Forex analysis review |

- Technical analysis of the GBP/USD pair for the week of May 18-23

- OPEC + kept its promise

- Activity in the currency markets will only increase if strong signals about the global economic recovery will appear (GBP/USD

- The world economy is falling into chaos; Overview of EUR and GBP

- EUR/USD Rising odds for a move lower!

- Technical analysis of the EUR/USD pair for the week of May 18-23

- Indicator analysis. Daily review on GBP / USD for May 18, 2020

- Elliott wave analysis of EUR/GBP for May 18 - 2020

- Indicator analysis. Daily review on EUR / USD for May 18, 2020

- Elliott wave analysis of GBP/JPY for May 18 - 2020

- GBP/USD. British pound remains under pressure.

- Technical Analysis of ETH/USD for May 18, 2020:

- EUR/USD and GBP/USD: Failure of trade negotiations between the UK and the EU harms the pound. Fed Chairman Jerome Powell

- Technical Analysis of BTC/USD for May 18, 2020:

- Fractal analysis of the main currency pairs for May 18

- Technical Analysis of EUR/USD for May 18, 2020:

- Technical Analysis of GBP/USD for May 18, 2020:

- Trade negotiations between UK and EU failed. Euro to continue falling

- DXY testing 1st resistance , potential drop!

- GBP/USD: plan for the European session on May 18 (analysis of yesterday's trades). Pressure on the pound returned after UK-EU

- EUR/USD: plan for the European session on May 18 (analysis of yesterday's trades). European currency buyers lack good news.

- Forecast for EUR/USD on May 18, 2020

- Forecast for GBP/USD on May 18, 2020

- Forecast for AUD/USD on May 18, 2020

- Forecast for USD/JPY on May 18, 2020

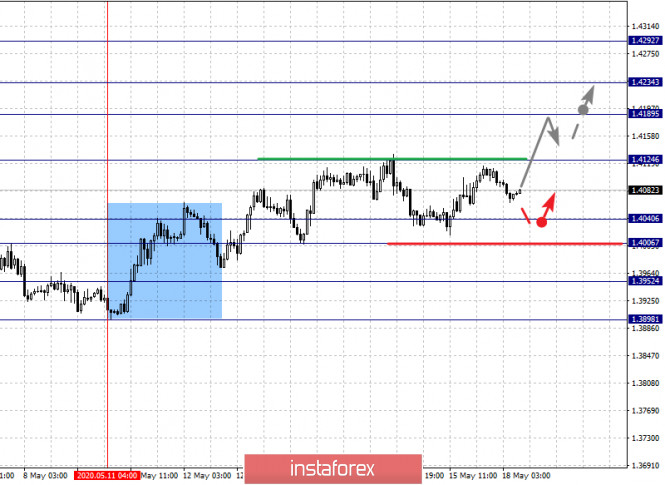

| Technical analysis of the GBP/USD pair for the week of May 18-23 Posted: 18 May 2020 12:27 AM PDT Trend analysis: This week, the price from the level of 1.2100 (closing of the last weekly candlestick) will move up with the target at 1.2282 - a pullback level of 14.6% (red dashed line), and in case of testing this level, work up with the next upper target at 1.2412 - a pullback level of 23.6% (red dotted line). In case of breaking through this level, the next target will be at 1.2623 - a pullback level of 38.2% (red dashed line).

Fig. 1 (weekly schedule). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - down; - trend analysis - down; - Bollinger Lines - down; - monthly chart - up. The conclusion of a comprehensive analysis is an upward movement. The total result of calculating the candle of the GBP/USD currency pair according to the weekly chart: the price of the week will most likely have an upward trend with the absence of the first lower shadow of the weekly white candlestick (Monday - up) and the presence of the second upper shadow (Friday - down). The first upper target at 1.2282 is a pullback level of 14.6% (red dashed line). The weekly upper target at 1.2412 is a pullback level of 23.6% (red dashed line). An unlikely scenario: the price from the level of 1.2100 (closing of the last closed weekly candle) working down with the lower target of 1.1883 - the lower border of the Bollinger line indicator (black dashed line). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 May 2020 12:25 AM PDT

OPEC + cuts production, in response to the rapid collapse of the oil market. According to Ed Morse, head of product research at Citigroup, "the actual cuts in production are deeper and more impressive than any reasonable person would have thought a week ago." Over the past three weeks, oil quotes have recovered by 60%, due to the increase in fuel consumption offset by the decrease in supplies. In Saudi Arabia, the crisis in the oil industry prompted the country to look for new ways to earn money. Thus, Saudi Arabia plans to borrow about $ 10 billion to contribute investments in the technological tool of SoftBank Group Corp. State-owned oil producer Saudi Aramco, meanwhile, will cut exports in June, at least for a dozen Asian customers. Shipments to the US and Europe will also be reduced sharply. Kuwait, United Arab Emirates and Oman have taken similar steps. "We are starting to see whether the producing countries are following the agreement they signed." said Clay Seigle, managing director of Vortexa, in an interview. According to tanker tracking data, only Iraq did not follow the agreement. The country reduced exports only slightly, as this month, the supply fell by only 190,000 barrels per day, much lower than the agreed production cut of over 1 million per day. Baghdad, on the other hand, distributes the million-barrel production cut with international oil companies such as BP Plc and Exxon Mobil Corp. Nevertheless, it is clear that even the most stubborn member of OPEC shows signs that it can be reformed. Saudi Arabian Energy Minister Abdulaziz bin Salman and OPEC Secretary General Mohammed Barkindo recently agreed with Baghdad to abide by the rules, in which Baghdad promised to improve discipline, Barkindo said on Friday. In the US, production cut will reach at least 2 million barrels per day in June, including liquefied natural gas, with Permian producers in West Texas and New Mexico, providing 42% of the expected reductions. "Looking at the overall picture, the worst is over, and the market is moving towards rebalancing," said Daniel Ghali, commodity strategist at TD Securities, "The reduction in supply was quite massive," he added Against this background, oil has been steadily growing for four weeks in a row:

|

| Posted: 18 May 2020 12:20 AM PDT Activity in the currency markets fell markedly on the wave of investors' clear expectation of developments around the current situation with the gradual exit of countries from strict quarantine measures. Markets' understanding that the global economy as a whole and the economies of a number of countries, starting with the United States, have suffered quite a lot against the background of the coronavirus pandemic has led to the fact that investor activity in the currency markets has significantly decreased. This behavior can be explained by the fact that the measures taken by the authorities and regulators in all economically significant countries have led to a significant weakening of the exchange rates of national currencies against the us dollar. At the same time, the US currency itself is under extreme pressure from the unprecedented stimulus measures taken by both the US Treasury Department and the Federal Reserve. Last week, as we previously thought, ended for most major currency pairs where the dollar is present, without noticeable changes. Only two currency pairs underwent the only significant changes - the British pound/US dollar and the New Zealand dollar/US dollar. A noticeable decrease in these currency pairs can be explained by the greater weakness of the pound and the New Zealand dollar against the "American" currency. This is due to the fact that additional pressure on these currencies began to exert problems of a "local" nature. The pound suddenly came under pressure again from Brexit's already forgotten topic, which receded into the background for some time in connection with the pandemic. Recent events have shown that the final compromise between the EU and the UK has not yet been found, which is causing the British currency to decline even in the face of a much weaker economic position of the dollar. In turn, the somewhat more complex picture emerging around the US-China trade relations puts pressure on the Australian and New Zealand dollars. The latter, unlike the former, began to experience more noticeable problems amid a decline in exports of goods from New Zealand to China. In general, the topic of resuming the tough confrontation between America and China will play a significant role this year. It will be good for the global economy if it ends after the election of the US President. So far, D. Trump has been actively using it in the political situation, trying to whitewash himself for his mistakes in a timely response to the start of the COVID-19 pandemic in America. Moving the topic of China's guilt for this pandemic will affect the mood of investors and force them to exercise noticeable caution in making investment decisions. We expect that a noticeable change in the situation will occur only in the case of more noticeable positive changes around the coronavirus crisis. We believe that only closer to the fall of the US and European economies, and then the global economy as a whole, will begin to recover, thus reviving the financial markets. Forecast of the day: The GBP/USD pair may correct upwards to 1.2140. If this level holds, then the pair will decline again amid Brexit's topic and rush to the level of 1.2025. The NZD/USD pair is also correcting upwards, which may lead to its local growth to 0.5970. Consolidating it below this level in the wake of the confrontation between the United States and China may lead to a decline again. In this case, it will resume to decline and fall to the level of 0.5840.

|

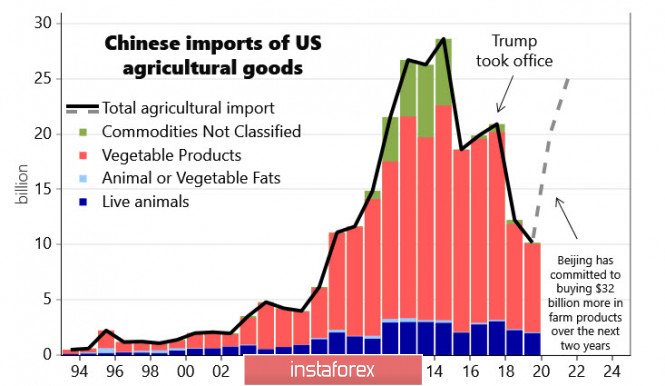

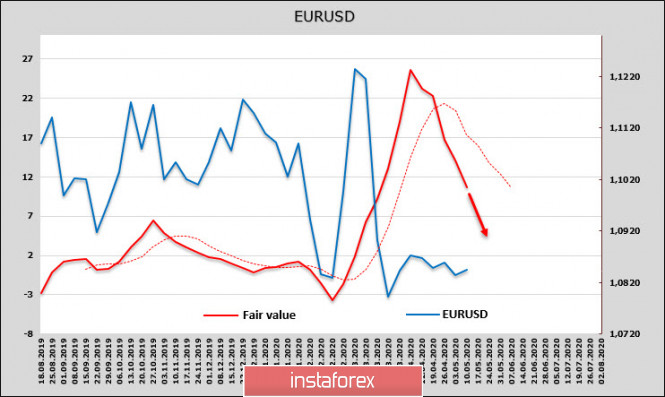

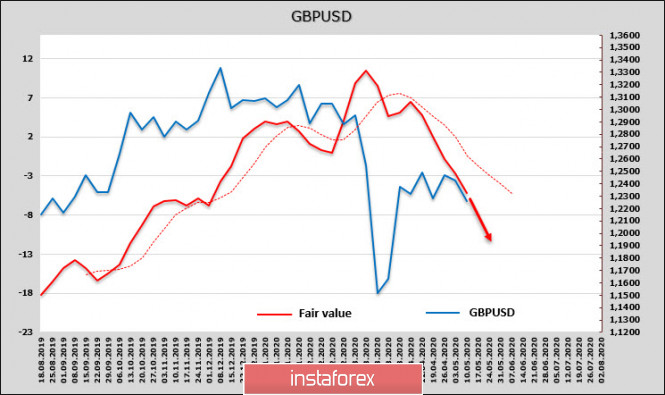

| The world economy is falling into chaos; Overview of EUR and GBP Posted: 18 May 2020 12:17 AM PDT According to the CFTC Friday report, speculative sentiment on major currencies did not change much last week. The total dollar short fell slightly, mainly due to the commodity currencies CAD, AUD and NZD increased the net short, which, together with a fairly noticeable increase in the short on oil, increases the chances of a resumption of sales and another wave of flight from risk. In favor of strengthening the dollar, there is also a reduction in the net long for gold, which, as a rule, indicates the development of a wave of strengthening of the USD. The approach of US elections is forcing candidates to look for steps that can enhance electoral support, and in this wave, Trump's anti-Chinese argument will inevitably increase. There are sufficient reasons – for example, an unrealized trade deal concluded before the pandemic. It is simply impossible to increase purchases of agricultural products by 32 billion due to low prices for raw materials; a number of banks expect USD / CNY growth in this regard and, as a result, pressure on commodity currencies will increase. A number of banks (in particular, Nordea and Scotiabank) suggest that pressure on China creates serious prerequisites for the development of deflationary trends, as China exported disinflationary momentum both during the trade confrontation and during the pandemic. In particular, the Nordea model assumes a decline in inflation in the United States to 0.5%, which, in turn, puts the Fed ahead of the need to look for additional measures to maintain demand. How to implement this task is completely incomprehensible. The vast majority of banks (DanskeBank, Mizuho and NAB can be added to the above) agree that rapidly lifting quarantine measures will not lead to a recovery of national economies, and the crisis will drag on for a much longer period than the market sees. Hence the conclusion - pressure on risky assets will continue in the long term. EUR/USD Despite the fact that the net long on the euro recovered slightly (by 257 million according to the CFTC report) after three weeks of sales, the overall situation on the euro continues to deteriorate. This is noticeable in other components of the estimated fair price - the yields of the 10-year-old Bundes have fallen over the past 4 weeks, while the US treasures have been holding above 0.6%, providing, albeit a minimal, increase in the yield spread in favor of the dollar. The main reason for the gradual reversal of sentiment in the euro is that the period of a panic exit from risky assets ends, which automatically reduces the demand for the euro as the main funding currency. Another reason is geopolitical. While the US Federal Reserve and Donald Trump are debating in public space, the German court takes a legally significant step, casting doubt on the legitimacy of a number of ECB decisions. Despite the fact that the ECB does not intend to execute court decisions, a fair amount of uncertainty has been added to investor sentiment, as the Bundesbank uses this decision to strengthen its position. On Tuesday, ZEW will present the May indicator of economic sentiment. Given that there is a 87% correlation between ZEW and GDP, it can be assumed that markets will receive a fairly accurate forecast of GDP growth. EUR/USD is still holding above support 1.0775, but the probability of breaking through down remains high, which will automatically lead to testing the support of 1.0726. GBP/USD The pound has no reason to expect a recovery on Monday morning. The net short position on the CME increased to 1.049 billion, this is not a very high advantage, but the trend is negative and it is confirmed by a number of other indicators. The failure of trade negotiations between the EU and the UK increases pressure on the pound, as investors return to the Brexit topic again. In any case, the transition period will be completed before the end of the year, and amid the global crisis, both parties, the EU and Great Britain, are desperately fighting for more favorable terms of trade. A report on the labor market will be released on Tuesday, but it will turn out to be uninformative, since it will include data for March and will not give a general picture of the decline in the labor market in April. On Wednesday, a report on inflation and prices in the manufacturing sector will be released, from which surprises are likely since there is no exact data on the depth of the economy's decline. In any case, an increase in anti-risk sentiment is not in favor of the pound. The GBP/USD pair went below the support level of 1.2160, the trend remains negative, and even the chances of a correction to 1.2230/50 look low. The current impulse has not yet been worked out, the decline to support at 1.1950/60 is justified, and it is clearly too early to look for a basis for purchases. The material has been provided by InstaForex Company - www.instaforex.com |

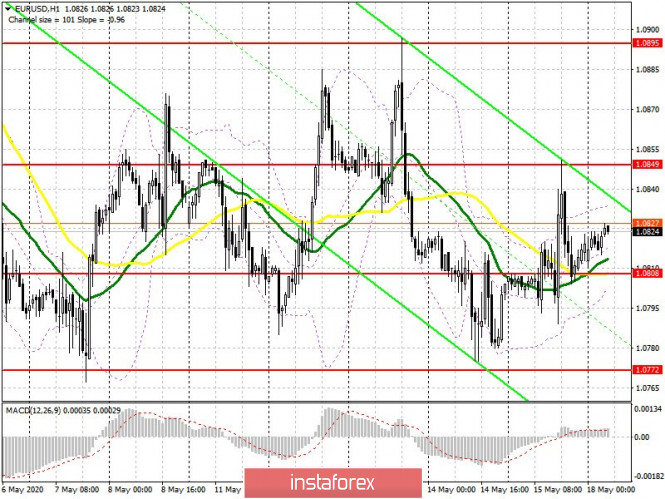

| EUR/USD Rising odds for a move lower! Posted: 18 May 2020 12:11 AM PDT EUR/USD has increased a little, but the selling pressure is still high as the USDX is about to break strong resistance. The Dollar Index further advance will force EUR/USD to drop further and to reach fresh new lows. The pair is trapped within an extended sideways movement, but I really hope that we'll have a clear direction soon. EUR/USD is trading near the range support, so a breakdown is favored if the USDX resumes the upside movement. Powell's speech about the COVID-19 crisis and economic outlook has lifted the price, but the increase could be only a temporary one.

EUR/USD is moving in a range between 1.0990 and 1.0777 levels, it was rejected by the static support, but it has failed to come back towards the pattern's resistance, signaling selling pressure. It has come back to retest the weekly Pivot Point (1.0829) after another failure to approach and reach the second warning line (wl2) of the orange ascending pitchfork. Technically, the failure to reach the warning line (wl2) has confirmed a minor bullish momentum, but personally, I believe that EUR/USD will reach this potential downside target/dynamic support soon. A valid breakdown below the warning line (wl2) is favored when it is reached by EUR/USD price. So, a valid breakdown below the second warning line (wl2) will most likely bring a breakdown below the 1.0777 static support and below the S1 (1.0762) level and will confirm a further drop. In the short term, a breakout above the PP (1.0829) level will validate an increase towards the R1 (1.0884) level.

Long - EUR/USD could register a broader increase if the price registers a valid breakout above the 1.0990 static resistance, after a valid breakout from this extended sideways movement, the first target will be somewhere at 1.1200 - 1.1215 area. However, the pair could increase in the short term as well, so a valid breakout above the R1 (1.0884) level and above the 1.0896 high will validate a further increase. Another false breakdown with a great separation below the 1.0777 static support will offer a great buying opportunity as well, the target will be at the 1.0990 level. Short - a further drop will be confirmed after a valid breakdown below the second warning line (wl2), below the 1.0777 static support and below the weekly S1 (1.0762) level. This potential downside breakout will suggest a drop at least till the 1.0654 level and towards the 1.0640. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of the EUR/USD pair for the week of May 18-23 Posted: 18 May 2020 12:04 AM PDT Trend analysis: This week, the price from the level of 1.0818 (closing of the last weekly candlestick) can start to move up with the first target at 1.0862 - a pullback level of 38.2% (blue dashed line). After breaking through this level, the price will continue to move up to the next upper target at 1.0892 - a pullback level of 50.0% (blue dashed line).

Fig. 1 (weekly schedule). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - neutral; - trend analysis - up; - Bollinger Lines - down; - monthly chart - up. The conclusion of a comprehensive analysis is an upward movement. The overall result of calculating the candle of the EUR/USD currency pair according to the weekly chart: the price of the week is likely to have an upward trend with the absence of a lower shadow for the weekly white candlestick (Monday - up) and the presence of a second upper shadow (Friday - down). The upper weekly target is 1.0921 - a pullback evel of 61.8% (blue dashed line). An unlikely lower scenario: working down with the target at 1.0711 - a pullback level of 85.4% (red dashed line) from the support line 1.0803 (blue bold line). The material has been provided by InstaForex Company - www.instaforex.com |

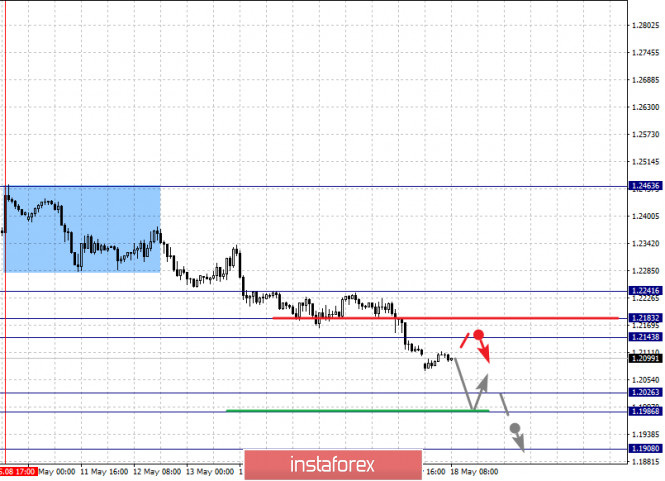

| Indicator analysis. Daily review on GBP / USD for May 18, 2020 Posted: 17 May 2020 11:53 PM PDT Trend analysis (Fig. 1). Today, an upward movement is possible from the level of 1.2108 (closing of the Friday afternoon candle) with the target of 1.2160 - a 14.6% retracement level (presented in a red dashed line). If this line is reached, the upward movement is likely to continue with the next target at the resistance line 1.2265 (presented in a red bold line).

Fig. 1 (daily chart). Comprehensive analysis: - Indicator analysis - up; - Fibonacci levels - up; - Volumes - up; - Candlestick analysis - up; - Trend analysis - up; - Bollinger Lines - up; - Weekly schedule - up. General conclusion: Today, the price may move upward with the target at the resistance line 1.2265 (presented in a red bold line). Another possible scenario is a downward trend from 1.2160 - a 14.6% retracement level (presented in a red dashed line) with the target of 1.1884 - a 61.8% retracement level (presented in a blue dashed line). The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EUR/GBP for May 18 - 2020 Posted: 17 May 2020 11:30 PM PDT

EUR/GBP has finally broken through key resistance at 0.8866. The pair is likely to move higher to 0.9066 as its first obstacle. However, in the longer-term, we should see EUR/GBP to go above the 0.9499 peak. Support is now seen at the former resistance at 0.8866. This should ideally protect the downside for a continuation higher to 0.9066 and ultimately to 0.9499. R3: 0.9183 R2: 0.9066 R1: 0.8987 Pivot: 0.8934 S1: 0.8914 S2: 0.8866 S3: 0.8850 Trading recommendation: We buy EUR from 0.8760 and we will move our stop higher to 0.8815 The material has been provided by InstaForex Company - www.instaforex.com |

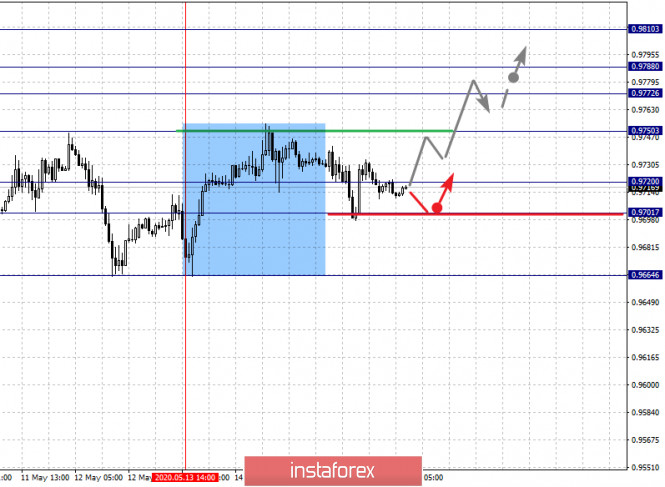

| Indicator analysis. Daily review on EUR / USD for May 18, 2020 Posted: 17 May 2020 11:22 PM PDT The pair traded upward on Friday after breaking through the support line 1.0790 (presented in a blue bold line). It then tested the 21 average EMA 1.0854 (presented in a black thin line) and then traded downwards. Today, the price may continue to move up. Nothing is expected from the economic calendar news. Trend analysis (Fig. 1). Today, an upward trend is possible from the level of 1.0822 (closing of the Friday afternoon candle) with the target of 1.0864 - a 38.2% retracement level (presented in a blue dashed line). It is very likely that from this level, the price may continue to move upward with the target of 1.0894 - a 50.0% pullback level (presented in a blue dashed line).

Fig. 1 (daily chart). Comprehensive analysis: - Indicator analysis - up; - Fibonacci levels - up; - Volumes - up; - Candlestick analysis - neutral; - Trend analysis - up; - Bollinger Lines - down; - Weekly schedule - up. General conclusion: Today, the price may continue to move upward with the target of 1.0864 - a 38.2% pullback level (presented in a blue dashed line). Another possible scenario is a downward trend from the level of 1.0822 (closing of the Friday afternoon candle) with the target at the support line 1.0794 (presented in a blue bold line). The material has been provided by InstaForex Company - www.instaforex.com |

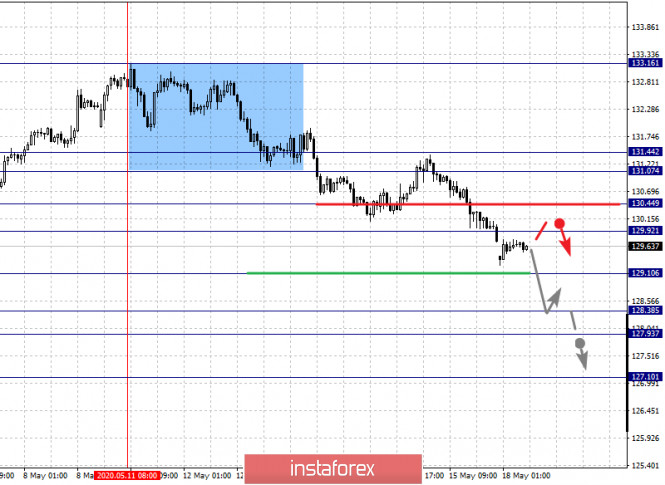

| Elliott wave analysis of GBP/JPY for May 18 - 2020 Posted: 17 May 2020 11:22 PM PDT

GBP/JPY has declined as we expected. It should now stay below minor resistance at 131.42 as the downside pressure is likely to extend towards 127.69 and ultimately below 123.99 to complete the long-term decline from 147.95. Ideally, resistance in the 130.22 - 130.58 area will cap the upside for a continued downside pressure towards 127.69 and 123.99. Only an unexpected break above resistance at 131.42 will question the bearish outlook and indicate a possible turn-around for a bullish outlook. R3: 131.42 R2: 130.58 R1: 130.22 Pivot: 129.85 S1: 129.24 S2: 128.80 S3: 128.35 Trading recommendation: We sold GBP at 131.88 and we will lower our stop to 131.50 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. British pound remains under pressure. Posted: 17 May 2020 11:07 PM PDT The pair is located at the levels of two-month lows and is testing the 20th pattern. The British pound remains under pressure. Even the relative vulnerability of the US dollar does not allow the GBP/USD bulls to organize a more or less large-scale correction. At the end of the weekend, the greenback depreciated throughout the market as dollar bulls reacted negatively to the debate over a $3 trillion additional assistance bill to the US economy. Let me remind you that the Democrats managed to approve this document in the House of Representatives, where they control the majority. Under the bill, a trillion dollars is to be allocated to state and local governments, including new direct payments to individuals, and financial aid to the unemployed, tenants and homeowners. However, representatives of the Democratic Party met with fierce criticism from the Republicans even in the lower house of parliament. They believe that Washington has already allocated enough funds to support the economy, while the initiative of the Democrats is just promotion of their party, especially in light of the upcoming presidential election. Republicans made it clear that the bill has no chance in the Senate. The White House also criticized the document hinting that Trump would not sign it, even if it got the approval of the Upper House of Parliament. In addition, Fed's Chairman Jerome Powell insisted on the adoption of an additional assistance package last week. As a result the greenback came under pressure.

The GBP/USD pair ignored these events and the weakening of the greenback did not affect positions of the British pound. On the contrary, the pound started the trading week with a small downward gap. On Friday, the trading ended at 1.2103, while on Monday the market opened at 1.2085. It happened due to several fundamental factors. Firstly, traders are still affected by the latest macroeconomic releases that were published last week. Let me remind you that in the first quarter, the UK's GDP fell by 2% in quarterly terms and by 1.6% in annual terms. Even though experts anticipated a worse result (-2.6% q/q -2.1% y/y), this was the largest drop over the past 11 years. Consumer spending decreased by 1.7% compared to the previous quarter. Last time it happened at the end of 2008. Meanwhile, industrial production collapsed by 4.2% m/m. It was the sharpest decline since January 1971. Secondly, traders reacted negatively to the data of the parliamentary report which was published by The Sun. According to the report, supporters of European integration are now putting strong pressure on Boris Johnson to approve the extension of the transition period for another two years since the parties obviously do not have time to agree on all points of a large-scale trade deal between London and Brussels amid the pandemic. Meanwhile, according to the same report, such a prolongation can be very expensive. Economists believe that if the transition period is postponed for another two years, the costs of the UK's withdrawal from the EU may increase ten times including obligatory payments to the EU budget (11 billion pounds per year), losses from unregulated exit from the free trade zone, bureaucratic costs, uncontrolled migration and obligations to save subsidized budgets in the eurozone. Britain's total losses could rise to five trillion pounds in the worst-case scenario. Given the extremely negative consequences of the epidemic for the British economy, such projected financial losses have led to a fall of the British pound, including the GBP/USD pair. According to another report, published by the Daily Telegraph, the crisis this year forms a 340 billionth hole in the state budget (this is more than a third of the total budget). In the less optimistic scenario, if the quarantine continues or the second wave of the epidemic occurs, the deficit of the British budget may amount to more than half a trillion pounds in the fiscal 2020-2021 year. Such huge losses amid the lack of progress in the negotiations between London and Brussels also put significant pressure on the GBP/USD pair. Thus, the general fundamental background for the pair is extremely negative. The news from the coronavirus front provided little support to the pound. On Sunday, the UK recorded the lowest mortality rate from the coronavirus. However, the number of deaths on weekends is often lower than during the week due to the specifics of reporting. Therefore, this factor had a weak effect on the dynamics of the pair. All this speaks about the advantages of short positions for the GBP/USD pair.

From the technical point of view, the pair on the daily chart is located on the lower line of the Bollinger Bands indicator which also indicates the priority of the downward movement. The pair shows a clear bearish trend which is confirmed by the main trend indicators such as Bollinger Bands and Ichimoku. The downward trend formed the strongest bearish Line Parade signal on all of the above time frames. On D1, all indicator lines are above the price chart demonstrating pressure on the pair. In order to determine the main downward target, let's take a look at the weekly time frame. It is better to focus on the Tenkan-sen line which is the price of 1.2030. It is important to be extremely careful with sell deals at the very base of the 20th pattern as the bears may not have enough strength to lower the price to the 19th price level. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of ETH/USD for May 18, 2020: Posted: 17 May 2020 11:01 PM PDT Crypto Industry News: Visa has applied for the creation of a digital currency on Blockchain at the United States Patent and Trademark Office. According to the published application, inventors Simon Hurry and Alexander Pierre of the Visa International Service Association in San Francisco applied for a patent for the digital currency registered on Blockchain and controlled by the computer of the central unit. The application cites Ethereum as a possible network, and the cryptocurrency itself would be a stablecoin. The application lists two points, one of which would indicate that "a digital currency was created for the amount associated with the denomination for the public key associated with the digital wallet." The second entry is about "removing physical currency from circulation in the currency system." While the US dollar is specifically mentioned as one of the fiat functional currencies to be used, the application said that the patent could apply to other central bank digital currencies such as pounds, yen and euros: "The physical currency of the central bank anywhere in the world can be digitized. " Technical Market Outlook: The ETH/USD pair has broken through the short-term trend line resistance around the level of $205 and made a new local high during the rally at the level of $216 (at the time of writing the article). The momentum behind the move up is strong, but the market conditions are extremely overbought on the daily time frame chart, so the rally might be short-lived. Nevertheless, the next target for bulls is seen at the level of $217.65 and $225.84. Weekly Pivot Points: WR3 - $259.01 WR2 - $231.70 WR1 - $222.59 Weekly Pivot - $197.56 WS1 - $188.48 WS2 - $163.94 WS3 - $154.56 Trading Recommendations: The larger time frame trend on Ethereum remains down and as long as the level of $288 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred.

|

| Posted: 17 May 2020 10:58 PM PDT Markets continue to ignore weak fundamental data and forecasts published by central bankers. Gold, amid all that is happening, is nearing October 1, 2012's high, at the level of 1800. Traders ignored the Fed statements over the weekend, but it's clear that the demand for risky assets is unlikely to increase in the near future, especially considering the weak reports that were published on Friday regarding the state of the US economy. Meanwhile, the British pound is to continue its decrease against the US dollar, after another failed negotiations on trade relations between the UK and the EU. Yesterday, Fed Chairman Jerome Powell made a number of forecasts saying that in the second quarter of 2020, the US economy will shrink by 20%, and total unemployment will reach above 25%. According to him, at present, the authorities need to coordinate their actions and continue to support both the business and the households that are most exposed to the coronavirus, so financial support should be provided over the next 3-6 months, until the effects of the economic downturn cease to have such a strong impact on the economy and population of the country. Powell did not rule out the possibility that the US economy may face a crisis comparable in scale to the Great Depression. With regards to the COVID-19, the United States is still pushing to conduct an investigation on the virus, threatening sanctions against China if it refuses to cooperate. This weekend, US Secretary of State Mike Pompeo revealed that there are no movements in the investigation, as China continues to refuse providing the necessary information for an objective assessment. Pompeo also said that all proposals to help China determine where the virus came from were rejected. The data published on Friday regarding US retail sales disappointed traders, because of the record drop observed in the April index. According to the report, the data turned out to be much worse than economists' forecasts, as many households were forced to abandon shopping because of the proliferation of COVID-19, as well as the decrease on goods available for purchase. Thus, US retail sales in April dropped immediately by 16.4%, much lower than economists' forecast of no more than 11%. In March, sales were already down by 8.3%. Industrial production in the US also showed a similar record drop in April of this year, due to the suspension of plant operations and interruptions in the supply chain. According to the US Federal Reserve, the index fell immediately by 11.2% in April, slightly lower than economists forecast of 11.1%. The manufacturing industry suffered the most, with a 13.7% decline recorded in production. The only good news on Friday was the report on consumer sentiment in the US, which slightly improved in early May, due to the expectations of government assistance. The report published by the University of Michigan revealed that the preliminary consumer sentiment index rose to 73.7 points in mid-May, up from economists forecast of 65.0 points. However, experts continue to note that many consumers do not expect a quick economic recovery, and are increasingly worried about problems related to employment and income. Meanwhile, production activity in the area of New York Fed declined in May this year. According to the report, the manufacturing index turned out to be -48.5 points in May, much lower than economists forecast of -60.0 points. A slight increase in production activity in the first half of the month had a positive effect on the indicator, but more than 63% of respondents reported deteriorating business conditions. As for the technical picture of the EUR/USD pair, the situation has not changed much. Trading continues to be conducted in the side channel, and buyers of risky assets need to make maximum efforts to break through the upper border at 1.0850, which will lead to an increase of the euro to the area of the 1.0900 and 1.0980 highs. Meanwhile, in case of a breakdown of the lower boundary of the side channel in the area of 1.0775, demand on the euro will decrease, which will bring the pair to the lows of 1.0700 and 1.0630. GBP/USD The pound resumed its decline against the dollar, after the lower border of the correction channel was broken through, the main reason of which is the failed trade negotiations between the UK and the European Union last Friday. Given the current state of the UK economy, the additional problems associated with trade relations after Brexit only exacerbated the situation. Recall that the transition period after Brexit ends at the end of this year, and as stated in the EU, should be extended to continue consultations. However, at the end of last year, British Prime Minister Boris Johnson announced that he does not plan to make such a request to his European partners, and so far had not changed his opinion regarding it. The most problematic issues related to the settlement of trade relations between the UK and the EU are the conditions for duty-free trade. The EU has put forward a number of requirements for compliance with common standards in the areas of environmental protection, regulation of labor relations and social support, but the UK does not want to comply with these requirements. The next EU summit will be held in June this year, and the trade negotiations will resume on June 1. As for the technical picture of the GBP/USD pair, there is a clear bearish mood in the pound, so opening buy positions will not be profitable. Thus, it is best to wait for the major lows to be updated in the areas of 1.2000 and 1.1930, and look for attempts to form the bottom in these ranges. Sellers attempt to break down the support level of 1.2075, the success of which will lead to further sell-offs of the pound. Meanwhile, in case of an upward correction, the increase will be limited by the resistance levels 1.2180 and 1.2250. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of BTC/USD for May 18, 2020: Posted: 17 May 2020 10:51 PM PDT Crypto Industry News: Counterfeit products "Made in Italy" are sold in markets around the world. The Italian government began the fight against these counterfeits by investing 15 million euros in developing a solution to this problem based on Blockchain. According to a new counterfeit report, the 'Made in Italy' label resulted in losses of EUR 12.4 billion in 2016 alone. Such losses directly affect the income as well as the future survival of many Italian artisans. The Italian fashion industry and the association of this country with handicrafts contribute to the prestigious reputation of the "Made in Italy" brand. If the name were registered as a brand, it would be the third most valuable property in the world (after Coca Cola and Visa). The high status of this brand has led to an increasing problem with counterfeit goods. These counterfeits facilitate the theft of intellectual property and destroy the reputation of the label, brands and craftsmen represented by the label. They also cost billions of dollars to the entire industry. The Italian government has recognized this threat and identified Blockchain technology as a potential solution. Recently, the government has allocated EUR 15 million to support the rapid implementation of digital technologies, including the financing of a joint project of IBM Italy and the artisan community. Aspects of the industry that are being considered for improvement include: authentication of goods and raw materials through the supply chain, secure book of intellectual property rights, demonstrable sustainability and ethical practices, and closer relationships between brands and their clients. Technical Market Outlook: The BTC/USD pair has been going up all the weekend and now is hovering around the level of $10,000, which is the key short-term technical resistance for the bulls. Any violation of this level will lead to the local up trend extension towards the level of $10,227 - $10,430. The nearest technical support is seen at the level of $9,382. Please notice, the market conditions on daily time frame chart are extremely overbought. Weekly Pivot Points: WR3 - $12,194 WR2 - $10,994 WR1 - $10,553 Weekly Pivot - $9,337 WS1 - $8,765 WS2 - $7,555 WS3 - 7,013 Trading Recommendations: The larger time frame trend remains down and as long as the level of $10,791 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred until the level of $10,791 is clearly violated.

|

| Fractal analysis of the main currency pairs for May 18 Posted: 17 May 2020 10:49 PM PDT Forecast for May 18: Analytical review of currency pairs on the scale of H1:

For the euro / dollar pair, the key levels on the H1 scale are: 1.0922, 1.0895, 1.0853, 1.0831, 1.0800, 1.0778, 1.0746, 1.0723 and 1.0694. Here, we monitor the formation of the initial conditions for the downward movement of May 13. At the moment, the price is in the zone of initial conditions. A short-term downward movement is expected in the range of 1.0800 - 1.0778. The breakdown of the last level should be accompanied by a pronounced downward movement. Here, the target is 1.0746. Price consolidation is in the range of 1.0746 - 1.0723. For the potential value for the bottom, we consider the level of 1.0694. Upon reaching which, we expect consolidation, as well as an upward pullback. A short-term upward movement is expected in the range of 1.0831 - 1.0853. The breakdown of the last level will favor the development of an upward trend. In this case, the first target is 1.0895. For the potential level for the top, we consider 1.0922. We expect consolidation near this level. The main trend is the formation of potential for the bottom of May 13 Trading recommendations: Buy: 1.0831 Take profit: 1.0850 Buy: 1.0856 Take profit: 1.0895 Sell: 1.0800 Take profit: 1.0780 Sell: 1.0776 Take profit: 1.0746

For the pound / dollar pair, the key levels on the H1 scale are: 1.2241, 1.2183, 1.2143, 1.2026, 1.1986 and 1.1908. Here, we monitor the development of the downward structure of May 8 and currently expect to reach the level of 1.2026. Short-term downward movement, as well as consolidation is in the range of 1.2026 - 1.1986. For the potential value for the bottom, we consider the level of 1.1908. The expressed movement to which, is expected after the breakdown of the level of 1.1984. A short-term upward movement is possible in the range of 1.2143 - 1.2183. The breakdown of the last level will lead to an in-depth correction. Here, the potential target is 1.2241. This level is a key support for the downward structure. The main trend is the downward cycle of May 8 Trading recommendations: Buy: 1.2143 Take profit: 1.2181 Buy: 1.2185 Take profit: 1.2240 Sell: 1.2026 Take profit: 1.1986 Sell: 1.1984 Take profit: 1.1910

For the dollar / franc pair, the key levels on the H1 scale are: 0.9810, 0.9788, 0.9772, 0.9750, 0.9720, 0.9701 and 0.9664. Here, we are following the formation of initial conditions for the upward movement of May 13. The continuation of the upward movement is expected after the breakdown of the level of 0.9750. In this case, the target is 0.9772. Short-term upward movement, as well as consolidation is in the range of 0.9772 - 0.9788. For the potential value for the top, we consider the level of 0.9810. Upon reaching this level, we expect a downward pullback. A short-term downward movement is possible in the range of 0.9720 - 0.9701. Hence, there is a high probability of an upward reversal. The breakdown of the level of 0.9701 will lead to the development of a downward trend. In this case, the potential target is 0.9664. The main trend is the upward structure of May 13 Trading recommendations: Buy : 0.9750 Take profit: 0.9786 Buy : 0.9790 Take profit: 0.9810 Sell: 0.9720 Take profit: 0.9702 Sell: 0.9698 Take profit: 0.9665

For the dollar / yen pair, the key levels on the scale are : 108.09, 107.91, 107.67, 107.46, 107.15, 107.02, 106.73, 106.45, 106.08 and 105.84. Here, we are following the formation of the descending structure of May 11. At the moment, the price is in correction and has formed a small potential for the top. We expect a short-term downward movement in the range of 107.15 - 107.02. The breakdown of the last level will lead to a resumption of a downward trend. In this case, the first target is 106.73. The breakdown of which will allow us to expect movement to the level of 106.45. Price consolidation is near this level. The breakdown of the level of 106.45 should be accompanied by a pronounced downward movement. Here, the goal is 106.08. We consider the level of 105.84 to be a potential value for the bottom. Upon reaching which, we expect consolidation, as well as an upward pullback. We expect the development of the rising structure from May 14 after the breakdown of 107.46. Here, the first goal is 107.67. Price consolidation is near this level. The breakdown of the level of 107.67 should be accompanied by a pronounced upward movement. Here, the goal is 107.91. We consider the level of 108.09 to be a potential value for the top. Upon reaching which, we expect a downward pullback. The main trend: the descending structure of May 11, the stage of deep correction Trading recommendations: Buy: 107.47 Take profit: 107.65 Buy : 107.69 Take profit: 107.90 Sell: 107.00 Take profit: 106.75 Sell: 106.71 Take profit: 106.47

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4292, 1.4234, 1.4189, 1.4124, 1.4071, 1.4040, 1.4006 and 1.3952. Here, we are following the development of the upward cycle of May 11. The continuation of the further upward movement is expected after the breakdown of the level of 1.4124. In this case, the target is 1.4189. The breakdown of which, in turn, will allow us to count on movement to 1.4234. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.4292. Upon reaching which, we expect a downward pullback. A short-term downward movement is possible in the range of 1.4040 - 1.4006. The breakdown of the last level will lead to an in-depth correction. In this case, the target is 1.3952. This level is a key support for the top. We expect the initial conditions for the upward cycle to be formed before it. The main trend is the upward cycle of May 11, the correction stage Trading recommendations: Buy: 1.4125 Take profit: 1.4187 Buy : 1.4191 Take profit: 1.4230 Sell: 1.4038 Take profit: 1.4006 Sell: 1.4003 Take profit: 1.3955

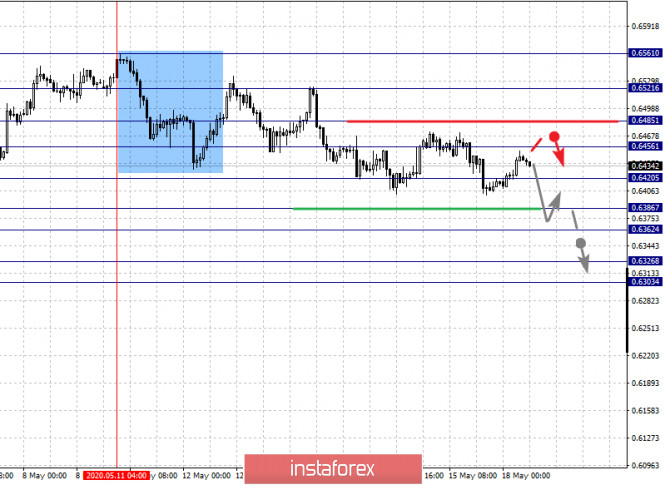

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6561, 0.6521, 0.6485, 0.6456, 0.6420, 0.6386, 0.6362, 0.6326 and 0.6303. Here, we are following the development of the descending structure of May 11. The continuation of the downward movement is expected after the breakdown of the level of 0.6420. In this case, the target is 0.6386. Price consolidation is in the range of 0.6386 - 0.6362. The breakdown of the level of 0.6362 will lead to a pronounced movement. Here, the target is 0.6326. For the potential value for the bottom, we consider the level of 0.6303. Upon reaching which, we expect consolidation, as well as an upward pullback. Short-term upward movement is possible in the range of 0.6456 - 0.6485. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.6521. This level is a key support for the downward structure and the price passing this will lead to the formation of initial conditions for the upward cycle. In this case, the potential goal is 0.6561. The main trend is the descending structure of May 11 Trading recommendations: Buy: 0.6456 Take profit: 0.6483 Buy: 0.6486 Take profit: 0.6520 Sell : 0.6420 Take profit : 0.6386 Sell: 0.6360 Take profit: 0.6326

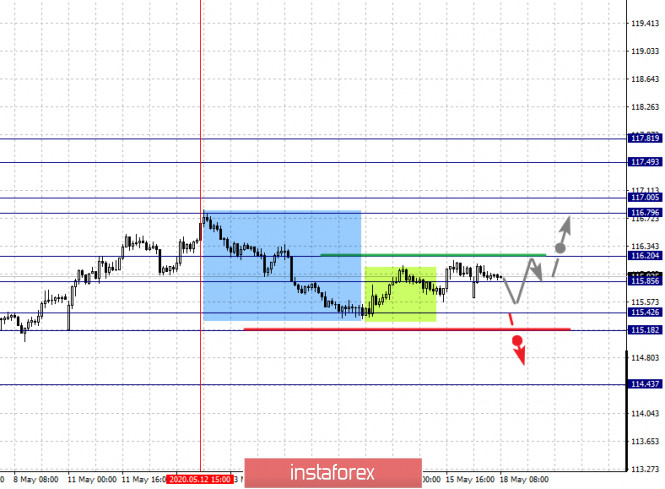

For the euro / yen pair, the key levels on the H1 scale are: 117.81, 117.49, 117.00, 116.79, 116.20, 115.85, 115.42, 115.18 and 114.43. Here, the price is close to the cancellation of the ascending structure from May 6, which requires passage of the noise range 115.42 - 115.18. In this case, the potential target is 114.43. A short-term upward movement is possible in the range of 115.85 - 116.20. The breakdown of the last level will have the subsequent development of an upward trend. Here, the goal is 116.79. The price passing the noise range of 116.79 - 117.00 will lead to movement to the level of 117.49. For the potential value for the top, we consider the level of 117.81. Upon reaching which, we expect consolidation, as well as a downward pullback. The main trend is the upward structure of May 6, the stage of deep correction Trading recommendations: Buy: 115.85 Take profit: 116.20 Buy: 117.00 Take profit: 117.47 Sell: 115.15 Take profit: 114.50 Sell: Take profit:

For the pound / yen pair, the key levels on the H1 scale are : 131.44, 131.07, 130.44, 129.92, 129.10, 128.38, 127.93 and 127.10. Here, we are following the development of the descending structure of May 11. The continuation of the downward movement is expected after the breakdown of the level of 129.10. In this case, the target is 128.38. Short-term downward movement, as well as consolidation is in the range 128.38 - 127.93. For the potential value for the bottom, we consider the level of 127.10. Upon reaching which, we expect consolidation, as well as an upward pullback. A short-term upward movement is possible in the range of 129.92 - 130.44. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 131.07. The range of 131.07 - 131.44 is the key support for the bottom, before it we expect the initial conditions for the upward cycle to be formed. The main trend is the descending structure of May 11 Trading recommendations: Buy: 129.92 Take profit: 130.40 Buy: 130.50 Take profit: 131.07 Sell: 129.10 Take profit: 128.40 Sell: 127.90 Take profit: 127.15 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of EUR/USD for May 18, 2020: Posted: 17 May 2020 10:42 PM PDT Technical Market Outlook: The EUR/USD pair has been trading inside of a narrow range between the levels of 1.0780 - 1.0846, but the bears are pushing the price towards the level of 1.0767 again. The bulls hasn't made a new local high yet, so the next target for them is still seen at the level of 61% Fibonacci retracement at 1.0921. This level must be clearly violated in order to rally towards the swing high at 1.1017. The momentum remains neutral, but might turn negative any time now. No clear trend indication, but the larger time frame trend remains down. Weekly Pivot Points: WR3 - 1.0995 WR2 - 1.0945 WR1 - 1.0876 Weekly Pivot - 1.0824 WS1 - 1.0753 WS2 - 1.0693 WS3 - 1.0627 Trading Recommendations: On the EUR/USD pair the main long term trend is down, but the reversal is possible when the coronavirus pandemic will be tamed. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

|

| Technical Analysis of GBP/USD for May 18, 2020: Posted: 17 May 2020 10:35 PM PDT Technical Market Outlook: The GBP/USD pair has made a new local low at the level of 1.2072. Despite the oversold market conditions the momentum remains negative well and the odds for another wave down are still high. The nearest technical resistance is seen at the level of 1.2165. If the level of 1.2072 is clearly violated, then the next target for bears is seen at the level of 1.2012, which is the key short-term technical support for bulls. No signs of down trend reversal yet. Weekly Pivot Points: WR3 - 1.2598 WR2 - 1.2514 WR1 - 1.2258 Weekly Pivot - 1.2179 WS1 - 1.1913 WS2 - 1.1832 WS3 - 1.1572 Trading Recommendations: On the GBP/USD pair the main trend is down, but the reversal will be possible when the coronavirus pandemic is tamed. The key long-term technical support has been recently violated (1.1983) and the new one is seen at the level of 1.1404. The key long-term technical resistance is seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518) or accelerate (1.1404). The market might have done a Double Top pattern at the level of 1.2645, so the price might move lower in the longer-term.

|

| Trade negotiations between UK and EU failed. Euro to continue falling Posted: 17 May 2020 10:17 PM PDT Signals for the EUR/USD pair: If the pair breaks through at 1.0849, the euro is likely to increase to 1.0895 and 1.0923 A breakthrough at 1.0808 may lead to a sell-off of the euro in the area of 1.0772 and 1.0727. Signals for the GBP/USD pair: If the pair breaks through at 1.2119, the British pound may rise to 1.2170 and 1.2225 A breakthrough at 1.2077 may lead to a sell-off of the British pound in the area of 1.2030 and 1.1927 The following fundamental data is set for release during the day:

|

| DXY testing 1st resistance , potential drop! Posted: 17 May 2020 09:57 PM PDT

Trading Recommendation Entry: 100.87 Reason for Entry: 50% fibonacci retracement ,100% fibonacci extension Take Profit :99.66 Reason for Take Profit: 100% fibonacci extension Stop Loss: 101.07 Reason for Stop loss: Horizontal pullback resistance The material has been provided by InstaForex Company - www.instaforex.com |

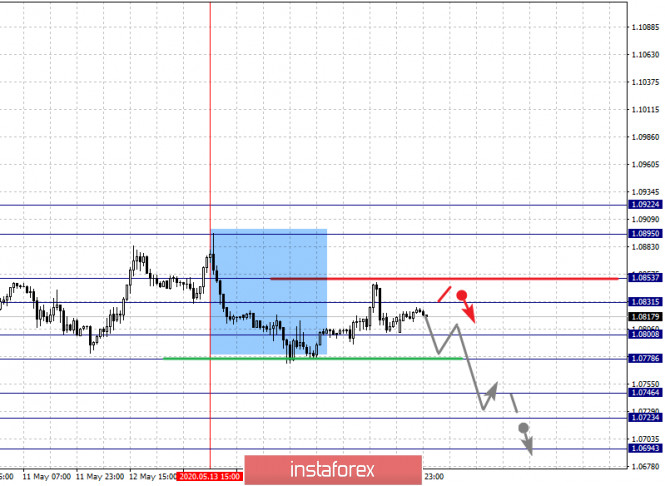

| Posted: 17 May 2020 09:21 PM PDT To open long positions on GBP/USD, you need: Friday's talks between the UK and the EU on the settlement of issues related to trade after Brexit, suffered another setback, negatively affecting the pound, which after breaking through major support levels, fell again. At the moment, the task of buyers is to maintain the low of 1.2077 and forming a false breakout on it will be a signal to open long positions. However, bulls must first break through and consolidate above the resistance of 1.2119, which will push EUR/USD to the highs of 1.2170, where the moving averages pass, and then to the resistance test of 1.2225, where I recommend taking profits. If there are no active actions on the part of buyers at the low of 1.2077, it is best not to try to catch the bottom, and postpone purchases until support is updated at 1.2030, or try long positions from the local low of 1.1927 in the expectation of a correction of 30-40 points within the day. To open short positions on GBP/USD, you need: Sellers have completely taken the market under their control and are now preparing to storm the next low of 1.2077, the test of which will only increase the pressure on the pound after the recent news, which will cause the pair to decline to the area of lows 1.2030 and 1.1927, where I recommend taking profits. However, when selling at current lows, do not forget about stop orders, since an upward correction can be formed at any time, and you will find yourself with short positions at the very bottom of the market. Therefore, it is better to wait for a false breakout to form in the resistance area of 1.2119, or sell GBP/USD on the rebound from the larger high of 1.2170 in the expectation of a correction from this level of about 25-30 points. A larger area for opening short positions is the resistance of 1.2225. Signals of indicators: Moving averages Trading is conducted below 30 and 50 moving averages, which indicates a bearish nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1. Bollinger bands In case of further decline, support will be provided by the lower border of the indicator in the region of 1.2050. Growth will be limited by the upper level at 1.2180. Description of indicators

|

| Posted: 17 May 2020 09:15 PM PDT To open long positions on EUR/USD, you need: Friday's data on the collapse of retail sales in the US did not result in a major strengthening of the European currency, and did not return the demand for the US dollar, only boosting the faith of investors in the need to buy gold. The current task of the bulls is to keep the 1.08 level, which was formed at the end of last week and also, forming a false breakout will be a signal for opening long positions based on a return and breakthrough of resistance 1.0849. This scenario will result in a larger upward wave in the area of highs 1.0895 and 1.0923, where I recommend taking profits. If there are no active actions in the support area of 1.08, it is best to postpone long positions in the euro until the test of a low of 1.0772, or buy immediately on the rebound from the larger support of 1.0728, since due to the lack of good news, the pressure on the market can return at any time. To open short positions on EUR/USD, you need: Sellers need to regain control of the 1.0808 level, consolidating below which will be a good signal to open short positions while expecting another decline in the area of the lower border of the 1.0772 side channel, which formed on May 7. A breakdown of this area will quickly pull down the euro to the lows of 1.0728 and 1.0636, where I recommend taking profits. If the bulls try to return to the market in the first half of the day, then an unsuccessful attempt to update last Friday's high in the area of 1.0849 will be a signal to open short positions. It is best to sell EUR/USD immediately for a rebound after testing the highs of 1.0895 1.0923, counting on a correction of 30-35 points within the day. Signals of indicators: Moving averages Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger bands Volatility has decreased. A break of the lower border of the indicator in the region of 1.0805 will increase pressure on the euro, which will result in another wave of decline in the pair. Bulls should not have problems with growth above the upper boundary of the indicator in the area of 1.0830. Description of indicators

|

| Forecast for EUR/USD on May 18, 2020 Posted: 17 May 2020 08:02 PM PDT EUR/USD The euro slightly grew last Friday, blocking Thursday's fall of 14 points. The quote is nearly unchanged today in the Asian session, and the euro will probably stand idle all day waiting for tomorrow's EU summit (ECOFIN), which will consider a trillion-dollar package of economic assistance in the form of loans and grants. The final size of the fund and its proportional distribution will obviously affect investor sentiment. At the moment, expectations are optimistic, which can be seen even from a technical point of view; The euro is below the indicator lines, but is growing, the signal line of the Marlin oscillator is moving along the border dividing the growth zone from the decline zone in potential (leading) market trends. Growth potential is the upper boundary of the horizontal band that has been running since April, at 1.0995. The price went above the balance (red) and MACD (blue) indicator lines on the four-hour chart, the Marlin oscillator pinned in the positive trend zone. The immediate goal for growth is the peak of May 13 at the price of 1.0897. Trading in any direction in a local situation today carries a risk of uncertainty. |

| Forecast for GBP/USD on May 18, 2020 Posted: 17 May 2020 07:58 PM PDT GBP/USD The pound went ahead of the market and lost around 130 points last Friday. The price is below both indicator lines, the Marlin Oscillator is in the decreasing trend zone. Now the goals are open for the pound: 1.1750 - 223.6% according to the Fibonacci level, 1.1530 - support for the embedded line of the price channel of the monthly scope. Friday's price reversal is clearly visible down from the Fibonacci level of 161.8% from the four-hour chart, this indicates the continued relevance of this instrument, built on the first branch of the movement on December 13, 2019 - February 28, 2020. A price gap is open today, you need to wait for it to close, and then you can finally look for points to sell. A correction is possible to a strong level of 1.2165 - this is the low of May 14 and April 7. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on May 18, 2020 Posted: 17 May 2020 07:58 PM PDT AUD/USD The Australian dollar lost 47 points on Friday and that was enough for the Marlin oscillator to move into the negative trend zone and this was a signal to the market's readiness to decline further. The aussie's first target is the embedded line of the price channel at around 0.6348, which, most likely, will be overcome without difficulty. Behind it is the second target 0.6255 - support for the MACD indicator line. The third target 0.6127 is the underlying price channel line. The price is trying to go above the MACD line on the four-hour chart, the Marlin oscillator is still in the territory of the bears' possessions. A deeper price exit above the MACD line will enable the price to fulfill the first growth target at 0.6495 - the resistance of the price channel line on the daily chart. Exit above the level opens the second target of 0.6562 - the May 11 high. We are waiting for the corrective growth to be completed and prices to fall by today or tomorrow. Unless, of course, an alternative scenario with medium-term growth is fully disclosed, which will happen when the price is consolidated above the 0.6562 level. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on May 18, 2020 Posted: 17 May 2020 07:58 PM PDT USD/JPY The yen turned down from the MACD indicator line last Friday, and ended the day with a black candle at 19 points. The signal line of the Marlin oscillator slightly went into the bulls' territory. The initial target, and it is the signal level for a medium-term decline of 106.56, is still open. The price is kept below the MACD line on the four-hour chart, the Marlin oscillator is falling in the negative zone. We expect the yen to strengthen further against the dollar with previously defined goals: 105.10, 103.95, 102.30. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment