Forex analysis review |

- Hot forecast and trading signals for GBP/USD on September 21. COT report. Disappointing news from the UK

- Hot forecast and trading signals for EUR/USD on September 21. COT report. Boring Friday gives way to dull Monday. Or not?

- Overview of the GBP/USD pair. September 21. The UK will lose much more from the lack of a Brexit deal than from the "coronavirus

- Overview of the EUR/USD pair. September 21. The assassination attempt on Donald Trump.

- Analytics and trading signals for beginners. How to trade EUR/USD on September 21? Getting ready for Monday session

- GBP/USD. Preview of the new week. In the UK, the second "wave" of the COVID-2019 epidemic began.

- EUR/USD. Preview of the new week. Two performances by Jerome Powell. The fundamental background in the US remains the most

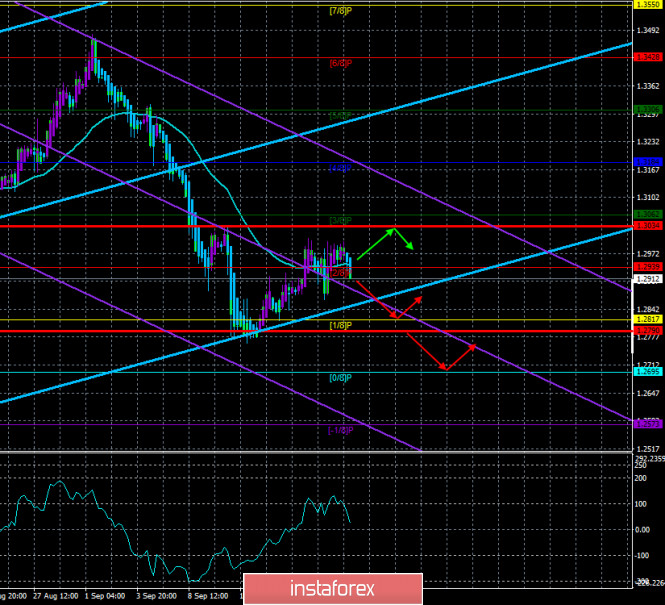

| Posted: 20 Sep 2020 06:25 PM PDT GBP/USD 1H The GBP/USD pair traded with a downward bias again on Friday, September 18, and by the end of the day it reached the critical Kijun-sen line, and also came close to the lower line of the rising channel. Thus, market participants show that they are going to return to selling the pound. This is also evidenced by the price rebounding from the resistance area of 1.3005-1.3025 and several downward reversals near it. So now the bears only have to overcome the rising channel and the pound can go into a new prolonged fall. The bullish prospects will remain if a rebound occurs from the Kijun-sen line. Then the pair may try to return to the 1.3005-1.3025 area again. GBP/USD 15M The lower channel turned to the downside on the 15-minute timeframe, a downward movement is possible due to several failures in the 1.3005-1.3025 area. The new Commitments of Traders (COT) report for the pound, which came out last Friday, was very, very expressive. The previous report showed that professional traders became more bullish despite the fact that the British currency fell 700 points in price. The new COT report turned out to be much more logical. Non-commercial traders closed 4,500 Buy-contracts (longs) and opened 7,000 Sell-contracts (shorts) during September 9-15. Thus, the net position for the "non-commercial" category of traders decreased by 11,500 contracts at once. This is very significant, since this group holds a total number of 81,000 contracts. Therefore, this time the data of the COT report coincides with the nature of trading in the foreign exchange market. The behavior of commercial traders was even more interesting, as they closed 37,000 Buy-contracts and 45,000 Sell-contracts in just a week. This suggests that many large players are currently not interested in the pound as an investment currency. The future of the UK and its economy is so uncertain that traders are not interested in buying or selling. Commercial traders are hedgers and, judging by the COT report, they simply switch to other currencies rather than use the pound in their accounts. The COT report at this time will not provide much help in predicting the pair's succeeding movement, since almost everything depends on the fundamental background at the moment. Fundamental background for the GBP/USD pair was neutral on Friday. However, this is only on Friday. Prime Minister Boris Johnson said that the second wave of the epidemic has begun in the country, which means that a deterioration in economic sentiment and business activity can be expected in the near future. Johnson assured that the government is not going to introduce tough quarantine measures in the country, however, no matter how pathetic it sounds, it is not up to him to decide. If the pandemic gains momentum and exceeds the incidence rate of the first wave, when the healthcare system was barely able to cope with the influx of patients, then like it or not, a new lockdown or "hard" quarantine will have to be introduced. In addition, the country still has problems in the form of a lack of a trade deal with the European Union, as well as a possible conflict with the EU on the basis of Johnson's new bill on the UK internal market. Any news on these three topics could potentially trigger another fall for the pound. We have two trading ideas for September 18: 1) Buyers, although they have support in the form of a rising channel, failed to overcome the 1.3004-1.3024 area twice, so long term upward movement is in doubt. You can open new long positions in case the price rebounds from the Kijun-sen line (1.2910) and the lower channel line while aiming for the resistance area of 1.3005-1.3025 and the Senkou Span B line (1.3060). Take Profit in this case will be from 80 to 130 points. 2) Sellers only need to leave the rising channel and it will open up amazing prospects. If the price settles below the critical line (1.2910) and below the rising channel, we recommend selling the British currency while aiming for 1.2661. The target is distant and may take several days to reach it. Take Profit in this case can be about 200 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2020 06:24 PM PDT EUR/USD 1H The EUR/USD pair was indistinctly trading on the hourly timeframe on Friday, September 18. If the pair traded ambiguously earlier because it proceeded in a narrow price range (1.17-1.19), then on Friday it was trading indistinctly because it was in an even more narrow price range, only about 50 points... Thus, market participants simply left ahead of schedule for the weekend. The pair crossed the Senkou Span B line at the end of the trading week, which is irrelevant at this time. All the lines of the Ichimoku indicator, although they remain relatively strong, nevertheless, do not signal a trend in the flat or even when prices rebound from them. Therefore, formally, you can expect to move to the resistance area of 1.1884-1.1910, but the probability of this is 50/50. Just like the probability of moving down to the support area of 1.1704-1.1728. EUR/USD 15M The higher linear regression channel turned to the upside on the 15-minute timeframe, and the lower one moved down, which implies that the pair might start moving down on the hourly timeframe. The EUR/USD pair continued to trade in the 1.17-1.19 horizontal channel last week. Thus, even if there were changes in the mood of large traders, it did not show on the pair's chart. And there were changes. Non-commercial traders closed as many as 17,000 Buy-contracts (longs) and only 1,500 Sell-contracts (shorts) during the reporting week (September 9-15). Thus, the sentiment of the most important group of traders, "non-commercial", has changed towards a bearish one. The net position for this group of traders also decreased by 15,000 contracts. And this, in turn, means that professional traders began to look towards buying the US dollar and selling the euro. Commercial traders also actively closed both types of contracts. However, we are less interested in this group. There are still no results of all these changes. And from September 16 to this day, the EUR/USD pair's movements still does not provide reasons to assume that they will appear in the near future. Thus, the changes reflected in the COT report do not coincide with what is currently happening in the foreign exchange market. Not a single important macroeconomic report in the European Union on Friday, just an insignificant consumer confidence index from the University of Michigan in the United States. Therefore, it is easy to explain why volatility was low and trading was absolutely calm. There was no other news of a general nature either. Thus, traders can only wait for news and new macroeconomic data. The macroeconomic events calendar is completely blank on Monday. Federal Reserve Chairman Jerome Powell may deliver a speech, but not all news calendars contain this event. With a high degree of probability, the day will be absolutely empty and, most likely, absolutely indistinct trading with low volatility will continue. We have two trading ideas for September 18: 1) Buyers could not break through several resistances near the upper line of the $1.17-1.19 horizontal channel. Therefore, we advise you to consider long positions once the 1.1884-1.1910 area has been overcome, and then you can aim for the resistance level at 1.2003. Take Profit in this case will be about 60 points. 2) Bears, with grief, pulled down the pair in half to the lower area of the horizontal channel (1.17-1.19), but also did not stay there for a long time. The upward movement resumed, so now the bears need to wait until they consolidate the price below the Kijun-sen line (1.1819) in order to open short positions while aiming for the support level at 1.1760. The potential Take Profit in this case is about 45 points. We remind you that the pair's current movements are absolutely indistinct and most closely corresponds to the meaning of the word flat. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2020 06:11 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 24.5593 After the British currency collapsed by 700 points down, a correction began, which continues to this day. Quotes of the pound/dollar pair broke the moving average line, but could not go far up. Thus, the downward trend may resume in the near future. However, there are questions here. The first round of the downward movement was frankly provoked by the fundamental background from the UK. Thus, for the same strong and powerful fall of the British pound in the second round, new fundamental reasons are needed, which are not yet observed. Thus, further downward movement may be quite weak, since all the problems of the US have not gone away, which means that demand for the dollar may begin to fall in the near future. As for the bill "on the internal market of Great Britain", which "started all this mess", the markets realized that so far London has not violated any international agreements, and Boris Johnson can use this law as blackmail or bluff in negotiations with the European Union. Thus, it is absolutely not necessary that London will go to conflict with the European Union at all. Boris Johnson cannot fail to understand all the consequences of this step. Meanwhile, expert agencies and economists continue to calculate the possible damage from the UK's exit from the EU without a deal. It turned out that the damage from the lack of a trade agreement will be much higher than the damage from the "coronavirus crisis". Recall that Britain suffered a record contraction in the economy, falling by 20% in the second quarter. Now it turns out that the losses from a "hard" divorce from the EU will be even worse. In fact, this is what we have been talking about in recent years. The British economy is suffering huge losses just because the Brexit process is launched. After the UK leaves the EU and officially loses access to the free market, the economy will lose billions of dollars more. The trade turnover with the European Union will be reduced, and the British government is still unable to offer new markets to British businessmen. Only a couple of weeks ago, it became known about the conclusion of a free trade agreement with Japan, which is only 15 billion dollars. This is the first agreement signed by an independent London. Experts from the investment bank Goldman Sachs conducted research and found that the long-term consequences of not having a deal with the EU are two or three times greater than the damage caused by the "coronavirus crisis". Thus, the prospects for the British economy remain vague, and with the arrival of 2021, the British economy may experience another shock. At the same time, do not forget that just a couple of days ago, Boris Johnson announced that the second "wave" of the COVID-2019 epidemic has begun in the country. Thus, it is absolutely possible that even before the onset of 2021, the UK economy will begin to slow down. In general, if we look at the long term, we would make a forecast that it is the British currency that will remain prone to falling. There are no major macroeconomic events scheduled for the first trading day of the new week in the UK. Thus, the entire fundamental background of the day will be reduced to the performance of Jerome Powell.

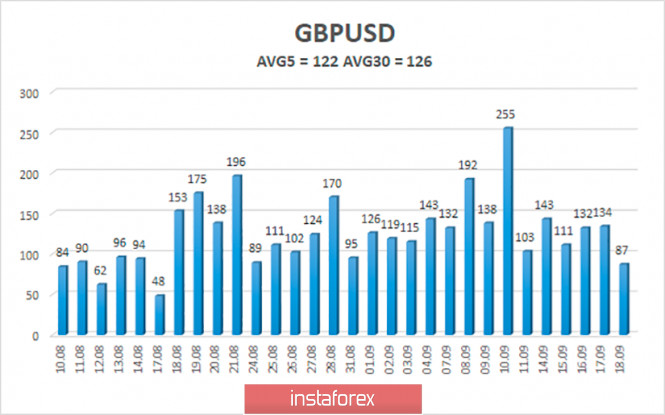

The average volatility of the GBP/USD pair is currently 122 points per day. For the pound/dollar pair, this value is "high". On Monday, September 21, therefore, we expect movement inside the channel, limited by the levels of 1.2790 and 1.3034. The reversal of the Heiken Ashi indicator downward may signal about a possible resumption of the downward movement. Nearest support levels: S1 – 1.2817 S2 – 1.2695 S3 – 1.2573 Nearest resistance levels: R1 – 1.2939 R2 – 1.3062 R3 – 1.3184 Trading recommendations: The GBP/USD pair settled below the moving average line on the 4-hour timeframe. Thus, today it is recommended to consider options for opening short positions with targets of 1.2817 and 1.2695 as long as the price is below the moving average, and the Heiken Ashi is directed downward. It is recommended to trade the pair for an increase with targets of 1.3034 and 1.3062 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the EUR/USD pair. September 21. The assassination attempt on Donald Trump. Posted: 20 Sep 2020 06:11 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - sideways. CCI: 11.7051 A new trading week begins on the Forex currency market and this can become "one of" a whole series of weeks in which the euro/dollar pair is trading in a frank flat. As we have repeatedly noted, it is very inconvenient to trade any instrument in a sideways movement. On the one hand, the quotes do not go beyond the designated range, thus, you can almost always expect the price to return to the original position if the transaction was opened incorrectly. On the other hand, it is always more convenient to trade on the trend, and not when the pair is "stormy" and every day we see a "swing". Thus, the pair starts the new week in the same flat that it has been in for almost two months, and traders can only hope that it will end this week. As a rule, any pair needs a good reason to change direction. A striking example of this is the pound sterling, which has fallen by 700 points since September 1 due to news of a new bill by Boris Johnson that violates previously reached agreements with the EU. Something similar is needed for the euro/dollar pair to leave the range of 1.17-1.19. Most likely, "something like this" should be expected from America, where the rapid news flow continues to flow almost non-stop. Everything is quiet and peaceful in the European Union. Meanwhile, nothing optimistic is happening in the States. The coronavirus continues to rage, with approximately 40,000 new cases reported daily. Donald Trump again stopped the "coronavirus briefings" and now only makes statements from time to time about the creation of a vaccine in the very near future, as well as about the beginning of vaccination of the population in October. Naturally, these statements of Trump are immediately criticized by many doctors, epidemiologists, and virologists, who continue to insist that creating a vaccine against a new virus requires a very long time – consuming process that can take from a year to two. Thus, even if a vaccine will be created before the end of 2020 (assuming that it passed all necessary clinical tests and is proven safe and effective for all segments of the population), in mass production, it will arrive no earlier than 2021, and the number of required doses will be created until mid-2021. It should be understood that about 330 million people live in the United States alone. Accordingly, it is necessary to create about 330 million doses of the vaccine. Not to mention export doses, since pharmaceutical companies that invent the vaccine will want to make money in other countries. Thus, we believe that the process of gradual vaccination of humanity should not be expected before the middle of 2021. However, Donald Trump can't wait until mid-2021. He needs to create the appearance of starting the vaccination process before November 3, 2020, when elections will be held in America. And all the processes in the country are now going through the prism of future elections. And the US dollar remains an outsider because of all this. Meanwhile, it became known that last week, someone tried to poison Donald Trump. Unknown attackers sent a package to the White House that contained the poison ricin. The parcel was intercepted by the security services, conducted several tests, and confirmed that the substance contained in it is indeed poison ricin. Also, a new scandal is brewing in the White House, which is related to the possible dismissal of the head of the FBI, Christopher Wray. The Director of the Federal Bureau of Investigation published a report saying that the main threat to the US presidential election is Russia and various right-wing groups. The report did not say anything about China and left-wing groups, which did not please Donald Trump, who benefits from considering China to be the culprit of all the troubles. Moreover, Trump believes that China supports Joe Biden in the election. Consequently, China is also interfering in the presidential election. According to Trump, "China should be at the very top of the list of threats to America." In general, the report of the FBI Director simply did not meet Trump's expectations, thus, Christopher Wray can now be fired. Meanwhile, recent opinion polls and surveys have shown that there is no reduction in the gap between Donald Trump and Joe Biden. Recall that in the last two weeks, some opinion polls showed that Trump has reduced the gap in political ratings to almost 5%. So in fact, the gap is still about 10% and has not significantly decreased or changed at all over the past two months. We have already questioned this information (that Trump is catching up with Biden) since nothing has happened in recent months that could increase Trump's ratings and lower Biden's ratings. So now Joe Biden just needs to not lose his advantage, which he formed a month and a half before the election. As for macroeconomic events and reports, nothing interesting is planned for the first trading day of the week. Some news calendars include a speech by Jerome Powell, so some information may still fall into the hands of traders at the beginning of the week. However, we strongly doubt that Powell will tell the markets something important that has not yet been reported after the end of the Fed meeting last week. Thus, the activity of the markets on Monday will directly depend on what the head of the Fed will report. From a technical point of view, the pair continues to trade not even between the levels of 1.17 and 1.19, but between the volatility levels of 1.1768 and 1.1910. Thus, fixing the price above the moving average can be used to open very short-term long positions.

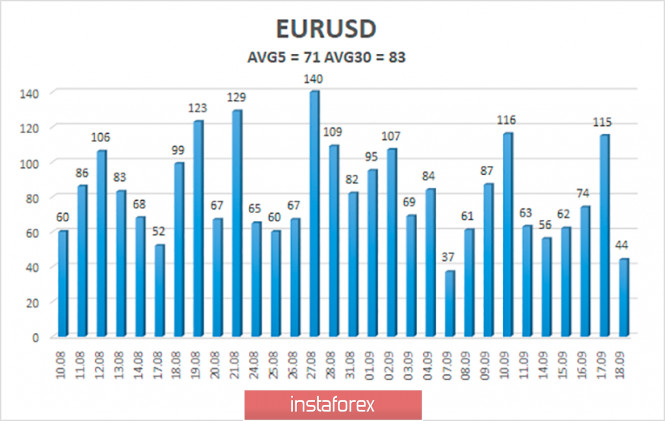

The volatility of the euro/dollar currency pair as of September 21 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1768 and 1.1910. The reversal of the Heiken Ashi indicator back up signals a round of upward movement in the remaining side channel of $ 1.17 - $ 1.19. Nearest support levels: S1 – 1.1841 S2 – 1.1719 S3 – 1.1597 Nearest resistance levels: R1 – 1.1963 R2 – 1.2085 R3 – 1.2207 Trading recommendations: The EUR/USD pair has fixed above the moving average line but continues to trade in an absolute flat. Thus, formally, we can now consider long positions with the goal of the volatility level of 1.1910, after the reversal of the Heiken Ashi indicator to the top. It is recommended to re-consider options for opening short positions if the pair is fixed back below the moving average with a target near the level of 1.1768. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2020 02:29 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair tried to start a new round of downward movement within the 1.1700-1.1900 channel on Friday, September 18. There were two attempts. The first was unsuccessful, and it is too early to draw conclusions on the second. The downward movement began on Friday, but did not last long, as trades were closed. Unfortunately for novice traders, the overall technical picture on Friday did not become clear at all. The pair still continues to trade in the 1.17-1.19 horizontal channel, but there were internal trend channels and trend lines earlier, from time to time, and now there is nothing like that. The movements have become more chaotic and "ragged" in the last few days. The last trend line, which we talked about in recent reports, could provide a sell signal, but did not do so. Therefore, it has already been canceled, and there are still no new technical patterns. In general, trading is now extremely difficult, especially for novice traders. You can trade at your own peril and risk only on one factor. The pair is in the upper area of the horizontal channel once again; therefore, it is much more advisable to sell from here than to buy. Accordingly, you can hypothetically work with each MACD sell signal. There was practically no fundamental background on Friday. No important and interesting events took place either in America or in the European Union. The markets completely retreated and recovered after the Federal Reserve meeting and eventually they did not understand which way to trade the pair. There was also not a single macroeconomic report during the day that deserved the attention of traders. The Michigan Institute's Consumer Confidence Index was released in the US in the afternoon, which exceeded forecasted values and reached 78.9. However, just as expected, it had no effect on the pair's movement. Fed Chairman Jerome Powell is set to deliver a speech on Monday, September 21. His last speech could be interpreted in different ways, since the theses that he voiced are not unambiguous and do not relate to the current state of the economy and its prospects. Simply put, market participants have not yet understood what to expect from the Fed in the future. There are only two options here: 1) further easing of monetary policy (bearish factor for the dollar); 2) unchanged monetary policy for several years. The Fed may still use other instruments to stimulate the economy even if the key rate does not go down any more. Or, at least, to declare the need for new stimulation of the economy. Traders are interested in this kind of information. And you can see for yourself that Powell's speech from last Wednesday had no effect on the dollar, even over several days. Possible scenarios for September 21: 1) Novice traders are still not recommended to place buy positions at this time, since the price failed to overcome the 1.1903 level once again, which is the upper line of the horizontal channel. In addition, there is not a single serious pattern that would support the upward trend now. Lastly, quotes are currently in the upper area of the horizontal channel, in which it is more logical to consider sell positions. 2) Selling still looks more attractive now, since traders have not overcome the 1.1903 level. Thus, novice traders may consider opening new short positions on a new sell signal from the MACD indicator while aiming for 1.1813 and 1.1772. However, keep in mind that all signals from MACD alone will be interpreted as weak. There is no trend line or channel. It is better to wait until morning to open new positions on Monday. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Preview of the new week. In the UK, the second "wave" of the COVID-2019 epidemic began. Posted: 20 Sep 2020 06:40 AM PDT Trading the British pound has been more fun in recent weeks. Since September 1, the British currency has fallen by 700 points and then recovered by 200. Such a strong fall was triggered by the activities of Boris Johnson as Prime Minister of Great Britain. The results of his work in recent months are simply "amazing": all rounds of negotiations with Brussels on a trade agreement have failed, and a bill has been initiated that violates the Brexit agreement with the European Union. The whole world has realized that the UK can violate the principles of international law and it will be Boris Johnson who is to blame for this. Unfortunately, if the countries of the world understand that London can withdraw from any agreement or violate it at any time, then any diplomatic negotiations with the Kingdom will be held more harshly. Further, some countries will refuse to cooperate with Britain at all. And Boris Johnson will sooner or later leave his post, however, the shadow on the UK may remain for a much longer time. So, from our point of view, former Prime Ministers Theresa May, David Cameron, Gordon Brown, Tony Blair, and John Major are right when they criticize Johnson and his bill. Why was it necessary to sign an agreement with the European Union on the Northern Ireland border at all, if it did not suit London? This is the art of conducting international negotiations in order to reach an agreement with all the parties to the agreement. It was the lack of this skill that cost Theresa May her post. She was unable to negotiate with Brussels in a way that would suit the UK parliament, so she had to go through two votes of no confidence and eventually leave her post. It turns out that Boris Johnson simply deceived everyone and intended to go this way from the very beginning when he simply blocked the work of parliament so that it would not prevent him from immediately implementing a "hard" Brexit. Now it turns out that the Northern Ireland protocol does not suit Johnson and he is going to break it. Well, let's see if the British Prime Minister will really take this step and whether it will cost him his post. Meanwhile, the same Boris Johnson officially announced that the second "wave" of the "coronavirus" epidemic has begun in the UK. "Now we are facing the second wave. I am afraid that this is absolutely inevitable - we will face this in our country," the Prime Minister said. Johnson also said that there will be no new quarantine because business and the economy are more important than human lives and the health of the nation. "I definitely don't want to introduce large-scale isolation measures, we want to keep schools open. It is fantastic that the work of educational institutions has returned to the previous level. We want to keep the economy as open as possible so that business can grow. The introduction of a nationwide quarantine is the last measure that anyone wants," the Prime Minister said. According to data from Johns Hopkins University, the number of cases in the UK has increased in the last two weeks to 3-4 thousand per day. Recall that the peak of the previous wave was 5-5.5 thousand diseases per day. As for macroeconomic statistics and various events, there will be few of them in the UK next week. Until Wednesday, traders will have nothing to pay attention to at all. Only on the third trading day of the week in Britain, data on business activity in the services and manufacturing sectors for September will be published. It is expected that the values of all indicators will decrease slightly compared to the previous month, but will remain at a fairly high level. On Thursday, there will be a speech by Bank of England Governor Andrew Bailey, who also did not particularly please market participants last week. And on Friday, only the publication of the report on consumer confidence will take place. So the news calendar for the British pound is very sparse next week. However, for the British pound at this time, all macroeconomic reports mean even less than for the US dollar. The pound now has two main themes that can easily lower it by another 500-600 points and can return it to the levels of 1.32-1.33. The first is the same ongoing negotiations on a trade agreement with Brussels. The second is Boris Johnson's controversial bill. The first theme is simply the continuation of the main series "Santa Barbara", which began back in 2016. The second topic is a resonant topic of the last few weeks, which is unclear what kind of continuation it will have. On the one hand, the British Parliament has already approved Boris Johnson's bill. On the other hand, the document has been sent for revision, and the very essence of the document does not mean that the agreement with the European Union will be violated without fail. Thus, it may be too early to sound the alarm, but one way or another, the future of the pound will depend on these two topics in the coming weeks. As has often happened in recent years, the rescue of the British currency may come from the US. 2020 showed that the US currency is not as stable as everyone used to think. The "coronavirus" crisis and epidemic have shown that the American economy is not the pyramids in Egypt, which have stood for several thousand years and will remain unbroken for as long. And against the background of all the economic problems, political ones have also developed. We won't even talk about the elections once again, since this topic has already become a byword. Thus, only a stream of negative news from America can save the pound from further falls. Fortunately for the pound, this option is indeed very likely, since the general situation in the States has not improved much recently. The situation with coronavirus remains very difficult, and the future is uncertain. Thus, it is the pound and the dollar that will fight for the title of the main loser in 2020. The technical picture of the pound/dollar pair so far indicates a very likely resumption of the downward movement. The pair's quotes only managed to enter the Ichimoku cloud, and even then with great difficulty. On Monday or Tuesday, they may return to the area below the critical line, which will contribute to the resumption of the downward trend. Trading recommendations for the GBP/USD pair: The pound/dollar pair continues to adjust within the downward trend. The pair entered the Ichimoku cloud on the 4-hour timeframe, but could not even reach its upper limit. The further movement of the pound depends entirely on the fundamental background from the UK, and theoretically, it can continue for as long as you want. In the current conditions, we recommend trading lower with targets of 1.2818 and 1.2612 if the pair is fixed below the Kijun-sen line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2020 06:40 AM PDT Another week in the currency market has ended. Its results are summarized in previous articles, and we just need to figure out what is waiting for traders next week. The euro/dollar pair has been trading between the levels of 1.1700 and 1.1900 for almost two months and has only left the specified range twice during this time. Thus, the new week will have to answer the question again: are market participants ready to finally end the flat and start a new trend? Unfortunately, most of the macroeconomic statistics continue to be ignored by the markets. In principle, from the very beginning of the pandemic and the subsequent crisis in March, we have noted this absolutely illogical behavior of the market. Although it is illogical only at first glance. In the first place in terms of significance, there were simply other factors. It is obvious that in times of a global epidemic, it is the issue of the epidemic that is most important and affects all spheres of life and the economy of any country. Thus, we can draw almost 100% conclusion that the economy of each country now depends on the scale of the coronavirus pandemic. And also on how the authorities of this country are dealing with the pandemic. Therefore, the second most important factor now is politics. Further, when we understand which two factors are most important for the market now, it becomes clear why the US currency has fallen by 13-14 cents against the euro in the last few months. Because there are a huge number of political problems in the United States and one big epidemiological problem, which we have already written about more than once. All this passes through the prism of upcoming elections, mass rallies and protests that recently covered half the country, as well as racial scandals and a possible constitutional crisis. Questions still remain: why is the dollar getting cheaper? More than that! Now, when buyers of the euro currency have been "resting in the Maldives" for the second month, bears (that is, buyers of the US dollar) are not even going to activate. Why? Because there is no reason to buy the US currency (at least in pairs with the euro). At least until the name of the new president of the country becomes known. By the way, do not forget that the United States continues to be involved in the trade conflict with China. Thus, the overall fundamental background is much more important now. This is especially true for America, as the situation in the European Union is much calmer. The new trading week will start with a speech by Jerome Powell. Recall that last week, the head of the Federal Reserve made a speech dedicated to the next meeting of the Fed. However, there was no special reaction to this event, since the theses voiced by Powell were not extremely important. The US dollar strengthened by 100 points after his speech, however, the same 100 points was lost the next day. Thus, market participants are waiting for important information from Powell, rather than his optimistic exclamations about "higher rates of economic recovery" and forecasts of a rate increase in 2023. Traders are interested in the immediate future. What actions can the Fed take in the coming months? Does the economy need a new stimulus package that is firmly stuck on the sidelines of Congress? What happens if Democrats and Republicans can't agree on it? What is the impact of the "coronavirus" on the economy at this time? No major events are scheduled for Tuesday in the United States or the European Union. However, on Wednesday, a whole scattering of business activity indices in the services and manufacturing sectors in the EU countries and States will be published. Again, unfortunately, these indices are not important indicators at this time. First, all economies are currently recovering from the lockdown. This explains the high values of business activity in recent months. However, for example, in Spain and France, the second "wave" of the coronavirus pandemic began. Therefore, in the near future, business activity in these countries may begin to fall. The same goes for America. The last two months have been "black" for the States in terms of epidemiology. Therefore, there will probably be no reaction to reports on business activity, but in the long term, these reports will be quite important. The main thing is to understand whether new downturns are beginning in different sectors of the economy of different countries. Recall that any value of business activity below 50.0 signals a downturn. On the same day, Wednesday, September 23, another speech by Jerome Powell is scheduled, this time in Congress. Again, the markets' questions will be very specific. Therefore, Powell's conversations are unlikely to arouse interest and be reflected on the chart of the EUR/USD currency pair. On Thursday, there will be no important macroeconomic reports either in the States or in the EU. Only data on applications for unemployment benefits in America. Here we are more interested in the indicator of secondary applications, which shows the total number of them and its change. Thus, we can conclude whether unemployment is decreasing in the country. A report on orders for durable goods is scheduled for Friday in the States, which is generally quite important, however, traders have been ignoring it with great pleasure recently. In addition, we recommend that traders continue to monitor any news and messages from the White House and top US officials. We remind you that it is the general fundamental background from overseas that is of great importance for the US currency. News can be different on the "coronavirus", the vaccine, the elections, the confrontation with China, and so on. And of course, the more negative the news, the more likely it is to resume the fall of the US currency. Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair shows that the price continues to trade in the side channel of $ 1.17 - $ 1.19, which we have already discussed a huge number of times. Only on the 4-hour timeframe, the flat is even more pronounced. The "swing" is visible to the naked eye, and the Ichimoku indicator generates many false signals. Thus, it is not recommended to use Ichimoku in trading right now. The red horizontal lines in the illustration are volatility levels, which also very accurately represent the current range in which trading is taking place. And it is even narrower than the channel of 1.17-1.19. Thus, traders can trade within the specified ranges or wait for the flat to finish. However, it is very difficult to say now when the flat will end. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

'

'

No comments:

Post a Comment