Forex analysis review |

- Forecast for AUD/USD on December 8, 2020

- Forecast for EUR/USD on December 8, 2020

- Forecast for GBP/USD on December 8, 2020

- Forecast for USD/JPY on December 8, 2020

- Overview of the GBP/USD pair. December 8. Brussels and London have once again decided to resume negotiations on a trade agreement.

- Overview of the EUR/USD pair. December 8. Poland and Hungary need to confirm their veto at the EU summit in order not to

- Forecast and trading signals for GBP/USD on December 8. COT report. Analysis of Monday. Recommendations for Tuesday

- Forecast and trading signals for EUR/USD on December 8. COT report. Analysis of Monday. Recommendations for Tuesday

- EUR/USD. False dollar strengthening: buying the pair on downturns

- Buying the euro remains relevant

- Analytics and trading signals for beginners. How to trade GBP/USD on December 8? Analysis of Monday deals. Getting ready

- Analytics and trading signals for beginners. How to trade EUR/USD on December 8? Analysis of Monday deals. Getting ready

- Outlook on EURUSD for December 7, 2020

- December 7, 2020 : EUR/USD daily technical review and trade recommendations.

- December 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- December 7, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- EUR/USD: USD gains ground

- Gold price to hit $2,300 in 2021

- EUR/USD may reverse soon

- Trading Signal for GBP/USD for December 07 - 08, 2020: Key level at 1.3375

- GBPUSD and EURUSD: Why did the pound fall sharply? The final fate of the Brexit trade agreement depends on today's negotiations

- EUR/USD analysis for December 7. EUR pulls back from early highs. US and EU await new stimulus measures

- GBP/USD analysis on December 7. The deal that Michel Barnier and David Frost can achieve can be rejected by the European

- BTC analysis for December 07,.2020 - Watch for the breakout of symmetrical triangle pattern to confirm further direction

- Analysis of Gold for December 07,.2020 - Potential completion of the bigger ABC correction. Upside opportunities in play....

| Forecast for AUD/USD on December 8, 2020 Posted: 07 Dec 2020 07:22 PM PST AUD/USD Yesterday, the Australian dollar showed increased volatility amid a slight panic due to a rumor about the preparedness of British Prime Minister Boris Johnson to withdraw from Brexit negotiations. The Aussie closed the day with a decrease of 6 points, thus consolidating under the level of 0.7440.

The triple divergence of the price with the Marlin oscillator is increasing, and the market trend is more and more adjusted to a reversal. The first target is the level of 0.7340 - the minimum on November 30 and the maximum on November 9 and 17. Fixing the price below 0.7340 opens the second target 0.7222, before which there is a serious support of 0.7255 created by the MACD line, ergo it is more correct to define the target with the range 0.7222 / 55.

On the four-hour scale chart, the price is preparing to fight with the support of the 0.7405 MACD line. The price is assisted by the Marlin oscillator, which created a divergence and moved to the negative area. Fixing the price at 0.7405 opens the first target of 0.7340. The material has been provided by InstaForex Company - www.instaforex.com |

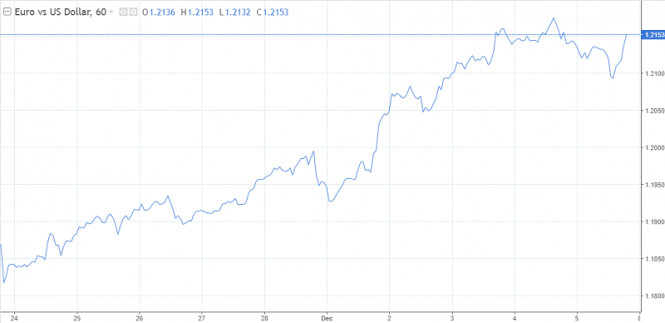

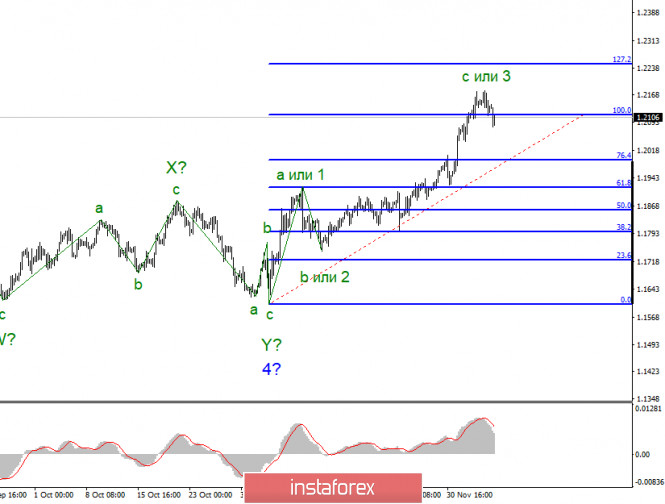

| Forecast for EUR/USD on December 8, 2020 Posted: 07 Dec 2020 06:44 PM PST EUR/USD The euro traded in a range of more than 80 points on Monday, closing the day with a 13-point decline, below the target level of 1.2117. The Marlin oscillator is turning down on the daily chart. The first downward target for the euro is the price channel line at 1.2036, getting the pair to settle below this level opens the way to the MACD line near 1.1935.

The price settled below the 1.2117 level on the four-hour chart. Yesterday's upward surge in price stopped at a time when the signal line of the Marlin oscillator reversed from the zero line downward (arrow). The MACD line (1.2072) will be an obstacle to reaching 1.2036. Being able to settle below it will be a sign that the price has successfully broken through the price channel line.

|

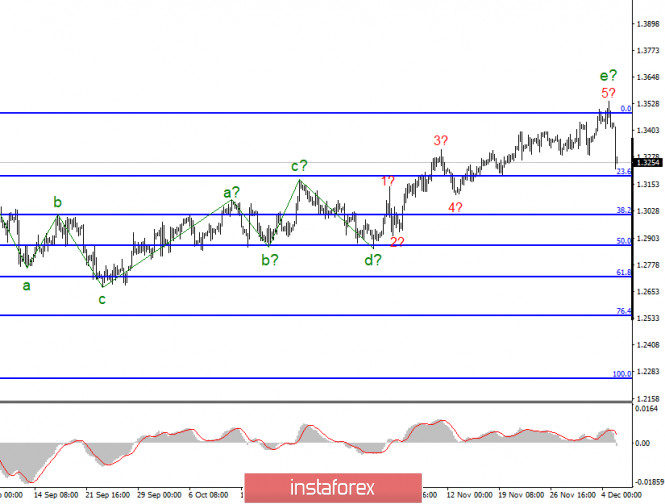

| Forecast for GBP/USD on December 8, 2020 Posted: 07 Dec 2020 06:38 PM PST GBP/USD The pound fell by 217 points due to yesterday's news about Prime Minister Boris Johnson's readiness to end the hopeless negotiation process on Brexit. Subsequently, the price won back most of the fall, and the day closed with a black candlestick at 58 points. The MACD line stopped the fall. If the negative Brexit scenario is confirmed (we consider it as the main one), a second attempt to attack the MACD line will be more successful, the target is the 1.3180 level.

The actual target will be the 1.3108 level (November 12 low). The double divergence according to Marlin has worked out, the signal line of the oscillator is about to move into the downward trend zone, which will strengthen the bearish market sentiment.

The four-hour chart shows that the price has settled below the MACD line, yesterday's growth fell slightly short of this line and a reversal is taking place this morning. The first target for support is 1.3290, getting the pair to settle below it will strengthen the decline. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on December 8, 2020 Posted: 07 Dec 2020 06:38 PM PST USD/JPY As a result of yesterday, the Japanese yen strengthened by 11 points following the weakening of the US stock market - the S&P 500 fell by 0.19%. The price goes down under both indicator lines - under the red balance line and the blue MACD line - market sentiment to sell.

The signal line of the Marlin oscillator is reversed from the border of the growth area, the line itself has formed a triangle, leaving it will accelerate the fall of the oscillator and the currency pair itself. The bears will initially aim for the November 6 low (103.18). Falling towards the second target of 102.35 is also possible.

The price briefly went above the balance line and the MACD line on the four-hour scale yesterday, which showed a false upward movement. Accordingly, the downward movement will be more significant. The Marlin oscillator is in the negative area, although it is currently driven by the price (Marlin is a leading indicator). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:32 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -86.7757 On Monday, December 7, the British pound fell by 200 points. Thus, first, traders can once again see that there is no correlation between the two main pairs at all, and, secondly, we have long warned that the strengthening of the British pound is even more strange than the growth of the euro currency. The strengthening of the euro can be explained at least by the interest of major speculators or the actions of major players. Thus, it is likely that the fall in the pound's quotes on Monday will be the long-awaited start of a new long-term downward trend. Of course, it is not quite correct to conclude for one day, however, it is also impossible to ignore the 200-point drop. So far, we can say one thing: the pound/dollar pair has fixed below the moving average line, so the trend has changed to a downward one. Therefore, starting from today, we should consider trading on the downside. Meanwhile, we can now say with confidence that another "brilliant" bluff by Boris Johnson did not work again. The British Prime Minister can not understand that he is not opposed (relatively speaking) to Uganda or Morocco. The entire European Union is now working against him, and his pathetic attempts to make a "good face at a bad game" do not impress Europeans. From the very beginning of the "divorce process", the European Union has clearly stated that it does not want to lose Britain and hopes that its power will change its mind (or change). Further, the EU authorities stated that they need a deal and are ready to work on it, however, it will take a long time to agree on such a large agreement that affects many areas of life. After all, London and Brussels are discussing not only trade conditions. They discuss future relations in all areas of mutual coexistence. Naturally, six months is extremely short for an agreement of this level and volume. Brussels has been talking about this from the very beginning, suggesting that London should extend the "transition period" for two years. However, Boris Johnson refused, and now the end of the "transition period" is just over three weeks away. Both sides make it clear from time to time that there is little progress, however, most of the statements from both sides reflect a lack of progress on three key issues. Meanwhile, France is increasingly interfering in the negotiations. It is France that may be most affected by the lack of access for its sailors to British waters for fishing. Or from the huge fish catch repatriations that London demands. Thus, Paris can safely veto the agreement with London if it does not suit it. This is exactly what we have already written about more than once. It's not enough for Michel Barnier and David Frost to agree on a deal. It still needs to be approved by both parliaments. And both parliaments are not just a few hundred deputies. 27 countries of the alliance are represented in the European Parliament, and all countries need to approve the agreement. Otherwise, the situation may be the same as it is now with the budget for 2021-2027 and the recovery fund. Well, there is very little time for everything about everything. Three weeks for the deputies of both parliaments to get acquainted with the multi-page document, analyze it, and then vote for it. Now it looks fantastic. Thus, we remain with our original opinion: either the negotiations will continue in 2021, or there will be no deal between London and Brussels at all. And also the second conclusion: the British pound will fall almost in any case. The current rate has long been based on a deal that has not yet been reached. Thus, even if it is eventually agreed, traders will not make new purchases of the British currency on this basis. Well, all other factors now do not play a special role. Traders persistently and diligently continue to ignore the macroeconomic background. For example, on Friday, quite important reports were published in the States, which in total should have provoked a new fall in the US currency. But, since the US dollar has been falling for quite a long time, traders once again ignored this data and the US currency began to rise in price. Well, from a technical point of view, yesterday's collapse was impossible to predict, and it is even more difficult to work out. The bar where the moving average line was broken immediately took the pair 200 points down. Naturally, it was too late to open short positions after this bar. However, the pound has not traded much better in recent weeks or even months. Such movements are now a normal situation. It reflects the mood of traders and their calmness (lack thereof).

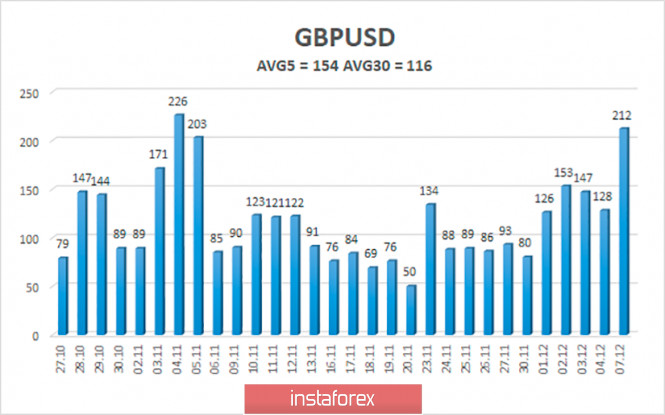

The average volatility of the GBP/USD pair is currently 154 points per day. For the pound/dollar pair, this value is "high". On Tuesday, December 8, therefore, we expect movement inside the channel, limited by the levels of 1.3191 and 1.3499. A reversal of the Heiken Ashi indicator up signals a new round of upward movement. Nearest support levels: S1 – 1.3306 S2 – 1.3245 S3 – 1.3184 Nearest resistance levels: R1 – 1.3367 R2 – 1.3428 R3 – 1.3489 Trading recommendations: The GBP/USD pair on the 4-hour timeframe is now in a new round of downward movement. Thus, today it is recommended to stay in short positions with targets of 1.3245 and 1.3191 until the Heiken Ashi indicator turns up. It is recommended to trade the pair again for an increase with targets of 1.3428 and 1.3489 if the price is fixed above the moving average line. In general, high-volatility "swings" are continuing now. This is not a good time to trade. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:32 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 41.8104 The first trading day of the week for the EUR/USD pair passed in a futile attempt to adjust to the moving average line. Given the fairly strong strengthening of the European currency in the last two weeks, traders were entitled to expect a correction at least to the moving average (which is the minimum in current conditions). However, as it turned out during Monday, the "bullish" mood among traders is so strong that the euro/dollar quotes could not even fall to the moving average. Already in the second half of the day, in the complete absence of any macroeconomic statistics and other fundamental events, the upward movement resumed. Thus, market participants, especially novice traders, could see a new round of absolutely groundless growth. In the last two weeks, the euro currency has only been growing for no reason. The growth is either purely speculative (as oil once grew to $ 140 per barrel) or the pair's rate is now influenced by major players who have different motivation and information from most traders. In the past few months, the fundamental background for the pair has been extremely plentiful. Perhaps most of the topics that we reviewed were not extremely important and did not have a momentary impact on quotes, however, they could not be ignored. Now we can only highlight a couple of the same topics that are not too important right now, which even theoretically cannot be the reasons for the current fall of the US dollar and the growth of the European currency. We'll look at them below. In the meantime, let me draw the attention of traders to how quickly and abruptly the flow of messages from the White House has dried up. Previously, Donald Trump spoke almost every day, his social media accounts were bursting with new messages and comments. In addition to Trump, representatives of the Senate, Congress, Nancy Pelosi, Steven Mnuchin, and Joe Biden regularly spoke. Now there is a complete news calm. Trump has only spent a couple of weeks trying to convince America that he is not giving up and will seek a review of the results of the vote. However, either he quickly got tired of this occupation, especially given its futility, or the American and world media became uninterested in publishing the US President (who will soon leave office) in their publications and issues. One way or another, global interest has fallen very much to the figure of Donald Trump after he lost the election. However, it seems that the government of the United States went on vacation. Steven Mnuchin or Jerome Powell make comments from time to time, and there is no more interesting information for currency traders and markets. It looks like everyone is just waiting. They are waiting for the official date of January 20, when Donald Trump will leave the White House. Only then will the new Congress and the White House resume their work. By the way, do not forget that Joe Biden still can not be called the winner of the election. Each state's electoral college will vote on December 14. And although in the vast majority of cases, this is a pure formality. And even though the majority of electors are already ready to vote for Joe Biden. Still, it's better to wait for the official results. However, the US government itself has already begun the process of transferring power from the team of Donald Trump to the team of Joe Biden. Meanwhile, the European authorities decided to issue an ultimatum to Poland and Hungary. This was stated by an unnamed EU official. Until December 8, that is, until today, the rulers of these countries will have to confirm their veto or express their desire and intentions to start negotiations that will lead to the lifting of the block. According to the European official, the EU authorities want to clearly understand how far the leaders of Poland and Hungary can and want to go in their unwillingness to approve a whole package of bills due to the new "rule of law mechanism". As we said earlier, EU countries can take a different path. They will not try to vote at the EU summit for the entire package of documents and bills at once. They can break it down into separate questions and vote for each one separately. What will it do? This will make it possible to adopt a seven-year budget and a recovery fund to start distributing funds from them in the first quarter of 2021. Individual issues do not require the approval of all 27 member countries of the alliance. 55% of the countries with the highest number of inhabitants will be enough. Thus, Poland and Hungary may be left out of the distribution of the EU's seven-year budget, and most importantly, out of the distribution of the recovery fund, most of the funds of which will be available to the countries most affected by the pandemic in the form of grants, that is, free of charge. European authorities, in particular Ursula von der Leyen, have already criticized Warsaw and Budapest, saying that millions of Europeans should not suffer because of the decision of the leaders of the two countries. However, Warsaw and Budapest have their truth. The only question is whether they are ready to defend it, or will they be saved from the threat of losing funds from the budget and the fund? According to the same unnamed EU politician, if Mateusz Morawiecki and Viktor Orban do not clarify this issue in the coming days, the European Union will launch the so-called "Plan B". It just implies the adoption of the fund and budget without the votes of Poland and Hungary, and the countries will remain without funding. The next EU summit is scheduled for December 10-11, so after these dates, it will become known for certain about the decision of the "blockers". Despite the high probability of conflict among the EU member states and not the most enviable state of the EU economy (due to the second "wave" of the pandemic and the second "lockdown"), the European currency continues to grow. As before, we recommend that traders follow the trend. If the euro/dollar pair is growing now (and it is growing almost continuously), then it should be bought. All COT report data and fundamental hypotheses must be supported by specific market movements and specific signals. Without confirmation, they don't make much sense. So far, the pair's quotes remain above the moving average, so the upward trend continues.

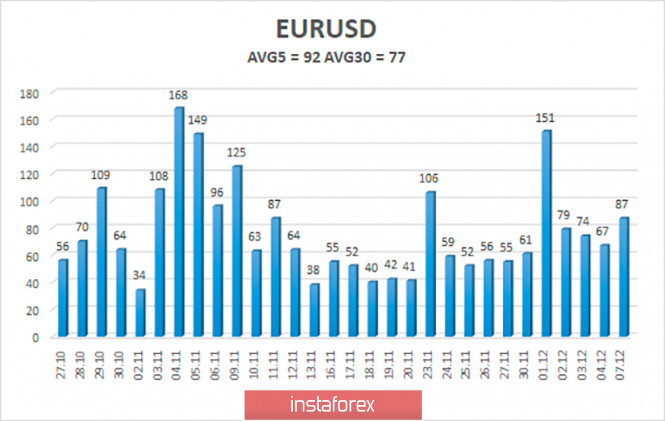

The volatility of the euro/dollar currency pair as of December 7 is 92 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.2020 and 1.2214. A reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement. Nearest support levels: S1 – 1.2085 S2 – 1.2024 S3 – 1.1963 Nearest resistance levels: R1 – 1.2146 R2 – 1.2207 R3 – 1.2268 Trading recommendations: The EUR/USD pair started to adjust. Thus, today it is recommended to open new buy orders with a target of 1.2207 and 1.2214 if the Heiken Ashi indicator turns up again. It is recommended to consider sell orders if the pair is fixed below the moving average with targets of 1.2020 and 1.1963. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:05 PM PST GBP/USD 15M Both linear regression channels turned to the downside on the 15-minute timeframe, which is fully consistent with what is happening on the hourly timeframe. Unfortunately, the first thing that should be highlighted is that the erratic movement persists, which means that in the near future the pair can rise 100-150 points and the end of the upward trend might have been false. GBP/USD 1H The GBP/USD pair fell 200 points on Monday. The pound recovered by 110-120 points in the afternoon, however, the fall itself was quite impressive. The most important thing is that the pair's quotes have settled below the rising channel, so now we can conclude that the upward trend is over. Over the past weeks, the price has already made similar maneuvers several times, and in general, the pair's movements are more like a "swing" now, so the breakout may be false. Moreover, as we see from the chart, the price did not notice the Senkou Span B line twice, which is generally quite strong. Therefore, we will not be surprised at all if the pair returns to its local highs on Tuesday or Wednesday. By the way, there were no reasons and grounds for the pound's decline on Monday. We mean that there was no unambiguously interpreted news or events that could provoke such a fall. The fact that the pound is too high has been ignored by market participants. COT report

The GBP/USD pair did not grow and did not fall by a single point during the last reporting week (November 24-30). There were no price changes during this period. But in general, there was still an upward trend that extended into the following week. If in the case of the euro/dollar pair, we had been waiting for the beginning of a new downward trend, in the pound/dollar pair's case, the Commitment of Traders (COT) reports did not allow such conclusions to be drawn. You only need to look at both indicators in the chart to understand that there is no trend in the mood of major players. The first indicator constantly shows a shift in the mood of commercial and non-commercial traders from bearish to bullish and vice versa. The second indicator constantly shows that the net position of the "non-commercial" group is growing and decreasing. That is, we can not draw conclusions regarding the pair's future from the COT reports. Non-commercial traders opened 3,600 new Buy-contracts (longs) and closed 4,400 Sell-contracts (shorts) during the reporting week. The net position immediately increased by 8,000, which is a lot for the pound. But there were no price changes. The number of open Buy and Sell contracts for the non-commercial group is practically the same. The fundamental background for the pound came down to the same topic of Brexit trade talks. Nothing new that concerns the pound. Traders are no longer interested in macroeconomic reports. The pound facing the 35 figure and this seems to be the highest acceptable level for this currency in current conditions. However, we were expecting the pound to sharply fall a few weeks ago, and instead the markets continued to buy it. As such, we advise you to wait until the end of negotiations between Michel Barnier and David Frost, as well as for final verdicts from the European Parliament and the British Parliament regarding the deal (if any). Until there is clarity on this issue, the markets may remain in a very agitated state regarding the pound/dollar pair. And no wonder. The economic future of Great Britain is at stake, and, accordingly, the future of the pound depends on this. The lack of an agreed and ratified trade agreement on January 1, 2021 means a new downturn for the UK economy and a collapse for British business. No important reports or events scheduled for the EU and the US on Tuesday. As well as Wednesday. Therefore, traders can and should turn their attention to technique and possible news from the negotiation process between London and Brussels. We can't identify any more important factors for the pair at the moment. We have two trading ideas for December 8: 1) Buyers for the pound/dollar pair have released the initiative from their hands. Now they need to return the pair above the resistance area of 1.3394-1.3402, and only after that should you trade up again while aiming for the resistance level of 1.3556, which is very far away. Take Profit in this case will be up to 130 points. At the same time, the so-called erratic movement persists, which has been going on for two weeks, if not more. 2) Sellers seem to have made a tangible step towards the downward trend, but they nearly missed the pair above the Senkou Span B line. We recommend selling the pound/dollar pair while aiming for the support area of 1.3160 -1.3184, if the quotes return to the area below the Senkou Span B line (1.3317). Take Profit in this case can be up to 100 points. Forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:05 PM PST EUR/USD 15M Both linear regression channels began to turn to the downside on the 15-minute timeframe, so the pair has a good chance of continuing the downward correction. We are waiting for the quotes to fall, at least to the Kijun-sen line, around which is the area where the pair's fate will be decided. Accordingly, we expect to see another round of the downward correction. EUR/USD 1H The EUR/USD pair tried to continue the downward correction movement on the hourly timeframe on Monday, December 7, but it could not even reach the Kijun-sen line during the day. And so there was no new buy signal either, since there was no rebound from any Ichimoku indicator line or from any support level, and the upward movement resumed, but Friday's high was not updated. The rising channel sustains the upward trend. By the way, it is wide enough, so breaking this trend will be quite problematic. Nevertheless, you can consider short positions when the pair settles below the critical line. We still believe that the euro is heavily overbought, but most timeframes show that the upward trend will still continue. This means that, whatever the fundamental background is, trading should now be bullish. COT report

The EUR/USD pair grew by only 80 points during the last reporting week (November 24-30). But the new Commitment of Traders (COT) report indicates that professional traders are becoming more bullish for the second consecutive week. This time, the "non-commercial" group opened 4,300 new Buy-contracts (longs) and closed 300 sell-contracts (shorts). These numbers are not great. Even the general changes in favor of the bulls over the past two weeks cannot be called "breaking the bearish trend". However, the net position of non-commercial traders has been growing for two consecutive weeks. And, apparently, it began to grow synchronously with the resumption of the euro/dollar pair's growth. Unfortunately, COT reports come out three days late. Thus, they can be used to determine the trend, but, as is the case with fundamental analysis, technical confirmation is always required for any conclusions drawn from the COT reports. What do we end up with? The number of open Buy-contracts for professional traders remains high at 212,000, and the number of Sell-contracts is three times less than 67,000. The gap between the two began to narrow around September (the second indicator showing the net position of the non-commercial group), but it is currently growing again. Therefore, we still expect the upward trend to end, because this is what the data of the COT report is implying (especially the first indicator). But we need technical confirmation of this. No important reports or events from the EU and the US on Monday. Traders still do not need any macroeconomic information. They trade for their own reasons now and it is best to analyze technical patterns on the 1-hour and 4-hour timeframes in order to be aware of everything that is happening. In the coming days, the European Union will resolve the issue with Poland and Hungary, which have blocked the budget and the recovery fund after the pandemic. If the leaders of these countries do not agree to a dialogue with Brussels, they may lose funding from this very budget and fund. From our point of view, Budapest and Warsaw will have to understand and withdraw their veto before the next EU summit, which will take place on December 10-11. Information about this topic will be announced in the coming days. No important reports or events scheduled for the US on Tuesday. Meanwhile, the EU will publish its GDP for the third quarter in the third estimate. There shouldn't be any surprises since this isn't the first estimate. The European economy lost very little in the second and third quarters (much less than the American economy), but now it is already the fourth quarter, and the European economy should have higher losses. Thus, we are still inclined to believe that the euro should start falling, but we do not recommend opening new short positions until this hypothesis receives technical confirmation. We have two trading ideas for December 8: 1) Buyers continue to hold the pair in their hands. Therefore, you are advised to continue trading upward while aiming for the resistance level of 1.2224 when the correction ends. A rebound from the Kijun-sen line (1.2067) can now be used as a signal for new long deals. Take Profit in this case can be up to 120 points. You can also look for possible points for long deals near the lower line of the rising channel. 2) Bears are releasing the pair from their hands more and more every day, nevertheless, the current fundamental background allows them to count on a downward reversal soon. Thus, you are advised to open sell orders while aiming for the support level of 1.1970 if the price settles below the Kijun-sen line (1.20511.2067). Take Profit in this case can be up to 70 points. Forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. False dollar strengthening: buying the pair on downturns Posted: 07 Dec 2020 01:24 PM PST Forex traders continue to play against the US currency. Simple tactics bear fruit, and in almost all dollar pairs - with the exception of the GBP/USD pair. The pound lives its own life and only focuses on Brexit, while ignoring the weakening or strengthening of the dollar. The greenback continues to lose its positions after a short-term correction in the remaining pairs of the so-called major group. Take note that the US dollar has tried several times over the past few weeks to show its character and go into correction. Even against the euro. But the EUR/USD bulls are using the decline in prices as a good reason to open longs. As a result, the price only weakened by several tens of points for a short period of time, afterwards buyers pulled it to new heights due to their activity.

It happened this time too. Rather ambiguous data were published on the growth of the US labor market - Nonfarm. On the one hand, we saw a decline in unemployment and an increase in wages. But on the other hand, all other components came out in the red zone, which means they turned out to be below the forecast values. We are talking, in particular, about the growth rate of the number of people employed in the non-agricultural sector, in the production sector and in the private sector of the economy. The market decided that the glass is half full rather than the other way around, so it focused on the positive aspects of the release. In addition, on the last trading day of the week, traders massively took profits after the pair soared to 1.2177 - this is the price high not only of the current year, but also of the previous one. Market participants did not hold back from opening trading positions over the weekend, afterwards they began to leave them en masse. The immediate reason for the dollar's growth was the news that the United States imposed sanctions against China because of the situation with Hong Kong. The new sanctions measures will affect at least 14 officials of the PRC. The sanctions will be imposed due to China's decision to remove four opposition members of the Hong Kong Legislative Council. The pair plummeted by almost 70 points amid a surge in anti-risk sentiment, dropping to the bottom of the 21st figure. The dollar has become temporarily in demand as a defensive asset. Today, the EUR/USD bears tried to develop a downward momentum, but they met quite strong resistance from buyers as soon as they entered the area of the 20-figure. As a result, their attack failed: the notorious Chinese factor could not reverse the trend. First, according to some experts, the White House, under the sensitive leadership of Donald Trump, is deliberately increasing pressure on China before Joe Biden takes his place. The current head of state does not intend to leave American politics after vacating the Oval office, so his current steps must be viewed through the prism of this fact. Secondly, the above-mentioned personal sanctions are not able to shake the situation in the market, provoking an increase in anti-risk sentiment, especially in the light of Biden's election victory. In light of these conclusions, demand for the US currency has declined again, while the euro has once again been in the spotlight. First of all, this is due to the growing interest in risky assets. Despite the second wave of coronavirus in Europe, traders are optimistic about the future, amid news of the start of mass vaccination against COVID-19. It will start on Tuesday in the UK. This process should start a little later in Europe, but the estimated time frame is calculated in weeks, not months. The European Medicines Agency is expected to approve a vaccine from Pfizer on December 29, and from Moderna early next year. If these drugs are approved, vaccination in the EU countries will begin in the second half of January. Such prospects push up risky assets, despite the increase in the number of cases in some EU countries.

Thus, the current fundamental background continues to contribute to the pair's growth. Corrective price dips can be used to open longs and the initial target would be 1.2177 (the 2.5-year high reached last week) and the primary target at 1.2200. This strategy will be relevant until Thursday, when the European Central Bank's final meeting for this year will take place. On the eve of this event, it is advisable to take a wait-and-see position, as the dovish rhetoric of the ECB members may exert significant pressure on the euro. The material has been provided by InstaForex Company - www.instaforex.com |

| Buying the euro remains relevant Posted: 07 Dec 2020 01:24 PM PST The dollar received short-term support today due to the growing appetite for safer assets. This was also due to new signs of strained relations between the US and China. Washington is considering another round of sanctions against Chinese officials. Nevertheless, the greenback is still under pressure, as investors have many reasons to be optimistic in the future. The introduction of vaccines will allow the world's economies to return to normal lifestyles over the next year. This should outweigh the current deterioration of the epidemiological situation in the world. Recall that Britain will start vaccination from December 8, then other countries will follow its example. The dollar index remained near 2.5-year lows as weak US employment data reinforced expectations of stimulus measures. Negotiations aimed at providing fresh aid were revived in Congress last Friday. Lawmakers may approve the package of measures as soon as possible, possibly on Monday, experts believe. In addition, the Federal Reserve may make adjustments to its quantitative easing at its upcoming December meeting. "Growing speculation about looser fiscal and monetary policy in the United States is supporting risky assets and weighing on the dollar," analysts wrote. The euro slightly weakened against the dollar, but its decline is limited by statistics that turned out to be better than the forecast. Industrial production in Germany expanded by 3.2% in October compared to September, the markets expected an increase of only 1.6%. Optimistic data suggest that the German economy will avoid contraction in the fourth quarter. As for US statistics, the next important report will be released on Thursday – the inflation indicator. Until then, traders will focus on the prospects of a new fiscal stimulus package from the US Congress. The possibility of further easing of monetary policy in the country will also be actively discussed. Given these factors, the dollar will retain its potential to decline, which means that the downward trend in the euro is a just temporary phenomenon. This week's ECB meeting could also be another potential trigger for bringing back the euro's growth. The central bank's management is expected to announce new measures to stimulate the economy. Estimates of the growth of the eurozone economy will increase, therefore, market optimism will increase. At the beginning of the year, the ECB's soft rhetoric supported the EUR/USD pair, and history may well repeat itself.

After maintaining the balance between 1.16 and 1.19 for an extended period, the EUR/USD pair made a successful breakout. In the last two weeks, its growth looked good enough in order to continue this trend. The main goal is 1.25. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 01:24 PM PST Hourly chart of the GBP/USD pair

The GBP/USD pair fell by 200 points on Monday, afterwards it quickly grew by 120 points. Thus, the nature of the pair's movement remains unchanged. It is very difficult, especially for novice traders, and is something that is between a flat and high-volatility movements. In fact, there is no trend right now (this is clearly seen from the chart). The pair is trading quite volatile, but at the same time in different directions. There is no classic trend, when the pair moves mainly in one direction, correcting from time to time. Thus, beginners are encouraged to continue to wait for a better time to trade. Logically, we can expect a new round of downward movement after such a strong fall, correction and recovery of the MACD to the zero level. However, with the same degree of probability the pair may also grow back to the 1.3515 level now. As you can see from the chart, there are no trend lines now. This makes it much more difficult to analyze the pair and predict its further movement. Everything still revolves around Brexit and negotiations on a trade deal between the UK and the EU when it comes to the British pound. And it was just announced that talks would RESUME. And that's it. No more information available. It is unclear how long this will last. How the parties want to have time to ratify the agreement on time is also unclear. It seems that the markets are tired of being optimistic, since it has not yet been concluded, and therefore the pound should collapse. If so, then according to this logic, a new round of decline may follow by today or tomorrow. However, we would like to remind you that the erratic movement is still present, and the pair has no technical constructions now. No major events or reports scheduled in the UK and the US on Tuesday. However, as shown on Monday, traders don't really need them now. Therefore, volatility may remain quite high. In the current situation, we can only assume that the downward movement will resume after the correction ends. From the fundamental background, novice traders can only expect news on the trade talks between London and Brussels. There is nothing to do but wait. It is fundamentally calm in America right now. Nothing that could affect the pair's movement in the short or medium term. Possible scenarios for December 8: 1) No particular trend at the moment, like any trend lines and channels. Therefore, although there is no trend now, there is no classic flat either. We advise you to wait a few days for a more convenient and better technical picture. In any case, even if you trade without a trend in the current situation, you will have to wait a long time for a new buy signal from MACD. 2) Sell positions, from our point of view, are also not convenient. There is neither a downward trend nor a signal about the end of an upward trend, and market participants are not particularly interested in the fundamental background. Even today's 200 point-drop cannot guarantee a new downward trend. Therefore, you can try to work out the next sell signal from the MACD (if it is formed near the zero level), but take note that trading is now associated with increased risks. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 01:24 PM PST Hourly chart of the EUR/USD pair

The EUR/USD pair dropped to the first support level of 1.2095 on Monday, December 7 and after that a round of upward movement began, which ended near the resistance level of 1.2162. Therefore, the pair showed decent volatility since there wasn't any news on Monday. The most important thing is that the quotes have not been able to update last Friday's high, which gives grounds to assume a new round of downward movement. In our previous review, we advised you to buy the euro based on a buy signal from MACD. This signal was generated this morning. Although it was not that successful, nevertheless, novice traders could earn 15-20 points. Now, taking into account the rebound from the 1.2162 level, we believe that quotes will start to drop, so we need to look for sell signals. Unfortunately, traders only have one formal trend line, which the quotes crossed a couple of days ago. This formality also preserves good chances for bringing back the upward trend. And the fundamental background has long been ranked third or fourth in importance among the factors that are taken into account by market participants. No important news or fundamental event in the European Union on Monday. Therefore, we would like to draw your attention to any event, but to do so now would just end up confusing newcomers. The most important thing that they should understand is that there are no visible reasons for strengthening the euro and there have not been any in recent weeks. Thus, there is a high degree of probability that the euro is strongly overbought. We still believe that a downward trend is very likely in the near future, but at the same time, the higher timeframes signal good chances for the pair to rise. Therefore, the situation is very ambiguous. You should be careful. No important publications or events scheduled in the EU and the US on Tuesday. All the topics that could theoretically interest traders are not momentary, they are unlikely to be followed by a reaction of "straight away". Novice traders can now follow the news regarding the conflict between Poland and Hungary and the European Commission. The development of this conflict could lead to an ideological split in the EU or to blocking the budget for 2021-2027 and the pandemic recovery fund for longer than a couple of weeks. Possible scenarios for December 8: 1) Long positions have ceased to be relevant at the moment, since the price overcame the trend line. Thus, since it rebounded from the 1.2162 level, we recommend closing long deals on the pair. We advise you to consider new long positions but there should be a new upward trend or the downward trend should end. Such a development is not expected in the next 10-12 hours. 2) Trading down on Tuesday is more appropriate. We believe that the euro/dollar pair can and should make a new downward spurt, and it can begin now. Thus, either you should wait for a sell signal from the MACD (it may take some time to appear), or do so right now, but with a Stop Loss above 1.2162, you can open short positions while aiming for 1.2095 and 1.2069. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Outlook on EURUSD for December 7, 2020 Posted: 07 Dec 2020 07:18 AM PST

EURUSD - a reversal is possible. You may keep buying from the level of 1.2000 - 1.2075. A downward pullback is possible from 1.2077. The ECB's meeting is scheduled on Thursday which will be the decisive day for the euro. The material has been provided by InstaForex Company - www.instaforex.com |

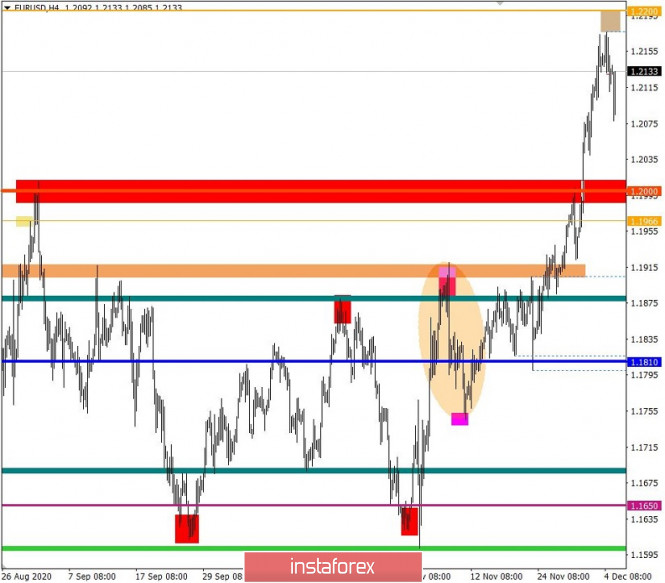

| December 7, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 07 Dec 2020 07:01 AM PST

After such downside movement that took place in November, evident signs of bullish reversal were demonstrated around the depicted price levels of 1.1600. Shortly after, the EUR/USD pair has demonstrated a significant BUYING Pattern after the recent upside breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1920 which exerted considerable bearish pressure bringing the pair back towards 1.1800 which constituted a prominent KEY-Zone for the EUR/USD pair. Recently, the price zone around 1.1840 was mentioned as a prominent KeyZone to be watched for Price Action. Since then, this price zone has been acting as a prominent SUPPORT & the pair has been failing to breakthrough below it. That's why, another upside movement was expressed towards 1.1950-1.1980 where the depicted trendline failed to offer sufficient resistance. Further upside movement is being demonstrated towards 1.2160 where a false breakout to the upside may be expressed as a possible bearish reversal signal. Hence, Bearish closure below the mentioned price zone of 1.2100 is needed to turn the intermediate outlook for the pair into bearish and enhance a quick bearish decline towards 1.1920 and 1.1840. Trade Recommendations :- Currently, Conservative traders should be looking only for SELL Positions. Bearish Closure below 1.2100 should be waited for confirmation. Exit level should be placed above 1.2160. The material has been provided by InstaForex Company - www.instaforex.com |

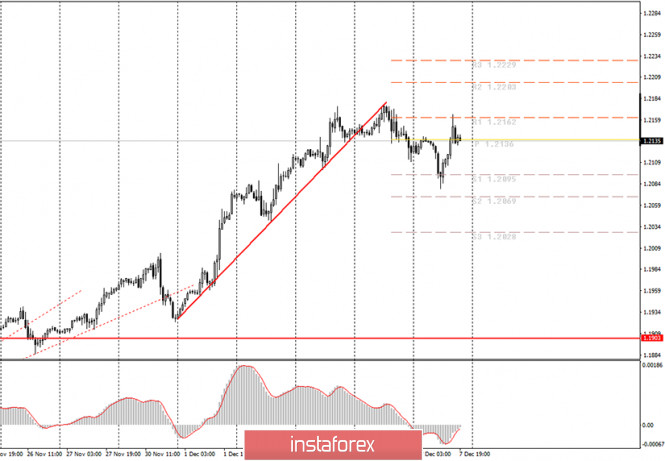

| December 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 07 Dec 2020 06:59 AM PST

Recently, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Hence, another bullish breakout was being demonstrated towards 1.1870 which corresponded to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal. All bearish targets were already reached at 1.1700 and 1.1630 where the recent bullish recovery was initiated. However, The recent bullish pullback towards the price zone of 1.1950-1.1970 failed to find sufficient bearish rejection. The EURUSD pair was trapped between below the previous key-level (1.1950) until bullish breakout occured to the upside. Further bullish advancement was expressed towards 1.2150 as expected. Bearish closure and persistence below 1.2050 then 1.1950 is needed to abort the ongoing bullish momentum to initiate a bearish movement at least towards 1.1860 and 1.1770. Otherwise, the intermediate-outlook for the pair remains bullish. The material has been provided by InstaForex Company - www.instaforex.com |

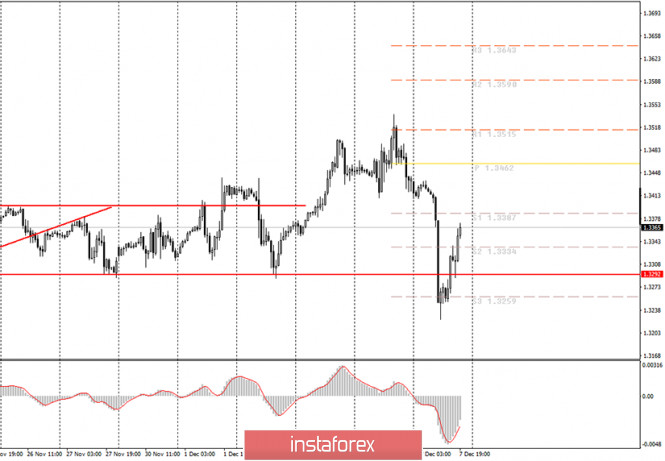

| December 7, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 07 Dec 2020 06:55 AM PST

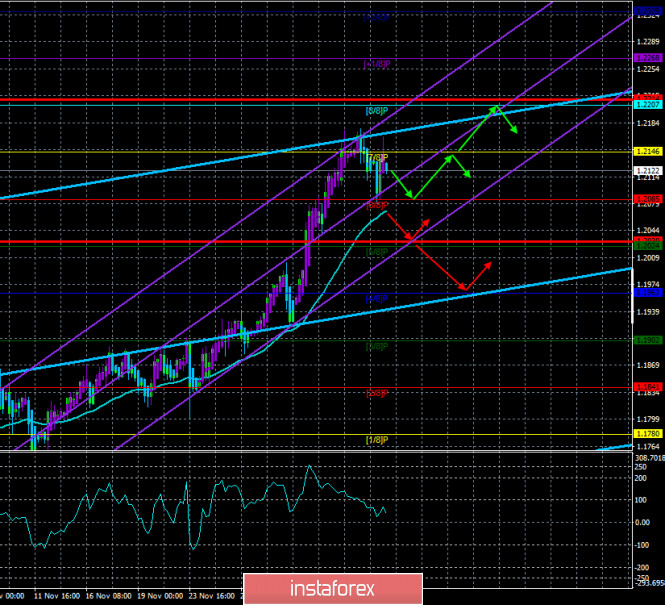

Back in August, the GBP/USD pair failed to pursue towards price levels around 1.3400 as a final projection target for the previous bullish pattern. Instead, another bearish movement was targeting the price level of 1.2840 and 1.2780 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000 which failed to maintain sufficient bearish momentum. That's why, the recent bullish breakout above 1.3000 has enabled further bullish advancement towards 1.3250-1.3270 where the upper limit of the new movement channel came to meet the GBP/USD pair. Later on, further bullish advancement was expressed towards 1.3380-1.3400 where the pair looked overbought after failure of the previous price zone to offer sufficient bearish pressure on the pair. Temporarily, bearish Price action was demonstrated around the price levels of (1.3380-1.3400) as a valid SELL Entry Signal. Initial bearish target was reached around 1.3300. However, the pair has failed to pursue towards lower targets. Instead, another bullish spike was expressed towards 1.3480-1.3500 where the upper limit of the depicted movement channel provided significant bearish pressure on the pair. As the GBPUSD pair looked overbought around the price levels of 1.3500. Hence, intermediate-term turned into bearish when the pair returned to move below 1.3400. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 06:39 AM PST

At the end of last week, the greenback sank to a 2.5-year low. However, it was able to end Friday's session with a sharp increase versus most of its main competitors. Instead of falling, the US currency advanced amid weaker-than-expected data on the US labor market for November. Last month, the US economy added only 245,000 new jobs, which was significantly lower than the 610,000 recorded in October and the preliminary estimate of 468,000. However, the nonfarm payrolls report was not a complete disaster as it showed that the unemployment rate in the country dropped from 6.9% to 6.7%, and the average hourly wage increased from 0.1% to 0.3% on a monthly basis. While economists are still voicing concerns about a surge in the number of new coronavirus cases in the United States, recent macroeconomic data have shown that the national economy is gradually recovering. Thus, investors switched their attention back to the US currency. In addition, the US authorities are developing projects for the distribution of the coronavirus vaccine, and Congress is working on a new package of stimulus measures.

On Thursday, the Food and Drug Administration (FDA will meet to grant an emergency use authorization for the COVID-19 vaccine developed by Pfizer and BioNTech. If US lawmakers agree on at least a $900 billion aid package, the US dollar is sure to gain ground. The fact is that the US Treasury will have to sharply increase the borrowing to attract an additional $300 billion over three months, which will lead to a shortage of dollar liquidity in the short term. On Monday, the greenback was able to recover to 91.2 after reaching the lowest values since April 2018 last week. Demand for the US dollar as a safe-haven asset was spurred by reports of new possible US sanctions against China. This time, they may be imposed on 14 high-ranking officials from China. Traders fear another escalation in relations between the world's two largest economies. On Friday, the EUR/USD pair reached its highest levels in two and a half years, but failed to consolidate at this level and pulled back from the area of 1.2170-1.2175. One of the reasons why investors have decided to lock in profits could be the expectation that the ECB may soften its monetary policy.

On Thursday, the regulator will announce its decision on monetary policy. At the end of the next meeting, the ECB is expected to announce an increase in the volume of the pandemic emergency purchase program by €500 billion to €1.85 billion. At the same time, the program is likely to be extended for six months until the end of 2021. Thus, the ECB will continue to print money. However, it is obvious that this is not the only way to help the European economy and fiscal measures are also necessary. Although the EU agreed on a €1.8 trillion recovery plan, its adoption was blocked by Poland and Hungary. At the two-day EU summit, which starts on December 10, EU members will make another attempt to solve this problem. While some experts believe that the ECB may not add its firepower to encourage EU leaders to break the deadlock. The euro is now at the peak of two and a half years, and this is another problem for inflation and economic growth in the EU, which may push the ECB to take decisive action. Although the EUR/USD pair has retreated from 32-month highs, its short-term bias remains bullish. Therefore, attempts at a downward correction below 1.2100 may be regarded by market participants as a good opportunity to open long deals and remain in the area of 1.2070. Further support is located at 1.2040 and 1.2000. The nearest strong resistance is located at 1.2180 and then at 1.2200 and 1.2250. If the pair breaks through the last level, it may rise to 1,2300. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price to hit $2,300 in 2021 Posted: 07 Dec 2020 05:52 AM PST

Analyst firm Metals Focus predicts that gold will rise to $2,300 in 2021. Also, analysts of the company do not exclude an increase in the cost of silver to $30. At the moment, the precious metals market is under pressure, as news of effective coronavirus vaccines has attracted investors' interest. They returned to the stock market again. Nevertheless, there is no point to think that the optimism in the market will last for a long time, as the distribution of the vaccines around the world will take a lot of time. In other words, the situation will remain difficult until at least mid-2021, as analysts from Metals Focus said. Analysts are confident that the gold market will continue to grow due to stimulating measures from central banks, low yields on government bonds, as well as the risk of inflation. Moreover, it is more profitable to store gold in comparison to low yields on government bonds. The yellow precious metal will act as a protective asset. It has proven its protective function during the previous crises. Today, the price of gold is experiencing a protracted correction. That is why this is a good chance to increase your investments in the face of the growing crisis. On Monday, gold is trading at 1,831.23.

Where will the gold price move next? Experts advise traders to look at a broad perspective. According to the previous crises, the price of gold has always been under pressure in the short term. Firstly, due to the panic, investors sold the most liquid assets to get cash. Secondly, after the price rally, speculators sold their positions in order to fix profits. Moreover, hope for a rapid recovery in financial markets also weighed on gold. Now everyone hopes for a gradual recovery of the global economy that could be triggered by mass vaccinations and the victory over the coronavirus. However, in the long term, gold has all chances to grow. Central banks continue to print unsecured money to overcome the crisis. As a result, national currencies will lose in value. The rise in inflation will force many investors to turn their attention to gold again, because gold is a precious metal that allows traders to save money from complete depreciation. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 05:33 AM PST Last week, the euro/dollar pair reached a new local high and touched the level of 1.2177. After that, it stopped its rally. The euro managed to hit the levels logged in spring 2018. However, it may unexpectedly drop. The Brexit issue is still weighing on currencies. There is a risk that the UK may leave the EU without a trade deal. This will have a significant influence on the pound sterling as early as next week. The euro is still afloat, but there are a lot of factors that are weighing on it. Yesterday, it became known that Bavaria declared an emergency situation for the second time during the pandemic. The number of new virus cases is still rising. During the emergency meeting, the local authorities decided to delay loosening of the containment measures that will be in force during winter holidays. This period will begin on December 9 and it will last up to January 9. Markus Zeder, Bavarian Prime Minister, said they would not change their decision as the number of infected people was too high. Educational institutions will partially switch to distance learning. Moreover, the curfew from 21.00 to 5.00 will be introduced in the regions, where 200 of 100 thousand people get ill. Thus, people in such regions will be allowed to leave their homes only in case of a sound reason. Today, Germany announced that it will impose tougher bans on movement. The Chancellor's administration plans to hold an online meeting with the regions before Christmas in order to discuss new restrictive measures. Notably, Germany has already closed restaurants, gyms and cinemas, but allowed schools and much of the economy to continue operating. The measures imposed at the beginning of November have not been effective. Summing up, we can say that the pressure on the euro is rising. If there is negative news about Brexit and COVID-19, the euro may sharply reverse. According to the technical analysis, last week, the euro advanced by more than 250 pips. It is quite a significant jump. Despite the overbought conditions, the euro did not drop enough to reduce pressure on long positions. On December 4, market dynamic was just 67 pips. It almost reached the average reading. The volatility level allows traders to earn money. On the daily trading chart, the price is fluctuating at the peak of its inertial uptrend. Today, traders are focused on the macroeconomic reports from the eurozone and the US. According to the current trading chart, the euro is dropping following the British pound. However, its decline is less significant than one of the pound sterling. There is still a chance that the euro will show a full-scale downward correction. Traders should be focused on the level of 1.2000. At the same time, the news flow has a significant influence on both currencies. News about containment measures and Brexit may result in high speculative activity in the market. That is why it is recommended to follow news reports. Indicator analysis According to the technical analysis of the one-minute chart, there is a buy signal that appeared due to the rebound after the sharp reversal at the beginning of the European session. On the one-hour chart, there is a sell signal due to the drop that occured in the morning. The daily chart points to the mid-term trend. Volatility for the week/Measurement of volatility: month, quarter, year The volatility measurement reflects the average daily fluctuation calculated for a month/quarter/year. At the moment, the market dynamic is 62 pips that is 18% below the average level.However, the volatility may increase amid the news flow. Key levels Resistance levels: 1.2200*; 1.2450**; 1.2550; 1.2825. Support levels: 1.2000***; 1.1890-1.1900- 1.1920**; 1.1810*; 1.1700. * Periodic level ** Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for GBP/USD for December 07 - 08, 2020: Key level at 1.3375 Posted: 07 Dec 2020 05:23 AM PST

In the early US session, the GBP/USD pair is trading below the 200 and 21 day EMA on the 1 hour chart. It is holding at 1.3278 under strong downward pressure. It is likely that we will still see a continuation of the bearish trend on the pair in the following days. The price left a daily low of 1.3220. This fall was in part triggered by the lack of progress on the Brexit deal, the strengthening of the USDX this morning, and the fall of the global stock markets which added some more pressure. The main negotiator on Brexit from the European Union, Michel Barnier, informed the national ambassadors on Monday, he was very pessimistic about the possibility of sealing a trade agreement with the United Kingdom. On the other hand, Boris Johnson is ready to cancels talks on Brexit if the EU refuses to budge on their demands last minute. On a technical level, you can see that GBP/USD has left some inverted pennants, which is a sign of weakness and a trend reversal in the short term. As long as the pair remains below the 200 EMA, around 1.3375, it is likely that any attempt to break through this area would be a good opportunity to sell the British pound. The pair will find strong resistance at the 5/8 Murray lines if it wants to continue with the rebound to 1.3375. If there is no breakout from this 5/8 Murray level, it would be a good opportunity to sell the pair with targets at 4/8 Murray at 1.3183. The eagle indicator on the H1 charts has touched the oversold level. The rebound is likely to continue to the resistance zone at the 200 EMA which will allow to sell this pair again. Market sentiment dropped -10% this morning, now leaving 52% of investors who are selling the pair. We will probably see a stronger drop in the next few days to the 1.31 and 1.30 area. We must first wait for a technical rebound. Trading tip for GBP/USD for December 07 – 08 Sell al 1.3305 (5/8 Murray), with take profit at 1.3260 and 1.3185, set stop loss above1.3340. Sell if price pulls back at 1.3375 (EMA 200) with take profit at 1.3305, 1.3260 and 1.3181, set stop loss above 1.3420. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 05:08 AM PST The EU's chief Brexit negotiator, Michel Barnier, warned on Monday that negotiations on a future trade agreement with the European Union could fail if the parties do not make concessions to each other by the end of the day. At the same time, Barnier said that it is the tough position of the British negotiators that does not allow us to move forward. The focus of the afternoon will be shifted to the conversation between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen. The conversation will take place this evening and will be a crucial moment in the UK-EU trade relationship. During a briefing in Brussels, Michel Barnier noted that the next step to the EU meeting should be made by Boris Johnson while making a negative statement that the parties are as close as possible to a breakthrough in their differences over fishing and areas where it can be conducted by European companies. Against this background, the British pound quickly fell against the US dollar, as in the event of unsuccessful negotiations between the two politicians, the probability of concluding a trade agreement will quickly tend to zero since there will simply be no time for this. Barnier said he was pessimistic about the prospects for a deal, but expressed hope that Johnson and von der Leyen would be able to reach a compromise tonight. Therefore, the focus is on the second half of the day and the news that will be related to these negotiations. In the event of a breakout, the level of 1.3250 will only be the beginning of a prolonged downward trend, which will lead to an update of the lows of 1.3115, 1.2970, and 1.2810. If the parties still make concessions to each other, the pound will quickly be able to win back today's fall and even achieve fresh highs around 1.3610 and 1.3750, where the bullish momentum may slow down again. Let me remind you that the market has more expectations that the deal will be concluded. Therefore, in the event of failure, the fall of the pound will be much stronger than in the case of growth, which will occur when an agreement is reached. The latest futures report on the positions and balance of power of large non-commercial players clearly shows a tendency to resume the bullish trend. In the December 1 reports, Commitment of Traders notes significant interest in the British pound. Long non-commercial positions rose to a level of 37,087 and at the same time, short non-commercial positions decreased to 44,986. As a result, the negative non-commercial net position was -7,899 against -17,130 a week earlier. And although this does not indicate that the sellers of the British pound remain in control and that they are outweighed in the current situation, the market is gradually beginning to come back to risks, and reaching a trade agreement will help it in this. EURUSD Now for the $ 908 billion aid package that has been talked about over the past week, which will be aimed at fighting the coronavirus pandemic. Party negotiators on the above aid package from both sides plan to release more details today on how they will try to satisfy fairly pragmatic Republicans and embezzled Democrats. This will allow the agreement to pass through Congress before the end of the year. Last week, both parties were optimistic about the new package of measures, and House Speaker Nancy Pelosi called for support for the new bill. Some Republican senators have expressed confidence that President Donald Trump and Senate majority leader Mitch McConnell will support a plan that will help the country fight the second wave of the coronavirus pandemic. As some experts note, this is not a bill on new incentive measures. This is a bill to help those who are in dire need of it now. As for another problem that the European Central Bank is already facing. We are talking about a major increase in the euro, which was observed last week after the news about the coronavirus vaccine appeared. The fact that the euro is now around the 22nd figure creates clear problems for the European Central Bank, which may try to make a verbal intervention against the single European currency this Thursday. However, the Bank's rhetoric alone will not be enough to deter investors who believe in strengthening risky assets at the beginning of a medium-term upward trend. The maximum that the ECB will get is to delay the growth of the European currency against the US dollar and achieve the return of EURUSD to the area of the 19th figure. The European Central Bank may also make significant policy changes, which will allow us to talk about a larger return of pressure on the European currency. This scenario will open a direct road to the area of 1.1840 and 1.1790 levels. A break in the resistance of 1.2175 will lead buyers of risky assets to new highs around 1.2260 and 12340. Now for today's numbers. Industrial production in Germany grew quite strongly in October this year, which once again highlights the active state of the economy even during its partial lockdown. According to the Federal Bureau of Statistics Destatis, German industrial production increased by 3.2% compared to the previous month. Economists had expected growth of 1.5%. Compared to the same period of the previous year, production has not yet recovered and fell by 3% in October. CAD The Canadian dollar continued to strengthen its positions against the US dollar on Friday, however, the movement stalled during today's European session, after which traders rushed to fix positions, which led to a slight rebound up. Good data on the number of jobs in Canada in November 2020 led to the strengthening of the pair, as this indicates that the market will continue to grow even at the time of the second wave of coronavirus. The unemployment rate also fell, however, this was only since many stopped trying to find a job. According to the statistics agency, the number of jobs in Canada increased by 62,100 in November, while economists had expected an increase of 20,000. The unemployment rate in November in Canada was 8.5% compared to 8.9% in October. As for the technical picture of the USDCAD pair, its further decline has so far stopped in the area of 1.2771 and traders are not taking new steps yet. A good breakout of the level of 1.2930 has played itself out to the full and now the bulls will try to return to it, so we can expect an upward correction. A breakout of 1.2770 will open new lows for the trading instrument in the area of 1.2680 and 1.2600. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:52 AM PST The wave pattern for the EUR/USD pair looks quite confusing due to the three distinctive sections of the trend. The upward wave, which is now identified as C, continues its formation and has made a successful attempt to break above the peak of the wave 3 or C. Thus, the formation of the next three ascending waves will continue. Also, the current ascending section can now be identified as a new major wave 5. The wave pattern on a smaller time frame also indicates that the next three-wave section of the trend will continue to form. It is also possible that the price has resumed an uptrend within the global wave 5, which began to form on March 20. A successful attempt to break above the high of the supposed wave 3 or C indicates the bullish trend on the euro. At the same time, the trend can end with the formation of the C wave that will be followed by a new three-section descending wave. A pullback of 100 pips from the early highs may signal that the formation of both an upward wave C and an upward wave 3 in the supposed wave 5 is completed. The same is true for the entire uptrend section. At the same time, a lot still depends on the news background. For example, on Friday markets evaluated several quite important reports from the United States. While the unemployment rate and a change in average hourly earnings encouraged US dollar bulls, the Nonfarm Payrolls report was certainly disappointing. It turned out that only 245,000 new jobs were created in November, well below markets expectations. Therefore, the demand for the US currency should have remained low even despite positive reports on unemployment and wages. Surprisingly, the US dollar advanced on Friday and it is still holding at this level today. Of course, this could be a phase of correction, that is, a wave 4 in 5, for example. Whether this is true or not, we will see in the coming days. At the moment, the global background is quite ambiguous. On the one hand, there are some important issues being discussed both in the United States and the European Union. However, they have a long-term effect. For example, both the US and the EU are facing serious economic challenges. The US lawmaker will address them with a new aid package. Hopefully, Democrats and Republicans will finally reach an agreement on that. In the meantime, some of the EU members have blocked a seven-year budget and a recovery fund. The recovery fund will not be available until Poland and Hungary lift their veto. The EU countries may try to bypass the veto, but this may lead to a conflict within the European Union. Conclusions and trading tips Supposedly, the euro/dollar pair continues the formation of a three-wave uptrend section. However, it may have already completed the trend. Thus, I recommend being extremely cautious when buying the pair. It is better to consider selling the instrument now. Even if wave 5 is being formed at the moment, it is very likely to complete the trend soon. Nevertheless, it is still possible to buy the pair following each of the new MACD buy signals with the targets set near 1.2250, which corresponds to 127.2% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:41 AM PST

In the most global terms, the construction of an upward section of the trend continues, even despite the departure of quotes from the previously reached highs. Moreover, at the moment, the wave pattern looks convincing enough to be considered complete. Five waves are built up as part of a non-impulse section of the trend. The attempt to break the maximum of the previous global wave Z was unsuccessful. Thus, now the markets can start selling the British dollar, which has been brewing for a long time.

The lower chart clearly shows the a-b-c-d-e waves of the upward trend section. The assumed wave e took a five-wave form, which is also visible on the chart. However, even with this complication, it is nearing completion. As I expected, the tool started building a minimum correction, a three-wave section of the trend. A decrease in quotes may also mean the end of the ascending section and that it will no longer be complicated. Much of this time depends on the news background. And it remains not too favorable for the British. Friday's reports from America should not have caused any increase in demand for the US currency. The most important report on Nonfarm Payrolls was weaker than market expectations. However, the decline in the British dollar on Monday is logical. First, the wave marking has long been warning about the instrument's readiness to decline. Second, the negotiations on the Brexit trade deal last week ended with the parties deciding to extend the talks for a few more days. This means that there is no tangible progress. This means that the parties will not have time to ratify the agreement in any case. Or both parliaments will have to read the text of the trade agreement in a very short time, which may lead to a lot of other problems in the future. I think everyone understands that such serious documents do not like to rush. However, this is exactly what is happening now. And even if by some miracle Michel Barnier and David Frost manage to agree on the terms of the trade deal before December 31 (although it was necessary before November 15), this does not mean that this deal will be ratified by both parliaments, whose deputies are not currently familiar with the text of the agreement. It is reasonable to assume that both parliaments will have questions and disagreements with the version of the deal that Frost and Barnier will offer them. However, there is not enough time to make adjustments. Thus, I believe that in any case, the parties will not have time to ratify the agreement before January 1. Most likely, the negotiations will simply continue next year. This is now the most logical scenario. The main thing now is for the parties to agree on extending the terms of negotiations. General conclusions and recommendations: The pound/dollar instrument presumably completed the construction of an upward trend section. Thus, now I recommend looking closely at the sales of the tool. The Briton will probably be aiming for the 29th figure now. I expect to build at least three wave formations for this purpose. Thus, at this time, I recommend selling the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:37 AM PST Further Development

Analyzing the current trading chart of BTC, I found that there is contraction in development, which is sign that we can expect stronger breakout mode in next period. Watch carefully for the breakout to define further direction... The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Dec 2020 04:31 AM PST Japan's new stimulus package reportedly worth about £73.6 trillion Bloomberg reports, citing a document on the packageFiscal measures are to comprise around £40 trillion, partly financed by £19.2 trillion in spending from a third extra budget. This is a bit on the higher end of reports on what ruling party lawmakers are calling for in terms of new measures.

Further Development

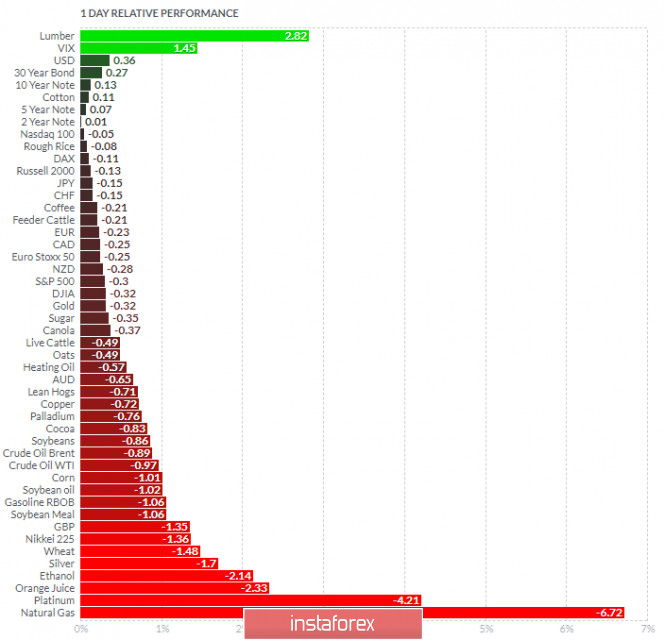

Analyzing the current trading chart of Gold, I found that there is potential for the completion of the ABC downside correction and new upwave to begin. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and VIX today and on the bottom Natural Gas and Platinum. Gold is slightly negative today on the list but with potential for upside continuation. Key Levels: Resistance: $1,834, $1,842 and $1,848 Support levels: $1,822 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment