Forex analysis review |

- Trading plan for the GBP/USD pair for the week of November 16-20. New COT (Commitments of Traders) report. The pound maintains

- Trading plan for the EUR/USD pair for the week of November 16-20. New COT (Commitments of Traders) report. The presidential

- The dollar and the euro are separated by a river of uncertainty, and time is running out against the pound

- The dollar needs the latest news about the vaccine

| Posted: 14 Nov 2020 12:55 AM PST GBP/USD - 24H. The GBP/USD currency pair started to adjust against the correction during the past trading week. We still consider the movement after September 23 as a correction against the fall from September 1. Thus, we consider the fall of the British pound on Wednesday and Thursday as a correction. If traders manage to fix the pound/dollar pair below the Ichimoku cloud, then we can talk about the resumption of the downward trend from the beginning of September 1. However, given the fact that the pound has been climbing for quite a long time, we are beginning to doubt that the downward trend will resume in the near future. The fundamental background for the pound remains extremely weak, however, market participants do not want to take it into account yet, and the pound, although not too strong, continues to strengthen. We have already said repeatedly that any hypothesis based on fundamental analysis requires confirmation of the "technique". The fundamental background can say anything, but if market participants do not trade according to this background, we will not see the necessary results. Therefore, from a technical point of view, the upward trend is still maintained. But on the fundamental side, we continue to expect the British currency to fall. The COT report. During the last reporting week (November 3 - 9), the GBP/USD pair increased by 250 points. Such a strengthening of the pound at that time is not at all surprising, since this was the period of the US presidential election, and the US dollar was declining against its main competitors. However, after this period, the pound began to grow. In general, it is the pound that has been growing in recent weeks. But the COT reports still don't give us any really useful information. During the reporting week, non-commercial traders closed 3.3 thousand buy-contracts and opened 1.1 thousand sell-contracts. Thus, their mood became more "bearish", and the net position decreased by 4.4 thousand, which is not so small for the pound. Recall that the total number of contracts opened by the "Non-commercial" group is 87 thousand. Thus, 4.4 thousand is 5%. As for the general trend among professional traders, the indicators in the illustration clearly show that there is no trend at this time. The green line (net position of non-commercial traders) on the first indicator constantly changes its direction. The second indicator also shows the absence of a trend, as professional traders increase the net position, then reduce it. Thus, no long-term conclusions or forecasts can still be made based on the COT report. We recommend paying more attention to "technique" and "foundation". The fundamental background for the GBP/USD pair last week was quite interesting. Most of the macroeconomic reports were again ignored, although overall they showed that the state of the British economy remains a concern. The unemployment rate is rising, GDP in the third quarter recovered less than experts expected, and industrial production also grew less than expected. As for more global topics, there is still no information on negotiations on a trade deal between the UK and the European Union. Negotiations are continuing, but it is not clear whether there is progress or not. The deadline set by Boris Johnson expires tomorrow, however, the parties said that negotiations will continue next week. It is also unknown how long they will continue. In general, complete uncertainty. In the UK, as well as in several other EU countries, anti-records for the number of diseases from the "coronavirus" are updated almost every day. This is despite the "relatively strict" quarantine in the country. Well, the Bank of England last week expanded its quantitative easing program, and in the coming months, it may also lower rates to negative values. How the pound manages to grow against such a fundamental background is unclear. After all, in fact, there is not single positive news from the Foggy Albion. If there were still disappointing news coming from overseas, we could conclude that demand for the dollar is declining, so the pound is strengthening. However, there is no frankly disastrous news from America right now either. Trading plan for the week of November 16-20: 1) Buyers retain some chances of forming an upward trend. Most of all, the fundamental background continues to confuse, which absolutely does not support the British pound. However, long positions remain relevant with targets at the resistance levels of 1.3336 and 1.3496, as the "technique" does not signal the end of the upward trend yet. 2) Sellers are also quite weak now. We can even conclude that neither the bulls nor the bears are now eager to trade the pound sterling. The COT report shows that even major market players do not have a clear plan of action right now. Sellers need to return the pair below the Ichimoku cloud in order to expect a downward trend to form again in the long term. We are still inclined to believe that the fall in the pound will resume and will be quite strong. But this hypothesis, like any other, needs technical confirmation. Explanation of the illustrations: Price levels of support and resistance (resistance/support) – target levels when opening purchases or sales. You can place Take Profit levels near them. Ichimoku indicators, Bollinger bands, MACD. Support and resistance areas – areas that the price has repeatedly bounced from before. Indicator 1 on the COT charts – shows the net position size of each category of traders. Indicator 2 on the COT charts – the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Nov 2020 11:53 PM PST EUR/USD - 24H. Over the past week, the EUR/USD pair has fallen by 50 points. It is even better to say that the European currency has fallen by 50 points. Thus, during the day, the trend was still absent, and trading took place between the levels of 1.1700 and 1.1900, between which the pair is trading (at least) for three months now. In the most long-term perspective, therefore, the flat persists. And even the US presidential election and its results could not force traders to withdraw the pair from this range. From a technical point of view, there's not much to say right now. All lines of the Ichimoku indicator on the 24-hour timeframe are not strong, and therefore, bounces from them and overcoming them do not have any weight. They are not signals to trade on. The Bollinger Bands are now directed sideways, thus, we have a huge amount of evidence of a side channel. Thus, traders will continue to trade between the borders of the side channel using lower timeframes. Or wait for the flat to finish and the euro/dollar pair to exit the side channel. The COT report. During the last reporting week (November 3-9), the EUR/USD pair increased by 170 points. The presidential election in America provoked a fairly strong drop in the US currency, however, it lasted no more than a few days. Nevertheless, the euro currency still rose in price, and market participants could count on a change in the mood of professional traders to a more "bullish" one. However, the latest COT report again showed that the mood of major traders has become more "bearish". The net position of the "Non-commercial" group of traders decreased again, this time by 17,000 contracts, which is quite a lot. Recall that non-commercial traders have been reducing their net position for several weeks in a row, which is eloquently indicated by the lower indicator in the illustration. A decrease in the net position means that the closing of buy-contracts and the opening of sell. The first professional traders in the reporting week closed 9.2 thousand, and the second - opened 7.8 thousand. However, although the net position of non-commercial traders has been falling since the beginning of September, the downward trend for the euro/dollar pair still does not begin. The green and red lines on the first indicator continue to move towards each other, which means that the trend has long started. However, there is no downward movement in the long term. Thus, based on the latest COT report, we can say the following: our forecasts remain the same since the reported data only allows us to draw such conclusions. We still believe that the upward trend ended around the 1.2000 level. What can we say about the fundamental background of the past trading week? A large number of important macroeconomic reports were published during the week. However, most of them were ignored again. There were several speeches by the heads of the central banks of the European Union and the United States, however, they did not contain any important information. Christine Lagarde and Jerome Powell talked more about Pfizer's new vaccine and the prospects for their economies if mass vaccination starts. And both heads of the Central Bank agreed that the positive effect of creating a vaccine will not be visible in the coming months. It may take months for the vaccine to be fully approved, for it to go into mass production, for it to be delivered to all end-users, given the number of doses that need to be produced. The topic of the presidential election has left the front pages of periodicals. In most states, all votes are counted, so it's safe to say that Joe Biden won the election, as predicted. The Democrat won about 279 "electoral votes", while Trump won 214. Thus, even a review of the results in one or two states will not allow Trump to turn the election results upside down. It turns out, even to sue for nothing. The Trump team, of course, filed lawsuits in the courts of many states with requests to recount the votes, not taking into account the votes received after November 3-4 (by mail) and other claims. However, most of the claims were rejected for insufficient evidence. Thus, Trump lost and, in our humble opinion, lost on all fronts, as it should have been. Even though Trump is probably not the worst President in the history of the United States, he still did not give the main thing that was expected of him – the result. And most importantly, there is no trust in him. Various agencies' calculations of the number of times Trump misled or outright lied with his comments or statements are the "cherry on the cake" of Trump's presidency. According to various estimates, the American President lied at least 14 times a day. Trading plan for the week of November 16-20 October: 1) The pair's quotes continue to trade in the side channel. It will be possible to talk about the resumption of the upward trend no earlier than overcoming the previous local maximum near the level of 1.2000. Until then, it is recommended to continue trading inside the side channel using lower timeframes. 2) To be able to sell the EUR/USD pair, you need to at least wait for the price to consolidate below the Kijun-sen and Senkou Span B lines. But even in this case, the potential for a downward movement is limited to the level of 1.1700. In this way, you can look for short-term trends on lower timeframes, but keep in mind that in the most long-term plan, it is the flat that remains. Explanation of the illustrations: Price levels of support and resistance (resistance/support) – target levels when opening purchases or sales. You can place Take Profit levels near them. Ichimoku indicators, Bollinger bands, MACD. Support and resistance areas – areas that the price has repeatedly bounced from before. Indicator 1 on the COT charts – shows the net position size of each category of traders. Indicator 2 on the COT charts – the net position size for the "Non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Nov 2020 08:50 PM PST

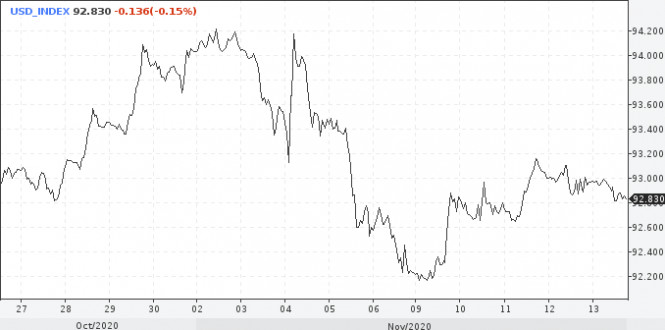

News about progress in the development of a vaccine against COVID-19 and the deterioration of the epidemiological situation in the world compete for the right to determine the dynamics of global markets. Key stock indices sell-off after touching local highs. A similar picture is observed in the foreign exchange market. Having failed to gain a foothold above 1.1900 at the very beginning of the week, the EUR/USD pair rolled back to the level of 1.1750, after which it returned to the area of 1.1800. The euro is losing about 0.6% over the week, helping the USD index to show a weekly increase of 0.7%. "The greenback is no longer showing the one-sided decline that was observed earlier. News about the vaccine from Pfizer and BioNTech set the bar high for future market expectations. Excessive optimism today may then turn into disappointment if further trials of the vaccine show weaker results. Also, even if the vaccine is completely successful, it may be difficult to produce and distribute it," Bloomberg experts said. The coronavirus continues to advance on both sides of the Atlantic. In the EU and the US, the second wave of the disease caused the re-introduction of social restrictions to stop the spread of COVID-19.

"Now we see the other side of a huge river of uncertainty. But I don't want to exaggerate the excitement about the vaccine and future vaccination, because there is still uncertainty," ECB President Christine Lagarde said. A similar opinion is held by the head of the Federal Reserve Jerome Powell. "Progress in the development of a COVID-19 vaccine is certainly good and welcome news in the medium term, but there remains significant uncertainty about the timing, production, distribution, and effectiveness of the vaccine," he said. The nearest strong resistance for EUR/USD is located near 1.1820, and while it is holding the pair back, the bears will try to push the pair to 1.1790, and then to the area of 1.1745-1.1750. Breaking the mark of 1.1740 will bring the levels of 1.1720 and 1.1700 into play. However, a break above 1.1830 will neutralize the "bearish" forecast and target the pair at 1.1850 and further - at 1.1880. The GBP/USD pair retreated from two-month highs around 1.3300 to weekly lows near 1.3110. This is not surprising, given the quarantine in the Foggy Albion, the lack of progress in Brexit negotiations, and the weakness of the UK's GDP and industrial production figures for the third quarter. New restrictive measures in the United Kingdom are only in effect for a week, and the daily rate of coronavirus infection in the country is hitting anti-records. As of Thursday, the number of new cases of COVID-19 infection in Britain was 33,470, compared to 22,950 recorded a day earlier.

According to preliminary estimates, the British economy in the third quarter declined by 9.6% in annual terms. Experts predicted its reduction by 9.4%. Industrial production in the country in September increased by 0.5% compared to August, instead of the expected increase of 0.8%. In annual terms, the indicator decreased by 6.3%, while the forecast was for a decrease of 6.1%. Meanwhile, trade talks between London and Brussels have stalled again. The EU still believes that the UK seeks exclusive access to the common market, but does not want to obey the same standards and rules. Foggy Albion, in turn, accuses the Alliance of still trying to bind the United Kingdom to itself and does not recognize Brexit. According to experts, the existing differences between the parties increase the likelihood that no trade deal will be concluded before the end of the transition period on December 31. Thus, the GBP/USD pair retains the potential for further decline. If the sales increase, the first line of defense for the pair may be the area of 1.2900. A deeper correction can send it to 1.2700, where the 200-day moving average and the 61.8% Fibonacci retracement line from the March-September growth are located. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar needs the latest news about the vaccine Posted: 13 Nov 2020 08:30 AM PST

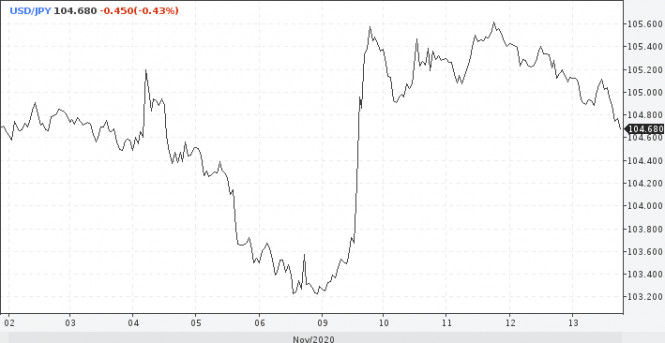

Currency markets are stuck between two factors – hopes for a vaccine and the reality of the spread of the coronavirus in the United States and Europe. The heads of the Federal Reserve and the ECB stressed that the economic outlook remains uncertain. The vaccine will be a source of investment, however, the Eurozone will still suffer from lockdowns. Despite these statements, investors remained risk-averse on Thursday and Friday. Perhaps this is due to the fact that the markets wanted to end the week in a good mood. Traders left long positions in the yen after Pfizer reported that its experimental vaccine showed its effectiveness at more than 90%. Now there is a backlash, with players buying the yen against the dollar. Despite the pullback, the Japanese yen is ending its worst week since June.

Global stock markets on Friday showed a moderately positive trend. The news background is calm. Investors seem to have taken a wait-and-see approach. The results of Moderna's vaccine trials are due to be published next week. The reaction of markets to the publication will depend on whether the effectiveness of the vaccine is equal to the drug from Pfizer and BioNTech. If the tests are successful, the market may show another wave of growth. This is one of the reasons why the trend towards aggressive sales is not observed now against the background of the worsening epidemiological situation. In the last couple of weeks, the main driver of changes in exchange rates, namely the dollar, was the US election. At first, the increase in volatility was associated with expectations of voting, where the tone was set by data from opinion polls and bookmakers' coefficients. Then the focus shifted to announcing the winner. Now the dynamics of the greenback depend on incoming news on vaccines. The fact that the drug from Pfizer and BioNTech turned out to be effective had an enchanting effect on the markets. However, it is not a fact that the announcement of another vaccine will set a similar tone in the markets. The 90% effectiveness of the drug is the minimum that companies should report. Pfizer's statements set a high bar for future market expectations. If further tests are less successful, then today's excessive optimism may turn into disappointment. The US currency has not seen a one-sided movement, as it was from November 3 to November 10. News about vaccines and the deterioration of the epidemiological situation in the world will compete with each other for the right to determine the dynamics of the dollar, which means that volatility cannot be avoided.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment