Forex analysis review |

- Forecast for EUR/USD on July 30, 2020

- Forecast for AUD/USD on July 30, 2020

- USDCAD testing downside confirmation, potential drop!

- Forecast for USD/JPY on July 30, 2020

- GBPJPY facing bullish pressure, potential for further upside

- Overview of the GBP/USD pair. July 30. The US GDP report can finish off the US dollar. A new international conflict is brewing

- Overview of the EUR/USD pair. July 30. Donald Trump and Mike Pompeo accuse China of openly supporting the Democratic Party

- AUDUSD holding above ascending trendline support!

- Pound prepares for another leap

- EUR/USD. July Fed meeting: preview

- Shares of American exporters. How will demand behave?

- EUR / USD: US loses battle against coronavirus while dollar sales may continue

- July 29, 2020 : EUR/USD daily technical review and trade recommendations.

- July 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- July 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Weekly warning signs in USDCHF

- Short-term Ichimoku cloud indicator analysis of Gold

- Bearish formation in USDCAD

- Short-term bounce imminent in USDJPY

- US stocks decline, while European and Asian stocks moved indefinitely

- Powell to try to convince world of USD stability

- Gold is expected to rise to $ 8,000 per ounce

- Oil market continues to sink

- GBP/USD: plan for the American session on July 29

- EUR/USD: plan for the American session on July 29

| Forecast for EUR/USD on July 30, 2020 Posted: 29 Jul 2020 08:10 PM PDT EUR/USD Yesterday, the euro fulfilled its irresistible and inextinguishable desire to work out the border of the global price channel at around 1.1804. This channel originates from the July 2008 high. The price begins to form a divergence with the Marlin Oscillator. The first target of the decline is 1.1620. The Marlin divergence looks unambiguous on the four-hour chart, and it was created twice in a row. We are waiting for the price to move to the target level of 1.1620. On the way to it, the price will face an obstacle in the form of the MACD line in the area of 1.1686. |

| Forecast for AUD/USD on July 30, 2020 Posted: 29 Jul 2020 07:59 PM PDT AUD/USD The Australian dollar reached the forming line of the triple divergence yesterday, forming it in an exemplary manner. Now we are waiting for the price reversal down to the target range of 0.6410/80. The goals for the downward movement will still be adjusted, but the closest is 0.7070 - the July 24 low and the June 10 high. There are no reversal signs on the 4-hour chart. Perhaps it will be the price divergence with the Marlin oscillator. At the moment, the situation is completely upward: the price is above the balance and MACD indicator lines, Marlin is moving sideways in the positive trend zone. The price falling below the MACD line at 0.7142 is a signal for a reversal. |

| USDCAD testing downside confirmation, potential drop! Posted: 29 Jul 2020 07:57 PM PDT

Trading Recommendation Entry: 1.3319 Reason for Entry: 78.6% fib extension Take Profit :1.3262 Reason for Take Profit: Horizontal swing low Stop Loss:1.3401 Reason for Stop loss: Horizontal overlap resistance The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on July 30, 2020 Posted: 29 Jul 2020 07:54 PM PDT USD/JPY The Japanese yen traded below the 105.15 level on Wednesday, but the second target at 104.60 was not reached. The signal line of the Marlin oscillator is turning up, the correction may continue with an attack on the descending line of the price channel, that is, above the 105.60 level. The double convergence is not strong on the four-hour chart, but it is fully working out, the signal line of the Marlin oscillator is about to penetrate into the positive trend zone. Consolidating the price above the 105.15 level could lead to a retest of the 105.70 level. Stock markets are complacent about the second wave of coronavirus; yesterday, the US S&P 500 rose by 1.24%, today the Japanese Nikkei 225 is growing by 0.20%. Accordingly, the dollar can somewhat restore the lost positions. |

| GBPJPY facing bullish pressure, potential for further upside Posted: 29 Jul 2020 07:00 PM PDT

Trading Recommendation Entry: 136.112 Reason for Entry: Ascending trend line, 23.6% fibonacci retracement, 78.6% fibonacci extension and horizontal overlap support Take Profit: 137.060 Reason for Take Profit: 127.2% fibonacci retracement Stop Loss: 135.688 Reason for Stop Loss: Horizontal swing low support, 50% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jul 2020 06:52 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 134.8997 Recently, we often write about the fact that a "cold war" is brewing between China and the United States. However, we should not forget that the UK also has serious claims to Beijing. And not just in the UK. Recently, the whole world has faced the "Chinese problem" and the "Chinese virus". In addition, China has adopted a law on "national security for Hong Kong", which, in fact, canceled the autonomy of this city and immediately caused a flurry of indignation in almost half of the countries of the world that conducted active business with Hong Kong, but are not going to continue to do so if Beijing establishes power over this city. Beijing has established power, and Hong Kong has already begun to experience all the delights of life as part of China. The United States has cut off most of its trade preferences, many countries and companies have refused to export technology to this district, and the situation in Hong Kong will only get worse in the future. However, it is the UK that has the most claims, first, for the "coronavirus" (the British government has already stated that it does not know how to conduct further business with China), and second, for Hong Kong, because it is according to the British-Chinese Treaty of 1984, since 1997, Hong Kong must be Autonomous for at least 50 years, that is, until 2047. However, the Chinese government, in its own way, asked London not to interfere in China's internal affairs, and that was the end of all diplomacy. However, Boris Johnson immediately said that he would provide opportunities for all residents of Hong Kong with British passports to live and work in the UK without visas, and in the future even have the opportunity to obtain British citizenship. However, China is unlikely to just let everyone go to Britain. According to the latest information, Beijing is going to block Boris Johnson's proposal by simply not recognizing the British foreign passports of everyone who wants to leave China. The Chinese Foreign Ministry officially stated: "The UK was the first to break the promise, so China will consider not recognizing the British national foreign passport as a valid document for travel." In general, it seems that the battle for Hong Kong is just beginning, and the world is on the verge of a new crisis. At the same time, China itself has serious claims to the UK. Recall that initially it was the Chinese company Huawei that was supposed to develop a 5G network in the Foggy Albion. However, at the very last moment, Boris Johnson refused the services of this company, not without the help of Donald Trump, who has long waged a diplomatic, economic and espionage war against this company Huawei and China in general. The EU countries are also inclined to the same decision. China believes that this was not without Washington's intervention and now threatens to impose retaliatory sanctions against Nokia and Ericsson, which may develop 5G networks instead of Huawei. No open threats have been made yet, however, some insider sources report exactly this. In addition, the Chinese government is considering banning the export of products of these two companies produced in China, which will mean a full-scale economic war. Thus, the EU is also now in a completely incomprehensible situation. After all, it is possible to transfer the production of Nokia and Ericsson companies from China, but all this will take a long time, require multi-billion-dollar investments, and it is also possible that Beijing will be happy to put sticks in the wheels. However, official China rejects such scenarios and assures that it is not going to launch any wars against the Finnish and Swedish telecommunications companies. Meanwhile, experts at the London school of Economics predict the biggest drop in the British economy in the country's history. Experts note that Brexit and the absence of an agreement may affect those sectors of the economy that emerged relatively unscathed from the "coronavirus crisis". The report notes that it does not matter whether Boris Johnson is able to negotiate a trade agreement with the European Union or not, if barriers and restrictions on trade arise between the bloc and the Kingdom, this will in any case have a negative effect. At the same time, nothing interesting in economic terms is happening in the UK. There is no new information about the progress of negotiations between London and Brussels, that is, on the topic that most worries traders right now. Macroeconomic statistics are also not planned for this week, so traders can trade only on the basis of technical factors and the fundamental background from overseas, which has not changed at all in recent weeks. This is probably why the nature of the movement of the pound/dollar pair has not changed in recent weeks. As for the macroeconomic background from overseas, yesterday's Fed meeting brought traders some important and interesting information. The Fed left the key rate unchanged, as expected by traders. No more reports were scheduled for Wednesday. On Thursday, the United States will release the key report of the week - on GDP for the second quarter. True, this is not the final value of the indicator, it may still change, but, you must agree, when the forecast promises -35%, it is unlikely that anything will change dramatically in the next month or two, during which the report can still be adjusted. In fact, this report alone may be enough to send the US dollar into a complete "knockdown". However, there is another side to the coin. The US dollar has been falling non-stop for quite a long time. And it falls not only because of the weakness of the US economy at this time, and not only against the pound. Thus, there is reason to assume that traders will ignore all of today's reports from America. Why do the pair's bulls need additional macroeconomic support, if they are already busy buying without it? Against the background of the GDP report, data on applications for unemployment benefits and personal consumption expenditures look absolutely not interesting. Thus, at this time, we do not see how the upward trend for the pound/dollar pair can end. To be more precise, what exactly needs to happen in order for it to end. Most likely, it will end without any high-profile events, just when the bulls get enough and remember that the situation with the British economy is not much better than with the American one. Then the British currency will not have to be envious, since it has not lost its potential for falling due to Brexit and the lack of desire for London to negotiate with Brussels, and not to put ultimatums.

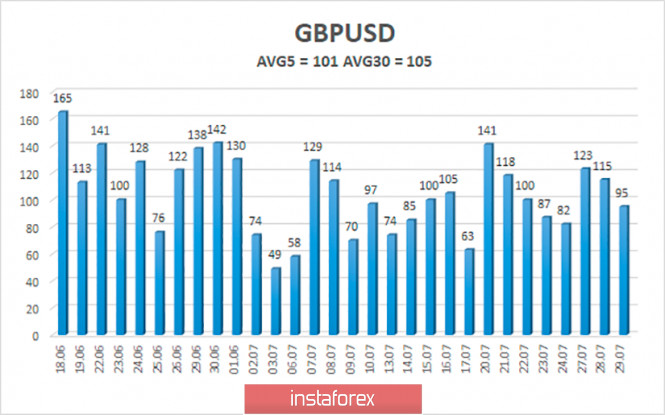

The average volatility of the GBP/USD pair continues to remain stable and is currently 101 points per day. For the pound/dollar pair, this value is "average". On Thursday, July 30, thus, we expect movement within the channel, limited by the levels of 1.2893 and 1.3095. Turning the Heiken Ashi indicator downwards will indicate a new round of downward correction. Nearest support levels: S1 – 1.2939 S2 – 1.2878 S3 – 1.2817 Nearest resistance levels: R1 – 1.3000 R2 – 1.3062 Trading recommendations: The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, it is recommended to stay in purchases of the British currency with the goals of 1.3062 and 1.3095 (the level of volatility on Thursday), until the Heiken Ashi indicator turns downwards. Short positions can be considered no earlier than fixing the price below the moving average with the first goal of 1.2756. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jul 2020 06:52 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 107.9624 The EUR/USD currency pair maintains the prospects of an upward movement. However, the technical picture now does not raise any questions, unlike the fundamental picture of the state of things. We have repeatedly said that, in principle, the current strengthening of the European currency, which had been falling for two years before, but lost only 2 cents in 2019, is quite logical and justified by the events that are happening now in the United States. Even yesterday, when the results of the Fed meeting were scheduled to be summed up, traders were not discussing the Fed meeting at all. All the topics that excite market participants have remained the same. And it is these topics that can contribute to a new fall in the US currency. At the same time, we have already noted the fact that the upward trend can end at any time. First, because of the purely technical need for a correction, and second, because the dollar can not fall forever on the same news. In any case, you need to go through the main ones. The topic of "coronavirus" remains the main one at this time. In the United States, a high number of COVID-2019 diseases is still recorded, but in recent days, the rate of spread of the epidemic has still begun to decrease and on Monday, less than 60 thousand cases of the disease were recorded. The consolation for the American healthcare system and Donald Trump personally is weak. But this is better than if the growth rate continued to increase. Meanwhile, riots and protests continue in many American cities. The situation is most difficult in Seattle and Portland, where protests have long been non-peaceful. Protesters use Molotov cocktails, rocks, stun guns, sledgehammers, bats, and so on. This is the same situation in many other cities in the United States. Earlier, Donald Trump sent special forces to several cities to stop riots and restore law and order as soon as possible. However, at the moment, it cannot be said that this plan of Trump has worked. Protests and rallies continue. The US Justice Secretary, who is also the Attorney General, called the actions of the protesters "an attack on the government". A lengthy speech followed, during which it became known that the US government would continue to resist the protesters in order to ensure calm and a safe life for American citizens. It is also reported that the mayors of six American cities at once sent Trump demands to remove special forces from their regions. Mayors have asked Congress to limit the powers of the US President in this matter. According to mayors and governors of many cities and states, the protesters are only exercising their right guaranteed by the Constitution, and all actions of the federal authorities only provoke violent clashes with law enforcement officials. It is also reported that the mayors of Chicago, Seattle, Portland, Albuquerque, Kansas city and Washington are outraged by the actions of Trump, who sent armed special forces to their cities. In general, what is currently happening in the United States, in other words, than "anarchy" and "chaos", can not be called. The most interesting and, unfortunately, funny thing is how Donald Trump himself is trying to influence the situation and sway voters in his direction three months before the presidential election. Naturally, Donald Trump blames China and the Democrats for all the troubles. Sometimes personally, sometimes through his proxies, such as Mike Pompeo, who is Secretary of State. On Tuesday, Pompeo said that the Chinese work closely with the Democratic Party and regularly hold talks with them on Capitol Hill. He complained that American diplomats also want to be able to "talk to the Chinese people", although it is unlikely that this is what he meant. Most likely, Pompeo is hinting that China actively supports Joe Biden, as Donald Trump himself has repeatedly said before. And, of course, regularly "gets" to Joe Biden himself from the current president of the United States. In recent interviews, Trump called Biden a "puppet of the left" and said that if he wins, "cities in the United States will burn with fire, and markets will collapse". Under him, according to Trump, the United States will enter the "Golden age". In general, once again we can note that when the country has a serious and difficult situation with "coronavirus" and "unrest", the US authorities are thinking more about the upcoming elections. However, the current state of affairs in the United States is a consequence of the problems of power that have accumulated over the years. We have repeatedly suggested that the current unrest and the "coronavirus" are supported by some hidden force. We don't want to guess who this force might be. However, somehow the whole world rallied against Trump and his administration, somehow too holistically and precisely in time. And finally, in Germany, the Minister of Education and Research of Germany, Anja Karlikzek, made another statement that reflects the real state of affairs in the development of a vaccine against "coronavirus". "Scientists are working at an unprecedented speed, but in such complex projects, steps in the opposite direction are always possible. Don't wait for a miracle. We should assume that the vaccine will be ready for the general population at the earliest in the middle of next year," Karliktsek said. Thursday will be quite an important day for the euro and the US dollar. The most important event of the day will be the publication of GDP for the second quarter in the US. However, we will analyze all American reports in the article on GBP/USD. In Europe today, there will also be something to pay attention to. Early in the morning, German unemployment figures will be published, which continue to please the traders. It is expected that the main unemployment rate will grow to only 6.5%, and the number of new unemployed will be +43 thousand. It will also publish a preliminary GDP for the second quarter with a forecast of -11.1% in annual terms and -9% in quarterly terms. This is, of course, a lot, but compared to the possible -35% of American GDP – nothing. Also on July 30, Germany will publish the consumer price index for July with a forecast of 0.2% y/y. Harmonised inflation should be 0.4% y/y. Weak values, but in the context of a pandemic and crisis, inflation is not an important indicator. For the EU, the unemployment rate and consumer confidence will also be released. We would say that the key report on Thursday in Europe will be German GDP.

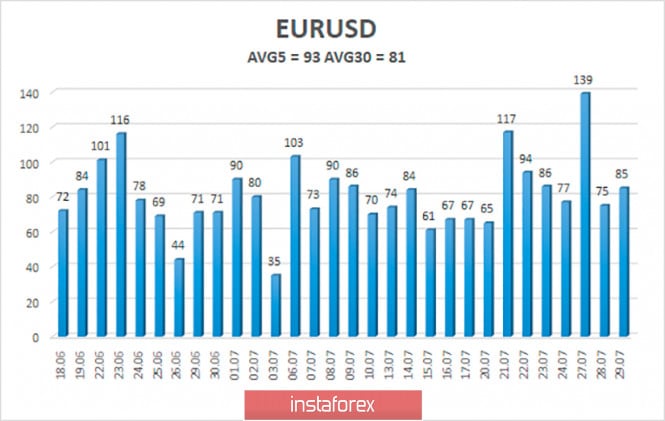

The volatility of the euro/dollar currency pair as of July 30 is 93 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1692 and 1.1878. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction within the ascending trend. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3 – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 Trading recommendations: The EUR/USD pair resumed its upward movement. Thus, today it is recommended to continue trading on the increase with the goals of 1.1841, 1.1878 and 1.1963 until the new reversal of the Heiken Ashi indicator downwards. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1597. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD holding above ascending trendline support! Posted: 29 Jul 2020 06:52 PM PDT

Trading Recommendation Entry: 0.71713 Reason for Entry: Ascending trendline support, moving average, 23.6% Fibonacci retracement Take Profit: 0.72191 Reason for Take Profit: -27.2% Fibonacci retracement Stop Loss: 0.71489 Reason for Stop Loss: 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Pound prepares for another leap Posted: 29 Jul 2020 12:49 PM PDT The national currency of Great Britain continues to feel confident enough against the background of the weakening of the US dollar. The sterling value is approaching the strategically important level of 1.30 dollars per pound. This morning, the sterling jumped again and managed to gain 0.3% against the US dollar. However, the pound did not show any significant dynamics against the single European currency and remained unchanged. The reason for the sterling's excitement and the dollar's fall lies in the difficult epidemiological situation in the United States of America, where the growth of coronavirus infection has not been stopped. It seems that America is fighting COVID-19 one on one, while the rest of the world was able to cope with the pandemic. The pound has already reached 1.29 dollars, which has put it at its highest level over the past five months, coming close to pre-crisis indicators, which, it should be noted, were still not the highest in history. What is alarming is the fact that the pound remains unchanged against the euro at 90.66. At the same time, the daily volatility of the pound against the US dollar is also increasing. So, its level has already reached the highest values for the last month and a half and is already within 11%. However, this does not cancel out the growth of interest in the national currency of the UK, which is provided by the revision of some currency risks associated with the fact that the cost of securities in the country in the second month of summer decreased. Hedge funds were the most active buyers of sterling on the market. However, many experts are still inclined to believe that the pound's popularity became obvious after the US currency entered a stage of decline and began to show weakness day by day. According to analysts, the pound's growth is affected by the level of economic recovery from the impact of the coronavirus pandemic. Thus, the US economy is clearly not coping with this, while the European economy is doing very well. At least, no grandiose problems have emerged lately. Moreover, it is increasingly likely that the European region will be able to avoid a serious second wave of coronavirus, which means that the negative impact on the economy will also be less severe. In support of this, we can add that data from Europe has been encouraging. This allows us to hope that next year will also be quite good and deep failures will not happen. But such a statement is still difficult in relation to America. Thus, the strategic mark of the pound at 1.30 dollars per sterling is very close, which will become a reliable support point for further upward movement. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. July Fed meeting: preview Posted: 29 Jul 2020 12:48 PM PDT The results of the July meeting of the US Federal Reserve will be announced today. Perhaps this is the central event of the current week, especially since this meeting will most likely not be a "pass-through". Recent events in the US suggest that the country's economy will recover at a slower pace than previously expected, so the Fed could take a soft position, putting additional pressure on the dollar. But an alternative option is not excluded: the central bank can ignore many negative factors (for example, leaving out the continued growth in the number of COVID-19 cases in the US), maintaining a wait-and-see position until the fall. In any case, higher volatility is expected for the EUR/USD pair this evening, as well as for other dollar pairs. And it is quite difficult to predict the direction of the price – the fundamental background is contradictory and uncertain. Therefore, you should only make trading decisions on the pair based on today's results. Let me remind you that the text of the accompanying statement will be announced at 21:00 (GMT) and press conference by Fed Chairman Jerome Powell will start at 21:30 (it lasts roughly 30-40 minutes). You should take note that the inconsistency of the fundamental background does not only lie in how the macroeconomic reports are diverse. For example, the number of people employed in the non-agricultural sector jumped by 4,800,000 in June. But at the same time, the indicator of wage growth turned out to be much worse than the forecast values. The level of average hourly wages on a monthly basis, firstly, remained in the negative area, and, secondly, collapsed to a multi-year low of -1.2%. The consumer confidence index also fell: this indicator dropped to 92.6 points in July. But the consumer price index showed a positive trend: the June CPI came out at the level of forecasts, reaching 0.6%. Core inflation (which does not include food and energy prices) last month was 1.2% on an annualized basis. This result turned out to be higher than the forecasts of most experts (who expected to see this indicator slightly lower - at around 1.1%). On a monthly basis, the core index rose to 0.2%, also beating analysts' forecasts. It should also be recalled that the US economy slowed by 5% in the first quarter. As for the second quarter, experts' estimates differ. But absolutely all analysts agree that the results of the second quarter will be much worse than the first. According to the consensus forecast, US GDP will slow to -35%. This is a historical anti-record. The preliminary estimate will be published tomorrow, so the regulator's members will have to operate with their own calculations today. As we can see, the macroeconomic reports are contradictory. This allows the controller to swing the pendulum both in one direction and in the other, deciding "the glass is half empty or half full". In my opinion, the Fed will voice pessimistic rhetoric, taking a dovish position. Firstly, the coronavirus is still not letting go of the United States - the situation is only getting worse, and the number of cases is only greater. For example, 1,600 deaths of patients with COVID-19 were recorded over the past day in the United States. This is the highest daily increase in mortality in the country over the past two and a half months. The daily increase in infected people did not exceed the 25,000 mark during the Fed June meeting. Whereas in July this figure does not decrease (with rare exceptions) below the 60,000 mark. The alarm is raised by both doctors and scientists, who wrote an open letter to the White House demanding to tighten quarantine in the country. Meanwhile, the bill on additional financial assistance to the US economy continues to be within the walls of Congress. Senators hacked the Democrats' $3 trillion initiative in May, considering the idea too costly. Now Congressmen are discussing the allocation of a trillion dollars. If Powell declares (directly or covertly) that this amount is not enough to "restart" the economy, the dollar will again be under strong pressure. It is worth noting here that the Fed will probably leave the parameters of monetary policy unchanged at its July meeting. This fact is absolutely expected and will not make any impression on traders. The main focus will be on the text of the accompanying statement and Powell's rhetoric at the press conference. If the Fed focuses its attention on positive trends in the labor market and inflation, while pointing to the need to reduce the amount of monetary stimulus in the foreseeable future, the dollar will receive quite firm support and strengthen throughout the market. But in my opinion, members of the Fed will not rush to such conclusions. On the contrary, most likely, the accompanying statement will contain a phrase about "potentially available incentive tools". In turn, Powell can talk about plans to introduce control of the bond yield curve at his press conference. In addition, the regulator will probably focus on the fact that low rates and incentive programs will continue to operate for a long time. Such rhetoric will increase pressure on the dollar throughout the market, including EUR/USD. At the moment, buyers of EUR/USD are besieging the resistance level of 1.1750 (the lower border of the Kumo cloud on the monthly chart). Bulls have already stormed this price barrier several times, but could not gain a foothold higher. If the meeting ends according to the above scenario, the euro-dollar pair will not only overcome 1.1750, but also test the 18th figure. Otherwise, we will see a deep downward pullback to the first support level of 1.1580 (the Tenkan-sen line on the daily chart). Given the high degree of uncertainty, trading decisions on the pair should only be made based on the results of Powell's press conference. The material has been provided by InstaForex Company - www.instaforex.com |

| Shares of American exporters. How will demand behave? Posted: 29 Jul 2020 08:16 AM PDT For several weeks in a row, analysts on both sides of the Atlantic have been talking about the impact of the weak dollar on the American economy. Many experts agree that US export-oriented companies dominate in the conditional list of beneficiaries. This idea has received another confirmation after the recently released forecast from market strategists Goldman Sachs. The investment company believes that this year only non-residents will purchase shares of American enterprises worth $ 300 billion. And most of the funds will be invested in businesses with a high share of international sales.

List of fifteen Citing Goldman Sachs, domestic and foreign media publish the TOP 15 companies whose shares will benefit from the dollar's fall. The list is dominated by semiconductor companies Lam Research, Texas Intruments, Broadcom, Maxim Integrated Products, Nvidia, Qualcom, Texas Intruments, Applied Materials, and KLA. Analysts also recommend paying attention to the tobacco giant Philip Morris, video game maker Electronic Arts, media holding News Corp, equipment manufacturer Waters. The tourism industry in the TOP-15 is represented by Booking Holdings, the food industry - Mondelez Int., The financial sector - Aflac. Goldman Sachs makes a bet on non-residents based on the analysis of its own data for a forty-year period. They indicate that it is the sinking of the dollar that has always stimulated the demand of foreign investors for shares of US companies. Exporter Rate Most Russian analysts agree that a weak dollar increases the competitiveness of American goods - not only in foreign markets but also domestically (due to the growth in the cost of imported analogs). This is a chance for the development of industry, which in the current economic conditions only plays into the hands of the Trump administration. In this regard, some media outlets suggest that it is from the White House that the initiative to take measures to prevent the strengthening of the dollar comes. This can include pressure on the Fed over the level of key rates, and soft policy. Accordingly, experts predict that exporters can, to a certain extent, be confident before the November presidential elections in the United States: no drastic steps by the authorities to stimulate dollar growth should be expected. Additional factor Within the United States itself, increased attention to the stock market, among other things, may be due to the minimum yield on bonds. That is, stocks have become for many traders a partly uncontested financial instrument. Paul Krugman, winner of the 2008 Nobel Prize in Economics, also speaks of this. According to him, investors are currently maniacally afraid of lost profits. In an interview with CNBC, the scientist focused on the FOMO (fear of missing out) effect and warned against investing "on the verge of insanity." The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: US loses battle against coronavirus while dollar sales may continue Posted: 29 Jul 2020 08:10 AM PDT

Although the market is full of rumors about the end of the era of the dominance of the US dollar, analysts at Barclays believe that the reserve status of the US dollar is now in no danger. Upon arguments, the bank's experts cite the depth of the US capital markets, as well as the significant share of USD in global trade. "Over the past years, central banks and investors have accumulated dollar assets. However, given the recent events, they decided to diversify their portfolios in favor of assets denominated in other currencies, "said Barclay's specialists. They predict that in the near future the USD rate will decline amid further diversification of portfolios. "The USD index, as well as the EUR / USD pair, have broken through important support / resistance levels. This attracted large long-term players who will sell the dollar for some time to come, "Barclays said. Another threat to the greenback, according to experts, is the US presidential election, which will be held in November. "The risks associated with the US presidential elections, apparently, have not yet been fully taken into account in the quotes. At the moment, investors' attention is focused on the fight against COVID-19 in the United States and the economic impact of the pandemic, "said strategists at Barclays. "The swap lines that the Fed established with other central banks at the height of the coronavirus crisis have flooded the world with dollars. Along with a sharp cut in interest rates in the United States, which caused the decline in the USD, "they added. The USD index continues to hold near its lowest values since June 2018, around 93.4 points. Investors remain concerned about the uncontrollable spread of COVID-19 cases in the United States, which is casting a shadow over the prospects for the world's largest economy. The pressure on the greenback is also exerted by the uncertainty regarding the next package of assistance to the US economy. Republicans reported disagreements over their own $ 1 trillion bailout plan on Tuesday, while negotiations with Democrats also stalled. Throughout the past week, the EUR / USD pair was in the overbought zone, but this did not prevent it from growing to the highs since September 2018, after which it slowed down its growth. The decision of the EU leaders to create a fund for economic recovery in the region continues to support the euro. With regard to the epidemiological situation in Europe, outbreaks of COVID-19 in some parts of Germany, Spain, and France remain local so far. As analysts at Credit Suisse note, there has been a pause in the upward movement of EUR / USD, however, in light of last week's close above 1.1495 and the formation of a base on the medium-term charts, the pair's prospects remain positive. "In the near future, some consolidation should be expected from EUR / USD, but only if the level of 1.1580 is broken, it will be possible to say that the" bulls "have started to run out of steam and a deeper correction can be expected from the pair. In the meantime, the focus of attention remains shifted to the highs of September 2018 and 61.8% of the decline since 2018 in the area of 1.1815-1.1822. Ultimately, we expect to see a storm of the bottom of the 2018 reversal top at 1.2155, "said strategists at Credit Suisse. The material has been provided by InstaForex Company - www.instaforex.com |

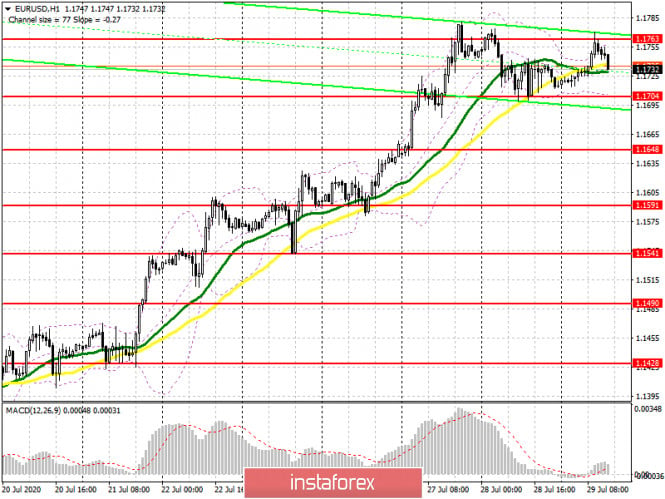

| July 29, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 29 Jul 2020 08:07 AM PDT

The EURUSD pair has been moving-up since the pair has initiated the depicted uptrend line on May 25. On June 11, a major resistance level was formed around 1.1400 which prevented further upside movement for some time and forced the pair to have a downside pause. Recently, the EURUSD demonstrated an ascending wedge around the mentioned price level of 1.1400 affected by a couple of contradictory Fundamental data from the U.S.However, Last week a few negative fundamental data from the U.S. have caused the EUR/USD to achieve another breakout to the upside. This week, the EURUSD has approached the price levels around 1.1750 pair where some signs of downside pressure were manifested as mentioned in Yesterday's article. Intraday traders should be waiting for a upcoming breakdown of the depicted short-term uptrend (1.1650) to the downside to be able to have a valid SELL Position. Estimated targets would be located around 1.1550, 1.1500 then 1.1450. The material has been provided by InstaForex Company - www.instaforex.com |

| July 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 29 Jul 2020 08:02 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. Hence, Bearish persistence below 1.1150 (consolidation range lower limit) was needed to enhance further bearish decline. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1600 (Fibonacci Expansion 78.6% level) which failed to offer sufficient bearish pressure. That's why, further bullish advancement pursued towards 1.1730 (Fibonacci Expansion 100% level) which is being tested now. Trade recommendations : Conservative traders should wait for the current bullish movement to pause and get back below 1.1730 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1600 and 1.1500 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| July 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 29 Jul 2020 08:01 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2265 (Previous Consolidation range Lower Limit) on the H4 Charts. On May 15, transient bearish breakout below 1.2265 (the depicted demand-level) was demonstrated in the period between May 13 - May 26, denoting some sort of weakness from the current bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD pair back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where another episode of bearish pullback was initiated. Short-term bearish movement was expressed, initial bearish targets were located around 1.2600 and 1.2520 which paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. Significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2780, where the mid-range of the depicted wedge-pattern failed to offer enough bearish rejection. This indicated a continuation of the current bullish movement towards 1.2970-1.2980 where the upper limit of the depicted pattern comes to meet the pair. Trade recommendations : Intraday traders can consider the current bullish pullback towards the depicted Supply Level (1.2980) for a valid SELL Entry. Stop Loss should be tight, it can be placed above 1.3050 while initial T/P level to be located around 1.2780 & 1.2600. The material has been provided by InstaForex Company - www.instaforex.com |

| Weekly warning signs in USDCHF Posted: 29 Jul 2020 07:50 AM PDT USDCHF is breaking to new short-term lows exiting a multi month upward sloping path it was in since December. The Dollar weakness is affecting this pair also and we expect the coming weeks to continue to see it under pressure in lower levels.

Black lines- bullish channel USDCHF has sustained a big decline over the last 20 years as shown in the weekly chart above. The last 10 years price has stopped the decline and gradually and steadily was moving higher in an upward sloping channel. Price is now showing weakness signs as price is exiting the upward sloping channel and is breaking to new 5 year lows. Such a formation usually brings price to its base and start. In this case the base is at 0.7660. Resistance and key level for bulls that they need to recapture is at 0.9850. As long as price is below that level we consider every bounce as a selling opportunity. The material has been provided by InstaForex Company - www.instaforex.com |

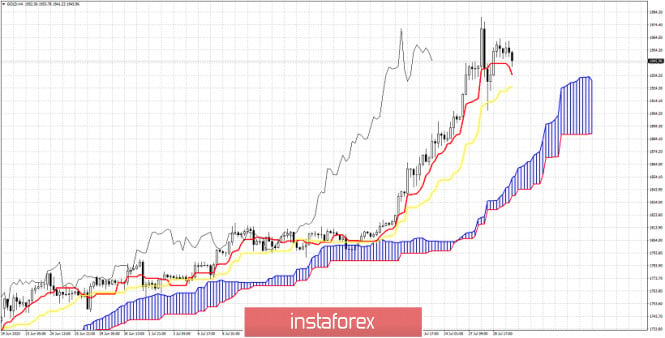

| Short-term Ichimoku cloud indicator analysis of Gold Posted: 29 Jul 2020 07:44 AM PDT Gold price is in a bullish trend. Price has risen in a parabolic pattern over the last few days making new all time highs above $1,900. Our targets of $1,930 and $1,964 have been met. Our next target is $2,010. However Gold price is showing signs of a possible pull back.

Using the Ichimoku cloud indicator we are going to identify the price levels that if broken will signal that a pull back is coming. As you can see the price remains above the tenkan-sen (red line indicator). Breaking below it ($1,934) will be the first weakness sign. The next support and key level is shown by the kijun-sen (yellow line indicator) at $1,925. A 4 hour close below that level will open the way for a bigger pull back towards the cloud body (Kumo). Depending on time, the pull back should push inside the $1,850-$1,900 range. We will know more when we see the break of support. Until then we remain short-term bullish looking for $2,010. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jul 2020 07:39 AM PDT USDCAD is in a bearish trend and we remain bearish since the break below 1.35. Price is now challenging important support at 1.3350. A bearish pattern has been identified that if triggered could open the way for a move towards 1.2950.

Blue lines- potential downside move equal to high of cup USDCAD is challenging June lows. Price bounced off 1.3350 towards 1.37 but bulls were not strong enough and now we have a higher low formation. Price has returned to June lows and breaking below the black line (1.3350 level) we see high chances of pushing lower towards 1.30-1.2950. Resistance is found at 1.35 and as long as price is below this level we remain bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term bounce imminent in USDJPY Posted: 29 Jul 2020 07:33 AM PDT USDJPY is in a bearish trend making lower lows and lower highs. However there are some indications that a short-term relief bounce could come by the end of the week, so bears need to be cautious and not too greedy.

As we see in the above 4 hour chart, the RSI is showing bullish divergence signs. USDJPY justifies a bounce towards the 38% Fibonacci retracement and the 105.75 area. Trend is bearish but with the end of the week close by, we could see some profit taking by bears to lock in profits and this could push price higher. I do not expect to see a major trend change but only a relief bounce. The material has been provided by InstaForex Company - www.instaforex.com |

| US stocks decline, while European and Asian stocks moved indefinitely Posted: 29 Jul 2020 07:01 AM PDT

Asian stock markets showed uncertainty and moved multidirectional on Wednesday. This was due to a not so very encouraging statistics on the work of companies in the region in the second quarter, which is still published. It also forces market participants to return to an extremely unpleasant issue for them regarding the more significant than previously assumed, the consequences of the crisis caused by the coronavirus pandemic. The scale of the disaster can be much more significant, and in order to cope with the consequences, it will take more time and effort. Japan's Nikkei 225 index went down Wednesday morning and fell 1.18%. A significant decline in the country's economic development against the backdrop of the coronavirus forced the country's level in the ranking to change. Thus, the forecast for Japan has moved from "stable" to "negative". At the same time, the state was not even helped by the fact that it got up to fight COVID-19 earlier and more effectively than others. The Japanese economy has still not been able to successfully cope with the negative impact of the virus. China's Shanghai Composite index, on the contrary, began to fix the positive sentiment, which eventually led to a good growth of 1.52%. Hong Kong Hang Seng Index was also able to climb by 0.36%. However, the situation may change overnight after the press releases data on the level of Hong Kong GDP for the second quarter of this year. In addition, the situation in the United States of America is putting pressure on the Chinese stock market. For the second day in a row, the country's Federal Reserve System, during its regular meeting, is trying to come to a consensus on the base interest rate. According to preliminary and more obvious data, the rate should remain unchanged at the extremely low, tending to zero level that is observed at present. Moreover, maintaining this low level is strategically important at a time when the country is still struggling to overcome the coronavirus crisis. Another important issue for the Federal Reserve will be a new portion of stimulus measures that can support the further economic recovery of the state. However, it becomes clear that there is no need to wait for further incentives since the Central Bank has repeatedly adhered to the political line that was adopted before. As long as the situation with the coronavirus remains so tense and there is no clarity in this regard, financial incentives will be a waste of money. According to some experts, continued incentives will not only not help level the situation, but will drive everyone into a dead-end even more. South Korea's Kospi index is rose by 0.34%. The Australian index, on the other hand, shows negative dynamics, which is within 0.24%. Meanwhile, according to the results of Tuesday's trading, US stock exchanges turned out to be in a negative sector: a decline was recorded in almost all directions. The Dow Jones Industrial Average fell 0.77% or 205.49 points. This forced it to move to the level of 26,379.28 points. The Standard & Poor's 500 index sank 0.65% or 20.97 points, which moved it within 3,218.44 points. The Nasdaq Composite index declined by 1.27% or 134.18 points. Its current level is at around 10,402.09 points and was also the lead in the fall. Market participants reacted with undisguised disappointment to the proposal of the Republicans to ratify a new portion of stimulus in the amount of $ 1 trillion. At the same time, the existing unemployment benefit premium should be significantly reduced from 600 to 200 dollars. However, the very fact that aid should continue to be provided is perplexing the US authorities, who are caught between two fires. Representatives of the Central Bank are actively promoting the idea of refusing to further stimulate, while the Republican Party insists on the opposite, in an abbreviated version. The Democrats, on the other hand, are in solidarity with the Republicans in this case and support the preservation of premiums at the current level. However, the stock markets can only be saved by consent from this continuous decline, which the US government have never been able to obtain. If there is no consensus before Friday, when current benefits expire, the value of stocks in the stock markets could be further reduced. At the same time, the consumer confidence index in America in the second summer month of this year fell to 92.6 points, which came as a complete surprise to analysts who, although claimed that there would be some correction, did not expect it to be so serious. Recall that in the last period, that is, in June, the indicator was within 98.3 points, and the expected reduction should have amounted to no more than 94.5 points. So far, investors do not fully assess the current events, but even this does not give them the opportunity to feel at least some confidence. The European stock exchanges have preferred to stop and wait since the economic, geopolitical, and epidemiological backgrounds force us to think hard about every further step. There is practically no dynamics in the markets. And the main event here is also the meeting of the Federal Reserve of the United States of America. The general index of large enterprises in the European region Stoxx Europe 600 slightly rose by 0.08%, which sent it to the level of 367.99 points. The UK FTSE 100 Index showed positive dynamics and rose 0.28%. France's CAC 40 index also rose 0.69%. In contrast, Germany's DAX index recorded a 0.2% contraction. Spain's IBEX 35 Index supported the negative trend and dropped 0.51%. Italy's FTSE MIB index is also in the red zone with 0.63%. The material has been provided by InstaForex Company - www.instaforex.com |

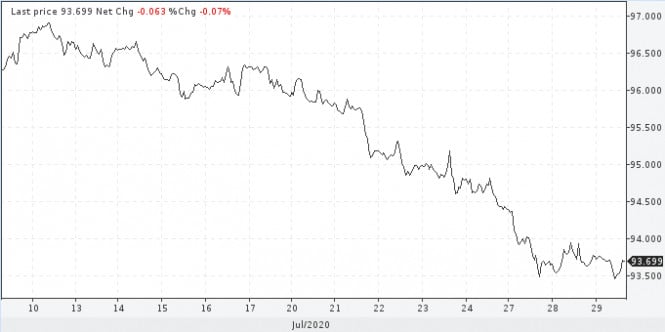

| Powell to try to convince world of USD stability Posted: 29 Jul 2020 06:17 AM PDT The US has made several attempts to contain the increase in the number of coronavirus cases, but all in vain. Four States in the South and West reported record daily deaths on Tuesday. Overall, the infection rate remained fairly high in the country. Markets are gradually losing hope for a rapid economic recovery. Recent macroeconomic data confirmed investors' fears. On Tuesday, the CB consumer confidence index for July was published in the US. The index declined in July to 92.6 points from 98.3 points. However, the data turned out to be worse than analysts had expected. Note that before the pandemic, the indicator was around 120-130 points. Today, results of the US Fed's meeting and Jerome Powell's press conference are the main events. Market participants do not expect any changes in the monetary policy. They are more interested in the rhetoric of the regulator. In light of recent events, it may turn out to be "pigeon". The Fed has already extended most of its anti-crisis programs for three months. Now, markets are interested in what else the Fed is ready to do if the economic recovery needs more time. It is possible that the regulator will start controlling the yield curve in the United States until the end of this year. How will the US dollar react to today's statements? This is an interesting question. Sellers of the US dollar are likely to welcome hints about further monetary policy easing. It is quite possible that the Fed may stand up for the national currency. Jerome Powell will try to convince markets of the firmness of its course. This, along with overheated sell positions on the US dollar, may turn into a pullback from the current lows. This scenario will allow the Treasury to gain time for new rounds of borrowing in the debt markets. At the same time, the greenback will hardly return to relatively recent highs in the near future. During the mentioned period, it was trading 100 pips above the basket of major currencies. This can happen only if the March disaster repeats. In general, the US dollar will hardly show a rapid recovery. Before the meeting, the US dollar index continued its downward trend and located near its 2-year lows. USDX Today, market participants will be waiting for hints dropped by the Fed. They believe that the regulator will show its willingness to increase its purchases of debt with a longer maturity. The financial authorities can set limits of profitability or discuss a higher level of inflation. As noted in Goldman Sachs, a shift towards "average inflation targeting" together with the very high level of the US government debt raises concerns about the US dollar's ability to remain a reserve currency. Here, you should pay attention to the jump in gold, which is trading near its record high of $1,980.5 per ounce that was set on Tuesday. Some economists believe that the US dollar should have collapsed long ago. Since March, the Fed has printed an unprecedented amount of money to cope with the recession. The Fed's balance advanced faster than that of other central banks, as banks and corporations felt a lack of the US dollar liquidity amid the quarantine. Recently, this indicator has somewhat decreased. The US dollar is also under pressure exerting by uncertainties about an additional aid package. Some Republicans did not support a $1 trillion stimulus proposal. At the same time, representatives of the Democratic party called for more significant support, including unemployment benefits of $600 a week. The problem is that the current fiscal support ends this week. To avoid the economic slump, it is necessary to continue stimulus program and even increase it. Lawmakers cannot come to an agreement. As long as there are risks of the US economic weakness, the US dollar sell-off will continue. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is expected to rise to $ 8,000 per ounce Posted: 29 Jul 2020 05:16 AM PDT

Gold has risen in price by almost 10% over the past month. The precious metal overcomes all obstacles on its way with amazing ease. "What really matters is how quickly the quotes passed the $1,920 per ounce level, which was the previous high. It is also very important that prices passed the $ 1,800 mark just as easily. All of this points to a very strong market," said Barry Dawes of Martin Place Securities. According to experts, there are currently many factors that support gold: a weak dollar, increasing geopolitical tensions in the world, cuts in real interest rates, and massive incentives from national governments and central banks. "Even in conditions of negative real interest rates and a depreciation of the dollar, there is still uncertainty about the relationship between the United States and China. Thanks to this combination of factors, gold continues to grow " said Wayne Gordon of the UBS Group. Some analysts expect the US authorities' failed fight against the coronavirus will cause the Fed to signal that rates will remain near zero for a longer period. "Based on the results of the July meeting, the Federal Reserve is likely to maintain a soft policy, confirming the need for additional fiscal measures. Real interest rates stuck in negative territory and the new COVID-19 outbreak hitting the USD index hard will help gold," said Nicholas Frappell of ABC Bullion. Leading investment banks predict that the precious metal price could reach $ 2,000 per ounce in August. "We do not see any reason in the short term for gold to stop the rise. The factors that have driven the precious metal to new highs are still in place," BNP Paribas said. According to the Bank of America forecast, gold may rise in price to $ 3,000 per ounce over the next 18 months. "The record rally in the precious metal reflects growing concern about the global economy," The Goldman Sachs said. The bank revised its 12-month forecast for gold prices upwards - from $ 2,000 to $ 2,300 per ounce. In turn, Juerg Kiener, Managing Director of Swiss Asia Capital, draws attention to the "measured move" technical analysis pattern, the implementation of which will lead gold to $2,834 per ounce. "I think this will be the initial target that the precious metal can reach pretty quickly. Long-term goals are much higher. Historically, prices have risen seven or eight times from their bottom. From the lows of 2015 ($ 1,050 per ounce), this could give rise to about $8,000," he said. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Jul 2020 05:14 AM PDT

The price of crude oil did not manage to break out of the negative zone on Wednesday due to the continuous decline. Nevertheless, several advantages can still be considered: the rate of decline is rather restrained and low, which allows us to speak of a less significant pullback. The main expected news for oil today is the level of reserves in the United States of America. Changes in this indicator will dictate to a greater extent the further movement of oil prices. The API data, which was released on Tuesday, reflected the decline in crude oil inventories last week until July 24 which amounted to 6.8 million barrels. At the same time, fuel (gasoline) stocks, on the contrary, turned out to be 1.1 million barrels higher, and distillates increased by 187 thousand barrels. At the strategically important terminal in Cushing, raw materials increased by 1.1 million barrels. According to preliminary forecasts by analysts, official data on crude oil inventories last week should show a decrease of at least 1.2 million barrels. Gasoline stocks should also go down by about 2 million barrels. But the level of distillates is likely to remain unchanged, which is also not critical. If the preliminary data turn out to be close to the official statistics of the United States Department of Energy, which will be presented Wednesday evening, the oil market will have at least some factor that can provide good support for the price. Otherwise, negative correction can accelerate its pace. The price of Brent crude oil futures contracts for September delivery on the London trading floor fell slightly by 0.05% or $ 0.02, which moved the price of this mark to the level of $ 43.2 per barrel. Tuesday's trading ended with a decline where the price fell by 0.4% or $ 0.19, and thus stopped at $ 43.22 per barrel. Such uncertainty in the movement can still act as support, since a negative correction has been brewing for a long time, but a huge decline has been avoided so far. The price of WTI light crude oil futures contracts for September delivery on the electronic trading floor in New York is also declining on Wednesday morning. So far, its level has decreased insignificantly by 0.19% or $ 0.08, which sent WTI to the level of $ 40.96 per barrel. Tuesday's trading also closed in the red: oil dropped quite substantially by 1.4% or $ 0.56, which forced it to drop to $ 41.04 a barrel. However, the black gold of this mark is holding above the level of 40 dollars per barrel, which is extremely important for further growth and support, and this gives hope that there will not be any too rapid reduction. The weak pace of global economic recovery continues to put pressure on the oil market. Tension is exacerbated by the growing supply of raw materials, which was formed against the backdrop of an increase in the production of black gold in the United States, as well as the softening of the conditions and amount of extraction of raw materials for countries that have signed an agreement with the OPEC organization. According to some experts, the supply of raw materials on the market will grow for at least four months in a row until a stable balance emerges. This, of course, is a potentially negative factor for oil, which can significantly affect its price. However, to this day, the main reason for the decline in prices in the hydrocarbon market remains due to the coronavirus pandemic. The end of which is not yet in sight. It is COVID-19 that continues to restrain the growth in consumption, on which prices on trading floors depend so much. In the aggregate of these factors, it can be assumed that in the near future oil will not be able to part with the bearish trend, which, however, is unlikely to grow stronger. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on July 29 Posted: 29 Jul 2020 04:42 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, buyers of the pound made a break through the resistance of 1.2949, and now they are fixed on it. If you look at the 5-minute chart, you will see that it was not possible to wait for a signal to enter the market from this support, since testing 1.2949 from top to bottom on the volume did not happen. As soon as this scenario is played out and the area of 1.2949 stands, you can open long positions in the expectation of continuing the upward trend to the maximum area of 1.3025, and then on the test of a new resistance of 1.3075, where I recommend fixing the profits. However, it is unlikely that a test of these levels will occur today without significant changes in the monetary policy of the Federal Reserve. If the pair returns to the level of 1.2949 and there is no bull activity at this level in the second half of the day, it is best to wait for the decline of GBP/USD to the support of 1.2893, where the lower border of the Bollinger indicator passes or open long positions immediately for a rebound from the minimum of 1.2839 in the calculation of a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need: Bears will expect the pound to return to the level of 1.2949, which they missed today in the first half of the day, even if a divergence is formed on the MACD indicator. However, it is worth noting that there was no rapid growth after the breakout of this range, which may indicate the absence of major players above the area of 1.2949. The bears' task for the second half will be to return GBP/USD to this range, which will increase pressure on the pound and lead to a decrease in the support area of 1.2893. However, only a consolidation below this level will indicate the beginning of a larger downward correction of the pound already in the area of lows 1.2839 and 1.2786, where I recommend fixing the profits. In the scenario of further growth of the pair, it is best not to rush to sell, and wait for the update of the maximum of 1.3025 or sell the pound immediately on the rebound from the larger resistance of 1.3075 in the calculation of a correction of 30-40 points within the day.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates further growth of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.2970 will lead to an increase in the pound. A break in the lower border of the indicator at 1.2893 will increase the pressure on the pair. Description of indicators

|

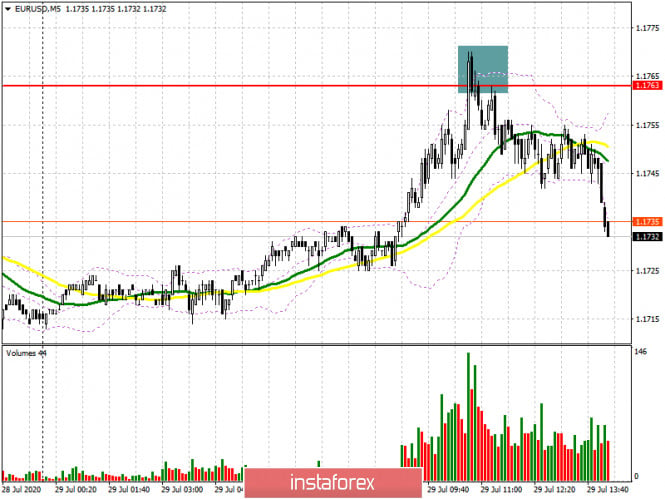

| EUR/USD: plan for the American session on July 29 Posted: 29 Jul 2020 04:42 AM PDT To open long positions on EURUSD, you need: In the first half of the day, the bears managed to form a good signal to sell the euro with the formation of a false breakout in the resistance area of 1.1763, which I paid attention to in my morning forecast. If you look at the 5-minute chart, you will see how sellers do not let the euro above 1.1763 and then retest this level from the bottom up to form a good entry point. Now the focus has shifted to the Federal Reserve meeting, which will determine the future direction of the euro. In the second half of the day, the bulls will try to regain the resistance of 1.1763, but only very unexpected news from the Fed on the expansion of the bond repurchase program or changes in interest rates will allow the bulls to gain a foothold above this range, which forms a good point for moving into long positions. In this scenario, you can expect to update the weekly maximum in the area of 1.1802, as well as a test of a longer-term resistance of 1.1830, where I recommend fixing the profits. If the pressure on EUR/USD returns in the second half of the day, then the bulls will have to protect the support of 1.1704. However, I recommend opening long positions from there only after forming a false breakout. It is best to buy euros immediately on a rebound from the minimum of 1.1648 in the expectation of a correction of 25-30 points within the day.

To open short positions on EURUSD, you need: Bears have already formed a good selling point for the euro and many have taken advantage of it. Now the focus has shifted to the new level of 1.1704, where the lower border of the Bollinger indicator passes. Only fixing below this range will be an additional signal to open short positions in the expectation of a decrease in EUR/USD to a minimum of 1.1648. A more distant goal will be the area of 1.1591, where I recommend fixing the profits. If the pair returns to the resistance area of 1.1763, then only the formation of a false breakout there will be a signal to open short positions in the euro. If there is no activity on the part of sellers in the area of 1.1763, I recommend to postpone sales until the update of the maximum of 1.1802 or even sell EUR/USD immediately on the rebound from the resistance of 1.1830.

Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily moving averages, which indicates market uncertainty in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.1763 will strengthen the demand for the euro. A breakdown of the lower border of the indicator in the area of 1.1704 will lead to a larger downward correction of the pair.Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment