Forex analysis review |

- Forecast for EUR/USD on November 19, 2020

- Forecast for AUD/USD on November 19, 2020

- Forecast for USD/JPY on November 19, 2020

- Overview of the GBP/USD pair. November 19. Negotiations on Brexit: there is no good news. The most important trump card of

- Overview of the EUR/USD pair. November 19. US election: the clowning continues. Donald Trump fires the second senior official.

- EUR/USD: the Euro has a negative factor

- Analytics and trading signals for beginners. How to trade EUR/USD on November 19? Getting ready for Thursday session

- Evening review of EUR/USD for November 18, 2020.

- Ichimoku cloud indicator Daily analysis of USDCHF

- Gold price continues to respect support but remains below resistance

- EURUSD remains in short-term bullish trend

- November 18, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- November 18, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Global optimism is pushing the EUR / USD pair higher reaching weekly peaks around 1.1900

- Pfizer Vaccine Efficacy Evaluation Raised To 95%

- GBP/USD: Trading signals for November 18, 2020

- Investors face difficulties trading EUR/USD amid pandemic

- Analysis of GBP/USD for November 18. Bank of England Governor Andrew Bailey advocates monetary policy easing

- Analysis of EUR/USD on November 18. Coronavirus anti-records in America prevent the US dollar from rising

- EUR/USD: Trading signals for November 18, 2020

- Deficit in precious metals market

- BTC analysis for November 18,.2020 - Balancing mode on BTC and potential for the downside rotation towards $17.700

- EURUSD. Weak retail sales, coronavirus anti-records, and rumors of re-lockdown

- Analysis of Gold for November 18,.2020 - Strong downside continuation as I expected and potential for test of $1.850/20

- EUR/USD analysis for November 18 2020 - Potential for the downside rotation towards 1.1850

| Forecast for EUR/USD on November 19, 2020 Posted: 18 Nov 2020 06:48 PM PST EUR/USD Yesterday, the euro fell to Tuesday's opening level, also trying to test the daily MACD line, and was unsuccessful at it. This morning the price touched the nearest support at 1.1830. The price must settle below this level in order to form a condition for it to decline further. The Marlin oscillator is moving to the downside, showing the price's intent to overcome the achieved support.

Examining the situation on the four-hour chart fully reveals the importance of the moment. The Marlin oscillator is decreasing at a normal rate, not at an accelerated rate, as we mentioned yesterday, which creates the actual uncertainty of the price's current state in the range of 1.1816-1.1904. The lower border can even be shifted lower to 1.1816, where the MACD line runs.

So, we are waiting for the price to settle below the MACD line, below 1.1816, afterwards the euro could fall to 1.1750. It is possible for the price to grow when it goes beyond the MACD line of the daily scale at 1.1904. The closest target will be 1.1940, getting the price to settle above the level opens the target range of 1.2010/40. The probability of such a scenario is 20%. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on November 19, 2020 Posted: 18 Nov 2020 06:45 PM PST AUD/USD The Australian dollar traded with a range of 30 points yesterday, closing the day near the area where it opened. The price divergence continues to operate with the Marlin oscillator, support for the aussie is the MACD line on the daily chart at 0.7262. Overcoming support will pull down the price. The first target is the November 12 low at 0.7222. Getting the pair to settle below the level will open the way to 0.7120.

Nevertheless, we formally have an ascending trend - the price is above the indicator lines, while Marlin is in the growth zone. Accordingly, the probability that the price will rise to 0.7380 is about 40-45%.

The four-hour chart shows that the declining potential is stronger. The price breaks below the MACD line and the balance line. Getting the pair to settle below them will lead to a decisive attack to the MACD line (0.7262) on the daily scale, if successful, the nearest target at 0.7222 will open. The Marlin oscillator is trying to overcome the border of the bears' territory on the four-hour chart. The material has been provided by InstaForex Company - www.instaforex.com |

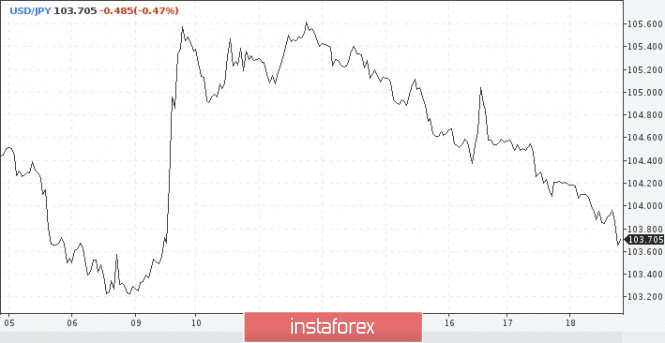

| Forecast for USD/JPY on November 19, 2020 Posted: 18 Nov 2020 06:44 PM PST USD/JPY USD/JPY fell yesterday, which means, the yen strengthened by 0.38%, supported by the declining US stock market that was down 1.16%. The price broke support at 104.05, now it's aiming for the 103.18 level. Settling in the area under it opens the second target of 102.35. Marlin is declining in the negative zone, strengthening the downward potential.

The four-hour chart shows that the price settled below the 104.05 level. The signal line of the Marlin oscillator has reached the upper boundary of its own channel; now it is likely to reverse to the downside, which will further strengthen the local downward trend. We are waiting for the price near the nearest target of 103.18.

|

| Posted: 18 Nov 2020 04:38 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 132.4724 The British pound sterling paired with the US dollar continued to rise in price for most of Wednesday, November 18, and eventually worked out the Murray level of "6/8"-1.3306, which is the previous local maximum. Thus, the upward trend in the pound sterling remains, although there is still no reason for this. We are referring to real fundamentals, not the hopes and optimism of traders regarding a trade deal between the UK and the EU. Thus, contrary to the fundamental background and common sense, the British pound may continue to rise in price in the coming days and even weeks. We have repeatedly said that any fundamental hypothesis must be confirmed by technical signals. So far, this is not the case. Thus, it is still recommended to trade for an increase. Meanwhile, there is still no positive news from the Brexit trade deal negotiations. The groups of Michel Barnier and David Frost continue to negotiate, but do not share any important information with the markets. Moreover, Michel Barnier will not report to EU ambassadors on progress in negotiations until the EU summit on Thursday. He usually did this on Wednesdays, and on Fridays, he held a briefing where he answered questions from journalists. Formally, the summit should focus on other issues, not Brexit. However, the trade deal and progress in the negotiations will necessarily be discussed by the heads of the European Union. In the meantime, the longer the negotiations continue, the less likely it is to reach a final agreement. Recall that it is important not just to reach an agreement, but also to have time to ratify this agreement before December 31, 2020. That is, to make sure that the British Parliament and the European Parliament approve this document. But all this takes a lot of time. Moreover, if one of the British parties or at least one of the EU countries is against the current version of the agreement, it can be blocked. You will need more time to make adjustments and to vote for the document again. And on the main issues between the parties, there are differences and it is unclear how much more time will be required to completely level them. Well, we have already talked about the prospects of the British economy for the next year many times. In short, they are extremely vague. And with all this, the pound sterling continues to rise in price. The UK has a huge number of problems right now. Starting from epidemiological, ending with economic. And only the rather ambiguous situation in America allows the pound to stay afloat in the last six months. We understand that one currency cannot become cheaper or more expensive all the time. However, for any currency, a negative fundamental background may persist for a long time. And this currency is now the pound sterling. The US dollar has not had many problems in the past four years. Yes, President Trump did everything to reduce the demand for the US currency, and the currency itself became cheaper. He has repeatedly stated that he needs a "cheap" dollar to make it easier to service the huge US government debt and get more profit from exports. However, the economy has been growing for most of Trump's term, the unemployment rate has remained at an all-time low, the labor market has been strong, and the stock market has consistently set growth records. But in the UK, the last four years can be called the "Brexit era", which can not but harm the country's economy and the value of its national currency. So slowly but surely, the pound has been sinking all this time. In any case, the next year will be a difficult one for the British economy. Experts have long calculated and reported that whether there is a deal with the EU or not, the British economy will still lose billions of pounds due to the "divorce" with the European Union. The only question is how serious the losses will be. Thus, the exclusively British fundamental background should continue to put pressure on the pound. If it were not for the American fundamental background and separately Donald Trump, the pound would most likely continue to fall at this time. However, the last six months are clearly under the auspices of the weakening of the US currency. First, there were "four types of crises" in the United States: epidemiological, social, economic, and political. They somehow managed to resolve economic and social problems. But the epidemiological one has worsened, and a possible constitutional one has been added to the political one. Traders understand that Trump will not just leave his post. And if he does, he may end up doing things that Biden and his team will have to deal with for years to come. Just before 2024, when Donald Trump wants to run for President again. The most interesting thing is that it is in the interests of Trump to maximize the deterioration of the situation in the United States. The worse the legacy Trump leaves behind, the worse the results will be for Joe Biden and Kamala Harris. Therefore, in the next four years, Trump can already criticize the new President and constantly point out his mistakes. That is what Joe Biden has been doing over the past year. Well, for America and the US dollar, this is the worst-case scenario. When the presidents (current and future) will continue to fight with each other and fight for power. Thus, so far, the technical picture predicts the continued strengthening of the UK currency. And if so, it is recommended to trade for an increase. None of the linear regression channels are directed down. The price in the last two months likes to overcome the moving average, but each time it inevitably returns to the area above it. Thus, the upward trend continues. But, from our point of view, the pound can still fall at any moment. It looks too overbought in recent times. You need to be prepared for this option.

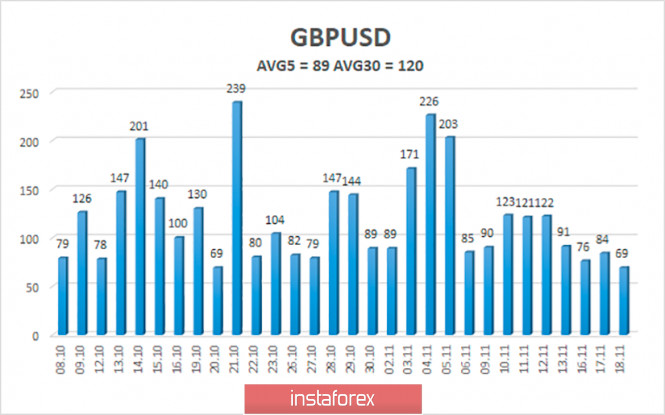

The average volatility of the GBP/USD pair is currently 89 points per day. For the pound/dollar pair, this value is "average". On Thursday, November 19, therefore, we expect movement inside the channel, limited by the levels of 1.3197 and 1.3375. A reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement. Nearest support levels: S1 – 1.3245 S2 – 1.3184 S3 – 1.3123 Nearest resistance levels: R1 – 1.3306 R2 – 1.3367 R3 – 1.3428 Trading recommendations: The GBP/USD pair continues to move slightly up on the 4-hour timeframe. Thus, today it is recommended to stay in long positions with targets of 1.3367 and 1.3428 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down with targets of 1.3123 and 1.3062 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Nov 2020 04:38 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 82.1472 The third trading day of the week for the EUR/USD pair was again fairly calm. During the day, the euro/dollar pair attempted to continue moving up, however, the efforts of buyers were reduced to nothing. Thus, we can say that most of the day, the quotes generally stood still or traded in a very narrow side channel. The technical picture now suggests that the upward trend continues, as the price continues to be located above the moving average line. At the same time, traders once again failed to withdraw the pair from the side channel of 1.1700-1.1900. On the approach to the upper line of this channel, the bulls' fuse began to dry up and so far everything looks as if a new round of downward movement will simply begin within the side channel. However, this is exactly the scenario we are waiting for. Traders still do not see any reason to continue serious purchases of the European currency, however, there are no reasons for serious purchases of the US currency now either. If we try to understand the movement of the euro/dollar pair over the past three months from a fundamental point of view, we can conclude that market participants generally ignored all events during the specified period. The pair spent most of these three months between the levels of 1.1700 and 1.1900, so a long-term flat is on the face. A flat means that either no important news or events occurred during this time or all of them were ignored. In our humble opinion, there were so many events in 2020 that would have been enough for 5 ordinary years. And the last three months are no exception. What are the US elections and all the "near-election" events worth? Thus, there is a high probability that market participants simply ignore most of the news, events, and macroeconomic reports. Even though the results of the US election are almost unambiguous and at this time no one doubts that Joe Biden won, Trump retains a theoretical chance of extending his term in the White House for another 4 years. We have already written in previous articles that everything is possible. So far, Trump and his team continue to challenge the election results in the states they lost. However, the results are not yet encouraging. Two states where the recount was carried out announced some inaccuracies, thanks to which Trump will get several thousand more votes than previously stated. However, even with these votes, the incumbent still lost in these states. So far, it is extremely difficult to understand what "2.7 million stolen votes" Trump was talking about? However, a little later, the clowning began (or continued). Recall that a few days ago, we reported on the dismissal of the US Secretary of Defense, who previously refused to send the army to American cities to disperse demonstrators and protesters during the summer riots on racial grounds. Chris Krebs, Director of the US Cybersecurity Agency, was the next to leave, saying there was no evidence of election fraud. Chris Krebs didn't see the fraud and Donald Trump did. Thus, Chris Krebs is fired. Here is simple logic. Earlier, the agency said that the past election was one of the safest in history. "Chris Krebs' recent statement about the security of the 2020 election was highly inaccurate, as there were massive violations and fraud, " Trump wrote on Twitter, as usual, without providing any proof of his words. To be honest, sometimes when we analyze news related to Trump, it seems that we are in a circus or some kind of humorous program. The President of the country with the largest economy in the world makes incompetent, false, and unconfirmed statements every day in the amount of at least 15 (these are statistics). At the same time, most of his statements look simply absurd and you don't need to be a political scientist to see this absurdity. But at the same time, Trump continues to make such statements and it is unclear what he is counting on. By and large, Trump can now disperse half of the White House altogether. All those who did not obey him, contradicted, refuted his words, and generally did not hold the same opinion as to the President. The most striking example is Anthony Fauci, who from the very beginning warned of the greatest danger of the "coronavirus" for Americans, while Trump said that "the virus will disappear by itself" and "it is no worse than a cold or flu". Fauci (like many other doctors and epidemiologists) refuted the President's words, so he may also lose his position in the near future. Well, Trump can continue to take revenge on all those who are guilty of his defeat in the election. And the main culprit, of course, is China. In fact, in the near future, Washington may impose new sanctions against Chinese officials, as well as new trade duties on imports from China. Reasons? You don't need a reason. China does not want to make concessions and trade the way Washington wants, so sanctions. That's the whole logic of the current White House. One thing is certain. We are waiting for a very fun last month and a half of 2020 and the last 10 weeks of Trump as President of America. Well, the US currency, which had a hard time in the last 7-8 months, will have to endure further. Demand for the US dollar in the foreign exchange market is not high right now, as it is completely unclear what to expect from Trump in the next few weeks and months. Many experts fear that Trump will finally slam the door, so much so that the echo will be heard all over the world. Thus, we believe that the best scenario for the US currency for the next couple of months is a movement on the same side-channel of 1.17-1.19. If traders manage to move the pair above the 1.1900 level, the chances of forming a new upward trend (or resuming the old one) will increase significantly.

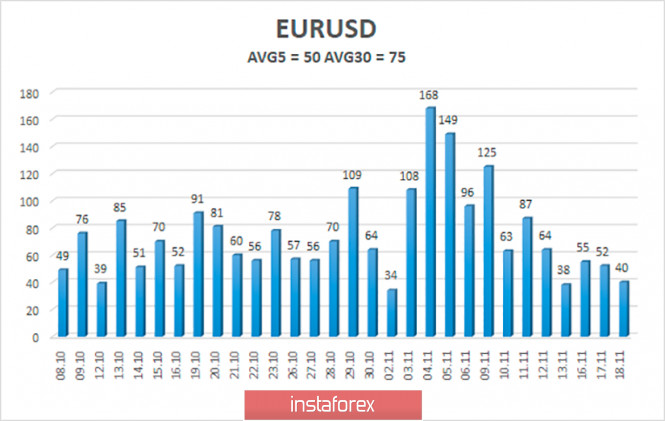

The volatility of the euro/dollar currency pair as of November 19 is 50 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1820 and 1.1920. A reversal of the Heiken Ashi indicator upward may signal a new round of upward movement. Nearest support levels: S1 – 1.1841 S2 – 1.1780 S3 – 1.1719 Nearest resistance levels: R1 – 1.1902 R2 – 1.1963 R3 – 1.2024 Trading recommendations: The EUR/USD pair has started a new round of correction but remains above the moving average. Thus, today it is recommended to open new long positions with targets of 1.1902 and 1.1920 if the Heiken Ashi indicator turns up. It is recommended to consider sell orders if the pair is fixed below the moving average with the first target of 1.1780. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: the Euro has a negative factor Posted: 18 Nov 2020 03:57 PM PST Investors have moderated their fervor and global markets are already less receptive to General optimism about the vaccine and are moving away from previously achieved peaks. However, this does not help the dollar, which continues to weaken against the basket of competitors. In addition to negative macroeconomic data, the degree of tension was raised by the speech of Federal reserve officials. Jerome Powell once again made it clear that difficult times are ahead and the US economy has a long way to go to recover. In addition, the Fed leadership spoke again about the need for new support measures. Although there were no hints of plans to strengthen support measures, markets are waiting for a decision to be made at one of the next meetings of the Federal reserve. Statements by regulatory officials on this issue may become an important support factor for stock markets, as the prospects for the adoption of fiscal measures by lawmakers remain uncertain. It is unlikely that the decline in the dollar can now be explained by risk appetite. This is most likely the desire of market players to reduce the share of dollars. Societe Generale believes that the driver of the fall in the dollar is now the collapse of the real yield of US Treasury bonds. This indicator sank after the Fed this year lowered interest rates and introduced stimulus measures in response to the pandemic. According to the experts, "The high rate of infection in the United States raises strong concerns about the prospects for economic growth in the country. Even news about vaccines cannot compensate for these worries. Therefore, the dollar remains under pressure even though the stock market has reached a maximum. " The dollar index barely reacted to the key support of 92.5, going below this value on Wednesday. If you look at the technical component, you can say that the dollar is now on the edge of the abyss and there is no reason to change the trend. The US currency index is trading at a 2-year low. The USD/JPY pair requires attention which is an important indicator of risk demand. Not so long ago, the rate dropped to 103.25, then went up on the expansion of the Bank of Japan's QE and the post-election rally. A week ago, the pair started a methodical decline and again fell below the 104 mark. Previously, this line was a key support level. It is interesting that the update of the highs of the US and Japan indices during the week took place at the time of the USD/JPY rate sagging. Moreoften, a steady rise in the yen is observed during a period of weakening markets or in extreme cases, precedes it. Interestingly, the Euro is now echoing the yen approaching its highs near the 1.19 mark against the dollar. This dynamic suggests some thoughts: perhaps the Euro has changed its status from a risky asset to a protective one. The Euro is expected to continue to recover but not so quickly. Optimism about vaccines is being held back by the spread of the coronavirus. In addition, the decline in the dollar will be restrained. This should keep the EUR/USD pair below 1.19. However, given the local uptrend and the weakness of the sellers of the main Forex pair, a breakdown of the 1.19 mark is not excluded. This will be a clear bullish signal. The excess of dollars in the financial system favors the EUR/USD pair. However, we should not hope too much for the Euro's growth, as the ECB has again expanded the volume of asset purchases. This is a negative signal for the single currency, which will deter investors from active purchases. The material has been provided by InstaForex Company - www.instaforex.com |

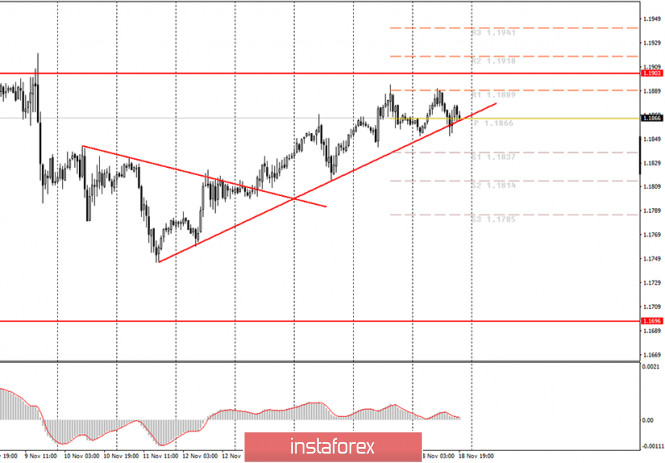

| Posted: 18 Nov 2020 01:07 PM PST Hourly chart of the EUR/USD pair

The EUR/USD pair tried to continue the upward movement on Wednesday, but it came across the resistance level of 1.1889 on its way, which it had already reached yesterday, and once again it failed to overcome the area. Therefore, it rebounded from this level and fell to the upward trend line, which the price also failed to overcome. The upward trend is still present. In the morning review, we warned that the upward movement is unlikely to resume and mentioned that it is not entirely advisable to buy the pair in the upper area of the horizontal channel at 1.1700-1.1900, since it is uncertain whether the price will be able to get out of it. In practice, this is what happened. The price did not leave the channel and is now preparing for a new round of downward movement within the same channel. Therefore, getting the price to settle below the trend line will change the current trend to a downward one within the horizontal channel. In this case, novice traders will be able to start trading down. Only one more or less significant macroeconomic report was published on Wednesday - inflation in the European Union. As expected, the consumer price index in October remained unchanged at -0.3% y/y. Therefore, the weak inflation report might have triggered the slight decrease in the euro's quotes during lunchtime. At the same time, the overall volatility of the day was only 40 points. This is an extremely low value. And this volatility has persisted since the beginning of the week. Therefore, we cannot generally conclude that traders reacted to something today. During the day, the euro/dollar pair was initially up by 30 points, and then about 40 points down. By and large, it's just flat. European Central Bank President Christine Lagarde is set to speak on Thursday. She has recently been speaking almost every day, but by and large these are not speeches, but participation in various video conferences. Of course, the head of the ECB can report something important there, but, as practice shows, this happens extremely rarely. Thus, we are inclined to the option that Lagarde will not report anything important on Thursday either. No more important reports or events scheduled for November 19. Accordingly, volatility might be extremely low during the day, and novice traders can only rely on unexpected and unplanned news. Possible scenarios for November 19: 1) Long positions are relevant since the price is trading above the upward trend line. The euro's growth potential, as always, is limited by the 1.1903 level, and now the price is as close as possible to it. Thus, formally, when opening new buy positions while aiming for 1.1889 and 1.1903, you need to wait for a new signal to buy MACD, but traders must decide for themselves whether they are ready to take risks on such a transaction. As we have already mentioned, there is now a high probability of starting a new round of downward movement. 2) Trading for a fall at this time is irrelevant, since there is a pronounced upward trend. Novice traders are advised to wait until the price settles below the upward trend line. In this case, we open sell orders while aiming for 1.1837 and 1.1814. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

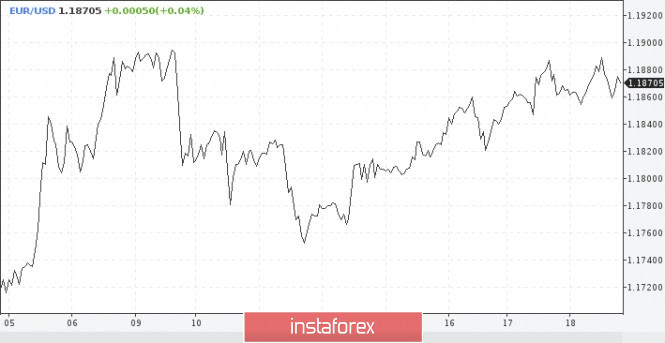

| Evening review of EUR/USD for November 18, 2020. Posted: 18 Nov 2020 10:58 AM PST EUR/USD In fact, in the near future, the euro may break either limit of the range. The euro has been hovering within the range for 3.5 months. During the last 24 hours, the single currency was fluctuating below the upper limit of the range that acts as the resistance area of 1.1900-1.1930. The euro will either drop to 1.1600 or even lower or break the upper limit of the range. Buy positions could be opened from 1.1895. Sell positions could be initiated from 1.1849. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of USDCHF Posted: 18 Nov 2020 08:09 AM PST USDCHF recently got rejected once again at 0.9190 very close to the recent high made at 0.9206. Price is moving lower towards 0.9080-0.9090 where we find the two key price indicators of the Ichimoku cloud.

The rejection at the cloud resistance confirms the bearish trend we are in. Support by the tenkan-sen and kijun-sen is found at 0.9085-0.9095. Breaking below this level will push price towards 0.9055. Bulls need to break above the Kumo (cloud). As long as price is below the Kumo, price is vulnerable to a visit of November lows. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price continues to respect support but remains below resistance Posted: 18 Nov 2020 08:02 AM PST Gold price is trading around $1,882. Support at $1,850-60 remains intact. As long as price remains above $1,850-60, there will be tendency to move higher towards $1,900 and maybe $1,950.

Red rectangles - resistance levels Green rectangle - support Gold price is bouncing once again off the support area. If bulls manage to recapture $1,900 then we might have a new upward move towards $1,950-60. Gold bulls must defend $1,850-60 support otherwise there will be danger of a move towards $1,750-80. Our view is neutral as long as price remains tight inside $1,850-$1,950. The material has been provided by InstaForex Company - www.instaforex.com |

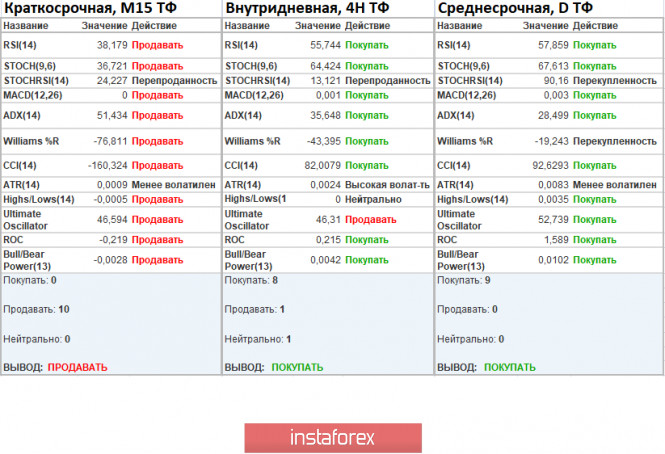

| EURUSD remains in short-term bullish trend Posted: 18 Nov 2020 07:57 AM PST EURUSD continues to trade inside the short-term upward sloping channel from the 1.1750 low. Price so far respects the lower channel boundary and each time price reaches this level, a bounce follows with higher highs and higher lows.

Blue lines - bullish channel EURUSD is climbing higher but as we warned in a previous analysis, the RSI isn't. This is a warning and not a reversal signal. The bearish divergence in the 1 hour chart could be a sign that a pull back towards 1.18-1.1820 is imminent. Trend remains bullish as long as price is above 1.1750. Below that level we expect 1.16 to be tested. Support is found at 1.1850, Bears need to at least break below this level in order to hope for challenging 1.16. Currently we prefer to be neutral and take short position if price breaks below 1.1850 support, looking at least for a pull back towards 1.1750. The material has been provided by InstaForex Company - www.instaforex.com |

| November 18, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 18 Nov 2020 07:52 AM PST

In July, the GBP/USD pair has expressed an Ascending Flag Pattern above the price level of 1.2780. Shortly after, bullish persistence above the price zone of 1.3300 was achieved. This was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested pattern. However, the GBP/USD pair failed to do so. Instead, another bearish movement was targeting the price level of 1.2840 and 1.2780 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000 which failed to maintain sufficient bearish momentum. That's why, the recent bullish breakout above 1.3000 has enabled further bullish advancement towards 1.3250-1.3270 where the upper limit of the new movement channel came to meet the GBP/USD pair. Upon any upcoming bullish pullback, price action should be watched around the price levels of (1.3270-1.3290) for signs of bearish pressure as a valid SELL Entry can be offered. Initial bearish target would be located at 1.3000. While S/L should be placed above 1.333. The material has been provided by InstaForex Company - www.instaforex.com |

| November 18, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 18 Nov 2020 07:45 AM PST

Intraday traders should have noticed the recent bearish closure below 1.1700. This indicated bearish domination for the market on the short-term. However, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponded to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal. All bearish targets were already reached at 1.1700 and 1.1630 where the current bullish recovery was initiated. The current bullish pullback towards the price zone of 1.1870-1.1900 is supposed to be considered for signs of bearish rejection and another valid SELL Entry. S/L should be placed just above 1.1950. Bearish closure and persistence below 1.1777 (61.8% Fibonacci Level) is needed to enhance further bearish decline at least towards 1.1630. Otherwise, another bullish pullback towards 1.1870-1.1900 should be considered for another valid SELL Entry. The material has been provided by InstaForex Company - www.instaforex.com |

| Global optimism is pushing the EUR / USD pair higher reaching weekly peaks around 1.1900 Posted: 18 Nov 2020 07:14 AM PST

Greenback continues to suffer losses for the fifth consecutive trading session. News about successful trials of the COVID-19 vaccine contributes to the decline of the US dollar which is also under pressure from concerns about the recovery of the US economy, as well as expectations that the Federal Reserve will be forced to ease monetary policy to compensate for the inability of the US authorities to adopt another package of fiscal stimulus. According to the President of the Federal Reserve of Atlanta, Raphael Bostic, compared with the strong recovery that was observed in the summer, the US statistical data in the fourth quarter may be weak. "We will be closely monitoring the incoming data to see if the recent weakening of retail sales growth in the country will lead to something more serious," he said. Fed Chairman Jerome Powell, in turn, noted that the increase in the incidence of coronavirus in the US will pose a serious risk to the national economy in the coming months. He believes that it is too early to say whether the appearance of the COVID-19 vaccine will change the forecasts. The world's largest economy is expected to contract by 3.6% this year. "The high incidence of coronavirus in the US is a source of great concern about the country's economic growth prospects. Even news about vaccines cannot compensate for these worries. Therefore, the dollar remains under pressure, even though the US stock market has reached its maximum levels, "said experts of Societe Generale.

The Fed often acts on the side of the weak dollar and strong stock market indices. However, the stock market now seems to have gone too far in its expectations. Apparently, investors believe that a divided Congress means a low probability of agreeing on a new package of fiscal stimulus measures, and they expect the Federal Reserve to intervene by increasing the volume of quantitative easing. However, the regulator may consider that it makes no sense to expand the QE program and risk financial stability in the country, especially in conditions when US stock prices are at record highs. The increased risk appetite of investors, along with a decrease in demand for a protective greenback, pushed the EUR / USD pair to the area of weekly peaks around 1.1900. "The EUR / USD exchange rate remains at a high level due to global optimism about the COVID-19 vaccine," ING strategists noted. Another factor in supporting the single currency is that the United States began taking tough measures to contain the coronavirus a few weeks later than the eurozone countries. This implies that the epidemiological situation in the US will worsen in the near future, and efforts to smooth the incidence curve in the country will bear fruit only after some time. However, it should be understood that the economy of the currency bloc may suffer more than the US economy since European countries have introduced very strict quarantine measures.

"I'm not sure that the news about the vaccine will change the rules of the game much for our forecasts," said ECB President Christine Lagarde. "Before we received news about the vaccine, we had negative data about the second wave of coronavirus and infection control measures that affected one country after another," the ECB chief added. According to her, new restrictive measures may lead to the fact that with the beginning of winter, the Eurozone economy will be on the verge of a new recession. The ECB estimates that the currency bloc's GDP will shrink by about 8% this year. News related to the COVID-19 vaccine gives investors hope for a faster end to the pandemic and the subsequent recovery of the global economy. At the same time, the short-term prospects for global recovery remain dim, as the rate of coronavirus infection in the world is not decreasing. Thus, the market is full of tailwind flows, and the task of investors is to set the sails in the right direction. "The euro retreated, referring to the local highs near $1,1893. The bullish momentum has somewhat weakened, and the chances of the EUR/USD pair rising to 1.1920 are currently low. Then the pair can continue to consolidate and trade in the range of 1.1830-1.1895. The next strong resistance is at 1.1970. The pair will remain bullish as long as it is trading above the support at 1.1790," UOB experts believe. The material has been provided by InstaForex Company - www.instaforex.com |

| Pfizer Vaccine Efficacy Evaluation Raised To 95% Posted: 18 Nov 2020 06:45 AM PST

Pfizer shares rose almost 3% premarket, BioNTech shares gained almost 6%. The study recruited 170 cases of coronavirus among participants. Of these, 162 cases in the control group, and only 8. In the test, the effectiveness of preventing severe forms of the disease has also been proven: nine out of 10 such cases were observed in the control group. It is also worth noting that Biontech and Pfizer intend to supply 300 million doses of the vaccine to Europe. Pfizer also says the vaccine was equally effective in groups of volunteers of different age, gender, race and ethnicity. Among adults over 65 years of age, the effectiveness of the drug was 94%. The only significant side effect was the passing feeling of extreme tiredness. This effect was observed in 3.7% of cases after the second injection. The companies added that they will be filing an emergency vaccine approval application with the US Food and Drug Administration in a few days. In 2020, they intend to produce up to 50 million doses of the drug, by the end of 2021 - up to 1.3 billion doses. On November 16, Moderna announced that its coronavirus vaccine was 94.5% effective in early trials. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Trading signals for November 18, 2020 Posted: 18 Nov 2020 06:36 AM PST

The GBP / USD pair continues to move higher, this morning in the American session it reached the maximum of 1.3297, while it is trading above the 21-day EMA, around 1.3260, it is very likely that it will still have bullish strength up to 1,3305 (5/8 of murray). The British pound has a bullish bias, supported by the hopes of a possible last minute Brexit deal, if so it is likely that there will be a rally to the 1.3427 zone (6/8 murray) On the other hand, since the eagle indicator is showing a bearish signal, we are likely to expect a correction, only if the pair breaks the 1.3250 level, it would advance to the 200-day EMA at 1.3183 (4/8 of a murray). We must be careful when selling this pair as it is being supported by fundamental data, so our recommendation is that you buy this pair every time it rebound around support. A more sustainable downward movement can be seen only if it trades below the 200 EMA 1.3183 zone, only then, we can sell with targets up to the psychological level of 1.30. The eagle indicator is at the level of 90, there could still be more strength up to the 95 overbought area, so it is likely that the market will still look for movements with an upward trend. Market sentiment shows that 61% of investors are short, which supports the analysis that there may be even more upward movement of the pair to levels of 1.3305 and 1.3427 in the medium term. Trading tip for GBP/USD for November 18: Buy if the pair rebounds around 1.3260 (EMA 21) with target at 1.3305 and 1.3367, stop loss below 1.3230 Buy if the pair rebounds around 1.3245 (Trend line) with target at 1.3305 and stop loss below 1.3220 Sell if the pair breaks below 1.3240 with take profit at 1.3183 (EMA 200) and stop loss above 1.3270 (EMA 21) The material has been provided by InstaForex Company - www.instaforex.com |

| Investors face difficulties trading EUR/USD amid pandemic Posted: 18 Nov 2020 06:35 AM PST Yesterday, we tackled the issue of restrictive measures in the US. Today, we got information about new containment measures in Europe. Let's take a look at the overall number of virus cases in various countries: France – 2,087,183 Spain – 1,510,023 Italy – 1,238,072 Germany -833,732 Austria – 214,597 Europe is suffering from the second wave of the coronavirus pandemic. Previously imposed restrictive measures in a number of EU countries cannot halt the influx of new cases of the infection. It is necessary to act radically. Many experts, including the heads of states of the European Union, are supporting this idea. Transition to tougher measures is the main topic of news flow. Austria is one of the first countries to introduce a full quarantine. Educational institutions are switching to distance learning, shopping centers are closing and only essential stores remain open. We went back to the spring scenario, and with only one difference, the situation got worse. The German government, which was one of the first to introduce new restrictive measures during the autumn, sees an urgent need to tighten the control regime even more. We will probably see actions from the German authorities next week. In France, bars and restaurants are already closed, but schools and parks are operating as usual. However, the country's authorities are thinking over new tools to contain the virus. Thus, the French government is working on a long-term strategy that will last even in 2021. Regions of Italy are currently divided into three zones according to the degree of restriction. ·Yellow zone has minimum restrictions ·Orange zone is a zone with strict control ·Red zone is a zone with a full lockdown At the moment, there are almost no yellow zones. There are orange and red marks everywhere. In Spain, restrictive measures have already been extended until May 9, 2021, and in many regions, there is a curfew from 23:00 to 6:00. Bars, restaurants, theaters, and museums are closed until at least early December. Greece has been under a lockdown since November 7. Everything is closed, in order to leave the house, you need to send an SMS message to the authorities. The situation in the world is very difficult, investors are trying to save their capital, but restrictive measures frighten them. We can see that Europe is trying to tighten the control regime even more, which may lead to a slowdown in the economy in the medium term. The United States, where the epidemiological situation is almost the same as in Europe, is introducing quarantine measures, but not as actively as Europe. However, speculators are quite successful due to changes in currencies exchange rates on the basis of the news flow. In terms of technical analysis, we can see that on November 17, the pair was doing its best to stay above the level of 1.1810. Moreover, it managed to reach again the high of 1.1868 logged on November 16. This indicates that the purchasing power is fairly high. In fact, the quote has already touched the area of interaction of trading forces that is 1.1900/1.1920. This means that the market recovered from the decline from 1.1920 to 1.1745. Market dynamic on November 17 was low again. The activity was just 50 points, which is 36% below the average level. Low dynamic did not stop speculators. On a daily chart, we can see local jumps. If we look at the daily chart, we can see that the sideways trend is still relevant in the market, even taking into account the current price changes. Today, in terms of the economic calendar, the final data on the eurozone inflation was revealed. Analysts' expectations were in line with the preliminary estimate, reflecting deflation of 0.3%. At the time of publication, the market showed no reaction to the final results. interaction of trading forces 1.1900/1.1920. Notably, the pair stopped rising near this area. Since the pair failed to consolidate above 1.1920 in the four-hour chart, there is a risk of a natural price rebound following the example of the dynamic logged on November 9. The perspective of the upward development considers the price's approach of the psychological level of 1.2000. There a sharp reduction in the volume of long positions is possible. This scenario may come true, if the price consolidates above 1.1920. At the same time, the price may rebound from the area of interaction of trading forces 1.1900/1.1920. If the pair fixes below 1.1850, it may drop even lower to 1.1810-1.1800. Indicator analysis Let's analyze the price movement on various time frames. Thus, on the one-minute chart, we can see sell signals that appeared after a rebound from the area of the interaction of trading forces. On the hourly and daily charts, uptrend prevails. A change in the signal may occur, only if the price fixes below 1.1800. Volatility for the week/Measurement of volatility: month; quarter; year The measurement of volatility reflects the average daily fluctuation, calculated for a month/quarter /year. At the moment, market dynamic is only 50 points, which is 36% below the average level. Activity is still low. However, in the event of a breakdown or rebound from the area of interaction of trading forces, there may be an acceleration of volatility. Key levels Resistance zones: 1.1900-1.1920**; 1.2000***; 1.2100*; 1.2450**; 1.2550; 1.2825. Support areas: 1.1810*; 1.1700; 1.1612*;1.1500; 1.1350; 1.1250*;1.1180**; 1.1080; 1.1000***. * Periodic level * * Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

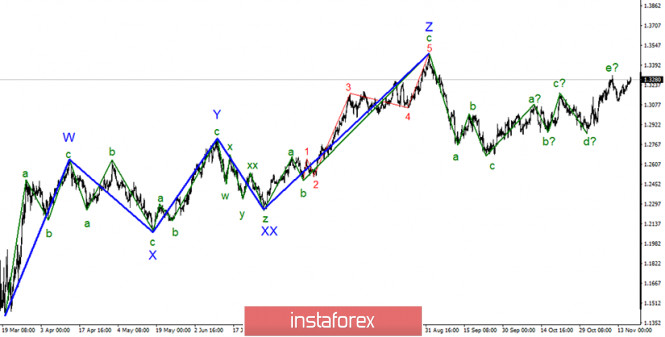

| Posted: 18 Nov 2020 05:49 AM PST A formation of the long-term uptrend section is still going on, though the wave structure is turning into a more complicated shape. The uptrend section, which began on September 23, now consists of five waves. This section could have been already completed. Thus, a new three-wave downtrend section could be in progress now, though the structure might be even more complicated. In case a wave's high designated as E is broken successfully, this could complicate wave E and even the whole uptrend section. In the chart of a shorter timeframe, we can clearly recognize a-b-c-d waves of the uptrend section. Therefore, this section could be over. If so, the currency pair will extend its decline from the current levels with targets at nearly 1.29 and lower. At the same time, the trend section, which started on September 23, could develop a more elongated shape. Wave E could get more complicated to consist of 5 waves. At present, the news background remains unusually mixed for the pound sterling. On the one hand, no positive news has been unveiled on the Brexit front. At the same time, the US also does not release any positive news. Nevertheless, the sterling is still enjoying moderate demand on Forex. This is rather weird. Indeed, the wave structure suggests a formation of a downward wave. Still, demand for the pound sterling is high. The only plausible explanation of this phenomenon is that the market pins all hopes that the long-awaited trade deal will be eventually settled between the UK and EU. Interestingly, such excessive optimism could dent GBP strength. Even if London and Brussels settle the trade deal, the pound sterling could not extend its advance following this news. On the contrary, it might reverse downwards because investors has already priced in this event in the GBP quotes. Besides, Bank of England Governor stated that monetary policy in the UK has to be softened with a view to encouraging long-term investments. This is needed to ensure a rapid economic recovery in the wake of the crisis and in case of a hard Brexit without a trade deal. Citing Andrew Bailey, the British economy needs much more investments now than in recent years. The Governor noted that the economy does not signal lack of investments, but there is evidence that investors are reluctant to provide more funds. The thing is that individuals and companies are worried about economic uncertainty and prefer to save their financial cushions for a rainy day. Besides, Andrew Bailey said that retirement funds invest modest funds in liquid assets, so this approach should be changed at the government level. Conclusions and trading tips GBP/USD has resumed a formation of the uptrend section. However, its last wave could have been already completed. To sum up, at present I would recommend considering short deals on GBP/USD at every downward signal of the MACD indicator. If the 23.6% fibo is broken successfully, this will confirm that the currency pair is likely to decline with targets at near 1.3010 and 1.2864 that are 38.2% and 50.0% fibo. I would advise you to wait for this breakout before opening short deals on GBP/USD. A successful breakout of the wave E peak will lead to a more complicated wave structure. The material has been provided by InstaForex Company - www.instaforex.com |

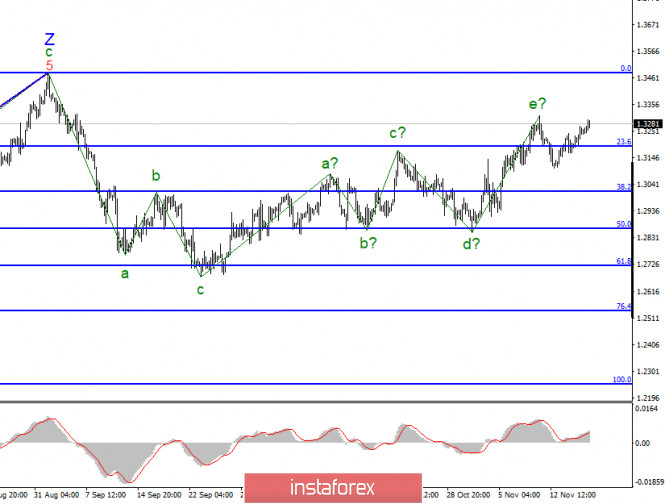

| Posted: 18 Nov 2020 05:46 AM PST The wave marking of the EUR/USD instrument continues to look quite confusing. I am still leaning towards the option with the completion of the construction of the assumed global wave 4 and the construction of the upward wave 5. However, it is also a possible scenario in which the tool will continue to move in three-wave structures, therefore, the construction of the assumed wave from the next uptrend section continues. In any case, according to the current counting, the instrument quotes are expected to increase in the next week. A smaller-scale wave marking also indicates the possible end of the downward section of the trend that begins on October 21. With the final decrease, the instrument could form a wave from the next three, so a new three can be built up, or the upward trend section within the global wave 5 will resume altogether, as I mentioned when analyzing the 24-hour timeframe. In any case, the current wave should lead to an increase in quotes above the peak of the previous wave a, that is, above the 19th figure. The European currency continues to be in demand in the foreign exchange market, so the news background now remains clearly in favor of this particular currency. There has been quite a lot of news of various kinds and nature in recent days. For example, yesterday, quite unexpectedly, Poland and Hungary blocked the adoption of the seven-year EU budget for 1.1 trillion euros and the fund for economic recovery after the pandemic for 750 billion euros, considering that funds are not distributed fairly, and the EU authorities reserve the right to cut funding for states that do not respect the principles of democracy and the rule of law. Whether these charges apply in Poland and Hungary, it is impossible to say for sure, but these countries clearly do not want to be left without aid and without a budget in such difficult economic times. Therefore, they used the right of veto and now the budget and the fund are hanging in the air, because until all 27 EU member states approve them, they will not come into force. As you can see, this news, however, did not negatively affect the euro currency and demand for it. In any case, the budget and the fund should be distributed much later than November 2020, so there will still be plenty of time to agree with each other. But in the US, the situation remains difficult. Epidemiological situation. There are more than 150,000 new cases of coronavirus in the country every day. People die, end up in hospitals. Doctors note that the virus is spreading freely and calmly in all states, cities, localities and among all segments of the population. It is not possible to curb the virus, although the authorities of some states have already tightened quarantine measures and introduced even partial "lockdowns". However, this is clearly not enough to stop the geometric spread of the epidemic. Donald Trump, who is still the President of the country, still refuses to introduce a total "lockdown". Thus, the US economy will not lose as much as during the spring lockdown, but it may still experience problems at the end of 2020. General conclusions and recommendations: The euro/dollar pair presumably completed the construction of a three-wave downward trend section. Thus, at this time, I recommend buying a tool with targets located near the 1.2010 mark, which corresponds to 0.0% Fibonacci, for each MACD signal "up", based on the construction of wave C. The assumed wave b has presumably completed its construction. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Trading signals for November 18, 2020 Posted: 18 Nov 2020 05:25 AM PST

In the early American session, the EUR/USD pair is trading below the pressure line of 1.1870. It is important to note that this pair has made a double top at 1.1890 on the 1-hour chart. If you look at the chart in the 3/8 murray zone it is a good resistance, since the Euro should break this zone of 1.1901. If it exceeds this level, we expect it to continue rising. After this zone, investors would focus the operation towards a probable test of the maximum of the month at 1.1920 and then visualize a potential upward movement until the August top at 1.1962, (4/8 of murray) only if it closes the daily price above 1.1890. On the other hand, quiet trade below 1.1840 will give the possibility of the bearish market for EUR/USD in the next few hours. In the chart, you can see that the eagle indicator is showing a bearish signal. The market sentiment is with a potential of 70% of investors who are selling this pair, which means that it still has bullish strength for the next few days, and it is likely that we will enter the 1.20 area in the short term. Our recommendation is that you sell the Euro, only if it trades below 1.1870 and makes a pullback with targets at 1.1840. If the downward pressure accelerates, and breaks the 200-day EMA zone, the pair could enter a new downtrend with a target of 1.1779 (1/8 of a murray). We can only buy as a last chance, if the pair bounces and consolidates at 1.1840, or if 1.1901 is broken, two key levels. Below 1.1840, we should take bearish positions. Above 1.19 we would enter before a bullish movement. Trading tip for EUR/USD for November 18: Sell below 1.1870 with take profit at 1.18.40 and stop loss above 1.1895 Buy if the pair rebounds around 1.1840 (EMA200) with target at 1.1880 and stop loss below 1.1810. Sell if the pair breaks below 1.1840 with take profit at 1.1779 (1/8 murray) and stop loss above 1.1870. The material has been provided by InstaForex Company - www.instaforex.com |

| Deficit in precious metals market Posted: 18 Nov 2020 04:24 AM PST

The usage of alternative energy sources, such as solar panels, becomes increasingly popular. But the main problem is that precious metals, such as silver, vanadium, lithium, iridium, platinum, and palladium may be in short supply because they are widely used in the production of solar panels. Experts say that the era of clean energy is not far away which may lead to a large shortage of essential minerals. Also, platinum group metals will sharply rise in price. Experts fear that someday humanity will reach the limits for the extraction of raw materials. In this case, it will be necessary to expand the resource base to meet the increased demand for clean energy. What dynamics will gold show? Recently, it became known about the effectiveness of a new vaccine against coronavirus developed by Biontech, Pfizer and Moderna. This news rocked the markets. Investors are again showing interest in risk assets which negatively affects gold and silver. The creation of a vaccine gives hope for the early lifting of quarantine measures, due to which the global economy has been hit hard. In this case, it does not matter how quickly we get back to normal life. The exchanges will immediately start selling "happy future". Gold will have a chance to grow when the euphoria in the markets ends, and it becomes known how many more millions or billions will be needed to overcome the consequences of the crisis. But by this time, other news may be in the spotlight. For example, the inauguration of the new US president who will announce his plans for the coming years. In any case, the central bank will continue to issue unsecured money in order to minimize losses from the pandemic. In other words, the purchasing power of currencies will fall, while gold will continue to rise. Meanwhile, gold futures declined during Asian trading on Wednesday. Gold lost 0.43% to trade at $1,876.90 per troy ounce. The support level is at $1,860.70 and the resistance level is at $1,898.00. Silver for December delivery lost 0.66% to settle at $24.488 per troy ounce. Copper also decreased by 0.09% to hit $3.2037 per pound. The US Dollar Index Futures, which measure the US dollar against a basket of six major currencies, fell by 0.04% to trade at 92.433. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Nov 2020 04:14 AM PST Further Development

Analyzing the current trading chart of BTC, I found that BTC is trading flat last 4 hours and I see potential for the downside rotation. Stochastic oscillator is in the overbought zone and the BTC is on the extended run. The breakout of support at $18,000 will confirm further downside movement. Key Levels: Resistance: $18,300 and $18,465 Support levels: $1,850 and $1,820. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD. Weak retail sales, coronavirus anti-records, and rumors of re-lockdown Posted: 18 Nov 2020 04:07 AM PST After a one-day flat "reflection", the euro-dollar pair resumed its upward movement, currently approaching the borders of the 19th figure. The growth is primarily due to the weakness of the US dollar which was hit by a wave of sales throughout the market, as evidenced by the downward dynamics of the dollar index. The euro, in turn, withstood a blow from Hungary and Poland, whose representatives blocked the implementation of the EU budget. This fundamental background contributes to the further growth of the pair: it is only a matter of time before the 19th figure is stormed. The US dollar which is a recent favorite in the currency market continues to weaken. There are several reasons for this dynamic. Against the background of a general decline in anti-risk sentiment, disappointing macroeconomic statistics were published in the US. Thus, the volume of retail trade in the country decreased to 0.3% (excluding car sales - to 0.2%) in October. For comparison, it is worth noting that in September, these indicators came out at 1.6% and 1.2%, respectively. The release not only reflected a decline in consumer activity but also came out in the red zone, falling short of the forecast values.

This suggests that the US economy continues to slow down gradually. Key macroeconomic indicators are increasingly disappointing, while the issue of accepting an additional aid package is still up in the air, due to the presidential and Congressional by-elections. Just last week, weak inflation data was published in the United States. The overall consumer price index slowed to zero in October, as did the core CPI. The "Coronavirus Factor", which has been supporting the greenback for some time, is now playing against it – especially when it comes to the EUR/USD pair. The fact is that widespread lockdowns, which were introduced in Europe in early November, are already producing results. The second wave of the pandemic was managed, if not stopped, then at least "curbed". The rate of spread of the disease has slowed: the corresponding indicators have either leveled off (if the country has reached a plateau) or show a downward trend. While the US continues to update its own anti-records. The daily incidence rate during the week is kept at the level of 150,000 - 170,000 – since the beginning of November, it has not fallen below the 100,000 mark. In the summer, when local outbreaks of coronavirus were recorded in a number of states in the US, the daily increase in infected people was at the level of 70,000 - 80,000 – and we are talking about peak periods. At the moment, the situation is more complicated. For example, just over the past day, 1,615 people died in the US (anti-record). During the same period, more than 157,000 cases were recorded in the country. More than two million Americans are expected to catch the coronavirus in the first three weeks of November, more than at the beginning of the epidemic. According to doctors, the spread of infection occurs in all age and ethnic groups, both in urban and rural areas. At the same time, in most states, the number of cases is growing even more rapidly than in the spring, when COVID-19 just came to the UnS. For this reason, the governors of some regions are already resorting to new quarantine restrictions. In particular, California and Michigan have introduced a partial lockdown, and are currently considering a curfew. In Oregon, Washington, and New Jersey, the current restrictions were significantly increased. Many States still refuse to tighten the quarantine – but, according to experts, in the end, all regions of the country will be forced to take this step. Moreover, according to Bloomberg, the team of President-elect Joe Biden offers to save the situation with a nationwide lockdown, with partial compensation for losses to closed businesses. Against the background of such prospects, as well as taking into account the uncertainty regarding the adoption of a new package of assistance to the Uba economy, the dollar is actively losing its position. After the congressional by-elections, the balance of power in both houses of the legislature remained the same: the House of Representatives is controlled by Democrats, the Senate by Republicans. Therefore, the issue of additional incentives will again be the subject of political negotiations. The previous negotiation process, which lasted several months (since May of this year), ended in nothing. As you can see, the greenback is under pressure from several fundamental factors of a negative nature. The euro is also under some pressure, but it looks more attractive compared to the dollar, against the background of the weakening of the coronavirus crisis in the Alliance countries. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Nov 2020 04:02 AM PST Vaccine shown to be 95% effective in final efficacy analysis of Phase 3 trial

Risk trades are getting another shot in the arm on the news here, albeit a more modest one this time around. European stocks are holding slight gains now of around 0.4% while US futures are pushing slightly higher as well on the headlines. The 95% efficacy rate bugs me a little, as this sort of reflects that this has turned into a huge vaccine race after Moderna announced a 94.5% efficacy rate earlier this week. But if they have the data to back that up, then sure all the better for humanity.

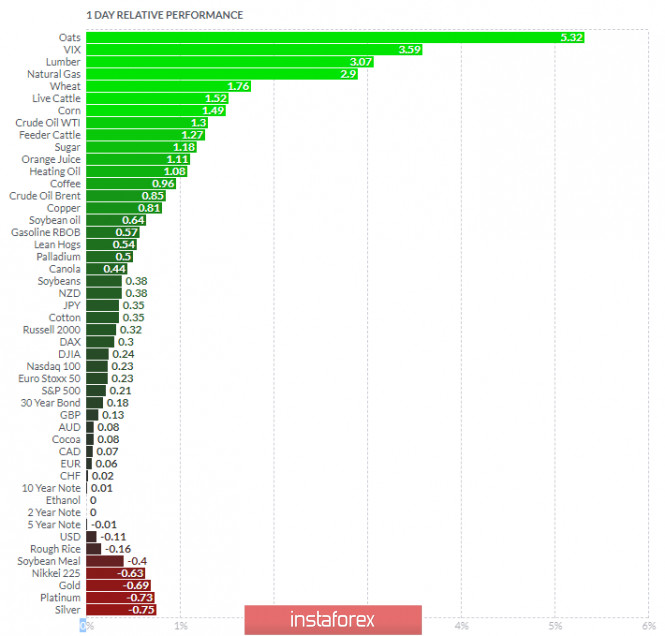

Based on the graph above I found that on the top of the list we got Oats and VIX today and on the bottom Silver and Platinum. Gold is negative on the list today, which is another sign of the weakness.. Key Levels: Resistance: $1,9000 Support levels: $1,850 and $1,820. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for November 18 2020 - Potential for the downside rotation towards 1.1850 Posted: 18 Nov 2020 03:53 AM PST Eurozone October final core CPI +0.2% vs +0.2% y/y prelim Latest data released by Eurostat - 18 November 2020CPI -0.3% vs -0.3% y/y prelim No change to the initial estimates as Eurozone inflation continues to remain more subdued. This just reaffirms the need for the ECB to take more decisive measures next month. Further Development

Analyzing the current trading chart of EUR/USD, I found that there is rejection of the important pivot level at 1,1890, which is good sign for further downside movement. My advice is to watch for selling opportunities with the targets at 1,1850 and 1,1820 Additionally, there is the bearish divergence on the Stochastic oscillator, which is another confirmation for the further downside.... 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Oats and VIX today and on the bottom Silver and Platinum. In my opinion both Gold and Silver might be extended today and ready for to downside rotation. Key Levels: Resistance: 1,1890 Support levels: 1,1850 and 1,1820 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment