245 points; Wednesday - 172 points; Thursday - 358 points; Friday - 359 points; Monday - 144 points; Tuesday - 271 points; Wednesday - 676 points; Thursday - 354 points; Friday - 522 points; Monday - 267 points; Tuesday - 296 points; Wednesday - 333 points; Thursday - 452 points; Friday - 352 points; Monday - 148 points; Tuesday - 227 points; Wednesday - 108 points; Thursday - 126 points; Friday - 198 points; Monday - 116 points; Tuesday - 217 points; Wednesday - 131 points; Thursday - 122 points. The average daily indicator, relative to the dynamics of volatility is 180 points [see table of volatility at the end of the article]. As discussed in the previous review, traders expected a slowdown relative to the upper boundary of the flat, which eventually happened, but there were no fundamental changes in the form of jumps relative to the frame of 1.2480 (1.2500). Considering the trading chart in general terms [the daily period], we see a global downward trend, where extreme fluctuations have the form of inertia with scales of more than 1000 points. The news background of the past day contained data for the UK, where industrial production maintained a decline of -2.8% with a forecast of -2.9%. At the same time, GDP data continued to show a slowdown from 0.7% to 0.3%. In the afternoon, weekly statistics on applications for unemployment benefits in the United States will be published. Initial applications amounted to 6 606 000, which is 261 000 less than a week earlier, but there were more repeated applications. Their number was 7 455 000, which is considered the maximum in history. The reaction of the market this time had a positive correlation with fundamental analysis, the US dollar rapidly began to lose its position, but in local consideration again. In terms of the general informational background, we see that the extremely difficult situation with coronavirus forced the Bank of England to use its overdraft for the first time in 12 years, which will become an additional short-term source of liquidity for the government. "As a temporary measure, this will give the government a short-term source of additional liquidity in case it is necessary to establish a quiet cash flow and maintain the stable functioning of markets during the period of destabilization caused by the coronavirus pandemic," the regulator said in a statement. Today, in terms of the economic calendar, we have inflation data in the United States, where a slowdown from 2.3% to 1.5% is recorded, which may directly affect future decisions of the Federal Reserve regarding actions regarding the refinancing rate, which means its future reduction. At the same time, do not forget that today is a holiday in many countries, including the United States and Britain, where they celebrate Good Friday. The upcoming trading week, in terms of the economic calendar, is not full of statistics, but we have negotiations between the working group of Britain and the EU on Brexit. In turn, the external background will continue to excite speculators and escalate fear on investors. The most interesting events displayed below ---> Monday, April 13 UK / EU - Bright Monday Wednesday, April 15 USA 12:30 Universal time - Retail sales USA 13:15 Universal time - Industrial output Thursday, April 16 USA 12:30 Universal time - Applications for unemployment benefits USA 12:30 Universal time - The number of construction permits issued USA 12:30 Universal time - The volume of construction of new houses Friday April 17th USA / EU / Britain - Good Friday USA 12:30 Universal time - Inflation Further development Analyzing the current trading chart, we see exactly the same slowdown that occurred yesterday when the price approached the upper boundary of the main flat. In fact, this accumulation of 1.2440 / 1.2485 is temporary in nature, where a local jump of activity may eventually occur. If we consider the movement relative to the main trend, it does not exclude the occurrence of a new turn of the downward move, just the tact to the lower border of the flat. At the same time, the market is still subject to an external background, which is used by speculators, so trading on the principle of local operations can be relevant. It can be assumed that the variable range of 1.2440 / 1.2485 will be broken soon, and the movement will not necessarily be the main one, but it will be possible to earn profit on a local surge. Therefore, do not miss the moment and work for the breakdown, with a moderate risk for the position. Based on the above information, we derive trading recommendations: - We consider buying positions higher than 1.2500, preferably with a consolidation in the direction of 1.2550 - 1.2620. - We consider selling positions lower than 1.2435, with the prospect of a movement of 1.2400 - 1.2350. Indicator analysis Analyzing a different sector of time frames (TF), we see that the indicators of technical instruments took a buy signal due to the return of the price to the upper boundary of the main flat. At the same time, minute intervals work exclusively on the existing slowdown, the signal is variable. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for Month / Quarter / Year. (April 10 was built taking into account the time of publication of the article) The volatility of the current time is 32 points, which is 82% lower than the daily average. It is possible to assume that volatility will increase by 2-3 times as soon as the slowdown framework is broken. Key levels Resistance Zones: 1.2500; 1.2620; 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support areas: 1.2350 **; 1.2280 (1.2240); 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000. * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD unaffected by oil drop Posted: 10 Apr 2020 01:20 AM PDT The Loonie has rallied again versus USD despite some poor data from Canada. USD/CAD dropped only because the US dollar weakened once again amid the Fed's measures. The US dollar has also retreated because there is some hope that the COVID-19 pandemic will slow down in the upcoming weeks. The oil price plunged in yesterday's session after OPEC meeting. However, the USD/CAD pair remained unaffected by this news. Therefore, it continues to drop. Technically, the pair is under massive pressure according to the Daily chart, so a further drop is favored if traders start selling off the US dollar.

USD/CAD has slipped below the 38.2% retracement level and below the weekly S1 (1.4014), it is traded below the downtrend line, channel's resistance. That's why it is still bearish and it could extend the sell-off. So, the bias is bearish as long as USD/CAD is traded within the down channel, the next potential target is seen at the S2 (1.3839) - 50% area, and only a valid breakdown through this downside obstacle will validate a broader drop towards the S3 (1.3672) towards the 61.8% retracement level and towards the channel's downside line.

Another low, a drop below 1.3930 and 1.3920 support will confirm a further drop at least till the S2 (1.3839) level. USD/CAD is bearish after the failure to take out the downtrend line. It has only tested and retested this line and the S1 (1.4014) level / 38.2% retracement level. USD/CAD could approach the downside line if the USDX drops towards the 98.00 psychological level again. A further drop could be invalidated only by a breakout from this descending channel above the downtrend line. You could search for long opportunities from above 1.4080 level. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of GBP/USD and USD/JPY for April 10 Posted: 10 Apr 2020 01:14 AM PDT GBP/USD Analysis: The direction of the short-term trend of the British pound since March 18 is set by an upward wave. The final part (C) started on April 4. By now, the price has reached the lower limit of a strong large-scale reversal zone. Forecast: After the active rise of the last days, a general sideways mood of the price movement is likely today. The stroke range is indicated by the nearest counter zones. In the US session, there may be an increase in volatility, with a return to the dominant upward rate. Potential reversal zones Resistance: - 1.2480/1.2510 Support: - 1.2400/1.2370 Recommendations: Today, trading the pound in the market is only possible within the intraday style. Purchases before the correction is completed are premature. When selling, you should reduce the lot. In the area of settlement support, it is recommended to track entry signals to long positions.

USD/JPY Analysis: The short-term trend wave on the Japanese yen chart starts on March 9. In the structure of the wave from the end of March, the final part (C) is formed. Within this framework, the price will be adjusted starting from April 6. Yesterday, the price rise began, which may be the beginning of a reversal design. Forecast: The pair's downward trend is expected to end in the next trading sessions. Further, in the area of the support zone, you can count on a reversal and return to the ascending rate. A break in the upper limit of the price range is unlikely today. Potential reversal zones Resistance: - 109.00/109.30 Support: - 108.20/107.90 Recommendations: When selling today, you should be careful. You need to reduce the lot and be ready for a sharp change of course. We recommend that you focus on searching for purchase signals on your vehicle.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements. Note: The wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

| Passionate projection (review of EUR/USD and GBP/USD on 04/10/2020) Posted: 10 Apr 2020 01:11 AM PDT We can say that something incredible is happening right now, since the coronavirus has magically disappeared from the editorials of all the media of agitation and misinformation. Self-respecting journalists suddenly turned from epidemiologists into hereditary oil workers. Moreover, the prolonged negotiations of the exporting countries on the issue of reducing oil production did not go without drama. However, the role of the main troublemaker was not Russia or Saudi Arabia, but Mexico. The descendants of the Aztecs definitely emerged from the negotiation process, allegedly due to the fact that they were imposed on conditions unacceptable to their proud nature. And as if by magic, all the media of agitation and misinformation shouted that the negotiations were broken and all that and even the price of oil immediately went down. However, after a couple of hours, Mexico said it is ready to reduce production by 100 thousand barrels per day. But in any case, the negotiations dragged on and will continue today. The most important thing in all this is that we see a clear desire of the largest oil exporters to reach a compromise that will inevitably stabilize the oil market. The trick is that there are no countries in the world that do not care about oil. Without oil, any country would have rolled back quickly a hundred years ago. Thus, if the oil market stabilizes, then the whole world economy may breathe out a little. After that, stabilization of the entire global financial market will begin. First, the raw materials market will come back to normal, followed by the stock market. Then there is the debt market, and so on. In short, this is very, very important. And the crucial point here is that if global markets can calm down a little, then the risks will decrease slightly. This means that major players will begin to gradually return to where the profitability is slightly higher than in the United States. The yield is now tight in the US, since there is so much capital there that there's nowhere to go, and therefore, profit is purely symbolic. It's a blessing that it still exists. That is, the stability of global markets is bad for the dollar, partly because of this, the dollar was losing ground yesterday although not without additional pullbacks.

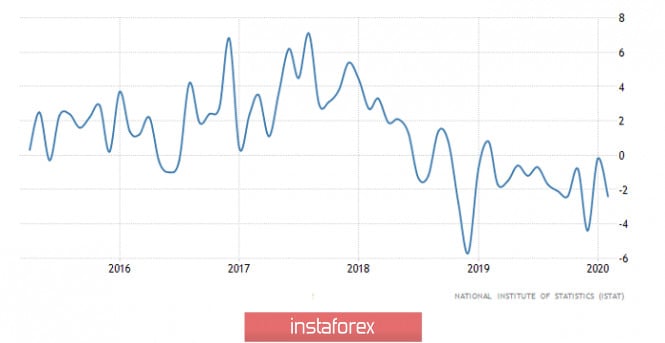

Now, let's move on to more uninteresting data, such as European macroeconomic statistics, which was ignored by everyone yesterday. Germany thought for a long time and finally issued that the surplus of the trade balance in February was not 18.2 billion euros, but already 20.8 billion euros. What will go on an additional 2.6 billion euros, has not yet been disclosed. And this happened due to an increase in exports by 1.3% and a decrease in imports by 1.6%. In short, continuous deepening and expansion. Things were good in Italy too. The fact that the decline in industrial production accelerated from -0.2% to -2.4%. The joy is that they expected the recession to deepen to -3.2%. Industrial production (Italy):

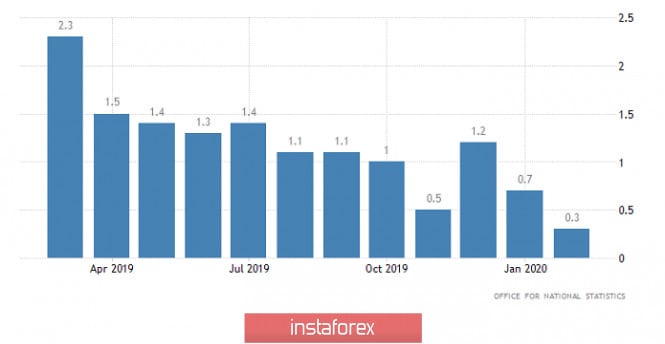

Similarly, the British statistics were ignored, which were beautiful in their own way. For example, the British found something in common with Italians and rejoiced with them. Indeed, the pace of decline in industrial production remained unchanged, although they expected acceleration from -2.8% to -3.0%. As a result, the flight is normal. But the economic growth rate slowed from 0.7% to 0.3%, which was worse than forecasts. Anyway, we were expecting a slowdown of only 0.4%. GDP growth rate (UK):

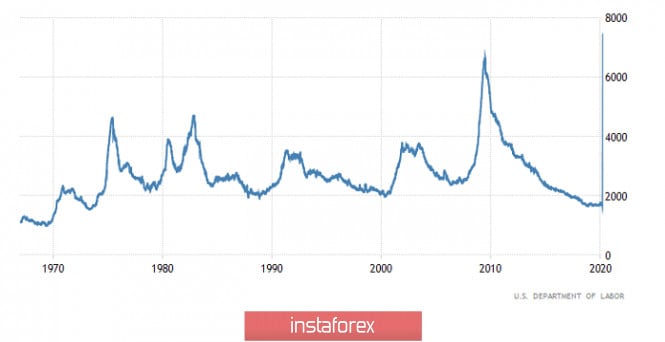

Now, we focus on the second reason for yesterday's slight weakening of the dollar. And we will talk about the labor market, which continues to create passion and continues to work. There was a crazy roll of initial applications for unemployment benefits this time. That is, the record of last week was not broken. For the first time, only 6,606 thousand applied for the benefit. It can be noted that this is as much as 261 thousand less than a week earlier. However, the number of initial calls a month ago was less than the difference between the values of two weeks. So the offices of the employment service are still stormed by several hard workers. But this time, they were joined by those who have not been able to find work so far, and are forced to submit a new application for benefits. Here, we saw a new historical record. Repeated applications for unemployment benefits were already 7,455 thousand, which is 837 thousand more than at the end of June 2009, when the previous record was set. This interesting situation lies in the fact that the rampant growth in the number of repeat applications, was accompanied by an influx in the number of primary ones. And if the previous two weeks, still somehow held on, and did not seek to get rid of dollars, and even vice versa, then now, everything is already somewhat different. The American labor market is collapsing, which happens in real time. Nobody has ever seen anything like it before. And it is difficult to compare even with the Great Depression, since then there were no such statistics yet. And yes, everyone understands that if this happens in the United States, then something similar will happen in other countries just a little later. And there are no similar statistics in other countries that are kept on a weekly basis. Perhaps, this is already happening in other countries, but we will just see it later. Nevertheless, the fact of what is happening, especially the unprecedented roll of the number of repeated applications, is scary. The truth was not without a disappointment in the form of producer prices, whose growth rate slowed down from 1.3% not to 0.3%, but only to 0.7%. Repeated Unemployment Insurance Claims (United States):

Today, the market will be calm, as both Europe and North America celebrate Good Friday. In this case, data on inflation in the United States, which should show its decline from 2.3% to 1.5% will be published. Well, such a rapid slowdown in inflation is likely to make the Fed think about another reduction again in the refinancing rate, probably in emergency mode again. Well, this will lead to the fact that the yield of US government debt securities, which has already declined already, will go down even more. For some, maybe even below zero. And if everyone has only been doing what they were in recent years such as running from risk and shifting everything to the United States, then the reverse process may begin. Moreover, the vile oil exporters are going to stabilize the oil market, which will start the process of stabilizing all other markets. Thus, the dollar can only hope for a short memory, especially for journalists, and by Monday, no one will remember about it. Inflation (United States):

Any progress in the single European currency should not be expected today due to Good Friday. So today, we are hanging around the level of 1.0950 and monitoring inflation. It may be necessary to move towards the level of 1.1050 on Monday.

The pound will behave similarly, and it will be at the level of 1.2500 all day, with a goal of 1.2625.

|

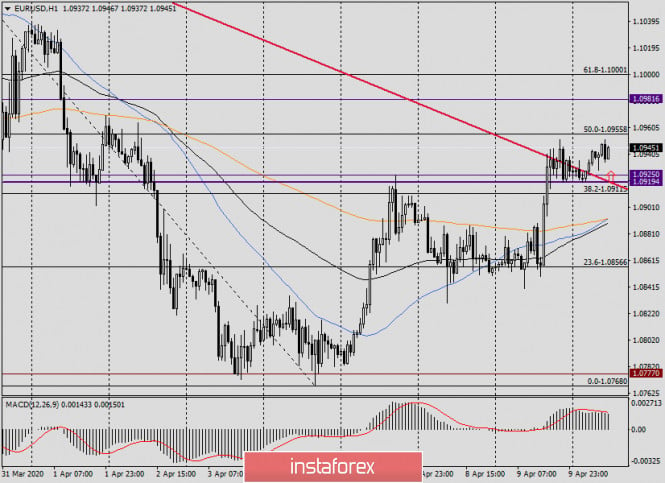

| Posted: 10 Apr 2020 01:08 AM PDT EUR/USD – 1H.

Hello, traders! As seen on the hourly chart on Thursday, the EUR/USD pair performed a new reversal in favor of the European currency and resumed the growth. And this reversal gave the opportunity to build a new upward trend line, which now determines the mood of traders more reliably as "bullish". Fixing the pair's exchange rate under the trend line will work in favor of the US dollar and significantly increase the pair's chances of resuming the fall in quotes. There were a few economic reports yesterday. However, late in the evening, even at night, it became known that the Eurogroup managed to agree on a package of assistance to the European economy for 540 billion euros. Also, an absolute surprise was the agreement of a new package of assistance to the American economy from the Fed of 2.3 trillion dollars. Both packages will be designed to help small and medium-sized businesses, as well as workers who are experiencing hard times due to the coronavirus pandemic, as well as national quarantine. EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a double rebound from the corrective level of 23.6% (1.0840) and a reversal in favor of the British currency. A new growth process has started in the direction of the corrective level of 38.2% (1.0964). The rebound of the pair's quotes from this Fibo level will work in favor of the US currency and some drop in the quotes in the direction of the corrective level of 23.6%. Also yesterday, a bearish divergence was formed in the CCI indicator, which also allows traders to count on a reversal in favor of the US dollar. Closing the pair's rate above the divergence peak and the Fibo level of 38.2% will increase the probability of continuing growth towards the next corrective level of 50.0% (1.1065). EUR/USD – Daily.

On the daily chart, the EUR/USD pair also continues to grow in the direction of the corrective level of 38.2% (1.0965) and also risks a rebound from this level. The picture remains identical to the 4-hour chart, since the same grid of Fibo levels is in effect. EUR/USD – Weekly.

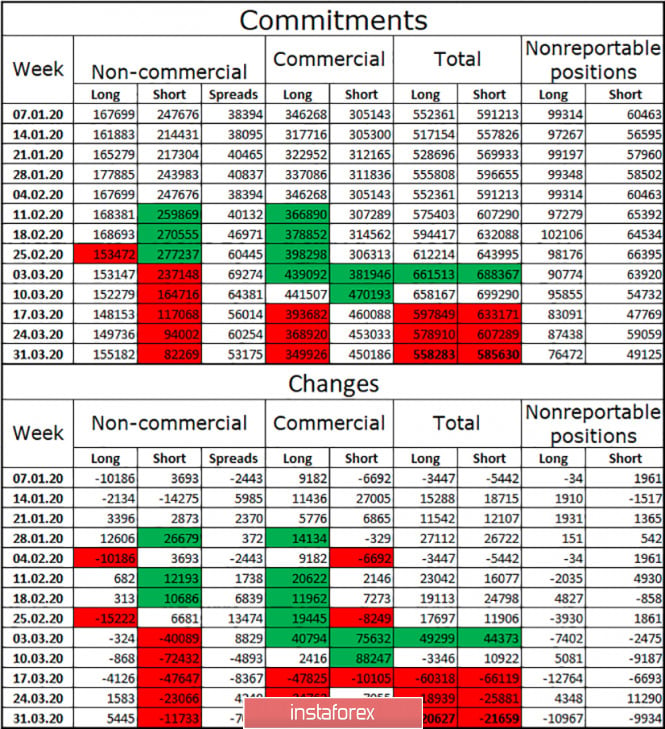

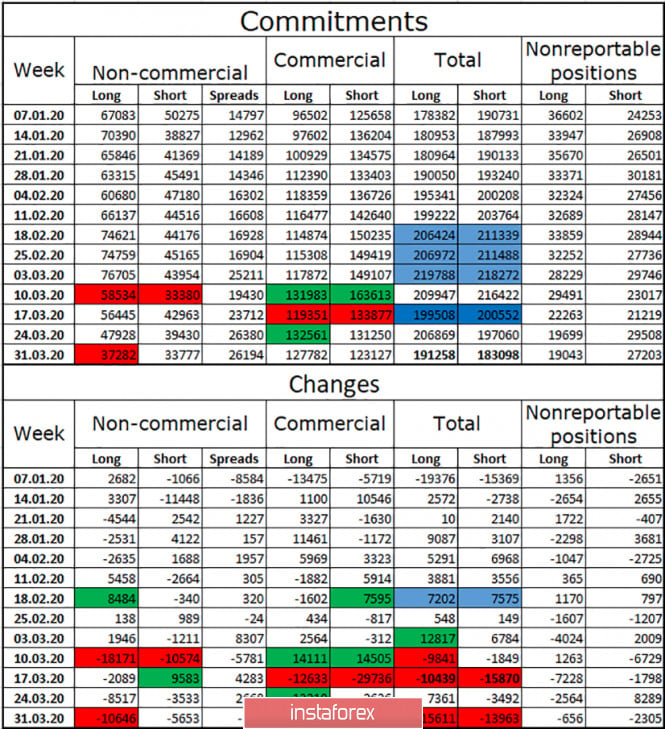

On the weekly chart, the EUR/USD pair continues to trade near the lower line of the "narrowing triangle". The rebound of quotes from the lower line of the "triangle" allows traders to count on the growth of quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). However, closing under the "triangle" will work in favor of the US currency and, possibly, a new long fall. Overview of fundamentals: On April 9, economic news was not in favor of the US dollar. I have already mentioned the Fed's $ 2.3 trillion measures. In addition, the number of initial applications for unemployment benefits was 6.6 million in addition to the 10 million of the previous two weeks, and the head of the Federal Reserve Jerome Powell said yesterday that interest rates will remain low until the US economy begins to recover. News calendar for the United States and the European Union: EU - Good Friday. USA - consumer price index (14:30 GMT). USA - consumer price index excluding food and energy prices (14:30 GMT). On April 10, the EU news calendar again does not contain anything interesting, since good Friday is celebrated in Europe today. In America, an important inflation indicator for March will be released today. COT (Commitments of Traders) report:

The latest COT report showed an even reduction in the number of long and short contracts among major market players. The advantage is small for short-contracts, there are 27,000 more of them. However, speculators have recently been actively reducing sales of the euro, which gives hope for continued growth. Today, a new COT report will be released, as always with a 3-day delay, and we will see whether the trend of getting rid of short contracts by the "Non-commercial" group will continue. If so, the chances of the planned growth of the euro will increase. Forecast for EUR/USD and recommendations for traders: Now I recommend being careful with the new sales of the euro, as there are no signals yet. I also recommend closing yesterday's purchases, as there is a bearish divergence on the 4-hour chart. I recommend selling the euro again when the quotes fall back from the level of 38.2% (1.0964) with the target of 1.0840. I recommend buying the pair at the close above the level of 38.2% with a target of 1.1065. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

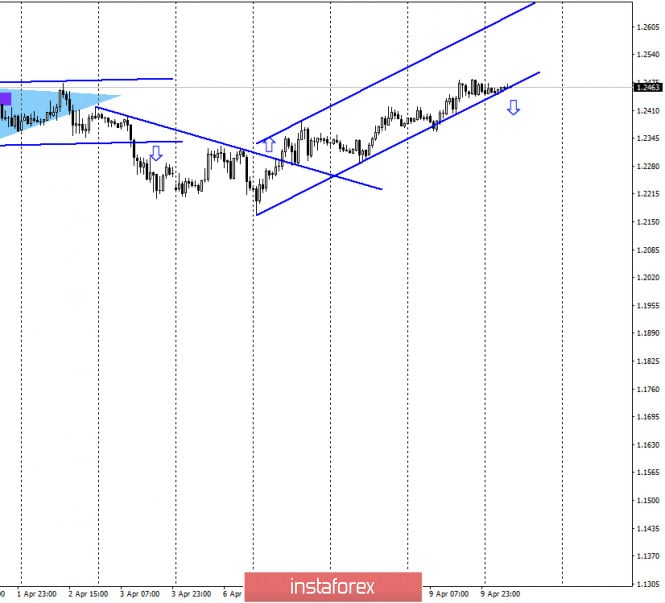

| Posted: 10 Apr 2020 01:08 AM PDT GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the English currency and continues the growth within the upward trend corridor. But it continues very hard, risking to close under the corridor in the next few hours. If this happens, the mood of traders will change from "bullish" to "bearish" and the pair's quotes will fall. The main events of yesterday were not related to economic reports, although in the UK there were several quite important ones published. However, much more important are the new aid packages for the American and European economies, and the agreements reached by Saudi Arabia and Russia during the OPEC meeting on reducing oil production. Also, all OPEC+ countries will have to reduce production by 10 million barrels per day in the period from May to June. By the end of the year, the total reduction in production should reach another 8 million barrels per day. Thus, the oil market should soon begin to recover. GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair continues to grow in the direction of the corrective level of 61.8% (1.2516). The rebound of the pair's exchange rate on April 10 from this level will work in favor of the US dollar and resume the fall in the direction of the corrective level of 50.0% (1.2303). There are no pending divergences in any indicator today. It is also possible to rebound from the level of 1.2486, from which the pair previously fought back three times (blue rectangle). Closing the pair's rate above the level of 61.8% will increase the probability of further growth of the British dollar in the direction of the next corrective level of 76.4% (1.2777). GBP/USD – Daily.

On the daily chart, the pair's quotes increased to the corrective level of 50.0% (1.2463). The rebound of the pair's exchange rate from this Fibo level will work in favor of the US currency and the beginning of the pair's fall in the direction of the corrective level of 38.2% (1.2215). Thus, on the two charts, we have three difficulty levels at once, from which the pair can perform a rebound. Closing quotes above the Fibo level of 50.0% and above the levels of 1.2486 and 1.2516 will keep the mood of traders "bullish", and the Briton will get a good opportunity for additional growth. GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the two upper trend lines. Overview of fundamentals: On Thursday, the UK released weak indicators of GDP and industrial production. But even more, disappointing data on initial applications for unemployment benefits in the United States has maintained the bearish mood of the majority of traders. News calendar for the US and UK: EU - Good Friday. USA - consumer price index (14:30 GMT). USA - consumer price index excluding food and energy prices (14:30 GMT). On April 10, news from the UK is not expected, as the day will be a holiday - Good Friday. In America, an important inflation indicator for March will be released today, which traders will most likely not pay due attention to. COT (Commitments of Traders) report:

The latest COT report showed that the activity of major market players continues to fall, as evidenced by the decreasing number of short and long contracts. Moreover, speculators get rid of both types of contracts, which indicates their low interest in the British as a trading instrument. Hedgers hold more contracts in their hands but usually trade against the main trend. Thus, I would say that it is the fall of the British dollar's quotes that are more preferable, despite the overall advantage of long-term contracts. Today, a new COT report will be released, which will show how the mood of major players has changed over the past week, and will allow you to draw new conclusions. Forecast for GBP/USD and recommendations to traders: I believe that today we should consider selling the pound with the target of 1.2303 when rebounding from any of the levels - 1.2463, 1.2486, 1.2516, or from all at once. I recommend buying the pound if it is possible to close above the level of 61.8% on the 4-hour chart with the target of 1.2777. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| Instaforex Daily Analysis - 10th April 2020 Posted: 10 Apr 2020 01:04 AM PDT Today we take a look at USDCAD and see how we are going to play the bounce! We use Fibonacci retracements, extensions, support/resistance, momentum and trend lines to identify trading opportunities in this exciting pair today! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment