| George Gilder Says Tech Investors Better Get Ready...

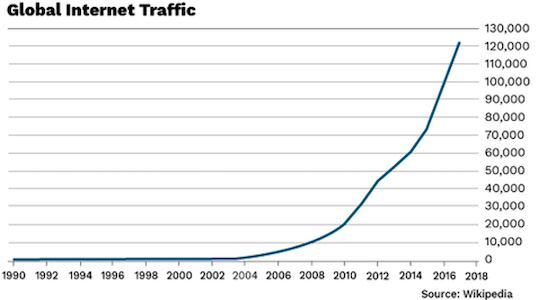

Leader of the Pack The reason for this is not any slackening demand in the market. We all know that total demand for bandwidth has been increasing exponentially since the dawn of the internet era (see the graph below). Beneath that rather generous curve, a number of optical transport component makers still thrive operating at more humble levels than the leaders. Addressing a viable market for systems operating at much lower than state of the art levels. (The same applies in the semiconductor world where there are dozens of manufacturers still operating at second and third tier levels.)  The graph of total demand tells us very little about what technologies will likely prevail in the fiercest aspect of the competition. Total demand, whether for beans or bandwidth, tells us little about how that demand is presented or how it will be met. Total demand tells us little about which technologies will win the high end of the market. As with demand for extreme integrated circuit densities, to know which technologies will prevail we need to know not total demand but demand at a single instant in time and a single point in space: how many gigabits we can send or receive right at this instant right at this node. The great optical engine makers, year after year, have been straining every muscle to reach first 100 Gbps, then 200, then 400, and now 800 not merely to show off, but because those peak speeds have become imperative to network function. Even if most of the time most nodes operate at much slower speeds. This is for two reasons, one long-standing and one rather new: - In an optical network, there are two ways to build total capacity: multiply less capable transceivers or focus on fewer high-end machines. Over time, the cost advantage to using fewer more power machines have become overwhelming. That’s the first driver.

- The new driver for peak performance is AI and its voracious demand for data right here and right now.

AI is a statistical phenomenon; more iterations, faster, are the key to machine learning success. There are points of diminishing returns but these recede with the growing power and complexity of the algorithms. The marginal advantages of processing a billion bits of data per second quickly become the absolute imperative of processing a hundred billion. In an AI world, more than ever the measure of a network is not total capacity, but a capacity at a single instant of time and at a single point in space. How Ciena and Infinera triumphed is too complicated a story to re-tell here. Head over to our website to catch the full story. However, the short version goes back once again to Clay Christensen and his “sustaining innovation” paradigm. Leave it to Clay Christensen When a technology, however powerful, still does not meet the maximum needs of the most demanding customers…sustaining innovation, continuous improvement, is required. Sustaining innovation, in turn, is typically achieved by very intimate integration of the design and manufacturing process, with every step tweaked and optimized for maximum performance. Interviewing the top technologists at both Ciena and Infinera, we kept looking for the one big secret. The one big move they had made to secure victory. Again and again, they told us there was no such thing. Each company had taken a very different path — Ciena focusing on traditional silicon circuits, and INFN working for two decades to perfect indium phosphide-based components. Yet at both firms, we were told that neither “silicon” for “indium phosphide” alone were the answer. There were five crucial points of leverage, or six, or four, but never just one. A competitor that wanted to steal their thunder would not only have to get every point of leverage right, but each decision would have to be the right one given multiple prior decision. Though neither company is a megalith on the order of TSMC, both have created very high barriers. The cost of trying to duplicate their efforts measured against the very real risk of failure would intimidate most rivals. Adding total capacity to a network is a thing that can always be done, at some price. But there is never any guarantee that we can increase capacity at single instant in time and or point in space. It was not foreordained that optical engines would someday send 200, 400, or 800 Gbps across a single lambda. It is not foreordained that we will reach 1,600, or even 1,000. It might just be too hard. But even if can be done, only a handful of extraordinary companies have a shot at the winners’ circle. Those are the companies we want to invest in and hold, and double up on when Mr. Market gives us the opportunity. Today’s Prophecy CIEN, INFN, and Huawei will continue to dominate the market for the highest-end optical transceivers against shrinking competition. Tomorrow: Qualcomm’s fountain of youth and the disruptive technology on the horizon. Regards,

George Gilder

Editor, Gilder's Daily Prophecy P.S. The central banks have opened up a Pandora’s box of opportunity. My colleague Graham Summers has discovered what he believes to be a flaw in the currency markets. With this breakthrough, his research might explain why some people have the potential to get richer every time the Fed takes action. No one has ever seen a strategy quite like this for income generation before. You need to check out this presentation Graham has created to find out what’s going on. |

No comments:

Post a Comment