Forex analysis review |

- EUR/USD. The creation of a vaccine against the "coronavirus" in America could level the gap between Donald Trump and Joe

- GBP/USD. Results of the week. America continues to increase the national debt. The UK cannot and does not want to negotiate

- EUR/USD. Results of the week. Italy is going to accept 209 billion euros of aid and leave the European Union following the

- Comprehensive analysis of movement options for #USDX vs EUR/USD & GBP/USD & USD/JPY (Daily) on July 27, 2020

- Silver in focus: prospects and trading ideas

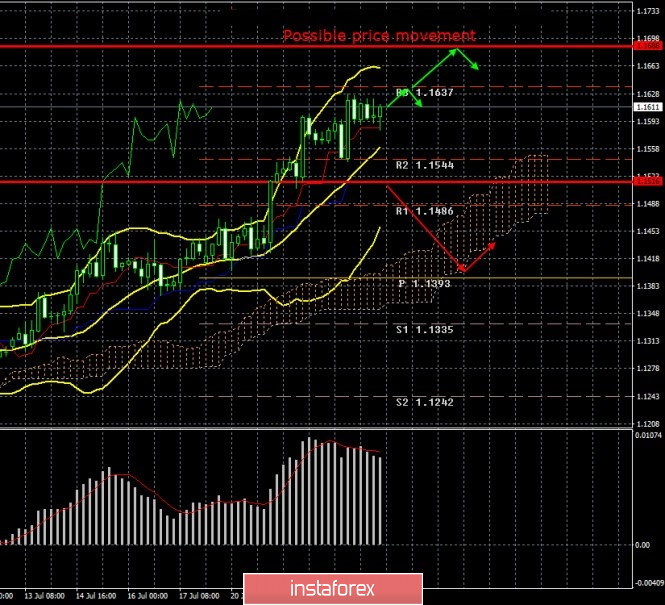

| Posted: 25 Jul 2020 10:42 AM PDT 24-hour timeframe Sometimes it is very useful to look at the daily chart of the pair's movement to understand what is happening to the instrument in the long term. And in the case of the European currency, everything becomes obvious. By and large, the upward trend began on May 7 after the markets recovered a little from the March and April shocks. Since then, the European currency has continued to appreciate and has already exceeded the highs of 2019 and 2020. That is, at this time, the euro currency is as expensive as possible over the past two years. We have repeatedly asked the question, what caused such a serious growth of the euro currency, given the fact that the European economy and the American one suffered approximately the same from the first "wave" of the epidemic, and according to experts, even the European one suffered more? It should also take into account the fact that even if the Fed cuts rates to the minimum level of 0.25%, they still remain higher than in the European Union. That is, what do we have in the dry balance? Monetary policy in the US remains more hawkish, and the economy is stronger. But at the same time, the euro currency is growing, despite the fact that there is no particularly positive news from the European Union. It is growing so that it updates two-year highs. In this case, you have to look at the situation as if from the outside and try to grasp all the factors. By the way, it should be said that the current situation in the currency market is very much satisfied with US President Donald Trump. Recall that from the very beginning of his presidential term, Trump dreamed of a "cheap" dollar. However, it was not possible to work in pairs with the Fed, so the dollar has basically continued to grow all this time (the last two years). What is happening now is great for America with its 26 trillion national debt. However, the dollar exchange rate on the international currency market does not depend on Trump. It depends at this time solely on the crises in which the United States have plunged. Social, economic, political, and epidemiological. We have covered all these crises in detail, and today we will focus in more detail on the political and prospects for Trump's re-election. Many experts and analysts have already buried the possibility of Trump winning the election again. And not without good reason. However, there are some experts who believe that the chances of Trump are not completely lost. First, the election is still three months away, and second, many have doubts about whether 77-year-old Joseph Biden will be able to lead the country adequately, and third, Trump is openly expected to play foul in the election. The sensitivity of the situation with Trump's political ratings is that the current US President is not to blame for the pandemic. Blame China, which accidentally or intentionally allowed the virus to spread around the world. Trump can only be blamed for the fact that his administration did not take the COVID-2019 virus seriously, which led to a huge number of diseases and deaths. But don't forget that 329 million people live in America. Therefore, in part, Trump is even right when he says that the incidence rates in the United States are not the highest in the world. If we take the percentage ratio between the number of cases and the number of the population, this is true. Plus, we should also not forget that the United States does conduct a lot of tests for "coronavirus". It is unlikely that, relatively speaking, the same Brazil or India, with their 2.3 and 1.3 million cases, has the same number of tests as in the United States. Thus, most likely, the first place in the world in terms of the number of diseases is not really the United States. Nevertheless, the Americans blame Trump for the fact that the "coronavirus" has spread to America. And not without good reason. And at the same time it is blamed for the economic crisis, because this is normal common logic. If Trump boasted for 3 years that the country is at its economic peak and this is his merit, then the current levels of recession and unemployment are also his "merit". Most importantly, states that traditionally vote for the Republicans or have supported Trump from the very beginning have the highest number of infections, which naturally cannot but affect the electoral mood of Americans. Trump is also losing support in the so-called "disputed" states, where the margin of one of the candidates is minimal in each election. According to the latest opinion polls, Joe Biden confidently holds the gap from Trump by 8-10% over the past 2-3 months. Statistics show that with this advantage three months before the election, only one candidate has not ended up as President since 1980. According to many experts, it is because of the "coronavirus" and the second "wave" of the epidemic in the United States that Trump lost most of his ratings. However, it is "coronavirus" that can become his main trump card in the fight against Biden. If American scientists manage to develop a vaccine before November 3, this achievement will also go into the piggy bank of the current president. He will be able to claim that it is because of his high attention to the pandemic that the country has invested heavily in developing a vaccine, so that now Americans have a cure, while other countries may not have one. And there is no doubt that in this case, for most Americans, Trump will immediately turn from an "anti-hero" to a "hero", and his political ratings will definitely grow. Also, many experts note that the ratio of tramp to the "coronavirus" has changed in recent years. Simply put, the US president has chosen a different strategy for dealing with the epidemic. If earlier Trump refused to wear a mask, called the virus a "runny nose" and claimed that it would not cause significant harm to America, now the mask is regularly present on Trump's face, he says that "the disease is very serious and the situation in the country may deteriorate", and also canceled several conventions of his party and election rallies, although a couple of weeks ago he held them. Also, Trump began to "set an example for Americans", which was missing from the very beginning of the epidemic. This was reported by the American president himself, which immediately shocked half of America. Although such changes in Trump's rhetoric are absolutely not new. The majority has long been accustomed to the fact that the US leader adheres to the principle "My word – I want to give it, I want to take it back". For the US currency, re-election or not re-election of Trump is a matter of long-term perspective. But creating a vaccine or reducing disease rates are pressing issues that can greatly help the dollar. So far, there is no question of a positive solution to these issues, so the dollar may continue to fall in price. Trading recommendations: On a 24-hour timeframe, the euro/dollar pair is moving steadily up, the bulls are extremely strong, and the bears are absent from the market. Therefore, buy orders with the target resistance level of 1.1725 remain relevant in July. It is recommended to sell the pair for the long term not before fixing the price below the critical line with the first goal being the support level of 1.1081. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Jul 2020 10:42 AM PDT 4-hour timeframe The British currency also continues to trade against the American currency with an increase. However, unlike the euro, the upward movement of the GBP/USD pair seems to have stalled over the past few days. Buyers hit the resistance area of 1.2755 and could not overcome this level until the close of trading on Friday. However, a strong downward correction has not started for all this time. Thus, in general, the upward trend continues. The reasons for the growth of the British pound, as in the case of the euro, should be found in the United States. They are identical. The only difference is the fundamental background of the Eurozone, which is essentially neutral. But the fundamental background from the UK continues to be very difficult. During this week, twice from Foggy Albion, we received news that an agreement with the European Union on relations after the final break will not be reached. First, the well-known British newspaper The Daily Telegraph wrote about this, citing a source close to government circles, and on Thursday, a similar statement was made by Michel Barnier, the chief negotiator for the European Union. "Because of its current refusal to commit to open and fair competition and a balanced fisheries agreement, the UK makes a trade agreement unlikely at the moment," Barnier said, speaking to the ambassadors of the 27 EU member states after the sixth round of negotiations. According to Barnier, London is not making any attempts to break the "impasse" in which negotiations are held on four key issues at once. According to Barnier, London refuses to take effective measures on climate, environment, labor, and social law that would avoid lowering standards. The EU's chief negotiator expresses a desire to trade with London without quotas, tariffs, but also without unfair competition. Mr. Barnier also said that Brussels deeply respects the choice of London and accepts all its political decisions, but this does not mean that the EU will pay for these decisions and the choice of the British. The most fundamental issue of fishing continues to hang like a sword of Damocles over the negotiation process, threatening at any moment to cut the thin rope that is still stretched between London and Brussels. According to Barnier, Britain wants to completely expel European fishermen from British waters, which is "absolutely unacceptable". In this regard, the EU also respects the right and desire of London to be a fully independent coastal state and in the future, Brussels is even ready to accept the privileged right of British fishermen, but the common fish stocks should be managed jointly following the principles of international law. Thus, we can only once again note that the positions of London and Brussels are located at different poles of the planet Earth and it is unlikely that anything will change in the near future. It is possible, of course, that the negotiations will move forward after Boris Johnson personally visits Brussels. But there is too little chance of that yet. Thus, from our point of view, the fundamental background for the British currency remains extremely negative, only saved by the fact that in America everything is even worse. On the last trading day of the week in the UK, business activity indices were published. In the manufacturing sector, business activity increased to a value of 53.6, and in the service sector – to a value of 56.6. However, we want to remind you that it is the UK that may become the most weakened country among all European countries from the "coronavirus" crisis. According to experts, the GDP of Britain in 2020 may be reduced by 14%. And the British have nowhere to wait for help now, they have left the European Union. If Italy, Spain, Poland, Hungary, Portugal, and others now receive billions of euros in grants and loans, for which all members of the alliance will pay, then the UK will now try to recover from the crisis itself. But at the same time and after Brexit. However, despite all these factors, the pound continues to be in demand (or the demand for the US dollar continues to decline). And looking at the discouraging situation in the United States, in principle, there are no questions why everything is happening this way. We have repeatedly said that with the current rate of growth in the incidence of coronavirus, the prospects for the American economy are generally clouded. Yes, the US Congress and the White House are likely to approve another trillion-dollar aid package by the end of this month. But what will happen if the epidemic continues to hold the United States firmly in its fist? This means that the next package of assistance to the economy will be needed in another month or two. And it turns out that America, which is very fond of living in debt, will continue to increase this very debt, which already amounts to 26 trillion dollars and will increase in 2020. Besides, it is unclear how the standoff with China will end, which could hit the American economy even harder. At the moment, it looks as if the presidential administration does not want to back down on the issue of confrontation with Beijing, but it does not want to inflame the situation with it. Washington is well aware(it has realized during the two years of the trade war) that the PRC will not go along with it. Any sanctions and duties are met with a mirror, and the fact that China is an export country, which means that it depends heavily on foreign markets(in particular, on the US), does not stop Xi Jinping from responding to Donald Trump on an equal footing. Thus, Washington would be happy to continue the escalation of the conflict. For "coronavirus", for "unfair treatment of America", for "theft of intellectual property", for Hong Kong and so on, but the state of its economy does not allow it to easily get involved in international conflicts. There was a certain stalemate. It is unlikely that Trump intended to end the trade standoff with Beijing by signing the "first phase" deal. However, the "second phase" is not even in question now. There are no new negotiations, the countries only continue to exchange mutual jabs in the form of sanctions against certain companies and officials, and have begun to close each other's consulates and representative offices on their territories. The only way out of this situation for us at this time is a change of power in America. If the Democrat Joe Biden comes to power, it will be possible to count on the fact that relations with China will improve. And everyone in the world will benefit from this since everyone depends on the American and Chinese economies to some extent. If Donald Trump remains in power for another 4 years, we can be sure that we will witness another 4 years of conflicts, trade wars, and other things. Recommendations for GBP/USD: For long positions: In the 4-hour timeframe, the EUR/USD pair continues its upward movement. Thus, the targets for long positions are now the levels of 1.2837 and 1.2846. For short positions: Sell orders can be opened in small lots no earlier than the price is fixed below the critical line with the first goal being the Senkou Span line B. Bear positions remain extremely weak. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Jul 2020 10:42 AM PDT 4-hour timeframe Another trading week ends on the currency market, and we summarize its results. First, consider the euro/dollar pair, which continues to trade higher, ignoring a huge number of fundamental and macroeconomic events. During the last trading day of the week, the upward movement did not continue, however, the downward correction did not begin. The pair just stood in one place for most of the trading day. Buyers do not see any new reasons for new purchases of the euro currency, and sellers continue to rest outside the market, so there is no one to help the US currency now. Throughout the week, no important macroeconomic reports were published in the United States or the European Union. We remind traders that since the coronavirus pandemic began in the world, markets have ignored all statistics. And this is even quite understandable, since it is not surprising that the economies of all countries of the world are simultaneously shrinking, and all the macroeconomic indicators have collapsed. Thus, traders are not interested in macroeconomic data in a state of "coronavirus crisis", however, they can not be ignored, since it is by them that we can judge the scale and speed of recovery of a particular economy. On Friday, July 24, several reports were finally published in the European Union. First, Germany and France released business activity indices for July for services and manufacturing, and then similar indices for the entire European Union. 8 out of 9 business activity indices exceeded the forecast values. The reaction of traders to these reports was eloquent – the euro remained in place. In the afternoon, similar indices were published in the United States and also did not cause any special reaction. Thus, we once again draw the attention of market participants to the fact that statistics now play an extremely insignificant role. What is important is the fundamental background and fundamental events. However, here, too, it all comes down to a few factors. We believe that the US dollar continues to fall in price against both the euro and the pound solely because of the events that are happening in the US now. We have repeatedly said that these are four crises at once (from our point of view) and the main factor pushing the dollar down is the "coronavirus" epidemic, for which anti-records are set almost daily. In short, now in America, 60-80 thousand new cases of the disease are registered every day. Over the past three days, more than 1,000 deaths from the virus have been recorded in the country. At the same time, the head of state, Donald Trump, continues to do nothing. It does not declare a state of emergency, it does not announce a new quarantine, it does not call on Americans to follow security rules, to distance themselves socially and to wear masks. For the first time in a long time, the head of the White House held a briefing on "coronavirus" and immediately stunned listeners and viewers with the phrase that "before the situation improves, it will probably get much worse". Many experts immediately asked the question, where is even worse? Moreover, if the situation is getting worse, why isn't the US government taking any drastic action? The answers to these questions remain shrouded in gloom, and Trump seems to continue to consider the "coronavirus" a runny nose. Well, while COVID-2019 continues to spread across the United States, investors and traders are afraid to buy the US currency, fearing both for its prospects and the prospects of the US economy as a whole. After all, it is no secret that the epidemic can not pass without a trace, even if the quarantine or "lockdown" in the country is not declared. Meanwhile, the European Union has begun to mature and a bad fundamental background. At the beginning of the trading week, markets were filled with optimism about the EU summit, at which all 27 participating countries agreed on both a 750 billion recovery fund and a budget for 2021-2027. However, on Thursday it became known that the European Parliament is dissatisfied with the current agreements and is not ready to approve both documents. The European Parliament, led by David Sassoli, believes that funding for many programs has been cut, and the entire budget is too small. Thus, Sassoli believes that negotiations with the European Commission and the European Council are now necessary to make a final decision, however, certain adjustments to the budget will still have to be made. The same applies to the recovery fund. Sassoli believes that the principle of "rule of law" is not well observed by Hungary and Poland, which are the beneficiaries of large sums, according to the current distribution plan of the recovery fund. Well, the most interesting information came on Friday, when it became known that the ItalExit party was being created in Italy. The party, which will be led by former TV presenter Gian-Luigi Paragone, will seek the country's exit from the European Union. In other words, the situation is as follows: at first, Italy receives about 200 billion euros from the EU, of which more than half is free aid, and later it can freely leave the European Union if the majority of Italians voted for the ItalExit party in the next election. And Italians can vote this way because "anti-European" sentiments have been maturing in this country for a long time. "The EU and the euro were imposed on us from above," Paragone says. "They damage the real economy, families and employees, and small and medium-sized businesses." The former TV host also believes that Italy needs to return to its national currency – the lira. Paragone believes that the euro was introduced to satisfy German interests. Experts, however, believe that the prospects for this process and the "ItalExit" party are still unclear. According to recent opinion polls, about 58% of Italians support the euro currency. But only 39% of Italians support the EU itself. However, in April, they were even less – only 27%. At the same time, more than 2/3 of Italians are not ready to vote for leaving the EU. Thus, if 209 billion in aid to Italy will be provided, the eurosceptics in the country may significantly decrease, but no one knows what will happen by 2023 when the country will hold the next parliamentary elections. In the current situation, we believe that the European currency has long since exhausted its growth potential. However, everything will depend on market participants, and especially on large traders. So far, there is no technical reason to say that the upward trend is complete, and the US dollar can be under massive pressure due to the "coronavirus" for as long as you want. Thus, we still recommend sticking to the trend and not trying to guess the pair's reversal down. However, the fact that there is no optimistic news coming from the Eurozone itself warns that the euro could also start to weaken at any moment. Recommendations for EUR/USD: For long positions: In the 4-hour timeframe, the EUR/USD pair calmly continues its upward movement. Thus, the target for buy orders now remains only the volatility level of 1.1688, all other targets were worked out and overcome during the week. For short positions: Sell orders can be opened no earlier than when the price is fixed below the critical line with the first goal being the Senkou Span B line (1.1362). However, this option is not expected to be implemented in the near future – the pair continues its steady upward movement. The material has been provided by InstaForex Company - www.instaforex.com |

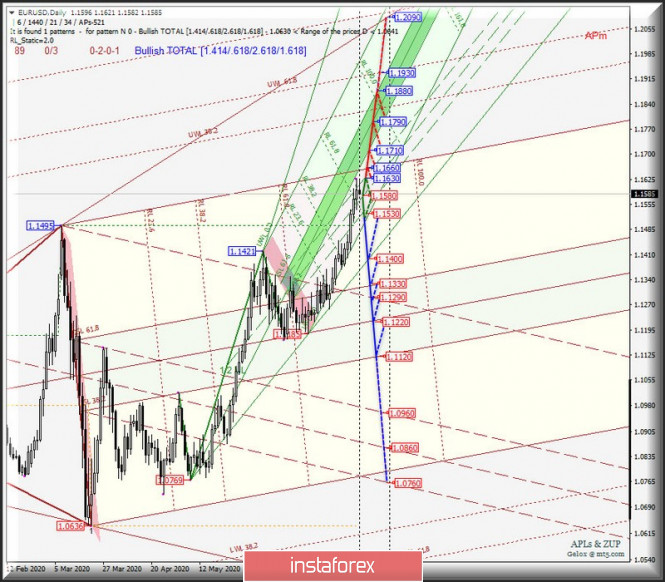

| Posted: 25 Jul 2020 10:42 AM PDT Minor operational scale (Daily) Options for the development of the movement #USDX vs EUR/USD & GBP/USD & USD/JPY - Daily from July 27, 2020. ____________________ US dollar index From July 27, 2020, the movement of the dollar index #USDX will be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (95.00 - 94.55 - 94.10) of the Minute operational scale forks - we look at the animated chart for details of how these boundaries were worked out. In the breakdown of the support level at 94.10 on the lower border of the channel 1/2 Median Line of the Minute operational scale fork, the movement of the dollar index will continue to the boundaries of the equilibrium zones of the Minor operational scale fork (93.65 - 92.40 - 91.20) - Minute (93.15 - 92.40 - 91.80). If the resistance level of 95.00 is broken at the upper border of the channel 1/2 Median Line of the Minute operational scale forks, it will be possible to develop an upward movement #USDX to the goals:

The layout of the #USDX movement options from July 27, 2020 is shown on the animated chart.

____________________ Euro vs US dollar The single European currency EUR/USD from July 27, 2020 will continue to develop its movement depending on the development and direction of the breakdown of the borders of the 1/2 Median Line channel (1.1530 - 1.1580 - 1.1630) of the Minute operational scale forks - details of movement inside the channel 1 / 2ML Minute are shown on the animated graph. If the resistance level of 1.1630 at the upper border of the channel 1/2 Median Line of the Minute operational scale forks, it will continue development of the upward movement of the single European currency to the target line FSL (1.1660) of the Minor operational scale forks and zone balance (1.1710 - 1.1790 - 1.1880) of the Minute operational scale forks. In case of a breakdown of the support level of 1.1530 at the lower border of the 1/2 Median Line Minute channel, the EUR/USD downward movement towards the LTL control line (1.1400) of the Minute operational scale forks will become relevant with the prospect of reaching the equilibrium zone boundaries (1.1330 - 1.1220 - 1.1120) of the Minor operational scale forks. The EUR/USD movement options from July 24, 2020 are shown on the animated chart.

____________________ Great Britain pound vs US dollar The development of the movement of Her Majesty's currency GBP/USD from July 24, 2020, as well as the previous instruments, will be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2610 - 1.2700 - 1.2770) of the Minute operational scale forks - details of movement inside this channel are shown on the animated chart. A breakdown of the resistance level of 1.2770 at the upper border of the channel 1/2 Median Line Minute, followed by an update of the local maximum 1.2812, will determine the continuation of the upward movement of the currency of Her Majesty to the equilibrium zone (1.3000 - 1.3120 - 1.3250) of the Minute operational scale forks. A breakdown of the support level of 1.2620 at the lower border of the channel 1/2 Median Line Minute will direct the movement of GBP/USD to the control line LTL (1.2390) of the Minute operational scale forks with the prospect of updating the local minimum 1.2251 - 1.2073. We look at the options for the movement of GBP/USD from July 6, 2020 on an animated chart.

____________________ US dollar vs Japanese yen The development of the movement of the currency of the "Land of the Rising Sun" USD/JPY from July 27, 2020 will be due to the development and direction of the breakdown of the boundaries of the equilibrium zone (106.45 - 105.80 - 105.15) of the Minute operational scale forks - the movement markings within this equilibrium zone are shown in the animated graphics. A breakout of the lower border ISL61.8 zone equilibrium of the Minute operational scale forks confirm the further development of the movement of the currency "Land of the Rising Sun" in the channel 1/2 Median Line (105.40 - 104.10 - 102.80) of the Minor operational scale forks. If the resistance level of 106.45 is broken at the upper border of the ISL38.2 equilibrium zone, it will be possible to reach the USD/JPY boundaries of the equilibrium zone (107.13 - 108.45 - 109.86) of the Minor operational scale forks and channel 1/2 Median Line (107.94 - 108.45 - 108.85) of the Minute operational scale forks. The marking of USD/JPY movement options since July 27, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). Formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. Where the power coefficients correspond to the weights of currencies in the basket: Euro - 57.6 %; Yen - 13.6 %; Pound sterling - 11.9 %; Canadian dollar - 9.1 %; Swedish Krona - 4.2 %; Swiss franc - 3.6 %. The first coefficient in the formula brings the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Silver in focus: prospects and trading ideas Posted: 24 Jul 2020 08:47 AM PDT Hi dear colleagues! Amid the stunning rally of gold, I shifted focus away from other precious metals. Today I decided to fill in this gap. Indeed, interesting developments have been unfolding in this market. As silver has spiked over 20% in the latest couple of days, many of you are bitten by the speculative big. I urge you, please read my article up to the end before you click the Sell button. Perhaps you will change your opinion. At the same time, I don't want to impose my views on you. Everyone is the architect of their own fortune! Gold, silver, and copper used to serve as money back in ancient times. In fact, any money is a unit recognized in a society as a medium of exchange. In Polynesia, sea shells were employed as money. First paper banknotes were printed in China. In the course of history, gold and silver were traditionally used as an equivalent to a certain value. They lost their property of a legal tender in the middle of XX century. As for copper, people still pay by coins made of copper. The Bretton Woods system required a currency peg to the US dollar which in turn was pegged to the price of gold. This concept was strongly disliked by the US. The Bretton Woods monetary system was replaced by the Jamaica international agreements. As a result, Forex came into being. The US dollar pegged to public debt is the cornerstone of the Jamaica system. In a nutshell, the debt concept is a new elixir stone created by American financial pundits. In fact, they failed to generate gold from lead but invented the idea of how to make money from air. Any monopoly does not tolerate competition. Gold poses a serious threat to the reign of the king dollar. Being a less valuable asset, the US dollar insists on its own rules of the game aiming to defeat its bitter rival in the financial field. In fact, gold has always remained a lucrative investment asset. However, silver has been squeezed out of the investment portfolio and turned into commodity. Banks set the rule that silver is not rated as an investment asset. Transactions with silver are subject to big taxes. Thus, buying silver as a physical asset does not make sense in terms of investment. Now I have a food excuse to say that InstaForex offers traders a great opportunity to earn from price fluctuations of gold (#XAUUSD), silver (#Silver) and other precious metals like platinum (#PLF) and palladium (#PAF). The broker charges minor commissions on that. Importantly, before you set about trading, you should grasp the point what's going on now in the market. The question of vital importance is to buy or to sell. You have to answer these questions on your own. As for me, I'll try to make you figure out what's actually happening. To begin with, let's find out the ratio between the gold price and the silver price. Traditionally, this ratio used to be 44:1. In other words, to buy 1 ounce of gold you had to pay 44 ounces of silver. However, some amendments were introduced to banking rules, so this ratio saw some changes. An average ratio has become 1:80 over the recent 5 years. In a broader timeframe, an average ratio has been 1:60 since 2007. These values are viewed as reference figures (picture 1). Picture 1. Ratio between gold price #XAUUSD and silver price #Silver According to chart 1, in March 2020 the ratio between the gold price and the silver price was 126 that was twice as big as average values over the recent 13 years. Besides, that ratio was thrice as big as historic values. Such developments made buying silver rather gainful investment. In July, the ratio between the gold price and the silver price returned to the zone of 5-year average values. However, the ratio is still 1.5 times bigger than average 13-year values and twice bigger than historic values. What I mean is that since 2011, we have been watching a steady trend of a growing gold/silver ratio that was caused by the banking rules which downplayed silver as investment. In terms of technical analysis, this trend is set to continue until it reverses. Therefore, I'm NOT going to predict that silver is likely to grow to the ratio of 60:1. I need clear-cut technical signals for that. Nevertheless, we have a great reference figure. If the gold/silver ratio closes July below 80, it means a reversal of the growing trend and the prospects of a decline towards 60. In this case, taking into account the current gold price of $1,875, the silver price could rise to $31 that is 50% up from the current level. Please keep that in mind when you are going to click the Sell button. Certainly, anything could happen. If the gold price loses in value, it will push silver down. We can only guess what will happen later. It is goes without saying that a trend is set to continue until we find out opposite conditions. Gold does not signal any trend reversal, so silver also is on the path to new highs. Another thing. A further bullish trend of silver is confirmed by the Commitment Of Traders (COT) Report. Two months ago, in mid-May, the open interest in the futures market dropped to the lowest level in 5 years that was 175,000 contracts. Speculators were unwilling to invest in silver. So, there were just 28,000 long contracts on silver. Today the situation is different. Amid growing open interest, the number of contracts increased to 219,000 contracts. Besides, long speculative contracts equaled 66,000. It proves that large market players are entering the market. Indeed, speculators sniffed out the trend which could bring nice profits. Picture 2. Technical analysis of silver A lot of traders have a bad habit which makes them lose money. Trading on Forex, they think that trends are over without being developed in full. However, this principle doesn't work for most markets. The theory and practice prove that if a trend has emerged and has been recognized, it will not be over immediately. At present, we think that silver is much overvalued and has nearly approached resistance. The problem is that it is extremely difficult to catch a perfect market entry point, so that you can relax in an armchair and watch your long order multiplying profits. Personally, I don't believe in such perfect entry points because you I have to make a trading decision from those levels which the market suggests, but not those levels which I like in theory. Analyzing the market dynamic, open interest in the futures market, and the fundamental background, I reckon that silver is set to carry on with the bullish run. So, the question is to find the right market entry point which the readers should decide on their own. Please look carefully at the pros and cons and eventually make a sensible trading decision. Be prudent and careful! Make sure you follow money management rules! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment