Forex analysis review |

- USDCAD continues lower following our bearish signal

- EURUSD strong week promises for more upside

- Gold reaches its all time highs

- Analysis on EUR / USD and GBP / USD for July 24, 2020

- Asia, America, and Europe stocks record declines

- Oil dynamics remains uncertain

- Sunset of American exceptionalism and sunrise of European currency

- GBP/USD: plan for the American session on July 24

- EUR/USD: plan for the American session on July 24

- July 24, 2020 : EUR/USD daily technical review and trade recommendations.

- July 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- July 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- EUR/USD: Euro remains hopeful for growth

- A trade war won't help the dollar

- BTC analysis for July 24,.2020 - Breakout mode in place and ptoetnia lfor the rally towards $9.750 and $10.000

- AUD/USd analysis for July.24.2020 - Bullish divergences on the momentum oscillator. Watch for buying opportutniies with the

- Analysis of Gold for July 24,.2020 - Rejection of the rising trendline and potential for the ALL TIME high test at $1.921

- GBP/USD In Uptrend Mode!

- USD/JPY Throwback At Support?

- EUR/USD. July 24. COT report. The unfounded threats from the European Parliament do not scare bull traders. The pair continues

- GBP/USD. July 24. COT report. Michel Barnier: an agreement with the UK is unlikely.

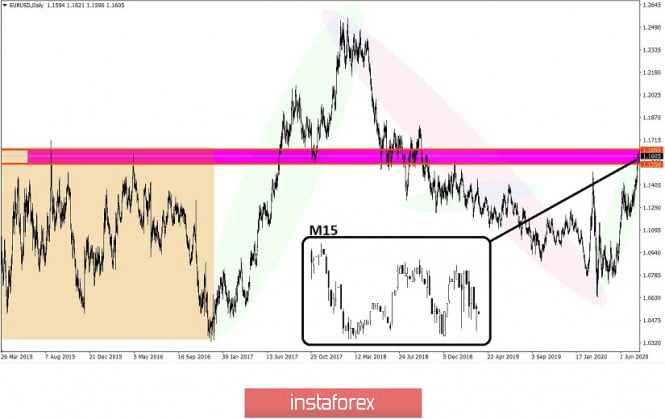

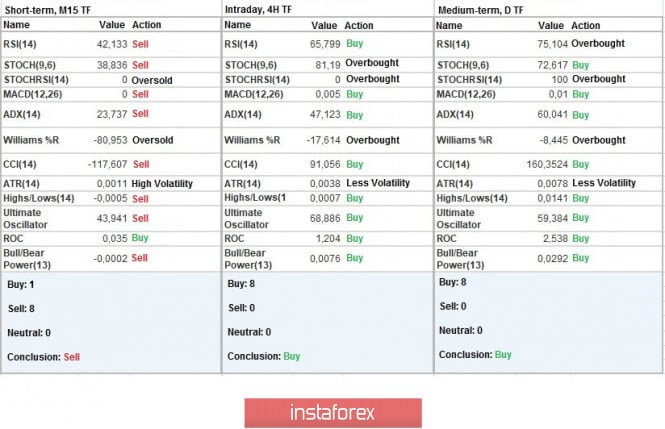

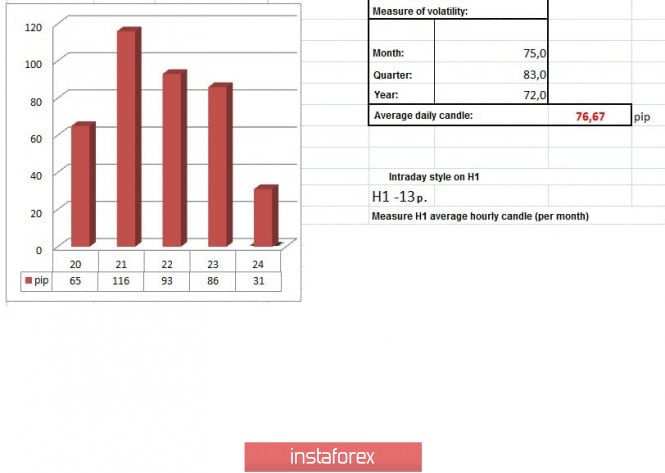

- Trading recommendations for EUR/USD pair on June 24

- Technical analysis of EUR/USD for July 24, 2020

- GOLD Accelerates Its Growth!

- EUR/USD: Be wary of buying the euro at current highs

| USDCAD continues lower following our bearish signal Posted: 24 Jul 2020 09:18 AM PDT USDCAD gave us a bearish signal when price broke down and out of the sideways trading range it was in. When price broke below 1.35 we called for a bearish signal. Now price is at 1.3420 after making a new low at 1.3350.

Black lines - trading range USDCAD traders can now lower their stops to the entry level of 1.35 for a risk free trade. Trend remains bearish as price is making lower lows and lower highs. We continue to expect price to move lower still as long as we do not break above 1.35 again. Next downside target is at 1.32. The material has been provided by InstaForex Company - www.instaforex.com |

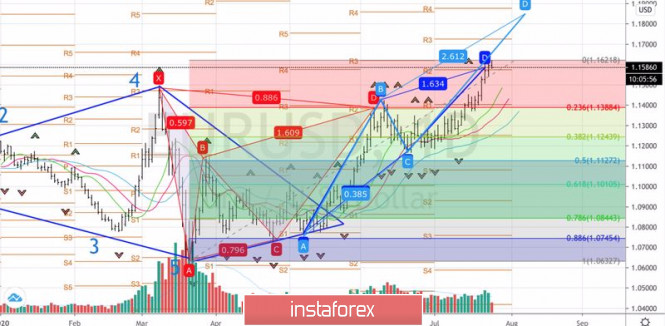

| EURUSD strong week promises for more upside Posted: 24 Jul 2020 09:14 AM PDT In the beginning of July we noted that the weekly resistance at 1.13 was very important and recapturing that level would open the way for a move much higher. Now at 1.16 we are in strong up trend having broken most long-term resistance trend lines and pushing through horizontal resistance levels.

At 1.18 there is confluence resistance by the Fibonacci retracement and the long-term downward sloping resistance trend line. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold reaches its all time highs Posted: 24 Jul 2020 09:08 AM PDT Gold price has reached the $1,900 level. This is an important price level as Gold made it this far back in 2011 and then pulled back towards $1,040 area. Having reached this level again is very promising for the coming years. Even if price does not manage to hold this level in the short-term, I expect to see price break it over the coming months.

Blue rectangle- support area Gold price as we mentioned in our last analysis is expected to reach $1,964 area if it is going to make an equal rise to the first leg up. The break out zone around $1,700 is important medium-term support. In the short-term I would not expect a pull back below $1,800. Gold is entering a high volatility phase and traders better not go against the trend. The material has been provided by InstaForex Company - www.instaforex.com |

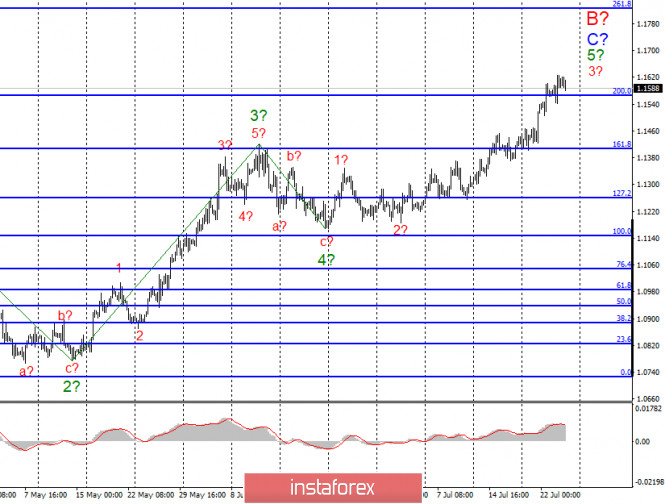

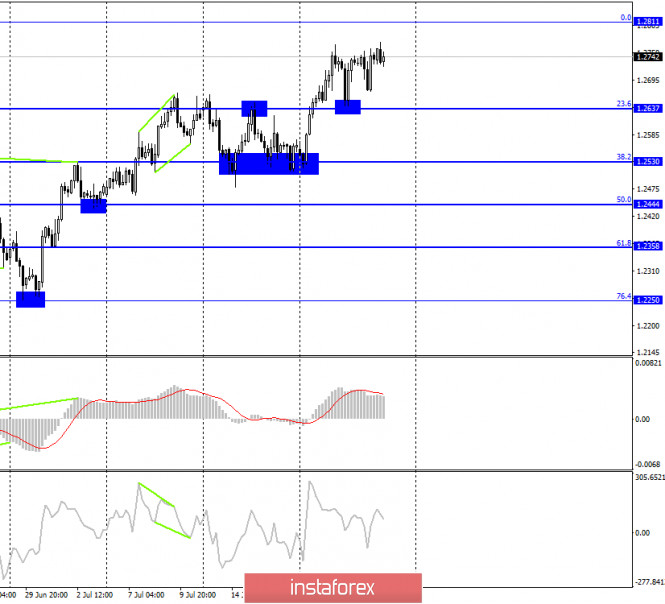

| Analysis on EUR / USD and GBP / USD for July 24, 2020 Posted: 24 Jul 2020 07:39 AM PDT EUR/USD On July 23, the EUR / USD pair gained about 20 basis points. Thus, the rise in the instrument quotes as part of the construction of wave 3 to 5 in C to B continues, and the wave itself takes a very extended form. The current wave counting has not undergone any changes in recent days, because the euro is constantly growing. A successful attempt to break through the 200.0% Fibonacci level indicates that the markets are ready for new purchases of the euro. Fundamental component: The euro continues to experience rise demand in the Forex market. Although we can say that this dollar is in extremely low demand now, which allows the Euro / Dollar instrument to continue to rise. Even this week, a fairly large number of important events took place in the European Union. Not everything can be described as positive for the EU and the euro. However, despite everything, the euro continues to grow. Thus, the conclusion suggests itself. Markets were not particularly impressed by the results of the EU summit, nor the altered allocation of 750 billion euros, which will go to the reconstruction of the countries most affected by the crisis, nor the subsequent comments of Christine Lagarde, David Sassoli, Angela Merkel and other EU officials. The EU can block all reached agreements as it desires and wishes were not met in the final documents of the budget for 2021-2027 and the Recovery Fund. Business activity indices in the eurozone and separately in Germany, which came out today in the first half of the day, also did not impress the markets too much, although all 6 indices (services, manufacturing, composite indices) were significantly better than expected. But instead of continuing to rise, the instrument began a systematic decline, which is very suitable for Friday, when many traders are closing individual positions, which leads to corrective waves. Probably something similar will happen today. Soon there will be more indexes of business activity in the services and manufacturing sectors in the US, but I believe that they will not have any effect on the markets either. The only thing that continues to excite the markets is the coronavirus epidemic in the United States. General conclusions and recommendations: The Euro-Dollar pair presumably continues to build an upward wave C in B. Thus, I recommend buying the instrument with targets located near the estimated 1.1827 mark, which equates to 261.8% Fibonacci, for each MACD "up" signal in the calculation to continue building wave 5 in C in B. GBP / USD The GBP / USD pair on July 23 gained only a few basic points at the end of the day. Despite the fact that for several days in a row the pound sterling has not been able to rise by the end of the day, the wave counting does not undergo any changes and still suggests building an upward wave 3 to 5. If this is true, then the increase in quotes will continue with targets located at about 76.4% and 100.0% Fibonacci. Wave 5 can become quite extended. Fundamental component: In the UK, there were also indices of business activity in the areas of manufacturing and services. The first turned out to be significantly better than the forecast - 56.6 against 51.1, the second - slightly, 53.6 against 52. Nevertheless, both indices show that business activity is growing, and the areas of production and services began to recover, as this is evidenced by the index values are above 50. However, the markets were not impressed by this data either. The pound stands still and does not even adjust. General conclusions and recommendations: The Pound-Dollar tool has complicated the current wave counting, which now suggests building an upward wave. Therefore, I recommend at this time to buy the instrument for each MACD signal "up" with targets located near the levels of 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| Asia, America, and Europe stocks record declines Posted: 24 Jul 2020 06:31 AM PDT

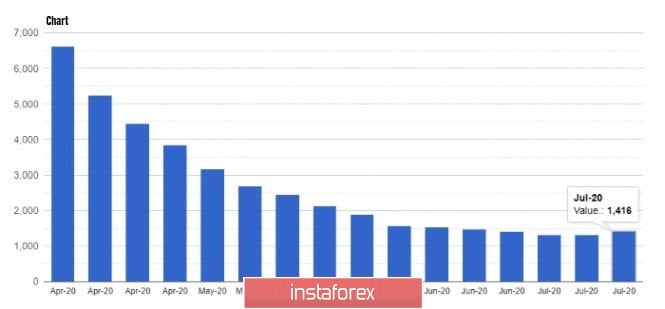

Asia-Pacific stock markets on Friday moved to a reduction in key indicators due to the unceasing conflict between the US and China. Note that Japanese trading floors are still closed due to the holidays, so the main negative message was received by the Chinese exchanges. China's Shanghai Composite index dropped significantly by 3.1%. The Chinese indicator - Shenzhen Composite also dropped by 4.02%. The Hong Kong Hang Seng index, on the other hand, suffered less with a decline of 2.34%. The escalation of the conflict between Beijing and Washington is the main topic of recent days. There were reports on Thursday that the US government is closing the Chinese diplomatic mission in Houston, Texas. The response from the PRC authorities was not long in coming. It has already become known that the Chinese government has decided to take a similar action, namely, to close the American consulate in Chengdu, which is the administrative center of Sichuan province. The US government has actively embarked on anti-Chinese rhetoric against the authorities. For example, the US Secretary of State yesterday issued an appeal to the Chinese people to unite with other nations of the world in the fight against the policies of the Chinese Communist Party. According to him, party interests are becoming higher than the freedoms of citizens and threaten the world community as a whole. However, there is no talk of the end of the negotiation process between the states, since China continues to fulfill all the obligations imposed on it. Nevertheless, the Americans plan to thoroughly check everything that the Chinese authorities do, since they no longer trust them at their word. All this, of course, has a negative effect on investor sentiment in the stock markets. The situation is becoming even tenser amid a sharp decline in major US indices following Thursday's trading session. South Korea's Kospi is down by 0.43%. The Australian S & P / ASX 200 also supported the negative trend and shed 1.28%. The US stock markets also experience difficulties, where at the close of Thursday's trading a rather significant decline was recorded in all major directions. Even the fact that during the previous four days a good climb was noted did not save the situation. The main reason for the fall is the sharp refusal of market participants from securities of the technology sector, which in turn occurred against the background of not very impressive economic statistics reflecting the activities of enterprises in the first half of this year. In addition, the aggravating epidemiological situation in the country and the world as a whole is putting pressure on the US stock market. Furthermore, investors are straining the investigation launched in several US states against Apple, which is once again accused of cheating its own customers. Against this background, its shares began to rapidly reduce their value, which has already gone into negative territory by 4.6%. The statistics from the US labor market are also not very impressive. Thus, the number of applications for unemployment benefits has increased and is now in the range of 1.42 million applications, while, according to preliminary data from experts, they should not have exceeded 1.3 million applications. Against this background, it becomes clear why the head of the US Treasury is insisting on the early adoption of a law on a new portion of stimulating measures in the country. Note that the previous package of measures will expire at the end of the current month. The new project should also include at least one trillion dollars in aid to the unemployed citizens of the country, and its validity - to last until the end of this year. The Dow Jones index fell by 1.31%, which forced it to move to the level of 26,652.33 points. The S&P 500 index sank 1.23%: its current value is within 3,235.66 points. The Nasdaq index leads the fall declining to as much as 2.29%, and the total value moved to the level of 10,461.42 points. Meanwhile, there is no positive on the European stock markets either. The escalating conflict between the United States and China makes investors in Europe quite worried. However, they also have one more topic that is closer to them, which concerns the agreements between the EU and Great Britain on the conditions for the future withdrawal of the latter from the alliance. The latest news suggests that so far no consensus has been reached and is unlikely to be achieved in the near future since there are too many disagreements. The possible adoption of some positive decisions on this issue can occur at best in September this year. However, the statistics on economic growth in the region are quite satisfactory. Thus, the PMI index, which includes nineteen countries in the region, in the second month of summer rose to 54.8 points, while the previous value was at 48.5 points. Preliminary forecasts were somewhat more modest: growth to 51.1 points was expected. An indicator is a fact that the level was able to cross the strategically important mark of 50 points, which indicates an increase in business activity. The general index of large enterprises in the EU Stoxx Europe 600, reflected a decline of 2.01% and stood at around 366.13 points. The UK FTSE 100 Index sank 1.58%. The German DAX index became the leader of the fall: it parted with 1.99%. France's CAC 40 index did not stray too far from its German counterpart: it decreased by 1.97%. Italy's FTSE MIB fell 1.92% while Spain's IBEX parted from 1.67%. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil dynamics remains uncertain Posted: 24 Jul 2020 06:31 AM PDT

Oil prices began to slowly rise on Friday. This movement is hardly noticeable, but the very fact of a change in the negative trend that has prevailed over the past two days is already a good sign, allowing us to hope for extremely positive forecasts that have been received earlier from analysts. The negative correction seems to have come to an end, which means that there is a rapid growth ahead, as far as the political, economic and, most importantly, epidemiological news in the world will allow. The price of futures contracts for Brent crude oil for delivery in September on the trading floor in London slightly increased to 0.09% or $ 0.04 per barrel. Its current level is around $ 43.35 per barrel. Thursday's trading ended on a minor note: the fall was quite substantial and amounted to 2.2% or 0.98 dollars. The price of WTI light crude oil futures contracts for September delivery on the electronic trading floor in New York continued to decline and fell 0.1% or $ 0.04, which sent it to the level of $ 41.03 per barrel. Yesterday, its value also stopped in the negative zone: declining to 2% or $ 0.83. The price of the main brands of oil on the market began to decline after it was able to reach its maximum value in the last four months last Tuesday. It was not possible to keep the occupied altitude, and a correction began, which was provided by news from the United States Department of Energy, which related to the growth of black gold reserves in the country by about 4.9 million barrels, which was not expected by experts, who indicate in their preliminary forecasts the possible reduction of raw material reserves. The situation was aggravated by the fact that almost all categories of demand showed a slight decrease, which some analysts had previously warned about. However, they said it was a necessary adjustment. Oil quotes received the most serious pressure from the increasing COVID-19 cases in the US. In addition, investors were on their guard in anticipation of new problems in the country's economy, which may arise against the background of the introduction of new quarantine measures. Meanwhile, the US Department of Labor released a not so pleasing data. According to the report, the total number of US residents who applied for unemployment benefits increased by 109 thousand last week totaling 1.416 million people. According to experts, it should not have surpassed the 1.3 million mark. It is alarming that the growth occurred for the first time since the end of March; it was then that a record number of applications was recorded in the amount of 6.867 million. This data is pushing crude oil prices downward as the question arises about further US economic growth. The recovery cannot start at a good pace, which means that even a rollback is possible, which is what investors in the market are so afraid of. The increase in the number of applications for unemployment benefits forced market participants to start selling their assets in the stock markets, as well as to abandon the risky sector. Traders rushed to protect their investments and began to move into more stable sectors. However, good news is also present on the market and encouraged investors a little. The American company Pfizer signed an agreement with the US government this week for the purchase of vaccines, which it is developing jointly with the German company BioNTech. The deal amounted to $ 1.95 billion for 100 million doses of the drug. Thus, the possible release of a vaccine against coronavirus infection in the fall calmed the markets a little, which even made it possible to draw conclusions about a fairly good long-term growth perspective. Nevertheless, there is also enough negativity on the oil market. Investors continue to closely monitor the escalating situation around relations between China and the US. Today the conflict has been supplemented by another unpleasant and tension-causing fact. The Chinese authorities began retaliatory steps, provoked by the forced closure of their own consulate in Houston. According to the news, the PRC authorities are closing the American diplomatic mission in Chengdu. Now one can only guess about Washington's reaction to this step, and most importantly, about the retaliatory measures that can be taken. In any case, it becomes clear that the tension not only does not end, but is also growing rapidly, which market participants are so afraid of in the difficult conditions of the economic crisis associated with the coronavirus pandemic. The material has been provided by InstaForex Company - www.instaforex.com |

| Sunset of American exceptionalism and sunrise of European currency Posted: 24 Jul 2020 06:25 AM PDT

Why do many people consider the EU economic and monetary union ineffective? The fact is that the eurozone lacks an important element – it is a financial union. However, everything has changed. On July 21, the EU agreed to create a €750 billion ($ 868 billion) Recovery Fund. Now, the EU has moved to a new level. It can be said that the EU countries are monitoring the situation as the agreement implies serious and long-term consequences for both the overvalued US dollar and the undervalued euro. Europe did not miss its chance In 2012, the eurozone was involved in a debt crisis. Then, Mario Draghi, President of the ECB, promised to do everything possible to keep the euro afloat. In fact, his promise strengthened the trust in the European Central Bank as an uncompromising protector of the single currency. However, in fact, it did not help to solve the problem. At that time, it should have been more profitable for the EU to sacrifice national sovereignty in order to create the European fiscal transfer mechanism. However, today, thanks to the reached agreement, the EU finally has a single currency, one central bank, and a commitment to a single fiscal policy. Of course, the deal still needs to be modified. This requires an approval of all 27 EU states. Taking into account the current situation, this will not be easy. Moreover, a real struggle has begun around the EU fund, which includes €390 billion in one-time subsidies to victims of COVID-19 and €360 billion in the form of long-term loans. The EU will issue the European sovereign bonds. This means that Europe will become another guarantor of a reliable asset. US Treasury bonds took a back seat. Today, the general euro index is 14% below the maximum set in October 2009. At the same time, the US dollar is 29% above the level logged in July 2011. An important reshuffle between the two major currencies is just beginning. Nevertheless, the US dollar index could drop by 35%. Analysts believe that the US dollar will continue to fall and there are reasons for this. Firstly, macroeconomic imbalances have increased in America. Secondly, the government has denied global leadership. Moreover, the historic step forward that happened in Europe on July 21 only adds confidence to the analysts' opinion. Europe is one step ahead While Europe has leaped forward and taken the opportunities that appeared during the COVID-19 pandemic, the United States is in an emergency situation. Domestic savings of the country are falling rapidly. Personal savings fell from 32% in April to 23% in May. Moreover, the federal budget deficit reached $863 billion just in a month, considering that for the whole 2019 the deficit was $984 billion. The US Congress intends to allocate further aid funds to combat COVID-19. This will hit the already thin internal savings even more. Europe's leadership is obvious. According to the International Monetary Fund, the US current account deficit will reach 2.6% of GDP in 2020. While the EU is able to accumulate the current account surplus of 2.7% of GDP. The difference is 5.3%. US financial reserves are limited and the government has resorted to aggressive fiscal measures after the beginning of the coronavirus crisis. Obviously, the difference in net savings and current accounts will continue to shift, but not in favor of the United States. The greenback is in danger. In 2017, Trump refused to sign the Paris Agreement and removed most of the environmental regulations. At the same time, Europe is fighting hard against climate change. The European Union has allocated almost a third of the expanded budget package for the green infrastructure development and related costs. Complete failure in the fight against COVID-19 The USA is striking with the number of new diseases. Just in a day, 67,000 people were infected with the coronavirus in the country. This is a record number and exceeds the figures for June by 208%. At the same time, the situation with the coronavirus in the eurozone has stabilized since the end of May. The number of new cases is approximately 5,000. Importantly, the EU population is 35% larger than in the United States. Moreover, the US has begun to conduct fewer tests for coronavirus, and the rate of the disease is rising. However, the President's administration said that an increase in tests leads to an increase in infections. Europe is undoubtedly a leader in all positions. The era of American exceptionalism is over. The material has been provided by InstaForex Company - www.instaforex.com |

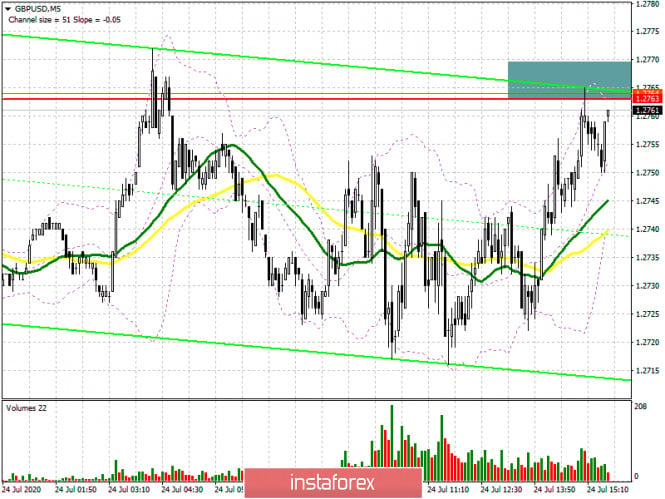

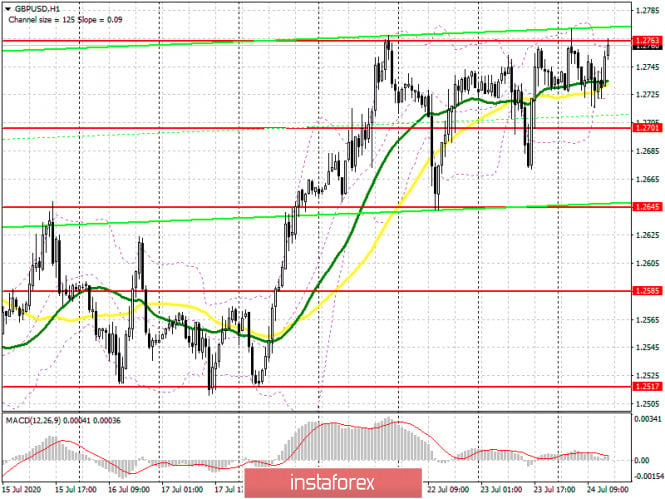

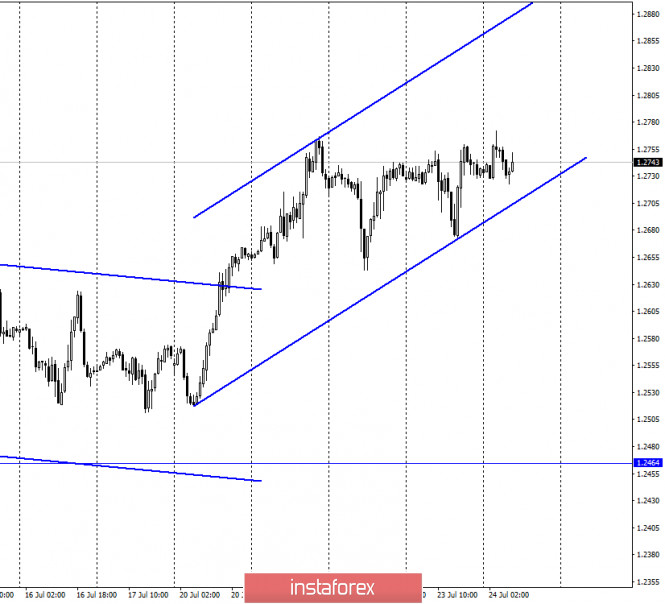

| GBP/USD: plan for the American session on July 24 Posted: 24 Jul 2020 06:06 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, nothing changed on the background of low market volatility, even after the release of such good fundamental data on the services sector and the UK manufacturing sector. This suggests that in general, the fundamentals, given their constant jumps due to the coronavirus pandemic, are not yet very exciting for traders. As a result, there were no signals for entering the market at the European session. If you look at the 5-minute chart, you will see how the bulls came close to the resistance of 1.2763, which remains their main target for the second half of the day. However, only a break and consolidation above the maximum of this week forms a signal to buy the pound with continued growth in the area of 1.2809 and 1.2906, where I recommend fixing the profits. Data on activity in the US, which is released this afternoon, may help buyers of the pound. If the pair declines and there is no activity in the resistance area of 1.2763, it is best to postpone long positions until the update of the minimum of 1.2701 or buy the pound immediately on the rebound from the support of 1.2645 in the expectation of a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need: Sellers have a great chance to return to the market, but you need to try. First of all, you need to prevent a breakout of the resistance of 1.2763 and form a false breakout on it, which is what the bears are trying to do now. However, you can be sure of a more accurate sell signal only after the release of data on activity in the US services and manufacturing sectors. The nearest target of sellers is also the support of 1.2701, fixing below which will only increase the pressure on the pound, which will lead to a complete overlap of yesterday's growth and update the minimum of 1.2645, where I recommend fixing the profits. The longer-term goal of sellers remains support for 1.2585. If the GBP/USD rises above the resistance of 1.2763 in the second half of the day, I recommend that you postpone short positions until the maximum of 1.2809 is updated or sell the pound immediately for a rebound from the resistance of 1.2906 in the expectation of a correction of 30-40 points by the end of the day.

Signals of indicators: Moving averages Trading is just above the 30 and 50 daily averages, which indicates the sideways nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands Volatility has decreased, which does not give signals for entering the market. Description of indicators

|

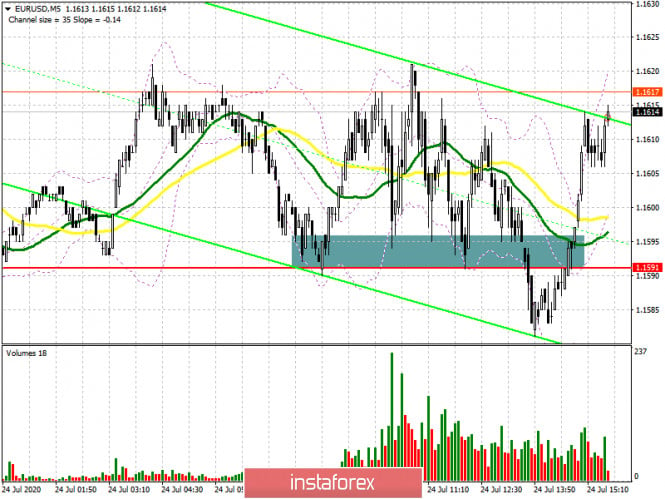

| EUR/USD: plan for the American session on July 24 Posted: 24 Jul 2020 05:54 AM PDT To open long positions on EURUSD, you need: In the first half of the day, there were fairly strong data on activity in the manufacturing sector and the services sector of the Eurozone, however, they did not provide the expected support for the euro, which indicates a clear lack of desire for traders to open long positions at current highs. However, the sellers of EUR/USD were not so active, which retreated from this level after an unsuccessful attempt to break through the support of 1.1591, forming a good signal to open long positions. If you look at the 5-minute chart, you will see how the bulls held the entire European session at 1.1591 and then only temporarily released this level to collect stop orders from speculative players, quickly returning the euro to their control. At the moment, while trading is conducted above the level of 1.1591, the buyers' goal remains the resistance of 1.1647, a break of which will lead to a test of the maximum of 1.1682, where I recommend fixing the profits. Much will depend on what reports will be released on activity in the US manufacturing and services sectors. If the indicators fall short of the forecast, then a repeated test of the EUR/USD support of 1.1591 may lead to a larger decline in the pair. In this case, it is best to postpone long positions until the minimum of 1.1490 is updated. But I recommend opening long positions immediately for a rebound from the support of 1.1428 in the expectation of a correction of 25-30 points within the day.

To open short positions on EURUSD, you need: Sellers are trying to do something, however, they lack the pressure and confidence in their actions, which is clearly visible after an unsuccessful attempt to break below the support of 1.1591. In the second half of the day, you need to wait for the release of reports on activity in the US. If the indicators turn out to be worse than economists' forecasts, the pressure on the euro may increase. However, I recommend opening short positions against the trend only after returning and fixing below the level of 1.1591. The main goal of the bears will be to return to the support level of 1.1541, the breakdown of which will lead to a larger sell-off in the area of the minimum of 1.1490, where I recommend fixing the profits. If activity reports come out better than economists' forecasts, the euro will continue to grow. In this scenario, you can count on sales only after updating the resistance at 1.1647, provided that a false breakout is formed. Or sell EUR/USD immediately on the rebound from the larger maximum of 1.1682 with the aim of correcting 25-30 points within the day.

Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily moving averages, which indicates the possible formation of a downward correction in the pair. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.1620 will strengthen the demand for the euro. A breakdown of the lower border in the area of 1.1580 will lead to a larger sell-off of the euro. Description of indicators

|

| July 24, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 24 Jul 2020 05:36 AM PDT

The EURUSD pair has been moving-up since the pair has initiated the depicted uptrend line on May 25. On June 11, a major resistance level was formed around 1.1400 which prevented further upside movement and forced the pair to have a downside pause towards the uptrend line. Since last week, the uptrend seems to show signs of weakness while moving above the mentioned resistance level (1.1400). A couple of contradictory Fundamental data from the U.S. have caused some hesitation manifested in the depicted ascending wedge-pattern during last week's consolidation. However, this week a few negative fundamental data from the U.S. have caused the EUR/USD to achieve another breakout to the upside. Estimated target for the pair is located around 1.1650 which stands as a prominent resistance level to be watched for a valid short-term SELL Position with estimated target down to 1.1500 The material has been provided by InstaForex Company - www.instaforex.com |

| July 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Jul 2020 05:25 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. Hence, Bearish persistence below 1.1150 (consolidation range lower limit) was needed to enhance further bearish decline. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1520 (Fibonacci Expansion 78.6% level) which failed to offer sufficient bearish pressure. That's why, further bullish advancement is expected to pursue towards 1.1690 (Fibonacci Expansion 100% level). Trade recommendations : Conservative traders should for the current bullish movement to pursue towards the price zone around 1.1690 where any signs of bearish rejection should be considered as avalid SELL signal.T/P levels to be located around 1.1530 and 1.1450 while S/L to be placed above 1.1750 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| July 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Jul 2020 05:20 AM PDT

On May 15, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26, denoting some sort of weakness from the current bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish targets were located around 1.2600 and 1.2520 which paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. Significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2780, where the backside of the broken uptrend line comes to meet the GBPUSD pair. This indicates a high probability of bearish reversal provided that early bearish breakout is achieved below 1.2600. Trade recommendations : Intraday traders can consider the current bullish pullback towards the depicted Supply Level (1.2780) for a valid SELL Entry. Stop Loss should be tight, it can be placed above 1.2850 while initial T/P level to be located around 1.2600, 1.2520 & 1.2400. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Euro remains hopeful for growth Posted: 24 Jul 2020 05:08 AM PDT

The USD index declined to its lowest level in almost two years around 94.5 points amid growing concerns about the pace of the US economic recovery. Analysts said that the delay in the adoption of the next stimulus package in the United States could worsen consumer sentiment at a time when the weaker statistics on the United States begin to come out. Yesterday, the labor Department reported that the number of Americans who first applied for unemployment benefits in the week ending July 18 increased by 109 thousand, to 1.416 million people. Experts expected the figure to be 1.3 million. In addition, the number of COVID-19 cases in the United States approached 4 million on Thursday, with an average of more than 2,600 new cases reported every hour, the highest in the world. The EUR/USD pair continues to hold in the area 1.16. The reports on business activity in the eurozone, published on Friday, became another addition for the single European currency. On the other hand, preliminary PMIs beat forecasts, showing a stronger rebound in services against manufacturing. This gives investors hope that the worst phase of the epidemic in the EU has already passed, despite the fact that the coronavirus rears its head in parts of Belgium, Spain and France. The single European currency is also supported by the results of the EU summit, at which a powerful stimulus package was agreed, which can accelerate the economic recovery in the region. The main threat to the euro is now represented by news from the United States. Diplomatic tensions between Washington and Beijing are escalating, which could boost demand for a safe dollar. Meanwhile, US Secretary of State, Mike Pompeo has sharply criticized China. In particular, he called the state regime in China, authoritarian. At the same time, he noted that the previously reached trade agreement between Washington and Beijing remains in force, which somewhat reassured investors. It is assumed that in the absence of unambiguously negative news for the euro, the EUR/USD pair will continue to grow. On Thursday, the level of 1.16 was broken, and the next resistance level is in the area of 1.17 (where several key Fibonacci levels are located). Now, breaking through this level can open the way to 1.20 for the main currency pair. The material has been provided by InstaForex Company - www.instaforex.com |

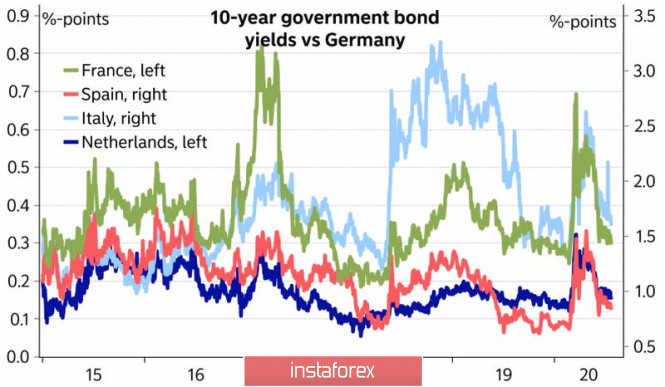

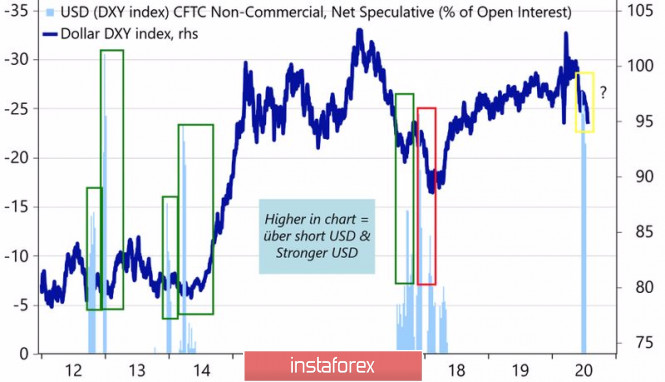

| A trade war won't help the dollar Posted: 24 Jul 2020 05:03 AM PDT The EU euphoria has pushed the EUR/USD quotes to the highest level since the beginning of 2019, allowing the implementation of the purchase strategy I announced. However, much more important is the fact that a new topic has appeared on the market. Two, actually. The issue of European bonds on behalf of the EU increases the likelihood of the euro coming to the US dollar in a variety of areas, from gold and foreign exchange reserves to conversion operations. In addition, the entire old world securities market will benefit from the unity of Europe. The 27 EU countries have approved a Franco-German proposal for a € 750 billion fiscal stimulus after four tense days of negotiations. Taking into account the € 1.1 trillion budget, the total amount of aid was € 1.8 trillion. After a long period of resistance, the "modest four" agreed to join the majority, the yield on peripheral Eurozone bonds and their spreads with their German counterparts declined, and the euro rose. Dynamics of yield spreads

European bonds that have the opportunity to participate in the ECB's asset purchase program are a very attractive instrument for investors, which in the near future can seriously compete with US Treasury bonds. The fact that the EU supports Italy and other troubled Eurozone countries with all its might increases the attractiveness of the bonds they issue. They are a serious alternative to the debt obligations of developing countries. At the same time, investors will pay increased attention to the EuroStoxx, DAX and other Old World indices, and the associated capital inflows to Europe will be a catalyst for the EUR/USD rally. Perhaps the main problem for the "bulls" on the main currency pair is the escalation of the conflict between the US and China. In 2018-2019, the Euro was seriously damaged due to trade wars, and speculators continue to increase net shorts for the dollar. In four of the five previous cases, this led to an increase in the USD index. Dynamics of speculative positions and the US dollar

If you add to this the increased risks of strengthening anti-Chinese sentiment in the run-up to the November US election, the chances of a deep correction in EUR/USD do not look so remote. In my opinion, whatever Donald Trump does, nothing good will come of it. The resumption of a trade war with the Middle Kingdom is fraught with a fall in US stock indices, which the President considers an indicator of the effectiveness of his activities. Moreover, unlike in 2019, when Beijing swallowed resentments, now it will not remain silent. China has a great opportunity to diversify its gold and foreign exchange reserves in favor of the euro, which does not allow us to say with certainty that the EUR/USD will fall if the trade conflict resumes. The main events of the last week of July will be the release of data on German and American GDP for the second quarter, as well as the FOMC meeting. If the German economy does not sink as deep as Bloomberg experts expect, the main currency pair will get a new boost for growth. Pullbacks to support at 1.1545 and 1.15 should be used for purchases with targets at 1.175 and 1.185. EUR/USD, the daily chart

|

| Posted: 24 Jul 2020 04:56 AM PDT

BTC has been trading sideways at the price of $9,550 but the upside breakout of the Bollinger upper band and contraction is strong sign that there is more upside to come. I still expect further upside movemevnt. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 04:46 AM PDT Technical analysis:

Trading recommendation:

Upward targets are references are set at : 0,7100 0,7123 0,7135 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 04:39 AM PDT Technical analysis:

Gold has been trading upwards as I expected. I still see potential for the rise towards the ALL TIME high at the price of $1,922. Trading recommendation: Watch for potential buying opportuntiies due to rejection of the rising trendline on the 1H time-frame and strong bullish momnentum in the background. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 03:35 AM PDT

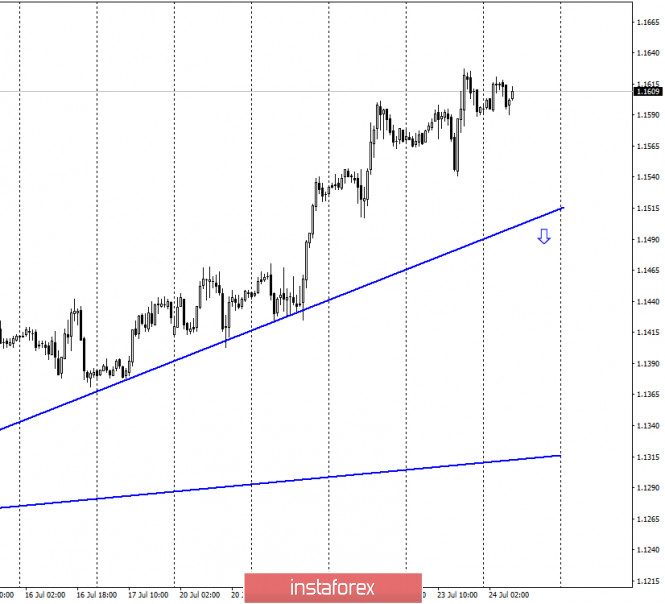

GBP/USD continues to grow and it approaches the 1.2787 former high as the USD is into a corrective phase, decrease, versus most of the major currencies. The pair is trading within a major up channel, above an uptrend, so the outlook is bullish. GBP/USD could resume its current uptrend. GBP/USD could climb higher as long as it stays above the uptrend line, another higher high, peak high, top, will validate a potential growth towards the upside line of the major up channel.

Sell only below the 1.2627 static support area, or after a valid breakdown below the uptrend line, if GBP/USD fails to stay above this trendline. This scenario is less likely to take shape. Buy GBP/USD if it moves and stays beyond the 1.2800 psychological level. Also, a minor decrease towards the uptrend line could give us a chance to go long, to buy this pair, but only if the pair stays above the uptrend line. The major upside target remains at the upside line of the major ascending channel. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 02:59 AM PDT The currency pair has plunged as the USDX and the JP225 are facing their sell-offs in the short term. USD/JPY is trading at 106.36, the next downward target is seen at the 105.98 static resistance. A USDX's bounce back, leg higher, from the 94.65 static support could attract the buyers on USD/JPY. The pair has got stuck in a range in the short term, so we need a strong signal before taking action.

USD/JPY is trapped between the upside 50% Fibonacci line and the median line (ML) of the descending pitchfork, but the 105.98 represents strong static support and it could stop the downside movement. The price moves sideways between the Pivot Point (107.94) and the S1 (106.04) levels, a downside breakout will suggest selling, while a false breakdown 106.04 - 105.98 will announce another bullish momentum.

Buy a false breakdown with great separation, reversal pattern, below the 105.98 static support, and below the median line (ML). Besides, a valid breakout above the upside 50% Fibonacci line will bring a long opportunity with the target at the upper median line (UML) of the descending pitchfork. If you want to sell USD/JPY, you should wait for a valid breakdown below the 105.98 and below the median line (ML) of the descending pitchfork, the target is seen at the inside sliding line (SL). A downside breakout from the current channel will announce a sharp drop, while the incapacity to close below the 105.98 will suggest a rebound. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 02:51 AM PDT EUR/USD – 1H.

Hello, traders! On July 23, the EUR/USD pair continued its growth process after another rebound from the upward trend line. We still have two upward trend lines at our disposal, each of which characterizes the current mood of traders as "bullish". The information background in the eurozone at this time is quite interesting. No sooner had the EU summit ended, which eventually lasted 2 days longer than planned, when the European Parliament announced that it did not support the draft budget for the next 7 years adopted at the summit. First, the Parliament believes that the budget is too small (1.074 trillion euros). Second, it opposes cutting funding for certain programs. Third, it believes that the allocation of funds from the reconstruction fund should be tied to the "rule of law" (in simple words, loyalty to the European Union). Since several countries (Italy, Hungary and Poland) do not fully comply with the principle of "rule of law" at the moment, the European Parliament accuses individual politicians of political agreements and blackmail. However, as we can all see, this news did not affect the European currency in any way. The bulls believe that the budget will be approved almost in any case. In addition, the complex epidemiological situation in America does not even allow us to consider buying American currency. EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair continue to grow in the direction of the corrective level of 127.2% (1.1729). Thus, the "bullish" mood of traders remains, which, in addition to the two upward trend lines on the hourly chart, is also indicated by the trend line on the current chart. The rebound of quotes from the Fibo level of 127.2% will allow traders to expect a reversal in favor of the US dollar and a slight fall in the direction of the corrective level of 100.0% (1.1496). EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation above the Fibo level of 200.0% (1.1566). Thus, the probability of continuing the growth of quotes in the direction of the corrective level of 261.8% (1.1825) has significantly increased. EUR/USD – Weekly.

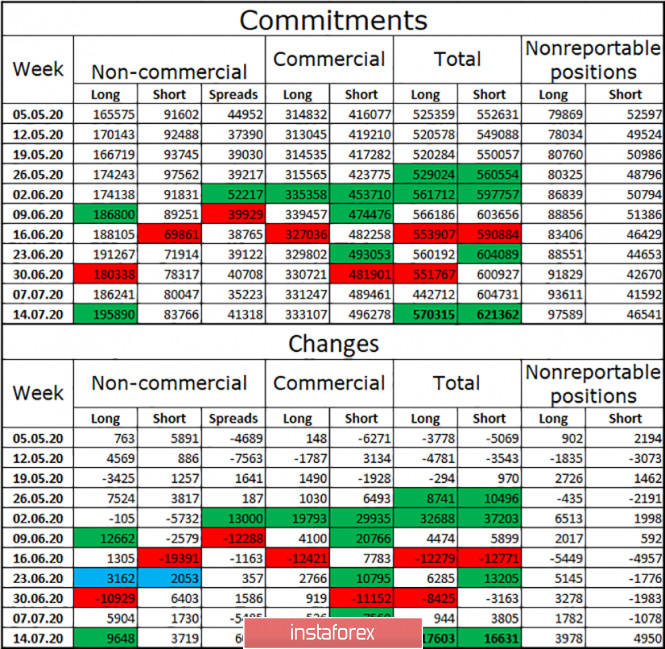

On the weekly chart, the EUR/USD pair, after rebounding from the lower line of the "narrowing triangle", performed an increase to the level of 1.1600, which I gave as a target a few months ago. Thus, the upper line of the "narrowing triangle" has been worked out, which now allows us to count on the rebound from it and the resumption of the fall. If the triangle is not closed. Overview of fundamentals: On July 23, the European Union did not have a single economic report. The number of initial applications for unemployment benefits in the United States increased again, by 1,416,000, but the total number of repeated applications for benefits fell to 16,197,000. News calendar for the United States and the European Union: Germany - index of business activity in the manufacturing sector (07:30 GMT). Germany - index of business activity in the service sector (07:30 GMT). EU - index of business activity in the manufacturing sector (08:00 GMT). EU - index of business activity in the service sector (08:00 GMT). US - index of business activity in the manufacturing sector (13:45 GMT). US - service sector PMI (13:45 GMT). On July 24, the US, Germany and the European Union will release business activity indices in the services and manufacturing sectors. However, I believe that traders will not pay much attention to them. Now there are more important topics. COT (Commitments of Traders) report:

The latest COT report showed a sharp increase in the number of long-term contracts in the hands of the "Non-commercial" group. This means that the most important major market players during the reporting week (July 8-14) looked only in the direction of purchases. Several thousand short contracts were also opened, but much less than long. Thus, it is not surprising that the euro currency grew all the previous week and continues to do so on the current one. The COT report tells us now about a persistent bullish trend, as for the second week in a row, speculators are actively increasing long-contracts. The results of the EU summit could make the "bullish" mood of speculators even stronger. The end of the current week shows that the mood of bull traders is only improving. Forecast for EUR/USD and recommendations to traders: Today, I recommend continuing to stay in the pair's purchases with a target of 1.1729. If the pair closes at 1.1496, then purchases can be closed until new signals are formed. I recommend selling the pair if the quotes close below the trend line on the hourly chart with the goal of 1.1347. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. July 24. COT report. Michel Barnier: an agreement with the UK is unlikely. Posted: 24 Jul 2020 02:51 AM PDT GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair continue the growth process, somewhat weakened growth. Nevertheless, the upward trend corridor still retains the prospects for continued growth and a "bullish" mood. Although the nature of the latest news from the UK is not conducive to the growth of the British. Let me remind you that in the middle of this week, there was information from the UK government circles that a deal with the European Union is unlikely to take place. And this morning, it became known that the next round of negotiations between London and Brussels failed, as stated by the head of the EU negotiating group, Michel Barnier. According to him, London refuses to concede on key issues, so the risk that there will be no progress in the negotiations until the end of 2020 is extremely high. I would also like to remind you that Boris Johnson believes that there is no point in continuing to negotiate until the end of 2020. If the parties can agree, why not do it within one or two months? Thus, I believe that in the current conditions it would be more logical for the British currency to fall, however, the situation in the US with the coronavirus does not allow the dollar to start growing. GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair rebounded from the corrective level of 23.6% (1.2637), turned in favor of the English currency, and resumed the growth process in the direction of the Fibo level of 0.0% (1.2811). The rebound of quotes from this level will allow traders to expect a reversal in favor of the US currency and a slight fall in the direction of the Fibo level of 23.6%. Today, the divergence is not observed in any indicator. Closing quotes above the Fibo level of 0.0% will work in favor of further growth of the British pound. GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 76.4% (1.2776). The rebound from it will allow you to expect a reversal in favor of the US dollar and a slight drop in quotes, closing above - further growth in the direction of the corrective level of 100.0% (1.3199). GBP/USD – Weekly.

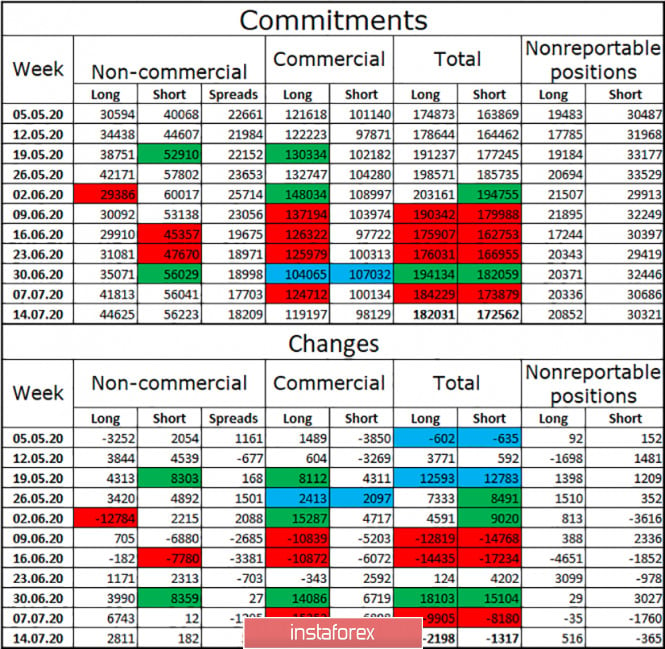

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines. It is in this direction that the pair's quotes continue to move in recent weeks. Overview of fundamentals: There were no economic data releases in the UK on Thursday. In the US, there is only an insignificant report on applications for benefits. Thus, the economic background was extremely weak. The economic calendar for the US and the UK: UK - change in retail trade volume (06:00 GMT). UK - index of business activity in the manufacturing sector (08:30 GMT). UK - index of business activity in the service sector (08:30 GMT). US - index of business activity in the manufacturing sector (13:45 GMT). US - service sector PMI (13:45 GMT). On July 24, the most important report on retail trade has already been released in the UK, which showed volume growth of 13.9% m/m and -1.6% y/y in June, which is higher than traders' expectations. Next, traders are waiting for less important data. COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long contracts among the "Non-commercial" group. However, this time the growth was small, which means a slight drop in interest among speculators in the British. Over the past 4 weeks, the Non-commercial group has been increasing its long-term contracts. For the last two weeks, I haven't opened any short contracts. Thus, the group of speculators has no interest in selling the pound. There is interest in the purchases of the Briton, but it is declining. In general, the group of speculators has more short contracts on their hands, but the difference has been decreasing in recent weeks. I still believe that the prospects for continued growth in the British are quite good. Mainly because of the information background from the US. Forecast for GBP/USD and recommendations to traders: I recommend selling the pound with the goal of 1.2637 if the closing is performed under the trend corridor on the hourly chart. I recommend opening new purchases of the pair with the goals of 1.2811 and 1.3199 if a close above the level of 1.2776 is made on the daily chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for EUR/USD pair on June 24 Posted: 24 Jul 2020 02:34 AM PDT The trading week is coming to an end and it's time for us to summarize the preliminary results. It is not so easy to stop a speculative upward move, all market participants were convinced of this after the quote updated the current year's maximum 1.1496 ---> 1.1626 and automatically hit the region of autumn 2018. More than 400 points since the beginning of July and 830 points since May, this is the scale we are dealing with. he angle of inclination during the inertia course is 70-82 degrees, and now compare it with the rate of price change and you get a clear signal that the European currency is overbought and thus the US dollar is oversold. A sell signal is nowhere clearer, and if you dive deeper into technical analysis, then the area of 1.1550/1.1650, where the quote is now located, is one of the most important resistance, which puts pressure on market participants. But even this may not be enough if the market has a high emotional mood, which covers all technical and fundamental factors, leaving only speculators' excitement. Examining the past trading day in detail, we can see two remarkable rounds of speculation. The first one took place from 11:30 to 12:30 UTC+00, where the quote broke through the overnight range of 1.1563/1.1600 and moved towards the value of 1.1500. The second round of speculation took place from 13:00 to 15:30 UTC+00, where the quote rebounded from the level of 1.1550, and, against the backdrop of the emotions of the news background, updated the maximum of 1.1600 ---> 1.1626. In terms of volatility, an acceleration is still recorded relative to the average daily indicator of 76 ---> 86 points, which indicates that the coefficient of speculative positions is at a high level. Looking at the trading chart in general terms (daily period), you can see medium-term price trends highlighted with colored ellipses on the trading chart below, but you should also pay attention to the period of 2015 and 2016. The quote had a medium-term sideways trend, where the 1.1550/1.1650 area played the role of resistance and the upper border of the range. The news background of the past day included data on the labor market in the United States, where weekly claims for unemployment benefits will be published, which shocked American investors. So, for the first time since spring, primary applications for benefits reflected an increase from 1,307,000 to 1,416,000 (+109,000), and with a stable information background about the economic recovery, this is like a shot. Repeated applications for benefits turned out to be better than the forecast, they declined by 1,107,000, which were noticed by traders. The market's reaction was as follows: at the time of the publication of the data (12:30 Universal time), the dollar rate locally strengthened, probably on the indicators of repeated orders, but after understanding the situation, a reverse price movement occurs, based on which the maximum is updated. Let me remind you that the historical record for the number of applications for benefits was recorded at the end of March, when 6,648,000 people applied for help. The coronavirus is still relevant in the world, and it continues to set anti-records in the United States. The other day in the United States passed the mark of +70 thousand daily gain, and the total figure since the beginning of the pandemic has completely exceeded 4 million. With the current trend, the reason for the increase in unemployment in the United States and the increase in new claims for benefits becomes clear. Today, in terms of the economic calendar, we have preliminary data on the index of business activity in Europe, which came out with a positive background. So the index in the service sector increased from 48.3 to 54.8, while the manufacturing sector increased from 47.4 to 51.1. The composite business activity index, in turn, is growing from 48.5 to 54.8. That is, all indicators came out better than forecasted, but the European currency continued to stand in one place, drawing Doji candlestick patterns. A similar PMI will be published in the afternoon, but for the United States, it is also expected to rise. 13:45 Universal time - Business activity index (PMI) in the services sector for July: Pre 47.9 ---> Forecast 51.0 13:45 Universal time - Manufacturing PMI for July: Pre 49.8 ---> Forecast 51.5 Finally, there are data on new home sales in the United States for June (14:00 Universal time), where sales are predicted to grow from 676 thousand to 700 thousand. The upcoming trading week in terms of the economic calendar, has a package of statistics on the US and Europe, but the key event will be the meeting of the Federal Reserve System. The most interesting events are displayed below (Universal Time UTC+00) ---> Monday July 27th USA 12:30 - Orders for durable goods (June) Wednesday 29 July USA 18:00 - Results of the meeting of the Federal Open Markets Committee of the FRS USA 18:30 - Fed press conference Thursday 30 July USA 12:30 - GDP (Q2), PRELIMINARY USA 12:30 - Claims for unemployment benefits Friday July 31st EU 9:00 - GDP (Q2), PRELIMINARY EU 9:00 - Inflation, PRELIMINARY Further development Analyzing the current trading chart, we see a low-amplitude price fluctuation within 1.1590/1.1626, which indicates high pressure and an overbought signal in the market. The area of 1.1550/1.1650 will continue to interact with traders' positions, which will be expressed in ambiguous fluctuations, although a sell signal is already clearly visible on the market. In terms of the emotional component of the market, there is a very high speculative coefficient, which worries most traders. It can be assumed that if the price consolidates below the level of 1.1590, a surge in short positions will occur, which will return the quote to the area of 1.1550. For the most significant changes in the quote, it is necessary to consolidate below 1.1550 on a four-hour period to get the clearest signal of recovery. An alternative scenario is considered in the case of price consolidation above 1.1650 on a daily period, which may indicate a change in price trends. Indicator analysis Analyzing different sectors of time frames (TF), we see that the indicators of technical instruments on 1-minute intervals have a buy/sell signal due to the price movement inside the accumulation 1.1590/1.1626. Meanwhile, the hourly and daily time frames continue to signal buy from fluctuations at current year highs. Weekly volatility / Volatility measurement: Month; Quarter; Year The volatility measurement reflects the average daily fluctuation calculated for the Month / Quarter / Year. (July 24 was built taking into account the time of publication of the article) The volatility of the current time is 31 points, which is 59% below the daily average. It can be assumed that the breakdown of the savings boundaries 1.1590/1.1626 will lead to the first round of acceleration. Key levels Resistance zones: 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support zones: 1.1500 1.1350; 1.1250 *; 1.1.180 **; 1.1080; 1.1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1.0500 ***; 1.0350 **; 1.0000 ***. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for July 24, 2020 Posted: 24 Jul 2020 02:15 AM PDT Overview: The EUR/USD pair faced resistance at the level of 1.1670, while minor resistance is seen at 1.1627. Support is found at the levels of 1.1529 and 1.1469. Pivot point has already been set at the level of 1.1571. Equally important, the EUR/USD pair is still moving around the key level at 1.1571, which represents a daily pivot in the H1 time frame at the moment. Yesterday, the EUR/USD pair continued moving upwards from the level of 1.1529. The pair rose to the top around 1.1627 from the level of 1.1529 (coincides with the ratio of 61.8% Fibonacci retracement). In consequence, the EUR/USD pair broke resistance, which turned into strong support at the level of 1.1529. The level of 1.1529 is expected to act as the major support today. We expect the EUR/USD pair to continue moving in the bullish trend towards the target levels of 1.1627 and 1.1670. On the downtrend: If the pair fails to pass through the level of 1.1670, the market will indicate a bearish opportunity below the level of 1.1670. So, the market will decline further to 1.1571 and 1.1529 to return to the daily support. Moreover, a breakout of that target will move the pair further downwards to 1.1469 in order to form the double bottom. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jul 2020 02:09 AM PDT Gold is trading at $1,896.91 and is about to reach the next upside target at $1,900 psychological level. The price is strongly bullish, so it could take out the near-term resistance levels and it could touch fresh new highs. The global risk, COVID-19 second wave fear, a slow recovery of the global economy, USD's weakness, are only a few reasons why the gold price is extending its rally and why it could approach and reach fresh new highs in the short term.

The gold price is strongly bullish, so it could ignore the $1,900 psychological level and it could resume its bullish momentum. Today's US and the eurozone data will bring high volatility on gold as well. I've said yesterday that Gold will remain bullish as long as it stays above the upper median line (UML) of the ascending pitchfork, the price has failed to retest this dynamic support signaling strong buyers.

Personally, I would have liked to see a consolidation below the $1,900 level and above the upper median line (UML) before going higher. The UML retest, rejection, would have given us a great buying opportunity. Gold is expected to climb higher, but only a jump and stabilization above the $1,900 will help us to enter long again. Now, is too risky, even if the price could edge higher in the short term. A valid breakout above the $1,900 and above the 150% Fibonacci line will signal a potential move up to the first warning line (WL1) and towards the R3 ($1,936) level. Gold could register a minor decline if it fails again to reach the $1,900 level, or if it makes a false breakout above this obstacle. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Be wary of buying the euro at current highs Posted: 24 Jul 2020 01:59 AM PDT The euro continues to rise, despite the surge in coronavirus infections around the world. This is because the recent rise in new cases deteriorated a number of economic indicators including the US labor market, which is one of the influencers on the USD rate. In addition, the dollar has weakened due to the expiration of some federal support measures, which seriously threatens the recovery of the US economy. Fortunately, the White House is already preparing a new package of measures, but it is unlikely to provide significant support to the dollar, since the trend has changed recently and the injection of next billions no longer contributes to the growth of confidence in the future, as it was at the very beginning of the pandemic. Sooner or later, the money will have to be returned and the bloated billion-dollar holes in the budget should be reduced, which will not benefit the economy in the future. If the support provided by the Fed is not extended, many households will experience a financial shock, as yesterday's labor market data indicated a gradual rise in unemployment claims. In addition, the deterioration of the situation will certainly affect the barely recovered consumption, which will affect the US economy. The report published by the US Department of Labor indicated that the count of initial applications for unemployment benefits rose to almost 1.42 million in the week of July 12 to July 18, while the week before it applications were just 1.31 million. The Economists expected the figure to drop slightly to 1.3 million. Meanwhile, the number of secondary applications from July 5 to July 11 was about 32 million. If coronavirus infection continues to rise in the United States, the US labor market will experience heavier problems in the future.

Meanwhile, the slight recovery of the economic index, which reflects the economic cycles in the US, leveled the situation in the country. The report published by the Conference Board showed that the index of leading indicators rose by 2.0% in June, reaching 102.0 points, which is a good news for the economy. Another report on manufacturing activity in the area of Kansas Fed added hope to economic recovery this summer. According to the report, activity in July of this year continued to grow, albeit in small topics, even against the background of a high number of cases of coronavirus infections in the region. The composite index rose to 3 points in June, while economists predicted the indicator to rise to 5 points. As for Europe, the data on consumer confidence in the eurozone, which were ignored by the market, became a rather alarming call for buyers of the European currency. According to the report, the preliminary index of consumer confidence fell to -15.0 points in July, although it was predicted to recover to -12 points. This suggests that, despite a gradual economic recovery in the past few months, consumers are pessimistic about the future, fearing new infections and a return to quarantine and social distancing measures that are still in place in many regions of the eurozone. As for the technical picture of the EUR / USD pair, the price will increase, if the bulls manage to push the quote above the level of 1.1590. Such could raise the price up to the highs of 1.1650 and 1.1690. But if the bears are able to lower the quote below 1.1590, profit-taking on long positions will begin, which short the price to the lows 1.1540 and 1.1490. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

In April 2020, the GBPUSD pair has been moving sideways within the depicted consolidation range extending between the price levels of 1.2265 and 1.2600.

In April 2020, the GBPUSD pair has been moving sideways within the depicted consolidation range extending between the price levels of 1.2265 and 1.2600.

No comments:

Post a Comment